Fastenal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fastenal Bundle

Fastenal navigates a competitive landscape shaped by powerful buyer and supplier relationships, alongside the constant threat of new entrants and substitutes. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis reveals the intricate interplay of these forces, offering a comprehensive view of Fastenal's market position and potential challenges.

Ready to move beyond the basics? Get a full strategic breakdown of Fastenal’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Fastenal's diverse product range means its bargaining power with suppliers varies significantly. For common, commoditized items like standard fasteners, where many manufacturers exist, Fastenal enjoys considerable leverage due to low supplier concentration. This allows them to negotiate favorable pricing.

However, the landscape shifts for specialized or proprietary Maintenance, Repair, and Operations (MRO) equipment. In these segments, fewer suppliers offer unique products, inherently increasing their bargaining power. This concentration means Fastenal has fewer alternatives, potentially leading to higher costs for these critical, specialized inputs.

The bargaining power of suppliers for Fastenal is influenced by switching costs, which differ across its product lines. For many of Fastenal's standard industrial and construction supplies, the cost and complexity associated with changing suppliers are minimal. This allows Fastenal to readily source from multiple vendors, thereby increasing its leverage in price negotiations and securing more favorable terms.

However, the dynamic shifts for more specialized offerings. When Fastenal procures integrated supply chain solutions or custom-manufactured components, the barriers to switching suppliers become more substantial. These higher switching costs arise from the need for rigorous supplier qualification, potential integration complexities with existing systems, and the risk of disrupting service continuity for its end customers. In 2023, Fastenal reported that its cost of goods sold represented approximately 64% of its net sales, highlighting the importance of managing supplier relationships and costs across its diverse product portfolio.

Suppliers to Fastenal generally do not pose a significant threat of forward integration into wholesale distribution. The industrial distribution business demands a robust logistics network, a comprehensive product selection, and established customer connections, creating substantial hurdles for most manufacturers.

Fastenal's unique 'high-touch, high-tech' service model further solidifies its position, making it difficult for suppliers to replicate its value proposition. For instance, in 2023, Fastenal reported a 5.9% increase in total sales, reaching $6.9 billion, demonstrating the strength of its distribution capabilities against potential supplier encroachment.

Importance of Fastenal as a Customer to Suppliers

Fastenal's substantial purchasing power, driven by its vast network of over 3,600 locations in 25 countries, positions it as a key customer for numerous suppliers. This immense scale allows Fastenal to negotiate advantageous terms, including pricing and product availability, significantly influencing supplier relationships.

The bargaining power of suppliers is a critical factor in Fastenal's operational landscape. However, Fastenal's considerable purchasing volumes and its extensive geographical reach across 25 countries, supported by more than 3,600 in-market locations, grant it significant leverage. This allows Fastenal to secure favorable pricing, delivery schedules, and product specifications from its suppliers, thereby mitigating the suppliers' ability to dictate terms.

- Significant Purchasing Volume: Fastenal's consistent demand across a broad product range allows it to negotiate bulk discounts and favorable payment terms.

- Extensive Distribution Network: With over 3,600 locations, Fastenal offers suppliers broad market access, reducing their individual sales and distribution costs.

- Supplier Dependence: For many specialized fastener and industrial supply manufacturers, Fastenal represents a substantial portion of their sales, increasing Fastenal's leverage.

- Negotiating Power: In 2023, Fastenal reported net sales of $7.3 billion, underscoring its capacity to influence supplier pricing and service levels.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for many of Fastenal's core products. For standard fasteners and general Maintenance, Repair, and Operations (MRO) items, the market offers a vast array of alternative materials and components. This abundance of choices means that no single supplier can easily dictate terms.

This widespread availability of substitutes directly translates into competitive pricing for Fastenal. Suppliers must remain competitive to secure Fastenal's business, as the company can readily switch to alternative sources if prices become unfavorable. For instance, in 2024, the global industrial fasteners market was estimated to be worth over $50 billion, with numerous players vying for market share, reinforcing the competitive landscape.

- Broad Substitute Availability: Many MRO and fastener products have numerous alternative materials and components, limiting individual supplier leverage.

