Fast Retailing Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

Unlock the strategic genius behind Fast Retailing's global success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they masterfully connect with their diverse customer segments and build powerful value propositions. Dive into the core activities and key resources that drive their innovation and efficiency.

Partnerships

Fast Retailing cultivates vital alliances with premier material manufacturers worldwide, notably with Toray Group. This collaboration is instrumental in sourcing advanced textiles like HEATTECH and AIRism, which are foundational to Uniqlo's distinctive product offerings and competitive edge.

These strategic supplier relationships are designed for mutual benefit, ensuring a consistent supply of premium, performance-driven fabrics. For instance, Toray's expertise in material science directly translates into Uniqlo's ability to deliver innovative apparel that resonates with consumers seeking comfort and functionality.

The company's commitment extends to ethical sourcing, with regular assessments of spinning mills to uphold responsible and sustainable manufacturing standards. This diligence in supply chain management reinforces Fast Retailing's dedication to corporate social responsibility and brand integrity.

Fast Retailing partners with a vast global network of garment factories, a crucial element for its efficient production. In 2024, the company continued to emphasize close monitoring of these partners to ensure adherence to its Code of Conduct for Production Partners, which covers labor and environmental standards.

These manufacturing relationships are fundamental to maintaining consistent quality and enabling the large-scale production required for Fast Retailing's brands like UNIQLO and GU. The company actively engages with factories to foster improvements in human rights and environmental protection throughout its supply chain.

Fast Retailing collaborates with key logistics providers to ensure its vast global supply chain operates smoothly, a critical component for a company with operations in numerous countries. These partnerships are vital for managing inventory and timely delivery, especially as the company expands its reach.

Investments in technology, such as automated warehouses, highlight a strategic focus on efficiency. For instance, their adoption of RFID technology has been instrumental in streamlining inventory management, contributing to a more responsive and accurate stock system. This directly supports their aim of meeting customer demand precisely when and where it arises.

Retail Space and Real Estate Developers

Fast Retailing’s aggressive global expansion, especially for Uniqlo in North America and Europe, hinges on strong relationships with retail space providers and real estate developers. These partnerships are crucial for securing prime locations that support the company's strategy of establishing large-format and flagship stores. For instance, in 2023, Uniqlo continued its North American growth, opening new stores in key metropolitan areas, often in high-traffic shopping districts identified through developer collaborations.

The company prioritizes securing premium real estate to bolster brand visibility and offer an enhanced customer experience. This involves not only new store openings but also a strategic approach to optimizing its existing physical presence, sometimes referred to as a 'scrap and build' policy. This policy ensures that stores are in the most advantageous locations and formats, reflecting market demand and brand positioning. In fiscal year 2023, Fast Retailing reported a significant increase in store count in North America, underscoring the importance of these real estate partnerships.

- Securing Prime Locations: Partnerships with real estate developers are vital for Fast Retailing to acquire high-visibility, high-traffic retail spaces, particularly for Uniqlo's expansion in North America and Europe.

- Flagship Store Strategy: Developers facilitate access to suitable properties for large-format and flagship stores, which are key to enhancing brand presence and customer experience.

- 'Scrap and Build' Policy: Collaborations with landlords enable the optimization of the existing store network through strategic closures and openings in better-suited locations.

- 2023 Expansion Data: Fast Retailing's continued investment in physical retail in 2023, marked by new store openings in key international markets, highlights the critical role of real estate developer alliances.

Designers and Brand Collaborators

Uniqlo's strategic alliances with prominent designers, artists, and global brands, including Disney and Star Wars, are crucial. These collaborations, such as the ongoing partnership with tennis legend Roger Federer, create unique product lines that significantly boost sales and elevate brand desirability. These exclusive collections not only attract new customer segments but also reinforce Uniqlo's position as a relevant player in the dynamic fashion landscape.

These designer and brand collaborations are a cornerstone of Uniqlo's marketing playbook. For instance, the UT (Uniqlo T-shirt) line consistently features partnerships with a wide array of cultural icons and intellectual properties, ensuring continuous buzz and consumer engagement. This strategy allows Uniqlo to tap into existing fan bases and generate excitement around limited-edition releases, a tactic that proved particularly effective in 2023 with several high-profile collections selling out rapidly.

- Designer Collaborations: Uniqlo partners with established and emerging designers to create limited-edition collections, driving both sales and brand prestige.

- Brand Alliances: Collaborations with major entertainment franchises like Disney and Star Wars, and cultural figures like Roger Federer, expand Uniqlo's reach and appeal.

- Marketing Impact: These partnerships generate significant media attention and social media engagement, enhancing brand relevance and attracting diverse customer demographics.

- Sales Driver: Exclusive collections from these collaborations are proven sales catalysts, often leading to sell-out events and increased foot traffic and online orders.

Fast Retailing's key partnerships extend to technology providers, crucial for optimizing operations. The company leverages collaborations for advancements in areas like AI and data analytics to enhance customer experience and supply chain efficiency. For example, their investment in RFID technology has been instrumental in streamlining inventory management, contributing to a more responsive and accurate stock system, as seen in their 2024 operational updates.

What is included in the product

This Business Model Canvas outlines Fast Retailing's strategy of offering high-quality, affordable casual wear through a vertically integrated model, focusing on efficient supply chains and private label brands like UNIQLO.

It details customer segments, value propositions, and channels, reflecting real-world operations and plans for global expansion.

Fast Retailing's Business Model Canvas offers a clear, actionable framework to pinpoint and alleviate operational inefficiencies and market misalignments.

It provides a structured approach to identify and address the core challenges within Fast Retailing's value chain, streamlining operations and enhancing customer satisfaction.

Activities

Fast Retailing dedicates significant resources to the design and development of its apparel, emphasizing quality, functionality, and innovation. This commitment is evident in their ongoing research into advanced fabric technologies like HeatTech and AIRism, which have become signature offerings.

The company's merchandising team is crucial, meticulously planning product assortments and quantities. They collaborate closely with research and development and production units to finalize designs and material choices for each upcoming season, ensuring alignment across the value chain.

Fast Retailing manages a vast global manufacturing and supply chain, crucial for getting its apparel to customers efficiently. This intricate network spans from sourcing raw materials to the final product on the shelf, emphasizing timely delivery. In 2024, the company continued its focus on optimizing these operations to meet demand effectively.

A significant aspect of their supply chain management is a commitment to sustainability and ethical practices. Fast Retailing actively monitors its partner factories, ensuring adherence to human rights and environmental standards, a critical component for brand reputation and responsible business. This oversight is vital in an industry facing increasing scrutiny.

