Fast Retailing Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

Uncover the strategic positioning of Fast Retailing's diverse portfolio with our comprehensive BCG Matrix analysis. See which brands are driving growth and which require careful resource allocation.

This preview offers a glimpse into the core of Fast Retailing's market performance. Purchase the full BCG Matrix report to gain actionable insights, detailed quadrant placements, and a clear roadmap for optimizing your investment strategy.

Stars

Uniqlo's aggressive international expansion, particularly in North America and Europe, firmly places it as a Star in the BCG Matrix. The company has ambitious plans to open a significant number of new stores across these regions in 2024 and 2025, signaling a strong commitment to growth.

These key international markets are already demonstrating impressive revenue and profit growth for Uniqlo, underscoring the brand's ability to capture market share in high-growth environments. For instance, Fast Retailing reported a 28.1% year-on-year increase in revenue for its overseas markets in the first half of fiscal year 2024, reaching ¥336.5 billion (approximately $2.2 billion USD).

Uniqlo's success is largely attributed to its 'LifeWear' philosophy, which emphasizes high-quality, functional, and affordable clothing, resonating well with diverse customer bases. Strategic marketing initiatives further amplify this appeal, driving substantial customer acquisition and brand loyalty in these expanding territories.

GU, Fast Retailing's more fashion-forward and budget-friendly sibling to Uniqlo, is making a significant leap into the United States. Its debut in late 2024 includes a flagship store and a dedicated e-commerce platform, both launching in New York City.

This expansion is a clear strategy to capture the attention of Gen Z consumers who are drawn to trendy, affordable apparel, aiming to bolster GU's international footprint. The company has set an ambitious target of ¥1 trillion in global sales in the medium term, a goal that this US venture is designed to accelerate.

Following a successful pop-up in the same market, GU's entry signals strong potential for high growth and a determined effort to gain substantial market share in a competitive fashion landscape.

Uniqlo's HEATTECH and AIRism lines are stars in the BCG matrix, consistently showing robust global sales. These functional apparel innovations appeal broadly due to their blend of quality, utility, and value. For example, HEATTECH's ability to generate and retain heat while remaining thin has made it a winter staple, contributing significantly to Uniqlo's revenue streams.

Digital Transformation and E-commerce Growth

Fast Retailing's commitment to digital transformation, including widespread RFID adoption, has been a significant catalyst for growth. This technology streamlines inventory management and checkout processes, enhancing operational efficiency. By 2023, Fast Retailing had implemented RFID tags across approximately 80% of its apparel products, a move that significantly improved stock accuracy and reduced lost sales.

The company's e-commerce capabilities have also seen substantial expansion, driving global sales and customer reach. This digital push is crucial for maintaining market share in the increasingly online retail environment. For instance, Fast Retailing's online sales represented a growing portion of its total revenue, with digital channels contributing over 15% to the group's sales in fiscal year 2023.

Key aspects of their digital strategy include:

- RFID Technology: Enabling real-time inventory tracking and improved customer experience through faster checkouts.

- E-commerce Enhancement: Expanding online sales channels and optimizing digital platforms for global customers.

- Omnichannel Integration: Seamlessly connecting online and offline shopping experiences to cater to evolving consumer preferences.

- Data Analytics: Leveraging customer data to personalize offerings and improve marketing effectiveness.

Strategic Product Development and Marketing

Fast Retailing's strategic product development is a key driver of its success, focusing on hyper-localization. This means adapting product assortments and marketing campaigns to specific regional tastes, cultural preferences, and crucially, local weather patterns. For example, their emphasis on year-round essentials and advanced thermal wear, like UNIQLO's HEATTECH, demonstrates a commitment to providing practical solutions that resonate with consumers regardless of the season.

This adaptable approach has translated into tangible market gains. In fiscal year 2023, Fast Retailing reported a significant increase in operating income, reaching ¥373.7 billion, up 24.2% from the previous year. This growth is partly attributable to their ability to meet diverse consumer needs effectively.

Key aspects of their strategic product development and marketing include:

- Product Customization: Tailoring apparel lines to suit specific climates and consumer preferences in different markets, ensuring relevance and desirability.