- Competitive Pricing Pressure: The presence of substitutes forces suppliers to offer competitive pricing to Fastenal.

- Reduced Supplier Dependence: Fastenal's ability to source from multiple suppliers mitigates reliance on any single entity.

- Market Dynamics: The large and fragmented nature of markets for standard industrial supplies reinforces the low bargaining power of individual suppliers.

Fastenal's substantial purchasing volume, stemming from its extensive network of over 3,600 locations, significantly limits the bargaining power of its suppliers. This scale allows Fastenal to negotiate favorable pricing and terms, as many suppliers rely on Fastenal for a considerable portion of their sales. In 2023, Fastenal's net sales reached $7.3 billion, underscoring its considerable influence in the market.

The availability of numerous substitute inputs for many of Fastenal's core products, particularly standard fasteners and MRO items, further erodes supplier leverage. The global industrial fasteners market, valued at over $50 billion in 2024, is highly competitive, forcing suppliers to offer attractive pricing to secure Fastenal's business.

Suppliers' ability to forward integrate into wholesale distribution is generally limited due to the high logistical and customer relationship requirements of Fastenal's business model. Fastenal's unique 'high-touch, high-tech' service approach also presents a barrier to replication, reinforcing Fastenal's strong position against supplier power.

| Factor | Impact on Fastenal | Supporting Data (2023/2024) |

|---|---|---|

| Purchasing Volume | Low Supplier Bargaining Power | Net Sales: $7.3 Billion |

| Substitute Availability | Low Supplier Bargaining Power | Global Industrial Fasteners Market: >$50 Billion (2024) |

| Supplier Dependence | Low Supplier Bargaining Power | Fastenal's broad reach means it's a key customer for many |

| Forward Integration Threat | Low Supplier Bargaining Power | High logistical and customer service barriers |

