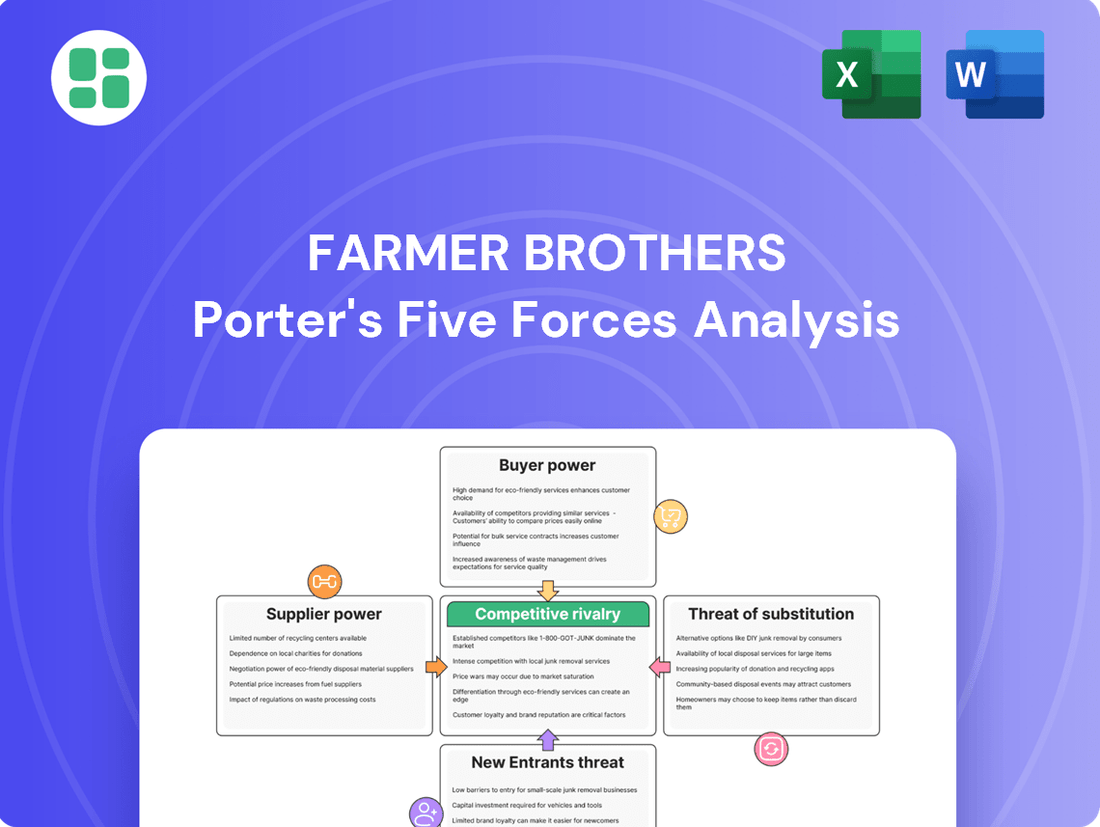

Farmer Brothers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Farmer Brothers Bundle

Farmer Brothers faces a dynamic competitive landscape, shaped by the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry within the coffee industry. Understanding these forces is crucial for strategic success.

The complete report reveals the real forces shaping Farmer Brothers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Farmer Brothers' reliance on specific, high-quality coffee beans, such as those from Ethiopia or Colombia, can grant significant bargaining power to concentrated groups of growers. If these specialty beans are essential and difficult to substitute, suppliers can command higher prices. For example, in 2023, the global coffee market saw price volatility, with certain origins experiencing supply chain disruptions that increased costs for roasters.

Farmer Brothers faces moderate supplier power due to switching costs associated with coffee bean sourcing. Establishing new supplier relationships and ensuring consistent quality and blend profiles can be time-consuming and costly, potentially increasing the leverage of existing suppliers.

However, Farmer Brothers mitigates this by standardizing its roasting and blending processes and maintaining a portfolio of multiple approved suppliers. This diversification strategy helps to reduce the dependency on any single supplier and lowers the overall switching costs, thereby diminishing supplier leverage.