To bolster control and visibility, Fast Retailing heavily utilizes technology. The implementation of RFID tags, for instance, provides real-time tracking of inventory throughout the supply chain, from procurement to the point of sale. This technological integration is key to managing the sheer volume and complexity of their global operations, enabling better inventory management and reducing waste.

Managing its extensive global network of physical retail stores, from flagship locations to smaller roadside stores, is a crucial activity for Fast Retailing. This involves meticulous attention to store design, visual presentation, customer engagement, and efficient stock control.

Fast Retailing is actively growing its physical footprint, with a particular focus on high-potential markets such as North America and Europe. Simultaneously, the company is working to improve the performance of its current store portfolio.

In fiscal year 2023, Fast Retailing operated over 3,500 stores worldwide, with a significant portion of these being UNIQLO stores. The company aims to further enhance the customer experience in these physical spaces, integrating them with digital channels.

E-commerce and Digital Transformation

Fast Retailing is deeply invested in a digital consumer retailing transformation, integrating cutting-edge technologies across its operations. This strategic focus is evident in the management of its robust e-commerce platforms and mobile applications, designed to deliver seamless online shopping experiences. The company is actively employing AI and robotics to optimize logistics and elevate customer service, ensuring products reach consumers precisely when and where they are desired.

In fiscal year 2023, Fast Retailing reported significant growth in its digital sales channels, contributing substantially to its overall revenue. The company’s commitment to digital transformation is underscored by its ongoing investments in technology infrastructure and data analytics capabilities. For instance, its UNIQLO digital sales in Japan saw a notable increase, reflecting the success of its online strategy.

- E-commerce Platform Enhancement: Continuous improvement of user experience and functionality on global UNIQLO and GU websites and mobile apps.

- AI and Robotics Integration: Deployment in warehouses for efficient inventory management and in customer service for personalized interactions.

- Data-Driven Personalization: Utilizing customer data to offer tailored product recommendations and promotions, boosting engagement and sales.

- Omnichannel Strategy: Seamless integration of online and offline retail channels, allowing for services like click-and-collect and easy returns.

Marketing, Branding, and Customer Engagement

Fast Retailing’s marketing, branding, and customer engagement are aggressive, aiming to boost visibility and sales for brands like Uniqlo. This includes a mix of traditional advertising, digital outreach, and partnerships with influencers. For instance, Uniqlo’s 2024 marketing efforts continue to highlight product innovation and functional benefits, a strategy that has proven effective in building a dedicated global customer base.

The company leverages multi-channel advertising, from television commercials to online platforms, to reach a broad audience. Social media engagement and collaborations with key influencers are also critical components, amplifying brand messaging and fostering community around its products. These efforts are designed to reinforce Uniqlo's brand identity, which centers on quality, versatility, and affordability.

- Brand Visibility: Uniqlo consistently invests in advertising across TV, print, and digital channels to maintain a strong presence.

- Customer Loyalty: Social media engagement and influencer collaborations are key tactics for building and retaining a loyal customer following.

- Sustainability Messaging: Marketing campaigns increasingly emphasize Uniqlo's commitment to sustainability, appealing to environmentally conscious consumers.

- Product Focus: The brand’s marketing narrative consistently highlights product innovation, functionality, and value, resonating with its target demographic.

Fast Retailing's key activities encompass a vertically integrated approach, from innovative product design and development, exemplified by their HeatTech and AIRism technologies, to meticulous merchandising and seasonal planning.

They manage a complex global supply chain, prioritizing efficiency, sustainability, and ethical manufacturing practices, bolstered by extensive technology adoption like RFID for inventory tracking.

The company actively operates and expands its global retail network, focusing on enhancing in-store customer experiences and integrating physical stores with digital channels.

Furthermore, Fast Retailing is committed to digital transformation, optimizing e-commerce platforms, leveraging AI and robotics in logistics, and utilizing data for personalized customer engagement.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Product Design & Development | Creating innovative, functional, and high-quality apparel. | Ongoing research into advanced fabric technologies. |

| Supply Chain Management | Efficient global sourcing, manufacturing, and distribution. | Focus on optimization, sustainability, and ethical oversight. |

| Retail Operations | Managing a global network of physical stores. | Expansion in North America/Europe; enhancing in-store experience. Over 3,500 stores operated in FY2023. |

| Digital Transformation | Enhancing e-commerce and integrating digital with physical retail. | Investing in AI, robotics, and data analytics for personalized experiences and logistics. Significant growth in digital sales in FY2023. |

| Marketing & Branding | Building brand visibility and customer loyalty. | Multi-channel advertising, influencer collaborations, emphasizing product innovation and sustainability. Uniqlo's 2024 efforts highlight functional benefits. |

