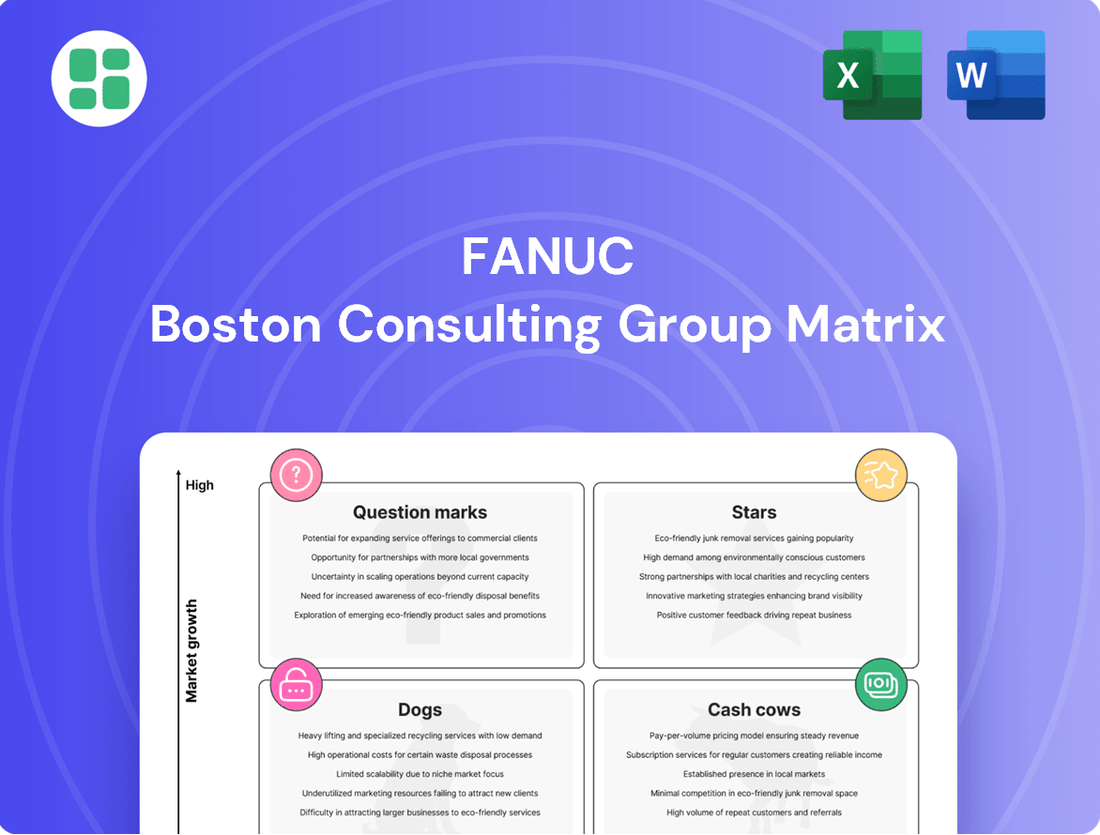

Fanuc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanuc Bundle

Understand the strategic positioning of Fanuc's product portfolio with this insightful BCG Matrix preview. See which robotic solutions are driving growth and which require careful consideration. Ready to unlock actionable strategies for optimizing your investments and maximizing market share?

Purchase the full Fanuc BCG Matrix report for a comprehensive quadrant-by-quadrant breakdown, detailed data analysis, and expert recommendations. Gain the clarity needed to make informed decisions about your automation investments and secure a competitive edge.

Stars

FANUC's CRX and CR series collaborative robots are strong contenders in the burgeoning cobot market. This segment is experiencing rapid expansion, with projections indicating a compound annual growth rate of 20-25% between 2025 and 2035. FANUC's commitment is evident in their continuous introduction of enhanced cobot arms, featuring greater payload capacities and novel applications, signaling a strategic push to capture a larger share of this dynamic market.

The company's emphasis on user-friendly programming and seamless integration with complementary technologies, such as autonomous mobile robots (AMRs), further solidifies their competitive edge. This focus on accessibility and interoperability is crucial for driving adoption across a wider range of industries and applications, making FANUC's cobots a key player in the evolving landscape of industrial automation.

FANUC's commitment to AI and advanced vision systems positions its robotics in a high-growth "Star" category. Innovations like the Smart Digital Twin Manager and AI-powered 3D vision for tasks such as automotive assembly on moving lines underscore this strategic focus. This investment is crucial as the demand for intelligent automation surges, allowing robots to learn and adapt to complex environments.