The complexity of integrating new coffee bean varieties into Farmer Brothers' established production lines and quality assurance protocols also contributes to switching costs. For instance, a significant change in bean origin or processing method could necessitate recalibrating roasting profiles and testing to maintain product consistency, a process that requires investment in time and resources.

Coffee beans are the bedrock of Farmer Brothers' business, directly impacting their core product. The quality and consistent availability of these beans are paramount for maintaining Farmer Brothers' brand image and ensuring product uniformity across their offerings. This makes the suppliers of these essential raw materials a significant force.

Suppliers of high-quality, particularly unique or single-origin coffee beans, can wield considerable bargaining power. For instance, if Farmer Brothers relies on specific varietals for their premium blends, those suppliers are in a stronger position to negotiate terms. In fiscal year 2023, Farmer Brothers reported that green coffee represented a substantial portion of their cost of goods sold, underscoring the financial impact of bean sourcing.

Threat of Forward Integration by Suppliers

While it's not typical for raw coffee bean suppliers to extensively move into roasting and distribution, there's a theoretical possibility for large coffee cooperatives or plantations to bypass existing roasters. This potential forward integration by suppliers could significantly boost their bargaining power, potentially restricting Farmer Brothers' access to essential raw materials or introducing new competitive pressures in the market.

The significant capital investment and specialized expertise needed for large-scale roasting and distribution operations often act as a deterrent for most coffee bean suppliers considering this move. For instance, establishing a roasting facility requires substantial upfront costs for machinery and infrastructure, and developing a robust distribution network demands considerable logistical planning and investment.

- Limited Forward Integration: Historically, raw coffee bean suppliers have focused on production, with forward integration into roasting and distribution being uncommon due to high capital and expertise barriers.

- Potential for Disruption: Should large, well-capitalized cooperatives or plantations pursue forward integration, it could disrupt the supply chain, potentially increasing costs or limiting raw material availability for companies like Farmer Brothers.

- Barriers to Entry: The significant financial investment and operational knowledge required for roasting and distribution act as a considerable deterrent, mitigating the immediate threat of widespread supplier forward integration.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers in the coffee industry. For Farmer Brothers, this means considering the variety of coffee beans, such as Arabica versus Robusta, and the diverse origins available globally. If the company can readily switch between different bean types or sourcing regions without a substantial increase in cost or a detriment to product quality, the power of any single supplier diminishes.

Farmer Brothers' ability to substitute inputs is crucial. For instance, if a particular origin experiences a supply shortage or price hike, having access to comparable quality beans from another region can mitigate supplier leverage. This flexibility is key to maintaining competitive pricing and operational stability. In 2023, global coffee production saw shifts, with Brazil continuing to be a dominant producer, but other regions like Vietnam and Colombia also playing vital roles, offering alternative sourcing options.

Furthermore, Farmer Brothers' diversification beyond just coffee can also reduce reliance on a single input type, thereby weakening supplier power. By offering products that may incorporate tea leaves or other culinary ingredients, the company spreads its dependency across a wider range of raw materials. This strategic diversification enhances the company's ability to negotiate favorable terms with individual suppliers.

- Bean Variety and Origin Flexibility: Farmer Brothers can source from multiple coffee-producing regions, lessening dependence on any one supplier or origin.

- Substitution of Coffee Types: The ability to substitute between Arabica and Robusta beans, or different grades within those types, provides leverage.

- Impact of Global Supply Dynamics: Fluctuations in global coffee production, such as those experienced in 2023 with varied yields across Brazil, Vietnam, and Colombia, create opportunities for sourcing alternatives.

- Product Diversification: Expanding product lines to include non-coffee items reduces the overall reliance on coffee bean suppliers.

Farmer Brothers' bargaining power with suppliers is influenced by the concentration of coffee bean growers and the availability of substitutes. Reliance on specialty beans from specific origins, like Ethiopia, can empower concentrated supplier groups, especially when these beans are critical and hard to replace. For instance, in 2023, global coffee prices saw significant swings due to supply chain issues in certain regions, directly impacting roasters' costs.

