Fastenal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fastenal Bundle

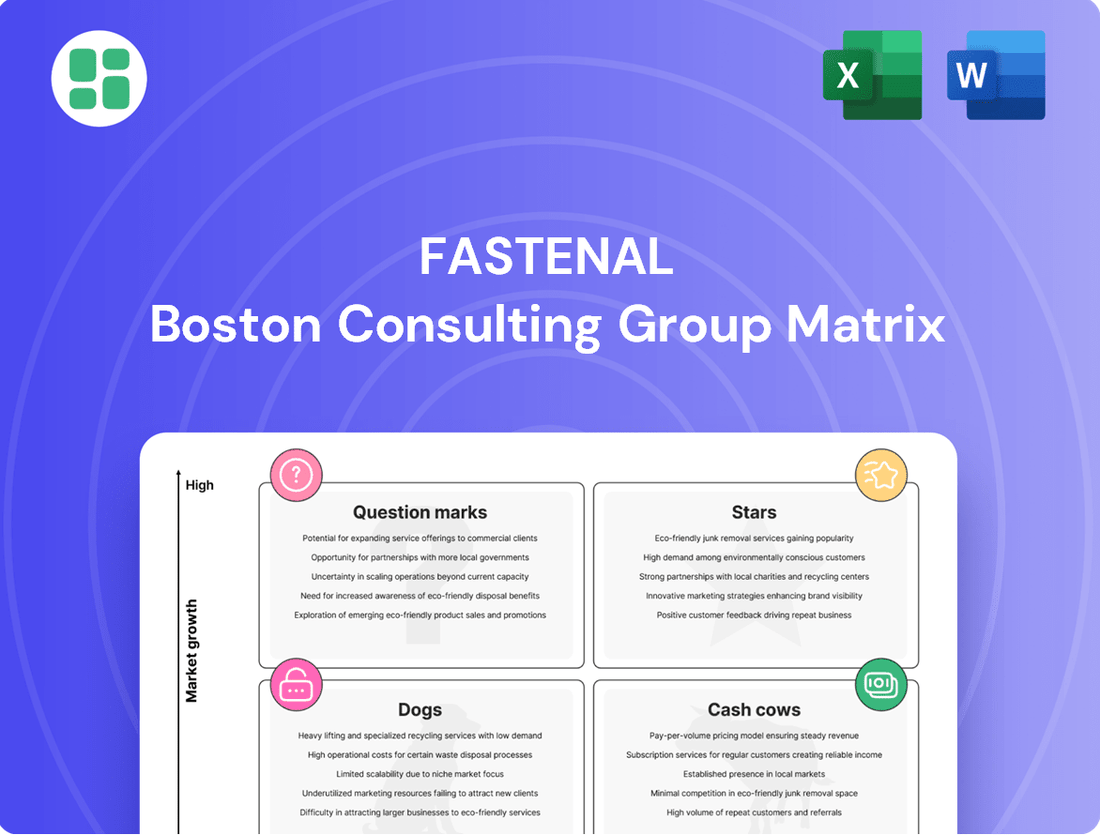

Curious about Fastenal's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete report for a comprehensive breakdown and actionable strategic insights.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Fastenal.

Stars

Fastenal's onsite locations, offering dedicated sales and service directly within or close to customer facilities, remain a key driver of strategic growth. This model deepens integration into customer operations, building robust relationships and securing recurring revenue streams.

In 2024, Fastenal significantly expanded its onsite presence by signing 358 new locations. This impressive growth pushed the total number of active sites past the 2,000 mark by the end of the year, showcasing strong market penetration and successful execution of this strategy.

Fastenal Managed Inventory (FMI) technology, encompassing devices like FASTVend and FASTBin, is central to Fastenal's digital transformation, automating inventory management at customer locations. The company aggressively expanded this offering, securing nearly 28,000 new device installations in 2024, with plans for further growth in 2025.

Fastenal's e-business and digital footprint expansion is a key driver of its growth, with e-commerce and FMI transactions making up more than 60% of sales in Q2 2025. This digital channel is a high-growth area for industrial supplies.

The company is targeting 66-68% of total sales from digital channels by the end of 2025, underscoring its commitment to digital procurement. This strategic focus is designed to lower transaction expenses and deepen customer connections.

Safety Supplies Segment

The Safety Supplies segment is a star performer for Fastenal, showing consistent and strong growth. Sales in this category saw a notable increase in Q4 2024 and continued this upward trend into Q2 2025, underscoring its market resilience.

This segment benefits from demand that is less prone to sharp fluctuations, distinguishing it from other product lines. This stability, coupled with growth, highlights Fastenal's solid footing in a vital and expanding part of the industrial MRO (Maintenance, Repair, and Operations) market.

