Fanuc Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanuc Bundle

Fanuc, a titan in industrial automation, faces intense competition, significant buyer power from large manufacturers, and a constant threat from emerging technologies. Understanding these forces is crucial for navigating its complex market landscape.

The complete report reveals the real forces shaping Fanuc’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FANUC, a leader in industrial automation, faces a significant bargaining power from its specialized component suppliers. For instance, the advanced sensors and precision motors crucial for FANUC's robots are often produced by a select few companies with unique technological expertise. This reliance means suppliers can dictate terms, impacting FANUC's production costs and ability to meet market demand, a common challenge in the high-tech manufacturing sector.

The industrial automation sector, including companies like FANUC, often features a concentrated supplier base for highly specialized components. This means there are frequently fewer alternatives available for critical parts, giving those suppliers significant leverage. For instance, if only a handful of manufacturers can produce a specific, high-performance sensor or advanced robotic arm joint that FANUC relies on, those suppliers hold considerable bargaining power. This concentration directly limits FANUC's ability to negotiate favorable pricing or easily switch to a different supplier if terms become unfavorable.

Switching suppliers for FANUC's highly integrated and specialized robotic components presents considerable challenges. These include substantial costs associated with redesigning existing systems, re-tooling manufacturing processes, and conducting rigorous testing to guarantee compatibility and maintain performance standards. This situation significantly limits FANUC's operational flexibility.

The high switching costs for FANUC effectively bolster the bargaining power of its current suppliers. The financial and time investment required to qualify and onboard new suppliers for critical components is often prohibitive, making it more advantageous for FANUC to continue with established relationships, even if pricing power shifts to the supplier.

Forward integration threat by suppliers

While not a frequent occurrence, there's a potential threat where highly influential suppliers of crucial technologies could explore forward integration, meaning they might start producing automation systems themselves. This scenario could compel FANUC to nurture strong supplier relationships and ensure competitive pricing for its components. For instance, a major sensor manufacturer with deep expertise in AI integration might consider developing its own robotic solutions.

However, the intricate nature of integrating complex automation systems presents a significant barrier for many component suppliers looking to make this leap. The technical expertise, capital investment, and established distribution networks required are substantial hurdles. In 2024, the global industrial automation market was valued at approximately $240 billion, demonstrating the scale of investment and complexity involved in entering this space.

- Forward Integration by Suppliers: While rare, powerful suppliers of key technologies could potentially enter FANUC's market by producing their own automation systems.

- Impact on FANUC: This threat necessitates FANUC maintaining robust supplier relationships and competitive pricing to mitigate the risk of suppliers becoming competitors.

- Barriers to Entry: The high complexity and capital requirements for system integration make it challenging for component suppliers to successfully pursue forward integration.

- Market Context: The substantial size of the industrial automation market, estimated at around $240 billion in 2024, highlights the significant barriers to entry for new players.

Uniqueness of supplier's input

Suppliers offering unique or patented technology significantly strengthen their bargaining position with FANUC. When FANUC relies on inputs that are difficult to replicate or source elsewhere, these suppliers gain considerable leverage.

For instance, if a supplier provides a critical component with unique intellectual property, FANUC’s ability to switch suppliers is diminished, increasing the supplier's power. This is particularly true for specialized software integrated into hardware or proprietary materials essential for FANUC's advanced robotics and automation systems.

- Proprietary Technology: Suppliers with patented or highly specialized technologies, crucial for FANUC's product performance, command greater negotiation power.

- Lack of Substitutes: When FANUC's production relies on inputs with no readily available alternatives, the supplier's leverage increases substantially.

- Critical Components: Inputs that are fundamental to FANUC's core offerings, whether specialized materials or embedded software, enhance supplier bargaining strength.