The company's ability to substitute inputs, such as switching between Arabica and Robusta beans or sourcing from diverse regions like Brazil, Vietnam, or Colombia, significantly weakens individual supplier leverage. This flexibility is crucial for managing costs and ensuring operational continuity, as demonstrated by the varied global production yields in 2023.

Farmer Brothers mitigates supplier power by standardizing processes, maintaining multiple approved suppliers, and diversifying its product portfolio beyond coffee. These strategies reduce dependency on any single supplier and lower switching costs, thereby enhancing the company's negotiating position.

| Factor | Impact on Farmer Brothers | Supporting Data/Examples |

|---|---|---|

| Supplier Concentration & Specialty Beans | Moderate to High Power | Reliance on specific origins (e.g., Ethiopia) for premium blends; 2023 coffee market volatility due to supply disruptions. |

| Switching Costs | Moderate Power | Time and cost to qualify new bean suppliers and maintain blend consistency. |

| Availability of Substitutes | Low to Moderate Power | Ability to switch between Arabica/Robusta and various origins (Brazil, Vietnam, Colombia); 2023 production shifts offered sourcing alternatives. |

| Farmer Brothers' Mitigation Strategies | Reduces Supplier Power | Supplier diversification, process standardization, and product line expansion beyond coffee. |

What is included in the product

Farmer Brothers' Porter's Five Forces analysis reveals the intense rivalry among coffee roasters, the significant bargaining power of large buyers, and the low threat of new entrants due to established distribution networks.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces model, enabling rapid identification of strategic threats and opportunities for Farmer Brothers.

Customers Bargaining Power

Farmer Brothers' customer base is varied, but significant bargaining power resides with large institutional buyers. These entities, such as major hotel chains or foodservice providers, can command substantial discounts due to the sheer volume of coffee and related products they purchase. For instance, if a large client represents a notable percentage of Farmer Brothers' revenue, their ability to negotiate favorable terms increases dramatically.

While many smaller, independent restaurants are also clients, their individual purchasing volume is typically too small to exert significant leverage. Their collective impact is less direct than that of a few large accounts. The overall bargaining power of customers is therefore a dynamic interplay between the concentration of purchasing power among a few large clients and the dispersed demand from a multitude of smaller ones.

If Farmer Brothers' coffee, tea, and culinary products are seen as interchangeable commodities, customers hold significant power. This is because they can easily switch to rivals offering lower prices, especially if there are no perceived differences in quality or features. For instance, in the broader foodservice industry, a significant portion of coffee sales can be driven by price sensitivity among certain customer segments.

However, Farmer Brothers can diminish this customer power through differentiation. Offering unique, proprietary blends of coffee or tea, cultivating a strong brand reputation associated with quality and reliability, or providing specialized equipment and maintenance services can make switching less attractive for customers. This focus on value beyond just price is crucial for retaining business and reducing customer bargaining leverage.

Customer switching costs play a significant role in the bargaining power of customers. For businesses that rely on coffee and food services, changing providers can incur expenses. These might include the cost of new equipment, training employees on new systems, or reconfiguring existing supply chains. For instance, if a customer needs to invest in new brewing machines or point-of-sale systems to work with a different coffee supplier, that represents a tangible switching cost.

Farmer Brothers' strategy can influence these costs. If Farmer Brothers offers bundled solutions that include equipment leasing or maintenance alongside their coffee products, the switching costs for customers increase. This integration makes it more complex and expensive for a customer to simply switch to a competitor for beans alone. In 2023, Farmer Brothers reported that its foodservice segment, which often includes equipment and service, contributed significantly to its revenue, highlighting the importance of these integrated offerings in potentially raising customer switching costs.

Buyer's Price Sensitivity and Information Availability

Farmer Brothers' customers, particularly large institutional buyers and restaurants with tight profit margins, exhibit significant price sensitivity. This means they are keenly aware of price differences and actively seek the best deals. For instance, in the competitive foodservice industry, even small price fluctuations can impact a restaurant's profitability.