Delivered as Displayed

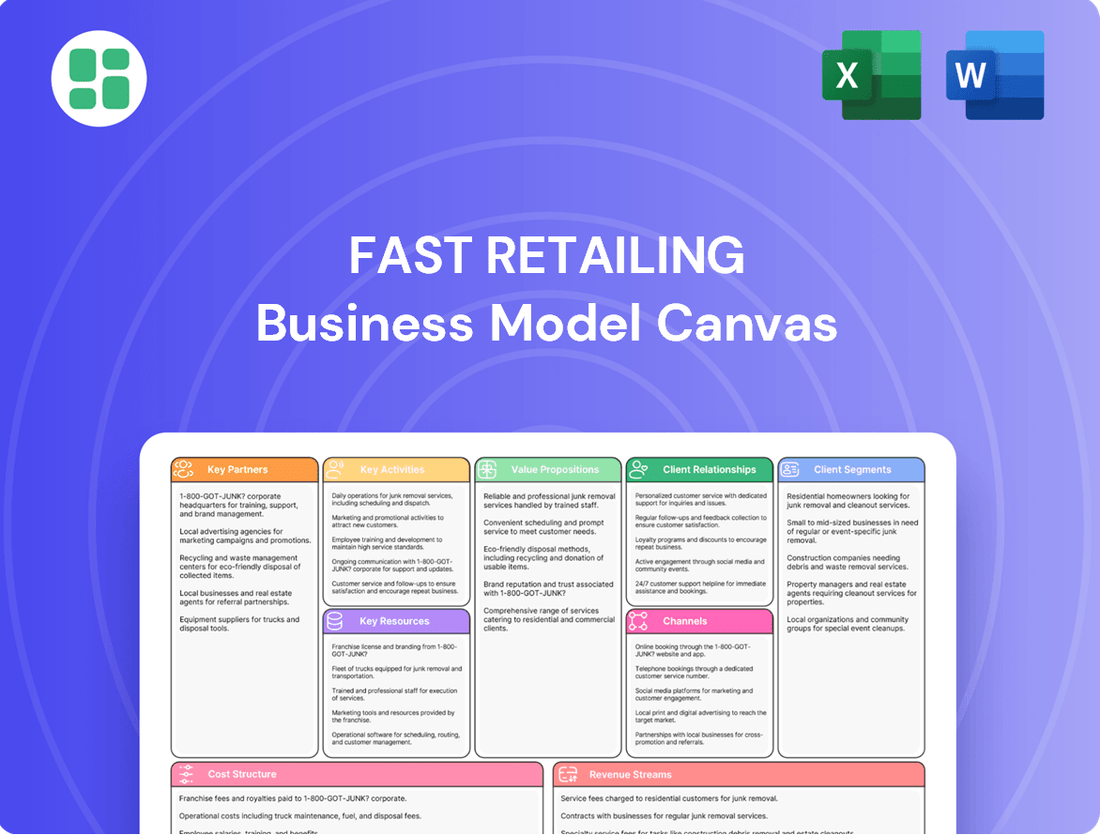

Business Model Canvas

This preview showcases the actual Fast Retailing Business Model Canvas that you will receive upon purchase. You're not seeing a mockup; this is a direct snapshot of the complete document, meticulously crafted to detail Fast Retailing's strategic framework. Once your order is complete, you'll gain full access to this identical, ready-to-use analysis.

Resources

Fast Retailing's brand portfolio is a cornerstone, anchored by the globally recognized Uniqlo. This is complemented by other significant brands like GU, Theory, PLST, and J Brand, each catering to different market segments and contributing to a robust market presence. In fiscal year 2023, Uniqlo alone generated approximately ¥2.4 trillion in revenue, highlighting its dominance within the group.

Crucial to Fast Retailing's competitive edge is its intellectual property, particularly its innovative fabric technologies. HeatTech and AIRism are prime examples, offering consumers unique benefits such as warmth retention and breathability. These proprietary technologies are not just product features; they are integral to the 'LifeWear' philosophy, which emphasizes functional, high-quality, everyday clothing.

Fast Retailing's global supply chain network is a cornerstone of its business model, enabling the efficient production and distribution of its apparel. This network spans raw material sourcing, manufacturing, and delivery, ensuring high-volume output and timely availability of products to customers worldwide. For instance, in fiscal year 2023, Fast Retailing continued to optimize its logistics, with a significant portion of its production handled by partner factories in Asia, leveraging their expertise and scale.

The company's commitment to an extensive and efficient global supply chain is evident in its strategic investments. These include fostering strong relationships with over 400 partner factories globally and implementing advanced logistics solutions, such as automated warehouses. This infrastructure is crucial for Fast Retailing's ability to offer high-quality clothing at affordable prices, maintaining a competitive edge in the fast-fashion market.

Fast Retailing's extensive physical retail store network, boasting over 2,500 Uniqlo locations worldwide, is a cornerstone of its business model. These stores, including prominent flagship and large-format outlets, are crucial for direct customer engagement and driving sales.

Strategically positioned in key urban centers and accessible residential zones, these retail spaces are vital for cultivating brand experience and fostering community connections. The company's continued investment in expanding this network, especially in growing markets like North America and Europe, highlights its enduring significance.

Digital and E-commerce Infrastructure

Fast Retailing's digital and e-commerce infrastructure is a cornerstone of its business, featuring company-owned websites and mobile apps that facilitate a direct-to-consumer approach. This robust digital backbone, supported by advanced IT systems such as RFID platforms, is crucial for delivering a seamless online shopping experience and optimizing inventory management.

The company's commitment to digital transformation is evident in its continuous efforts to enhance customer convenience and operational efficiency. For instance, in fiscal year 2023, Fast Retailing reported that its global digital sales accounted for approximately 10% of total sales, demonstrating the growing importance of its online channels.

- Company-Owned E-commerce Platforms: Direct control over online sales channels ensures brand consistency and customer data capture.

- Mobile Applications: Offering dedicated apps enhances customer engagement and provides personalized shopping experiences.

- RFID Technology: Implemented for efficient inventory tracking, reducing stockouts and improving supply chain visibility.

- Data Analytics: Leveraged to understand customer behavior, personalize offerings, and drive strategic decisions.

Human Capital and Expertise

Fast Retailing's human capital is a cornerstone of its success, encompassing a diverse range of talent from skilled designers and R&D specialists to adept supply chain professionals and frontline retail staff. This collective expertise is critical for driving product innovation, ensuring operational efficiency, and delivering a consistent, high-quality customer experience that underpins the UNIQLO brand.

The company actively invests in nurturing its workforce, fostering an environment where employees and managers are encouraged to internalize and embody Fast Retailing's core corporate philosophy. This focus on shared values and continuous development ensures that the human element remains a powerful competitive advantage.

- Design and Product Development: Fast Retailing employs numerous designers and product developers globally, contributing to the creation of innovative and functional apparel that resonates with a wide customer base.

- Supply Chain Management: Specialists in logistics and supply chain operations are vital for managing Fast Retailing's complex global network, ensuring timely production and distribution of goods.

- Retail Operations: The company's retail staff are trained to provide exceptional customer service, acting as brand ambassadors and crucial touchpoints for customer engagement.

- Global Management: Experienced international managers guide the company's expansion and adaptation to diverse market needs, demonstrating expertise in cross-cultural business practices.

Fast Retailing's key resources are its strong brand portfolio, led by Uniqlo, proprietary fabric technologies like HeatTech and AIRism, an extensive global supply chain, a vast physical retail presence, robust digital e-commerce platforms, and its skilled human capital. These elements collectively enable the company to deliver its LifeWear philosophy.

The company's intellectual property, particularly its innovative fabric technologies, serves as a significant differentiator. HeatTech and AIRism, for example, offer unique functional benefits, enhancing the value proposition of its apparel. These technologies are central to Fast Retailing's strategy of providing high-quality, functional clothing.

Fast Retailing's global supply chain and extensive retail network are critical operational assets. The company manages over 400 partner factories and maintains more than 2,500 Uniqlo stores worldwide, ensuring efficient production and widespread customer access. In fiscal year 2023, this infrastructure supported global operations and continued expansion.