What is included in the product

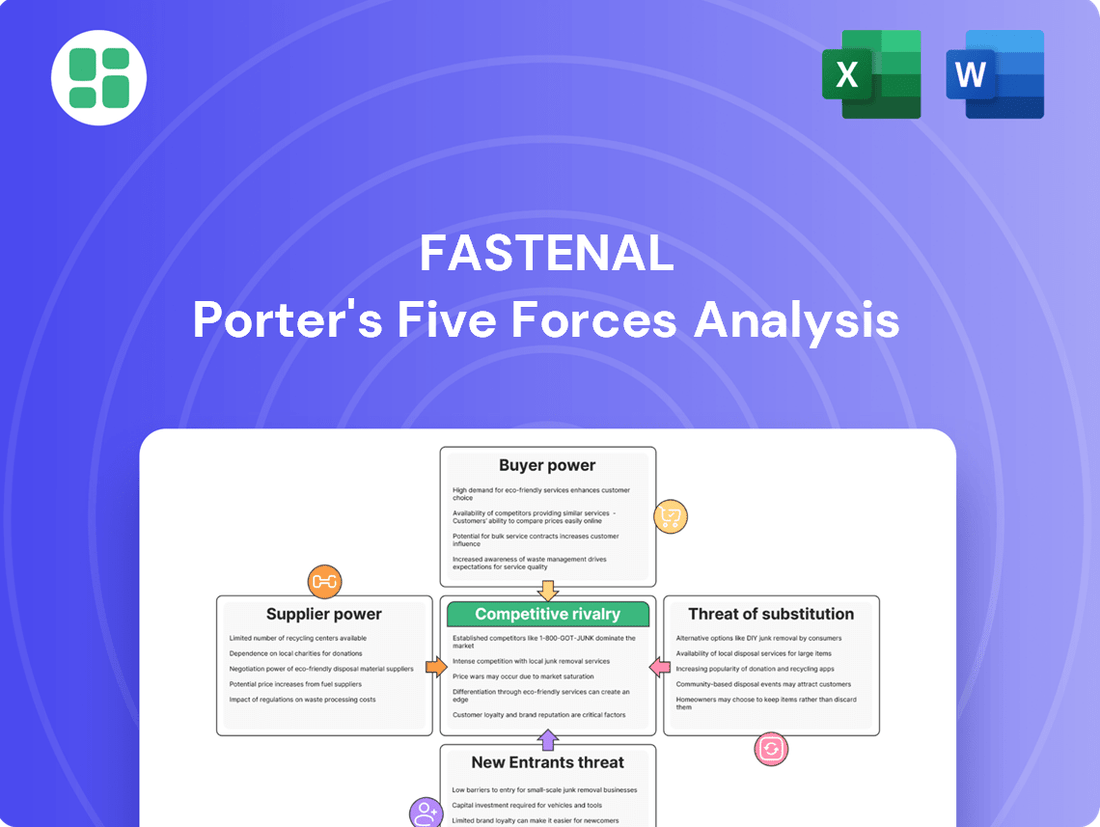

This analysis dissects the competitive forces impacting Fastenal, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industrial and construction supply sector.

A visual representation of Fastenal's competitive landscape, allowing for rapid identification of key threats and opportunities.

Customers Bargaining Power

Fastenal's customer base is broad, encompassing businesses of all sizes, from small operations to major players in manufacturing and construction. This wide reach reduces the impact of any single customer's demands.

While some major clients, especially those utilizing Fastenal's on-site inventory management (FMI), contribute substantial order volumes, the sheer diversity of Fastenal's clientele prevents any one customer from wielding excessive bargaining power. For instance, in 2023, Fastenal reported that its largest customers, while important, did not represent an unmanageable portion of its overall revenue, underscoring this diversification.

Fastenal's commitment to integrated supply chain solutions significantly elevates customer switching costs. Services like FASTVend, their vending machine system, and inventory management tools such as FASTBin and FASTStock, represent substantial investments for their clients.

These technologies streamline operations and reduce transaction friction, making a move to a competitor less appealing. For instance, in 2023, Fastenal reported that its vending and inventory management solutions served over 10,000 customer locations, demonstrating the widespread adoption and embedded nature of these services.

Fastenal's customers enjoy a robust selection of alternative distributors, including major national players like Grainger and MSC Industrial Supply, alongside numerous regional specialists and burgeoning online platforms. This extensive choice directly translates into significant bargaining power for buyers.

In 2024, the industrial supply market continued to see intense competition, with companies like Grainger reporting strong revenue growth, underscoring the availability of viable alternatives for Fastenal's customer base. This competitive landscape compels Fastenal to focus on delivering superior service and unique value propositions to retain its market share.

Customer Price Sensitivity

Customer price sensitivity is a significant factor in the industrial and construction supply market, especially for products that are largely undifferentiated. Fastenal navigates this by offering competitive pricing on many items, but its real strength lies in the value-added services that can offset higher product costs.

For instance, Fastenal's supply chain solutions, which include inventory management and on-site vending, aim to reduce overall customer spending by minimizing waste and improving efficiency. This approach allows them to justify a premium on certain products because the total cost of ownership for the customer is often lower. In 2023, Fastenal reported that its industrial vending solutions served over 12,000 customer locations, highlighting the broad adoption of these cost-saving services.

- Price Sensitivity: Customers in the industrial and construction sectors are often highly sensitive to price, particularly for standard, commoditized products.

- Value-Added Services: Fastenal leverages its supply chain solutions, such as vending machines and inventory management, to provide value beyond just the product price.

- Total Cost of Ownership: By offering efficiency gains and cost reductions in other areas, Fastenal can command higher prices for its products because the overall cost to the customer is reduced.

- Market Penetration: The widespread use of Fastenal's vending solutions, serving over 12,000 locations in 2023, demonstrates customer acceptance of its value proposition.

Threat of Backward Integration by Customers

Customers generally do not pose a significant threat of backward integration by manufacturing their own industrial supplies or establishing their own extensive distribution networks. The capital investment, expertise, and economies of scale required for such an undertaking are typically prohibitive for most of Fastenal's clients.

For instance, a typical manufacturing client, while needing fasteners or safety equipment, would find it uneconomical to set up production lines or logistics for these items. This is especially true when considering the specialized nature and broad product range Fastenal offers. The cost of replicating Fastenal's supply chain and product sourcing capabilities would far outweigh the benefits for most individual customers.