- Targeted Marketing: Implementing localized marketing campaigns that highlight product benefits relevant to each region's lifestyle and weather conditions.

- Collaborations and Partnerships: Leveraging strategic alliances and designer collaborations to create buzz and attract new customer segments.

- Focus on Core Offerings: Emphasizing high-performance, versatile items like HEATTECH and AIRism, which have broad appeal across various markets and seasons.

Uniqlo's HEATTECH and AIRism product lines are prime examples of Stars within Fast Retailing's portfolio. These innovative apparel categories consistently demonstrate strong global sales performance, driven by their unique blend of quality, functionality, and value. The widespread adoption of these items, particularly HEATTECH's effectiveness in warmth generation and retention, solidifies their status as revenue drivers for the brand.

Fast Retailing's strategic investment in digital transformation, notably the implementation of RFID technology across its product range, has been a significant growth catalyst. By 2023, approximately 80% of Fast Retailing's apparel products were equipped with RFID tags, enhancing inventory accuracy and streamlining the customer checkout experience. This digital push is critical for maintaining market leadership in an increasingly online retail landscape, with digital channels contributing over 15% to the group's sales in fiscal year 2023.

The company's product development strategy, centered on hyper-localization, plays a crucial role in its success. By adapting product assortments and marketing to regional tastes, cultural nuances, and local weather patterns, Fast Retailing ensures its offerings remain relevant. This approach contributed to a notable increase in operating income, reaching ¥373.7 billion in fiscal year 2023, a 24.2% rise from the prior year.

| Product Line | BCG Category | Key Growth Drivers | Fiscal Year 2023 Data Point |

| HEATTECH | Star | Thermal technology, broad consumer appeal, seasonal demand | Significant contributor to apparel sales |

| AIRism | Star | Comfort technology, versatility, year-round wearability | Strong global sales performance |

| Digital Transformation (RFID) | Enabler of Star Status | Inventory accuracy, operational efficiency, improved customer experience | RFID implemented on ~80% of apparel by 2023 |