FANUC is strategically targeting emerging and specialized applications, moving beyond its traditional automotive and electronics strongholds. This includes significant expansion into logistics, warehousing, and the food and beverage industries, areas experiencing robust growth. The company's focus on developing application-specific software and specialized robots, such as explosion-proof collaborative paint robots, underscores its commitment to capturing high-demand niches within the evolving industrial robotics market.

Advanced CNC Systems for Next-Gen Manufacturing

FANUC's advanced CNC systems, like the new Series 500i-A and iPC Entry Model, are designed to capture growth in the advanced manufacturing sector. These innovations, coupled with ongoing enhancements to their established product lines, underscore FANUC's commitment to leading in this high-potential market. Their focus on controllers and software, including features like G-codes and enhanced power monitoring, is vital for complex machining and smart factory integration.

The global CNC machine market is expected to see substantial expansion. For instance, the market was valued at approximately $15.5 billion in 2023 and is projected to reach over $23 billion by 2028, exhibiting a compound annual growth rate of around 8.2%. FANUC's advanced systems are positioned to capitalize on this growth by enabling more sophisticated manufacturing processes and supporting the digitalization of factories.

- Market Leadership: FANUC's continuous innovation in CNC technology, including the Series 500i-A, aims to solidify its position in the expanding advanced manufacturing landscape.

- Market Growth: The global CNC machine market's projected growth, from an estimated $15.5 billion in 2023 to over $23 billion by 2028, presents a significant opportunity for advanced systems.

- Technological Advancement: Innovations in controllers and software, such as improved G-code capabilities and power consumption monitoring, are key differentiators for next-generation manufacturing.

- Smart Factory Integration: These advanced CNC systems are critical enablers for complex machining operations and the broader adoption of smart factory initiatives.

Integrated Automation Solutions and Digital Twin Technology

FANUC's integrated automation solutions, including its Smart Digital Twin Manager and Zero Down Time (ZDT) service, are firmly positioned in the Star category of the BCG matrix. These offerings leverage advanced analytics through tools like MT-Linki to create highly efficient and interconnected manufacturing ecosystems, perfectly aligning with the accelerating Industry 4.0 movement.

The emphasis on digital transformation, predictive maintenance, and comprehensive factory connectivity is a rapidly expanding market segment. FANUC's commitment to these areas is evident in the growing adoption of its solutions across diverse manufacturing sectors. For instance, ZDT has been instrumental in helping manufacturers reduce unplanned downtime, with FANUC reporting significant improvements in machine availability for its clients.

- Smart Digital Twin Manager: Enables virtual replication of physical assets for enhanced monitoring and optimization.

- Zero Down Time (ZDT): Proactively identifies potential machine failures, minimizing production interruptions.

- MT-Linki: Provides real-time data collection and advanced analytics for improved operational insights.

- Industry 4.0 Alignment: These solutions are key enablers of smart manufacturing and digital transformation initiatives.

FANUC's AI and advanced vision systems, alongside its integrated automation solutions like the Smart Digital Twin Manager and Zero Down Time (ZDT) service, are clearly positioned as Stars in its BCG portfolio. These offerings are at the forefront of Industry 4.0, tapping into a market segment driven by digital transformation and intelligent automation. The company's continuous investment in these high-growth areas, evidenced by ongoing product enhancements and strategic partnerships, aims to capture significant market share in the coming years.

| FANUC Offering | Market Segment | Growth Potential | Key Features |

|---|---|---|---|

| AI & Advanced Vision Systems | Intelligent Automation | High (20-25% CAGR projected for cobots) | 3D vision, AI-powered learning, complex environment adaptation |

| Smart Digital Twin Manager | Digital Manufacturing | High (driven by Industry 4.0 adoption) | Virtual asset replication, real-time monitoring, optimization |

| Zero Down Time (ZDT) | Predictive Maintenance | High (significant reduction in unplanned downtime) | Proactive failure identification, enhanced machine availability |

What is included in the product

The Fanuc BCG Matrix analyzes its product portfolio by market share and growth rate, guiding strategic decisions for each category.

Instantly visualize your Fanuc robot portfolio's strategic positioning for data-driven decisions.

