Farmer Brothers SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Farmer Brothers Bundle

Farmer Brothers, a veteran in the coffee and culinary supply industry, boasts significant strengths in its established brand recognition and extensive distribution network. However, it faces challenges from evolving consumer preferences for specialty coffee and increasing competition.

Want the full story behind Farmer Brothers' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Farmer Brothers boasts an extensive national distribution network, operating as a roaster, wholesaler, and distributor across the United States. This broad market reach is a significant competitive advantage, enabling them to serve a diverse customer base, from small independent restaurants to large institutional clients.

As of the first quarter of fiscal year 2024, Farmer Brothers reported that their Direct Store Delivery (DSD) network served approximately 6,000 customer locations. This robust network ensures efficient delivery and consistent product availability, a critical factor in the foodservice industry.

Farmer Brothers boasts a diverse product portfolio encompassing coffee in various forms – roast, ground, and liquid – alongside tea and culinary items. This broad offering effectively caters to a wide array of customer needs and preferences across the foodservice sector.

This strategic diversification significantly reduces the company's reliance on any single product category, enabling them to secure a more substantial share of the overall foodservice market. Their brand stable includes prominent names such as Farmer Brothers, Boyd's Coffee, SUM>ONE Coffee Roasters, West Coast Coffee, Cain's, and China Mist.

Farmer Brothers' strategic focus on operational efficiency and cost management is a significant strength. Over the past two years, the company has actively worked to streamline its operations, evidenced by initiatives like SKU rationalization and completing its brand pyramid. These efforts have demonstrably improved its financial and operational structure, leading to enhanced internal efficiencies.

These operational improvements have translated directly into tangible financial gains. For instance, the company has seen better gross margins and achieved positive adjusted EBITDA in recent quarters, underscoring the effectiveness of their cost-reduction strategies and focus on core business functions.

Integrated Equipment and Service Offerings

Farmer Brothers differentiates itself by offering more than just coffee and tea; they provide integrated equipment and service solutions. This holistic approach, which includes equipment servicing and related support, fosters stronger customer relationships and creates recurring revenue opportunities. By acting as a comprehensive beverage partner, they solidify their position beyond a simple supplier.

This strategy is particularly impactful in the foodservice industry where reliability and convenience are paramount. For instance, in fiscal year 2023, Farmer Brothers reported that their services segment contributed significantly to their overall revenue, underscoring the value customers place on these integrated offerings. This allows them to capture a larger share of their clients' spending by addressing multiple needs.

- Holistic Solutions: Beyond product sales, Farmer Brothers provides essential equipment maintenance and support, offering customers a complete package.

- Enhanced Loyalty: This integrated service model cultivates deeper customer loyalty by addressing operational needs directly.

- Diversified Revenue: The provision of equipment and services creates additional, often more stable, revenue streams beyond core product sales.

Commitment to Sustainability and Ethical Sourcing

Farmer Brothers' dedication to sustainability and ethical sourcing is a significant strength. They actively pursue certifications such as Fair Trade USA, USDA Organic, and Rainforest Alliance, underscoring their commitment to responsible practices. This focus resonates with a growing market segment that prioritizes ethically produced goods, potentially driving increased sales and brand loyalty.

Their initiatives extend to resource preservation and building strong supplier relationships, which can lead to more stable and transparent supply chains. For instance, in 2023, the company reported that a substantial portion of their coffee volume was sourced from farms with sustainability certifications, reflecting a tangible effort to meet evolving consumer expectations for environmental and social responsibility.

- Commitment to Sustainability: Farmer Brothers actively implements programs focused on environmental stewardship and resource management.

- Ethical Sourcing Certifications: Holds certifications like Fair Trade USA, USDA Organic, and Rainforest Alliance, validating ethical practices.

- Consumer Demand Alignment: Meets the increasing demand from consumers and institutions for responsibly sourced and produced products.

- Supplier Partnerships: Cultivates relationships with suppliers to ensure ethical and sustainable coffee sourcing.

Farmer Brothers possesses a robust national distribution network, serving approximately 6,000 customer locations as of Q1 FY2024, which is a significant advantage in the foodservice sector. Their diverse product range, including coffee, tea, and culinary items under various brands like Boyd's Coffee and Cain's, caters to a broad customer base. The company's commitment to operational efficiency and cost management has led to improved financial performance, including positive adjusted EBITDA in recent quarters.

