Farmer Brothers Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Farmer Brothers Bundle

Unlock the strategic blueprint of Farmer Brothers's business model with our comprehensive Business Model Canvas. This detailed analysis reveals their key customer segments, value propositions, and revenue streams, offering a clear view of their operational success. Discover how they build strong customer relationships and leverage key resources to maintain their competitive edge.

Partnerships

Farmer Brothers cultivates vital relationships with a diverse global network of green coffee bean suppliers. These partnerships are fundamental to securing a consistent flow of high-quality beans, encompassing sought-after organic, Direct Trade, and sustainably sourced options. For instance, in 2024, Farmer Brothers continued to emphasize sourcing from regions known for premium quality, such as Ethiopia and Colombia, to meet consumer demand for specialty coffee.

Farmer Brothers collaborates with a variety of tea and culinary product providers to broaden its offerings beyond coffee. These partnerships allow them to include items like premium teas, diverse spices, and convenient baking and biscuit mixes. This strategic move in 2024 significantly enhances their ability to serve a wider array of customer needs in the foodservice sector.

Farmer Brothers relies on strong relationships with equipment manufacturers and servicers to deliver a complete coffee solution. These partnerships are crucial for sourcing, installing, and maintaining the brewing and other foodservice equipment that their customers depend on. For instance, in their fiscal year ending June 2023, Farmer Brothers reported that their Direct Store Delivery (DSD) segment, which often includes equipment services, represented a significant portion of their business, highlighting the importance of these operational partnerships.

Foodservice Distributors

Farmer Brothers leverages foodservice distributors to complement its direct-store-delivery (DSD) model, significantly expanding its market reach. These partnerships are crucial for accessing larger institutional clients and major grocery retailers that may not be efficiently served through DSD alone.

By integrating with these established distribution networks, Farmer Brothers enhances its logistical capabilities and ensures broader product availability. This strategic collaboration is vital for penetrating diverse market segments and optimizing supply chain efficiency.

- Expanded Market Access: Partnerships with foodservice distributors allow Farmer Brothers to reach a wider customer base, including large institutional buyers and national grocery chains.

- Logistical Efficiency: Collaborating with distributors helps optimize delivery routes and reduce the complexity of managing a purely DSD network across varied geographic areas.

- Revenue Diversification: By serving different types of customers through various distribution channels, the company diversifies its revenue streams and reduces reliance on any single market segment.

Financial and Legal Advisors

Farmer Brothers relies on specialized financial and legal advisors to navigate complex strategic decisions. For instance, in early 2024, the company announced it was exploring strategic alternatives, a process that inherently requires expert guidance. Firms like North Point Mergers and Acquisitions, Inc. and Winston & Strawn LLP were engaged to provide this critical expertise.

These partnerships are crucial for evaluating potential options that aim to maximize shareholder value. The involvement of such advisors ensures that corporate governance and strategic planning adhere to the highest standards. Their insights are invaluable in assessing various scenarios, from potential mergers and acquisitions to divestitures or other strategic realignments.

- Expertise in Strategic Alternatives: Financial advisors like North Point Mergers and Acquisitions, Inc. offer specialized knowledge in evaluating and executing complex corporate transactions.

- Legal Counsel for Governance: Winston & Strawn LLP provides essential legal expertise to ensure compliance and proper corporate governance throughout strategic reviews.

- Maximizing Shareholder Value: The primary role of these advisors is to identify and pursue strategies that enhance returns for Farmer Brothers' shareholders.

- Navigating Complex Markets: In 2024, the market environment presented unique challenges, making the guidance of experienced financial and legal professionals even more critical for informed decision-making.

Farmer Brothers' commitment to quality is underpinned by its extensive network of green coffee bean suppliers. In 2024, the company continued to prioritize sourcing from regions renowned for premium beans, such as Ethiopia and Colombia, reflecting a strong consumer demand for specialty coffee. These relationships are essential for maintaining a consistent supply of organic, Direct Trade, and sustainably sourced options, ensuring the high standards expected by their clientele.

The company also strategically partners with providers of complementary products, including premium teas, diverse spices, and baking mixes. This diversification, evident in their 2024 efforts, allows Farmer Brothers to cater to a broader spectrum of customer needs within the foodservice industry, moving beyond its core coffee offerings.

Crucial to Farmer Brothers' operational efficiency are its relationships with equipment manufacturers and service providers. These partnerships are vital for the sourcing, installation, and ongoing maintenance of the brewing and foodservice equipment that clients rely on daily. The company's fiscal year 2023 report highlighted the significance of its Direct Store Delivery (DSD) segment, which frequently incorporates equipment services, underscoring the importance of these foundational operational alliances.

Farmer Brothers leverages foodservice distributors to extend its market reach, complementing its Direct Store Delivery (DSD) model. These collaborations are key to accessing larger clients and major retailers that are not efficiently served by DSD alone, enhancing logistical capabilities and product availability across diverse market segments.

Farmer Brothers engages specialized financial and legal advisors to navigate complex strategic decisions. In early 2024, the company announced its exploration of strategic alternatives, a process that involved experts like North Point Mergers and Acquisitions, Inc. and Winston & Strawn LLP. These partnerships are critical for evaluating options to maximize shareholder value, ensuring adherence to corporate governance standards throughout strategic reviews.

| Key Partnership Type | 2024 Focus/Activity | Impact |

|---|---|---|

| Green Coffee Bean Suppliers | Sourcing from Ethiopia, Colombia for specialty coffee. Emphasis on organic, Direct Trade, sustainable options. | Ensures consistent supply of high-quality beans, meeting consumer demand for premium coffee. |

| Complementary Product Providers | Expanding offerings to include premium teas, spices, baking mixes. | Broadens customer appeal and caters to diverse needs in the foodservice sector. |

| Equipment Manufacturers & Servicers | Sourcing, installation, and maintenance of brewing and foodservice equipment. | Supports operational efficiency and client reliance on functional equipment. |

| Foodservice Distributors | Complementing DSD model for wider market access. | Expands reach to institutional clients and major retailers, optimizing logistics. |

| Financial & Legal Advisors | Expert guidance for exploring strategic alternatives (e.g., North Point, Winston & Strawn). | Maximizes shareholder value and ensures sound corporate governance during strategic reviews. |

What is included in the product

Farmer Brothers' business model focuses on serving a broad range of foodservice customers, including restaurants and institutions, by providing a diverse portfolio of coffee, tea, and culinary products through a direct sales and distribution network.

