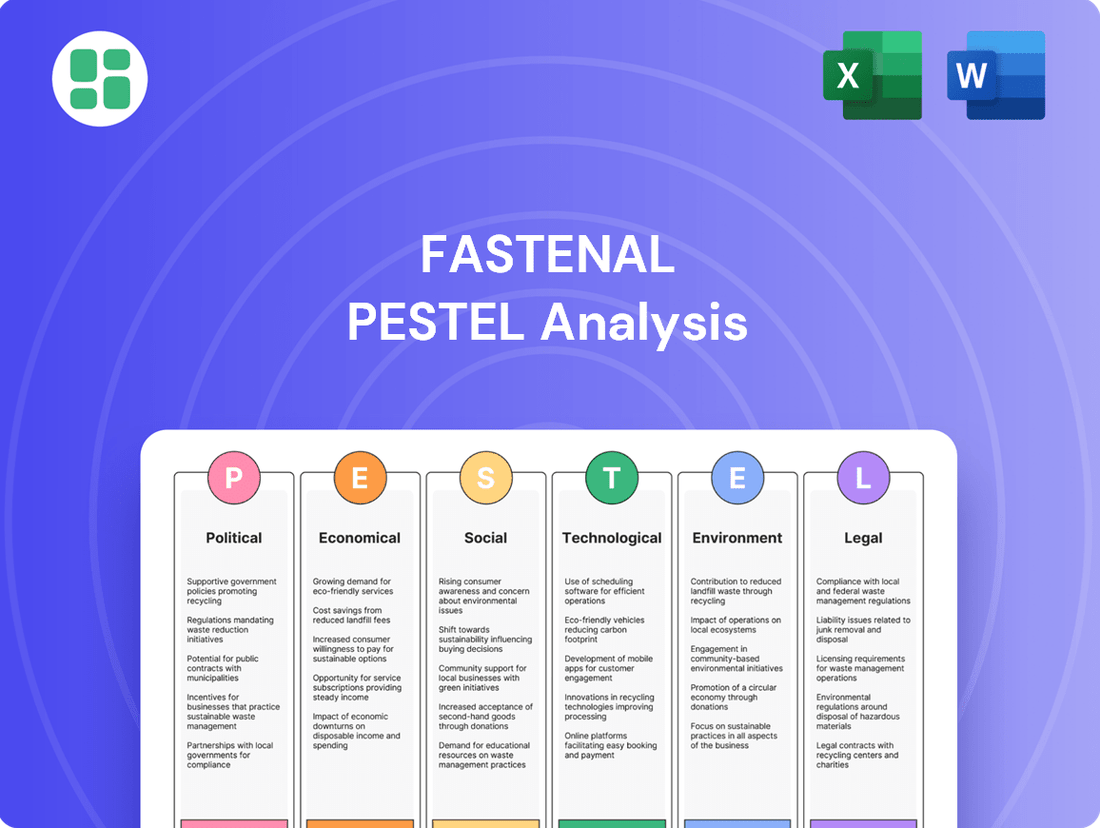

Fastenal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fastenal Bundle

Uncover the critical external forces shaping Fastenal's trajectory with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors present both opportunities and challenges for this industrial supply giant. Equip yourself with actionable intelligence to refine your own market strategy and gain a competitive edge. Download the full PESTLE analysis now and unlock a deeper understanding of Fastenal's operating landscape.

Political factors

Government infrastructure spending, particularly initiatives like the Infrastructure Investment and Jobs Act, directly fuels demand for industrial supplies, including fasteners. This legislation, with its substantial allocations for roads, bridges, and other public works, creates a robust market for companies like Fastenal, whose products are essential to these construction and manufacturing sectors. Such government investment translates into sustained growth opportunities for Fastenal.

Fluctuating U.S. trade policies, such as Section 301 tariffs on Chinese imports and duties on steel and aluminum, directly influence Fastenal's sourcing costs and supply chain management. For instance, the ongoing Section 301 tariffs, which remained largely in place through early 2024, continue to add pressure on imported goods.

'Buy American' initiatives, increasingly prevalent in government procurement, also shape Fastenal's sourcing decisions for federal projects, requiring greater emphasis on domestic content. This trend necessitates strategic diversification of supply chains to mitigate risks and manage potential increases in operational expenses.

