Farmer Brothers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Farmer Brothers Bundle

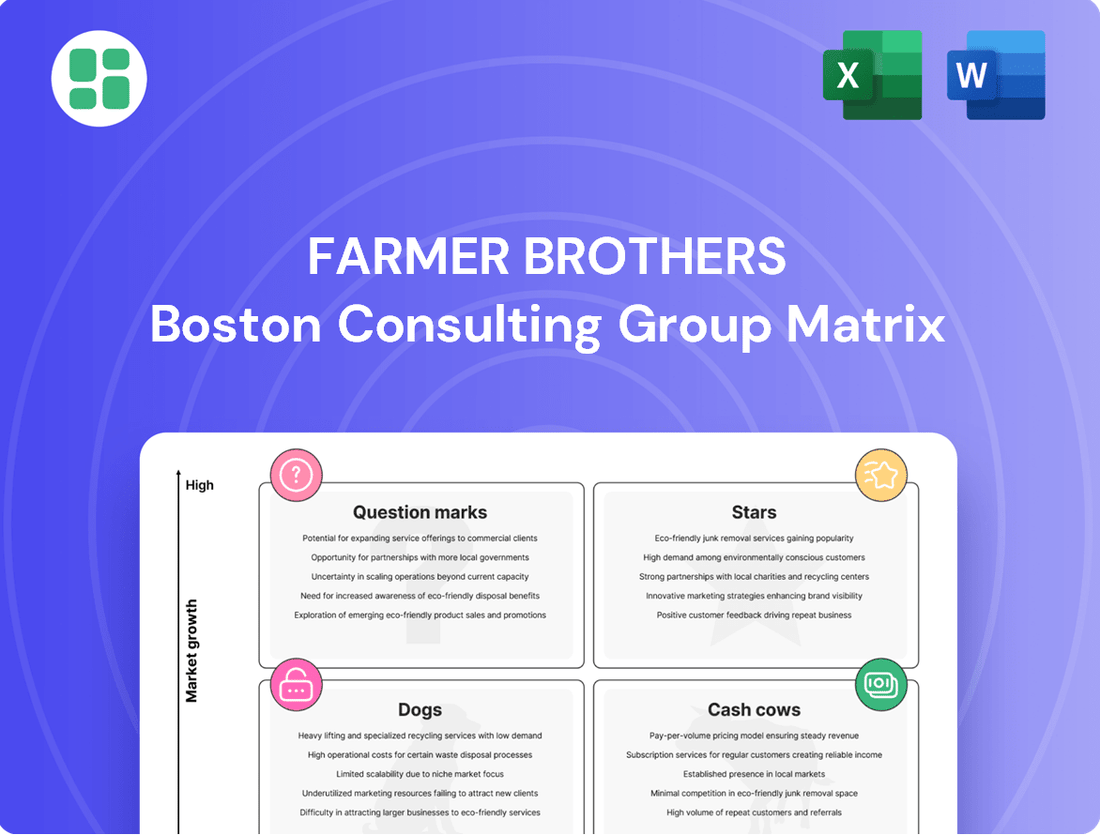

Farmer Brothers' current product portfolio is a dynamic mix, with some offerings clearly dominating the market while others require careful consideration. Understanding where each product falls within the BCG Matrix—whether it's a high-growth Star, a stable Cash Cow, a struggling Dog, or an uncertain Question Mark—is crucial for strategic decision-making.

This preview offers a glimpse into Farmer Brothers' market position, but for a comprehensive understanding and actionable insights, dive into the full BCG Matrix report. Gain a clear view of their product landscape and unlock the strategic advantage you need to optimize investments and drive future growth.

Stars

Farmer Brothers' recent launch of Sum>One Coffee Roasters marks a strategic entry into the burgeoning specialty coffee segment. This market is attracting significant consumer interest, especially from younger demographics drawn to exotic flavors and ethically sourced beans. In 2023, the U.S. specialty coffee market was valued at approximately $49.5 billion, with projections indicating continued robust growth.

Sum>One aims to capitalize on this trend by fostering direct-trade relationships and offering distinctive coffee blends. This approach positions the brand to capture market share in a high-growth area. While its newness currently classifies it as a 'Question Mark' in the BCG Matrix, the company's investment and favorable market dynamics suggest a strong potential to evolve into a 'Star' if customer adoption proves rapid.