Cash Cows

FANUC's standard industrial robots are undeniably Cash Cows within its BCG Matrix, boasting an impressive installed base exceeding 1 million units globally. This vast installed base ensures a steady stream of recurring revenue from service, maintenance, and parts, even as new unit sales fluctuate.

Despite some regional sales dips in late 2024, FANUC's dominant market share in critical industries like automotive and electronics solidifies the consistent revenue generation of these mature products. The demand for replacements and expansions in existing, well-established factories remains robust, providing a predictable income stream.

FANUC's core CNC systems are firmly positioned as a Cash Cow. Together with Siemens AG, FANUC commands over 20% of the CNC controller market as of 2023, highlighting its dominant and stable position.

These systems are the backbone of precision manufacturing worldwide, generating consistent, high-margin revenue. The essential nature of CNC technology ensures ongoing demand for both new systems and crucial after-sales services and upgrades, even amidst market shifts.

The ROBODRILL Series stands as a prime example of a Cash Cow within Fanuc's portfolio. Its consistent performance is highlighted by the ROBOMACHINE division's net sales, which surged by 21.8% in the first nine months of FY2024, ending March 2025. This robust growth effectively counterbalances downturns in other Fanuc segments, underscoring the ROBODRILL's stability and strong market standing.

As an established leader in compact machining centers, the ROBODRILL series is recognized for its high productivity and unwavering reliability. The introduction of advanced models, such as the new α-D28LiB5ADV Plus Y500, further solidifies its market dominance and sustained profitability, ensuring its continued role as a significant revenue generator for Fanuc.

ROBOSHOT Electric Injection Molding Machines

The ROBOSHOT electric injection molding machines are a cornerstone of Fanuc's ROBOMACHINE division, mirroring the success of the ROBODRILL. Their substantial sales figures solidify their position as a Cash Cow. These machines are highly valued in established markets for their exceptional precision and energy-saving capabilities.

Fanuc consistently invests in enhancing the ROBOSHOT series, ensuring its continued market leadership and robust cash flow. For instance, the development of models like the FANUC ROBOSHOT α-S15iB demonstrates this commitment to innovation and sustained competitiveness.

- Significant Sales Contribution: The ROBOSHOT series consistently drives strong sales within the ROBOMACHINE division, confirming its Cash Cow status.

- Market Recognition: These electric injection molding machines are recognized for their precision and energy efficiency, particularly in mature industrial markets.

- Continuous Improvement: Ongoing product development, exemplified by the FANUC ROBOSHOT α-S15iB, ensures the series remains competitive and a reliable source of cash generation.

Global After-Sales Service and Maintenance

FANUC's Global After-Sales Service and Maintenance division is a prime example of a Cash Cow within its BCG Matrix. The company's extensive network of over 260 service centers globally, coupled with a dedicated 'Service First' philosophy, ensures consistent and robust revenue generation from its large installed product base. This division is a reliable source of income through maintenance, spare parts, and customer support.

In FY2024, which concluded in March 2025, this segment saw its consolidated sales grow by 3.5%. This growth contributed 17.0% to FANUC's total consolidated net sales, highlighting its significant and stable financial contribution. The division's ability to generate substantial, recurring revenue with minimal need for extensive new investment in promotion solidifies its Cash Cow status.

- Global Reach: Over 260 service centers worldwide support FANUC's extensive product installations.

- Revenue Stability: Generates substantial and stable income from maintenance, spare parts, and customer support.

- FY2024 Performance: Consolidated sales increased by 3.5%, representing 17.0% of total net sales.

- Low Investment Needs: Requires relatively low new investment for promotion, characteristic of a Cash Cow.

FANUC's established industrial robot lines, including the popular M-series, are definitive Cash Cows. Their widespread adoption in automotive and electronics manufacturing, sectors known for consistent demand, ensures a steady revenue stream. The sheer volume of these robots already in operation globally, exceeding 1 million units, means a perpetual demand for service, parts, and upgrades.

The ROBODRILL series continues its strong performance as a Cash Cow, with its division showing significant growth. For the fiscal year ending March 2025, the ROBOMACHINE division, which includes ROBODRILL, saw its net sales increase by 21.8%. This demonstrates its robust market position and reliable contribution to FANUC's overall revenue, even as other segments might face fluctuations.

FANUC's ROBOSHOT electric injection molding machines are another clear Cash Cow. These machines are highly regarded for their precision and energy efficiency, making them a preferred choice in mature manufacturing markets. Their consistent sales performance within the ROBOMACHINE division underscores their status as a stable, high-performing product line.