- Low Threat: Most of Fastenal's diverse customer base lacks the resources and scale to backward integrate into industrial supply manufacturing.

- Capital & Expertise Barriers: The significant capital outlay and specialized knowledge needed to produce and distribute industrial supplies are deterrents for customers.

- Economies of Scale: Fastenal benefits from economies of scale in purchasing and distribution that individual customers cannot easily match.

Fastenal's bargaining power of customers is moderate. While customers have numerous alternatives and can be price-sensitive, Fastenal mitigates this by embedding its services, increasing switching costs and focusing on total cost of ownership. The threat of backward integration is minimal due to high capital and expertise barriers.

| Factor | Assessment | Supporting Data/Reasoning |

| Customer Concentration | Low | Broad customer base, largest customers not unmanageable portion of revenue (2023). |

| Switching Costs | High | Integrated supply chain solutions (FASTVend, FASTBin, FASTStock) embed services, increasing costs to switch. Over 10,000 customer locations served by vending/inventory management in 2023. |

| Availability of Substitutes | High | Numerous competitors (Grainger, MSC Industrial Supply) and online platforms. Intense competition in 2024. |

| Price Sensitivity | Moderate to High | Customers sensitive to price for commoditized products, but value-added services can offset higher product costs. |

| Threat of Backward Integration | Low | Prohibitive capital investment, expertise, and economies of scale required for customers to self-produce or distribute. |

Same Document Delivered

Fastenal Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Fastenal Porter's Five Forces Analysis delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industrial and construction supplies sector. You'll gain actionable insights into the strategic factors influencing Fastenal's market position and profitability.

Rivalry Among Competitors

The industrial and construction supply distribution market is quite fragmented. You have a few big names like Fastenal, Grainger, and MSC Industrial Supply operating nationally, but there are also many smaller, regional players and specialized distributors. This means competition is coming from many different angles.

Fastenal also faces competition from online retailers, which offer convenience and often competitive pricing. Furthermore, direct-from-manufacturer sales represent another competitive force, as some customers may bypass distributors altogether to purchase directly from the source. In 2023, Fastenal reported net sales of $6.9 billion, highlighting the scale of operations within this competitive environment.

The MRO and industrial distribution market is seeing steady, albeit moderate, growth. Forecasts suggest a compound annual growth rate (CAGR) between 2.8% and 5.41% from 2024 through 2034. This kind of expansion means companies are likely to compete more fiercely for existing customers rather than simply benefiting from a rapidly expanding pie.

Competitive rivalry in the industrial and construction supply sector extends beyond mere price competition. Fastenal actively combats this by emphasizing product availability and a suite of value-added services. This approach aims to build customer loyalty and differentiate its offerings in a crowded market.

Fastenal's extensive network of over 1,300 local branches and more than 200 on-site locations provides a significant competitive advantage, ensuring product accessibility. Furthermore, their inventory management solutions, including FMI, FASTVend, and FASTBin, along with deep supply chain expertise, help customers streamline operations and reduce overall costs, a critical factor in purchasing decisions.

Exit Barriers

Distributors in the industrial supply sector face substantial exit barriers due to the significant capital investment required for their operations. These include maintaining extensive branch networks, substantial inventory levels, and intricate logistics systems. For instance, a company like Fastenal has over 3,000 locations, each representing a considerable fixed cost.

These high fixed costs mean that exiting the market is not a simple decision. Companies are often compelled to remain operational and continue competing to recover their investments, even in challenging economic conditions. This can intensify competitive rivalry as firms fight to maintain their market share and profitability.

- High Fixed Costs: Investments in physical infrastructure, such as numerous branches and warehouses, create a significant financial commitment.

- Inventory Investment: Maintaining a broad range of products necessitates substantial capital tied up in inventory.

- Logistics Complexity: Developing and operating efficient distribution networks adds another layer of fixed cost.

- Incentive to Stay: High exit barriers encourage companies to remain in the market and compete aggressively rather than abandon their investments.

Intensity of Advertising and Promotions

Competitive rivalry within the industrial supply sector, including Fastenal, is significantly fueled by intense advertising and promotional activities. Companies actively vie for market share through aggressive marketing campaigns, often highlighting product availability, pricing, and service advantages. This constant push to capture customer attention intensifies the competitive landscape.

