Fastenal Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fastenal Bundle

Fastenal's marketing success hinges on a masterful blend of its 4Ps. From their expansive product catalog designed for industrial efficiency to their strategic pricing that emphasizes value and volume, every element is meticulously crafted.

Their extensive distribution network, a cornerstone of their "place" strategy, ensures accessibility, while their targeted promotional efforts reach the right decision-makers. Discover the intricate details of how Fastenal leverages each P to dominate the industrial supply market.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fastenal's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Fastenal's product strategy centers on an extensive catalog of industrial and construction supplies. This includes everything from essential fasteners and cutting tools to critical safety equipment, designed to be a one-stop shop for businesses. Their product depth is a key differentiator, ensuring they can equip a broad spectrum of operational requirements for their clients.

This comprehensive product offering directly serves a diverse B2B customer base. Sectors such as manufacturing, construction, warehousing, and government agencies rely on Fastenal for their day-to-day operational needs. For instance, in 2023, Fastenal reported that sales of their core industrial and construction supplies remained a significant driver of their overall revenue, highlighting the importance of this product category.

Fastenal's MRO Equipment & Solutions represent a cornerstone of their product strategy, encompassing a vast array of indirect materials crucial for industrial operations. This segment includes items like abrasives, fasteners, cutting tools, and personal protective equipment (PPE), designed to ensure facilities function efficiently and safely. For instance, in 2023, Fastenal reported that MRO products and services accounted for a substantial portion of their revenue, reflecting the critical demand for these essential supplies.

Fastenal’s supply chain solutions go beyond just selling fasteners and industrial supplies. They offer services like inventory management, vending machines, and on-site support to keep customer operations running smoothly. For example, in 2023, Fastenal reported that their inventory management solutions helped customers reduce their carrying costs by an average of 15%.

These customized programs are designed to integrate seamlessly with a customer's existing workflow, aiming to cut down on waste and boost productivity. Fastenal’s logistics expertise ensures that the right parts are available when and where they are needed, a critical factor for maintaining efficiency. Their focus is on reducing a customer’s total cost of ownership, not just the price of the product itself.

Fastenal Managed Inventory (FMI) Technology

Fastenal Managed Inventory (FMI) Technology, featuring FASTBin and FASTVend vending solutions, serves as a critical product in Fastenal's marketing mix. This technology offers customers secure, on-site access to essential supplies, coupled with automated inventory management and restocking. It significantly boosts product visibility and control, streamlining operations for all parties involved.

The digital nature of FMI enhances traceability and operational efficiency, directly impacting the product's value proposition. This focus on advanced inventory solutions addresses a core customer need for streamlined supply chain management.

Fastenal reported a notable increase in FMI sales during the second quarter of 2025, underscoring its growing significance within the company's portfolio. This growth highlights the market's positive reception to these automated inventory solutions.

Key aspects of FMI Technology include:

- Secure, point-of-use access to supplies

- Automated inventory tracking and replenishment

- Enhanced product visibility and traceability

- Increased operational efficiency for customers

Custom Manufacturing & Services

Fastenal’s custom manufacturing and services offering significantly enhances its product strategy by providing bespoke solutions. This moves beyond mere product distribution to address unique customer needs, a key differentiator in the industrial supply sector.

The company leverages subject matter experts in critical areas such as lean manufacturing, safety protocols, and engineering to deliver added value. This expertise allows Fastenal to offer high-touch services that directly support customer operational efficiency and safety, setting it apart from competitors.

- Tailored Solutions: Fastenal provides custom manufacturing services, aligning product offerings with specific client requirements.

- Expertise Integration: Subject matter experts in lean manufacturing, safety, and engineering are integrated into service delivery.

- Value-Added Services: These specialized services offer significant value beyond traditional product distribution.

- Market Differentiation: High-touch services are a core element of Fastenal's competitive market positioning.

Fastenal's product strategy is built upon a vast and diverse catalog of industrial and construction supplies, aiming to be a comprehensive solution provider. This extensive range, from fasteners and tools to safety equipment, caters to the essential operational needs of a broad B2B client base. Their commitment to offering a wide selection ensures they can meet varied demands across sectors like manufacturing and construction.