What is included in the product

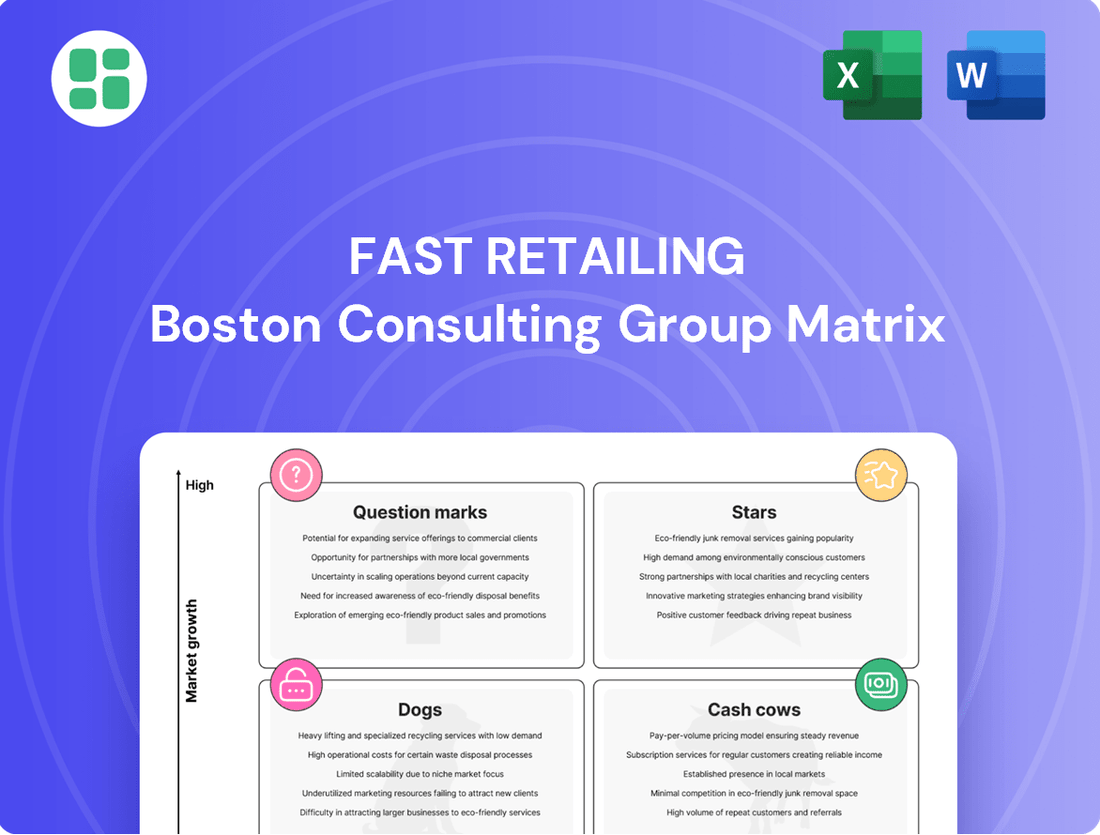

This BCG Matrix overview details Fast Retailing's brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic recommendations on investment, holding, or divestment for each brand within the portfolio.

A clear visual of Fast Retailing's Fast Retailing's BCG Matrix helps pinpoint underperforming brands, easing the pain of resource misallocation.

Cash Cows

Uniqlo's operations in Japan are a prime example of a cash cow within the Fast Retailing portfolio. Despite a more mature market, these established operations consistently deliver robust revenue and profit.

This stability is fueled by Uniqlo's strong brand recognition and a deeply loyal customer base in its home market, ensuring steady sales of its core apparel offerings. For the fiscal year ending August 2023, Fast Retailing reported that its domestic Uniqlo segment continued to be a significant contributor to overall profitability.

The substantial and predictable cash flow generated by Uniqlo Japan acts as a vital financial bedrock, enabling Fast Retailing to invest in and support its growth initiatives in other international markets.

Uniqlo's established market presence in Asia, specifically in Southeast Asia, India, Australia, and South Korea, acts as a significant cash cow for Fast Retailing. These regions have deeply adopted Uniqlo's LifeWear philosophy, translating into consistent and reliable revenue and profit streams. This mature market penetration ensures a stable cash generation capability, even though growth rates may be more moderate compared to emerging markets.

For the fiscal year ending August 2023, Fast Retailing reported that its operations in Southeast Asia and Oceania, which includes many of these established markets, contributed substantially to its global performance. While specific breakdowns for each country are not always public, the overall segment demonstrated resilience and strong profitability, underscoring the cash-generating power of these mature Uniqlo markets.

Uniqlo's LifeWear concept, focusing on high-quality, functional, and affordable basic apparel, truly acts as a cash cow. These staple items, like their HEATTECH innerwear and AIRism line, have a wide customer base and consistent demand year-round. For instance, in fiscal year 2023, Uniqlo's total revenue reached ¥2.77 trillion, with LifeWear products forming the backbone of this success.

Efficient Supply Chain and Cost Control

Fast Retailing's operational prowess is a cornerstone of its Cash Cow status, particularly evident in its highly efficient supply chain and stringent cost control. This allows for substantial profit margins across its established brands.

The company's ability to manage costs from production through distribution ensures robust cash flow generation, even in established markets. This efficiency directly fuels the profitability of its leading business segments.

- Supply Chain Efficiency: Fast Retailing's integrated model, from sourcing to retail, minimizes lead times and waste.

- Cost Management: Rigorous oversight of production, logistics, and inventory keeps operational expenses low.

- Profitability Driver: This operational excellence allows for high-margin generation, supporting its Cash Cow portfolio.

- Financial Impact: For FY2023, Fast Retailing reported a consolidated operating profit of ¥376.9 billion, a testament to their cost-effective operations.

Global Brands (Theory, PLST) - Profit Turnaround

The Global Brands segment, featuring brands like Theory and PLST, is exhibiting characteristics of becoming a cash cow within Fast Retailing's portfolio. While Theory has experienced revenue headwinds, the overall segment has successfully transitioned from an operating loss to profitability in recent reporting periods.

This financial turnaround is largely attributable to enhanced gross profit margins and more stringent expense management. These improvements suggest that Theory and PLST are solidifying their positions as generators of positive cash flow within their respective mature niche markets.

