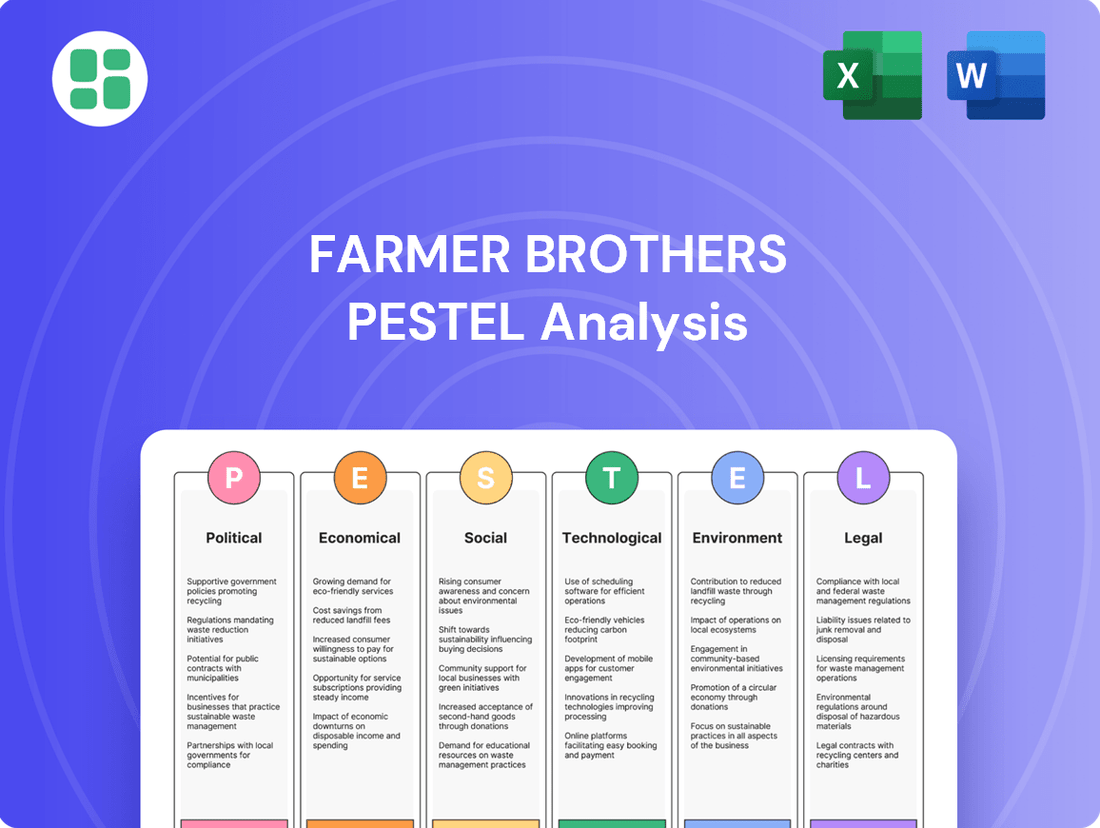

Farmer Brothers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Farmer Brothers Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Farmer Brothers' future. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify growth opportunities. Download the full version now to gain a strategic advantage.

Political factors

Government regulations concerning food safety, product labeling, and import/export tariffs are critical for Farmer Brothers. These policies directly influence operational costs and the efficiency of their global supply chain. For instance, the EU Deforestation Regulation (EUDR), which began its phased implementation in June 2023 and is expected to be fully enforced by December 2024, with a potential extension for large entities until December 2025, impacts coffee sourcing by requiring due diligence on deforestation-free commodities.

Geopolitical stability in coffee-producing nations is paramount for Farmer Brothers' consistent supply. For instance, the 2023 Global Peace Index highlighted ongoing instability in several coffee-growing regions, impacting production. This instability can lead to significant price fluctuations and shortages of raw coffee beans, directly affecting Farmer Brothers' operational costs and product availability.

Farmer Brothers, as a major national roaster, is particularly vulnerable to disruptions stemming from political unrest or policy changes in countries like Brazil and Vietnam, which are major coffee suppliers. For example, changes in export policies or trade agreements in these nations, driven by political shifts, can create immediate challenges in securing adequate volumes of quality beans. Keeping a close watch on these political dynamics is therefore a critical component of their supply chain risk management strategy.