A significant product pillar is their MRO Equipment & Solutions, which covers indirect materials vital for industrial functionality and safety. This includes critical items such as abrasives, fasteners, cutting tools, and personal protective equipment (PPE). In 2023, these MRO products and services represented a substantial portion of Fastenal's revenue, underscoring their importance to customer operations.

Fastenal's innovative Fastenal Managed Inventory (FMI) Technology, including FASTBin and FASTVend, is a key product differentiator. This system provides secure, on-site access to supplies with automated tracking and replenishment, enhancing product visibility and control. The digital nature of FMI boosts traceability and operational efficiency, directly adding value for customers by streamlining supply chain management.

The company also excels in custom manufacturing and specialized services, moving beyond simple distribution to create tailored solutions. By integrating subject matter experts in areas like lean manufacturing and safety, Fastenal offers high-touch services that boost customer efficiency and safety, setting them apart in the market.

| Product Category | Description | 2023 Revenue Impact (Illustrative) | Key Benefit | 2025 Outlook Indicator |

|---|---|---|---|---|

| Industrial & Construction Supplies | Core offerings including fasteners, tools, safety gear. | Significant driver of overall revenue. | One-stop shop for operational needs. | Continued strong demand. |

| MRO Equipment & Solutions | Indirect materials for operations and safety. | Substantial revenue contribution. | Ensures efficient and safe facility function. | Critical demand remains high. |

| Fastenal Managed Inventory (FMI) Technology | Vending and bin solutions for automated inventory. | Growing segment, notable Q2 2025 sales increase. | Streamlined supply chain, enhanced control. | Positive market reception and growth. |

| Custom Manufacturing & Services | Bespoke solutions and expert-driven support. | Value-added revenue stream. | Addresses unique client needs, boosts efficiency. | Key market differentiator. |

What is included in the product

This analysis provides a comprehensive examination of Fastenal's marketing mix, detailing its product offerings, pricing strategies, distribution channels (place), and promotional activities. It offers insights into how Fastenal leverages these elements to maintain its market position and serve its industrial and construction customer base.

Simplifies Fastenal's marketing strategy by highlighting how each P addresses customer pain points, making it a valuable tool for quick comprehension and strategic alignment.

Place

Fastenal's extensive branch network serves as a cornerstone of its marketing mix, providing local access to inventory and personalized customer service. This physical presence ensures customers can quickly obtain needed products and receive tailored support, a key differentiator in the industrial supply sector.

While Fastenal has strategically streamlined its traditional branch footprint, the company has actively expanded its reach through Onsite locations. As of the end of 2023, Fastenal operated over 3,000 total locations, including a significant number of Onsite vending and service locations, demonstrating a commitment to in-market accessibility.

Fastenal's Onsite locations are a critical component of its product strategy, bringing inventory and service directly to the customer. This model, which manages client-specific stock, directly fuels daily sales and strengthens customer relationships. As of December 31, 2024, Fastenal had grown its active Onsite locations to 2,031, marking an impressive 11.5% increase from the previous year.

Fastenal's Managed Inventory (FMI) devices, like FASTBin and FASTVend, represent a crucial element of their product strategy, placing automated inventory management directly at the customer's doorstep. This point-of-use availability ensures that essential supplies are always on hand, streamlining operations and boosting efficiency for clients. These smart devices are a cornerstone of Fastenal's expanding digital infrastructure, reflecting a commitment to technological innovation in service delivery.

Digital Footprint (eBusiness & eCommerce)

Fastenal's digital footprint, a crucial element of its marketing mix, is rapidly expanding through robust eProcurement and eCommerce platforms. This digital channel is significantly enhancing product accessibility for its customer base. The company's commitment to digital integration is evident in its advanced electronic data interchange (EDI) capabilities and a transactional website designed for efficient product procurement.

Looking ahead, Fastenal anticipates a substantial shift towards digital sales. The company projects that its digital channels will account for a significant majority of its sales volume.

- Projected Digital Sales: Fastenal expects its digital footprint to represent 66% to 68% of its sales volume by the end of 2025.