The company’s digital infrastructure, including its e-commerce sites and mobile apps, is increasingly vital. In fiscal year 2023, digital sales represented about 10% of total revenue, underscoring the importance of these channels for customer engagement and sales growth. The use of RFID technology further optimizes inventory management and supply chain visibility.

| Key Resource | Description | Fiscal Year 2023 Impact/Data |

|---|---|---|

| Brand Portfolio | Globally recognized brands, primarily Uniqlo, supported by GU, Theory, PLST, and J Brand. | Uniqlo revenue: approx. ¥2.4 trillion. |

| Intellectual Property | Proprietary fabric technologies like HeatTech and AIRism. | Integral to the LifeWear philosophy, enhancing product differentiation. |

| Global Supply Chain | Extensive network for sourcing, manufacturing, and distribution. | Leverages over 400 partner factories, primarily in Asia, for high-volume output. |

| Physical Retail Network | Over 2,500 Uniqlo stores globally, including flagship locations. | Crucial for direct customer engagement and brand experience, with ongoing expansion in North America and Europe. |

| Digital Infrastructure | Company-owned e-commerce platforms and mobile apps, supported by RFID. | Digital sales accounted for approx. 10% of total sales in FY2023, enhancing customer convenience. |

| Human Capital | Diverse talent in design, R&D, supply chain, and retail operations. | Fosters innovation and operational efficiency, with a focus on shared corporate philosophy and employee development. |

Value Propositions

Fast Retailing's commitment to high-quality, functional, and innovative clothing is a cornerstone of its business model. Their proprietary technologies, such as HeatTech and AIRism, offer tangible benefits like warmth and breathability, directly addressing customer needs for comfort in various conditions. This focus on practical innovation ensures their apparel is not just fashionable but also highly useful.

The 'LifeWear' philosophy perfectly encapsulates this value proposition, highlighting clothing designed to enhance everyday life. By prioritizing simple, durable, and high-quality designs, Fast Retailing creates garments that are built to last, reducing the need for frequent replacements and appealing to a growing consumer desire for sustainability. For instance, in fiscal year 2023, UNIQLO, Fast Retailing's flagship brand, saw strong performance driven by these core product strengths.

Fast Retailing's core value proposition centers on delivering high-quality, functional clothing at prices that are accessible to a wide range of consumers globally. This commitment to value-for-money resonates strongly with individuals who prioritize practicality and durability in their apparel choices, seeking reliable items without the premium price tag.

The company's strategy of focusing on essential, timeless pieces rather than fast-changing fashion trends is key to maintaining this affordability. For instance, in fiscal year 2023, UNIQLO, Fast Retailing's flagship brand, continued to emphasize its LifeWear concept, which underscores the creation of clothing designed to improve the lives of wearers, directly supporting the accessible and functional fashion promise.

Uniqlo's commitment to timeless and versatile designs is a cornerstone of its value proposition. Their clothing, characterized by basic styles, seamlessly integrates into any wardrobe, offering enduring appeal beyond fleeting fashion trends. This approach resonates with consumers seeking practical, long-lasting apparel.

This philosophy empowers customers by providing foundational pieces that facilitate personal style expression. For instance, Uniqlo's LifeWear concept, emphasizing everyday comfort and functionality, saw strong performance in fiscal year 2023, contributing to Fast Retailing's overall revenue growth.

Customer-Centric Product Development

Fast Retailing's product development is deeply rooted in understanding its customers. They actively gather feedback and monitor market trends to ensure their offerings resonate with what people actually want and need.

This customer-centric philosophy means they are constantly refining existing products and creating new ones based on direct consumer input. For example, in fiscal year 2023, UNIQLO, a key brand under Fast Retailing, continued to emphasize product innovation driven by customer insights, leading to popular items like their HEATTECH range which sees iterative improvements year-on-year based on user wearability feedback.

This focus on customer demand builds a strong bond, fostering loyalty by consistently delivering products that meet specific preferences.

Key aspects of this value proposition include:

- Direct Customer Feedback Integration: Incorporating user reviews and direct comments into product design cycles.

- Market Trend Responsiveness: Swiftly adapting product lines to emerging fashion and lifestyle demands.

- Product Improvement Cycles: Continuously enhancing existing products based on performance and customer satisfaction data.

- New Product Innovation: Developing novel items that address identified gaps in consumer needs.

Sustainable and Responsible Fashion Choices

Fast Retailing increasingly highlights sustainability in its products and operations, resonating with consumers who prioritize environmental impact. This focus includes the expanded use of recycled materials and efforts to minimize waste throughout the production cycle.

The company's commitment extends to ethical sourcing, ensuring fair labor practices and human rights within its extensive supply chain. For instance, by 2023, Uniqlo had increased its use of recycled polyester to over 50% for its fleece products, a significant step towards reducing reliance on virgin materials.

- Sustainable Materials: Continued expansion of recycled polyester and organic cotton in product lines.

- Waste Reduction: Initiatives like the 'Re.Uniqlo' program to collect and recycle used garments.

- Ethical Supply Chain: Ongoing audits and partnerships to uphold human rights and fair labor standards.

- Environmental Impact: Targets set for reducing carbon emissions and water usage in manufacturing processes.

Fast Retailing's value proposition is built on offering high-quality, functional, and innovative clothing that enhances everyday life, known as LifeWear. This approach emphasizes durability, timeless design, and affordability, making well-made apparel accessible to a broad global customer base.

The company's success in fiscal year 2023, with UNIQLO driving significant growth, underscores the appeal of its LifeWear philosophy. This strategy focuses on creating essential, versatile pieces that offer lasting value and comfort, directly addressing consumer demand for practical and reliable clothing.

By integrating customer feedback into product development and focusing on continuous improvement, Fast Retailing ensures its offerings align with evolving consumer needs and preferences. This customer-centric model, exemplified by iterative enhancements to popular lines like HEATTECH, fosters strong brand loyalty.

Sustainability is also a growing component, with increased use of recycled materials and ethical sourcing practices. For instance, by 2023, UNIQLO had achieved over 50% recycled polyester usage in its fleece products, reflecting a commitment to environmental responsibility.

| Value Proposition Aspect | Description | Key Initiatives/Data (FY2023) |

|---|---|---|

| LifeWear Philosophy | High-quality, functional, innovative clothing for everyday life. | UNIQLO's continued focus on comfort, durability, and timeless design. |

| Accessibility & Value | Offering well-made apparel at affordable global prices. | Strong performance of UNIQLO in FY2023, driven by value-for-money appeal. |

| Customer-Centricity | Product development driven by customer feedback and market responsiveness. | Iterative improvements to products like HEATTECH based on user wearability feedback. |

| Sustainability | Commitment to environmental responsibility and ethical sourcing. | Over 50% recycled polyester in fleece products; Re.Uniqlo garment recycling program. |

Customer Relationships

Fast Retailing cultivates direct-to-consumer relationships through its vast network of physical stores and sophisticated online presence. This approach allows for immediate customer feedback and personalized engagement, building a strong brand connection. For instance, in fiscal year 2023, Fast Retailing's global store count reached over 3,600, with its e-commerce sales continuing to grow significantly, demonstrating the reach of its direct engagement strategy.

Fast Retailing, through its Uniqlo brand, cultivates customer loyalty via robust programs designed to reward repeat business and foster engagement. These initiatives are key to building a dedicated customer base.