The digital age has dramatically amplified this by making information readily accessible. Buyers can now easily compare prices, product specifications, and supplier reviews online. This increased transparency empowers them to negotiate more effectively, putting pressure on suppliers like Farmer Brothers to offer competitive pricing. In 2024, the continued growth of online procurement platforms for businesses further facilitates this price comparison.

- Price Sensitivity: Many of Farmer Brothers' clients, such as large hotel chains or restaurant groups, operate on thin margins, making them highly susceptible to price changes in coffee and related supplies.

- Information Availability: The proliferation of online marketplaces and industry price indices in 2024 allows buyers to swiftly benchmark Farmer Brothers' offerings against competitors, enhancing their ability to demand lower prices.

- Value Proposition: To counter this, Farmer Brothers needs to articulate a value proposition that extends beyond mere price, highlighting quality, reliability, and service.

Threat of Backward Integration by Customers

Large foodservice operators and restaurant chains possess the potential to engage in backward integration, which involves roasting their own coffee or establishing direct sourcing relationships. This capability, while demanding substantial capital for roasting equipment and specialized knowledge, grants these significant customers considerable bargaining power. For example, a major national coffee chain might evaluate the economics of bringing roasting in-house to control costs and quality.

Farmer Brothers counters this threat by focusing on delivering value through cost-effectiveness, consistent high quality, and convenient supply chain solutions. By optimizing their own operations and leveraging economies of scale, Farmer Brothers can offer competitive pricing and reliable product availability that makes backward integration less attractive for their larger clients. Their ability to manage complex sourcing and roasting processes efficiently is a key differentiator.

- Potential for Backward Integration: Large foodservice clients can explore roasting their own coffee or direct sourcing, a move that could increase their leverage.

- Investment Threshold: Significant capital investment in roasting facilities and expertise is required for customers to effectively integrate backward.

- Farmer Brothers' Counter-Strategy: Offering competitive pricing, superior quality, and streamlined logistics helps mitigate the threat of customer integration.

The bargaining power of Farmer Brothers' customers is considerable, particularly among large institutional buyers who can leverage their volume for better pricing. In 2024, the ease of online price comparison further empowers these clients, making them highly sensitive to cost. While smaller clients have less individual sway, the collective purchasing power of numerous smaller accounts can still influence market dynamics.

To mitigate this, Farmer Brothers emphasizes product differentiation and value-added services, such as equipment and maintenance, to increase customer switching costs. The potential for large clients to engage in backward integration, like roasting their own coffee, presents another avenue for increased leverage, though significant investment is required.

| Factor | Impact on Farmer Brothers | Mitigation Strategies |

|---|---|---|

| Volume Purchasing Power | High leverage for large clients, leading to price pressure. | Focus on value-added services, brand loyalty. |

| Information Availability (2024) | Increased price transparency, easier competitor benchmarking. | Competitive pricing, clear value proposition. |

| Switching Costs | Can be high if Farmer Brothers offers bundled solutions (equipment, service). | Integrate offerings, build strong client relationships. |

| Backward Integration Potential | Threat from large clients bringing processes in-house. | Cost-effectiveness, consistent quality, supply chain efficiency. |

Full Version Awaits

Farmer Brothers Porter's Five Forces Analysis

This preview displays the complete Farmer Brothers Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the coffee industry. The document you see here is precisely what you will receive instantly after purchase, ensuring no hidden content or alterations. You are looking at the actual, professionally formatted analysis, ready for immediate download and application to your strategic planning.

Rivalry Among Competitors

The coffee roasting and distribution landscape is notably fragmented, featuring a multitude of competitors at local, regional, and national levels. This includes established giants and a growing number of specialized, smaller roasters, creating a diverse competitive environment.

This sheer volume and variety of players, from large consumer packaged goods companies to artisanal coffee makers, significantly escalates rivalry. Companies actively compete for market share, targeting different customer segments with tailored offerings.

