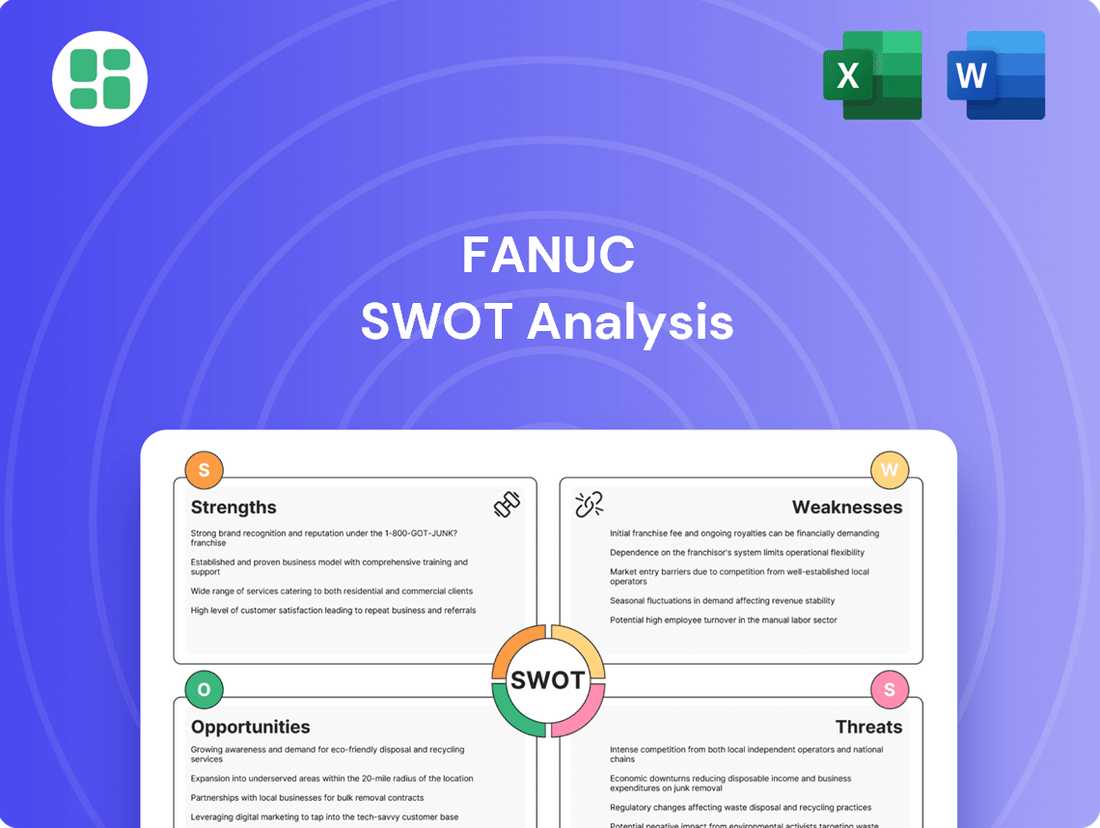

Fanuc SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanuc Bundle

Fanuc's dominance in industrial automation is clear, boasting strong brand recognition and a vast product portfolio. However, navigating the evolving landscape of AI and increasing competition presents unique challenges.

Want the full story behind Fanuc's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FANUC stands as a titan in factory automation, commanding substantial market shares in essential areas like CNC systems and industrial robots. Its technology forms the backbone of manufacturing across the globe, impacting sectors from automotive to electronics. This dominance is further solidified by its expansive global service network, boasting over 270 offices in more than 100 countries, which fosters deep customer loyalty and reliable support.

FANUC boasts an extensive selection of cutting-edge automation technologies, encompassing CNC systems, industrial robots, and specialized ROBOMACHINEs such as ROBODRILL, ROBOCUT, and ROBOSHOT. This comprehensive offering enables the company to deliver fully integrated solutions tailored to diverse manufacturing requirements, from intricate precision machining to complex assembly and welding operations.

The company's robust and balanced product mix, where robotics plays a significant role in revenue generation, highlights its diversified market strength. For instance, FANUC's industrial robot sales have consistently shown strong performance, contributing significantly to its overall financial results in recent years.

