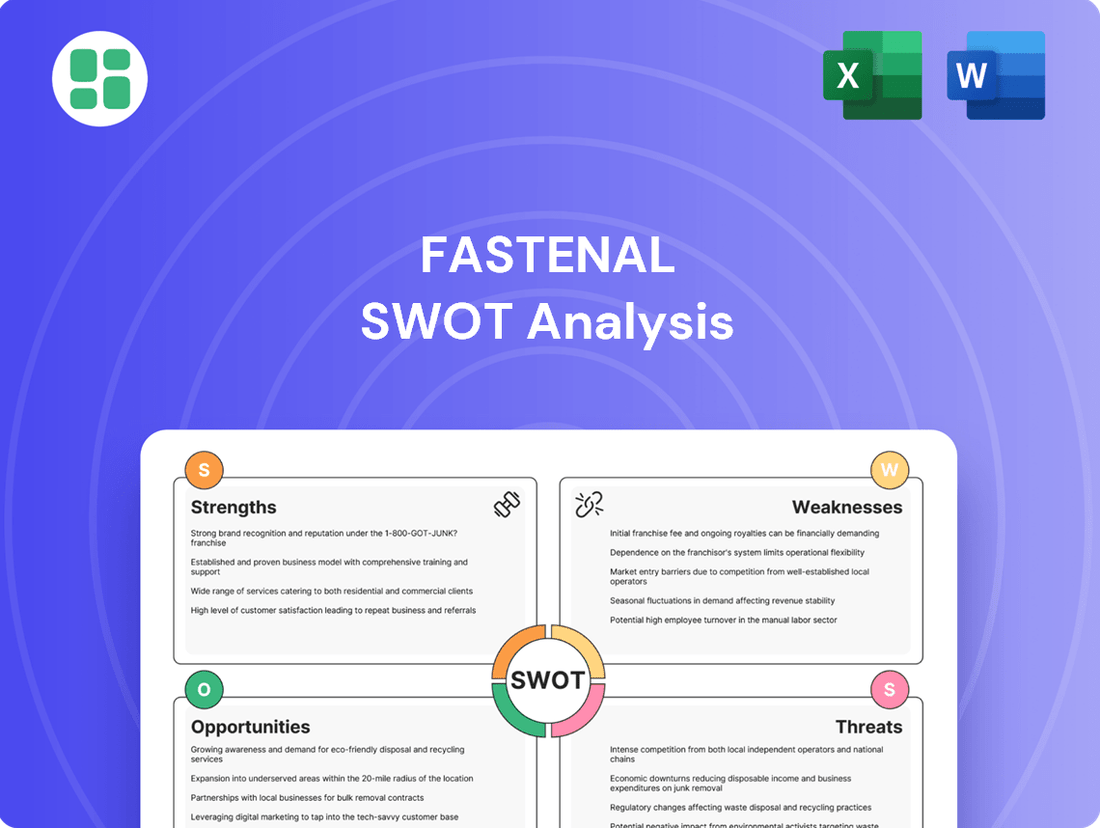

Fastenal SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fastenal Bundle

Fastenal leverages its extensive distribution network and strong customer relationships as key strengths, while facing potential threats from economic downturns and increasing competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate the industrial supply landscape.

Want the full story behind Fastenal’s market position, competitive advantages, and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Fastenal's extensive distribution network is a cornerstone of its strength, featuring over 3,600 in-market selling locations across 25 countries. This vast footprint includes 2,031 Onsite locations, strategically positioned within or adjacent to customer facilities, facilitating unparalleled accessibility and service. This dense physical presence allows for rapid product delivery and deeply integrated customer support, offering a distinct competitive edge.

Fastenal stands out for its pioneering supply chain innovations, notably its Fastenal Managed Inventory (FMI) programs. These include advanced systems like FASTBin and FASTVend, which leverage technologies such as infrared and RFID sensors.

These technologies automate critical inventory processes, including tracking, replenishment, and control. This automation significantly boosts efficiency and directly contributes to lowering operational costs for their customers.