What is included in the product

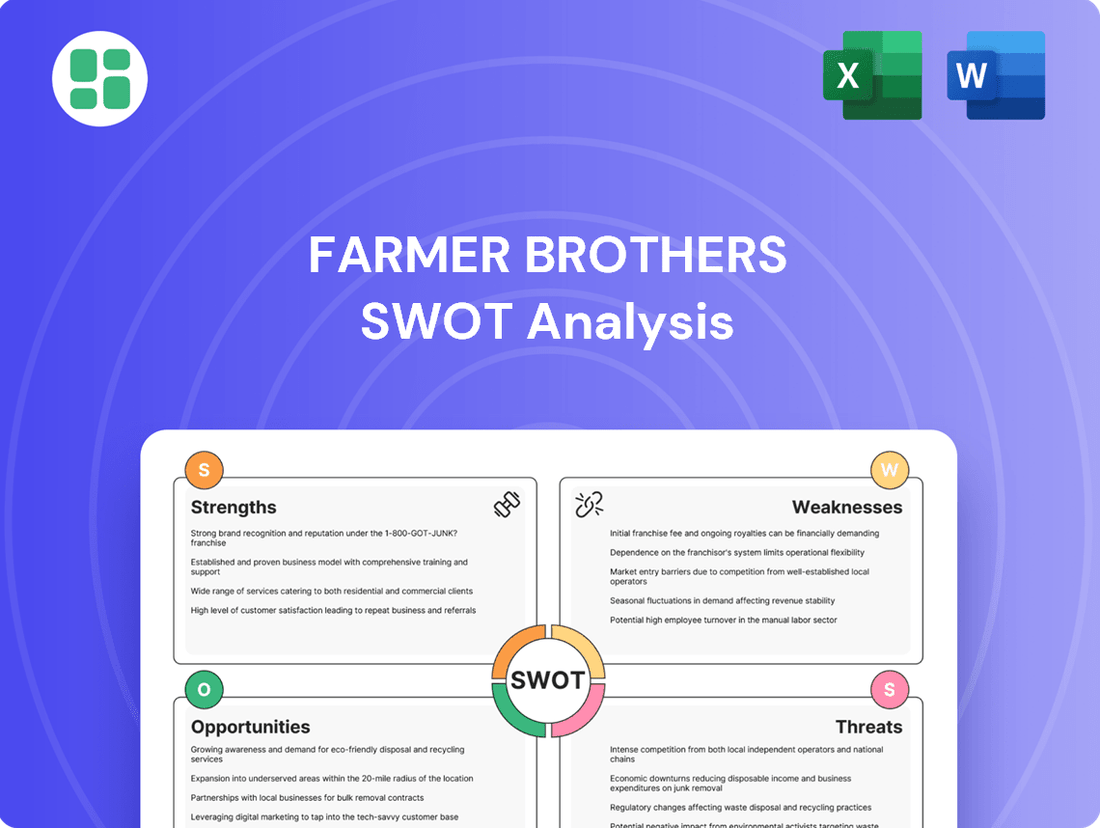

Delivers a strategic overview of Farmer Brothers’s internal and external business factors, highlighting its brand recognition and distribution network while acknowledging challenges in product innovation and market competition.

Farmer Brothers' SWOT analysis offers a clear roadmap to identify and address operational inefficiencies, thereby relieving the pain of suboptimal resource allocation.

Weaknesses

Farmer Brothers has faced headwinds with declining net sales, as evidenced by Q3 fiscal 2025 reporting $82.1 million compared to $85.4 million in Q3 fiscal 2024. This trend is further underscored by a significant drop in coffee volumes, with total pounds sold decreasing by 9.4% year-over-year in the same quarter. These figures highlight a struggle to maintain sales momentum and grow the core coffee business.

Farmer Brothers continues to grapple with persistent net losses, a significant weakness. For instance, the company reported a $5.0 million net loss in the third quarter of fiscal year 2025, even as adjusted EBITDA showed improvements. This highlights a persistent gap between operational profitability and overall net earnings.