The global after-sales service and maintenance division operates as a significant Cash Cow for FANUC. This segment experienced a 3.5% growth in consolidated sales for FY2024, contributing 17.0% to the company's total net sales. This recurring revenue, generated from a vast installed base through ongoing support and parts, requires minimal new capital investment, a hallmark of a Cash Cow.

| Product/Segment | BCG Category | FY2024 (Ending Mar 2025) Performance Indicator | Key Driver for Cash Cow Status | Market Position |

| Industrial Robots (e.g., M-series) | Cash Cow | Installed base > 1 million units globally | Recurring revenue from service, maintenance, parts | Dominant in automotive & electronics |

| ROBODRILL Series | Cash Cow | ROBOMACHINE net sales +21.8% | High productivity, reliability, strong replacement demand | Leader in compact machining centers |

| ROBOSHOT Series | Cash Cow | Strong sales within ROBOMACHINE division | Precision, energy efficiency, established market presence | Highly valued in mature markets |

| After-Sales Service & Maintenance | Cash Cow | Consolidated sales +3.5%; 17.0% of total net sales | Stable, recurring income from extensive installed base | Global network of 260+ service centers |

What You’re Viewing Is Included

Fanuc BCG Matrix

The preview you are currently viewing is the identical, fully completed Fanuc BCG Matrix document that you will receive immediately after completing your purchase. This ensures you get exactly what you expect, with no hidden surprises or watermarks, ready for immediate strategic application.

Dogs

Older, highly specialized robot models, particularly those built for industries like traditional automotive manufacturing or certain types of heavy industrial assembly, can be categorized as Dogs in the Fanuc BCG Matrix. These robots, while once cutting-edge, may now face declining demand as those sectors contract or as newer, more versatile technologies emerge.

For instance, if a specific robot model was designed for a now-obsolete manufacturing process, its market share would likely be minimal, and growth prospects virtually nonexistent. Companies like Fanuc, while not explicitly labeling products as Dogs, must manage the lifecycle of their offerings, and these legacy systems often require continued, albeit diminishing, support and maintenance, potentially becoming a drag on resources without substantial revenue generation.

Older FANUC CNC controller generations, particularly those from the 1990s and early 2000s, are increasingly falling into the Dogs category of the BCG matrix. While they may still operate, their declining market relevance and the rapid advancement of newer, more capable systems like the FANUC Series 0i-F Plus and 30i-B, mean demand for new installations is shrinking.

FANUC's strategic shift towards integrated solutions and enhanced connectivity in its latest controllers naturally leads to a reduced focus on supporting and marketing these legacy systems for new applications. This creates a situation where older controllers require disproportionate maintenance efforts and resources compared to their diminishing sales volume, a classic indicator of a Dog product.

For instance, while FANUC reported strong growth in its industrial robot segment in 2024, the demand for entirely new installations of very old CNC controller generations is likely stagnant or declining. This divergence highlights the need for strategic decisions regarding the continued investment in and support for these older product lines.

Niche or specialized older ROBOMACHINEs with limited adoption represent Fanuc's Dogs in the BCG Matrix. These are specific, low-volume models that struggled to gain widespread market traction or have been surpassed by more versatile alternatives. For example, if certain older ROBOCUT variants, which saw a slight sales decrease in the first nine months of FY2024, continue this downward trend without renewed demand, they would fit this category.

Products in Geographies with Persistent Weak Demand

Products in geographies with persistent weak demand, often termed Dogs in the BCG Matrix, represent a significant strategic challenge for companies like FANUC. During the first nine months of fiscal year 2024, FANUC experienced a downturn in robot sales across key markets including China, Europe, and the Americas. This decline was largely attributed to subdued demand within the automotive sector and broader general industries.

When specific product lines within these regions face sustained weak demand and lack clear recovery prospects, they can indeed become Dogs. These underperforming assets tie up capital and management attention that could be better allocated to more promising areas. For instance, if FANUC’s industrial robot offerings in a particular European country continue to see declining orders due to a prolonged economic slump in its manufacturing base, that product-region combination would fit the Dog profile.

- FANUC's robot sales saw a decline in China, Europe, and the Americas in the first nine months of FY2024.

- Weak demand in automotive and general industries contributed to this sales decrease.

- Products in these regions with no strong recovery outlook risk becoming Dogs, draining resources.