Fastenal navigates a growing web of regulations, from workplace safety to environmental standards, demanding constant vigilance. For instance, the increasing focus on Environmental, Social, and Governance (ESG) reporting, driven by investor demand and potential regulatory mandates, requires significant investment in data collection and transparent disclosure. Failure to comply with these evolving rules can result in substantial penalties, such as the potential fines associated with violations of environmental protection laws, impacting profitability and brand trust.

Geopolitical Instability

Global geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, significantly impact international supply chains. For Fastenal, this translates to potential disruptions in the availability and cost of essential raw materials and finished goods. For instance, disruptions in shipping routes due to conflicts can increase transit times and freight costs, directly affecting Fastenal's operational expenses and product pricing.

These instabilities create considerable uncertainty and risk in logistics and sourcing strategies. Fastenal's ability to secure reliable transportation and manage inventory levels is directly challenged by unpredictable events. The company's reliance on a global network means that regional conflicts can have cascading effects worldwide, necessitating robust contingency planning.

To navigate these challenges, Fastenal must prioritize building and maintaining resilient supply chains. This involves diversifying sourcing locations, exploring nearshoring options, and investing in advanced inventory management systems. For example, in 2024, many industrial distributors have focused on increasing inventory levels for critical components to buffer against potential supply chain shocks.

- Disrupted Supply Chains: Geopolitical events can halt or delay shipments, impacting Fastenal's ability to deliver products on time.

- Increased Costs: Higher freight rates and raw material prices stemming from instability directly affect Fastenal's cost of goods sold.

- Supplier Risk: Political instability in countries where Fastenal sources materials can lead to supplier failures or production halts.

- Inventory Management: The need for greater buffer stock to mitigate disruptions adds complexity and cost to inventory management.

Government Incentives for Domestic Production

Government initiatives aimed at encouraging domestic manufacturing and onshoring are increasingly influencing the industrial landscape. For distributors like Fastenal, these policies can translate into heightened demand for industrial materials within the U.S. For instance, the CHIPS and Science Act of 2022, with its significant investment in semiconductor manufacturing, is a prime example of a policy designed to bolster domestic production, which in turn creates a ripple effect for industrial suppliers.

These incentives often foster a shift in supply chain strategies, prioritizing local sourcing over international options. This trend directly benefits companies like Fastenal, which possess a robust network of local service centers and inventory. Fastenal's established presence across the U.S. positions it well to capitalize on this reshoring movement by providing readily available materials and support to manufacturers bringing production back home.

- Increased Demand: Policies promoting domestic production, such as those encouraging reshoring, directly boost the need for industrial supplies.

- Supply Chain Realignment: A focus on local sourcing strengthens the value proposition of distributors with extensive U.S. footprints.

- Operational Advantage: Fastenal's network of service centers and inventory allows it to efficiently meet the localized needs of manufacturers participating in onshoring trends.

- Economic Impact: Government incentives for domestic manufacturing are projected to create significant job growth and economic activity, further stimulating demand for industrial goods and services.

Government infrastructure spending, exemplified by the 2023 Bipartisan Infrastructure Law's $1.2 trillion allocation, directly drives demand for fasteners and industrial supplies. This legislation's focus on roads, bridges, and public transit projects creates a sustained market for Fastenal's products. Furthermore, evolving trade policies, including tariffs on imported steel and aluminum, continue to influence sourcing costs and supply chain strategies for companies like Fastenal, impacting its cost of goods sold.

Increasingly stringent environmental regulations, such as those concerning emissions and waste management, necessitate investments in compliance and sustainable practices, potentially increasing operational costs. Simultaneously, 'Buy American' initiatives in government procurement favor domestic sourcing, aligning with Fastenal's U.S. manufacturing support. For instance, federal projects often require a higher percentage of domestically sourced materials, influencing Fastenal's supply chain decisions.

Geopolitical instability, as seen in ongoing global conflicts, poses risks to international supply chains, potentially disrupting material availability and increasing freight costs. Fastenal's reliance on a global network means these events can directly impact its operational expenses and product pricing. The company's strategy to mitigate these risks involves diversifying suppliers and increasing inventory levels for critical components, a trend observed across the industrial distribution sector in 2024.

| Factor | Impact on Fastenal | Data/Trend (2023-2024) |

|---|---|---|

| Infrastructure Spending | Increased demand for industrial supplies | Bipartisan Infrastructure Law: $1.2 trillion allocated for projects. |

| Trade Policies | Fluctuating sourcing costs, supply chain adjustments | Continued tariffs on steel and aluminum impacting import prices. |

| Environmental Regulations | Increased compliance costs, focus on sustainability | Growing investor and regulatory pressure for ESG reporting. |

| 'Buy American' Initiatives | Favoring domestic sourcing for government contracts | Higher demand for U.S.-manufactured industrial materials. |

| Geopolitical Instability | Supply chain disruptions, increased freight costs | Global shipping route volatility impacting transit times and costs. |

What is included in the product

This Fastenal PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic direction.