Looking ahead, Fastenal has set an ambitious target: to have between 66% and 68% of its total sales volume flowing through its digital channels by the close of 2025. This digital footprint encompasses both its e-business sales and the comprehensive FMI services.

Fastenal's strength lies in its extensive product catalog, encompassing fasteners, tools, safety gear, and maintenance, repair, and operations (MRO) supplies. This broad offering caters to a wide array of industrial and construction needs, making them a one-stop shop for many businesses.

Beyond just selling products, Fastenal differentiates itself with valuable services such as on-site inventory management, custom manufacturing solutions, and engineering assistance. These services are designed to help clients optimize their supply chains and achieve significant cost savings, fostering deeper customer relationships and loyalty.

In 2023, Fastenal reported net sales of $6.9 billion, with their diverse product and service mix contributing to this robust performance. This diversification allows them to tap into multiple revenue streams and build resilience against market fluctuations in any single product category.

Strong Financial Health and Cash Generation

Fastenal demonstrates remarkable financial strength, consistently generating substantial cash flow. In 2024, the company achieved net sales of $7.55 billion, underscoring its strong market presence and operational efficiency. This robust performance, coupled with a strategic reduction in total debt, provides significant financial flexibility.

This financial health is crucial for Fastenal's strategic investments. The company is actively channeling resources into enhancing its digital platforms, expanding its distribution network, and pursuing various growth opportunities. This proactive approach ensures Fastenal is well-positioned to adapt to changing market conditions and capitalize on future expansion.

- Consistent Cash Flow: Fastenal's ability to generate strong cash flow provides a stable financial foundation.

- Reduced Debt: Lowering total debt in 2024 enhances financial stability and reduces risk.

- Investment Capacity: Financial flexibility allows for continued investment in key growth areas like digital capabilities and distribution.

- Resilience: A strong balance sheet enables the company to effectively manage economic downturns.

Commitment to Sustainability and Safety

Fastenal's dedication to sustainability and safety is a significant strength. Their 2024 ESG Report details robust environmental, social, and governance initiatives, including a silver medal from EcoVadis for their sustainability management system and a new plastic recycling program. This focus on responsible operations is increasingly valued by stakeholders.

The company also excels in workplace safety, a critical factor in the industrial supply sector. Fastenal consistently reports an Experience Modification Rate (EMR) that is substantially lower than the industry average, indicating a safer working environment and potentially reduced operational costs associated with accidents.

- Sustainability Recognition: Awarded a silver medal by EcoVadis for its sustainability management system in 2024.

- Environmental Initiatives: Launched a significant plastic recycling program to reduce waste and promote circularity.

- Safety Performance: Maintains an Experience Modification Rate (EMR) considerably better than industry benchmarks, showcasing a strong safety culture.

Fastenal's expansive distribution network, featuring over 3,600 locations globally including 2,031 strategically placed Onsite locations, ensures unparalleled customer accessibility and rapid service delivery. Their commitment to digital transformation is evident in their goal for 66-68% of sales to flow through digital channels by the end of 2025, encompassing e-business and FMI services.

The company's diversified product catalog, covering fasteners, tools, safety, and MRO supplies, positions them as a comprehensive solution provider for industrial and construction sectors. Complementing this is their suite of value-added services, such as on-site inventory management and engineering assistance, which foster strong customer relationships and drive cost efficiencies.

Fastenal demonstrates robust financial health, underscored by $7.55 billion in net sales for 2024 and a strategic reduction in total debt, providing significant financial flexibility for investments in digital platforms and network expansion. This financial stability, coupled with a strong focus on sustainability—highlighted by a 2024 EcoVadis silver medal and a new plastic recycling program—and superior safety performance, as indicated by a low Experience Modification Rate, solidifies its market leadership.

What is included in the product

Delivers a strategic overview of Fastenal’s internal and external business factors, highlighting its market strengths and operational challenges.

Offers a clear framework to identify and address Fastenal's competitive vulnerabilities and operational weaknesses, thereby mitigating potential business disruptions.