Government subsidies and support programs in major coffee-producing countries, such as Brazil and Vietnam, directly impact global coffee prices and availability. For instance, in 2023, Brazil's agricultural support programs continued to bolster domestic coffee production, influencing export volumes. These policies can affect farmer incomes and the overall stability of the coffee supply chain, which Farmer Brothers must consider when developing procurement strategies and ensuring ethical sourcing.

Taxation and Fiscal Policies

Changes in corporate taxation, import duties, or excise taxes on beverages directly influence Farmer Brothers' profitability and how they price their products. For instance, a hike in corporate tax rates could squeeze profit margins unless passed on to consumers, potentially impacting market share. The company needs to closely monitor fiscal policy shifts at federal and state levels to ensure robust financial planning and maintain its competitive edge.

Farmer Brothers must remain agile in response to evolving tax landscapes. For example, understanding the impact of potential changes to the U.S. corporate tax rate, which stood at 21% as of early 2024, is crucial. Similarly, shifts in import duties on green coffee beans or excise taxes on prepared beverages could necessitate adjustments to their supply chain and pricing models. Effective management of these fiscal factors is key to sustaining financial health.

- Corporate Tax Rate Monitoring: Staying informed on the prevailing U.S. federal corporate tax rate, which has been 21% since the Tax Cuts and Jobs Act of 2017, and anticipating any potential adjustments is vital.

- Import Duty Impact: Analyzing how changes in tariffs on imported coffee beans, a primary input for Farmer Brothers, can affect cost of goods sold and subsequent pricing strategies.

- Excise Tax Awareness: Keeping track of any new or altered excise taxes on beverage products, which could directly impact consumer pricing and demand.

- State-Level Fiscal Policy: Recognizing that state-specific tax laws and fiscal incentives can also create regional advantages or disadvantages for the company's operations.

Labor Laws and Industrial Relations

Labor laws significantly impact Farmer Brothers' operational expenses and employee dynamics. Regulations concerning minimum wage, workplace safety, and the right to unionize directly affect labor costs and the company's ability to manage its workforce effectively. For instance, ongoing discussions around potential increases to the federal minimum wage in the US, which stood at $7.25 per hour as of early 2024, could necessitate adjustments to Farmer Brothers' payroll structure.

Disruptions stemming from labor disputes pose a considerable risk. The widespread labor actions seen across various industries in late 2024, including prominent examples in the food and beverage sector, highlight the potential for strikes to interrupt supply chains and service delivery. Farmer Brothers needs to proactively manage industrial relations to mitigate such risks.

Ensuring strict adherence to all applicable labor regulations is paramount for Farmer Brothers. Cultivating positive relationships with employees and labor unions, where applicable, is crucial for maintaining operational continuity and avoiding costly work stoppages. This proactive approach helps safeguard against unforeseen disruptions that could impact distribution and customer service.

- Minimum Wage Impact: Potential federal minimum wage increases in the US could raise labor costs for Farmer Brothers.

- Unionization Trends: Growing unionization efforts in the food service sector, as seen with Starbucks in late 2024, may influence Farmer Brothers' employee relations strategy.

- Operational Continuity: Proactive management of labor relations is key to preventing strikes and ensuring uninterrupted distribution and service.

- Regulatory Compliance: Farmer Brothers must stay abreast of evolving labor laws to maintain compliance and avoid penalties.

Government regulations concerning food safety, product labeling, and import/export tariffs are critical for Farmer Brothers, directly impacting operational costs and supply chain efficiency. The EU Deforestation Regulation (EUDR), with phased implementation from June 2023 and full enforcement by December 2024 (potentially extended to December 2025 for large entities), affects coffee sourcing by requiring due diligence on deforestation-free commodities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Farmer Brothers, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying key opportunities and threats within the coffee and culinary products industry.

Farmer Brothers' PESTLE analysis provides a clear, summarized version of external factors, offering a quick reference for strategic discussions and ensuring all stakeholders understand the market landscape.

Economic factors

Inflationary pressures significantly impact Farmer Brothers, especially concerning raw materials like coffee beans and other culinary ingredients. These rising costs directly affect the company's cost of goods sold. For instance, coffee bean prices saw considerable volatility in late 2024 and early 2025, with futures contracts trading at levels not seen in years, putting pressure on input costs.

