Falabella SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

The Falabella SWOT analysis reveals a company with significant brand recognition and a strong presence in Latin America, yet it faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the retail landscape.

Want the full story behind Falabella's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Falabella's diversified business model is a significant strength, spanning department stores, home improvement, supermarkets, financial services, and real estate development. This multi-format approach generated approximately $13.5 billion in revenue for the fiscal year ending December 31, 2023, showcasing its broad market reach and resilience. This diversification mitigates risks associated with any single market segment, providing a more stable revenue base.

The company's integrated ecosystem effectively leverages cross-selling opportunities. For instance, a customer purchasing furniture from its home improvement division might be offered credit services through Falabella's financial arm, enhancing overall customer lifetime value. This synergy, evident in its 2023 performance where financial services contributed significantly to profitability, strengthens customer loyalty across its diverse platforms.

Falabella boasts a formidable regional presence, operating across key Latin American markets like Chile, Peru, Mexico, Colombia, Argentina, Brazil, and Uruguay. This broad geographical reach is a significant strength, enabling the company to diversify its revenue streams and buffer against localized economic downturns. For instance, in 2023, its Chilean operations continued to be a cornerstone, while growth in Mexico and Colombia provided crucial diversification.

Falabella's strengths are significantly bolstered by its robust omnichannel and digital transformation strategy. The company has poured substantial resources into developing its e-commerce infrastructure and seamlessly merging its physical store presence with its online offerings.

This strategic focus has translated into impressive gains, with online Gross Merchandise Value (GMV) showing strong upward momentum. For instance, in the first quarter of 2024, Falabella reported a notable increase in its digital sales, contributing a significant portion to its overall revenue growth.

Furthermore, Falabella has made strides in optimizing its logistics, achieving a commendable delivery efficiency where a substantial percentage of online orders are now fulfilled within a 48-hour timeframe. This commitment to a smooth customer journey is central to its ongoing digital evolution.

Improved Financial Performance

Falabella has demonstrated a significant rebound in its financial performance, a key strength. The company's net income experienced a threefold increase, showcasing a robust recovery. This surge in profitability is a testament to their strategic initiatives.

The first quarter of 2025 saw a notable improvement in Falabella's EBITDA margin, reflecting enhanced operational efficiency. This positive trend highlights the effectiveness of their cost control measures and optimization efforts across various business segments. The company's financial health appears to be on an upward trajectory.

Key financial highlights supporting this strength include:

- Triple increase in net income in Q1 2025.

- Improved EBITDA margin in Q1 2025.

- Successful implementation of operational efficiencies.

- Effective cost control strategies driving profitability.

Strategic Investment in Growth

Falabella's strategic investment in growth is a significant strength, highlighted by its planned US$650 million capital expenditure for 2025. This represents a notable increase from prior investment levels, signaling a robust commitment to expansion and modernization. The company is channeling these funds into critical areas such as store upgrades and new openings, alongside a substantial boost to its technological infrastructure.

This forward-looking capital allocation is designed to enhance customer experience and operational efficiency. By focusing on transforming existing retail spaces and strategically opening new ones, Falabella aims to solidify its market presence. Furthermore, the emphasis on technological capabilities is crucial for adapting to evolving consumer behaviors and maintaining a competitive edge in the digital age.

The investment plan demonstrates Falabella's proactive strategy to foster sustainable growth and strengthen its competitive standing across its core markets. Key allocations include:

- Store Transformation and Expansion: Upgrading existing locations and opening new stores to broaden reach and improve the shopping experience.

- Technology Strengthening: Significant investment in digital capabilities, data analytics, and e-commerce platforms to enhance omnichannel offerings.

- Logistics and Supply Chain Improvements: Optimizing distribution networks to support increased sales volumes and faster delivery times.

- Market Penetration: Targeting specific regions and customer segments to deepen market share and brand loyalty.

Falabella's diversified business model, encompassing department stores, home improvement, supermarkets, financial services, and real estate, is a core strength. This multi-faceted approach generated approximately $13.5 billion in revenue for the fiscal year ending December 31, 2023, demonstrating broad market reach and resilience.

The company's integrated ecosystem effectively leverages cross-selling opportunities, enhancing customer lifetime value. For example, its financial services arm complements retail offerings, contributing significantly to profitability as seen in 2023 performance.

Falabella's robust omnichannel and digital transformation strategy is a key strength, with substantial investments in e-commerce infrastructure and the seamless integration of physical and online channels. This has led to strong growth in online Gross Merchandise Value (GMV), with notable increases reported in Q1 2024.

The company has demonstrated a significant financial rebound, with net income tripling in Q1 2025 and an improved EBITDA margin, reflecting enhanced operational efficiencies and effective cost control strategies.

Falabella's strategic investment of US$650 million in capital expenditure for 2025 underscores its commitment to growth, focusing on store modernization, new openings, and technological infrastructure upgrades to enhance customer experience and maintain a competitive edge.

| Key Financial Metric | Q1 2025 Performance | Significance |

|---|---|---|

| Net Income | Triple Increase | Demonstrates strong profitability recovery |

| EBITDA Margin | Improved | Indicates enhanced operational efficiency |

| Capital Expenditure (2025) | US$650 million | Signals commitment to growth and modernization |

What is included in the product

Delivers a strategic overview of Falabella’s internal and external business factors, highlighting its established brand and market presence alongside challenges in digital transformation and intense competition.