- Consistent Growth: Safety supplies sales increased significantly in Q4 2024 and Q2 2025.

- Market Resilience: Demand in this segment is less volatile than other product categories.

- Strategic Importance: Fastenal is effectively capturing market share in essential MRO supplies.

Strategic Growth with National Accounts

Fastenal's strategic growth is significantly fueled by its concentrated efforts on expanding and deepening relationships with large national accounts. These customers, especially those with substantial managed spend, are key beneficiaries of Fastenal's integrated service model and advanced technology solutions such as Onsite and FMI. This strategic focus enables Fastenal to secure a larger share of the market within high-value customer segments, thereby driving the company's overall expansion.

In 2023, Fastenal reported that its top 100 national accounts grew at a faster pace than the company average, highlighting the effectiveness of this strategy. These accounts often represent complex supply chain needs that Fastenal is well-equipped to address through its unique value proposition. The company's investment in technology and customized solutions for these clients continues to pay dividends, solidifying its position as a preferred partner.

- National Account Growth: Fastenal's focus on large national accounts is a primary driver of its expansion, capturing significant market share.

- Value Proposition: These customers benefit greatly from Fastenal's comprehensive service model and technology-driven solutions like Onsite and FMI.

- 2023 Performance: The top 100 national accounts experienced growth exceeding the company's overall average in 2023, demonstrating the strategy's success.

- Market Penetration: By addressing complex supply chain needs, Fastenal strengthens its partnerships and market position within high-value segments.

Fastenal's Safety Supplies segment is a clear star performer, demonstrating consistent and robust growth. This segment's sales saw a notable uptick in Q4 2024 and maintained this strong trajectory into Q2 2025, indicating significant market resilience.

The demand within this category is inherently less volatile compared to other product lines, providing a stable foundation for Fastenal's revenue. This combination of steady growth and stability highlights Fastenal's successful penetration into a crucial and expanding segment of the industrial MRO market.

Fastenal's strategic focus on national accounts is a significant growth engine, with its top 100 accounts outperforming the company average in 2023. These large clients leverage Fastenal's integrated services and technologies like Onsite and FMI, allowing the company to capture substantial market share within high-value customer segments.

The expansion of Fastenal's onsite locations is another key driver, with 358 new sites added in 2024, surpassing 2,000 active locations. Coupled with the aggressive rollout of Fastenal Managed Inventory (FMI) technology, which saw nearly 28,000 new device installations in 2024, these initiatives are solidifying Fastenal's market leadership.

| Growth Area | 2023 Performance | 2024 Expansion | Q2 2025 Status |

| Safety Supplies | Strong Growth | Continued Upward Trend | Resilient Demand |

| National Accounts | Top 100 grew > Avg | N/A | N/A |

| Onsite Locations | N/A | 358 new sites | > 2,000 active sites |

| FMI Technology | N/A | ~28,000 new installs | Aggressive Rollout |

What is included in the product

This BCG Matrix analysis categorizes Fastenal's offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Fastenal BCG Matrix provides a clear, one-page overview of business units, alleviating the pain of strategic confusion.

Cash Cows

Traditional Fastener Distribution is a cornerstone for Fastenal, representing around 30% of their total revenue. This signifies a robust market share within a well-established product segment.

While daily sales growth might be moderate and influenced by industrial cycles, this business unit reliably generates substantial cash flow, acting as a significant Cash Cow for the company.

Fastenal's deep-rooted experience and comprehensive inventory in fasteners reinforce its dominant standing in this essential market.

Standard MRO product sales represent a mature segment for Fastenal, characterized by its stable revenue streams and robust profit margins. This business, which excludes more advanced vending solutions, benefits from established customer loyalty and a highly efficient supply chain. In 2024, Fastenal's industrial vending and onsite services, which often include MRO products, continued to be a significant driver of growth, contributing to overall revenue stability.

Fastenal's established branch network, a cornerstone of its distribution strategy, continues to be a significant cash cow. This extensive physical footprint, comprising over 3,200 locations as of late 2023, provides a high-market-share advantage in traditional distribution, serving a loyal base of regional and local customers.

These branches generate consistent revenue streams through established customer relationships and local accessibility. The mature nature of this infrastructure means that capital expenditure is primarily focused on maintenance rather than expansion, further enhancing its cash-generating capabilities.

In 2023, Fastenal reported net sales of $6.4 billion, with its industrial and construction customers forming the backbone of these steady revenues. The company’s ability to maintain this strong performance in its core business segments highlights the enduring strength of its branch network as a reliable source of cash flow.