Farmer Brothers, in particular, encounters competition from a broad spectrum of entities. For instance, in 2024, the U.S. specialty coffee market alone was valued at over $45 billion, highlighting the immense scale and the numerous participants vying for consumer attention and loyalty within this dynamic sector.

The coffee industry, especially within the foodservice sector, is experiencing a moderate growth rate. This can heat up competition as existing companies vie for a bigger slice of a market that isn't expanding rapidly into entirely new areas. In 2024, the global coffee market was valued at approximately $136.7 billion, with projections indicating continued, albeit measured, expansion.

When growth slows, businesses often resort to more aggressive tactics like price wars and intensified marketing campaigns to capture market share. This dynamic directly fuels competitive rivalry among established players in the coffee market.

To counter this, companies are focusing on innovation. Developing unique product blends, offering premium or specialty coffee options, and enhancing customer service are key strategies to drive growth within specific, often niche, segments of the market.

Farmer Brothers aims to stand out in the coffee market, which can often feel like a commodity space. They focus on creating unique coffee blends, emphasizing sustainable sourcing practices, and building a strong brand reputation. Additionally, offering integrated service solutions, like equipment maintenance and training, further differentiates them from competitors.

While differentiation is key, achieving and maintaining it remains a constant battle in a crowded market. The company's success hinges on its ability to cultivate strong brand loyalty, particularly with specific customer segments like restaurant chains. This loyalty can soften the intensity of rivalry, as these established relationships are harder for competitors to disrupt.

The challenge lies in consistently meeting diverse customer needs with tailored solutions. For instance, in 2024, the foodservice industry continued to demand customized coffee programs that cater to varying tastes and operational requirements, pushing companies like Farmer Brothers to innovate in their product development and service delivery.

Exit Barriers for Competitors

Farmer Brothers faces significant competitive rivalry due to high exit barriers. Specialized assets like extensive roasting facilities and dedicated distribution networks represent substantial sunk costs. These assets are not easily repurposed, trapping companies in the coffee market even when facing losses. For instance, the capital-intensive nature of food and beverage production often means that selling off specialized equipment at a reasonable price is difficult.

These high exit barriers mean that even struggling competitors are compelled to remain active, intensifying the fight for market share. This can manifest as aggressive pricing strategies or a persistent oversupply of coffee, both of which erode profitability across the industry. The financial burden of ceasing operations or finding alternative uses for these specialized assets can be prohibitive for many players.

Consider these factors contributing to intense rivalry:

- Specialized Assets: Farmer Brothers' significant investment in roasting plants and a national distribution system creates high switching costs for competitors looking to exit.

- Long-Term Contracts: Commitments with suppliers or major clients can further bind companies to the industry, even in unfavorable economic conditions.

- Brand Loyalty and Switching Costs: While not an exit barrier in itself, established brand recognition and the effort required for customers to switch suppliers can make it harder for new entrants and keep existing, less efficient players in the game.

- Industry Overcapacity: High fixed costs associated with production facilities can lead to a drive to maintain high utilization rates, even if market demand is weak, thus fueling price competition.

Cost Structure and Capacity Utilization

The coffee industry, particularly for roasters like Farmer Brothers, is characterized by substantial fixed costs. These include investments in roasting machinery, extensive warehousing facilities, and a complex distribution network. These high initial outlays create a significant barrier to entry and also pressure existing players to maximize their operational efficiency.

To offset these high fixed costs and achieve economies of scale, companies often strive for high capacity utilization. This can lead to aggressive pricing and sales tactics as firms compete to secure market share and keep their expensive assets running at optimal levels. For instance, in 2024, many coffee distributors reported increased promotional activities aimed at boosting volume sales.

- High Fixed Costs: Roasting equipment, warehousing, and distribution represent significant capital investments.

- Capacity Utilization Drive: Companies aim to maximize output from these fixed assets to reduce per-unit costs.

- Intensified Rivalry: The pursuit of scale can lead to price wars and aggressive sales efforts among competitors.