FANUC's bargaining power with its suppliers is constrained by the specialized nature of components and the limited number of viable alternatives. Suppliers of critical, high-performance parts, such as advanced sensors or precision motors, often hold significant leverage due to their unique technological capabilities. This concentration in the supply chain means FANUC faces fewer options, impacting its ability to negotiate favorable terms and potentially increasing production costs.

| Factor | Impact on FANUC | Example |

|---|---|---|

| Supplier Concentration | Limited negotiation power for FANUC | Few manufacturers produce FANUC's required high-performance sensors. |

| Switching Costs | Reinforces existing supplier power | Significant investment needed for redesign, re-tooling, and testing new components. |

| Proprietary Technology | Increases supplier leverage | Suppliers with unique intellectual property for critical components limit FANUC's alternatives. |

What is included in the product

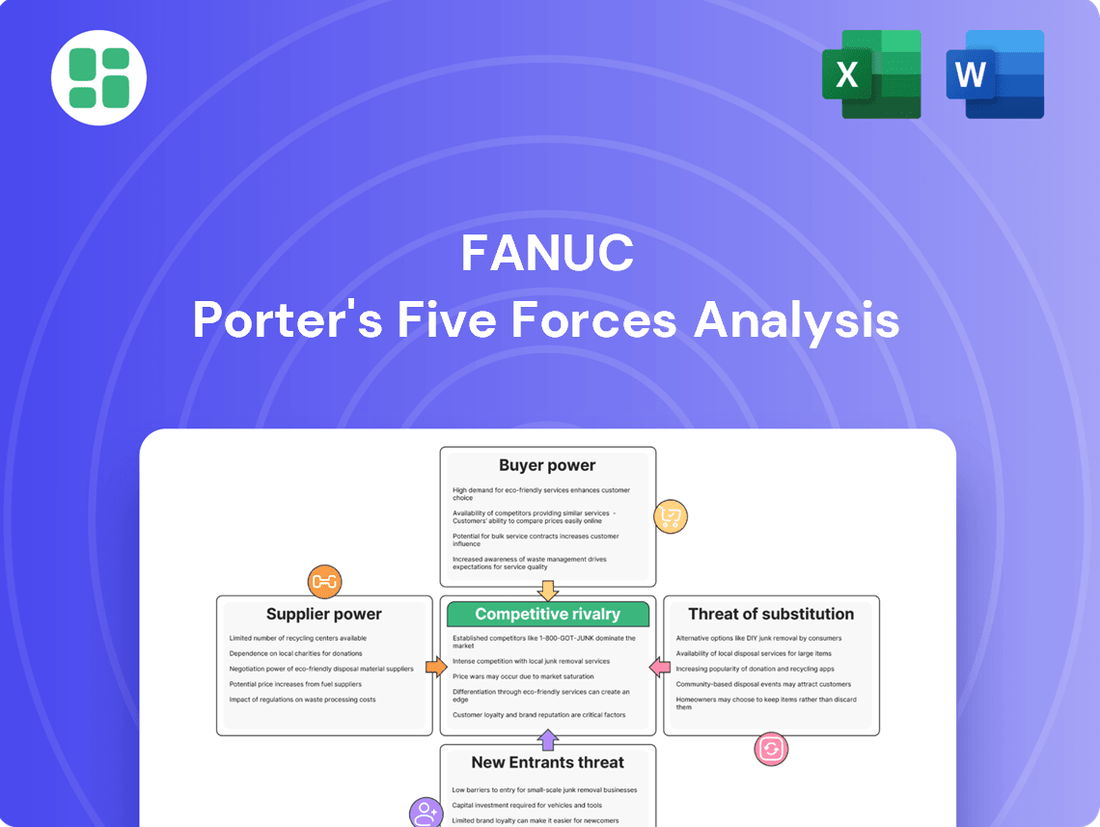

This analysis examines the five competitive forces shaping Fanuc's industry, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

FANUC's customer base is remarkably diverse, spanning critical sectors like automotive, electronics, aerospace, and general manufacturing. This broad industry reach significantly dilutes the bargaining power of any single customer segment, as FANUC is not overly reliant on any one market. For instance, in 2024, the automotive sector, while a major client, represented only a portion of FANUC's overall revenue, preventing it from exerting undue influence.