For instance, Uniqlo's membership program offers exclusive benefits, encouraging continued patronage. The company also invests in community building, creating a sense of belonging that strengthens the emotional connection customers have with the brand.

In 2024, Uniqlo continued to expand its digital presence, integrating loyalty features into its app to streamline the customer experience and gather valuable data for personalized engagement, further solidifying customer relationships.

Fast Retailing champions an omnichannel approach, ensuring a unified brand experience whether customers interact online or in physical stores. This seamless integration allows for flexible shopping, from browsing on a mobile app to trying on items in a UNIQLO store, and even utilizing click-and-collect services.

This strategy enhances customer convenience and brand loyalty by offering consistent product information, pricing, and promotions across all channels. For instance, in 2023, UNIQLO reported strong digital sales growth, underscoring the effectiveness of its omnichannel investments in meeting evolving consumer preferences.

Digital and Social Media Engagement

Uniqlo actively uses digital and social media to connect with its customers. They share styling advice, highlight new products, and offer glimpses into their brand's story across platforms. This direct interaction helps build a strong connection.

The brand is known for its responsiveness on social media, engaging with customer comments and messages. This approach fosters a sense of community and generates excitement for upcoming releases and marketing initiatives. For instance, Uniqlo's Instagram engagement saw a significant increase in follower interaction during their 2024 Spring/Summer collection launch campaigns.

Email marketing plays a crucial role in their customer relationship strategy. Uniqlo utilizes email to inform customers about exclusive promotions and new arrivals, maintaining a consistent line of communication. In 2024, their email campaigns achieved an average open rate of 22%, driving traffic to their online store.

- Social Media Presence: Uniqlo maintains active profiles on platforms like Instagram, X (formerly Twitter), and Facebook, sharing engaging content daily.

- Direct Customer Interaction: The brand prioritizes responding to customer inquiries and feedback across all digital channels, aiming for quick and helpful replies.

- Email Marketing Campaigns: Targeted email newsletters are sent to subscribers, featuring new product announcements, sales, and personalized recommendations, with a focus on driving conversions.

- User-Generated Content: Uniqlo encourages customers to share their Uniqlo outfits using specific hashtags, amplifying brand visibility and fostering a sense of community.

In-Store Customer Service and Experience

Fast Retailing, the parent company of UNIQLO, leverages its physical stores as crucial touchpoints for customer engagement and brand immersion. These locations are designed not just for transactions, but to offer a tangible experience of the brand's commitment to functional and stylish apparel. In 2024, UNIQLO continued to emphasize this, with a focus on creating welcoming environments that encourage exploration and interaction with their diverse product lines.

The in-store experience is meticulously crafted to facilitate customer satisfaction. Staff are integral to this, undergoing training to provide attentive and helpful service. This personal interaction is a key differentiator, especially when contrasted with purely online shopping. The store layout itself prioritizes convenience, ensuring customers can easily navigate and access the wide array of clothing on offer.

- In-Store Engagement: Physical stores are primary hubs for customers to experience the UNIQLO brand and its product philosophy firsthand.

- Staff Training: Employees are equipped to deliver attentive customer service, enhancing the overall shopping journey.

- Store Environment: The design focuses on convenience and accessibility, allowing customers to easily discover and try on functional, stylish clothing.

- Omnichannel Synergy: This in-person experience complements digital channels, contributing to a holistic and satisfying customer relationship.

Fast Retailing prioritizes direct customer engagement through both its extensive physical store network and growing e-commerce platforms. This dual approach allows for immediate feedback and personalized interactions, fostering strong brand loyalty. In fiscal year 2023, the company operated over 3,600 stores globally, with digital sales showing robust growth, highlighting the effectiveness of their direct outreach.

The company cultivates loyalty through programs that reward repeat customers, such as Uniqlo's membership benefits, which encourage continued patronage and build a dedicated base. In 2024, Uniqlo enhanced its app with integrated loyalty features, streamlining the customer experience and enabling more personalized engagement through data utilization.

Fast Retailing employs an omnichannel strategy, ensuring a consistent brand experience across online and offline channels. This seamless integration, from app browsing to in-store experiences and click-and-collect services, enhances customer convenience and brand affinity. Uniqlo's strong digital sales growth in 2023 reflects the success of these omnichannel investments.

Uniqlo actively engages customers via social media and email marketing, sharing styling tips, new product information, and exclusive promotions to maintain consistent communication and drive conversions. For instance, in 2024, Uniqlo's email campaigns achieved an average open rate of 22%, effectively driving traffic to their online store.

Channels

Fast Retailing leverages an extensive global retail store network, with its flagship brand, Uniqlo, surpassing 2,500 stores worldwide by September 2024. This physical presence is crucial for brand visibility and direct customer interaction.

These stores are strategically situated in high-traffic urban centers and accessible residential zones across key markets in Asia, Europe, and North America. The company actively pursues expansion, targeting new territories and prime retail spaces to enhance its reach.

The retail stores function not only as sales channels but also as vital touchpoints for customer engagement and brand experience. They are instrumental in Fast Retailing's strategy to connect with consumers and drive brand loyalty.

Company-owned e-commerce websites, such as Uniqlo's official online store, are vital direct-to-consumer channels for Fast Retailing. These platforms provide an extensive product selection, a user-friendly shopping experience, and secure transaction capabilities, forming a cornerstone of the company's digital growth strategy.

These digital storefronts are instrumental in driving online sales, which have experienced substantial increases. For instance, Fast Retailing reported a significant surge in digital sales for fiscal year 2023, reflecting the growing importance of these channels in reaching a broader customer base and enhancing convenience.

Fast Retailing's dedicated mobile applications serve as a crucial touchpoint, offering customers a convenient and personalized digital shopping experience. These apps provide direct access to product catalogs, exclusive promotions, and tailored content, fostering deeper engagement.

By integrating loyalty programs and ensuring a seamless user interface, these mobile platforms cater to the on-the-go consumer. In 2024, Fast Retailing continued to leverage these apps to drive online sales and enhance customer retention, with mobile commerce representing a significant portion of their digital revenue.

Social Media Platforms

Social media platforms like Instagram and X (formerly Twitter) are integral to Fast Retailing's strategy, especially for brands like Uniqlo. These channels are used not just for marketing but also for direct customer engagement. In 2024, Uniqlo continued to leverage these platforms to share interactive content, styling advice, and updates on new arrivals, effectively building a community around the brand and boosting awareness.

These digital avenues are crucial for expanding reach and generating excitement for new collections and marketing campaigns. For instance, Uniqlo's Instagram presence often features user-generated content and influencer collaborations, amplifying their message. By the end of 2023, Uniqlo reported a significant increase in social media engagement, with millions of followers across its global accounts, underscoring the effectiveness of this outreach.