It offers actionable insights by detailing specific impacts and trends within each category, enabling informed decision-making for stakeholders.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Fastenal's external landscape to identify and address potential challenges.

Economic factors

Fastenal's financial results are significantly influenced by the manufacturing sector's vitality. Throughout 2024, this sector encountered a period of subdued activity, impacting Fastenal's top line. Despite a modest uptick in net sales, the tempered growth underscores the persistent headwinds within manufacturing operations.

The company's future revenue trajectory is intrinsically linked to a resurgence in industrial output and a corresponding increase in production volumes from its core customer base. For instance, the Institute for Supply Management (ISM) Manufacturing PMI hovered below the 50-point expansion threshold for much of 2024, signaling contractionary conditions. This economic backdrop directly translates to lower demand for Fastenal's products and services.

Persistent inflation continues to be a significant factor for Fastenal, with the US Consumer Price Index (CPI) showing a year-over-year increase of 3.3% as of May 2024. This directly impacts Fastenal's operational costs, from the price of nuts and bolts to transportation expenses, forcing adjustments to their pricing models and potentially squeezing profit margins.

The current interest rate environment, with the Federal Reserve holding the federal funds rate steady in the 5.25%-5.50% range through mid-2024, also plays a crucial role. Higher borrowing costs for Fastenal itself can impact investment in new facilities or technology. More importantly, it influences capital expenditure decisions for their diverse customer base, potentially slowing down projects that would require new equipment or supplies.

The industrial distribution market is experiencing heightened competition, significantly fueled by the expansion of e-commerce and the emergence of new players. Fastenal faces the challenge of constantly improving its digital presence and services to cater to customers who increasingly prefer omnichannel shopping experiences and swift service delivery. This dynamic environment necessitates aggressive pricing strategies and a commitment to ongoing innovation.

Labor Market Conditions

The labor market continues to present challenges, with the U.S. unemployment rate hovering around 3.9% as of April 2024, indicating a persistently tight environment. This scarcity of available workers puts upward pressure on wages, directly impacting Fastenal's employee-related costs. For instance, average hourly earnings in the private sector saw a 3.9% increase year-over-year in April 2024, a trend that directly affects a company with a significant field sales and service workforce.

Labor shortages within key customer industries, such as construction and manufacturing, can dampen demand for Fastenal's products and services. If these sectors struggle to find skilled labor, their project pipelines may slow, reducing the need for the supplies and on-site support Fastenal provides. This dynamic underscores the importance of Fastenal's ability to adapt to fluctuating customer operational capacities.

To navigate these conditions, effective workforce management and robust talent retention strategies are paramount for Fastenal. This includes competitive compensation, benefits, and training programs to attract and keep skilled employees. The company's success in managing its workforce directly correlates with its ability to maintain operational efficiency and customer service levels in a competitive labor landscape.

- Low Unemployment: U.S. unemployment rate at 3.9% (April 2024) signifies a tight labor market.

- Wage Growth: Average hourly earnings increased by 3.9% year-over-year (April 2024), raising labor costs.

- Industry Impact: Shortages in construction and manufacturing can reduce demand for Fastenal's offerings.

- Strategic Need: Focus on talent retention and workforce management is critical for operational stability.

Global Industrial Distribution Market Growth

The global industrial distribution market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028, reaching an estimated $1.2 trillion by 2028. This expansion is fueled by escalating demand in emerging economies and the widespread integration of Industry 4.0 technologies, such as automation and data analytics, within manufacturing sectors. Fastenal, with its established international presence and focus on supply chain efficiency, is well-positioned to leverage these growth trends.

Key drivers for this market expansion include:

- Increased manufacturing output: Global manufacturing output saw a 2.0% increase in 2023, according to the World Bank, directly boosting demand for industrial supplies.

- Technological adoption: The push towards smart factories and digital supply chains is enhancing the need for integrated distribution solutions.

- Emerging market penetration: Developing nations are increasingly investing in industrial infrastructure, creating new avenues for market growth.

- E-commerce growth: The shift towards online procurement platforms for industrial goods is streamlining access and increasing sales volumes.