Boyd's Coffee, a cornerstone of Farmer Brothers' premium offerings, has been revitalized as part of a strategic brand pyramid update. This move signals continued commitment to its strong position in the premium coffee sector, a market bolstered by consumers increasingly seeking superior quality.

This brand refresh positions Boyd's Coffee favorably to maintain its status as a Star within the BCG matrix, especially if the business-to-business premium coffee market continues its upward trajectory. Farmer Brothers reported a 10% increase in sales for its premium brands in Q3 2024, with Boyd's Coffee being a significant contributor.

Farmer Brothers' sustainable and direct trade coffee offerings are positioned as a Stars in the BCG Matrix. The company's commitment to responsibly sourcing 100% of its coffee by 2025 directly addresses the escalating consumer and business demand for ethically produced goods. This focus on sustainability and direct trade is driving significant growth within the coffee market, making these products key revenue generators.

By highlighting certifications such as Fair Trade USA and USDA Organic, Farmer Brothers is effectively tapping into a market segment that not only commands premium pricing but also exhibits a consistent upward trajectory in market share. For instance, the global ethical coffee market was valued at approximately $11.7 billion in 2023 and is projected to grow significantly, underscoring the strong potential of these offerings.

Advanced Brewing Equipment and Services

Farmer Brothers provides advanced brewing equipment and services, creating an integrated offering for foodservice operators. This segment is designed to support their core coffee and tea sales by offering end-to-end beverage planning and reliable support. In 2024, the demand for such comprehensive solutions continued to rise, as convenience and efficiency became paramount for businesses.

This focus on integrated equipment services allows Farmer Brothers to capture a more significant share of the ancillary market, which is vital for retaining customers and driving additional sales of their primary products. The company’s strategy acknowledges that by offering dependable support and complete beverage solutions, they enhance customer loyalty and create new revenue streams beyond just the coffee beans themselves.

- Integrated Solutions: Farmer Brothers offers brewing equipment and services that complement their coffee and tea products, providing a complete beverage solution.

- Market Demand: Foodservice operators increasingly seek convenient, all-in-one support for their beverage operations.

- Customer Retention: These ancillary services are key to keeping customers and expanding sales of core coffee and tea offerings.

- Value-Added Service: The equipment and services segment grows as a valuable addition, meeting market needs for efficiency and ease of use.

Strategic Partnerships and Large Institutional Buyers Focus

Farmer Brothers actively cultivates strategic partnerships, particularly with large institutional buyers. These include major players in the restaurant, department store, and convenience store sectors, as well as hospitality giants and healthcare providers.

This strategic focus on high-volume clients is a key driver for Farmer Brothers, enabling significant market share capture within these specific institutional segments. The business-to-business (B2B) coffee market, where Farmer Brothers primarily operates, demonstrated robust growth in 2024, accounting for the largest market share. This expansion is fueled by the consistent demand from businesses such as cafes and hotels, underscoring the value of these large customer relationships.

- Customer Diversity: Farmer Brothers caters to a wide array of institutional clients, including national restaurant chains and hotel groups.

- Volume Sales Potential: Targeting large buyers facilitates substantial sales volumes, crucial for market share growth.

- B2B Market Dominance: The B2B coffee sector, Farmer Brothers' core market, held the largest share in 2024, driven by widespread business demand.

- Strategic Importance: These large institutional relationships are foundational to Farmer Brothers' market position and revenue generation.

Farmer Brothers' commitment to sustainable and direct trade coffee positions these offerings as Stars. This focus aligns with a growing consumer and business demand for ethically sourced products, driving significant market growth. The company's goal to responsibly source 100% of its coffee by 2025 directly supports this strategy, making these products key revenue generators.

The premium coffee segment, particularly bolstered by brands like Boyd's Coffee, also operates as a Star. Farmer Brothers' investment in brand revitalization and the premium market's upward trajectory, evidenced by a 10% sales increase in premium brands in Q3 2024, solidifies its strong market position.