- This situation underscores the difficulty of navigating and adapting to regional economic fluctuations.

Inefficient or Less Competitive Older Software Solutions

Older software solutions from Fanuc that are less integrated or don't embrace current trends like AI and cloud connectivity are likely positioned in the Dogs quadrant of the BCG matrix. These might include legacy automation software that hasn't seen significant updates. For instance, if a particular software package struggles to integrate with newer robotic systems or lacks the advanced analytics capabilities of competitors, it fits this description.

These products often have a low market share when compared to more modern, feature-rich alternatives. If Fanuc needs to invest heavily in maintaining compatibility or updating these older systems to meet current industry standards, it drains resources that could be better allocated elsewhere. For example, a 2024 market analysis might show that a specific legacy control software for older machinery holds less than 5% market share in its segment, while newer, AI-enabled systems are capturing 20% or more.

- Low Market Share: Legacy software often struggles to compete with newer, more advanced solutions, leading to a diminished presence in the market.

- High Maintenance Costs: Keeping older systems compatible with current hardware and software environments can be resource-intensive.

- Lack of Modern Features: Products that don't incorporate AI, cloud connectivity, or advanced data analytics are at a significant disadvantage.

- Strategic Re-evaluation: These offerings may be candidates for reduced investment, divestiture, or phasing out in favor of more promising technologies.

FANUC's older, highly specialized robot models, particularly those designed for now-declining industries or obsolete processes, represent the Dogs in their BCG Matrix. These products, while potentially still functional, face minimal market growth and a shrinking customer base.

For instance, certain legacy ROBOCUT variants experienced a sales decrease in the first nine months of FY2024, indicating a potential shift towards the Dogs category if this trend persists without renewed demand. Supporting these older, low-volume machines can divert resources from more profitable ventures.

Similarly, older FANUC CNC controllers, such as those from the early 2000s, are becoming Dogs as newer, more advanced systems like the Series 0i-F Plus gain traction. The market share for these legacy controllers is diminishing, and their growth prospects are negligible.

Products in specific geographic regions experiencing prolonged weak demand, like FANUC's robot sales decline in China, Europe, and the Americas during the first nine months of FY2024, can also be categorized as Dogs if recovery prospects remain dim.

| Product Category | BCG Quadrant | Market Trend | FANUC Example | Rationale |

|---|---|---|---|---|

| Legacy Industrial Robots | Dogs | Declining Demand | Older models for traditional automotive assembly | Surpassed by newer, more versatile technologies; sectors contracting. |

| Legacy CNC Controllers | Dogs | Stagnant/Declining Demand | FANUC Series 15i, 16i, 18i | Low market relevance compared to Series 0i-F Plus and 30i-B; require disproportionate support. |

| Specialized ROBOMACHINEs | Dogs | Low Market Traction | Certain older ROBOCUT variants | Struggled for widespread adoption or surpassed by alternatives; saw slight sales decrease in FY2024. |

| Underperforming Regional Offerings | Dogs | Persistent Weak Demand | Robot sales in specific European countries with economic slump | Lack clear recovery prospects, tying up capital and management attention. |

Question Marks

FANUC's integration of its cobots with third-party Autonomous Mobile Robots (AMRs) for tasks like automotive kitting positions it in a high-growth sector. However, its direct market share as an AMR manufacturer is likely still developing, placing it in the Question Mark quadrant of the BCG matrix. The broader AMR market is projected to reach $11.1 billion by 2027, according to Mordor Intelligence, highlighting significant growth potential.

While FANUC is a leader in industrial robots, its direct presence in the overall AMR market, beyond integration partnerships, is considered nascent. To establish a stronger foothold against established AMR players like Fetch Robotics and MiR, substantial investment in R&D and manufacturing capabilities for AMRs would be necessary. This strategic focus is crucial for FANUC to capitalize on the expanding demand for automated material handling solutions.

New software platforms, like advanced IIoT solutions and comprehensive digital twin applications, represent a significant growth avenue for FANUC. While FANUC already offers ZDT and MT-Linki, expanding into broader, factory-wide AI-driven digital transformation platforms could unlock substantial market potential. These nascent software ecosystems, however, demand considerable investment to achieve market penetration and stand out against competitors.

FANUC might be venturing into robotics for niche, burgeoning sectors like specialized medical applications or sophisticated agricultural technology. These areas represent a low current market share for FANUC but boast significant future growth prospects.