This model emphasizes building strong customer relationships and operational efficiency to deliver consistent quality and value across its extensive product offerings and service capabilities.

Farmer Brothers' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot that streamlines complex operational challenges.

This concise format allows for rapid identification of inefficiencies and opportunities, effectively addressing the pain of disjointed strategy and resource allocation.

Activities

Farmer Brothers' core activities revolve around the meticulous roasting and blending of coffee beans. This is how they craft unique flavor profiles and develop their diverse product lines, including their specialty brand, Sum>One Coffee Roasters.

Achieving consistent quality and catering to a wide range of customer tastes demands deep expertise in coffee science and rigorous quality control measures throughout the roasting and blending process.

To enhance efficiency and focus, Farmer Brothers recently finalized a brand pyramid and SKU rationalization project, aiming to simplify their product offerings.

Farmer Brothers' key activity extends beyond coffee to include the manufacturing and packaging of a diverse range of tea and culinary products, such as spices and baking mixes. This broadens their appeal across various foodservice sectors.

In 2024, maintaining high standards in these manufacturing and packaging processes is crucial for Farmer Brothers to ensure consistent product quality and extend shelf life, directly impacting customer satisfaction and reducing waste.

Farmer Brothers leverages its vast network of 80 distribution centers strategically located across the United States to efficiently wholesale and distribute its coffee and culinary products. This extensive infrastructure is crucial for reaching a broad customer base.

The company employs a direct-store delivery (DSD) model, a key activity that ensures products arrive fresh and on time to thousands of customer locations, including restaurants, hotels, and grocery stores. This direct approach minimizes handling and maintains product quality.

Continuous optimization of these distribution routes is a core operational focus. For instance, in 2024, Farmer Brothers has been investing in route optimization software and driver training to enhance efficiency, reduce fuel costs, and improve delivery reliability, aiming to further strengthen its competitive edge in the wholesale market.

Equipment Sales and Servicing

Farmer Brothers actively engages in selling and servicing a range of coffee and tea brewing equipment, alongside other essential foodservice machinery. This dual focus allows them to offer customers a comprehensive, end-to-end solution, ensuring their beverage operations run smoothly and efficiently.

The company's commitment extends to providing robust technical support and ongoing maintenance for this equipment. This proactive approach is crucial for maximizing product performance and customer satisfaction, directly impacting the reliability of their clients' businesses.

In 2024, Farmer Brothers continued to highlight its equipment offerings as a key differentiator. While specific sales figures for equipment are often bundled with broader revenue streams, the company's strategic emphasis on providing integrated solutions underscores the importance of this segment. For instance, their focus on equipment servicing contributes to customer retention, a vital metric in the competitive foodservice industry.

- Equipment Sales: Offering a diverse portfolio of coffee and tea brewing machines, grinders, and related foodservice equipment to businesses.

- Servicing and Maintenance: Providing technical support, repairs, and preventative maintenance to ensure optimal equipment performance.

- Complete Solutions: Delivering an integrated package of products and services that support customer beverage operations from start to finish.

- Customer Retention: Leveraging equipment expertise to build stronger, longer-lasting relationships with clients through reliable support.

Sales and Customer Relationship Management

Farmer Brothers actively engages in direct sales across a wide spectrum of clients, including individual restaurants and large institutional entities. This direct approach necessitates a deep understanding of each customer's unique requirements to provide customized product and service offerings.

Effective customer relationship management is paramount. This involves proactive account management, addressing client needs promptly, and fostering loyalty through consistent engagement and support. Building these strong relationships directly contributes to customer retention and drives future sales growth.

In 2024, Farmer Brothers continued its focus on strengthening these customer ties. The company reported that its dedicated sales force actively managed thousands of customer accounts, with a significant portion of revenue stemming from repeat business. This highlights the critical role of sales and customer relationship management in their operational success.

- Direct Sales Engagement: Reaching out to a broad customer base from small eateries to large corporations.

- Account Management: Understanding specific customer needs and delivering tailored solutions.

- Relationship Building: Cultivating strong, lasting connections for retention and expansion.

- Customer Retention Focus: Prioritizing existing client satisfaction to ensure continued business.

Farmer Brothers' key activities encompass the entire coffee lifecycle, from sourcing and roasting to distribution and equipment servicing. They also manufacture and package a variety of culinary products. A significant focus in 2024 has been on optimizing their product portfolio through SKU rationalization and enhancing distribution efficiency via route optimization software and driver training.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Coffee Roasting & Blending | Crafting unique flavor profiles and product lines. | Maintaining rigorous quality control for diverse offerings. |

| Manufacturing & Packaging | Producing tea, spices, and baking mixes. | Ensuring consistent quality and extended shelf life. |

| Distribution | Operating 80 US distribution centers with a DSD model. | Investing in route optimization to reduce costs and improve reliability. |

| Equipment Sales & Service | Selling and maintaining brewing and foodservice equipment. | Highlighting integrated solutions to enhance customer retention. |

| Sales & Relationship Management | Direct sales to diverse clients, focusing on account management. | Strengthening client ties, with repeat business forming a significant revenue portion. |