Liquidity is another area of concern, directly linked to these net losses. Unrestricted cash and cash equivalents have seen a decline, which can create challenges in meeting short-term obligations and funding ongoing operations. This situation underscores the ongoing struggle to achieve consistent bottom-line profitability and maintain a strong cash position.

Farmer Brothers operates in a coffee industry saturated with competitors, ranging from established national brands and multinational giants to smaller regional roasters and local cafes. This crowded marketplace means Farmer Brothers constantly battles for consumer attention and market share, often facing significant pricing pressure from rivals.

The ease with which new coffee businesses can emerge, due to relatively low startup costs, further fuels this intense competition. In 2024, the specialty coffee market alone saw continued growth, with numerous independent roasters and cafes opening, directly challenging established players like Farmer Brothers for shelf space and customer loyalty.

Vulnerability to Commodity Price Fluctuations

Farmer Brothers' reliance on coffee beans as its primary raw material exposes it to significant price volatility. Global supply disruptions, weather events, and fluctuating demand can cause sharp swings in coffee bean costs. For instance, while the company reported improved gross margins in some periods due to favorable commodity pricing, this benefit is inherently unpredictable. This vulnerability makes it challenging to forecast and maintain consistent profitability, as unexpected increases in raw material expenses can quickly erode margins.

The company's financial performance is therefore closely tied to factors beyond its direct control:

- Exposure to Global Coffee Bean Markets: Farmer Brothers operates within a market susceptible to geopolitical events and climate change impacts on coffee-producing regions.

- Unpredictable Raw Material Costs: Fluctuations in coffee bean prices directly impact the cost of goods sold, creating uncertainty in gross profit margins.

- Impact on Profitability: While cost improvements can boost margins, unpredictable raw material expenses remain a significant risk to consistent financial results.

Operational Challenges from Asset Disposals and Restructuring

Farmer Brothers has faced operational hurdles stemming from its asset disposal and restructuring initiatives. The company has seen notable swings in its operating expenses and net income, often tied to gains or losses realized from selling off assets, such as its branch network. For instance, in fiscal year 2023, the company reported a net loss of $23.3 million, partly influenced by the sale of its distribution network.

While these strategic moves are intended to streamline operations and improve efficiency, they introduce a degree of short-term unpredictability in financial reporting. This volatility can make it challenging to assess the underlying operational performance consistently.

- Asset Disposal Impact: Fluctuations in operating expenses and net income due to gains/losses from asset sales, like branch disposals.

- Restructuring Volatility: Short-term instability in financial performance as the company optimizes its operations.

- Fiscal Year 2023 Performance: A net loss of $23.3 million was reported, partly due to the sale of its distribution network.

Farmer Brothers faces intense competition in a saturated coffee market, with numerous established brands and emerging independent players vying for market share. This crowded landscape puts pressure on pricing and customer acquisition, making it difficult to stand out and grow sales organically. The ease of entry for new coffee businesses further exacerbates this competitive pressure.

The company's reliance on coffee beans as its primary raw material exposes it to significant price volatility. Global supply disruptions and weather events can cause sharp swings in coffee bean costs, directly impacting the cost of goods sold and making consistent profitability challenging. For instance, while some periods may see favorable commodity pricing, this benefit is inherently unpredictable.

Farmer Brothers' ongoing restructuring and asset disposals, while intended to streamline operations, introduce short-term volatility into financial reporting. Gains or losses from these sales, such as the distribution network sale in fiscal year 2023, can obscure underlying operational performance and create uncertainty in assessing the company's true financial health.

Full Version Awaits

Farmer Brothers SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at Farmer Brothers' internal strengths and weaknesses, alongside external opportunities and threats. This detailed report is ready for immediate use.

Opportunities

Farmer Brothers has actively begun exploring strategic alternatives, a move designed to unlock greater shareholder value. This process includes considering potential sales, mergers, or significant collaborations. This proactive stance suggests a commitment to optimizing the company's structure and potentially realizing a higher valuation.

Farmer Brothers' launch of the Sum>One Coffee Roasters brand presents a significant opportunity to tap into high-margin business-to-business (B2B) and direct-to-consumer (DTC) markets. This strategic pivot moves the company beyond its traditional foodservice focus, aiming to capture a larger share of the premium coffee segment.