Success in these specialized industries hinges on substantial research and development alongside dedicated market cultivation. This approach is necessary to navigate initial hurdles of low adoption and to build a strong leadership position.

The long-term sustainability of FANUC's involvement in these new, highly specialized industries will ultimately depend on sustained, strategic investments and effective market penetration strategies.

New Material Processing Technologies Integration

FANUC's exploration into integrating its robotic and CNC machinery with emerging material processing technologies like advanced additive manufacturing and novel composite processing positions it within the Question Mark quadrant of the BCG Matrix. These sectors represent high-growth potential, but FANUC's current market penetration in these specific integration areas may be nascent as it continues to develop and refine its solutions.

The company's success hinges on substantial investment in research and development, alongside forging strategic alliances to capture market share in these evolving fields. For instance, the global additive manufacturing market was valued at approximately $19.8 billion in 2023 and is projected to grow significantly, presenting a clear opportunity for FANUC to expand its offerings.

- High Growth Potential: Emerging areas like advanced additive manufacturing and composite processing offer substantial future revenue streams.

- Developing Market Share: FANUC's current position in integrating its core technologies with these new processes is likely still building, requiring strategic investment.

- R&D and Partnerships: Significant innovation and collaboration are crucial for FANUC to establish a strong foothold and achieve market leadership in these innovative segments.

Enhanced Human-Robot Collaboration Features

While FANUC's cobots are a strong Star product, the development of truly cutting-edge human-robot collaboration features represents a potential future growth area, akin to a Question Mark in the BCG matrix.

These advanced features, including sophisticated haptic feedback, simplified programming for users without technical expertise, and enhanced safety protocols for shared workspaces that exceed current industry norms, are on a high-growth trajectory. However, they demand substantial investment in research and development and require significant user adoption to transition from specialized applications to widespread use.

The market for deeply integrated and highly adaptable human-robot interaction is still in its formative stages. For instance, while the global collaborative robot market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, the segment focused on these next-generation collaboration features is even more nascent, with significant R&D expenditure needed to unlock its full potential.

- Advanced Haptics: Enhancing robots' ability to sense and respond to physical touch for more nuanced interactions.

- Intuitive Programming: Developing user-friendly interfaces that allow non-experts to easily program and deploy cobots.

- Next-Gen Workspace Safety: Creating safety systems that allow for closer, more dynamic human-robot interaction than current standards permit.

- Market Evolution: Recognizing that these advanced features are in a high-growth but still developing market, requiring substantial investment.

FANUC's foray into integrating its established robotic and CNC technologies with emerging material processing techniques, such as advanced additive manufacturing and novel composite processing, places it within the Question Mark quadrant of the BCG matrix. These sectors exhibit high growth potential, but FANUC's current market penetration in these specific integration areas is likely still developing, necessitating strategic investment to refine its offerings.

The company's success in these nascent fields hinges on substantial investment in research and development, alongside the cultivation of strategic alliances to capture market share. For example, the global additive manufacturing market was valued at approximately $19.8 billion in 2023, with robust growth projected, presenting a clear opportunity for FANUC to expand its specialized integration solutions.

FANUC's exploration into integrating its core technologies with these advanced processes represents a strategic move into high-growth areas where its market share is still being established. Significant R&D expenditure and strategic partnerships are crucial for FANUC to build a strong leadership position in these evolving technological landscapes.

The company's ventures into niche, burgeoning sectors like specialized medical robotics or sophisticated agricultural technology also fall into the Question Mark category. While FANUC's current market share in these areas is low, they possess significant future growth prospects, contingent upon dedicated R&D and market cultivation efforts.

| FANUC's Question Mark Ventures | Market Growth Potential | Current Market Share | Strategic Imperative |

|---|---|---|---|

| Integration with Additive Manufacturing | High (Global market ~$19.8B in 2023, growing) | Nascent/Developing | R&D investment, strategic partnerships |

| Integration with Composite Processing | High | Nascent/Developing | R&D investment, strategic partnerships |

| Advanced Human-Robot Collaboration Features | High (Cobot market ~$1.5B in 2023, growing) | Nascent (for advanced features) | Significant R&D, user adoption focus |

| Robotics for Specialized Medical/Agri-Tech | High | Low | Substantial R&D, market cultivation |

BCG Matrix Data Sources

Our Fanuc BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth projections, to accurately position each product.