Basic Tools and General Industrial Supplies

Fastenal's extensive range of basic tools and general industrial supplies, beyond its core fastener and safety offerings, serves a diverse industrial customer base. This segment, characterized by commoditized products in a mature market, benefits from Fastenal's robust distribution network and comprehensive catalog, driving consistent sales volumes and maintaining a significant market share.

This segment acts as a reliable generator of cash flow for Fastenal. In 2024, Fastenal reported that its industrial supplies segment, which includes many of these basic tools, continued to be a strong performer, contributing significantly to overall revenue. The company's ability to manage inventory and logistics efficiently for these high-volume, lower-margin items solidifies their position as a cash cow.

- Broad Product Offering: Encompasses everything from hand tools and power tools to cleaning supplies and material handling equipment.

- Mature Market Dynamics: While competitive, Fastenal leverages its scale and service model to maintain strong sales in this segment.

- Consistent Cash Generation: The predictable demand for these essential supplies underpins its role as a stable cash flow contributor.

- Market Share Dominance: Fastenal's efficient supply chain and extensive branch network allow it to capture a substantial portion of the industrial supplies market.

Optimized Supply Chain and Logistics

Fastenal's sophisticated supply chain, featuring a widespread network of distribution centers and strategically placed local inventory, is a significant driver of its Cash Cow status. This optimized infrastructure ensures efficient product delivery and tight cost control, directly contributing to the high profit margins seen in its core offerings.

The company's operational efficiency, stemming from its robust logistics, minimizes expenses and guarantees product availability. This seamless operation generates substantial cash flow, reinforcing its position as a Cash Cow within the BCG framework.

- Efficient Delivery: Fastenal's supply chain enables rapid and reliable product delivery to a broad customer base.

- Cost Management: Optimized logistics and inventory staging reduce operational expenses, boosting profitability.

- Product Availability: High product availability across its network supports consistent sales and customer satisfaction.

- Strong Cash Flow Generation: The efficiency of its supply chain translates directly into strong, predictable cash flow for the company.

Fastenal's traditional fastener distribution and its broad MRO product offerings are prime examples of its Cash Cows. These segments benefit from a mature market, strong customer loyalty, and Fastenal's extensive distribution network, ensuring consistent revenue and substantial cash flow generation. The company's established branch network, a key asset, further solidifies these segments as reliable cash generators.

In 2023, Fastenal's industrial and construction customer base contributed significantly to its $6.4 billion in net sales, underscoring the stability of these core business areas. The company's focus on operational efficiency within its supply chain, including optimized logistics and inventory management, directly translates into high profit margins and strong cash flow from these mature product lines.

The company's industrial supplies segment, encompassing basic tools and general industrial equipment, also acts as a cash cow. Despite being a mature market, Fastenal's scale, efficient supply chain, and broad product catalog allow it to maintain significant market share and generate consistent sales volumes. This segment's predictable demand, coupled with Fastenal's operational strengths, makes it a vital contributor to the company's overall cash generation.

| Segment | Approximate Revenue Contribution (2023) | Key Characteristics | Cash Flow Contribution |

|---|---|---|---|

| Traditional Fastener Distribution | ~30% of total revenue | Mature market, strong market share, established customer base | High and stable |

| MRO Products (excluding advanced vending) | Significant contributor to overall revenue | Stable revenue, robust profit margins, efficient supply chain | High and stable |

| Basic Tools & General Industrial Supplies | Strong performer in industrial supplies segment | Commoditized products, mature market, benefits from distribution network | Consistent and reliable |

Preview = Final Product

Fastenal BCG Matrix

The Fastenal BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in the final document, ensuring you get a professional, ready-to-use strategic tool.

What you see here is the definitive Fastenal BCG Matrix analysis, identical to the file that will be delivered after your purchase. This ensures complete transparency and guarantees that the strategic insights and clear presentation you observe are precisely what you will obtain.

This preview accurately represents the complete Fastenal BCG Matrix document you will download immediately after completing your purchase. You can be confident that the analysis and formatting are final, allowing for seamless integration into your business planning processes.

The Fastenal BCG Matrix report you are examining is the actual, unedited file that becomes yours upon purchase. This preview serves as a direct reflection of the polished, analysis-ready document that will be instantly available for your strategic decision-making.

Dogs

Fastenal's reseller end market sales saw a downturn in Q4 2024, suggesting a potential struggle with market share in this segment. This dip is likely a consequence of wider industry pressures, including efforts by resellers to reduce inventory levels and a highly competitive landscape.