The economic landscape in 2024 presented a mixed bag for Fastenal, with manufacturing sector performance being a key determinant of its sales. While there was a slight increase in net sales, the overall subdued activity in manufacturing, evidenced by the ISM Manufacturing PMI often staying below the 50-point expansion mark, directly translated to tempered demand for Fastenal's products. Persistent inflation, with the US CPI at 3.3% year-over-year in May 2024, continued to pressure operational costs and pricing strategies.

The Federal Reserve's decision to maintain the federal funds rate between 5.25%-5.50% through mid-2024 influenced borrowing costs for both Fastenal and its customers, potentially impacting capital expenditure decisions. Furthermore, a tight labor market, reflected in a 3.9% unemployment rate in April 2024 and a 3.9% rise in average hourly earnings, increased labor costs and highlighted the need for effective talent management.

The global industrial distribution market, however, showed resilience and growth, projected at a 5.8% CAGR from 2023 to 2028. This expansion is driven by increased manufacturing output, technological adoption like Industry 4.0, and growing e-commerce penetration in industrial procurement, positioning Fastenal to capitalize on these broader trends.

| Economic Factor | Metric/Indicator | Value/Trend (as of mid-2024) | Impact on Fastenal |

| Manufacturing Activity | ISM Manufacturing PMI | Below 50 (Contractionary) | Reduced demand for products |

| Inflation | US CPI (YoY) | 3.3% (May 2024) | Increased operational costs, pricing pressure |

| Interest Rates | Federal Funds Rate | 5.25%-5.50% (Steady) | Influences customer capex, borrowing costs |

| Labor Market | Unemployment Rate | 3.9% (April 2024) | Tight labor market, increased wage pressure |

| Global Market Growth | Industrial Distribution CAGR | 5.8% (2023-2028) | Opportunities for international expansion |

Same Document Delivered

Fastenal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fastenal covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

Sociological factors

The industrial and construction sectors are grappling with persistent labor shortages and significant skills gaps, directly affecting Fastenal's capacity to meet customer demands. For instance, the U.S. Bureau of Labor Statistics projected a need for 3.6 million new manufacturing jobs by 2028, with a significant portion requiring advanced technical skills that are currently in short supply.

Fastenal's investment in its workforce, comprising over 24,000 employees, is paramount in navigating these challenges. By prioritizing talent development, the company can better equip its staff to address evolving industry needs and provide enhanced customer support.

Effectively bridging these skills gaps through robust training programs and strategic retention efforts is essential for maintaining operational efficiency and fostering continued growth for Fastenal in the dynamic market landscape.

Modern business-to-business customers now demand effortless, multi-channel purchasing. This means being able to buy online, over the phone, or via email, all while receiving personalized attention and quick order fulfillment. Fastenal's strategy of combining local expertise with advanced customer-facing technology, which they call 'high-touch, high-tech,' is designed to meet these changing expectations head-on.

The ability to provide speed and convenience in how orders are processed and delivered is becoming a critical factor for success. For instance, in 2023, Fastenal reported that its digital sales channels continued to grow, reflecting this shift in customer behavior and the increasing importance of e-commerce integration in B2B transactions.

Societal and regulatory pressure for robust workplace safety is a significant factor, especially in industries Fastenal serves. Companies are increasingly held accountable for their safety records, influencing purchasing decisions and partnerships.

Fastenal's commitment to workplace safety is a key differentiator. In 2023, the company reported an Experience Modification Rate (EMR) of 0.65, significantly below the industry average of 1.0, indicating fewer workers' compensation claims than expected for a business of its size. This superior EMR not only protects employees but also translates to lower insurance premiums, contributing to cost efficiencies.

This focus on safety enhances Fastenal's brand image, positioning it as a responsible employer and a reliable supplier. Customers, particularly those with stringent safety standards, are more likely to engage with companies that demonstrate a proactive approach to protecting their workforce.

ESG Vision and Community Engagement

Fastenal's ESG vision, focusing on empowering people, preserving the world, and being a trusted partner, aligns with growing societal demands for businesses to act responsibly. This commitment translates into tangible actions regarding workplace safety and community investment.

The company's dedication to these principles is evident in its operational focus. For instance, in 2023, Fastenal reported a lost-time injury frequency rate of 0.95 per 200,000 hours worked, demonstrating a strong emphasis on employee well-being.

Transparent reporting on these initiatives is crucial for building and maintaining stakeholder trust. Fastenal's sustainability reports detail progress in areas like:

- Employee Safety: Continued efforts to reduce workplace incidents and promote a safety-first culture.