Weaknesses

Fastenal's significant exposure to the cyclical industrial and construction sectors presents a notable weakness. These industries are inherently sensitive to economic cycles, meaning that downturns can directly impact Fastenal's sales and profitability. For instance, the company observed a soft manufacturing environment persisting through 2024, which translated into subdued growth and production curtailments by its key clientele.

This dependence on industries prone to economic fluctuations makes Fastenal vulnerable to broader macroeconomic shifts. A slowdown in construction or manufacturing activity, driven by factors like interest rate hikes or reduced consumer spending, can quickly translate into weaker demand for Fastenal's products and services, impacting its overall financial performance.

Fastenal faces challenges with its margins due to shifts in customer and product sales, alongside rising logistics expenses. For instance, in the first quarter of 2024, while net sales grew, the company noted that a less favorable product mix and increased transportation costs weighed on its gross profit margin, which saw a slight dip compared to the prior year's period.

Higher freight and shipping costs, exacerbated by global supply chain disruptions throughout 2023 and into early 2024, directly impact Fastenal's cost of goods sold. Additionally, import duty fees on certain products contribute to this pressure, making it harder to maintain previous profitability levels even as sales volume increases.

Fastenal's fastener sales have shown slower growth compared to other product categories like safety supplies. This is a notable weakness because fasteners still represent a substantial portion of the company's overall revenue, even as they focus on higher-margin items.

For instance, in the first quarter of 2024, while overall sales saw an increase, the fastener segment's performance lagged, impacting the pace of total revenue expansion.

Competition in a Fragmented Market

Fastenal operates in a highly competitive and fragmented industrial supply distribution market. Key rivals such as Grainger and MSC Industrial Direct, along with the growing presence of Amazon Business, exert significant pressure. This intense rivalry can result in downward pressure on pricing and necessitates ongoing innovation to secure and grow market share.

The fragmented nature of the market means Fastenal must constantly adapt to a diverse set of competitors, each with varying strengths and market focuses. This environment demands agility in product offerings, service delivery, and pricing strategies to remain competitive.

- Market Share Dynamics: While Fastenal is a significant player, the combined market share of its numerous competitors, both large and small, dilutes any single entity's dominance.

- Pricing Pressures: Intense competition, particularly from online marketplaces and larger distributors, forces Fastenal to be highly competitive on pricing, potentially impacting profit margins.

- Customer Acquisition Costs: Winning new customers in a crowded market can be expensive, requiring substantial investment in sales, marketing, and service to differentiate Fastenal's value proposition.

- Innovation Imperative: To stand out, Fastenal must continuously innovate its product lines, digital platforms, and supply chain solutions to meet evolving customer needs and stay ahead of emerging threats.

Challenges in Meeting Growth Targets for Onsite and FMI Signings

Fastenal's strategy of expanding its Onsite locations and FMI (Factory Maintenance and Improvement) technology installations is a key growth driver, but meeting the ambitious signing targets for these initiatives has presented challenges. In 2024, the company experienced a shortfall in new Onsite location signings compared to its annual objectives. This indicates a potential difficulty in consistently securing the desired number of new locations needed to fully capitalize on its business model.

Consistently achieving these aggressive growth targets is vital for Fastenal's sustained expansion and for maximizing the benefits of its unique, customer-centric approach. The inability to meet signing goals, even for a single year, can impact the projected revenue streams and the overall momentum of this strategic expansion.

- 2024 Onsite Signing Shortfall: Fastenal's new Onsite location signings in 2024 did not meet the company's internal targets, highlighting a specific area of concern for this growth initiative.

- Importance of Consistent Growth: Meeting ambitious signing goals for both Onsite and FMI is critical for Fastenal to sustain its expansion and leverage its distinctive business model effectively.

- Impact on Business Model: Falling short of these targets can hinder the full realization of the advantages offered by Fastenal's integrated supply chain solutions and onsite presence.