- Farmer Brothers' Efficiency: Effective management of operational costs is crucial for Farmer Brothers' competitive standing and profitability.

Competitive rivalry within the coffee sector is intense, driven by a fragmented market with numerous players, from large corporations to niche roasters. This dynamic is amplified by a moderate but steady growth rate in the global coffee market, which was valued at approximately $136.7 billion in 2024, encouraging companies to fight aggressively for market share.

Farmer Brothers faces this rivalry head-on, competing in a market where differentiation is challenging but crucial, with strategies like unique blends and sustainable sourcing as key differentiators. The U.S. specialty coffee market alone, valued at over $45 billion in 2024, illustrates the crowded landscape where customer loyalty is paramount.

High exit barriers, such as specialized roasting and distribution assets, trap companies in the market, perpetuating rivalry even during downturns. This forces companies to focus on efficiency and innovation to maintain their position.

Farmer Brothers must navigate this competitive terrain by leveraging its brand, service offerings, and operational efficiency to secure its market standing.

| Market Factor | Description | Impact on Rivalry |

|---|---|---|

| Market Fragmentation | Numerous local, regional, and national competitors. | Increases direct competition for customers. |

| Market Growth Rate | Moderate global growth (e.g., $136.7 billion market in 2024). | Drives aggressive tactics to capture share from a limited expansion. |

| Differentiation Efforts | Focus on unique blends, sustainability, and service. | Attempts to reduce price-based competition and build loyalty. |

| Exit Barriers | High fixed costs in specialized assets (roasting, distribution). | Keeps less profitable firms in the market, intensifying competition. |

SSubstitutes Threaten

The threat of substitutes for Farmer Brothers' coffee is quite high. Consumers have a vast array of alternative beverages readily available, including tea, juices, soft drinks, energy drinks, and even plain water. This wide selection means customers can easily switch their consumption habits based on factors like taste preference, emerging health trends, or simply price point. For instance, the global market for bottled water alone was valued at over $300 billion in 2023, demonstrating the sheer scale of competition from non-coffee options.

The threat of substitutes for Farmer Brothers' coffee products is significant, especially when alternatives offer comparable benefits like caffeine, refreshment, or a social experience at a more attractive price point or with perceived superior performance. For instance, energy drinks can provide a faster caffeine hit, while bottled water might be positioned as a healthier choice, both potentially diverting consumers from traditional coffee. In 2024, the global energy drink market was valued at over $80 billion, highlighting the substantial consumer adoption of these alternatives.

Buyer willingness to substitute for Farmer Brothers' coffee is influenced by evolving consumer habits and preferences. While many consumers exhibit loyalty to coffee, a growing emphasis on health and wellness, or a simple desire for beverage variety, can make them more open to alternatives. For instance, the increasing popularity of specialty teas and energy drinks, which saw significant market growth in 2024, presents a direct challenge.

Marketing efforts by producers of substitute beverages also play a key role in shifting consumer perceptions and encouraging trial. Farmer Brothers needs to closely monitor these trends, understanding that a significant portion of the market might be swayed by compelling campaigns for plant-based beverages or functional drinks, impacting overall coffee demand.

In-House Solutions or DIY Alternatives

For certain customer segments, particularly smaller businesses or individual consumers, the threat of substitutes in the form of in-house brewing or simpler beverage alternatives is present. These DIY options, such as brewing coffee at home or opting for instant coffee, can bypass the need for a full-service roaster and distributor. While this may not significantly impact Farmer Brothers' large institutional sales, it represents a portion of potential demand that can be met without their services.

The appeal of these do-it-yourself solutions lies in their inherent convenience and cost-effectiveness. For instance, the average cost of a cup of coffee brewed at home can be as low as $0.25-$0.50, compared to the higher price point of professionally prepared beverages. This cost differential can be a significant factor for budget-conscious consumers and smaller businesses looking to manage expenses.

- Home Brewing: Offers significant cost savings per cup compared to purchasing from cafes or distributors.