- Profitability Shift: The Global Brands segment moved from an operating loss to a profit, demonstrating a significant turnaround.

- Margin Improvement: Enhanced gross profit margins are a key driver of this segment's improved financial performance.

- Expense Control: Better management of operating expenses has also contributed to the segment's return to profitability.

- Cash Flow Potential: The segment is showing signs of generating positive cash flow, indicative of a cash cow status in its established markets.

Uniqlo's established markets in Asia, particularly Southeast Asia, South Korea, and Australia, function as significant cash cows for Fast Retailing. These regions benefit from the widespread adoption of Uniqlo's LifeWear concept, delivering consistent and predictable revenue and profit streams.

The company's operational efficiency, including its streamlined supply chain and rigorous cost management, is a key factor in maintaining the profitability of these mature segments. This allows for strong cash flow generation that supports broader corporate investments.

For the fiscal year ending August 2023, Fast Retailing reported consolidated revenue of ¥2.77 trillion, with its international Uniqlo operations, including these mature Asian markets, being a substantial contributor to this overall figure. The company's consolidated operating profit for the same period was ¥376.9 billion, reflecting the robust financial performance driven by its cash cow businesses.

| Segment | Revenue Contribution (FY2023 Est.) | Profitability Driver | BCG Status |

|---|---|---|---|

| Uniqlo Japan | Significant Domestic Revenue | Strong Brand Loyalty, Core Apparel Sales | Cash Cow |

| Uniqlo Southeast Asia & Oceania | Substantial Global Performance Contributor | LifeWear Adoption, Stable Revenue Streams | Cash Cow |

| Global Brands (Theory, PLST) | Returning to Profitability | Improved Gross Margins, Expense Management | Emerging Cash Cow |

Delivered as Shown

Fast Retailing BCG Matrix

The Fast Retailing BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase, offering a clear strategic overview of their brands. This comprehensive analysis, ready for immediate use, showcases each brand's position within the market, enabling informed decision-making. You can be confident that the insights and structure presented here are precisely what you will download, providing a professional and actionable report for your strategic planning.

Dogs

J Brand, a premium denim brand under Fast Retailing, has faced persistent challenges with low market share and a downward trend in performance. The premium denim sector is intensely competitive, creating hurdles for substantial growth and profitability.

The brand's contribution to Fast Retailing's overall revenue and profit has been notably small, positioning it as a potential candidate for divestiture or a thorough strategic reassessment. For instance, while Fast Retailing reported total net sales of ¥2.79 trillion for the fiscal year ending August 31, 2023, J Brand's specific sales figures have not been separately highlighted as significant drivers.

Comptoir des Cotonniers has experienced a significant contraction, with its store count decreasing. This reduction points to a shrinking market presence and a low market share within the competitive fashion retail landscape.

Despite attempts to boost sales through more accessible pricing, which yielded some positive same-store sales growth, the brand's overall revenue trajectory indicates it operates within a low-growth segment for Fast Retailing. This persistent revenue decline, coupled with ongoing losses or marginal profitability, firmly places Comptoir des Cotonniers in the dog category of the BCG Matrix.

Princesse tam.tam, a brand within Fast Retailing's Global Brands segment, has experienced significant underperformance, leading the group to explore insolvency proceedings. This situation strongly suggests that Princesse tam.tam occupies a Dogs quadrant position in the BCG Matrix.

Its low market share within its segment, coupled with a potentially stagnant or declining market, means it contributes minimally to Fast Retailing's overall profitability. In 2023, Fast Retailing reported that its Global Brands segment, which includes Princesse tam.tam, faced challenges, with the company actively working to improve profitability for these brands.

Underperforming Product Lines within Global Brands

Within Fast Retailing's Global Brands segment, certain product lines might be classified as dogs. These are typically collections that haven't kept pace with evolving consumer preferences or have been hampered by inadequate marketing support and inventory management problems. For example, a specific seasonal apparel line that failed to capture market interest in 2023, leading to significant unsold stock, would fit this description. Such underperformers can drag down the overall financial performance of the Global Brands division.