- Diversity and Inclusion: Initiatives aimed at fostering a more diverse workforce and inclusive environment.

- Community Impact: Programs supporting local communities where Fastenal operates.

By openly sharing its ESG performance, Fastenal enhances its brand reputation and strengthens its relationships with customers, employees, and investors who increasingly prioritize sustainability.

Demographic Shifts in Industrial Sectors

Demographic shifts within manufacturing and construction directly impact Fastenal's talent pipeline and the availability of skilled labor. For instance, the aging workforce in these sectors means a potential loss of experienced personnel, necessitating new approaches to knowledge transfer and recruitment.

Fastenal must actively adapt its recruitment and training programs to attract a more diverse and younger workforce, which may possess different skill sets and expectations. This includes focusing on digital literacy and adaptability to new technologies. A recent survey indicated that 60% of Gen Z workers prioritize companies with strong training and development programs, a trend Fastenal needs to address.

- Aging Workforce: The average age of skilled trades workers continues to rise, creating a critical need for new talent acquisition strategies.

- Skills Gap: A growing mismatch exists between the skills demanded by modern industrial roles and those possessed by the available workforce.

- Diversity and Inclusion: Attracting a broader demographic, including women and underrepresented minorities, is crucial for expanding the talent pool and fostering innovation.

- Technological Adoption: The increasing integration of technology in industrial processes requires a workforce with enhanced digital capabilities.

Societal expectations are increasingly driving businesses towards greater transparency and accountability in their operations. Fastenal's commitment to Environmental, Social, and Governance (ESG) principles, including robust safety protocols and community engagement, directly addresses these evolving demands.

The company's focus on employee well-being and safety is a significant differentiator, as evidenced by its 2023 Experience Modification Rate (EMR) of 0.65, well below the industry average. This commitment not only protects its workforce but also resonates with customers who prioritize partnering with socially responsible suppliers.

Furthermore, demographic shifts, such as an aging workforce in key industries, present both challenges and opportunities for Fastenal in talent acquisition and development, requiring innovative approaches to attract and retain a skilled labor force.

Fastenal's strategy of combining local expertise with advanced technology, termed 'high-touch, high-tech,' is designed to meet modern B2B customer demands for seamless, multi-channel purchasing experiences, reflecting a societal shift towards convenience and digital integration.

Technological factors

The manufacturing and distribution sectors are rapidly embracing digital transformation, with technologies like AI, machine learning, and the Internet of Things (IoT) becoming more prevalent. Fastenal is actively integrating these advancements to refine its operational efficiency, forecast equipment upkeep, and bolster quality assurance measures.

By adopting Industry 4.0 principles, Fastenal aims to maintain a competitive edge and streamline its operations. For instance, in 2023, Fastenal reported a 9.4% increase in its industrial vending machine sales, a clear indicator of its investment in technology-driven solutions that enhance customer access and inventory management.

Fastenal's commitment to expanding its digital footprint is a key technological driver. Sales through its Fastenal Managed Inventory (FMI) services, such as FASTStock, FASTBin, and FASTVend, alongside eBusiness channels, are crucial. This digital integration accounted for a substantial 62.2% of total sales in the fourth quarter of 2024.

Looking ahead, Fastenal anticipates this digital channel to grow even further, projecting it to represent between 66% and 68% of sales in 2025. This strategic digital push is designed to streamline operations, lower the costs associated with each transaction, and ultimately foster stronger customer loyalty and retention.

Fastenal leverages advanced supply chain technologies to maintain high operational efficiency. Their use of real-time monitoring and sophisticated data analytics for inventory management, including automated reorder points, ensures optimal stock levels. This data-driven strategy, critical in the volatile 2024-2025 period, allows for precise control and reduces the risk of stockouts or overstocking.

This technological integration directly translates to enhanced customer service and reduced supply chain volatility for Fastenal's clientele. By providing accurate inventory visibility and ensuring product availability, the company solidifies its position as a reliable partner. For instance, in Q1 2024, Fastenal reported a 7.5% increase in sales, partly attributed to their robust supply chain technology enabling consistent product delivery.

Customer-Facing Technology Solutions

Fastenal's investment in customer-facing technology is a significant driver of its business model. The FAST360° platform and robust e-commerce capabilities streamline how customers find, order, and manage industrial supplies. This digital infrastructure provides enhanced product visibility and control, which is crucial for businesses aiming to optimize their supply chains. For instance, in 2023, Fastenal reported that its digital sales channels continued to grow, reflecting the increasing adoption of these tools by its customer base.