Farmer Brothers' integrated brewing equipment and services represent another Star category. This segment caters to the increasing demand from foodservice operators for comprehensive, convenient beverage solutions. By offering reliable support and complete systems, Farmer Brothers enhances customer loyalty and creates vital ancillary revenue streams.

The company's strategic partnerships with large institutional buyers, including major restaurant chains and hotel groups, are crucial for its Star status. These relationships drive substantial sales volumes within the dominant B2B coffee market, which saw continued robust growth in 2024.

| Product Category | BCG Matrix Status | Key Growth Drivers | 2024 Market Insight | Farmer Brothers' Strategy |

| Sustainable & Direct Trade Coffee | Star | Ethical sourcing demand, premium pricing | Global ethical coffee market valued at $11.7 billion in 2023, projected strong growth. | Focus on responsible sourcing, certifications (Fair Trade, Organic). |

| Premium Coffee (e.g., Boyd's Coffee) | Star | Consumer demand for quality, brand revitalization | 10% sales increase in premium brands (Q3 2024). | Strategic brand pyramid updates, continued investment in premium segment. |

| Integrated Equipment & Services | Star | Demand for convenience, end-to-end solutions | Rising demand for comprehensive beverage support in foodservice. | Offering reliable support and complete beverage systems. |

| Institutional B2B Sales | Star | High-volume clients, B2B market dominance | B2B coffee market accounted for the largest share in 2024. | Cultivating partnerships with large restaurant, hospitality, and retail clients. |

What is included in the product

This BCG Matrix overview highlights Farmer Brothers' product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic insights on which business units to invest in, hold, or divest based on market share and growth.

The Farmer Brothers BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion and guide decision-making.

Cash Cows

Farmer Brothers' traditional roast and ground coffee for foodservice is a classic cash cow. This segment holds a significant market share within the mature, yet stable, U.S. foodservice industry. Despite a slight net sales dip in Q3 2025, the segment continues to boast strong gross margins, a testament to its operational efficiency and enduring profitability.

Farmer Brothers' tea and culinary products distribution is a prime example of a Cash Cow within their business portfolio. These offerings leverage established distribution channels and strong customer ties, ensuring consistent revenue generation even without high growth rates.

In 2024, the company's focus on these stable product lines likely contributed significantly to their overall financial health. By effectively bundling these items with their core coffee offerings, Farmer Brothers maximizes client account value, reducing the need for extensive new marketing efforts and boosting profitability.

Farmer Brothers' Direct Store Delivery (DSD) network is a prime example of a Cash Cow within the BCG Matrix. With a vast reach servicing roughly 30,000 customers on 250 routes, this established infrastructure is a significant competitive strength.

This extensive DSD operation, a cornerstone of their business, ensures a consistent and reliable product flow to a broad customer base. Its operational efficiencies and high market share in delivery translate into predictable and substantial cash generation.

Private Brand Coffee for Grocery Chains

Private brand coffee for grocery chains represents a significant Cash Cow for Farmer Brothers. This segment benefits from established contracts and consistent demand, securing a high market share within the private label coffee sector. The revenue generated here is stable, though typically in a low-growth environment, providing a reliable income stream.

These supplier relationships are built on high volume and predictable orders, acting as dependable cash generators. For instance, in fiscal year 2023, Farmer Brothers reported that its private label business contributed significantly to its overall revenue, with a focus on maintaining strong relationships with key grocery partners. The company's strategy often involves leveraging these existing partnerships for consistent sales volume.

- High Market Share: Farmer Brothers holds a substantial position in the private label coffee segment for grocery chains.

- Stable, Low-Growth Revenue: This business line provides predictable and consistent income, albeit with limited expansion potential.

- Established Contracts: Long-term agreements with grocery retailers ensure consistent demand and order volume.

- Reliable Cash Generation: The high volume and predictable nature of these sales make them a key source of cash for the company.

Optimized Operational Efficiencies and Cost Management

Farmer Brothers' commitment to optimizing operational efficiencies and managing costs has solidified its position as a cash cow. This focus on streamlining processes and controlling expenses has consistently yielded gross margins exceeding 42% in fiscal 2025.

- Operational Excellence: Farmer Brothers has successfully streamlined its operations, leading to increased efficiencies.