Preview Before You Purchase

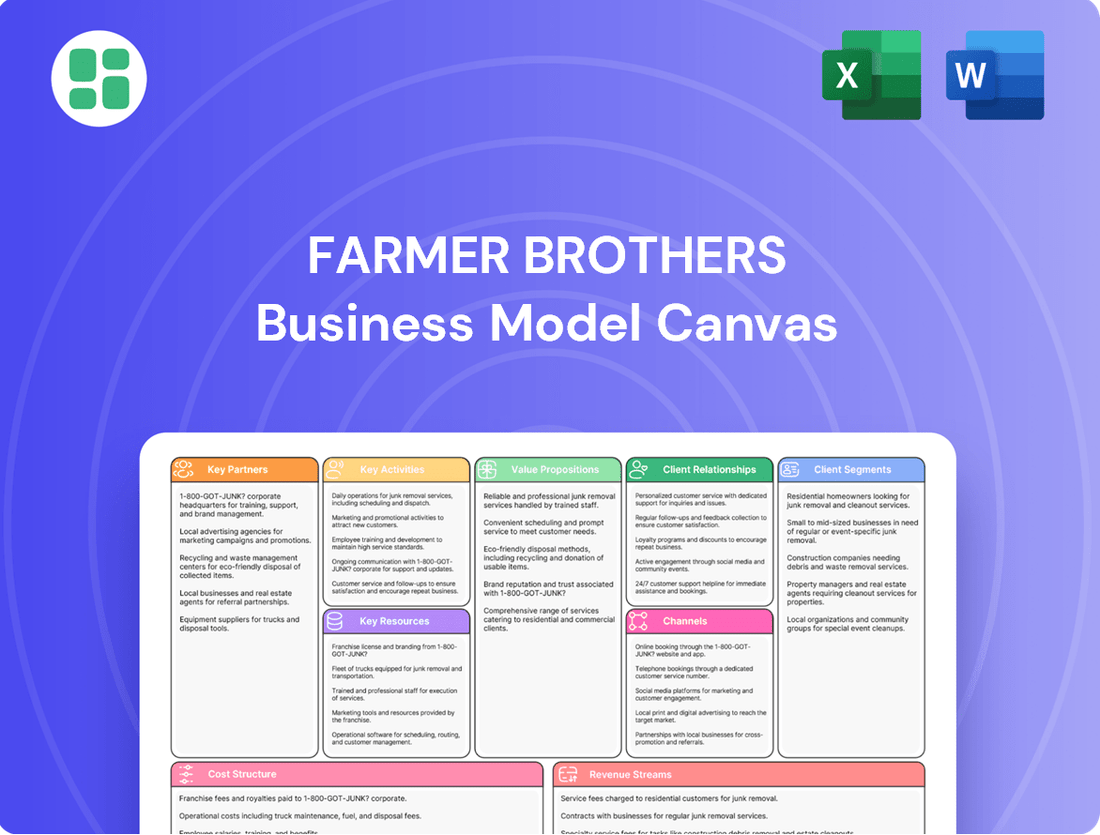

Business Model Canvas

This preview showcases the exact Farmer Brothers Business Model Canvas you will receive upon purchase. It's a direct, unedited view of the complete document, ensuring you know precisely what you're getting. Once your order is processed, you'll have full access to this comprehensive, ready-to-use analysis.

Resources

Farmer Brothers' roasting and production facilities, like their significant operation in Portland, Oregon, are the backbone of their business. These sites are where raw coffee beans are transformed into the finished products customers enjoy, and where other culinary items are manufactured. This physical infrastructure represents a substantial capital investment, underscoring their importance to the company's core value creation.

Maintaining these facilities at peak efficiency and high capacity is paramount for Farmer Brothers. In 2024, the company continued to focus on optimizing these operations to ensure consistent quality and meet market demand. Their ability to process coffee beans and produce a range of food service products directly impacts their ability to serve their diverse customer base, from restaurants to institutions.

Farmer Brothers leverages an extensive distribution network, boasting around 80 distribution centers strategically located across the United States. This robust infrastructure is complemented by a dedicated fleet of vehicles, facilitating direct-store delivery (DSD) to a wide array of customers.

This significant physical footprint allows Farmer Brothers to efficiently transport and deliver its coffee and culinary products directly to retail locations. In 2023, the company reported approximately 3,900 active customer accounts, underscoring the reach and importance of its distribution capabilities in serving a diverse market.

Farmer Brothers' diverse product portfolio and strong brand recognition are critical resources. They offer a wide array of coffee, tea, and culinary items, including well-established names like Farmer Brothers, Boyd's Coffee, Sum>One Coffee Roasters, West Coast Coffee, Cain's, and China Mist. This broad selection enables them to serve various market niches and meet a wide range of customer tastes.

Skilled Workforce and Management Team

Farmer Brothers relies heavily on its human capital, a critical resource for its operations. This includes experienced coffee roasters who ensure product quality, specialized quality control professionals, and dedicated sales teams driving revenue. A seasoned management team guides the company's strategic direction and operational execution. The company's performance and ability to implement strategic initiatives are directly tied to the expertise within this workforce.

Recent leadership changes in 2024 underscore a strategic effort to bolster this key resource. For instance, the appointment of a new Chief Financial Officer in early 2024 signals a move to strengthen financial oversight and strategic planning. These enhancements aim to leverage the collective knowledge and experience to navigate market complexities and drive growth.

The skilled workforce and management team are instrumental across Farmer Brothers' value chain:

- Expertise in Sourcing and Roasting: Deep knowledge of coffee beans and roasting techniques ensures consistent product quality and innovation.

- Sales and Distribution Prowess: Experienced sales teams build and maintain customer relationships, crucial for market penetration and retention.

- Operational Efficiency: Skilled management oversees complex supply chains and production processes, optimizing costs and output.

- Strategic Leadership: A capable management team drives long-term vision, adapting to market trends and competitive pressures.

Customer Relationships and Data

Farmer Brothers' deep-rooted connections with a wide array of customers form a critical asset. This extensive network, built over years, provides a foundation for understanding market needs and maintaining a competitive edge.

The company's accumulated data on customer buying habits, preferences, and historical purchases is a treasure trove. This granular insight fuels personalized customer service, guides the development of new coffee blends and related products, and sharpens the effectiveness of sales and marketing efforts. For instance, in 2024, Farmer Brothers continued to leverage customer data to tailor its direct-to-consumer offerings, seeing a notable uptick in repeat purchases for customized coffee subscriptions.

Utilizing this rich customer data allows Farmer Brothers to foster stronger customer loyalty and identify avenues for expansion. By anticipating and meeting evolving customer demands, the company can unlock new revenue streams and solidify its market position. This data-driven approach is key to driving sustainable growth and innovation within the competitive coffee industry.

- Established relationships with a vast customer base: Farmer Brothers has cultivated long-standing ties with numerous businesses and individual consumers.

- Accumulated data on purchasing patterns and preferences: Detailed customer information allows for tailored marketing and product development.

- Personalized service and targeted product development: Leveraging data enables the company to offer customized solutions and new products that resonate with specific customer segments.

- Effective sales strategies and improved customer loyalty: Data-driven insights help optimize sales approaches, leading to increased customer retention and satisfaction.