The company's performance here could signal a need to reassess its commitment to this market, possibly by reducing investment or exploring strategic exits. For instance, if reseller sales represent a small fraction of Fastenal's overall revenue, say under 5% in 2024, such a move could streamline operations.

Legacy manual inventory management systems are Fastenal's Dogs in the BCG Matrix. As Fastenal champions its FMI technology, these older, less efficient methods, which don't use digital tools, are losing ground. They are characterized by low growth and low market share because customers are increasingly opting for automated and integrated solutions.

Fastenal's smaller local customers, while a significant portion of their business, are currently a point of concern. Sales to these non-national accounts experienced a dip in both the third and fourth quarters of 2024. This trend suggests these segments might be in a slower-growth market, and if not efficiently managed through digital channels or made more profitable, they could be candidates for resource reallocation.

Niche, Highly Commoditized Product Lines with Intense Competition

Within Fastenal's extensive product range, some industrial items are highly commoditized, meaning they are easily substitutable and face fierce price wars, leading to minimal profit margins. In these segments, Fastenal doesn't command a leading market position.

These particular product lines might be kept to ensure a comprehensive offering for customers, but they don't significantly drive either sales growth or profitability. They could also tie up valuable capital without generating substantial returns.

- Commoditized Products: Industrial fasteners, abrasives, and certain safety supplies often fall into this category, characterized by low differentiation and intense price sensitivity.

- Thin Margins: For these items, gross profit margins can be as low as 10-15%, a stark contrast to higher-margin specialty items.

- Limited Market Share: In these specific niches, Fastenal might hold only a small percentage of the market, perhaps 1-3%, compared to dominant players in more specialized areas.

- Capital Tie-up: Inventory holding costs for these slow-moving, low-margin items can represent a drag on working capital, impacting overall return on invested capital (ROIC).

Historically Lagging Non-Residential Construction Sector

The non-residential construction sector has faced a challenging period, showing prolonged softness for ten consecutive quarters leading up to Q2 2025, when it began to exhibit recovery signs.

If Fastenal's market share within this segment was historically low, it would likely be classified as a 'dog' in the BCG matrix. This classification stems from the combination of low market growth and potentially a less dominant competitive position compared to its stronger segments like manufacturing.

- Historically Lagging Sector: Non-residential construction experienced ten consecutive quarters of softness before showing signs of recovery in Q2 2025.

- Low Growth Environment: This prolonged weakness indicates a low-growth market, a key characteristic of 'dogs' in the BCG matrix.

- Potential for Low Market Share: If Fastenal's penetration in this specific sector was minimal, it further reinforces the 'dog' classification, suggesting limited competitive strength.

Fastenal's legacy manual inventory management systems are considered 'Dogs' in the BCG matrix. These older, less efficient methods lack digital integration and are characterized by low growth and low market share as customers increasingly adopt automated solutions.

Commoditized industrial products, such as certain fasteners and safety supplies, also fall into the 'Dog' category. These items have thin profit margins, often between 10-15%, and Fastenal may hold only a small market share, perhaps 1-3%, in these highly competitive niches.

The non-residential construction sector's prolonged weakness, with ten consecutive quarters of softness leading up to Q2 2025, also positions it as a potential 'Dog' if Fastenal's market share was historically low within this segment.

| Category | Characteristics | Examples | Potential Actions |

| Legacy Manual Systems | Low growth, low market share, inefficient | Manual inventory tracking | Phase out, invest in digital alternatives |

| Commoditized Products | Thin margins, low differentiation, high price sensitivity | Basic industrial fasteners, some safety supplies | Maintain for customer completeness, optimize inventory |

| Weak Sector Exposure | Low growth market, potentially low market share | Non-residential construction (pre-recovery) | Re-evaluate investment, focus on profitable niches |

Question Marks

Fastenal's advanced custom manufacturing services represent a potential growth area, aligning with the increasing demand for specialized, integrated supply chain solutions. This segment is characterized by high growth potential, as businesses look for partners capable of delivering unique product configurations and streamlined production processes.

While the market for custom manufacturing is expanding, Fastenal's current penetration in this specialized niche might be less established compared to its dominant position in industrial and construction supplies. This positions custom manufacturing as a question mark in the BCG matrix, indicating a need for significant investment to build market share and compete effectively.

The company's investment in this area is crucial for transforming it into a Star. For instance, Fastenal reported a 7.2% increase in total sales for 2024, reaching $6.9 billion in the first half of the year, demonstrating overall company strength that can be leveraged to fund growth initiatives in new service areas like custom manufacturing.