FANUC's dedication to technological advancement is a significant strength, evidenced by its substantial and consistent investment in research and development. This focus fuels continuous innovation, particularly in key areas like artificial intelligence, collaborative robots, and sophisticated motion control systems.

The company's product pipeline consistently showcases cutting-edge developments. For instance, recent showcases in 2024 and early 2025 highlighted advancements in AI-powered image processing, the creation of digital twins for simulation, and the introduction of more intuitive programming tools. These innovations are designed to boost operational efficiency and simplify user interaction within industrial automation environments.

This unwavering commitment to R&D ensures FANUC's offerings remain competitive and at the leading edge of the industrial automation landscape. For example, their 2024 fiscal year saw a notable increase in R&D spending, underscoring their strategy to maintain technological leadership.

Strong Financial Performance and Stability

FANUC exhibits remarkable financial strength, underscored by an impressive 33-year streak of consistent dividend payments. This long-standing commitment to shareholders highlights the company's stable and profitable operations.

The company's liquidity position is exceptionally robust, as indicated by a current ratio of 6.91. This signifies FANUC's ample ability to meet its short-term obligations.

For the full year 2025, FANUC reported a healthy 11% increase in net income, reaching a profit margin of 19%. Earnings per share (EPS) also surpassed market expectations, demonstrating strong profitability despite flat revenue.

These financial metrics collectively paint a picture of a financially secure and consistently performing enterprise.

- Consistent Dividend Payments: Over 33 consecutive years.

- Strong Liquidity: Current ratio of 6.91.

- 2025 Financial Highlights: 11% net income increase, 19% profit margin, EPS beat.

- Operational Stability: Profitable operations despite flat revenue.

Commitment to Sustainability and ESG

FANUC's dedication to sustainability is a significant strength, underscored by ambitious goals like achieving carbon neutrality by 2050 and a 10% reduction in electricity consumption by 2030. This commitment extends to product development, where FANUC prioritizes energy-efficient solutions to help its customers lower their environmental impact. The company is also actively involved in environmental preservation efforts, such as reducing freshwater usage and implementing a long-term tree restoration initiative.

FANUC's market leadership in CNC systems and industrial robots is a core strength, supported by a vast global service network that ensures customer satisfaction and loyalty. Its comprehensive product portfolio, including specialized ROBOMACHINEs, allows for integrated automation solutions across various manufacturing needs. The company's financial health is robust, marked by 33 years of consistent dividend payments and a strong current ratio of 6.91, indicating excellent short-term liquidity. For the fiscal year 2025, FANUC achieved an 11% increase in net income, a 19% profit margin, and exceeded EPS expectations, demonstrating sustained profitability even with flat revenue.

| Strength Category | Key Metric/Fact | Supporting Data/Example |

|---|---|---|

| Market Dominance | Market Share | Leading in CNC systems and industrial robots |

| Global Reach | Service Network | Over 270 offices in 100+ countries |

| Product Portfolio | Integrated Solutions | CNC, robots, ROBOMACHINEs (ROBODRILL, ROBOCUT, ROBOSHOT) |

| Financial Stability | Dividend History | 33 consecutive years of payments |

| Financial Health | Liquidity | Current ratio of 6.91 |

| Profitability (FY2025) | Net Income Growth | 11% increase |

| Profitability (FY2025) | Profit Margin | 19% |

What is included in the product

Delivers a strategic overview of Fanuc’s internal and external business factors, highlighting its technological prowess and market leadership while identifying potential challenges in evolving automation landscapes.

Offers a clear breakdown of Fanuc's competitive landscape, simplifying complex market dynamics for focused strategic action.

Weaknesses

FANUC's significant exposure to the automotive sector presents a notable weakness. In the first nine months of fiscal year 2025, the company saw a 16.4% decline in robot sales, directly linked to reduced demand within the automobile industry across major markets such as China, Europe, and the Americas.

This heavy reliance on a cyclical industry means FANUC's financial performance can be highly susceptible to downturns in automotive production and investment. Such dependence can lead to unpredictable revenue streams and impact overall profitability when the automotive market experiences a slowdown.

The industrial robot market is intensely competitive, with price wars especially prevalent among traditional robot manufacturers. This environment significantly squeezes profit margins for all players. FANUC, despite its strong market standing, faces this pressure as new entrants aggressively seek market share, potentially driving down average selling prices and impacting profitability.