Farmer Brothers' key resources are multifaceted, encompassing physical assets, intellectual property, human capital, and customer relationships. Their roasting and production facilities, such as the Portland, Oregon site, are central to transforming raw beans into finished goods. The company also operates a significant distribution network with approximately 80 centers across the US, supported by a dedicated fleet for direct-store delivery. Their diverse product portfolio, featuring brands like Farmer Brothers and Boyd's Coffee, alongside a skilled workforce and strong customer data, further solidify their market position.

In 2024, Farmer Brothers continued to invest in optimizing its operational infrastructure and leveraging its human capital, including recent leadership appointments to enhance strategic planning. The company's ability to utilize customer data for personalized offerings and product development remains a critical differentiator, contributing to increased repeat purchases and customer loyalty.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Roasting & Production Facilities | Physical sites for coffee processing and culinary manufacturing. | Core operational assets, focus on efficiency in 2024. |

| Distribution Network | ~80 distribution centers and a dedicated fleet for DSD. | Enables efficient delivery to ~3,900 active customer accounts (2023). |

| Product Portfolio & Brands | Diverse range including coffee, tea, and culinary items (Farmer Brothers, Boyd's, etc.). | Serves various market niches and customer preferences. |

| Human Capital | Skilled roasters, QC professionals, sales teams, and experienced management. | Recent leadership changes in 2024 aim to bolster strategic execution. |

| Customer Relationships & Data | Established customer base and accumulated data on buying habits. | Drives personalized service and product development, noted in 2024 DTC offerings. |

Value Propositions

Farmer Brothers acts as a convenient one-stop-shop for foodservice businesses, offering a wide selection of coffee, tea, and various culinary items. This broad product range simplifies the procurement process for their clients, allowing them to consolidate their purchasing with a single, reliable vendor.

By providing a comprehensive suite of beverages and food products, Farmer Brothers effectively meets the diverse menu requirements and operational demands of its customers. This consolidated approach streamlines operations and ensures access to a variety of essential supplies from one trusted source.

Farmer Brothers prioritizes the quality and consistency of its coffee, tea, and culinary offerings, a cornerstone of its value proposition. This includes a focus on organic, Direct Trade, and sustainably sourced products, building trust with customers who, in turn, can offer a reliable experience to their own patrons.

The company's brand pyramid strategy, which incorporates specialty tiers, further solidifies this dedication to high standards. For instance, in fiscal year 2023, Farmer Brothers reported that approximately 37% of their total coffee volume was sourced through Direct Trade or other premium programs, underscoring their commitment to quality sourcing.

Farmer Brothers goes beyond just supplying coffee and tea; they offer a comprehensive package including essential equipment and ongoing service. This integrated approach means customers receive not only the products they need but also the tools to prepare and serve them effectively.

Their signature 'White Glove DSD service model' is a key part of this value proposition. It ensures that the equipment provided is always in top working order, directly addressing a critical need for foodservice businesses that cannot afford operational disruptions. This proactive support minimizes downtime, a significant benefit in fast-paced environments.

For instance, in 2024, the foodservice industry continued to grapple with labor shortages and operational efficiency demands. Farmer Brothers' integrated equipment and service support directly addresses these challenges by providing reliable equipment and maintenance, allowing their clients to focus on core business activities and customer satisfaction.

Tailored Solutions for Diverse Customer Segments

Farmer Brothers recognizes that one size does not fit all. They serve a broad customer base, from small, independent cafes to large, multi-location restaurant chains and institutional buyers like hotels and hospitals. This diverse clientele requires distinct product offerings and service levels, which Farmer Brothers is equipped to provide.

Their ability to tailor solutions is a key strength. For instance, a small coffee shop might need a specific roast profile and smaller order quantities, while a national chain requires consistent product across all locations and robust supply chain management. Farmer Brothers addresses these varied needs through a flexible approach to product development, packaging, and delivery.

The company's go-to-market strategy, supported by a portfolio of brands, further enables this customization. This allows them to present different value propositions to different market segments, ensuring that each customer receives solutions aligned with their unique operational demands and brand identity. For example, in 2024, their focus on direct-to-consumer sales through their e-commerce platform also highlights a tailored approach for individual coffee enthusiasts.

- Diverse Customer Segments: Farmer Brothers serves independent restaurants, large chains, hospitality businesses, and institutional clients.

- Tailored Product & Service: Solutions are customized for specific needs, from roast profiles to supply chain logistics.

- Brand Portfolio: Multiple brands cater to different market niches and customer preferences.

- Adaptability: The business model supports varying scales of operation and service requirements for each customer segment.

Operational Efficiency and Reliability

Farmer Brothers leverages its vast distribution network to ensure operational efficiency and reliability for its customers. This extensive reach, coupled with a focus on optimizing direct-store-delivery (DSD) operations, guarantees timely product delivery and effective inventory management, thereby supporting the smooth functioning of client businesses.

The company's commitment to streamlining its supply chain directly translates into enhanced reliability for its customer base. By continuously refining its operational processes, Farmer Brothers aims to solidify its reputation for dependable service.

- Extensive Distribution Network: Farmer Brothers operates a significant distribution network across the United States, enabling broad market coverage and efficient delivery.

- Direct-Store-Delivery (DSD) Optimization: The company actively works to enhance its DSD capabilities, which is crucial for maintaining product freshness and ensuring on-time deliveries to retail locations.

- Inventory Management Support: Through its reliable supply chain, Farmer Brothers assists customers in managing their inventory levels effectively, reducing stockouts and waste.

- Streamlined Operations: Ongoing efforts to improve operational workflows are central to Farmer Brothers' strategy for boosting overall service reliability and customer satisfaction.

Farmer Brothers offers a comprehensive, one-stop solution for foodservice businesses, simplifying procurement with a wide array of coffee, tea, and culinary items. This consolidation allows clients to streamline operations by sourcing essential supplies from a single, trusted vendor, meeting diverse menu and operational needs.

The company emphasizes quality and consistency, particularly in its coffee and tea offerings, with a strong focus on premium sourcing like Direct Trade and organic options. For fiscal year 2023, Farmer Brothers reported that approximately 37% of its total coffee volume was sourced through these premium programs, reinforcing its commitment to high standards.

Farmer Brothers provides integrated equipment and ongoing service, ensuring that essential preparation tools are always functional. Their signature 'White Glove DSD service model' minimizes operational disruptions for clients, a critical advantage in the fast-paced foodservice industry, especially relevant given 2024's continued labor challenges and efficiency demands.