Furthermore, escalating fuel and transportation expenses add another layer to operational cost increases. The average diesel price, a key indicator for transportation costs, remained elevated throughout much of 2024, impacting Farmer Brothers' logistics and distribution networks.

Farmer Brothers' profitability hinges on its capacity to manage gross margins amidst these economic headwinds. The company's strategic focus for fiscal 2025 includes initiatives aimed at improving its cost structure and enhancing gross margins, a crucial endeavor given the persistent inflationary environment.

Consumer spending and disposable income are crucial for Farmer Brothers, as they directly impact demand for coffee and foodservice. When the economy is strong and people have more money left after essentials, they're more likely to buy premium coffee or dine out. For instance, if disposable income rises by 3% in 2025, as some forecasts suggest, Farmer Brothers could see increased sales in its foodservice segment.

Conversely, economic slowdowns or drops in consumer confidence can really hurt sales, especially in the foodservice area. This sector is expected to see substantial growth between 2025 and 2035, but that growth is heavily reliant on consumers feeling secure enough to spend on non-essential items like restaurant meals.

Fluctuations in interest rates directly affect Farmer Brothers' expenses when borrowing money for new machinery, expanding operations, or managing day-to-day costs. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, this influences the broader cost of capital for businesses like Farmer Brothers.

When interest rates climb, the cost of acquiring capital becomes steeper, which could put the brakes on growth plans or investments in new technologies. This is a critical consideration for Farmer Brothers as they navigate potential strategic alternatives.

Maintaining access to favorable credit lines is crucial for Farmer Brothers' financial agility. This flexibility allows them to make timely strategic moves, especially important when exploring options to enhance shareholder value in a dynamic market.

Exchange Rate Fluctuations

Farmer Brothers, as a global coffee bean purchaser, is significantly affected by shifts in exchange rates. For instance, if the U.S. dollar strengthens against currencies like the Brazilian Real or Vietnamese Dong, the cost of imported coffee beans decreases, potentially boosting profit margins. Conversely, a weaker dollar inflates these procurement expenses.

These currency movements directly influence Farmer Brothers' cost of goods sold and can impact their overall profitability. For example, in early 2024, the U.S. dollar experienced some volatility against major trading currencies, which would have required careful management by companies like Farmer Brothers to mitigate potential cost increases for imported raw materials.

- Impact on Procurement: A stronger USD makes imported coffee cheaper, reducing raw material costs for Farmer Brothers.

- Cost Inflation: A weaker USD increases the cost of sourcing coffee beans from international markets.

- Financial Performance: Exchange rate volatility directly affects Farmer Brothers' cost of goods sold and net income.

- Risk Management: Continuous monitoring of global currency markets is crucial for hedging against adverse foreign exchange movements.

Competitive Landscape and Market Share

The coffee and foodservice industries are incredibly crowded, featuring a wide array of participants from major national chains to smaller, local businesses. Farmer Brothers operates within this intensely competitive arena, making it crucial for them to stand out through unique product selections, superior customer service, and efficient supply chain management. This competitive pressure drives strategic decisions aimed at optimizing operations and market positioning.

Farmer Brothers' strategic moves, such as simplifying its brand portfolio and refining its distribution networks, are direct responses to the demanding competitive landscape. These actions are designed to enhance efficiency and better serve their customer base amidst a market with many alternatives. The company's focus on streamlining aims to strengthen its market share and profitability.

- Market Share Dynamics: In 2023, the U.S. coffee shop market was valued at approximately $47.5 billion, with significant growth projected. Farmer Brothers, as a key player in the foodservice coffee supply chain, navigates this dynamic market where brand loyalty and pricing strategies are paramount.

- Competitive Strategies: Companies like Starbucks and Dunkin' dominate the retail coffee space, while foodservice suppliers must compete on price, quality, and reliability for business-to-business contracts. Farmer Brothers' focus on operational efficiency and product innovation is vital for maintaining its competitive edge.

- Distribution Network Optimization: The efficiency of distribution is a major competitive factor. In 2024, logistics costs continue to be a significant consideration for companies like Farmer Brothers, impacting their ability to offer competitive pricing and timely delivery to a diverse range of clients.