These technological solutions directly support Fastenal's strategy of combining high-tech efficiency with a high-touch local service approach. By simplifying procurement and offering greater traceability, Fastenal empowers its customers to manage their inventory more effectively. This focus on user experience and operational efficiency through technology is a key differentiator in the industrial distribution market.

The benefits for customers are tangible:

- Streamlined Procurement: Digital platforms reduce the time and effort required for ordering.

- Enhanced Visibility and Control: Customers gain better insight into product availability and spending.

- Improved Fulfillment: Technology optimizes the delivery and management of goods.

- Data-Driven Insights: Tools can provide analytics to help customers manage their MRO (Maintenance, Repair, and Operations) spend more strategically.

Investment in IT Infrastructure and Automation

Fastenal is significantly boosting its IT infrastructure and automation investments. This includes substantial capital expenditure dedicated to enhancing distribution center automation, such as automated picking systems, and expanding its digital capabilities. These strategic outlays are designed to bolster operational resilience and efficiency.

For instance, in 2023, Fastenal reported capital expenditures of $374.6 million, a notable increase from $310.1 million in 2022, reflecting this commitment to technological advancement. These investments are vital for supporting the ongoing growth of Fastenal's digital services and ensuring future scalability and competitiveness in the market.

- Increased IT Spending: Fastenal is prioritizing capital allocation towards technology upgrades.

- Distribution Center Automation: Investments are being made in automated picking and other warehouse technologies.

- Digital Capabilities: The company is focused on developing and enhancing its online platforms and digital services.

- Operational Efficiency: These technological advancements aim to improve speed, accuracy, and overall operational performance.

Fastenal is deeply integrating advanced technologies like AI and IoT to optimize operations, from inventory management to predictive maintenance. The company reported that its digital channels, including vending solutions and e-commerce, accounted for a significant 62.2% of total sales in Q4 2024, demonstrating a strong shift towards tech-enabled transactions.

This digital focus is projected to continue its upward trajectory, with Fastenal anticipating digital channels to represent 66% to 68% of sales in 2025. These investments in IT infrastructure and automation, including distribution center upgrades, underscore a commitment to efficiency and scalability. For instance, capital expenditures rose to $374.6 million in 2023, reflecting this strategic technological push.

| Metric | 2023 | 2024 (Q4) | 2025 (Projected) |

|---|---|---|---|

| Digital Sales % of Total | N/A | 62.2% | 66%-68% |

| Capital Expenditures | $374.6 million | N/A | N/A |

Legal factors

Fastenal operates within a complex web of state and local product safety and suitability regulations for its industrial and construction goods. The company’s 2023 annual report highlights ongoing efforts to ensure compliance, though it reiterates that ultimate responsibility for product application and adherence to specific municipal codes rests with the customer. This dynamic requires Fastenal to maintain detailed product documentation and provide clear customer guidance to mitigate risks associated with varied installation and usage requirements across different jurisdictions.

Fastenal's digital operations, including its e-commerce platforms and the use of cookies, are governed by a growing landscape of data privacy laws. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set stringent requirements for how companies collect, process, and store personal data.

Ensuring compliance with these regulations is paramount for Fastenal to protect its customers' sensitive information and avoid significant penalties. In 2024, data privacy fines globally are projected to continue their upward trend, underscoring the financial risks associated with non-compliance.

Beyond privacy, robust cybersecurity measures are critical. Fastenal must invest in advanced threat detection and prevention systems to safeguard its data infrastructure. A significant data breach in 2024 could result in not only substantial financial losses due to regulatory fines and recovery costs but also severe damage to Fastenal's reputation and customer trust.

Fastenal navigates a complex web of labor laws and workplace safety regulations across its global operations. Compliance with standards like ISO 45001 is paramount for ensuring employee well-being and mitigating operational risks. Maintaining a superior Experience Modification Rate (EMR), a key metric for workers' compensation insurance, directly impacts Fastenal's cost of doing business and its reputation as an employer.

International Trade Compliance and Tariffs

Fastenal's global operations necessitate strict adherence to international trade regulations, encompassing tariffs, sanctions, and export controls. For instance, the ongoing trade tensions and tariffs between the United States and China, which saw tariffs on billions of dollars worth of goods in 2023 and 2024, directly affect Fastenal's sourcing and pricing strategies for imported components and finished goods.