While this diversification is a strength, certain large, global manufacturing clients, particularly those with substantial order volumes, can still wield considerable individual leverage. These key accounts may negotiate for preferential pricing or customized solutions, impacting FANUC's margins. However, the sheer breadth of FANUC's client portfolio, which includes thousands of smaller and medium-sized enterprises, acts as a natural counterbalance to the power of these few major players.

Customers investing in FANUC's advanced CNC systems, industrial robots, and ROBOMACHINEs typically encounter significant switching costs. These costs can encompass substantial investments in retraining their workforce on new equipment, reconfiguring existing production lines to accommodate different machinery, and the complex process of integrating entirely new systems into their operational workflows. For instance, a major automotive manufacturer deeply embedded with FANUC robotics for its assembly lines would face millions in costs to switch to a competitor, including the expense of new programming, tooling, and potential downtime during the transition.

FANUC's robots and automation systems are fundamental to its customers' manufacturing operations. These technologies directly influence production speed, product quality, and the overall efficiency of factories. For instance, in 2024, the automotive sector, a major FANUC client, continued its push for advanced automation to meet production targets and maintain competitiveness, highlighting the critical nature of these investments.

Because FANUC's offerings are so integral to achieving core business objectives like increased productivity and a stronger competitive edge, customers view them as essential capital investments. This means they are less likely to treat them as optional purchases where price is the sole deciding factor. The emphasis remains on the performance and reliability that FANUC provides, which often outweighs minor price concessions.

Customer price sensitivity

Customer price sensitivity significantly influences Fanuc's bargaining power of customers. While businesses generally aim for operational efficiency, their willingness to pay for automation solutions like Fanuc's robots is tied to economic conditions and their own industry's competitive pressures. For instance, in sectors where manufacturing is highly commoditized, like basic assembly or packaging, customers are likely to be more sensitive to price. This increased sensitivity allows them to exert greater pressure on suppliers for lower costs.

However, this sensitivity isn't uniform across all of Fanuc's customer base. For more specialized or high-value applications, such as those in the automotive or aerospace industries, the emphasis shifts from just price to performance, reliability, and the total cost of ownership. In these scenarios, customers may be less deterred by a slightly higher upfront cost if the solution offers superior precision, speed, or integration capabilities that ultimately lead to greater long-term savings and competitive advantage.

- Price Sensitivity in Commoditized Markets: In 2024, industries like general manufacturing and consumer goods, which often deal with standardized production, are expected to see continued focus on cost optimization, potentially increasing price sensitivity for automation equipment.

- Value-Based Purchasing in High-Tech Sectors: Conversely, sectors such as semiconductor manufacturing or advanced medical device production, where precision and uptime are paramount, demonstrate lower price sensitivity, prioritizing technological superiority and reliability from suppliers like Fanuc.

- Impact of Economic Climate: Economic downturns can heighten price sensitivity across the board as companies tighten budgets, potentially impacting demand for capital equipment unless clear ROI is demonstrable.

Customer knowledge and information availability

Industrial clients are often highly informed, possessing deep knowledge of the technologies and products available from various suppliers. This awareness means they can readily compare FANUC's offerings with those of its competitors. In 2024, the increasing availability of online product specifications and independent reviews further empowers these sophisticated buyers, allowing them to conduct thorough due diligence before making purchasing decisions.

This readily accessible information significantly enhances the bargaining power of FANUC's customers. They can effectively leverage competitive pricing and feature comparisons during negotiations, often using quotes from rival companies to secure more favorable terms. For instance, a customer evaluating robotic automation solutions might gather data on the total cost of ownership, including maintenance and integration, from multiple vendors before engaging with FANUC.

- Informed Buyers: Industrial customers are sophisticated and well-researched.

- Information Access: The internet and industry reports provide extensive data on competing technologies.

- Negotiating Leverage: Customers use comparative information to negotiate better pricing and terms.

- Competitive Bidding: This knowledge allows customers to leverage competitive bids effectively.