- Key Digital Components: This includes integrated electronic data interchange (EDI) and transactional website sales.

- Customer Benefit: These platforms enable customers to procure products with greater efficiency.

Regional Distribution Centers & Captive Logistics

Fastenal's commitment to its customers is strongly supported by its network of regional distribution centers and its own captive logistics fleet. This infrastructure is designed to efficiently move goods across its supply chain, ensuring products are readily available and staged near customer locations. This focus on logistics directly enhances customer convenience and boosts sales opportunities.

In 2023, Fastenal operated 16 distribution centers, strategically positioned to serve its vast network of over 1,300 in-market locations. This extensive physical presence, coupled with its dedicated logistics capabilities, allows for rapid replenishment and precise inventory management. The company's investment in its supply chain infrastructure, including its fleet, underpins its ability to deliver on its promise of "On Time, Every Time."

- 16 Distribution Centers: Strategically located to support the extensive in-market store network.

- Captive Logistics Fleet: Ensures efficient and reliable product movement throughout the supply chain.

- Inventory Staging: Products are positioned close to customer sites for faster fulfillment.

- Customer Convenience: Optimized logistics directly translate to improved customer experience and sales potential.

Fastenal's "Place" strategy is multifaceted, combining a robust physical branch network with an expanding digital presence and strategically located onsite solutions. This approach ensures product availability and accessibility across diverse customer needs and locations. The company's commitment to bringing inventory closer to the point of use is a key driver of its success.

As of December 31, 2024, Fastenal operated 2,031 active Onsite locations, a 11.5% increase year-over-year, demonstrating aggressive expansion in this critical area. This growth is complemented by a projected digital sales volume of 66% to 68% by the end of 2025, highlighting a significant shift towards online procurement channels. Fastenal's 16 distribution centers, supported by its own logistics fleet, ensure efficient product flow to its extensive network, directly enhancing customer convenience and sales opportunities.

| Metric | Value (as of latest available data) | Significance |

| Total Locations (incl. Onsite) | Over 3,000 (end of 2023) | Broad physical reach and accessibility |

| Active Onsite Locations | 2,031 (December 31, 2024) | 11.5% YoY growth, bringing inventory to customer sites |

| Projected Digital Sales Volume | 66%-68% (by end of 2025) | Significant shift towards eProcurement and eCommerce |

| Distribution Centers | 16 (2023) | Support for the extensive in-market store network |