FANUC's financial health is closely tied to global economic stability, making it vulnerable to downturns. Factors like product demand, competitive pressures, and the economic climate in key regions significantly impact its performance. The industrial automation market saw a slowdown in 2024, a trend expected to persist into 2025 as investment sentiment cools, highlighting the company's exposure to broader economic challenges.

Geographic Concentration Risk in Key Markets

FANUC's reliance on specific geographic markets presents a notable weakness. While China is a significant revenue contributor, making up 28.8% of sales in 2024, this concentration exposes the company to substantial risk. Any downturn in the Chinese economy or heightened geopolitical tensions could severely affect FANUC's financial performance.

This geographic concentration risk is further highlighted by recent trends. For instance, a slowdown in robot sales within China, a key market, directly impacts FANUC's overall revenue and profitability. This dependence means that external factors affecting a single region can have a disproportionate negative effect on the company.

- China's significant revenue share: 28.8% of FANUC's total revenue in 2024.

- Vulnerability to economic slowdowns: A decline in China's economic activity directly impacts sales.

- Geopolitical sensitivity: Tensions affecting China can disrupt FANUC's operations and market access.

- Impact on profitability: Reduced sales in key markets directly translate to lower overall profits.

Potential for Slower Growth in Established Segments

While the industrial automation sector continues its upward trajectory, some of Fanuc's more established robot segments might see a slowdown. For instance, certain traditional robot types experienced shipment declines ranging from 1% to 3% in 2024, indicating a maturing market for these products.

Although collaborative robots represent a significant growth avenue, this area is becoming increasingly competitive. This heightened competition has resulted in noticeable price reductions for collaborative robots, which could temper Fanuc's revenue growth from these newer, albeit promising, product lines.

- Slowing Demand in Mature Segments: Established robot categories may face reduced demand, with some types seeing 1-3% shipment decreases in 2024.

- Price Erosion in Collaborative Robots: Increased competition in the collaborative robot market is driving down prices, impacting potential revenue gains.

FANUC's substantial reliance on the automotive sector is a significant vulnerability, as evidenced by the 16.4% drop in robot sales during the first nine months of fiscal year 2025, directly linked to decreased automotive demand in key markets like China, Europe, and the Americas. This concentration makes FANUC's performance highly susceptible to automotive industry cycles and investment fluctuations, leading to potentially volatile revenue and profitability.

The intense competition within the industrial robot market, particularly price wars among established manufacturers, poses a threat to FANUC's profit margins. New entrants are aggressively vying for market share, which could further drive down average selling prices and impact the company's overall profitability despite its strong market position.

FANUC's financial performance is closely tied to global economic stability, with a slowdown in industrial automation investment observed in 2024 and projected into 2025 due to cooling investment sentiment. This economic sensitivity means that broader economic downturns can disproportionately affect the company's results.

| Market Segment | FY2024 Performance Indicator | Implication for FANUC |

|---|---|---|

| Automotive | Robot sales down 16.4% (first 9 months FY2025) | High dependence on cyclical auto industry creates revenue volatility. |

| Geographic Concentration (China) | 28.8% of revenue in 2024 | Economic downturns or geopolitical tensions in China pose significant risk. |

| Mature Robot Segments | Shipment declines of 1-3% for some traditional robot types in 2024 | Slowing demand in established product lines could limit growth. |

| Collaborative Robots | Increasing price competition | Heightened competition is reducing profit margins on promising new products. |

Full Version Awaits

Fanuc SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, in-depth report.

Opportunities

The global industrial automation market is experiencing robust expansion, with projections indicating it will reach USD 420.49 billion by 2033, expanding at a compound annual growth rate of 9.1% from 2025. This upward trend is fueled by industries worldwide seeking enhanced efficiency, greater precision, and improved productivity. Fanuc is well-positioned to capitalize on this demand, offering a comprehensive suite of robotics and automation solutions that cater to these evolving needs.

FANUC has a prime opportunity to tap into emerging markets, with India standing out as a key growth area. India's robot penetration is notably low, presenting a substantial runway for expansion. For instance, in 2023, India's industrial automation market was projected to reach USD 6.5 billion, with significant upside from sectors like automotive and electronics, where FANUC already has a strong presence.