Fastenal's approach to this rivalry is increasingly digital. The company is making substantial investments in its online presence, evidenced by the growth of its eBusiness sales. This digital transformation is not just about having an online store; it's about creating personalized customer experiences and streamlining the purchasing process. By enhancing its e-commerce platforms, Fastenal aims to differentiate itself and capture a larger share of sales through digital channels.

- Digital Investment: Fastenal is actively investing in its digital transformation, focusing on e-commerce platforms and personalized customer experiences.

- eBusiness Growth: The company has seen notable growth in its eBusiness sales, indicating a successful shift towards digital channels.

- Future Outlook: Fastenal expects its eBusiness segment to represent an increasingly significant portion of its total sales in the coming periods.

Competitive rivalry in the industrial supply market is intense due to a fragmented landscape with national players like Fastenal, Grainger, and MSC, alongside numerous regional and specialized distributors. This means competition is multifaceted, coming from direct sales and online retailers as well. The market’s moderate growth, projected between 2.8% and 5.41% CAGR from 2024 to 2034, further fuels this rivalry as companies focus on gaining share from existing customers.

Fastenal differentiates itself by emphasizing product availability through its extensive branch network and offering value-added services like inventory management solutions. High fixed costs associated with infrastructure and inventory create significant exit barriers, compelling companies to remain competitive. Aggressive advertising and a strong digital presence, including growth in eBusiness sales, are key strategies for capturing market share.

| Competitor | 2023 Net Sales (USD Billions) | Key Differentiators |

|---|---|---|

| Fastenal | 6.9 | Extensive branch network, inventory management solutions, digital presence |

| Grainger | 15.2 (FY23) | Broad product assortment, customer service, technical expertise |

| MSC Industrial Supply | 4.1 (FY23) | Metalworking solutions, technical support, supply chain services |

SSubstitutes Threaten

Customers can bypass distributors like Fastenal and buy directly from manufacturers, especially for large orders or specialized products. This direct procurement can offer cost savings or tailored solutions, posing a significant threat.

General retailers and online marketplaces like Amazon Business offer a convenient alternative for common industrial and MRO items. For smaller, less specialized purchases, these channels present a viable substitute for Fastenal's transactional sales, potentially drawing away customers seeking ease of acquisition.

Large industrial customers might bypass traditional suppliers like Fastenal by producing certain components internally or repairing existing machinery. This trend is amplified by technological progress; for instance, 3D printing advancements in 2024 are making it more feasible for businesses to create custom parts on-demand, reducing reliance on external procurement for specific needs.

Alternative Technologies or Service Models

Emerging technologies and alternative service models pose a significant threat to Fastenal's established distribution network. Highly automated, direct-to-consumer industrial supply platforms could bypass traditional distributors, offering a more streamlined purchasing experience for certain customer segments. For instance, advancements in e-commerce logistics and warehouse automation are enabling new players to compete on speed and cost.

Predictive maintenance solutions represent another disruptive force. By leveraging IoT sensors and data analytics to anticipate equipment failures, these technologies can reduce the demand for routine maintenance, repair, and operations (MRO) parts, which form a core part of Fastenal's business. Companies are increasingly investing in these capabilities to optimize their operational efficiency and minimize downtime.

Fastenal is actively addressing this threat by enhancing its own digital solutions and service offerings. Their investment in vending technology, e-commerce platforms, and on-site inventory management systems aims to integrate more deeply into customer workflows and provide value beyond simple product delivery. This strategic focus on digital transformation is crucial for maintaining relevance in a rapidly evolving market.

- Digitalization: Fastenal reported a 16.7% increase in digital sales in Q1 2024, highlighting the growing importance of online channels.

- Automation: Competitors leveraging advanced robotics in their distribution centers can achieve faster order fulfillment, a key differentiator.

- Data Analytics: The adoption of predictive maintenance in the industrial sector is projected to grow significantly, potentially impacting MRO spending patterns.

- Customer Integration: Fastenal's vending solutions manage inventory for over 100,000 customer locations, demonstrating a strategy to embed services directly into client operations.