FANUC's diverse customer base, spanning automotive to electronics, limits the power of any single buyer. While large clients can negotiate, the sheer number of smaller customers acts as a buffer. Switching costs for FANUC's integrated automation solutions are substantial, involving retraining and reconfiguring production lines, which discourages customers from easily switching suppliers.

Customers view FANUC's offerings as essential for productivity and competitiveness, making them less price-sensitive and more focused on performance. However, in more commoditized manufacturing sectors, price sensitivity is higher, giving customers more leverage. In 2024, sectors like basic assembly showed this trend, while high-tech industries prioritized reliability over cost.

| Factor | Description | Impact on FANUC |

| Customer Diversification | FANUC serves many industries (automotive, electronics, aerospace). | Reduces reliance on any single customer segment, diluting individual customer power. |

| Switching Costs | High costs for retraining, reconfiguring production lines, and system integration. | Increases customer loyalty and reduces their ability to switch easily, limiting bargaining power. |

| Product Integration | FANUC's automation is critical for customer production efficiency and quality. | Customers see solutions as essential investments, not just purchases, reducing price-based negotiation. |

| Price Sensitivity | Varies by industry; high in commoditized sectors, low in high-tech. | Customers in commoditized markets have more leverage; those in high-tech prioritize performance, limiting their price-driven power. |

| Information Availability | Customers are well-informed about competing technologies and pricing. | Empowers customers to negotiate better terms by comparing offerings effectively. |

What You See Is What You Get

Fanuc Porter's Five Forces Analysis

This preview showcases the complete Fanuc Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape for Fanuc. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The industrial automation market is inherently global, meaning companies like FANUC face rivals in nearly every significant economic region. This widespread presence intensifies competition for market share across the board.

Major players such as ABB, Siemens, and Rockwell Automation operate on a global scale, directly challenging FANUC in key markets. For instance, in 2024, the global industrial automation market was valued at approximately $230 billion, with significant portions of this revenue generated from international sales by all major competitors.

This global competition necessitates continuous innovation and strategic adaptation to meet the varied demands and regulatory landscapes of different regions. Companies must balance global standardization with localized product offerings to remain competitive.

The industrial robot and CNC system manufacturing sectors are characterized by substantial research and development expenditures and considerable fixed costs associated with production plants. This financial structure inherently pushes firms towards maximizing their operational capacity.

To cover these high fixed costs, companies like Fanuc must achieve high capacity utilization. This often results in competitive pricing pressures as firms vie for market share to spread their overheads. For instance, in 2024, the global industrial robotics market is projected to grow, but intense competition means companies are constantly looking for ways to optimize production efficiency and cost per unit.

The drive to utilize production capacity fully intensifies rivalry. Companies are incentivized to accept lower profit margins on individual sales if it means securing a higher volume of orders, thereby covering their substantial fixed investments. This dynamic can lead to price wars, particularly in periods of slower demand growth.

FANUC distinguishes itself through relentless innovation and product differentiation, emphasizing advanced features, superior precision, and unwavering reliability in its robotics and automation solutions. This focus allows them to command a premium and build strong customer loyalty, particularly in demanding industrial sectors.

However, the competitive landscape is fierce, with rivals like ABB, KUKA, and Yaskawa heavily investing in research and development, creating a continuous cycle of technological advancement. For instance, in 2024, the global industrial robotics market saw significant R&D spending, with major players allocating substantial portions of their revenue to developing next-generation AI-powered and collaborative robots.

Success in this arena hinges on the ability to differentiate beyond hardware. FANUC's strategic emphasis on software capabilities, seamless AI integration, and user-friendly interfaces is paramount. This allows them to offer more intelligent, adaptable, and easier-to-deploy solutions, a critical factor as industries increasingly seek to optimize production lines with minimal downtime and specialized expertise.