What You See Is What You Get

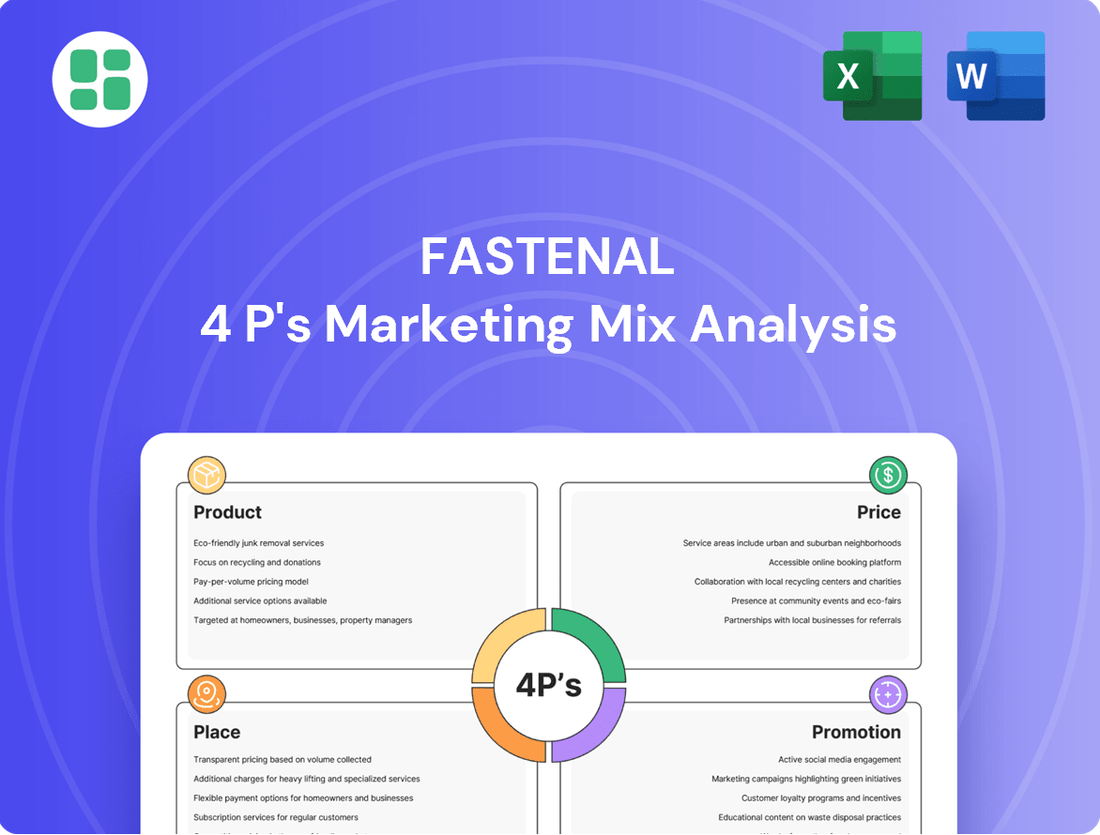

Fastenal 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Fastenal 4P's Marketing Mix Analysis you'll receive immediately after purchase. This detailed document covers Product, Price, Place, and Promotion strategies. You can be confident that the quality and content displayed are precisely what you'll be downloading, ready for your immediate use.

Promotion

Fastenal's direct sales force is the backbone of its relationship selling strategy, with over 2,000 sales associates actively engaging customers. This localized approach allows for deep understanding of client needs, fostering loyalty and repeat business. In 2024, this direct engagement was crucial in helping customers navigate supply chain disruptions, with sales teams identifying an average of 15% in potential cost savings for key accounts through tailored solutions.

Fastenal's promotional efforts consistently emphasize how they help businesses slash supply chain expenses and minimize operational risks. For example, in 2023, Fastenal reported a 10.1% increase in industrial and construction sales, indicating growing customer trust in their ability to deliver value and manage complexity.

By showcasing integrated solutions like advanced inventory management and on-site vending, Fastenal positions itself as a vital partner for tackling scalability challenges, not merely a vendor. This strategic focus on tangible benefits resonates deeply with B2B clients seeking efficiency gains.

Fastenal actively promotes its digital engagement tools, like FAST360° and its eBusiness platforms. These digital solutions are marketed as ways to give customers better control over product visibility and usage, streamlining procurement processes.

The company emphasizes how the data collected from these digital interactions allows them to provide valuable insights, helping customers optimize their operations. This data-driven approach is a core component of their promotional strategy, highlighting efficiency gains.

Fastenal's increasing digital footprint is a significant promotional message, underscoring their commitment to technological advancement and customer convenience. This digital push is designed to drive adoption and demonstrate tangible benefits in the 2024/2025 period.

Strategic Partnerships & National Accounts Program

Fastenal’s strategic partnerships, especially through its National Accounts Program, are a cornerstone of its marketing strategy, focusing on large, multi-site customers. This program is designed to integrate Fastenal's services directly into client operations, making it harder for them to switch providers.

By embedding solutions like onsite facilities and vending systems, Fastenal builds significant switching costs and cultivates robust customer loyalty. This approach is a key driver for the company's sustained growth and market presence.

For example, in the first quarter of 2024, Fastenal reported a 4.7% increase in daily sales compared to the prior year, reflecting the success of its customer-centric strategies and deep integration with key accounts.

Key aspects of this strategy include:

- National Accounts Program: Tailored solutions for large, geographically dispersed clients.

- Onsite & Vending Solutions: Deep integration into customer workflows to enhance efficiency and reduce costs.

- Partnership Focus: Building long-term relationships rather than transactional sales.

- High Switching Costs: Creating sticky customer relationships through embedded services.