Customer Inventory Optimization

Customers are increasingly focused on streamlining their operations, which can lead them to implement more aggressive inventory optimization strategies. This means they might aim to reduce the amount of stock they hold, directly impacting their demand for external supplies from companies like Fastenal.

While Fastenal's Vendor Managed Inventory (VMI) and onsite inventory management solutions, like their Fastenal Managed Inventory (FMI) program, are designed to help customers manage stock more efficiently, customers may also develop their own independent methods. These could involve just-in-time ordering or improved forecasting, potentially decreasing their overall purchasing volume with Fastenal.

For instance, in 2024, many manufacturing and construction sectors are prioritizing lean operations. A significant portion of businesses are investing in supply chain visibility tools, with some reporting reductions in excess inventory by as much as 15-20% through enhanced planning and data analytics.

- Customer-driven inventory reduction: Businesses are actively seeking ways to minimize on-hand stock, which can lessen reliance on external suppliers.

- Impact on demand: More efficient inventory management by customers directly translates to potentially lower order volumes for Fastenal.

- Fastenal's VMI/FMI solutions: These programs aim to mitigate this threat by offering integrated inventory management services to customers.

- Independent customer strategies: Customers may bypass supplier-specific solutions to implement their own inventory optimization plans, further reducing purchasing needs.

The threat of substitutes for Fastenal is significant as customers can increasingly bypass traditional distribution channels. Direct procurement from manufacturers, especially for large or specialized orders, offers potential cost savings and tailored solutions. Furthermore, general retailers and online marketplaces like Amazon Business provide convenient alternatives for common industrial and MRO items, particularly for smaller, less specialized purchases.

Technological advancements are also enabling new substitutes. In 2024, the rise of 3D printing allows businesses to produce custom parts internally, reducing reliance on external suppliers. Additionally, advancements in e-commerce logistics and warehouse automation are paving the way for streamlined, direct-to-consumer industrial supply platforms that compete on speed and cost.

Predictive maintenance solutions, driven by IoT and data analytics, are another disruptive force. By anticipating equipment failures, these technologies can decrease the demand for routine MRO parts. In 2024, companies are investing heavily in these capabilities to optimize operations, with some industrial sectors prioritizing lean operations and reducing excess inventory by up to 20% through enhanced planning.

| Threat Category | Example Substitute | Impact on Fastenal | 2024 Trend/Data |

| Direct Procurement | Manufacturers selling directly to customers | Reduced sales volume for Fastenal | Continued growth in B2B e-commerce |

| Online Marketplaces | Amazon Business, other e-tailers | Loss of transactional sales, especially for commodity items | Digital sales for Fastenal increased 16.7% in Q1 2024 |

| Internal Production/Repair | 3D printing for custom parts | Decreased demand for specific MRO components | Advancements in additive manufacturing making in-house production more feasible |

| Alternative Service Models | Predictive maintenance, automated supply platforms | Reduced need for routine MRO parts, shift in customer service expectations | Increased adoption of IoT for industrial maintenance |

Entrants Threaten

Launching a business in the industrial and construction supply distribution sector demands considerable upfront capital. Newcomers must fund extensive inventory, establish warehousing facilities, build a reliable logistics network, and set up a broad network of physical branches to compete effectively. For instance, a comprehensive distribution center, including inventory and operational setup, could easily run into millions of dollars, creating a significant hurdle for potential entrants.

Established players like Fastenal leverage substantial economies of scale in procurement, inventory management, and logistics. This allows them to negotiate better prices from suppliers and operate more efficiently, translating into cost advantages. For instance, in 2023, Fastenal reported revenues of $6.59 billion, demonstrating the scale of its operations.

Newcomers would find it incredibly challenging to match these efficiencies. They would likely face higher per-unit costs for everything from sourcing inventory to delivering it to customers, creating a significant barrier to entry. This cost disadvantage makes it difficult for new entrants to compete on price or offer the same breadth of services.

Fastenal's formidable network of over 3,600 in-market locations and on-site programs presents a significant barrier to new entrants. Building a comparable distribution infrastructure requires immense capital investment and time, making it difficult for newcomers to achieve similar reach and service levels.