Number and diversity of competitors

FANUC operates in a highly competitive environment, facing rivals like KUKA, ABB, Yaskawa, and Siemens, all significant global players with extensive product lines. This intense rivalry is further amplified by numerous smaller, specialized companies that focus on specific market segments or technologies, forcing FANUC to constantly innovate and adapt its strategies to maintain market share. For instance, in 2023, the global industrial robotics market was valued at approximately $50 billion, with these major players holding substantial portions of that market.

The diversity of competitors means FANUC must contend with a wide array of strategic approaches. While large competitors offer comprehensive solutions across automation, smaller firms often excel in niche areas, providing highly specialized robotic arms or advanced software. This broad spectrum of competition, from established giants to agile specialists, intensifies the pressure on FANUC to deliver both breadth and depth in its offerings, impacting pricing and innovation cycles.

- Major Competitors: KUKA, ABB, Yaskawa, Siemens

- Niche Competitors: Numerous smaller, specialized automation and robotics firms

- Market Value: Global industrial robotics market valued at approximately $50 billion in 2023

- Competitive Dynamic: Broad portfolio offerings versus highly specialized solutions

Industry growth rate and market maturity

The industrial automation market, while generally robust, exhibits varied growth rates across its segments. This disparity fuels competitive rivalry, particularly in mature areas where market share is fiercely contested. For instance, while the broader robotics market is expected to see continued expansion, specific applications like collaborative robots (cobots) are experiencing more rapid adoption, potentially attracting new entrants and intensifying competition in those niches.

Slower growth within certain product lines, such as traditional industrial robots in established manufacturing sectors, can indeed trigger aggressive strategies. Companies might engage in price reductions or ramp up marketing efforts to secure sales. In 2024, many automation providers were observed to be offering more flexible financing options and bundled service packages to differentiate themselves in these more saturated markets.

Conversely, segments experiencing rapid expansion, like automation solutions for electric vehicle (EV) battery production or advanced semiconductor manufacturing, offer more room for multiple competitors. These high-growth areas can absorb new players more readily, as the overall demand outpaces the existing supply of automation capabilities.

- Market Maturity Impact: Mature segments within industrial automation, such as those for general-purpose industrial robots, are seeing increased price sensitivity and promotional activity as companies fight for existing customers.

- Growth Segment Dynamics: Rapidly expanding areas, like automation for renewable energy infrastructure and advanced logistics, tend to have less intense rivalry as the market can accommodate more participants.

- Competitive Tactics: In slower-growing product categories, expect intensified competition through price adjustments, enhanced service offerings, and increased R&D investment to maintain market relevance.

- 2024 Trends: Data from 2024 indicated that companies focused on niche, high-growth applications, such as AI-driven quality inspection systems, were better positioned to avoid intense price wars compared to those in more commoditized automation segments.

The competitive rivalry within the industrial automation sector is intense, driven by a global landscape populated by major players like ABB, Siemens, and Rockwell Automation, alongside numerous specialized firms. This broad competitive spectrum forces FANUC to constantly innovate and differentiate its offerings, from advanced robotics to CNC systems. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023, with these key competitors holding significant market shares.

High fixed costs and the need for capacity utilization push companies toward aggressive pricing strategies, especially in more mature market segments. While rapid growth in areas like EV battery automation offers more room, established sectors see intensified competition through price adjustments and enhanced service packages. In 2024, companies focusing on niche, high-growth applications like AI-driven quality inspection systems were better positioned to avoid intense price wars.

| Key Competitor | 2023 Market Share (Est.) | Key Product Areas |

| FANUC | 15-20% | Robotics, CNC Systems, Factory Automation |

| ABB | 12-17% | Robotics, Electrification, Motion, Automation |

| Siemens | 10-15% | Industrial Automation, Digitalization, Drives |

| KUKA | 8-12% | Robotics, Automation Solutions |

| Yaskawa | 7-10% | Robotics, Drives, Motion Control |

SSubstitutes Threaten

The threat of substitutes for FANUC's core robotic offerings primarily stems from alternative automation technologies that can achieve similar manufacturing efficiency goals. This includes a range of competing robotic platforms from other manufacturers, as well as advanced modular production systems or highly specialized, single-purpose machinery. These alternatives can pose a significant threat if they present a more compelling cost-benefit ratio for specific applications, potentially diverting customer investment away from traditional FANUC robots.