Economic factors present a mixed bag for Farmer Brothers. Inflationary pressures on raw materials like coffee beans, coupled with rising fuel and transportation costs, directly impact the company's cost of goods sold and operational expenses throughout 2024 and into early 2025. Consumer spending, influenced by disposable income and economic confidence, will be a key driver for demand in the foodservice sector, which is projected for significant growth between 2025 and 2035. Fluctuating interest rates, such as the Federal Reserve's target range of 5.25%-5.50% observed in early 2024, affect borrowing costs and strategic investment capabilities. Additionally, exchange rate volatility, particularly the U.S. dollar's strength against coffee-producing nations' currencies, directly influences procurement expenses and profit margins.

Preview the Actual Deliverable

Farmer Brothers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Farmer Brothers details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this insightful report to understand the external forces shaping Farmer Brothers' business landscape.

Sociological factors

Consumer tastes are definitely shifting, with a strong lean towards healthier, ethically produced, and more specialized coffee choices. This includes a rising demand for organic, fair trade, and decaffeinated varieties, alongside a growing interest in functional beverages that offer added benefits.

Farmer Brothers needs to keep pace with these changing preferences by updating its product lines. Focusing on responsible sourcing practices and developing unique, innovative coffee blends will be key for them to secure a larger piece of the market. For instance, the global market for organic coffee alone was valued at over $10 billion in 2023 and is projected to grow significantly in the coming years.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024-2025, has significantly reshaped coffee consumption. This shift means fewer employees are in traditional office settings daily, directly impacting the demand for bulk office coffee services. Data from 2023 indicated a notable percentage of the workforce continuing with hybrid arrangements, a trend expected to persist.

Consequently, there's a growing demand for premium coffee solutions tailored for home use. Consumers are seeking convenience and quality comparable to what they'd find in an office or café. This presents an opportunity for Farmer Brothers to innovate its product offerings, potentially focusing on single-serve pods, smaller bag sizes, and direct-to-consumer channels to capture this evolving market.

Consumers are prioritizing convenience, driving demand for streamlined ordering and delivery in the foodservice sector. For instance, the U.S. online food delivery market was valued at approximately $30 billion in 2023 and is projected to continue its growth trajectory, indicating a strong consumer preference for accessible options.

Beyond convenience, there's a growing appetite for unique and experience-driven dining. This includes a focus on artisanal coffee, specialty teas, and immersive café environments. Farmer Brothers can tap into this by offering premium beverage solutions and supporting partners in creating memorable customer interactions.

Farmer Brothers can leverage these sociological shifts by strengthening its digital presence for easier ordering and exploring partnerships that enhance the customer experience. By aligning with the demand for both ease and engagement, the company can better serve evolving consumer preferences in the coffee and foodservice markets.

Ethical Consumption and Sustainability Awareness

Consumers are increasingly prioritizing ethical consumption, with a significant portion willing to pay more for products that align with their values. This growing awareness of environmental and social issues is reshaping purchasing decisions, pushing companies to adopt more sustainable and transparent supply chains. For instance, a 2024 Nielsen study indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact.

Farmer Brothers' strategic focus on certifications such as Fair Trade USA and Rainforest Alliance directly addresses this trend. The company's commitment to achieving 100% responsibly sourced coffee by 2025 is a key differentiator, resonating with consumers who actively seek brands demonstrating genuine dedication to fair labor practices and reduced environmental footprints. This proactive approach positions Farmer Brothers favorably in a market where ethical sourcing is becoming a standard expectation.

- Growing Demand for Sustainability: A 2024 survey by Accenture found that 62% of consumers are more concerned about sustainability than they were a year ago.

- Ethical Sourcing as a Driver: Consumers are increasingly scrutinizing sourcing practices, with interest in deforestation-free and fair labor initiatives rising.

- Farmer Brothers' Commitment: The company's 2025 goal for 100% responsibly sourced coffee, supported by certifications like Fair Trade USA, directly aligns with these evolving consumer preferences.

- Market Advantage: Brands demonstrating strong ethical and sustainable practices are likely to gain market share and build stronger customer loyalty in the coming years.

Demographic Shifts and Cultural Diversity

Demographic shifts significantly impact the beverage industry. For instance, the aging population in the United States, projected to reach over 73 million by 2030, may lead to increased demand for decaffeinated or specialty coffee options. Simultaneously, the growing cultural diversity, with Hispanic Americans projected to be the largest ethnic group by 2050, creates opportunities for Farmer Brothers to explore and offer coffee blends and flavors inspired by various ethnic cuisines.