- Instagram and X (Twitter) are key for marketing and customer interaction.

- Uniqlo shares styling tips, product news, and interactive content to build community.

- These platforms are vital for brand awareness and generating buzz around new releases.

- Social media engagement is a significant driver for reaching a wider, global audience.

Pop-up Stores and Experiential Retail

Pop-up stores and experiential retail events serve as dynamic channels for Fast Retailing, allowing them to generate buzz around new collections and test emerging markets. These temporary installations offer a unique avenue for customers to engage directly with the LifeWear concept, fostering deeper brand connection. For instance, in 2023, many apparel brands saw significant ROI from well-executed pop-ups, with some reporting a 20-30% increase in immediate sales during the pop-up period.

These experiential activations are crucial for creating memorable brand interactions and can be particularly effective in cities where Fast Retailing may not have a permanent large-scale presence. They allow for a more intimate and curated customer experience, which is vital for communicating the quality and philosophy behind their products. The global experiential marketing market was valued at over $50 billion in 2023, highlighting the growing importance of such channels.

- Market Testing: Pop-ups provide a low-risk way to gauge customer response to new product lines or store concepts in specific geographic areas.

- Brand Engagement: Experiential events create memorable interactions, reinforcing the brand's values and encouraging social media sharing.

- Sales Generation: While temporary, these channels can drive significant short-term sales and attract new customer segments.

- Collection Launches: Pop-ups are ideal for creating excitement and exclusivity around the introduction of seasonal or limited-edition collections.

Fast Retailing utilizes a multi-channel approach, blending physical retail with robust digital platforms. This integrated strategy aims to maximize customer reach and engagement across various touchpoints. The company's extensive store network, particularly Uniqlo's global presence exceeding 2,500 stores by September 2024, serves as a primary sales and brand experience hub.

Complementing its physical footprint, Fast Retailing's e-commerce websites and mobile applications are critical for direct-to-consumer sales, offering convenience and a wider product selection. Digital sales saw substantial growth in fiscal year 2023, underscoring their increasing importance. Social media platforms like Instagram are actively used for marketing, community building, and direct customer interaction, with Uniqlo boasting millions of followers globally by the end of 2023.

Experiential channels, such as pop-up stores, are employed to generate buzz, test new markets, and create memorable brand interactions. These temporary activations, part of a global experiential marketing market valued over $50 billion in 2023, can drive significant short-term sales and attract new customer segments.

| Channel Type | Key Brands/Platforms | Key Functions | 2023/2024 Data Points |

| Physical Stores | Uniqlo, GU | Sales, Brand Experience, Customer Interaction | Uniqlo surpassed 2,500 global stores by Sep 2024. |

| E-commerce | Uniqlo.com, GU.com | Direct Sales, Product Variety, Convenience | Significant surge in digital sales for FY2023. |

| Mobile Apps | Uniqlo App, GU App | Personalized Shopping, Loyalty Programs, Direct Engagement | Mobile commerce represented a significant portion of digital revenue in 2024. |

| Social Media | Instagram, X (Twitter) | Marketing, Community Building, Customer Engagement | Uniqlo had millions of followers globally by end of 2023; increased social media engagement. |

| Experiential Retail | Pop-up Stores, Events | Market Testing, Brand Buzz, New Collection Launches | Experiential marketing market valued over $50 billion in 2023. |

Customer Segments

Fast Retailing's global mass market consumers represent a vast demographic seeking stylish, functional, and affordable apparel. The company's strategy centers on making high-quality fashion accessible to everyone, everywhere. This broad appeal is evident in their expansive store footprint, which reached over 3,500 stores globally by early 2024, serving millions of customers daily.

The 'MADE FOR ALL' philosophy underscores their commitment to serving a diverse customer base, transcending age, gender, and cultural barriers. In 2023, Fast Retailing reported total revenue of ¥2.79 trillion (approximately $19 billion USD), a testament to the significant purchasing power and sheer volume of this mass market segment.

Value-conscious shoppers represent a cornerstone for Fast Retailing, particularly within the Uniqlo brand. These consumers actively seek apparel that offers a strong balance between quality and price, looking for items that are both durable and affordable. Their purchasing decisions are often driven by the perceived long-term utility and comfort provided by the clothing.

Uniqlo's success with this segment is largely attributed to its focus on consistent quality and functional innovations. Products like HeatTech and AIRism are prime examples, offering tangible benefits such as warmth and breathability that justify the price point for these customers. This segment appreciates that they aren't sacrificing quality for affordability.

In 2024, Uniqlo's commitment to this value proposition resonated strongly, contributing to its robust performance. The brand's ability to deliver on both quality and accessible pricing remains a key differentiator, ensuring a loyal customer base that prioritizes smart, long-lasting purchases over fleeting trends.

Individuals seeking functional and comfortable everyday wear are a cornerstone for Fast Retailing, particularly through its Uniqlo brand. This segment prioritizes clothing that seamlessly integrates into their daily routines, offering both ease of wear and practical solutions for various situations. They are drawn to Uniqlo's emphasis on 'LifeWear,' a philosophy that centers on creating high-quality, innovative apparel designed for everyday living.

Uniqlo's success with this customer segment is significantly boosted by its investment in fabric technologies. Innovations like AIRism, which offers breathability and moisture-wicking properties, and HEATTECH, designed to generate and retain heat, directly address the need for performance features in casual clothing. In 2024, Uniqlo continued to see strong demand for these functional basics, reflecting a growing consumer preference for versatile garments that adapt to different climates and activities without sacrificing comfort.

Fashion-Conscious yet Practical Consumers

These consumers seek apparel that blends timeless style with everyday wearability. They prioritize versatile pieces that can be mixed and matched, reflecting a modern aesthetic without being dictated by fast-changing trends. For instance, UNIQLO's LifeWear philosophy directly addresses this, offering functional yet fashionable basics that form the foundation of a lasting wardrobe. In 2024, UNIQLO reported strong sales growth, partly attributed to its appeal to this segment, with particular success in its HEATTECH and AIRism lines, demonstrating the enduring demand for practical, innovative fabrics.

Their appreciation for personal expression is met through designs that are stylish but not overly ornate, allowing individual tastes to shine through. This segment values the longevity and adaptability of their clothing. Fast Retailing's strategic collaborations, such as those with designers and artists, further resonate with these consumers, offering them access to unique, high-quality items that complement their existing style and offer a touch of exclusivity without sacrificing practicality.

- Focus on Versatility: Consumers prioritize clothing that can transition between different occasions and seasons.

- Modern Aesthetics, Not Fleeting Trends: They appreciate contemporary style that remains relevant beyond a single season.