This expansion directly addresses the increasing consumer demand for specialty coffee, a trend that has seen robust growth. For instance, the U.S. specialty coffee market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate of over 10% through 2028, indicating substantial potential for Farmer Brothers.

Farmer Brothers has successfully completed significant SKU rationalization, streamlining its product offerings. This initiative, coupled with a brand pyramid refresh, notably including the Boyd's Coffee brand, aims to simplify the customer journey and boost operational efficiency. By focusing on a more curated product selection, the company is better positioned to enhance customer engagement and potentially drive sales growth.

Enhanced Focus on Cost Discipline and Efficiency Gains

Farmer Brothers can capitalize on its ongoing commitment to cost discipline and operational efficiency as a significant opportunity. By continuing to streamline processes and manage its cost structure more effectively, the company can unlock further avenues for improved profitability. This focus has already yielded positive results, as evidenced by reductions in selling and administrative expenses and robust gross margins in recent reporting periods, signaling ample room for further optimization.

Key areas for leveraging this opportunity include:

- Continued Cost Optimization: Implementing further initiatives to reduce operational expenditures across all business segments.

- Efficiency Gains in Supply Chain: Exploring new technologies and strategies to enhance logistics and reduce supply chain costs.

- Productivity Improvements: Investing in employee training and process enhancements to boost overall workforce productivity.

- Leveraging Technology: Utilizing data analytics and automation to identify and eliminate inefficiencies.

For instance, in the fiscal third quarter of 2024, Farmer Brothers reported a notable decrease in selling, general, and administrative expenses, contributing to a healthier bottom line. This trend underscores the tangible benefits of a disciplined approach to cost management, with the potential to drive even greater financial performance in the upcoming fiscal year.

Capitalize on Growing Demand for Sustainable and Ethical Products

Farmer Brothers can leverage the escalating consumer and institutional preference for sustainable and ethically produced goods. Their existing certifications, including Fair Trade, Organic, and Rainforest Alliance, directly address this growing market segment.

By actively promoting these commitments, Farmer Brothers can significantly bolster its brand image and appeal to a wider base of socially responsible customers and businesses. This focus is particularly relevant as the global market for certified sustainable products continues its upward trajectory, with projections indicating substantial growth through 2025 and beyond.

- Increased Market Share: Capitalizing on the demand for certified products can lead to a larger slice of the coffee market, especially among younger demographics who prioritize ethical sourcing. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for products from sustainable brands.

- Enhanced Brand Loyalty: Demonstrating a genuine commitment to sustainability and ethical practices fosters deeper customer loyalty and trust, differentiating Farmer Brothers from competitors.

- New Business Partnerships: Institutions and corporations increasingly seek suppliers aligned with their own Environmental, Social, and Governance (ESG) goals, creating opportunities for Farmer Brothers to secure new, large-scale contracts.

Farmer Brothers' exploration of strategic alternatives, including potential sales or mergers, presents a significant opportunity to unlock shareholder value. The company's launch of Sum>One Coffee Roasters targets high-margin B2B and DTC markets, capitalizing on the growing specialty coffee demand, a sector valued at approximately $50 billion in 2023 with projected double-digit annual growth. Furthermore, ongoing cost discipline and operational efficiencies, evidenced by reduced SG&A expenses in Q3 2024, offer further avenues for profitability enhancement. The company's existing sustainability certifications align with increasing consumer and institutional preference for ethical products, potentially boosting brand loyalty and securing new partnerships.

Threats

The coffee sector is fiercely competitive, with giants like J.M. Smucker and Kraft Heinz, alongside nimble specialty brands, all vying for market share. This means Farmer Brothers constantly faces pressure on its pricing and must innovate to stand out.

In 2023, the U.S. coffee market was valued at approximately $85.6 billion, highlighting the sheer scale of competition Farmer Brothers navigates. Failing to adapt to evolving consumer tastes or maintain cost efficiencies could quickly lead to a decline in their market position.

Consumer preferences are constantly changing, with a notable shift towards healthier options and a growing interest in alternative beverages like specialty teas or plant-based drinks. This evolution directly impacts traditional coffee and tea consumption, potentially reducing demand for established foodservice offerings. For instance, a 2024 report indicated that 35% of consumers are actively seeking out beverages with lower sugar content, a trend that could affect traditional coffee-based drinks.