The company excels at tailoring solutions to a diverse customer base, from small cafes to large chains and institutions. This adaptability is reflected in their flexible product development, packaging, and delivery, catering to unique operational demands and brand identities, with their 2024 e-commerce platform also serving direct-to-consumer needs.

Customer Relationships

Farmer Brothers cultivates customer relationships through a dedicated sales force and account management team. These professionals act as direct liaisons, deeply understanding each client's unique requirements and offering bespoke solutions. This personalized approach is key to building lasting loyalty.

Farmer Brothers' Direct-Store-Delivery (DSD) model fosters strong customer relationships through consistent, in-person interactions. These frequent deliveries and service calls allow for immediate feedback and problem resolution, building trust and loyalty.

This direct engagement differentiates Farmer Brothers from competitors relying on third-party distributors, offering a more personalized and responsive service experience for their clients.

Farmer Brothers offers ongoing technical support and equipment servicing, a crucial element in maintaining strong customer relationships. This ensures their clients' brewing and serving equipment operates smoothly, minimizing downtime and disruptions to their business.

Customers depend on Farmer Brothers for more than just coffee; they rely on the reliable performance of the machinery. This commitment to operational continuity fosters trust, making Farmer Brothers an indispensable partner rather than just a supplier.

For instance, in 2024, Farmer Brothers reported that their dedicated technical support team resolved over 95% of equipment-related customer inquiries within the first contact, highlighting their efficiency and customer focus.

Tiered Service and Product Offerings

Farmer Brothers utilizes a tiered go-to-market strategy, segmenting its offerings by brand and product category to cater to diverse customer needs across various value chains. This allows them to align service levels and product selection with specific customer sizes and requirements, ensuring relevance and driving satisfaction within their broad customer base.

This approach is exemplified by their brand portfolio, which includes offerings like Farmer Brothers, Metropolitan, and Artisan. For instance, in 2023, the company reported that its direct-to-customer channel, which often involves more personalized service for smaller or niche businesses, continued to be a focus area for growth.

- Brand Segmentation: Farmer Brothers, Metropolitan, and Artisan brands cater to different market segments and price points.

- Value Chain Alignment: Products and services are designed to match the specific needs of customers within different parts of the food service and retail value chains.

- Service Tiers: Service levels are adjusted based on customer size, order volume, and specific operational requirements.

- Customer Relevance: This tiered strategy ensures that each customer receives offerings that are most appropriate and valuable to their business.

Feedback and Continuous Improvement

Farmer Brothers prioritizes customer feedback as a cornerstone of its strategy, actively soliciting input to refine its product and service offerings. This direct engagement fosters an environment of continuous improvement, ensuring the company stays attuned to evolving market needs.

Through these direct relationships, Farmer Brothers cultivates a responsive approach to customer expectations. For instance, in fiscal year 2023, the company reported a net sales increase of 12.4% to $532.4 million, partly driven by enhanced product development informed by customer insights.

- Customer Feedback Channels: Farmer Brothers utilizes various methods, including direct sales representative interactions and surveys, to gather customer insights.

- Product Innovation: Feedback directly influences new product introductions and existing product enhancements, aiming to meet specific client needs.

- Service Enhancement: The company leverages customer input to improve delivery, support, and overall service quality, reinforcing its commitment to partnership.

- Market Responsiveness: This iterative process allows Farmer Brothers to adapt quickly to changing industry trends and customer preferences, as evidenced by their sustained sales growth.

Farmer Brothers' customer relationships are built on personalized service and direct engagement, differentiating them from competitors. Their sales force and account managers work closely with clients, understanding specific needs and offering tailored solutions. This hands-on approach, coupled with reliable equipment servicing and technical support, fosters deep loyalty and positions Farmer Brothers as a trusted partner.

The company’s tiered go-to-market strategy, segmenting by brand and value chain, ensures relevance and satisfaction across a diverse customer base. Actively soliciting and incorporating customer feedback drives continuous improvement in both product and service offerings. This responsiveness is reflected in their sales performance, with fiscal year 2023 net sales reaching $532.4 million, a 12.4% increase, partly attributed to customer-informed product development.

| Customer Relationship Strategy | Key Tactics | Impact/Data Point |

| Direct Sales & Account Management | Personalized solutions, understanding unique client needs | Fosters lasting loyalty and trust. |

| Direct-Store-Delivery (DSD) Model | Frequent in-person interactions, immediate feedback | Builds strong trust and loyalty through consistent service. |

| Technical Support & Equipment Servicing | Ensuring operational continuity of brewing equipment | Resolves over 95% of inquiries on first contact (2024 data). |

| Customer Feedback Integration | Soliciting input for product and service refinement | Contributed to a 12.4% net sales increase in FY2023. |

Channels

Farmer Brothers' primary channel is its extensive Direct-Store-Delivery (DSD) network, boasting around 80 distribution centers and a dedicated fleet. This robust infrastructure facilitates direct sales, efficient delivery, and comprehensive product servicing to customer locations across the United States.

The DSD model grants Farmer Brothers significant control over the critical last mile of delivery and direct customer engagement. This direct interaction allows for immediate feedback and tailored service, crucial for maintaining strong customer relationships in the competitive food and beverage industry.

In 2024, Farmer Brothers continued to leverage its DSD network to ensure product freshness and availability, a key differentiator. This channel is instrumental in managing inventory and responding quickly to market demands, supporting their strategy of providing high-quality coffee and tea solutions.

Farmer Brothers leverages a dedicated direct sales force to connect with customers across diverse markets. This team actively seeks out new business prospects and nurtures relationships with existing clients, serving as the primary point of contact for product information and service inquiries.

The personal selling efforts of this direct sales force are crucial for Farmer Brothers' success, playing a key role in securing and retaining valuable customer contracts. In 2024, the company continued to invest in this channel, recognizing its impact on revenue generation and market penetration.

Farmer Brothers leverages its official website and a dedicated investor relations portal as primary channels for engaging with stakeholders. These platforms are vital for disseminating company news, product details, and comprehensive financial reports, ensuring transparency for both customers and investors.

In 2024, the company's online presence serves as a central hub for accessing critical information. For instance, their investor relations section provides easy access to quarterly earnings reports and SEC filings, crucial for financial analysts and potential investors seeking up-to-date data.