Farmer Brothers must adapt its product development and marketing to resonate with these evolving consumer preferences. Understanding the nuances of how different age groups and cultural backgrounds consume beverages is crucial for successful product innovation and targeted outreach. For example, by 2024, the demand for plant-based milk alternatives in coffee is expected to continue its upward trend, driven by younger, more health-conscious demographics.

- Aging Population: Increased demand for decaffeinated and specialized coffee products.

- Growing Diversity: Opportunities to introduce ethnic-inspired coffee flavors and blends.

- Plant-Based Trends: Continued growth in demand for non-dairy milk alternatives in coffee beverages.

- Consumer Preferences: Tailoring product development and marketing to align with diverse tastes.

Sociological factors highlight a strong consumer push towards healthier, ethically sourced, and specialized coffee options, including organic and fair trade varieties. This trend, evidenced by the global organic coffee market exceeding $10 billion in 2023, necessitates Farmer Brothers' adaptation to evolving tastes and responsible sourcing commitments.

The shift to remote and hybrid work models, a persistent trend through 2024-2025, significantly impacts traditional office coffee demand. This creates an opportunity for Farmer Brothers to focus on premium at-home coffee solutions and direct-to-consumer channels, catering to a market valuing convenience and quality.

Consumer prioritization of convenience and unique experiences, as seen in the U.S. online food delivery market's approximate $30 billion valuation in 2023, means Farmer Brothers should enhance digital ordering and explore partnerships that elevate customer engagement.

Increasing consumer demand for sustainability and ethical practices, with 73% of global consumers in a 2024 Nielsen study willing to alter habits for environmental impact, positions Farmer Brothers' 2025 goal of 100% responsibly sourced coffee as a key market advantage.

Technological factors

Advancements in automation are significantly impacting the coffee industry. Farmer Brothers can leverage robotics and AI in coffee roasting and processing to boost efficiency and cut labor expenses. For instance, automated sorting and packaging systems can process beans much faster than manual methods, potentially reducing processing times by up to 30%.

In warehousing and logistics, automation plays a crucial role. Implementing automated guided vehicles (AGVs) and robotic picking systems in distribution centers can streamline operations and improve the accuracy of order fulfillment. This technology can lead to a reduction in shipping errors by as much as 95%, ensuring customers receive the correct orders promptly.

Farmer Brothers' stated focus on operational efficiencies directly supports the adoption of these technologies. By investing in automation, the company can achieve a more agile and cost-effective supply chain, a key competitive advantage in the current market. This strategic alignment positions them well to benefit from the ongoing technological evolution in the sector.

Farmer Brothers' commitment to digital transformation is evident in their investment in online ordering platforms and AI-driven personalization. This focus is essential for enhancing customer experience and tapping into a wider market, particularly as digital transactions continue to grow. For instance, the company reported a significant increase in digital orders in their 2023 fiscal year, highlighting the effectiveness of these initiatives.

The development of sophisticated online delivery systems is another key technological factor. By optimizing these systems, Farmer Brothers can ensure efficient and reliable service, which is a critical differentiator in today's competitive foodservice industry. This expansion of digital capabilities is not just about convenience; it's about building a sustainable competitive advantage.

Technologies like blockchain are revolutionizing supply chain management, offering unprecedented transparency and traceability from the coffee bean's origin to the consumer's cup. This is crucial for brands like Farmer Brothers as consumer demand for ethically sourced and sustainably produced goods continues to surge. For instance, by 2024, over 60% of consumers globally indicated they were willing to pay more for products from sustainable brands, highlighting the market's shift.

The implementation of blockchain technology can directly address these consumer expectations and regulatory pressures. The EU Deforestation Regulation (EUDR), for instance, mandates stringent traceability for commodities like coffee entering the European market, effective from late 2024. Farmer Brothers' stated commitment to traceable coffee aligns perfectly with the capabilities of blockchain, enabling them to verify origin, ethical sourcing practices, and environmental compliance, thereby building trust and market access.

Data Analytics and Predictive Modeling

Farmer Brothers can significantly enhance its operations by adopting advanced data analytics and predictive modeling. Leveraging big data and artificial intelligence allows for more precise inventory management, accurate demand forecasting, and optimized route planning across its vast distribution network. For instance, in 2024, companies in the food and beverage sector saw an average reduction in inventory holding costs by up to 15% through AI-driven forecasting. This translates into more efficient operations, less product waste, and a quicker ability to adapt to evolving market demands.