Beyond its established automotive and electronics sectors, FANUC can strategically broaden its reach into diverse and rapidly expanding industries. Sectors such as food and beverage, healthcare, and logistics are increasingly adopting automation to boost efficiency and quality. FANUC's broad product range, from collaborative robots to high-precision CNC systems, is well-suited to meet the unique demands of these varied industries, driving new revenue streams.

The burgeoning field of artificial intelligence and collaborative robots, or cobots, offers significant avenues for FANUC's expansion. The global cobot market is projected to reach approximately $12.45 billion by 2027, indicating robust growth potential.

FANUC's investment in AI-powered robotics allows for smarter manufacturing processes, leading to reduced operational downtime and predictive maintenance capabilities. This technological integration is crucial for enhancing production efficiency and competitiveness in the evolving industrial landscape.

FANUC is actively demonstrating its AI-enabled solutions, positioning itself to capture a larger share of this expanding market. These advancements are key to driving further innovation and deepening market penetration for the company.

Industry 4.0 and Smart Factory Integration

The global Industry 4.0 market is projected to reach $370 billion by 2027, highlighting a significant opportunity for FANUC. This trend fuels demand for FANUC's advanced automation and robotics, crucial for smart factory development.

FANUC's integrated solutions, from CNC to AI-driven software, directly address the need for real-time monitoring and predictive maintenance in smart manufacturing environments.

- Smart Factory Growth: The increasing adoption of smart factory technologies presents a substantial market for FANUC's automation and robotics.

- Efficiency Gains: FANUC's offerings enable manufacturers to achieve greater operational efficiency through real-time data and optimized workflows.

- Predictive Maintenance: The demand for reduced downtime through predictive maintenance aligns perfectly with FANUC's advanced diagnostic and monitoring capabilities.

Increased Investment in Training and Workforce Development

The growing demand for digital and technical expertise in automation and robotics creates a significant opportunity for FANUC to solidify its market leadership through targeted educational programs. By investing in its workforce and providing advanced training, FANUC can directly address the skills gap prevalent in the industry.

FANUC America's commitment to the FANUC Academy, poised to be the largest corporate robotics and industrial automation training center in the United States, is a prime example of capitalizing on this opportunity. This initiative is designed to tackle labor shortages and cultivate a new cadre of skilled professionals, thereby deepening customer engagement and accelerating market penetration for its automation solutions.

- FANUC Academy Expansion: FANUC America is developing the largest corporate robotics and industrial automation training facility in the U.S.

- Addressing Skills Gap: The initiative aims to equip the workforce with essential digital and technical skills for the automation and robotics sector.

- Customer Relationship Enhancement: Investing in training fosters stronger customer partnerships and improves the adoption of FANUC's technologies.

- Market Adoption Driver: A skilled workforce is crucial for the successful implementation and utilization of advanced automation solutions.

FANUC can leverage the global industrial automation market's projected growth to USD 420.49 billion by 2033, with a 9.1% CAGR from 2025, to expand its offerings. The company is also poised to benefit from the increasing adoption of AI and collaborative robots, a market expected to reach approximately $12.45 billion by 2027. Furthermore, FANUC's commitment to training through initiatives like the FANUC Academy addresses the critical skills gap, fostering stronger customer relationships and driving market penetration.

Threats

The industrial robot market is becoming more fragmented, with the top 10 vendors, including FANUC, seeing their combined market share decrease in 2024. This trend suggests that smaller and newer companies are making significant progress, directly challenging established manufacturers.

This heightened competition could lead to more aggressive pricing and a tougher fight for market share. For instance, while FANUC remains a leader, the growing presence of companies like ABB, KUKA, and Yaskawa, alongside emerging players, intensifies the competitive landscape.

A global economic slowdown presents a significant threat to Fanuc, as companies are likely to reduce capital expenditures. This cooling investment climate directly impacts the industrial automation sector, where demand for robots and related technologies is closely tied to business expansion and modernization plans. Expecting a gradual recovery in 2025, the immediate future could still see subdued robot demand, particularly in the first half of the year, due to persistent high inventory levels and weak order intake across various industries.

Persistent supply chain disruptions remain a significant concern for industrial manufacturers. For instance, the disruptions seen in 2021 and 2022, which saw shipping costs skyrocket by over 500% for some routes, highlight the vulnerability of global logistics. These ongoing issues, coupled with rising global trade tensions, could directly impact FANUC's ability to source components and deliver finished products efficiently, potentially affecting production schedules and costs.