Industry Events & Thought Leadership

Fastenal's commitment to industry events and thought leadership, while not always explicitly detailed in forward-looking statements for 2024-2025, remains a cornerstone of its marketing strategy. Historically, the company has actively participated in key trade shows and conferences, such as the National Association of Wholesaler-Distributors (NAW) annual meeting and various manufacturing and supply chain expos. These engagements allow Fastenal to showcase its expertise in areas like inventory management, logistics optimization, and safety solutions, directly addressing the needs of its B2B clientele.

By presenting on best practices and demonstrating innovative product applications, Fastenal reinforces its position as a trusted advisor in the industrial supply sector. This strategy is crucial for building brand equity and fostering deeper relationships with customers and partners. For instance, in 2023, Fastenal reported strong growth in its vending and onsite services, areas often highlighted at industry forums as key differentiators for efficiency and cost savings in procurement.

The company's thought leadership extends to sharing insights on evolving supply chain dynamics, including the impact of technology and sustainability initiatives. This proactive approach not only educates the market but also positions Fastenal at the forefront of industry trends. Their emphasis on digital solutions, such as their online ordering platform and inventory management tools, is frequently a topic of discussion at these events, demonstrating their forward-thinking approach.

- Industry Event Presence: Fastenal historically leverages major industry trade shows to connect with customers and demonstrate solutions.

- Thought Leadership: The company actively shares expertise on supply chain efficiency, inventory management, and safety protocols.

- Brand Credibility: Participation in events and knowledge sharing enhances Fastenal's reputation as an industry leader.

- Showcasing Innovation: Events provide a platform to highlight advancements like vending solutions and digital procurement tools.

Fastenal's promotional strategy centers on demonstrating tangible value and operational efficiency for its B2B clients. They highlight how their integrated solutions, including advanced inventory management and on-site vending, help businesses reduce costs and mitigate supply chain risks. This focus on solving customer pain points is key to their marketing efforts.

The company actively promotes its digital platforms, such as FAST360° and its eBusiness portal, positioning them as tools for enhanced customer control and streamlined procurement. Fastenal emphasizes the data-driven insights these digital interactions provide, helping customers optimize their operations and achieve efficiency gains, a significant message for 2024/2025.

By embedding services like onsite facilities and vending systems, Fastenal builds strong customer loyalty and creates high switching costs. This partnership approach, particularly through their National Accounts Program, is a core promotional element designed to foster long-term relationships and sustained growth, as evidenced by their Q1 2024 daily sales increase of 4.7%.

Fastenal also leverages industry events and thought leadership to showcase its expertise in supply chain management and inventory optimization. This strategy reinforces their image as a trusted advisor, highlighting innovations like vending solutions and digital procurement tools, which were key growth areas in 2023.

| Promotional Focus | Key Initiatives | Impact/Data Point |

|---|---|---|

| Value Proposition | Cost savings, risk reduction, operational efficiency | Sales teams identified an average of 15% in potential cost savings for key accounts in 2024. |

| Digital Engagement | FAST360°, eBusiness platforms | Driving adoption of digital tools to enhance product visibility and procurement control. |

| Customer Integration | National Accounts Program, Onsite & Vending Solutions | 4.7% increase in daily sales in Q1 2024, reflecting deep client integration. |

| Industry Presence | Trade shows, thought leadership, best practices | Strong growth in vending and onsite services reported in 2023, often showcased at industry forums. |

Price

Fastenal's pricing for its supply chain solutions is deeply rooted in a value-based strategy. This means the price isn't just about the cost of goods, but about the significant savings and efficiencies customers gain. For instance, by optimizing inventory and streamlining procurement, Fastenal helps clients slash carrying costs and reduce administrative overhead.

This approach allows Fastenal to price its integrated services above the sum of their individual product costs. In 2024, the company continued to emphasize these value-added services, with its industrial and construction supply segment, which heavily features these solutions, showing robust performance. This strategy directly ties the price to the demonstrable economic benefits delivered to the customer's bottom line.

Fastenal leverages contractual agreements with its major B2B clients, especially national accounts and Onsite customers, to solidify its market position. These agreements often feature tiered pricing based on purchase volume, a strategy designed to reward loyalty and encourage consistent business. For instance, in 2023, Fastenal reported that its national account program continued to be a significant driver of growth, underscoring the success of these structured relationships.