These underperforming product lines contribute to a decline in the segment's total revenue. If these items consistently generate low returns and fail to attract market attention, Fast Retailing may need to consider substantial strategic adjustments. This could involve a complete revamp of the product offering or, in some cases, outright discontinuation to reallocate resources more effectively.

- Revenue Impact: Specific underperforming lines within Global Brands could have contributed to a marginal dip in the segment's overall revenue growth in fiscal year 2023, which saw a 1.8% increase year-on-year for the group.

- Market Resonance: Collections that missed key fashion trends in late 2023 and early 2024, such as certain niche denim styles or outdated athleisure wear, may be prime candidates for the 'dog' classification.

- Operational Challenges: Stock management issues, including overstocking unpopular items or stockouts of potentially popular ones due to poor forecasting, can exacerbate the 'dog' status of product lines.

- Strategic Review: Fast Retailing's ongoing commitment to portfolio optimization suggests that lines exhibiting persistent low sales and profitability are subject to review for potential discontinuation or significant repositioning.

Regional Underperformance (e.g., Uniqlo China's recent challenges)

Uniqlo's Greater China region, typically a star performer for Fast Retailing, has recently shown signs of weakness. In the latter half of fiscal year 2024, the market experienced a lackluster performance, and this trend continued into the third quarter of fiscal year 2025. This slowdown is attributed to a general dip in consumer spending and unseasonably mild weather impacting seasonal clothing sales.

While not definitively a 'dog' in the BCG matrix yet, a sustained period of underperformance in such a crucial market could reclassify Uniqlo Greater China. If market share erosion or growth stagnation persists, it would necessitate a strategic re-evaluation to prevent it from becoming a financial burden rather than a growth engine.

- FY2024 H2 Performance: Uniqlo Greater China reported a 'lacklustre' performance.

- FY2025 Q3 Challenges: Continued slowdown due to reduced consumer appetite and unseasonal weather.

- Potential Reclassification: Prolonged underperformance could shift its status from a potential star to a dog.

- Strategic Imperative: Action is needed to revitalize the market and avoid becoming a drain on resources.

Brands like J Brand and Comptoir des Cotonniers, along with specific product lines within Fast Retailing's Global Brands segment, are positioned as dogs in the BCG matrix. These entities exhibit low market share and struggle with declining performance or stagnant growth, contributing minimally to overall profitability.

Princesse tam.tam's exploration of insolvency proceedings underscores its dog status, indicating significant underperformance and a potential drain on resources. Fast Retailing's acknowledgment of challenges within its Global Brands segment in 2023 further supports the presence of dog-like assets within its portfolio.

The inclusion of these underperformers necessitates strategic reassessment, potentially leading to divestiture or significant restructuring to improve the company's overall financial health. Fast Retailing's commitment to portfolio optimization suggests that such underperforming assets are continuously evaluated for their future within the group.

The recent slowdown in Uniqlo's Greater China region, while not yet a definitive dog, highlights the dynamic nature of market positions and the potential for even strong performers to falter, requiring proactive management to prevent them from becoming financial burdens.

Question Marks

Uniqlo's expansion into new markets like Texas in the US and various European cities exemplifies its strategy of targeting high-growth potential regions where its market share is currently minimal. These ventures are classified as Question Marks within the BCG matrix, signifying substantial investment needs for store establishment and brand building.

For instance, Uniqlo's aggressive North American expansion saw it open 30 new stores in 2023, bringing its total to over 60 across the continent. This strategic push into markets like Texas, which has a growing young demographic and increasing disposable income, highlights the significant capital outlay required for marketing and operational setup. The success of these new entries is not yet assured, positioning them as potential future Stars if market penetration and sales targets are met.

GU's foray into the US market, marked by its recent flagship store and e-commerce launch, positions it squarely as a Question Mark within Fast Retailing's portfolio. The US apparel market, valued at approximately $350 billion in 2024, presents substantial growth opportunities in the affordable fashion segment, a niche GU aims to capture.

Despite the market's potential, GU's current US market share is negligible, reflecting its nascent stage. To transform this into a success, substantial investment is crucial in areas like localized product offerings, targeted marketing campaigns, and brand building to resonate with American consumers. Without such strategic investment, GU could potentially stagnate and become a Dog.