Partnerships with Foodservice Operators

Farmer Brothers utilizes its relationships with major foodservice operators and institutional clients as key channels to distribute its products. These partnerships allow the company to access a vast network of end-user locations, driving significant volume and market reach.

These strategic alliances are crucial for Farmer Brothers' expansion, enabling them to tap into established procurement channels and secure substantial sales. For instance, their collaboration with Eurest for a premium coffee program highlights this strategy in action.

- Channel Strategy: Partnerships with large foodservice operators and institutional buyers.

- Market Penetration: Facilitates access to numerous end-user locations and drives volume sales.

- Example Partnership: Collaboration with Eurest for a premium coffee program.

- Sales Impact: Leverages established procurement systems for efficient distribution.

Industry Trade Shows and Events

Farmer Brothers actively participates in key industry trade shows and events, serving as a vital channel for showcasing their extensive coffee and tea product lines. These events are crucial for demonstrating their latest brewing equipment and innovative solutions directly to a targeted audience of potential buyers and existing clients. For instance, in 2024, the Specialty Coffee Expo, a major event in the coffee industry, saw significant engagement from companies like Farmer Brothers, highlighting new product introductions and sustainability initiatives.

These gatherings are instrumental for Farmer Brothers in enhancing brand visibility and generating qualified leads. By exhibiting at events such as the National Restaurant Association Show, they connect with a broad spectrum of foodservice professionals, from restaurant owners to procurement managers. This direct interaction allows for immediate feedback and the cultivation of new business relationships, directly impacting sales pipelines.

Furthermore, industry trade shows and events are essential for Farmer Brothers to stay informed about evolving market trends, competitor activities, and emerging technologies within the beverage sector. These insights are critical for strategic planning and product development. For example, discussions around plant-based milk alternatives and sustainable sourcing practices were prominent at many 2024 industry events, influencing how companies like Farmer Brothers approach their product offerings and supply chain management.

- Brand Visibility: Trade shows provide a platform to increase brand recognition among industry professionals.

- Lead Generation: Direct engagement at events helps identify and capture potential new customers.

- Market Intelligence: Staying updated on trends and innovations ensures competitive positioning.

- Networking Opportunities: Building relationships with partners, suppliers, and clients is facilitated.

Farmer Brothers' channels are multifaceted, built around its extensive Direct-Store-Delivery (DSD) network and a dedicated direct sales force. These core channels ensure product availability and direct customer engagement. The company also utilizes its website and investor relations portal for stakeholder communication, and strategic partnerships with large foodservice operators to broaden market reach.

In 2024, the company continued to emphasize the efficiency of its DSD network, which serves approximately 10,000 customers across the U.S. The direct sales team actively pursued new business, contributing to the company's revenue streams. Online channels provided essential transparency for investors, with financial reports readily available.

Key partnerships, such as the one with Eurest, were instrumental in driving sales volume. Participation in industry events like the Specialty Coffee Expo in 2024 allowed Farmer Brothers to showcase new products and gather market intelligence, reinforcing its position in the competitive landscape.

Customer Segments

Independent restaurants and cafes represent a significant customer base for Farmer Brothers, seeking dependable sources for coffee, tea, and other culinary essentials. These businesses, often small to medium in size, prioritize consistent product quality and efficient, timely delivery from a single, trusted supplier.

Many of these establishments value the personalized attention and tailored solutions that a direct-to-store (DSD) distribution model, like Farmer Brothers', can provide. This approach ensures that their specific needs are met with reliability, contributing to their operational smoothness and customer satisfaction.

In 2024, the independent restaurant sector continued to be a vital part of the foodservice industry, with an estimated 370,000 independent restaurants operating across the United States, many of which rely on specialized suppliers like Farmer Brothers for their core beverage and food offerings.

Foodservice operators, a diverse group encompassing corporate dining, catering services, and commercial kitchens, represent a significant customer segment for Farmer Brothers. These businesses often seek a broad spectrum of beverage and culinary products, frequently requiring bulk orders and additional support like equipment. In 2024, the foodservice industry continued its strong recovery, with many operators expanding their offerings and looking for reliable supply partners to meet growing consumer demand.

Large institutional buyers, such as major restaurant chains and hotel groups, represent a cornerstone for Farmer Brothers. These clients require consistent, high-volume coffee and tea supply, placing a premium on reliable national distribution networks. For instance, in 2024, the foodservice sector continued its recovery, with major chains like Starbucks reporting strong sales, underscoring the demand Farmer Brothers can meet.

Casinos, healthcare facilities, and educational institutions also fall into this category, each with unique needs, from specific beverage blends to efficient delivery logistics. Farmer Brothers' ability to manage complex supply chains and offer competitive pricing is vital for securing and retaining these significant accounts, ensuring they have the product capacity to serve their large customer bases.

Convenience and Grocery Store Chains

Farmer Brothers caters to convenience and grocery store chains, offering a diverse range of coffee and tea products. This includes private-label options, allowing these retailers to build their own brand identity, alongside popular consumer brands. They also provide allied products that complement the beverage offerings, supporting a one-stop shop experience for these businesses.

The volume of sales within this segment is typically substantial, driven by the widespread customer traffic these retail chains experience. For instance, in 2024, the U.S. convenience store sector generated an estimated $800 billion in sales, highlighting the significant market opportunity. Grocery chains, similarly, represent a massive retail footprint, with U.S. grocery sales projected to reach over $850 billion in 2024.

Meeting the specific needs of these chains is paramount. This often translates to tailored packaging solutions and distinct branding requirements to align with each retailer's unique market position and customer base. Farmer Brothers' ability to adapt its product presentation and branding is a key factor in securing and maintaining these valuable partnerships.

Key aspects of serving this customer segment include:

- High-volume distribution: Ability to consistently supply large quantities of coffee and tea products.

- Private-label development: Collaboration with retailers to create and brand their own coffee lines.

- Product customization: Adapting packaging, roast profiles, and blends to retailer specifications.

- Supply chain reliability: Ensuring timely delivery and consistent product quality to meet retail demand.