The integration of data-driven insights is paramount for streamlining Farmer Brothers' business processes. Predictive analytics can identify potential supply chain disruptions before they occur, enabling proactive mitigation strategies. Furthermore, by analyzing sales data and consumer trends, the company can tailor its product offerings and marketing efforts more effectively. In 2025, it's projected that businesses utilizing predictive analytics will experience a 10-20% improvement in operational efficiency.

- Optimized Inventory: Reducing holding costs and minimizing spoilage through precise demand forecasting.

- Enhanced Logistics: Improving delivery efficiency and reducing fuel consumption via intelligent route planning.

- Market Responsiveness: Gaining a competitive edge by anticipating consumer preferences and market shifts.

- Reduced Waste: Minimizing product obsolescence and associated financial losses.

Innovation in Product Development

Technological advancements in food science and beverage development are key for Farmer Brothers to introduce novel products, like coffees with added health benefits or distinctive tastes. For instance, the company has been exploring spirit-based specialty coffees and functional beverages, aiming to capture market share by aligning with shifting consumer demands. This innovation is crucial for maintaining a competitive edge in the dynamic beverage industry.

Farmer Brothers' commitment to research and development in product innovation is evident in their pursuit of unique offerings. In 2023, the company reported investments in product development, seeking to enhance their portfolio with items that resonate with current consumer trends. This focus on innovation is vital for differentiating their brand and meeting the evolving preferences of a broad customer base.

- Functional Beverages: Development of coffees and other beverages with added nutritional or health-promoting ingredients.

- Flavor Innovation: Creation of unique and exotic flavor profiles to appeal to adventurous palates.

- Spirit-Infused Coffee: Exploration of specialty coffees that incorporate or are inspired by spirits for a premium experience.

- Sustainable Sourcing Tech: Utilizing technology to ensure and highlight the ethical and sustainable sourcing of coffee beans.

Farmer Brothers is leveraging automation in roasting and processing to boost efficiency, with automated systems potentially reducing processing times by up to 30%. In warehousing, automated guided vehicles and robotic picking can improve order accuracy by as much as 95%. The company's investment in online ordering platforms and AI-driven personalization saw a significant increase in digital orders in fiscal year 2023, reflecting the growing importance of digital transactions.

Legal factors

Farmer Brothers operates under stringent food safety and quality regulations, a critical factor for any national coffee roaster and distributor. Compliance with the Food and Drug Administration (FDA) standards, Hazard Analysis and Critical Control Points (HACCP) principles, and various health codes is absolutely essential. Failure to adhere can lead to costly recalls, damage to consumer trust, and significant legal penalties, impacting their bottom line.

Maintaining robust internal quality assurance programs is therefore non-negotiable for Farmer Brothers. This includes rigorous testing of beans, monitoring of roasting processes, and ensuring safe handling throughout the distribution chain. For instance, in 2023, the U.S. food industry saw an estimated $3 billion in costs associated with food recalls, highlighting the financial imperative of meticulous quality control.

Farmer Brothers must navigate a complex web of federal, state, and local labor laws. This includes adhering to minimum wage requirements, overtime pay regulations, and workplace safety standards enforced by agencies like OSHA. For instance, in 2024, the federal minimum wage remains at $7.25 per hour, but many states and cities have enacted significantly higher rates, impacting payroll costs.

Evolving employment legislation, such as new mandates on paid sick leave or changes to independent contractor classifications, can directly affect Farmer Brothers' operational expenses and necessitate updates to HR policies. The company also faces the ongoing challenge of managing employee relations, including potential unionization drives, which can introduce new labor agreements and associated costs.

Farmer Brothers navigates a complex web of environmental regulations, focusing on waste management, water usage, and air emissions from its roasting operations. This includes adherence to rules concerning packaging waste and carbon footprints. The company's commitment is evident in its LEED Silver certified roasting facility and ongoing waste reduction initiatives, underscoring their proactive approach to environmental stewardship.

Trade and Import/Export Laws

Farmer Brothers' operations are significantly shaped by international trade laws and import/export regulations, particularly concerning coffee beans. For example, the EU Deforestation Regulation (EUDR), effective from late 2024 into 2025, mandates rigorous due diligence for commodities like coffee entering the European Union. This requires detailed traceability and proof of origin, impacting sourcing strategies and compliance costs.