- Value in Collaborations: Unique partnerships offer distinct pieces that align with their practical yet stylish outlook.

- Brand Alignment: UNIQLO's LifeWear concept, emphasizing quality, functionality, and timeless design, directly caters to this consumer profile.

Environmentally and Socially Conscious Consumers

An increasingly important customer segment for Fast Retailing comprises consumers who prioritize sustainability and ethical production. These individuals actively seek out brands that align with their values regarding environmental impact and social responsibility.

Fast Retailing's dedication to using sustainable materials, minimizing its environmental footprint, and upholding human rights throughout its supply chain directly appeals to this conscious consumer base. For instance, in fiscal year 2023, Fast Retailing reported that 61% of its main product materials were sustainable, a significant increase from previous years.

Initiatives such as their LifeWear recycling programs, which collect used garments for reuse or recycling, and the adoption of more eco-friendly manufacturing processes further attract and foster loyalty among these environmentally and socially aware shoppers. These efforts are crucial in a market where consumer awareness of fashion's impact is rapidly growing.

- Growing Demand for Sustainable Fashion: Consumers are increasingly scrutinizing brands' environmental and ethical practices.

- Fast Retailing's Sustainability Commitments: The company's focus on eco-friendly materials and supply chain ethics resonates with this segment.

- Key Initiatives: Garment recycling programs and reduced environmental impact in production attract and retain these customers.

- Impact on Purchasing Decisions: Data from early 2024 indicates that over 70% of consumers consider sustainability when making apparel purchases.

Fast Retailing's customer base is broad, encompassing individuals seeking affordability, functionality, and modern style. The company's 'MADE FOR ALL' philosophy ensures wide appeal across demographics, evident in their extensive global store network, exceeding 3,500 locations by early 2024.

Value-conscious shoppers are a primary focus, drawn to Uniqlo's blend of quality and accessible pricing, exemplified by innovations like HeatTech and AIRism. These consumers prioritize durable, comfortable apparel, making Uniqlo's consistent quality a key differentiator. In 2023, Fast Retailing's revenue reached ¥2.79 trillion, reflecting the significant purchasing power of these segments.

Consumers prioritizing sustainability and ethical production represent a growing and influential segment. Fast Retailing's commitment to eco-friendly materials, with 61% of main product materials being sustainable in fiscal year 2023, and initiatives like garment recycling programs directly address this demand. By early 2024, over 70% of consumers were reported to consider sustainability in their apparel purchases.

| Customer Segment | Key Characteristics | Fast Retailing's Appeal | Supporting Data (as of early 2024) |

|---|---|---|---|

| Mass Market Consumers | Seeking stylish, functional, affordable apparel | 'MADE FOR ALL' philosophy, global store presence | Over 3,500 stores worldwide |

| Value-Conscious Shoppers | Prioritize quality and price balance, durability | Uniqlo's LifeWear, HeatTech, AIRism innovations | Fiscal Year 2023 Revenue: ¥2.79 trillion |

| Sustainability-Minded Consumers | Value ethical production and environmental impact | Sustainable materials, recycling programs | 61% sustainable materials (FY2023); 70%+ consider sustainability in purchases |

Cost Structure

Raw material procurement is a major expense for Fast Retailing, particularly for their innovative product lines. For instance, the specialized fibers used in their renowned HeatTech and AIRism ranges represent a significant outlay. This focus on quality materials is a cornerstone of their product differentiation.

Fast Retailing's extensive knowledge of textiles and its established partnerships with material suppliers are crucial for maintaining the consistent quality demanded by consumers. This deep integration helps mitigate risks associated with sourcing advanced materials.

The company actively manages these procurement costs through highly efficient sourcing strategies and continuous optimization of its supply chain. This ensures that the investment in high-quality raw materials translates into competitive product pricing and profitability.

Fast Retailing's manufacturing and production expenses are significant, encompassing the design, creation, and assembly of apparel through its worldwide network of partner factories. These costs include labor, factory operational expenses, and stringent quality assurance processes.

In fiscal year 2023, Fast Retailing reported cost of goods sold of ¥1,035.7 billion, reflecting the substantial investment in producing its diverse product lines. The company actively pursues production efficiency and rigorous oversight to ensure competitive pricing for its customers.

Fast Retailing's cost structure is heavily influenced by logistics and supply chain expenses. These include the costs of moving goods globally, storing them in warehouses, managing inventory levels, and distributing them to both physical stores and online shoppers. For instance, in fiscal year 2023, the company's Cost of Goods Sold (COGS) was ¥1,158.8 billion, a substantial portion of which is tied to these operational aspects.

To mitigate these significant costs, Fast Retailing is investing in advanced technologies. Initiatives like automated warehouses and the implementation of RFID (Radio Frequency Identification) technology are designed to streamline operations, enhance accuracy, and ultimately lower expenses. This focus on efficiency is crucial for maintaining competitive pricing and ensuring timely product availability.

The company’s commitment to quick and precise delivery is a core element of its strategy, directly impacting customer satisfaction and sales volume. Efficient supply chain management, therefore, is not just a cost center but a critical enabler of Fast Retailing's business model, directly affecting its ability to meet consumer demand promptly.

Retail Store Operating Costs

Operating a large global network of physical stores is a significant expense for Fast Retailing. These costs encompass rent in prime locations, utilities to keep stores running, salaries for store associates, ongoing maintenance, and the expense of visual merchandising to create an appealing shopping environment. For instance, in the fiscal year 2023, Fast Retailing's selling, general and administrative expenses, which include many of these store operating costs, amounted to approximately ¥489.1 billion.

As Fast Retailing continues to grow, particularly by opening larger stores and entering more premium retail spaces, these operating expenses become even more critical to manage. The company's strategy of 'scrap and build,' which involves closing underperforming stores and opening new, potentially more profitable ones, is a direct effort to optimize the profitability of its physical retail footprint. This approach acknowledges the substantial investment required for each store and seeks to ensure those investments yield strong returns.

- Rent: A major component, especially in high-traffic urban areas globally.

- Staffing: Salaries and benefits for a large retail workforce across numerous locations.

- Utilities & Maintenance: Ongoing costs for electricity, water, heating, cooling, and upkeep of store facilities.

- Visual Merchandising: Expenses related to store displays, signage, and product presentation.

Marketing, Advertising, and R&D Expenses

Fast Retailing allocates significant capital to marketing and advertising to cultivate global brand recognition and boost sales. For the fiscal year ending August 31, 2023, the company reported selling, general and administrative expenses (which include marketing and advertising) of ¥461.3 billion. These efforts are vital for staying relevant and attracting a broad customer base.