Fastenal's reliance on cyclical industries like manufacturing and construction makes it susceptible to economic downturns, as seen with the soft manufacturing environment in 2024 impacting client production. Additionally, margin pressures arise from unfavorable product mix shifts and escalating logistics costs, with Q1 2024 showing a dip in gross profit margin due to increased transportation expenses and import duties. The slower growth in fastener sales, a significant revenue contributor, also presents a challenge, impacting overall revenue expansion pace as observed in Q1 2024 performance.

The company faces intense competition in a fragmented industrial supply market from players like Grainger and Amazon Business, leading to pricing pressures and requiring continuous innovation to maintain market share. Furthermore, Fastenal experienced a shortfall in new Onsite location signings in 2024, indicating challenges in meeting ambitious growth targets crucial for its business model's full potential.

| Weakness | Description | Impact | Supporting Data (2024/2025) |

|---|---|---|---|

| Cyclical Industry Dependence | Exposure to manufacturing and construction sectors sensitive to economic cycles. | Vulnerability to economic slowdowns, impacting sales and profitability. | Soft manufacturing environment persisted through 2024, leading to subdued growth. |

| Margin Pressures | Unfavorable product mix and rising logistics expenses. | Reduced profitability even with sales growth. | Q1 2024 gross profit margin saw a slight dip due to increased transportation costs and import duties. |

| Slower Fastener Sales Growth | Fasteners, a substantial revenue segment, growing slower than other categories. | Impacts overall revenue expansion pace. | Q1 2024 fastener segment performance lagged, affecting total revenue growth. |

| Intense Competition | Highly competitive and fragmented market with strong rivals. | Pricing pressures and need for constant innovation. | Rivals include Grainger, MSC Industrial Direct, and Amazon Business. |

| Onsite Location Signing Shortfall | Challenges in meeting ambitious targets for Onsite and FMI installations. | Hinders full realization of business model advantages and growth potential. | 2024 new Onsite location signings did not meet company targets. |

Preview Before You Purchase

Fastenal SWOT Analysis

The preview you see is taken directly from the full Fastenal SWOT analysis report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the company's strategic position.

Opportunities

Fastenal is well-positioned to leverage its digital presence, with e-business and FMI services already accounting for a substantial 62.2% of sales in Q4 2024. This digital channel is expected to grow, with projections indicating it will reach 66-68% of sales by the close of 2025, highlighting a clear opportunity for further expansion.

By investing in and enhancing its e-commerce capabilities, Fastenal can tap into underserved smaller customer segments and simplify the purchasing journey for all clients. This strategic focus on digital tools promises to drive greater efficiency and unlock new avenues for revenue growth.

Fastenal's Onsite program is a significant growth engine, offering specialized sales and service directly within customer facilities. This strategic approach aims to capture larger customer accounts by providing tailored solutions and dedicated support.

The company's focus on expanding its Onsite footprint and deepening relationships with key accounts is expected to drive increased unit sales and foster more robust, higher-volume business partnerships. As of the first quarter of 2024, Fastenal reported a 6.5% increase in total sales, with their Onsite locations showing particularly strong performance.

Fastenal is well-positioned to enhance its operational efficiency by more deeply integrating data analytics and Artificial Intelligence (AI). For instance, by leveraging predictive analytics, the company can refine its demand forecasting, ensuring optimal stock levels and reducing carrying costs. This is particularly relevant given the projected 4.5% growth in the industrial distribution market for 2024, according to industry reports.

Further AI applications can automate inventory management and optimize delivery routes, leading to significant cost savings and improved customer service. Fastenal's existing investment in technology, including its e-commerce platform, provides a strong foundation. In 2023, Fastenal reported a 6.6% increase in net sales, partially driven by its digital initiatives, highlighting the tangible benefits of such technological adoption.

Diversification into New Product Categories and Services

Fastenal has a significant opportunity to broaden its product portfolio beyond its core fastener business. Expanding into higher-margin Maintenance, Repair, and Operations (MRO) supplies, such as specialized tools, safety equipment, and industrial chemicals, could unlock new revenue streams. For instance, by the end of 2024, the industrial MRO market was projected to reach over $600 billion globally, presenting a substantial addressable market for Fastenal to capture.