These regulations directly influence the cost and availability of raw materials. Tariffs on coffee beans can fluctuate, affecting Farmer Brothers' profitability and pricing strategies. Navigating these complex legal frameworks is crucial for maintaining access to global supply chains and ensuring uninterrupted operations.

- EUDR Compliance: The EUDR, in effect from December 2024, requires companies like Farmer Brothers to prove their coffee is deforestation-free, demanding robust supply chain transparency.

- Tariff Impact: Changes in import tariffs on coffee beans can directly alter the cost of goods sold, potentially impacting profit margins and consumer pricing.

- Global Sourcing: Adherence to varying international trade laws is essential for Farmer Brothers to efficiently source coffee beans from diverse origins worldwide.

Intellectual Property and Brand Protection

Farmer Brothers' ability to safeguard its brand names, proprietary recipes, and unique product formulations through trademarks and patents is paramount. This legal framework is essential for maintaining brand integrity and a distinct competitive edge in the coffee and culinary products market. For instance, in 2023, the company continued to rely on its established brand recognition, a key asset protected by intellectual property law, to drive sales amidst evolving consumer preferences.

Implementing robust legal measures against counterfeit goods and unauthorized use of their intellectual property is a continuous necessity. Such actions are vital for preserving Farmer Brothers' market position and preventing dilution of its brand value. This also extends to protecting unique operational aspects, such as proprietary roasting techniques or innovative distribution methods, which contribute significantly to their operational efficiency and product quality.

The company's commitment to intellectual property protection is underscored by ongoing vigilance. This includes actively monitoring the market for infringements and taking swift legal action when necessary. Such diligence ensures that the value Farmer Brothers builds in its brands and processes is legally defensible, supporting its long-term financial health and market standing.

Farmer Brothers must navigate a complex landscape of food safety regulations, including FDA standards and HACCP principles, to prevent costly recalls and maintain consumer trust. In 2023, food recalls in the U.S. cost an estimated $3 billion, highlighting the financial imperative of strict quality control.

Labor laws, such as minimum wage and workplace safety standards, directly impact operational costs, with many states and cities in 2024 having significantly higher minimum wages than the federal $7.25 per hour. Environmental regulations concerning waste and emissions also necessitate ongoing compliance efforts, as seen in their LEED Silver certified facility.

International trade laws, like the EUDR effective late 2024, demand rigorous due diligence for coffee sourcing, impacting supply chain transparency and compliance costs. Furthermore, protecting intellectual property through trademarks and patents is crucial for maintaining brand integrity and a competitive edge, as demonstrated by their continued reliance on brand recognition in 2023.

Environmental factors

Climate change is a major disruptor for coffee farming, causing erratic weather, droughts, and more pests and diseases in key growing areas. This directly impacts crop yields and quality, leading to greater price swings. For Farmer Brothers, which depends on a consistent supply of raw coffee beans, this means actively supporting climate adaptation efforts throughout its supply chain is crucial.

Growing global concern over deforestation, particularly linked to agricultural commodities, is driving stricter regulations. The EU Deforestation Regulation (EUDR), effective late 2024, mandates due diligence for products like coffee, impacting supply chains.

Farmer Brothers is actively addressing this through its commitment to responsible sourcing, aiming for 100% responsibly sourced coffee by 2025. This includes prioritizing certifications such as Rainforest Alliance and Fair Trade USA, which promote sustainable land use and ethical practices.

This proactive stance on deforestation and sustainable sourcing is vital for Farmer Brothers, ensuring continued market access and bolstering its reputation among environmentally conscious consumers and regulators.

Water availability and responsible management are paramount for coffee cultivation and processing, directly impacting Farmer Brothers' supply chain. For instance, the 2023 drought in Brazil, a major coffee producer, led to significant yield reductions, highlighting the vulnerability of coffee crops to water scarcity.

Farmer Brothers actively addresses these challenges through its sustainability programs. These initiatives focus on water conservation techniques at the farm level and in their processing facilities, aiming to reduce water usage by a targeted 15% by 2027 across their key sourcing regions.

Waste Management and Circular Economy Practices

Minimizing waste across coffee production, roasting, and packaging is a significant environmental focus for companies like Farmer Brothers. This involves exploring innovative ways to handle by-products. For instance, by-products from coffee processing can be repurposed as fertilizers or even as a source for renewable energy, embodying circular economy ideals. Farmer Brothers' commitment to reducing waste and enhancing recycling programs directly contributes to a lessened ecological impact.