- Instant Coffee: Provides extreme convenience and a lower price point, appealing to those prioritizing speed and affordability.

- Simpler Beverage Options: Businesses may opt for tea or other readily available drinks as a substitute for a full coffee service.

- DIY Culture: A growing trend in consumers seeking to control ingredients and preparation methods, including their coffee.

Technological Advancements in Beverage Preparation

Technological advancements are significantly increasing the threat of substitutes for traditional coffee providers like Farmer Brothers. Innovations such as sophisticated home brewing systems, personalized coffee subscription services, and advanced beverage dispensing technologies are making it easier for consumers to craft high-quality coffee at home. For instance, the market for home coffee makers, including espresso machines and cold brew makers, has seen robust growth, with some analysts projecting continued expansion through 2028.

While Farmer Brothers provides coffee and related equipment, the growing accessibility of these at-home solutions directly challenges their business model. Customers can now achieve a café-like experience without relying on traditional coffee shops or bulk suppliers. This trend empowers consumers to seek out unique flavor profiles and preparation methods, thereby increasing the substitution threat from non-traditional beverage sources.

To counter this, Farmer Brothers must emphasize superior convenience, a wider variety of high-quality beans, and exceptional customer service. The company's ability to differentiate itself through these factors will be crucial in retaining its customer base against the rising tide of accessible, personalized beverage alternatives.

- Home Brewing System Market Growth: The global home coffee maker market is expanding, with projections indicating continued strong performance.

- Subscription Service Popularity: Direct-to-consumer coffee subscriptions have gained traction, offering convenience and customization.

- Technological Accessibility: New technologies are lowering the barrier to entry for creating premium coffee beverages at home.

- Farmer Brothers' Competitive Imperative: Differentiation through convenience, variety, and service is key to mitigating substitution threats.

The threat of substitutes for Farmer Brothers' coffee is significant due to the wide availability of alternative beverages like tea, juices, and energy drinks. Consumers can easily switch based on price, health trends, or taste preferences, with the global energy drink market alone exceeding $80 billion in 2024.

DIY coffee solutions, including home brewing and instant coffee, also pose a threat, offering cost savings and convenience. For example, home-brewed coffee can cost as little as $0.25 per cup, a stark contrast to professionally prepared options.

Technological advancements in home brewing systems and subscription services further empower consumers to create quality coffee at home, directly challenging traditional suppliers. This trend necessitates Farmer Brothers to focus on differentiation through convenience, variety, and superior customer service.

| Substitute Category | Key Differentiators | Market Data (2024 Estimates) | Impact on Farmer Brothers |

| Alternative Beverages (Tea, Juice, Soda) | Health trends, variety, price | Bottled Water: >$300 Billion (2023) | Diversion of consumer spending |

| Energy Drinks | Caffeine boost, perceived performance | Global Market: >$80 Billion | Direct competition for morning/afternoon consumption |

| Home Brewing / Instant Coffee | Cost savings, convenience, control | Home Brewing Cost: $0.25-$0.50/cup | Reduced demand for bulk/service coffee |

| Advanced Home Systems/Subscriptions | Customization, quality, convenience | Growing market for home coffee makers | Erosion of café-style demand |

Entrants Threaten

Entering the coffee roasting and national distribution market, where Farmer Brothers operates, demands significant upfront capital. This includes substantial investments in state-of-the-art roasting facilities, extensive warehousing infrastructure, and the development of a comprehensive, nationwide distribution network. For instance, establishing a large-scale roasting operation can easily run into millions of dollars, not to mention the ongoing costs associated with logistics and fleet management.

These high capital requirements serve as a formidable barrier to entry for many aspiring competitors. They effectively limit the pool of companies that can realistically challenge established players like Farmer Brothers on a national scale. While smaller, specialized roasters might find ways to enter niche markets, the sheer financial commitment needed for widespread distribution and large-volume roasting deters significant new competition at the industry's upper echelons.