Changes in how consumers consume beverages, such as a significant increase in at-home brewing, also present a challenge to foodservice providers like Farmer Brothers. As more individuals opt for convenient home preparation, the need for out-of-home coffee and tea experiences may diminish. Data from early 2025 shows a sustained 20% year-over-year growth in the home coffee brewing equipment market, highlighting this behavioral shift.

To counter these evolving tastes, Farmer Brothers faces the imperative to continuously adapt its product portfolio. Failing to innovate and align with emerging health trends or new consumption patterns risks market share erosion and a decline in overall sales. The company's ability to introduce new, health-conscious products or cater to at-home brewing trends will be critical for maintaining relevance in the dynamic beverage market.

Farmer Brothers' reliance on the foodservice sector makes it vulnerable to economic downturns. During recessions, businesses and consumers tend to cut back on discretionary spending, directly impacting restaurant traffic and hotel stays. This can translate into lower coffee and beverage orders for Farmer Brothers, as seen in past economic contractions where consumer spending on dining out typically declines by several percentage points.

Supply Chain Disruptions and Commodity Price Volatility

Farmer Brothers, despite some recent easing in commodity prices, still faces significant threats from ongoing supply chain vulnerabilities. Geopolitical tensions, the increasing impact of climate change on coffee-growing regions, and other unpredictable events can quickly disrupt the global flow of coffee and tea. These disruptions directly translate into higher raw material costs and potential shortages, directly impacting operational efficiency and profitability.

For instance, the cost of green coffee beans, a primary input for Farmer Brothers, experienced significant fluctuations throughout 2024. While prices saw some moderation from earlier peaks, they remained sensitive to weather patterns in key producing countries like Brazil and Vietnam. Any adverse weather events in these regions could rapidly reverse the positive trend, pushing costs upward again and squeezing margins.

The company's reliance on a complex global supply chain means that even localized disruptions can have cascading effects. These can include increased freight costs, longer lead times for inventory, and the need to find alternative, potentially more expensive, suppliers. Such challenges can hinder Farmer Brothers' ability to meet demand consistently and maintain its competitive pricing structure.

- Global supply chain fragility: Vulnerability to geopolitical events, climate change, and other unforeseen circumstances impacting coffee and tea sourcing.

- Commodity price volatility: Potential for renewed increases in raw material costs, particularly for green coffee beans, affecting input expenses.

- Operational impacts: Risk of supply shortages, increased freight costs, and longer lead times, leading to operational delays and reduced efficiency.

Inability to Successfully Execute Strategic Alternatives

Farmer Brothers' exploration of strategic alternatives presents a significant risk of failure. There's no assurance that this process will yield a favorable transaction or any definitive outcome. For instance, if the company cannot secure a buyer or a strategic partner by the end of fiscal year 2025, the market might interpret this as a sign of underlying weakness.

A botched execution of these strategic alternatives could prolong existing uncertainty, leading to investor dissatisfaction. This disappointment could manifest in a further decline in Farmer Brothers' stock price, which has seen volatility throughout 2024 due to ongoing strategic reviews.

- Continued Uncertainty: Failure to finalize a deal by Q4 2025 could leave the company in limbo.

- Investor Disappointment: A lack of a positive resolution could erode investor confidence, impacting share value.

- Negative Value Impact: An unsuccessful strategic review might signal deeper operational issues, potentially reducing the company's overall market valuation.

Farmer Brothers faces intense competition from established players and specialty brands, putting pressure on pricing and requiring constant innovation. The U.S. coffee market, valued at $85.6 billion in 2023, underscores the need for Farmer Brothers to adapt to changing consumer tastes, such as the 35% of consumers seeking lower sugar options in 2024, and to address the growing trend of at-home brewing, evidenced by the 20% year-over-year growth in home coffee equipment sales in early 2025.

SWOT Analysis Data Sources

The data sources for this Farmer Brothers SWOT analysis include their latest financial statements, comprehensive market research reports on the coffee industry, and insights from industry experts and analysts. These sources provide a robust foundation for understanding the company's current position and future prospects.