These trade dynamics can significantly alter material costs and complicate supply chain management, requiring constant vigilance. Proactive monitoring of evolving trade agreements and tariff structures is crucial for mitigating financial risks and ensuring operational continuity.

- Tariff Impact: Tariffs on goods from countries like China can increase the cost of inventory for Fastenal. For example, tariffs implemented in 2018-2019 continued to influence supply chain costs into 2024, with some sectors experiencing price increases of 10-25% on affected goods.

- Sanctions and Export Controls: Compliance with sanctions imposed on certain countries or entities is mandatory, preventing transactions that could lead to penalties.

- Trade Agreement Changes: Updates to trade pacts, such as potential revisions to USMCA or new agreements, can create new opportunities or challenges for Fastenal's international sourcing and sales.

- Supply Chain Resilience: Fastenal's strategy involves diversifying suppliers and locations to buffer against disruptions caused by trade policy shifts.

Environmental Regulations and Reporting Mandates

Fastenal is navigating a landscape of escalating environmental regulations and reporting mandates. The European Union's Corporate Sustainability Reporting Directive (CSRD), effective for many companies starting in 2024, requires extensive disclosure on environmental, social, and governance (ESG) matters. This, alongside other global carbon reporting requirements, necessitates robust data collection and transparent communication from Fastenal.

To address these legal obligations, Fastenal has proactively undertaken materiality assessments to identify its most significant environmental impacts. The company has also invested in specialized carbon reporting solutions. For instance, in 2023, Fastenal reported its Scope 1 and Scope 2 greenhouse gas emissions, a foundational step in meeting evolving disclosure standards.

- CSRD Compliance: Fastenal must adhere to the detailed reporting requirements of the EU's Corporate Sustainability Reporting Directive, which came into full effect for many large companies in 2024.

- Carbon Reporting Investments: The company has invested in technology and processes to accurately measure and report its carbon footprint, including Scope 1 and Scope 2 emissions as reported in 2023.

- Increasing Stringency: Environmental laws and reporting mandates are becoming more rigorous and complex globally, demanding continuous adaptation and compliance efforts from Fastenal.

Fastenal's legal environment is marked by evolving product safety standards and customer responsibility. The company's 2023 report emphasizes that while it provides guidance, the end-user ultimately bears responsibility for correct product application, a crucial distinction in a market with varied local building codes and usage requirements.

Data privacy laws, such as GDPR and CCPA, significantly impact Fastenal's digital operations. As of 2024, global data privacy fines are projected to rise, highlighting the critical need for robust cybersecurity and strict adherence to data handling protocols to protect customer information and company reputation.

Labor laws and workplace safety are also key legal considerations. Maintaining strong safety records, reflected in metrics like the Experience Modification Rate (EMR), is vital for managing operational costs and employer branding.

International trade regulations, including tariffs and sanctions, directly influence Fastenal's supply chain. For example, tariffs on goods from countries like China, which saw continued impact into 2024, can increase inventory costs by 10-25% for affected items.

| Legal Area | Key Considerations for Fastenal | 2023/2024 Data/Trends |

|---|---|---|

| Product Safety & Compliance | Adherence to state/local regulations; customer responsibility for application. | Ongoing compliance efforts noted in 2023 annual report. |

| Data Privacy & Cybersecurity | GDPR, CCPA compliance; protection of customer data. | Projected increase in global data privacy fines in 2024; significant breach risk. |

| Labor & Workplace Safety | Compliance with labor laws and safety standards (e.g., ISO 45001). | Impact of EMR on insurance costs and employer reputation. |

| International Trade | Tariffs, sanctions, export controls; trade agreement changes. | Continued impact of US-China tariffs in 2024; potential 10-25% cost increase on affected goods. |

Environmental factors

The industrial sector is increasingly focused on reducing its environmental impact, leading to a surge in sustainability and green manufacturing efforts. This shift is driven by regulatory pressures and growing consumer demand for eco-friendly products and operations.

Fastenal is actively participating in this trend by investing in renewable energy sources for its facilities and championing circular economy principles, which aim to minimize waste and maximize resource utilization. For instance, in 2023, Fastenal reported a 12% increase in the use of renewable energy across its operations compared to 2022.

These initiatives by Fastenal are not just about environmental responsibility; they also align with broader industry movements towards more sustainable business models, potentially leading to cost savings and enhanced brand reputation in the long run.

Fastenal's commitment to environmental stewardship is clearly articulated in its annual ESG Reports, which adhere to recognized global frameworks such as GRI, SASB, and TCFD. These reports serve as a crucial tool for communicating the company's sustainability performance.