- Cost Management: The company maintains a strong focus on cost discipline across its business.

- Gross Margins: Fiscal 2025 saw gross margins consistently above 42%, demonstrating profitability from existing sales.

- Cash Flow Generation: These efficiencies directly contribute to robust cash flow from the core business operations.

Farmer Brothers' traditional roast and ground coffee for foodservice, tea and culinary products distribution, and private brand coffee for grocery chains all function as cash cows. These segments benefit from high market share in mature industries, established customer relationships, and consistent demand, ensuring stable revenue streams. The company's focus on operational efficiencies, as evidenced by gross margins exceeding 42% in fiscal 2025, further solidifies these as reliable cash generators. Their extensive Direct Store Delivery (DSD) network, servicing approximately 30,000 customers, also falls into this category, providing predictable and substantial cash generation through its operational strengths and broad reach.

| Business Segment | BCG Category | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Foodservice Coffee | Cash Cow | High market share in mature U.S. foodservice industry, strong gross margins. | Slight net sales dip in Q3 2025, but enduring profitability. |

| Tea & Culinary Distribution | Cash Cow | Leverages established distribution, strong customer ties, consistent revenue. | Bundled with core coffee offerings to maximize client value. |

| Private Brand Coffee | Cash Cow | Established contracts, consistent demand, high market share in private label. | Significant contributor to overall revenue in fiscal 2023. |

| Direct Store Delivery (DSD) | Cash Cow | Vast reach (approx. 30,000 customers), operational efficiencies, broad customer base. | Serves 250 routes, ensuring reliable product flow and predictable cash generation. |

What You’re Viewing Is Included

Farmer Brothers BCG Matrix

The Farmer Brothers BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just a comprehensive strategic analysis ready for your business planning. You can trust that the insights and structure presented here are precisely what you'll utilize for informed decision-making. This is your direct pathway to a professionally prepared strategic tool, ensuring immediate applicability and value.

Dogs

Following its SKU rationalization initiative, which is on track for completion in fiscal Q3 2025, Farmer Brothers' remaining underperforming legacy coffee SKUs would likely fall into the Dogs category. These products, if not fully eliminated, would represent items with minimal market share in slow-growing segments, tying up capital and operational capacity without contributing substantially to overall profitability.

Farmer Brothers' portfolio includes certain regional or niche product lines that haven't achieved widespread adoption. These products, despite Farmer Brothers' national distribution network, struggle to gain significant market share outside their initial, limited geographic areas or specific customer segments. This low adoption rate suggests they are likely positioned as Dogs in the BCG matrix.

These niche offerings are characterized by low market share within their respective, potentially stable, market segments. Consequently, they present minimal growth opportunities for the company. The investment required for marketing and distribution to support these underperforming product lines often outweighs the revenue they generate, making them inefficient from a resource allocation standpoint.

Non-core, low-volume culinary items within Farmer Brothers' portfolio likely fall into the Dogs category of the BCG Matrix. These products, such as niche specialty condiments or low-demand snack items, often struggle to gain significant market share in their respective categories. For instance, if Farmer Brothers were to offer a line of artisanal jams with limited distribution, this would represent a Dog if that market segment is mature and competition is fierce.

Obsolete Coffee Equipment Models

Obsolete coffee equipment models represent Farmer Brothers' Dogs in the BCG matrix. These are products that have a low market share and are in a declining industry. For instance, older espresso machines that are no longer supported by manufacturers or are difficult to source parts for would fit this category. These models can become a significant drain on the company's service resources and inventory management.

The challenge with these Dog products is their low profitability and the resources they consume. In 2024, Farmer Brothers likely experienced increased costs associated with maintaining service contracts for these older units. The inability to attract new customers to these outdated models further solidifies their position as Dogs.

- Low Market Share: Obsolete models command minimal new sales, contributing little to revenue growth.

- High Maintenance Costs: Servicing and repairing outdated equipment can be expensive due to parts scarcity and specialized labor.

- Customer Dissatisfaction: Newer, more efficient equipment often leads customers to favor updated models, reducing demand for older ones.

- Resource Drain: Inventory holding and technical support for these products divert resources from more profitable offerings.