Furthermore, Fastenal's long-standing, deeply embedded relationships with B2B customers are a critical hurdle. These established trusts and loyalty, cultivated over years of reliable service, are not easily replicated by new players entering the market.

Product Differentiation and Brand Loyalty

Fastenal's robust 'high-touch, high-tech' service model, featuring innovative vending solutions and sophisticated supply chain management, cultivates significant customer loyalty. This creates a formidable barrier for potential new entrants who must not only match but exceed Fastenal's established value proposition to attract customers. The inherent switching costs associated with integrating new suppliers into existing operational workflows further solidify Fastenal's market position.

For instance, in 2023, Fastenal reported a 5.1% increase in total sales, reaching $6.9 billion, demonstrating continued customer retention and growth. This performance underscores the effectiveness of their differentiation strategy in a competitive industrial supply landscape.

- High-Touch, High-Tech Model: Fastenal's unique service offering, combining personalized customer interaction with advanced technology, builds strong relationships.

- Vending Solutions: Their industrial vending machines provide convenient, on-site access to essential supplies, reducing downtime and improving inventory control for customers.

- Integrated Supply Chain: Fastenal manages inventory and delivery for clients, streamlining procurement processes and lowering operational costs for businesses.

- Brand Loyalty and Switching Costs: The established trust and operational integration make it challenging and costly for customers to switch to a new supplier, thereby deterring new entrants.

Regulatory Hurdles and Expertise

While the industrial supply sector isn't as intensely regulated as, say, pharmaceuticals, new entrants face significant compliance challenges. Navigating safety standards, product certifications, and intricate supply chain regulations requires substantial expertise and investment. For instance, Fastenal, a major player, invests heavily in ensuring its products meet various industry-specific certifications, a cost barrier for newcomers.

The need for specialized knowledge in handling and distributing a wide array of industrial and construction materials can be a deterrent. Understanding material safety data sheets (MSDS), proper storage, and transportation logistics for diverse products, from chemicals to heavy machinery parts, demands a steep learning curve. This expertise is crucial for maintaining operational efficiency and customer trust.

- Regulatory Compliance: Adherence to OSHA standards, EPA regulations, and specific product safety certifications is non-negotiable.

- Supply Chain Complexity: Managing logistics for a broad product catalog, including hazardous materials, requires sophisticated systems and knowledge.

- Industry Expertise: Understanding the technical specifications and applications of industrial supplies is vital for effective sales and support.

- Capital Investment: Establishing the necessary infrastructure to meet these regulatory and operational demands requires significant upfront capital.

The threat of new entrants in the industrial and construction supply distribution sector is moderately low, primarily due to the substantial capital required to establish a competitive operation. New businesses need significant investment for inventory, warehousing, logistics, and physical branch networks, creating a high barrier to entry.

Fastenal's established economies of scale, with 2023 revenues of $6.59 billion, allow for cost advantages in procurement and operations that are difficult for newcomers to match. This scale translates into competitive pricing and operational efficiencies that deter potential entrants.

The company's extensive network of over 3,600 locations, combined with deeply ingrained customer relationships and high switching costs associated with its integrated service models, further solidifies its market position and discourages new competition.

Additionally, navigating complex regulatory compliance and acquiring specialized industry knowledge for handling diverse materials present significant operational hurdles for new entrants, demanding considerable expertise and investment.

| Factor | Impact on New Entrants | Fastenal's Position |

|---|---|---|

| Capital Requirements | High (inventory, facilities, logistics) | Leverages scale for cost efficiencies |

| Economies of Scale | Challenging to achieve | Significant cost advantages from large-scale operations |

| Distribution Network | Costly and time-consuming to replicate | Extensive network of 3,600+ locations |

| Customer Relationships & Switching Costs | Difficult to build trust and overcome inertia | Strong loyalty and high integration in customer workflows |

| Regulatory & Expertise Demands | Requires significant investment and knowledge | Established compliance and industry expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fastenal is built upon a foundation of publicly available financial data from SEC filings and investor relations reports, complemented by industry-specific market research from firms like IBISWorld and Statista.