The 2025 ESG Report details Fastenal's advancements in sustainability management and the foundational work being undertaken. This transparency is key to building stakeholder confidence and demonstrating a genuine dedication to environmental preservation.

Fastenal is actively integrating circular economy principles, notably through its partnership with Trex Company, Inc., to recycle substantial volumes of plastic. This program targets waste diversion from its extensive distribution network, demonstrating a commitment to reducing its environmental footprint.

In 2023, Fastenal's sustainability efforts included diverting 1.7 million pounds of plastic from landfills through this initiative alone, showcasing tangible progress in waste reduction. Such practices not only minimize environmental impact but also enhance resource efficiency, aligning with growing global demands for sustainable business operations.

Carbon Emissions Reduction and Reporting

Fastenal is actively working to lower its carbon footprint, particularly concerning transportation. The company is implementing strategies like optimizing delivery routes and incorporating electric vehicles into its fleet to achieve this. This focus on reducing emissions is a key part of their environmental strategy.

Further demonstrating their commitment, Fastenal has conducted a scope 3 materiality assessment. They are also investing in advanced solutions for carbon reporting and compliance, which will help them more effectively track and manage their overall carbon inventory. These steps are vital for establishing credible science-based targets.

- Transportation Emissions Reduction: Fastenal is optimizing logistics and integrating electric vehicles to reduce transport-related carbon emissions.

- Scope 3 Assessment: The company has completed a scope 3 materiality assessment to understand its indirect emissions.

- Carbon Reporting Investment: Fastenal is investing in leading solutions for carbon reporting and compliance to manage its carbon inventory.

- Climate Change Action: These initiatives are crucial for setting science-based targets and addressing the broader challenge of climate change.

Sustainable Procurement and Eco-Friendly Materials

Fastenal is actively developing guiding principles for sustainable procurement, with a notable focus on increasing the use of eco-friendly materials, especially in its packaging. This initiative is crucial as consumer and regulatory pressure for environmentally conscious business practices continues to rise.

The company's commitment extends to its supply chain, where it works diligently with suppliers to monitor and address compliance concerns, particularly regarding forced labor. This proactive stance on ethical sourcing is becoming a significant factor in supplier selection and overall brand reputation.

- Sustainable Procurement Focus: Fastenal's development of guiding principles for sustainable procurement signals a strategic shift towards integrating environmental and social considerations into its sourcing decisions.

- Eco-Friendly Materials: The company is prioritizing the increased use of eco-friendly materials, particularly in packaging, aligning with broader industry trends and customer expectations for reduced environmental impact.

- Supply Chain Ethics: Fastenal actively engages with suppliers to ensure compliance and address issues like forced labor, demonstrating a commitment to ethical sourcing that is increasingly scrutinized by stakeholders.

Environmental regulations are tightening globally, pushing companies like Fastenal to adopt more sustainable practices. This includes reducing waste, emissions, and increasing the use of renewable resources. Fastenal's commitment to these areas is evident in its operational shifts and reporting.

In 2023, Fastenal reported a 12% increase in renewable energy usage compared to the previous year, demonstrating a clear investment in cleaner energy sources for its facilities. Furthermore, their partnership with Trex Company successfully diverted 1.7 million pounds of plastic from landfills in 2023, highlighting tangible progress in waste reduction and circular economy principles.

The company is also actively addressing transportation emissions by optimizing routes and exploring electric vehicle integration, a critical step in managing its Scope 3 emissions. Fastenal's investment in advanced carbon reporting solutions underscores its dedication to transparently tracking and managing its environmental footprint, crucial for meeting evolving stakeholder expectations and regulatory demands.

| Environmental Initiative | 2023 Data/Progress | Impact/Goal |

|---|---|---|

| Renewable Energy Usage | 12% increase vs. 2022 | Reduced reliance on fossil fuels, lower carbon footprint |

| Plastic Diversion (Trex Partnership) | 1.7 million pounds diverted from landfills | Waste reduction, circular economy advancement |

| Transportation Emissions | Route optimization, EV exploration | Lowering Scope 3 emissions, improved logistics efficiency |

| Sustainable Procurement | Developing guiding principles, focus on eco-friendly materials | Reducing environmental impact in supply chain, meeting consumer demand |

PESTLE Analysis Data Sources

Our Fastenal PESTLE analysis is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry research firms. We integrate insights from regulatory updates, market trend reports, and technological advancements to provide a comprehensive view.