Manual labor can be a significant substitute for FANUC's automation solutions, particularly in regions with lower wage rates or for tasks that don't demand extreme precision. For instance, in some developing economies, the cost-benefit analysis might still favor human workers over advanced robotics, especially for simpler assembly or material handling operations.

Companies may also opt for less capital-intensive alternatives to full-scale automation. This could involve investing in improved tooling, lean manufacturing techniques to optimize existing manual processes, or using simpler, off-the-shelf machinery rather than sophisticated robotic systems. This is especially true for small and medium-sized enterprises (SMEs) with tighter budgets.

While FANUC's core strength lies in high-precision, high-volume automation, the availability of these lower-cost manual or semi-automated alternatives presents a competitive threat. For example, the global manufacturing sector continues to see significant employment in manual assembly roles, with millions employed in such capacities across various industries.

Advances in software, particularly AI and machine learning, are paving the way for 'software-only' automation solutions. These innovations could lessen the reliance on intricate physical machinery in various operational contexts.

While not a direct replacement for a robotic arm, sophisticated software that manages simpler mechanical setups or refines existing workflows might diminish the demand for new, high-performance hardware. This trend poses an evolving, long-term challenge to traditional automation hardware providers.

In-house developed automation systems

Large manufacturing firms with substantial R&D budgets may develop their own in-house automation solutions. These proprietary systems can be tailored to highly specific production needs, diminishing reliance on external vendors like FANUC. For example, a major automotive manufacturer might invest heavily in custom robotics for its assembly lines, creating a unique competitive edge.

This trend is amplified by the increasing availability of modular automation components that can be integrated into bespoke systems. Companies that possess strong internal engineering talent can leverage these building blocks to create solutions that precisely match their operational requirements. This allows them to gain greater control over their automation strategy and potentially reduce long-term costs compared to purchasing off-the-shelf systems.

- Proprietary Systems: Major manufacturers can design and build their own automation, reducing dependence on suppliers.

- Specialized Needs: Custom solutions are often developed for unique or highly specialized manufacturing processes.

- R&D Investment: Companies with significant research and development capabilities are more likely to pursue in-house development.

- Modular Components: The availability of flexible automation building blocks facilitates custom system integration.

Outsourcing to highly automated third parties

The threat of substitutes for FANUC's automation technology can manifest through companies opting to outsource manufacturing to highly automated third parties. Instead of directly investing in their own robotic systems and automation equipment, some businesses might find it more economical to contract with specialized manufacturers that already have advanced automation infrastructure in place. This approach doesn't replace the need for automation itself, but it does alter the purchasing dynamic, potentially reducing FANUC's direct customer base for its own equipment sales.

This trend is particularly relevant in sectors where capital expenditure on automation is a significant barrier to entry or expansion. For instance, a small to medium-sized enterprise might find it more feasible to partner with a contract manufacturer already equipped with FANUC's industrial robots and CNC systems rather than undertaking the substantial investment required to build that capability in-house. This strategic choice by manufacturers can impact FANUC's market penetration by shifting the decision-making locus from the end-user to the outsourcing provider.

Consider the growth in the contract manufacturing sector, especially in regions with established automation ecosystems. As of 2024, the global contract manufacturing market is projected to continue its upward trajectory, driven by the pursuit of efficiency and scalability. This expansion means more companies are leveraging existing automation rather than building it, which represents a subtle but significant substitution threat to direct equipment sales for companies like FANUC.

The implications for FANUC involve a potential decrease in direct sales of its automation solutions to a segment of the market that now relies on third-party providers. This necessitates a strategic focus on maintaining strong relationships with these contract manufacturers and potentially adapting sales and service models to cater to this indirect customer channel. The value proposition for FANUC might need to emphasize not just the technology itself, but also the support and integration services that make these contract manufacturers competitive.