Established players like Farmer Brothers leverage significant economies of scale in sourcing green coffee, processing, and nationwide distribution. This scale allows them to negotiate better prices for raw materials and spread fixed costs over a larger volume, resulting in lower per-unit costs. For instance, in 2023, the global coffee market was valued at over $126 billion, with major players benefiting from optimized supply chains.

New entrants would struggle to match these cost efficiencies initially. They would likely face higher per-unit production and distribution expenses, making it challenging to compete on price with established brands unless they focus on a premium, niche market segment with higher profit margins. The learning curve in optimizing roasting profiles and developing proprietary blends also presents a barrier, as years of experience contribute to quality and efficiency.

Farmer Brothers' established national distribution network for foodservice operators and institutional buyers presents a significant barrier to new entrants. Building such a complex and costly infrastructure requires substantial upfront investment and time, making it difficult for newcomers to compete effectively.

Existing relationships with key distributors and a proven logistics infrastructure offer Farmer Brothers a competitive edge. New companies would face considerable challenges in efficiently reaching the diverse customer base that Farmer Brothers currently serves without significant capital outlay or strategic alliances.

Furthermore, Farmer Brothers benefits from existing contracts and preferred supplier status with many of its clients, which further complicates market entry for potential competitors. These established ties create a loyalty that new entrants would find hard to overcome.

Brand Loyalty and Product Differentiation

Farmer Brothers, a company with a significant history, has cultivated strong brand loyalty among its existing customer base. New competitors entering the coffee and foodservice industry face a substantial hurdle in overcoming these deeply ingrained customer preferences. Significant investment in marketing and product differentiation is therefore crucial for any new entrant aiming to capture market share.

The cost and time required to build comparable brand recognition and trust present a considerable barrier. For instance, in the competitive coffee market, brands often spend millions on advertising campaigns to establish their identity. Farmer Brothers' established relationships mean new entrants must offer a compelling and unique value proposition to even begin chipping away at incumbent loyalty.

- Established Brand Recognition: Farmer Brothers benefits from decades of operation, fostering trust and familiarity with its customer base.

- Customer Loyalty: Long-term relationships with clients, particularly in the foodservice sector, create a sticky customer base.

- High Marketing Investment: New entrants must commit substantial resources to marketing and advertising to build brand awareness and overcome existing loyalty.

- Product Differentiation Necessity: Unique product offerings or service models are essential for new players to attract customers away from established brands.

Regulatory Hurdles and Quality Standards

The food and beverage sector, including coffee roasting, faces stringent health, safety, and quality regulations. New companies must meticulously navigate these complex requirements, secure necessary certifications, and maintain ongoing compliance. For instance, the U.S. Food and Drug Administration (FDA) oversees food safety, and in 2024, continued focus on supply chain transparency and allergen labeling adds layers of complexity for new entrants.

Meeting specific quality standards for coffee beans, roasting profiles, and finished products demands significant expertise and investment in robust quality control systems. This includes sourcing high-grade beans, implementing precise roasting techniques, and ensuring consistent product quality, which can be a substantial barrier for those without established operational capabilities.

- Regulatory Compliance Costs: New entrants face costs associated with meeting FDA regulations, state-specific food safety laws, and international import/export requirements, which can run into tens of thousands of dollars annually for smaller operations.

- Quality Control Infrastructure: Establishing laboratory testing, sensory evaluation panels, and traceability systems for coffee sourcing adds significant capital and operational expenditure.

- Certification Requirements: Obtaining certifications like USDA Organic or Fair Trade, while beneficial for market positioning, requires adherence to strict standards and audit processes, further increasing the time and cost to market.

The threat of new entrants in the coffee roasting and distribution market, where Farmer Brothers operates, is generally low due to substantial barriers. High capital requirements for roasting facilities and nationwide distribution networks, estimated in the millions of dollars, deter many potential competitors. Furthermore, established players like Farmer Brothers benefit from significant economies of scale, which translate into lower per-unit costs that newcomers would struggle to match.

Porter's Five Forces Analysis Data Sources

Our Farmer Brothers Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available SEC filings. This blend ensures a comprehensive understanding of competitive dynamics.