Furthermore, enhancing its service offerings can differentiate Fastenal and build stronger customer loyalty. Developing specialized services like on-site inventory management for specific industries, customized vending solutions, or sustainability-focused product sourcing and disposal programs can create recurring revenue and deepen customer relationships.

- Expand into higher-margin MRO categories beyond fasteners.

- Develop specialized services like sustainability solutions and advanced technical support.

- Leverage the growing global MRO market, projected to exceed $600 billion by the end of 2024.

- Deepen customer relationships through value-added service offerings.

Capitalizing on Infrastructure and Manufacturing Onshoring Trends

The reshoring of manufacturing and increased focus on domestic production in North America, particularly the U.S., creates a substantial tailwind for Fastenal. This trend directly translates to higher demand for the fasteners, tools, and supplies Fastenal provides. For instance, the U.S. government's Infrastructure Investment and Jobs Act, passed in 2021 and continuing to drive project spending through 2025, is expected to inject significant capital into construction and manufacturing sectors.

Fastenal's established domestic distribution network and expertise in supply chain management are key advantages. They are well-positioned to support the increased operational needs of manufacturers bringing production back home or expanding existing facilities. This includes providing the essential MRO (Maintenance, Repair, and Operations) products that keep factories running smoothly.

- Increased Demand: Onshoring trends are projected to boost U.S. manufacturing output, directly increasing the need for industrial supplies.

- Infrastructure Spending: Government initiatives like the Infrastructure Investment and Jobs Act are fueling construction and manufacturing activity, benefiting Fastenal's core markets.

- Supply Chain Solutions: Fastenal's ability to manage and deliver critical components efficiently is a significant draw for companies re-evaluating their supply chain resilience.

- Automation Growth: The push for industrial automation also requires a steady supply of specialized fasteners and components, a segment Fastenal serves.

Fastenal can capitalize on the growing global Maintenance, Repair, and Operations (MRO) market, which was projected to exceed $600 billion by the end of 2024. By expanding its product offerings into higher-margin MRO categories beyond fasteners, such as specialized tools and safety equipment, the company can unlock new revenue streams. Deepening customer relationships through value-added services like on-site inventory management or sustainability solutions further enhances its competitive edge and creates recurring revenue opportunities.

| Opportunity Area | Market Projection/Growth Driver | Fastenal's Advantage |

| MRO Market Expansion | Global MRO market projected to exceed $600 billion by end of 2024. | Broaden product portfolio beyond fasteners into higher-margin MRO supplies. |

| Digital Channel Growth | E-business and FMI sales expected to reach 66-68% of sales by close of 2025. | Leverage existing digital infrastructure to capture smaller customer segments and streamline purchasing. |

| Onsite Program Expansion | Q1 2024 saw a 6.5% increase in total sales, with Onsite locations showing strong performance. | Deepen relationships with key accounts by providing tailored solutions and dedicated support within customer facilities. |

| Reshoring & Infrastructure Spending | Infrastructure Investment and Jobs Act driving construction and manufacturing activity through 2025. | Benefit from increased demand for industrial supplies due to onshoring and government infrastructure projects. |

Threats

A prolonged economic downturn or continued softness in the manufacturing and construction sectors presents a significant threat to Fastenal's financial performance. Sluggish market conditions, characterized by reduced industrial activity and potential production cuts from key customers, directly impact sales volume and daily sales rates. For instance, Fastenal experienced a slowdown in its daily sales rates during parts of 2024, a trend that could worsen if economic headwinds persist.

Fastenal operates in a fiercely competitive industrial distribution landscape. The rise of online retailers and the persistent efforts of traditional rivals mean constant pressure on pricing, forcing Fastenal to remain agile. This intense competition makes it challenging to maintain healthy profit margins, especially during times when product prices are not increasing.