Geopolitical uncertainties, including the potential for new tariffs or trade restrictions, pose a direct threat to FANUC's international operations. In 2023, global trade growth slowed, with the WTO forecasting only a 0.8% increase in merchandise trade volumes. Such an environment could lead to reduced machinery orders from key international markets and negatively impact FANUC's global sales performance and revenue streams.

Technological Disruption and Rapid AI Evolution

The accelerating pace of AI development, particularly in areas like generative AI and humanoid robotics, presents a significant threat to FANUC. If the company struggles to integrate these rapidly advancing technologies, it risks falling behind competitors who are quicker to adapt. For instance, while FANUC is a leader in industrial robotics, the emergence of more versatile and intelligent AI-powered systems could challenge its market position if its own R&D doesn't keep pace.

This constant need for innovation demands substantial investment in research and development. FANUC's commitment to R&D is crucial, but the sheer speed of AI evolution means that even significant investments can be quickly outpaced by breakthroughs from agile competitors. This creates intense competitive pressure to not only develop new AI capabilities but also to anticipate and mitigate emerging risks associated with these powerful technologies.

- Rapid AI Advancement: The swift evolution of AI, including generative AI and humanoid robots, poses a threat if FANUC cannot match the pace of these advancements.

- R&D Investment Needs: Continuous innovation and adaptation to new AI capabilities and emerging risks necessitate substantial R&D investment, potentially straining resources.

- Competitive Pressures: The fast-moving technological landscape creates significant competitive pressures, requiring FANUC to constantly innovate to maintain its market leadership.

Fluctuations in Exchange Rates

FANUC's financial performance is sensitive to currency fluctuations, as evidenced by their regular adjustments to assumed exchange rates in financial reporting. For instance, a weakening of the US Dollar against the Japanese Yen could directly reduce the Yen-denominated value of FANUC's overseas earnings.

Significant adverse movements in exchange rates, especially when the Japanese Yen strengthens, pose a substantial threat. This could diminish the reported revenues and profitability derived from FANUC's global sales and operational activities. In 2023, FANUC reported that a 1 yen appreciation against the US dollar would have reduced operating profit by approximately 3.2 billion yen.

Consider these specific impacts:

- Reduced Yen Value of Foreign Earnings: A stronger Yen means that revenue earned in currencies like the US Dollar or Euro translates into fewer Yen, impacting the company's top and bottom lines.

- Increased Cost of Imported Components: While FANUC manufactures many components, it also relies on some imported parts, the cost of which can rise with a weaker Yen.

- Pricing Competitiveness: Unfavorable exchange rate movements can make FANUC's products more expensive for customers in certain markets, potentially affecting sales volume.

- Hedging Costs and Effectiveness: The company may incur costs to hedge against currency risks, and the effectiveness of these hedges can vary, leaving some exposure.

The industrial robot market is seeing increased fragmentation, with top vendors like FANUC experiencing a decline in their combined market share in 2024. This trend indicates that emerging companies are gaining ground, directly challenging established players and potentially leading to more aggressive pricing strategies.

A global economic slowdown poses a significant threat, as businesses are likely to curb capital expenditures, directly impacting demand for industrial automation. While a gradual recovery is anticipated for 2025, subdued robot demand may persist into early 2025 due to high inventory levels and weak order intake across various sectors.

Persistent supply chain disruptions and rising global trade tensions continue to be a major concern. These factors can hinder FANUC's ability to source components and deliver products efficiently, potentially affecting production schedules and increasing costs. For instance, shipping costs saw significant increases in prior years, highlighting the vulnerability of global logistics.

Geopolitical uncertainties, including potential tariffs and trade restrictions, directly threaten FANUC's international operations. Global trade growth slowed in 2023, with forecasts indicating limited expansion, which could reduce machinery orders from key markets and negatively impact FANUC's global sales performance.

The rapid advancement of AI, particularly in generative AI and humanoid robotics, presents a competitive challenge. If FANUC cannot effectively integrate these evolving technologies, it risks falling behind competitors who are quicker to adapt, potentially impacting its market leadership.

SWOT Analysis Data Sources

This Fanuc SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations to provide accurate and actionable strategic insights.