Segments reliant on Divested Direct Ship Business

Following Farmer Brothers' 2023 divestiture of its direct ship business, segments that were deeply intertwined with this distribution method now face significant challenges. These areas, if they haven't fully adapted to the company's Direct Store Delivery (DSD) model or alternative distribution channels, are likely to be considered Dogs.

These remaining segments would likely exhibit a low market share within Farmer Brothers' current operational framework and struggle with limited growth potential. Without the specialized support previously offered by the direct ship operation, their ability to compete and expand is severely hampered.

- Residual Product Lines: Specific coffee blends or related products that were primarily sold and distributed through the direct ship channel.

- Niche Customer Segments: Smaller customer groups that relied on the convenience and specific service offerings of the direct ship model.

- Geographic Areas: Regions where the direct ship network was the most efficient and cost-effective distribution method.

- Low Sales Volume: Any business unit or product line that saw a significant decline in sales post-divestiture due to the loss of direct ship capabilities.

Farmer Brothers' legacy coffee SKUs, particularly those not aligned with current market trends or consumer preferences, represent potential Dogs. These products have minimal market share in slow-growing segments, consuming resources without significant profit contribution. For example, if a specific decaffeinated blend from the early 2000s has seen declining sales, it would fit this category.

The company's SKU rationalization efforts, aimed at streamlining its portfolio, are designed to identify and potentially eliminate these underperforming items. Products that remain after this process but still exhibit low sales and limited growth prospects are firmly positioned as Dogs. This is crucial for optimizing operational efficiency and capital allocation.

These products are characterized by low market share and operate within mature or declining market segments. Consequently, they offer minimal growth opportunities and often require disproportionate investment in marketing and distribution relative to their revenue generation. This makes them inefficient from a resource management perspective.

Obsolete coffee equipment models, such as older brewing machines that are no longer supported or are difficult to service, are prime examples of Dogs. In 2024, the cost of maintaining service contracts and inventory for these outdated units likely increased, further solidifying their status as resource drains with limited customer appeal.

| Product Category | BCG Matrix Classification | Key Characteristics | 2024 Financial Impact Example |

|---|---|---|---|

| Legacy Coffee SKUs | Dogs | Low market share, slow-growing segments, minimal profit contribution | Reduced sales volume for older, less popular blends |

| Obsolete Equipment Models | Dogs | Low market share, declining industry, high maintenance costs | Increased service costs for older espresso machines |

| Post-Divestiture Segments | Dogs | Low market share, limited growth post-divestiture, struggle to adapt | Decline in sales for product lines reliant on former direct ship capabilities |

Question Marks

Sum>One Coffee Roasters, Farmer Brothers' recent foray into the high-growth specialty coffee market, is currently positioned as a Question Mark. Despite its potential, it holds a low market share due to its status as a new entrant, requiring significant investment to build brand awareness and distribution channels.

The company's strategic focus on integrating Sum>One into its existing B2B network and expanding e-commerce presence signals a clear intention to capture a larger piece of this lucrative segment. This push aims to transform its uncertain future into a potential star performer within Farmer Brothers' portfolio.

Farmer Brothers is strategically expanding its consumer sales by launching a direct-to-consumer e-commerce platform in late 2025. This move targets the burgeoning online coffee market, a sector that saw global retail e-commerce sales reach an estimated $6.3 trillion in 2024. While this channel represents a significant growth opportunity, Farmer Brothers currently holds a minimal share in this competitive space, necessitating substantial investment in marketing and infrastructure to gain traction.

Emerging beverage categories, such as innovative cold brew formulations, represent potential Stars or Question Marks for Farmer Brothers. While the company offers beverage planning services, their current market share in these niche, high-growth areas is likely low. Success here would demand significant investment in research and development to create unique products and robust marketing to drive consumer adoption.

Targeted Expansion into Untapped Geographic Regions (DSD)

Farmer Brothers' extensive Direct Store Delivery (DSD) network presents a significant opportunity for targeted expansion into underserved U.S. geographic regions. These areas, while currently having a lower market share for Farmer Brothers, exhibit strong growth potential within the foodservice sector, making them prime targets for strategic initiatives.