Fastenal navigates a highly competitive landscape for its standard industrial and construction supplies, making competitive pricing a critical element of its strategy. The company strives to maintain stable price levels, even as some categories, like fasteners, experience minor pricing pressure influenced by broader market dynamics.

To ensure its market position, Fastenal actively monitors competitor pricing and analyzes market demand. This ongoing vigilance allows them to adjust their pricing strategies effectively, ensuring they remain a compelling option for customers seeking value.

Flexible Payment Terms and Credit Options

Fastenal understands that managing cash flow is crucial for its B2B customers. To address this, the company provides flexible payment terms and offers credit options, making it easier for businesses to acquire the essential supplies they need. This approach not only supports customer operations but also solidifies Fastenal's role as a reliable partner.

These credit and payment flexibility initiatives are backed by Fastenal's robust financial standing. For instance, as of the first quarter of 2024, Fastenal reported a strong balance sheet, enabling them to extend these beneficial terms.

- Flexible Payment Options: Fastenal offers various payment schedules to suit different customer needs.

- Credit Facilities: The company provides credit lines to qualified businesses, facilitating larger or recurring purchases.

- Cash Flow Management: These terms help customers manage their working capital effectively.

- Customer Loyalty: Offering financial flexibility enhances customer relationships and encourages repeat business.

Strategic Pricing Actions Amidst Market Conditions

Fastenal adjusts its pricing strategies to navigate evolving market dynamics, such as inflationary trends and fluctuating supply chain expenses. The company's proactive approach includes pricing adjustments implemented in April 2025, with further potential adjustments planned for the latter half of 2025, designed to support revenue expansion.

These strategic pricing maneuvers are calibrated to maintain a delicate equilibrium between enhancing profitability and preserving strong customer partnerships.

- Revenue Growth Focus: Pricing actions in 2025 are directly linked to contributing to Fastenal's overall revenue growth objectives.

- Inflationary Response: The company actively uses pricing to offset the impact of rising costs, including those associated with inflation.

- Supply Chain Cost Management: Pricing adjustments also serve to recover and manage increased supply chain expenditures.

- Customer Relationship Balance: Fastenal aims to implement price changes in a manner that minimizes disruption and maintains customer loyalty.

Fastenal's pricing strategy centers on delivering value, often exceeding the cost of individual products through integrated solutions. This approach is reinforced by contractual agreements with key clients, offering tiered pricing that rewards volume and fosters loyalty. In 2023, national accounts, a key segment for these agreements, showed significant growth, highlighting the effectiveness of this pricing model.

The company also employs competitive pricing for its standard offerings while actively managing price adjustments to counteract inflation and supply chain costs. For example, Fastenal implemented pricing changes in April 2025 and planned further adjustments for late 2025 to support revenue growth, balancing profitability with customer relationships.

Financial flexibility, including payment terms and credit options, is a core component of Fastenal's pricing. This is supported by its strong financial health, as evidenced by its robust balance sheet in Q1 2024, allowing them to offer beneficial terms that aid customer cash flow management and build loyalty.

| Pricing Strategy Element | Description | Impact/Example |

|---|---|---|

| Value-Based Pricing | Pricing based on customer savings and efficiencies gained. | Optimizing inventory reduces customer carrying costs. |

| Contractual Agreements | Tiered pricing for national accounts and Onsite customers. | National accounts drove growth in 2023. |

| Competitive Pricing | Maintaining stable prices for standard supplies amidst market dynamics. | Addressing minor pricing pressure in categories like fasteners. |

| Dynamic Adjustments | Responding to inflation and supply chain costs. | Price changes in April 2025 and planned for late 2025. |

| Payment Flexibility | Offering credit and varied payment terms. | Supported by a strong balance sheet in Q1 2024. |

4P's Marketing Mix Analysis Data Sources

Our Fastenal 4P's Marketing Mix Analysis leverages a comprehensive blend of internal company data, including sales figures, product catalog details, and pricing structures. We also incorporate external market intelligence from industry reports, competitor analysis, and customer feedback platforms to ensure a holistic view.