The company also incurs substantial research and development (R&D) costs focused on pioneering new fabric technologies and driving product innovation. This commitment to R&D ensures Fast Retailing remains at the forefront of the rapidly evolving fashion landscape.

- Brand Building: Marketing and advertising campaigns are core to Fast Retailing's strategy for global brand awareness.

- Product Innovation: R&D investments focus on developing advanced fabric technologies and novel product designs.

- Competitive Edge: These expenditures are critical for maintaining market position and attracting new customers in the dynamic fashion sector.

Fast Retailing's cost structure is a complex interplay of material sourcing, manufacturing, logistics, retail operations, and marketing. The company's investment in high-quality, innovative materials like those in HeatTech and AIRism represents a significant portion of its expenses. Efficient supply chain management, including global logistics and inventory control, is also a major cost driver, with ¥1,158.8 billion in Cost of Goods Sold reported for fiscal year 2023, a figure heavily influenced by these operational aspects.

Physical store operations, encompassing rent, staffing, utilities, and visual merchandising, contribute substantially to overheads, with selling, general and administrative expenses totaling approximately ¥489.1 billion in fiscal year 2023. Furthermore, significant capital is dedicated to marketing and advertising to build global brand recognition, alongside research and development for new fabric technologies and product innovation, ensuring Fast Retailing maintains its competitive edge.

| Cost Category | Fiscal Year 2023 (¥ Billion) | Key Drivers |

| Cost of Goods Sold (COGS) | 1,158.8 | Raw materials, manufacturing, logistics |

| Selling, General & Administrative (SG&A) | 461.3 | Marketing, advertising, store operations, R&D |

Revenue Streams

The core of Fast Retailing's income comes from selling clothes and accessories directly to customers in their many physical stores worldwide. This hands-on approach allows them to connect with shoppers and showcase their products effectively.

In fiscal year 2024, both Uniqlo's operations in Japan and internationally performed exceptionally well. This strong showing was a major driver behind the company achieving its highest-ever consolidated revenue, demonstrating the power of their retail store strategy.

Sales of apparel through e-commerce platforms are a crucial and expanding revenue source. Fast Retailing is heavily investing in its digital infrastructure, including company-owned websites and mobile apps, to cater to changing consumer habits.

This focus on digital growth is yielding significant results. For instance, Uniqlo Japan's e-commerce sales saw a robust 10.9% year-on-year increase in the first half of fiscal year 2025, contributing 15.2% to its overall sales, underscoring the channel's growing importance.

Fast Retailing generates revenue primarily through the direct sale of apparel and accessories across its diverse brand portfolio. Key brands like Uniqlo, GU, Theory, PLST, and J Brand each target different consumer segments and price points, contributing to a broad revenue base.

The company experienced significant growth in fiscal year 2024, with GU alone seeing an 8.1% revenue increase. This demonstrates the effectiveness of Fast Retailing's strategy to diversify its offerings and capture a wider market share through distinct brand identities.

International Market Expansion Revenue

Fast Retailing's aggressive global expansion is a significant revenue engine, with a particular focus on North America and Europe. This strategic push is designed to capture new customer bases and diversify revenue streams beyond its established Asian markets.

Uniqlo International demonstrated robust performance in fiscal year 2024, exceeding revenue projections and playing a crucial role in the group's record-breaking financial results. This growth highlights the effectiveness of their international strategy.

The company is actively pursuing new store openings in these key international territories. These new locations are not just about increasing physical presence but are strategically placed to maximize sales potential and brand visibility in these competitive markets.

- Aggressive Global Expansion: Focus on North America and Europe as primary growth markets.

- FY2024 Performance: Uniqlo International exceeded revenue expectations, contributing to record group performance.

- Strategic Store Openings: New stores are being launched to bolster global sales and market penetration.

Collaborations and Special Collections Sales

Fast Retailing leverages collaborations and special collections as a significant revenue stream. These limited-edition partnerships with designers, artists, and popular franchises generate substantial sales, often creating considerable buzz and amplifying consumer demand. For instance, UNIQLO's ongoing collaborations, such as those with artists like KAWS or brands like JW Anderson, have historically driven strong sales performance and attracted significant media attention.

These special collections serve a dual purpose: they not only attract new customer segments who might be drawn in by the featured collaborator but also incentivize existing loyal customers to make purchases. This strategy adds a unique and often exclusive dimension to Fast Retailing's product offerings, differentiating them from standard merchandise and fostering a sense of urgency and collectibility.

- Limited-Edition Sales: Revenue generated from exclusive, time-bound product releases through designer, artist, and franchise collaborations.

- Brand Buzz and Demand: These collections create significant marketing impact, driving consumer interest and purchase intent.

- Customer Acquisition and Retention: Special collections attract new demographics and provide existing customers with unique offerings, encouraging repeat business.

- Product Diversification: Adds a unique, collectible element to the product portfolio, enhancing brand appeal beyond everyday wear.

Fast Retailing's revenue is primarily driven by the direct sale of apparel and accessories through its network of physical stores and growing e-commerce channels. The company's diverse brand portfolio, including Uniqlo and GU, caters to various market segments, contributing to a broad revenue base.

In fiscal year 2024, Fast Retailing achieved record-high consolidated revenue, with Uniqlo's strong performance in both Japan and international markets being a key factor. The company's strategic global expansion, particularly in North America and Europe, is a significant growth engine, supported by new store openings designed to maximize sales potential.

E-commerce sales are increasingly vital, with Uniqlo Japan's online sales growing by 10.9% year-on-year in the first half of fiscal year 2025, representing 15.2% of its total sales. Collaborations and limited-edition collections also contribute significantly, generating buzz and driving both new customer acquisition and loyalty.

| Revenue Source | Key Brands/Channels | FY2024 Impact/Strategy |

|---|---|---|

| Direct Retail Sales | Uniqlo, GU, Theory, PLST, J Brand (Physical Stores) | Core revenue driver; Uniqlo Japan and International performed exceptionally well. |

| E-commerce | Uniqlo.com, Mobile Apps | Growing channel; Uniqlo Japan e-commerce sales up 10.9% H1 FY2025 (15.2% of total sales). |

| Global Expansion | Uniqlo International (North America, Europe focus) | Key growth engine; exceeding revenue expectations, driving record group performance. |

| Collaborations & Special Collections | Designer/Artist Partnerships (e.g., KAWS, JW Anderson) | Drives sales, brand buzz, and customer engagement; attracts new segments and retains loyalty. |

Business Model Canvas Data Sources

The Fast Retailing Business Model Canvas is built upon comprehensive market research, internal financial disclosures, and extensive competitive analysis. These diverse data sources ensure each component of the canvas accurately reflects the company's operational realities and strategic positioning.