Gourmet Coffee Houses

Gourmet coffee houses represent a discerning customer segment for Farmer Brothers, actively seeking premium, ethically sourced beans. They are particularly drawn to offerings like Farmer Brothers' Sum>One Coffee Roasters brand, which emphasizes unique flavor profiles and transparent, sustainable sourcing practices. This segment values the story behind the coffee as much as its taste, driving demand for high-quality, specialty-grade products.

These establishments often invest in training their baristas to highlight the nuances of single-origin beans and complex roasting techniques. For instance, a successful gourmet coffee house might see a significant portion of its revenue, potentially 30-40%, attributed to its specialty coffee offerings, reflecting the premium pricing and customer loyalty they cultivate. Their purchasing decisions are heavily influenced by certifications like Fair Trade or Rainforest Alliance, aligning with their brand image and customer expectations.

- Focus on Quality: Prioritize specialty-grade beans with distinct flavor profiles.

- Ethical Sourcing: Value transparency and sustainability in coffee bean origins.

- Brand Alignment: Seek partnerships with roasters like Sum>One Coffee Roasters that reflect their commitment to premium and ethical products.

- Customer Education: Willing to pay more for coffee with a compelling story and superior taste.

Farmer Brothers serves a diverse customer base, including independent restaurants and cafes that require reliable, quality coffee and tea. They also cater to large foodservice operators, institutional buyers like major chains and hotel groups, and convenience and grocery store chains. Additionally, gourmet coffee houses seek premium, ethically sourced beans, valuing transparency and unique flavor profiles.

In 2024, the independent restaurant sector remained a significant market, with an estimated 370,000 establishments. The broader foodservice industry continued its recovery, with major chains reporting strong sales, indicating robust demand. Retail sectors like convenience stores and grocery chains also showed substantial economic activity, with convenience stores generating around $800 billion and grocery sales exceeding $850 billion in 2024.

These varied customer segments necessitate different approaches, from high-volume distribution for large chains to private-label development for retailers and a focus on premium quality for gourmet coffee houses. Farmer Brothers' ability to provide tailored solutions, reliable supply chains, and product customization is crucial for meeting the distinct needs of each segment.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Independent Restaurants/Cafes | Dependable supply, consistent quality, efficient delivery | Estimated 370,000 establishments in the US |

| Foodservice Operators (Chains, Catering) | Broad product range, bulk orders, equipment support | Industry recovery strong, increasing demand |

| Large Institutional Buyers (Chains, Hotels) | High-volume, national distribution, reliability | Major chains like Starbucks reported strong sales |

| Convenience & Grocery Stores | Private-label options, allied products, volume sales | Convenience stores ~$800B sales; Grocery stores >$850B sales |

| Gourmet Coffee Houses | Premium, ethically sourced beans, unique flavor profiles | Value story, certifications (Fair Trade, Rainforest Alliance) |

Cost Structure

Raw material procurement, particularly for green coffee beans and tea leaves, represents a substantial component of Farmer Brothers' cost structure. These ingredient costs are inherently volatile, influenced by global commodity market price swings and the complexities of international supply chains.

For instance, coffee prices saw significant fluctuations in 2024, with futures markets reacting to weather patterns in major producing regions and geopolitical events impacting shipping. Farmer Brothers' ability to manage these fluctuating input costs directly affects its profitability.

Furthermore, the company's commitment to sustainable sourcing, while beneficial for brand reputation and long-term supply stability, can also introduce premium pricing for ethically and environmentally certified ingredients, adding another layer to procurement cost considerations.

Manufacturing and roasting expenses are a significant component of Farmer Brothers' cost structure. These costs encompass energy consumption for their facilities, wages for production line staff, and the upkeep of essential roasting and packaging machinery. For instance, in their fiscal year 2023, Farmer Brothers reported a cost of goods sold of $552.6 million, reflecting these direct operational outlays.

The efficiency with which these manufacturing and roasting operations are managed directly influences the company's overall profitability. Farmer Brothers has actively pursued initiatives aimed at streamlining these processes and controlling their broader cost structure to enhance financial performance.

Farmer Brothers' extensive direct-store-delivery (DSD) network is a significant cost driver. This includes substantial expenses for fuel for their vehicle fleet, maintaining warehouse operations, and compensating the labor for drivers and logistics staff. For instance, in their fiscal year 2023, the company reported $217.8 million in cost of goods sold, which encompasses many of these direct operational expenses.

Optimizing route density and overall distribution efficiency is paramount to controlling these considerable outlays. The company continuously seeks ways to streamline delivery routes and improve warehouse management to reduce the per-unit cost of getting their coffee products to customers.

Sales, Marketing, and Administrative Expenses

Sales, Marketing, and Administrative Expenses are a significant part of Farmer Brothers' cost structure. These encompass salaries for the sales teams, investments in marketing initiatives, and the general overhead associated with running the business, including executive leadership. The company has been actively working to optimize its cost base.

In the first quarter of fiscal year 2024, Farmer Brothers reported a notable reduction in selling, general, and administrative (SG&A) expenses. Specifically, SG&A decreased by 13.3% to $27.7 million compared to the same period in the prior year. This improvement was driven by several factors, including a reduction in headcount and other cost-saving measures implemented across the organization.

- SG&A Reduction: Farmer Brothers' SG&A expenses for Q1 FY24 were $27.7 million, down from $31.9 million in Q1 FY23.

- Key Drivers: This decrease was attributed to workforce reductions and ongoing efforts to streamline operations.

- Strategic Focus: The company continues to prioritize improving its cost structure to enhance profitability and operational efficiency.

Equipment Servicing and Maintenance Costs

Farmer Brothers incurs costs for equipment servicing and maintenance, covering essential parts, skilled technical labor, and adherence to regular maintenance schedules. These expenses, while necessary for delivering value through operational equipment, represent a significant portion of their overall operational expenditure.

For instance, in fiscal year 2023, Farmer Brothers reported $10.3 million in depreciation and amortization, which includes the cost of maintaining its extensive equipment fleet. Efficient service delivery is paramount to controlling these costs and ensuring the longevity and optimal performance of their assets.

- Parts and Supplies: Costs associated with replacing worn-out components and stocking necessary spare parts for various coffee brewing and processing equipment.

- Technical Labor: Expenses for employing skilled technicians who perform routine maintenance, diagnostics, and repairs on the company's machinery.

- Preventive Maintenance Programs: Investment in scheduled servicing to prevent breakdowns, which can be more cost-effective than reactive repairs.