Fastenal's international market expansion, particularly into emerging economies, represents a significant growth frontier. While the company has a strong North American presence, its footprint in high-growth regions outside this core market is currently limited, positioning these as potential Stars in the BCG Matrix. For instance, in 2023, Fastenal reported that approximately 90% of its revenue was generated in North America, highlighting the vast untapped potential in other global markets.

Capturing meaningful market share in these developing international regions necessitates substantial upfront investment. These investments are crucial for establishing distribution networks, building brand awareness, and adapting product offerings to local needs. The success of these ventures hinges on transforming these nascent international operations from question marks into Stars, driving future revenue growth for Fastenal.

Fastenal is significantly investing in artificial intelligence and advanced digital solutions like FAST360° to enhance product search, knowledge management, and overall customer experience. These cutting-edge technologies are poised for high growth within the industrial distribution sector, though Fastenal's current market penetration in these specific advanced digital areas is still emerging. The company recognizes the need for substantial investment to establish a distinct market position and achieve scalability for these digital offerings.

Expansion into New, Specialized Product Categories

Expanding into new, specialized product categories represents a strategic move for Fastenal, potentially transforming current Question Marks into future Stars. These niche markets, often characterized by high growth rates, could absorb Fastenal's established distribution and customer service infrastructure. For instance, the industrial automation and robotics sector, projected to grow significantly, presents an avenue for diversification.

- High Growth Potential: Specialized industrial segments like advanced materials handling or predictive maintenance solutions are experiencing rapid adoption.

- Leveraging Existing Strengths: Fastenal's extensive network of over 3,200 locations can facilitate swift market entry and customer access.

- Initial Low Market Share: While new categories would start with minimal market penetration, the company's operational efficiency can drive rapid scaling.

- Diversification Benefits: Entering these specialized areas mitigates reliance on traditional product lines and captures emerging market opportunities.

Specific Emerging Technologies in Supply Chain Optimization

Fastenal is actively exploring and integrating emerging technologies to refine its supply chain. These advancements aim to proactively reduce costs and mitigate risks, leveraging data analytics to solidify its competitive edge. Significant investments in IT infrastructure and sophisticated logistics are core to this strategy.

Specific proprietary technologies in early adoption phases focus on addressing evolving market demands for greater efficiency and transparency. These could include AI-powered demand forecasting tools or blockchain solutions for enhanced traceability.

- AI-Driven Predictive Analytics: Implementing AI to forecast demand with greater accuracy, reducing stockouts and excess inventory. For instance, by analyzing historical sales data, weather patterns, and economic indicators, Fastenal could potentially improve forecast accuracy by 5-10% in the coming years.

- IoT for Real-time Visibility: Utilizing Internet of Things (IoT) sensors on inventory and transportation to provide real-time tracking and condition monitoring, minimizing loss and ensuring product integrity. This could lead to a reduction in spoilage or damage by up to 15% for sensitive materials.

- Robotics and Automation in Warehousing: Deploying advanced robotics for picking, packing, and sorting operations to increase throughput and reduce labor costs. Companies adopting similar technologies have seen efficiency gains of 20-30% in warehouse operations.

Fastenal's foray into advanced custom manufacturing represents a segment with high growth potential, yet it currently holds a relatively low market share. This positions it as a Question Mark, requiring strategic investment to gain traction and compete effectively against established players.

Similarly, international market expansion outside of North America, where Fastenal generated approximately 90% of its revenue in 2023, presents a significant growth opportunity. These regions are currently underdeveloped for Fastenal, necessitating substantial investment to build infrastructure and brand presence.

The company's investments in AI and advanced digital solutions like FAST360° are also in their early stages, indicating a need for further development and market penetration. These areas are critical for future competitiveness but currently represent nascent ventures within Fastenal's portfolio.

Emerging specialized product categories, such as industrial automation, also fall into the Question Mark quadrant. While these markets exhibit strong growth trends, Fastenal's current penetration is minimal, requiring dedicated resources to establish a foothold and leverage its existing operational strengths.

| BCG Quadrant | Segment | Market Growth | Relative Market Share | Strategic Implication |

| Question Mark | Custom Manufacturing | High | Low | Requires significant investment to build share. |

| Question Mark | International Markets (ex-North America) | High | Low | Needs substantial investment for network and brand building. |

| Question Mark | Advanced Digital Solutions (AI, FAST360°) | High | Low | Investment needed for market positioning and scalability. |

| Question Mark | Specialized Product Categories (e.g., Industrial Automation) | High | Low | Strategic entry with focus on leveraging existing infrastructure. |

BCG Matrix Data Sources

Our Fastenal BCG Matrix is built on comprehensive data, including Fastenal's financial reports, industry growth rates, and market share analysis to accurately position each business unit.