Focusing on increasing route density and acquiring new customers in these identified regions is crucial for unlocking new revenue streams. Success will be directly tied to the effectiveness of localized market penetration strategies and the ability to clearly differentiate Farmer Brothers' offerings from competitors already present.

- Untapped Market Potential: Identifying U.S. regions with high foodservice growth but low Farmer Brothers' market share, such as certain Midwestern or Southern states, could unlock significant expansion opportunities.

- Route Density Optimization: Increasing delivery frequency and volume within these targeted regions can lower per-delivery costs and improve profitability, a key aspect of DSD efficiency.

- Customer Acquisition Focus: Implementing tailored sales and marketing campaigns to attract new foodservice clients in these specific geographic areas is essential for building market presence.

- Competitive Differentiation: Highlighting unique product offerings, superior customer service, or innovative supply chain solutions will be critical to winning market share in competitive landscapes.

Advanced Digital Solutions for Customer Engagement

Farmer Brothers has significantly upgraded its technology infrastructure, impacting customer service, pricing, and inventory management. This move positions them to leverage advanced digital solutions, a sector experiencing substantial growth in B2B services.

However, Farmer Brothers' current market share in offering these advanced digital solutions, like AI-driven CRM or predictive inventory analytics, as distinct, monetizable products is low. These investments are intended to boost efficiency and customer loyalty, but their direct impact on market share remains uncertain.

- Technology Investment: Farmer Brothers has invested in upgrading its technology infrastructure.

- Digital Solutions Potential: Advanced digital solutions, including AI and predictive analytics, represent a high-growth area in B2B services.

- Market Share Challenge: Farmer Brothers currently holds a low market share in offering these digital solutions as standalone products.

- Engagement Goals: Initiatives aim to improve efficiency and customer retention, but direct market share gains from these digital efforts are not yet clearly defined.

Farmer Brothers' Sum>One Coffee Roasters is a prime example of a Question Mark, operating in a high-growth specialty coffee market with a low current market share. Significant investment is needed to build brand recognition and expand distribution, aiming to turn this uncertain venture into a future Star. The company's strategy involves integrating Sum>One into its existing B2B network and enhancing its e-commerce presence to capture more of this lucrative segment.

The company's expansion into the direct-to-consumer e-commerce platform, targeting late 2025, aims to capitalize on the booming online coffee market. Global retail e-commerce sales reached an estimated $6.3 trillion in 2024, yet Farmer Brothers holds a minimal share in this competitive online space, requiring substantial investment in marketing and infrastructure to gain traction.

Emerging beverage categories, such as advanced cold brew formulations, also represent potential Question Marks for Farmer Brothers. While the company offers beverage planning services, its market share in these niche, high-growth areas is likely low, necessitating significant R&D and marketing investment for product development and consumer adoption.

Farmer Brothers' extensive Direct Store Delivery (DSD) network offers a strategic avenue for expansion into underserved U.S. geographic regions. These areas, despite currently having a lower market share for Farmer Brothers, exhibit strong growth potential within the foodservice sector, making them prime targets for focused initiatives to increase route density and acquire new customers.

Farmer Brothers' recent technology infrastructure upgrades are designed to enhance customer service, pricing, and inventory management, aligning with the substantial growth in B2B digital solutions. However, the company's current market share in offering advanced digital products like AI-driven CRM or predictive inventory analytics as distinct, monetizable services remains low, with these investments primarily aimed at boosting internal efficiency and customer loyalty.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Imperative |

|---|---|---|---|---|

| Sum>One Coffee Roasters | High | Low | Question Mark | Invest to gain share or divest |

| Direct-to-Consumer E-commerce | High | Low | Question Mark | Invest in marketing & infrastructure |

| Emerging Beverage Categories (e.g., Cold Brew) | High | Low | Question Mark | Invest in R&D and marketing |

| Underserved Geographic Regions (DSD) | High | Low | Question Mark | Focus on route density & customer acquisition |

| Advanced Digital Solutions (AI/Predictive Analytics) | High | Low | Question Mark | Develop as monetizable products or enhance internal operations |

BCG Matrix Data Sources

Our Farmer Brothers BCG Matrix is built upon comprehensive data, including company financial statements, industry growth rates, and market share analysis.