The threat of substitutes for FANUC's automation solutions is multifaceted. While direct competitors offer similar robotic systems, the broader landscape includes less capital-intensive alternatives like manual labor, especially in lower-wage regions. Companies might also opt for lean manufacturing techniques or simpler machinery, particularly SMEs with budget constraints.

Furthermore, advancements in software and AI could lead to 'software-only' automation, reducing the need for physical hardware. Even proprietary, in-house developed systems by large manufacturers, built from modular components, represent a substitution threat by reducing reliance on external vendors like FANUC.

Outsourcing manufacturing to highly automated third parties also acts as a substitute for direct investment in automation equipment. This trend, growing in 2024, shifts purchasing decisions and impacts FANUC's direct sales channels, requiring adaptation to serve contract manufacturers.

| Substitution Type | Key Characteristics | Impact on FANUC | Example Scenario |

|---|---|---|---|

| Competing Robotic Platforms | Similar functionality, varying price points and features | Direct competition for market share | A Tier 1 automotive supplier choosing a competitor's robot for a new assembly line due to a slight cost advantage. |

| Manual Labor | Lower initial cost, flexibility for simple tasks, regional wage dependency | Threat in low-wage economies or for non-precision tasks | A garment factory in Southeast Asia continuing to use skilled seamstresses instead of investing in automated sewing machines. |

| Lean Manufacturing/Simpler Machinery | Optimizing existing processes, lower capital outlay | Reduced demand for advanced automation from SMEs | A small metal fabrication shop improving workflow and using more efficient conventional machinery rather than purchasing a robotic welding cell. |

| In-house Developed Systems | Tailored solutions, proprietary technology, control over development | Reduced reliance on external vendors | A large electronics manufacturer designing and building its own specialized pick-and-place machines for a unique product line. |

| Outsourcing to Automated Third Parties | Leveraging existing automation infrastructure, reduced capex for end-user | Shift in direct sales opportunities | A startup launching a new product and contracting production to a specialized facility that already utilizes FANUC robots. |

Entrants Threaten

The industrial automation sector, particularly for advanced robotics and CNC machinery, demands substantial upfront capital. Companies looking to enter this space must invest heavily in research and development to innovate, build state-of-the-art manufacturing plants, and establish extensive global sales and service networks. This creates a significant barrier for potential newcomers.

For instance, developing a new generation of collaborative robots or sophisticated AI-driven automation systems can easily run into hundreds of millions of dollars in R&D alone. Add to that the cost of building or acquiring manufacturing facilities and setting up distribution channels worldwide, and the entry cost becomes prohibitive for many. FANUC, a leader in this field, has spent decades and billions of dollars building its robust infrastructure, making it difficult for new players to compete on scale and capability.

The development of advanced CNC systems and industrial robots, Fanuc's core business, demands profound technological expertise and continuous innovation. New entrants face a significant hurdle in acquiring or developing this specialized knowledge, requiring substantial investment in research and development. For instance, the global industrial robotics market was valued at approximately $58.5 billion in 2023 and is projected to grow significantly, indicating the high capital required to compete.

The learning curve for precision engineering, sophisticated motion control, and AI integration is exceptionally steep, creating a substantial barrier to entry. Companies like Fanuc have decades of experience and accumulated intellectual property, making it difficult for newcomers to match their capabilities quickly. This deep-seated expertise translates into higher product quality and reliability, which is a critical factor for customers in the automation sector.

FANUC's formidable brand loyalty, cultivated over decades of delivering reliable and precise automation solutions, presents a significant barrier to new entrants. This established reputation for quality and robust after-sales support means customers often stick with FANUC, especially in critical manufacturing sectors where downtime is extremely costly.

For instance, FANUC's commitment to uptime, often backed by extensive service networks, directly addresses a key concern for industrial clients. New competitors would find it incredibly challenging to replicate this deep-seated trust and credibility quickly, as businesses are inherently risk-averse when investing in essential production machinery.