Global supply chain issues, including ongoing tariffs and trade policy uncertainties, continue to pose a significant threat. These factors can drive up freight costs and import duties, making it harder to secure necessary products. For instance, in 2024, many industries saw freight costs fluctuate significantly due to geopolitical events and capacity constraints.

Fastenal has already felt the pinch, experiencing margin compression from elevated freight expenses and import duties. These disruptions aren't just temporary; they can persistently challenge operational efficiency and profitability. The company's reliance on a global network means it's particularly exposed to these ongoing supply chain vulnerabilities.

Technological Disruption by Competitors

While Fastenal is actively investing in its own technological capabilities, the swift pace of technological advancement and the growing embrace of digital solutions by rivals, including major e-commerce players, pose a significant threat. This rapid evolution could potentially undermine Fastenal's current market standing if it cannot keep pace.

The imperative for continuous innovation in supply chain technology and the enhancement of digital platforms is paramount for Fastenal to maintain its competitive edge in the evolving industrial distribution landscape. Staying ahead requires consistent upgrades and forward-thinking strategies.

- Competitor Digital Investments: Competitors are channeling significant resources into e-commerce platforms and digital supply chain solutions, aiming to offer more streamlined customer experiences.

- E-commerce Giants' Entry: The increasing presence of large e-commerce platforms in the industrial supply sector introduces a new competitive dynamic, leveraging established logistics and broad customer reach.

- Pace of Innovation: Fastenal must match or exceed the innovation cycle of competitors in areas like AI-driven inventory management, predictive analytics for demand forecasting, and enhanced online customer portals.

- Supply Chain Resilience: Disruptions can arise from competitors leveraging more agile and technologically advanced supply chains, potentially impacting Fastenal's delivery times and cost-efficiency.

Fluctuations in Raw Material Costs

Fastenal, as a major distributor of industrial supplies, faces significant exposure to the volatile costs of raw materials, especially steel, which is a key component in many fasteners. These price swings can directly impact the company's bottom line, particularly on its custom manufacturing offerings where material costs are a larger portion of the final price.

For instance, steel prices saw considerable volatility throughout 2023 and into early 2024. While Fastenal's ability to implement pricing adjustments can offset some of this pressure, sustained and unpredictable surges in raw material expenses could compress product margins and ultimately hinder overall profitability.

- Steel prices experienced significant fluctuations in 2023, with benchmarks like hot-rolled coil showing month-over-month changes exceeding 10% at various points.

- The company's custom manufacturing segment is particularly vulnerable, as raw material costs represent a more substantial percentage of its revenue compared to standard distribution.

- While Fastenal's pricing power can absorb some cost increases, extreme volatility can still strain profitability and necessitate careful inventory management.

Fastenal faces considerable threats from a deteriorating economic climate, which could dampen demand in its core manufacturing and construction markets. Persistent inflation and rising interest rates, evident through much of 2023 and into 2024, continue to pressure customer spending and capital investment. This economic uncertainty directly impacts Fastenal's daily sales rates, as seen in some periods of 2024 where growth moderated due to these macroeconomic factors.

Intensifying competition, particularly from e-commerce players and digitally advanced rivals, poses a significant challenge to Fastenal's market share and pricing power. These competitors are increasingly investing in sophisticated online platforms and streamlined supply chains, creating pressure on Fastenal to innovate rapidly. The threat is amplified as these entities leverage established logistics networks and broad customer bases, potentially eroding Fastenal's traditional advantages.

Ongoing global supply chain disruptions, including trade policy shifts and freight cost volatility, remain a critical concern for Fastenal. These issues can inflate operational expenses and complicate product availability, impacting Fastenal's ability to maintain competitive pricing and efficient delivery. For example, freight costs in 2024 continued to be influenced by geopolitical events and capacity constraints, directly affecting Fastenal's cost structure.

The rapid pace of technological advancement in areas like AI-driven inventory management and predictive analytics presents another threat, requiring substantial and continuous investment from Fastenal. Failure to keep pace with competitors' digital innovations could lead to a loss of competitive edge and market relevance.

SWOT Analysis Data Sources

This Fastenal SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded perspective.