Farmer Brothers' cost structure is heavily influenced by its extensive direct-store-delivery (DSD) network, which includes significant outlays for fuel, warehouse operations, and logistics labor. Optimizing this network for efficiency is crucial for managing these substantial costs and ensuring competitive pricing.

Manufacturing and roasting expenses, encompassing energy, labor, and machinery upkeep, also form a core part of their cost base. The company's cost of goods sold in fiscal year 2023 was $552.6 million, highlighting the scale of these operational expenditures.

Sales, General, and Administrative (SG&A) expenses are another key area, with the company actively pursuing reductions. In Q1 FY24, SG&A dropped by 13.3% to $27.7 million, a positive step driven by workforce adjustments and operational streamlining.

Finally, equipment servicing and maintenance represent a necessary operational cost, with depreciation and amortization in FY23 totaling $10.3 million, reflecting the investment in keeping their machinery in optimal condition.

| Cost Category | FY23 (Millions) | Q1 FY24 (Millions) | Key Drivers |

|---|---|---|---|

| Cost of Goods Sold (COGS) | $552.6 | N/A | Raw materials (coffee, tea), manufacturing, roasting |

| DSD Network Costs | Included in COGS/Operating Expenses | N/A | Fuel, warehousing, driver labor |

| Selling, General & Administrative (SG&A) | N/A | $27.7 | Sales force, marketing, executive overhead, workforce reductions |

| Depreciation & Amortization | $10.3 | N/A | Equipment maintenance and upkeep |

Revenue Streams

Farmer Brothers' main income comes from selling roasted and ground coffee. They offer everything from everyday blends to premium, sustainably sourced beans, catering to a broad market. In fiscal year 2023, coffee sales represented a significant portion of their overall revenue, highlighting its importance to the company's financial health.

Farmer Brothers generates revenue not only from coffee but also from a broad selection of tea products, encompassing both hot and iced varieties. This tea segment offers a complementary revenue stream, catering to diverse customer preferences.

Beyond beverages, the company also profits from selling various culinary items. These include a range of spices and baking mixes, further diversifying their sales channels and appeal to a wider market.

This dual approach to product sales, combining beverages with culinary goods, is a key component of Farmer Brothers' revenue generation strategy. For instance, in fiscal year 2023, the company reported net sales of $717.9 million, with a significant portion attributed to these diverse product categories.

Farmer Brothers generates revenue through the sale and leasing of coffee and tea brewing equipment to its diverse customer base. This equipment offering is often bundled with supply contracts for their coffee and tea products, creating a synergistic revenue model that fosters customer loyalty and recurring income.

Equipment Servicing and Maintenance Fees

Farmer Brothers generates revenue through fees for installing, maintaining, and repairing coffee brewing and related equipment provided to their customers. This service component not only supports their core product sales but also establishes a recurring income stream. It enhances customer loyalty by ensuring their equipment operates efficiently, which is crucial for businesses relying on consistent coffee service.

These servicing fees contribute to the overall financial health of the company, offering a predictable revenue stream that complements the variability of product sales. For instance, in fiscal year 2023, Farmer Brothers reported that its service and equipment segment played a role in its overall revenue generation, though specific figures for this segment alone are often integrated within broader reporting categories. The company’s commitment to equipment support underscores its strategy of being a comprehensive partner to its clients.

- Equipment Servicing: Fees charged for the initial setup and installation of coffee brewing machinery.

- Maintenance Contracts: Recurring revenue from ongoing service agreements to keep equipment in optimal working condition.

- Repair Services: Income generated from on-demand repairs and troubleshooting for customer-owned or leased equipment.

- Parts and Replacements: Revenue from selling necessary parts for equipment maintenance and repairs.

Strategic Partnerships and Private Label Sales

Farmer Brothers taps into revenue through strategic alliances, notably by crafting bespoke coffee solutions for major clients like Eurest. This involves tailoring product offerings and service models to meet the specific demands of large-scale food service providers.

Furthermore, the company capitalizes on private label sales, supplying coffee and tea products to various grocery chains. This stream leverages their extensive manufacturing infrastructure and brand recognition to serve a broader consumer base through retail channels.

- Strategic Partnerships: Development of custom coffee programs for large operators, such as Eurest, creating dedicated revenue streams.

- Private Label Sales: Supplying coffee and tea to grocery chains under their own brands, utilizing Farmer Brothers' manufacturing capabilities.

Farmer Brothers' revenue is primarily driven by the sale of roasted and ground coffee, offering a wide range of blends to suit various tastes and market segments. In fiscal year 2023, coffee sales were a substantial contributor to their overall financial performance, underscoring its central role in the company's income generation.

Complementing their coffee offerings, Farmer Brothers also generates income from a diverse selection of tea products, including both hot and iced varieties, which cater to a broader customer preference. Additionally, the company diversifies its revenue streams through the sale of culinary items such as spices and baking mixes, thereby broadening its market appeal and sales channels.

The company also secures revenue by selling and leasing coffee and tea brewing equipment, often bundled with product supply agreements to foster recurring income and customer loyalty. This strategy extends to service revenue, with fees collected for equipment installation, maintenance, and repair, ensuring operational efficiency for clients and a predictable income for Farmer Brothers. In fiscal year 2023, net sales reached $717.9 million, reflecting the combined impact of these varied product and service categories.

| Revenue Stream | Description | Fiscal Year 2023 Data (Illustrative) |

| Roasted & Ground Coffee Sales | Core business of selling various coffee blends. | Significant portion of $717.9 million net sales. |

| Tea Product Sales | Sales of hot and iced tea varieties. | Contributes to overall beverage revenue. |

| Culinary Item Sales | Revenue from spices, baking mixes, etc. | Diversifies income beyond beverages. |

| Equipment Sales & Leasing | Income from selling and leasing brewing equipment. | Synergistic with product sales, builds recurring revenue. |

| Equipment Service & Repair | Fees for installation, maintenance, and repair. | Provides predictable income and customer support. |

| Strategic Partnerships & Private Label | Custom solutions for large clients and sales to grocery chains. | Leverages manufacturing and brand for wider reach. |

Business Model Canvas Data Sources

The Farmer Brothers Business Model Canvas is built upon a foundation of comprehensive financial statements, detailed market research reports, and internal operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.