Access to distribution channels and customer relationships

Established players like FANUC have deeply entrenched global sales, service, and distribution networks. These networks, built over decades, represent a significant barrier for newcomers. For instance, FANUC's extensive presence across North America, Europe, and Asia allows for efficient customer support and product delivery, a feat difficult and costly for new entrants to replicate quickly.

Furthermore, FANUC and its competitors cultivate long-standing relationships with major industrial clients. These relationships are often characterized by trust, customized solutions, and integrated supply chains. New entrants would struggle to displace these established ties and gain access to key customer segments, as evidenced by the loyalty shown to incumbent automation providers in sectors like automotive manufacturing.

The challenge for new entrants is not just about offering competitive products but also about building the infrastructure and trust necessary to compete. Consider the cost and time involved in establishing a global service and support framework comparable to FANUC's. This capital expenditure and market penetration effort can easily run into hundreds of millions of dollars, making it a formidable hurdle.

Key challenges for new entrants include:

- Establishing a global sales and service infrastructure: Replicating FANUC's extensive network requires massive investment and time.

- Building trust and relationships with key industrial customers: Incumbents benefit from years of proven performance and partnership.

- Gaining access to established distribution channels: Existing networks are often exclusive or difficult to penetrate.

- Overcoming brand loyalty and perceived reliability of established players: Customers often prioritize proven solutions in critical industrial applications.

Regulatory hurdles and safety standards

The industrial automation sector faces significant regulatory hurdles. For instance, in 2024, compliance with safety standards like ISO 13849 for machinery safety functions can involve extensive testing and documentation, potentially costing tens of thousands of dollars per product line.

New entrants must also contend with diverse international regulations, such as CE marking in Europe and UL certification in North America, which add layers of complexity and expense. Failing to meet these stringent requirements can prevent market access entirely.

- Navigating Compliance: New companies must invest heavily in understanding and meeting varied safety protocols.

- Certification Costs: Obtaining necessary certifications can be a substantial upfront expense, often running into thousands or tens of thousands of dollars per product.

- Time to Market: The certification process itself can add months, or even years, to the time it takes for a new product to reach the market.

- International Standards: Adherence to differing global standards, like those for robotic safety or cybersecurity in industrial control systems, presents a continuous challenge for global market entry.

The threat of new entrants into FANUC's industrial automation market is relatively low due to immense capital requirements and established brand loyalty. Developing advanced robotics and CNC machinery demands significant investment in R&D, manufacturing, and global distribution, creating high barriers. For example, the global industrial robotics market was valued at approximately $58.5 billion in 2023, highlighting the scale of investment needed.

New companies must overcome steep learning curves in precision engineering and AI integration, areas where FANUC possesses decades of accumulated expertise and intellectual property. This deep-seated knowledge translates into superior product quality and reliability, factors crucial for industrial clients who prioritize operational continuity.

FANUC's extensive global sales, service, and distribution networks, built over years, are difficult and costly for newcomers to replicate. For instance, establishing a comparable service framework can easily cost hundreds of millions of dollars, a prohibitive expense for most potential entrants.

Regulatory compliance, such as obtaining certifications like CE marking and UL certification, adds further complexity and cost. In 2024, meeting safety standards like ISO 13849 can cost tens of thousands of dollars per product line, delaying market entry.

| Barrier | Description | Estimated Cost/Effort |

|---|---|---|

| Capital Requirements | R&D, manufacturing facilities, global distribution | Hundreds of millions of dollars |

| Technological Expertise | Precision engineering, AI integration, decades of IP | Years of specialized development |

| Brand Loyalty & Trust | Proven performance, reliable after-sales support | Decades to cultivate |

| Distribution & Service Networks | Global reach for sales, support, and maintenance | Hundreds of millions of dollars and years to build |

| Regulatory Compliance | Safety standards (ISO 13849), certifications (CE, UL) | Tens of thousands of dollars per product line, significant time |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fanuc leverages data from annual reports, industry-specific market research from firms like IDC and Gartner, and financial databases such as Bloomberg and S&P Capital IQ to assess competitive dynamics.