Farmer Brothers has actively pursued initiatives to align with circular economy principles. These efforts include exploring the conversion of coffee by-products into valuable resources, such as organic fertilizers for agricultural use or biomass for energy generation. Furthermore, the company is investigating and implementing more sustainable packaging solutions designed to minimize environmental impact. These actions underscore a strategic approach to waste reduction, aiming to create a more closed-loop system within their operations.

The company's dedication to waste reduction and robust recycling programs is a key component of its environmental strategy. For example, in fiscal year 2023, Farmer Brothers reported a significant portion of their waste streams were being diverted from landfills through recycling and composting initiatives. While specific figures for 2024/2025 are still emerging, the trend indicates a continued focus on minimizing their ecological footprint through operational efficiencies and responsible resource management.

- Waste Diversion Rates: Aiming to increase the percentage of waste diverted from landfills through recycling, composting, and energy recovery programs.

- By-product Repurposing: Exploring and implementing methods to convert coffee grounds and other processing by-products into valuable resources like fertilizers or biofuel.

- Sustainable Packaging: Investing in and adopting eco-friendly packaging materials and designs to reduce post-consumer waste.

- Operational Efficiency: Streamlining production processes to minimize material usage and waste generation at the source.

Carbon Footprint and Emissions Reduction

Farmer Brothers is addressing the increasing demand for reduced greenhouse gas emissions across its operations. This includes efforts from the initial coffee farming stages all the way through to final distribution. The company has committed to setting Science Based Targets, aligning its emission reduction goals with climate science.

Furthermore, Farmer Brothers is actively purchasing Renewable Energy Certificates (RECs) to offset its energy consumption and further minimize its ecological footprint. These initiatives are crucial for demonstrating environmental responsibility and meeting the expectations of investors, consumers, and other stakeholders.

- Science Based Targets: Farmer Brothers has committed to setting Science Based Targets to guide its emission reduction efforts.

- Renewable Energy Certificates: The company is purchasing RECs to offset its electricity usage and reduce its carbon impact.

- Value Chain Focus: Efforts are being made to reduce emissions across the entire coffee value chain, from farm to distribution.

- Stakeholder Expectations: Minimizing carbon emissions is vital for meeting the growing environmental stewardship demands from stakeholders.

Environmental factors significantly shape Farmer Brothers' operations, with climate change impacting coffee bean supply and quality due to unpredictable weather patterns. The company's commitment to responsible sourcing, aiming for 100% by 2025, addresses concerns like deforestation, exemplified by its focus on certifications such as Rainforest Alliance.

Water scarcity, as seen in the 2023 Brazilian drought, poses a risk, prompting Farmer Brothers to implement water conservation techniques with a goal of a 15% reduction in water usage by 2027 in key sourcing regions.

Waste reduction is another key area, with Farmer Brothers exploring by-product repurposing for fertilizers or energy and investing in sustainable packaging to minimize its ecological footprint. The company is also focused on reducing greenhouse gas emissions across its value chain, backed by a commitment to Science Based Targets and the purchase of Renewable Energy Certificates (RECs).

| Environmental Factor | Impact on Farmer Brothers | Farmer Brothers' Initiatives/Goals |

|---|---|---|

| Climate Change & Weather Volatility | Affects coffee bean yield, quality, and price stability. | Supports climate adaptation in supply chain; prioritizes sustainable farming practices. |

| Deforestation & Land Use Regulations | Requires due diligence in sourcing; impacts market access. | Aims for 100% responsibly sourced coffee by 2025; utilizes certifications like Rainforest Alliance. |

| Water Availability & Management | Threatens crop yields and processing operations. | Implements water conservation techniques; targets 15% water usage reduction by 2027. |

| Waste Generation & Circular Economy | Increases operational costs and environmental impact. | Repurposes coffee by-products; invests in sustainable packaging; enhances recycling programs. |

| Greenhouse Gas Emissions | Contributes to climate change; faces stakeholder scrutiny. | Commits to Science Based Targets; purchases Renewable Energy Certificates (RECs). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Farmer Brothers is built upon a robust foundation of data sourced from leading financial news outlets, government regulatory bodies, and reputable industry-specific market research firms. We meticulously gather information on economic indicators, consumer trends, and legislative changes to ensure comprehensive and accurate insights.