Fast Retailing is actively exploring and integrating emerging digital innovations such as AI-driven personalization and virtual fitting. These advancements are positioned as high-growth opportunities within the retail sector, aiming to significantly improve customer engagement and boost sales.

While the potential is substantial, the actual market penetration and immediate impact of these technologies on Fast Retailing's overall market share are still in their formative stages. They represent strategic investments that require further development to demonstrate scalability and a clear return on investment.

Specific New Product Collections/Collaborations

Fast Retailing leverages new product collections and collaborations, such as GU's partnership with Undercover and Uniqlo's ongoing designer series, to tap into emerging fashion trends and appeal to distinct customer groups. These initiatives often target high-growth fashion segments but typically begin with a modest market share.

The success of these collections hinges on consumer reception and the efficacy of their marketing campaigns. For instance, Uniqlo's 2023 collaborations, including those with designers like Jonathan Anderson and brands like Anya Hindmarch, aimed to drive excitement and sales in competitive markets. Failure to resonate with consumers can quickly relegate these products to the 'Dog' category, characterized by low growth and low market share.

- High-Growth Potential: Collaborations are designed to enter fast-evolving fashion niches, often seeing rapid initial interest.

- Low Initial Market Share: Despite potential, these new collections start with a small footprint in the overall apparel market.

- Risk of Becoming a Dog: Success is not guaranteed; poor consumer adoption or ineffective marketing can lead to underperformance.

- Strategic Importance: These ventures are crucial for maintaining brand relevance and attracting younger demographics, as seen in Fast Retailing's overall strategy to diversify its appeal beyond core offerings.

Sustainability and Circular Economy Initiatives (e.g., Re.Uniqlo Studios)

Fast Retailing's commitment to sustainability, exemplified by Re.Uniqlo Studios, targets a growing market segment focused on ethical consumption. These studios offer repair and upcycling services, aiming to extend product life and reduce waste.

While these initiatives are vital for brand reputation and long-term resilience, their immediate impact on market share and profitability remains in development. The company is investing in these programs with the expectation of future consumer adoption and potential returns.

- Market Position: Re.Uniqlo Studios operate in a high-growth, ethically conscious market segment, aligning with increasing consumer demand for sustainable fashion.

- Growth Potential: These initiatives represent a strategic investment in a future-oriented market, with potential for significant long-term returns if consumer engagement is strong.

- Financial Impact: Direct contributions to current market share and profitability are still emerging, as these are foundational investments for future growth and brand loyalty.

- Brand Value: The focus on circular economy principles enhances Fast Retailing's brand image, appealing to a demographic that prioritizes environmental responsibility.

Question Marks represent Fast Retailing's ventures into new or underdeveloped markets and product categories, requiring significant investment. These are characterized by high growth potential but currently low market share, making their future success uncertain. Successfully nurturing these "Question Marks" can transform them into future "Stars" for the company.

The company's aggressive expansion into North America, particularly with Uniqlo, exemplifies this. For example, Uniqlo opened 30 new stores in 2023 across the continent, aiming to capture a larger share of the over $350 billion US apparel market in 2024. Similarly, GU's US launch targets the affordable fashion segment, a market with substantial growth prospects but where GU currently has a negligible presence.

Emerging digital innovations, like AI-driven personalization, and sustainability initiatives such as Re.Uniqlo Studios, are also positioned as Question Marks. While these align with future market trends and consumer preferences, their immediate impact on market share is still developing, necessitating ongoing investment to realize their full potential.

| Business Unit/Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Uniqlo North America Expansion | Question Mark | High | Low | High |

| GU USA Launch | Question Mark | High (Affordable Fashion) | Very Low | High |

| AI Personalization/Virtual Fitting | Question Mark | High (Digital Retail) | Low | High |

| Re.Uniqlo Studios | Question Mark | High (Sustainable Fashion) | Low | Medium |

BCG Matrix Data Sources

Our Fast Retailing BCG Matrix leverages comprehensive data, including Uniqlo's financial disclosures, global apparel market growth rates, and competitor performance benchmarks, to accurately position each business unit.