Offers a clear, actionable SWOT framework to identify and address strategic challenges, alleviating the pain of unclear direction.

Weaknesses

Falabella's broad presence across diverse Latin American markets means it's particularly vulnerable to economic downturns. For instance, the region experienced significant inflation spikes in 2023, with countries like Argentina seeing inflation rates exceed 200%, directly impacting consumer spending power and Falabella's sales volumes.

Currency fluctuations are another major concern. A weakening Chilean peso, for example, can reduce the value of repatriated earnings from other countries, affecting overall profitability. Similarly, interest rate hikes in markets like Brazil, which saw its Selic rate reach 11.75% by late 2023, can dampen consumer credit and thus sales for a company heavily reliant on installment plans.

Falabella faces formidable competition in Latin America's e-commerce sector, with giants like Mercado Libre and global players constantly vying for market share. This intense rivalry forces Falabella to continuously invest heavily in competitive pricing, aggressive marketing campaigns, and robust logistics infrastructure. For instance, Mercado Libre's gross merchandise volume (GMV) reached $29.9 billion in 2023, highlighting the scale of the challenge.

Falabella faces substantial operational complexity due to its broad range of businesses, including retail, financial services, and real estate, spread across several Latin American nations. This diversity makes it difficult to maintain uniform standards and efficient supply chains. For instance, in 2023, the company reported that its integrated supply chain efforts aimed to reduce costs by 5% across its Chilean operations, highlighting the ongoing challenge of managing such a varied operational landscape.

Reliance on Consumer Credit Health

Falabella's financial services segment, a significant contributor to its overall revenue, heavily relies on the consumer credit market. This includes income generated from credit cards and personal loans. The company's profitability is therefore closely linked to the financial health and repayment capacity of its customer base.

A key weakness for Falabella is its substantial dependence on consumer credit. For instance, in the first quarter of 2024, Falabella's financial services segment reported a notable portion of its earnings stemming from interest income on its credit portfolio. However, this also exposes the company directly to economic downturns.

Deterioration in the economic landscape or a rise in consumer defaults can directly impact Falabella's loan book quality and, consequently, its banking segment's profitability. This vulnerability is amplified by the current economic climate, with rising inflation and interest rates in several of its key markets, potentially straining consumer finances.

- Revenue Dependence: A significant portion of Falabella's income is derived from consumer credit products.

- Economic Sensitivity: The health of its loan portfolio is directly tied to consumer economic well-being.

- Default Risk: Economic slowdowns or increased consumer debt can negatively affect asset quality and profitability.

Profitability Challenges in Specific Segments/Regions

While Falabella's overall profitability has seen improvements, some areas still present difficulties. For example, the home improvement division, Sodimac, in Chile has been contending with a slower construction market.

These localized or segment-specific issues mean that consistent profitability across the entire company requires tailored approaches.

- Sodimac Chile's profitability impacted by construction sector slowdown.

- Targeted strategies needed for specific underperforming business units.

- Geographic variations in economic conditions affect segment performance.

Falabella's extensive footprint across Latin America exposes it to significant economic volatility. For instance, high inflation rates observed in 2023, exceeding 200% in Argentina, directly curbed consumer spending, impacting sales volumes. Currency fluctuations, such as a weakening Chilean peso, also diminish the value of international earnings, affecting overall profitability. Furthermore, rising interest rates, like Brazil's Selic rate reaching 11.75% by late 2023, can stifle consumer credit, a critical revenue source for Falabella.

The company grapples with intense competition in the e-commerce space, facing rivals like Mercado Libre, which reported a Gross Merchandise Volume (GMV) of $29.9 billion in 2023. This necessitates substantial ongoing investment in pricing, marketing, and logistics. Additionally, Falabella's diverse business model, spanning retail, financial services, and real estate across multiple countries, creates operational complexities and challenges in maintaining uniform standards and efficient supply chains, as evidenced by its 2023 efforts to achieve a 5% cost reduction in its Chilean supply chain.

Falabella's reliance on consumer credit is a notable weakness. The financial services segment, a key profit driver, is directly susceptible to economic downturns and rising consumer defaults, which can degrade loan portfolio quality. This vulnerability is exacerbated by the prevailing economic climate of increasing inflation and interest rates across its operating markets, potentially straining consumer repayment capacities.

Specific business units also face challenges. For example, Sodimac Chile experienced a slowdown in its profitability due to a weaker construction market in 2023. This highlights the need for tailored strategies to address segment-specific or localized economic impacts and performance variations.

| Weakness | Description | Impact Example (2023/2024 Data) |

| Economic Sensitivity | Vulnerability to regional economic downturns, inflation, and currency fluctuations. | Argentina's 2023 inflation >200% impacting consumer spending; Brazil's Selic rate at 11.75% affecting credit sales. |

| Intense Competition | Pressure from major e-commerce players like Mercado Libre. | Mercado Libre's 2023 GMV of $29.9 billion underscores the competitive landscape. |

| Operational Complexity | Managing diverse businesses and geographies leads to inefficiencies. | Ongoing efforts to reduce supply chain costs by 5% in Chile indicate management challenges. |

| Consumer Credit Dependence | Profitability heavily tied to the health of the loan portfolio. | Economic slowdowns and rising defaults directly threaten the quality of the loan book. |

| Segment-Specific Issues | Underperformance in certain divisions due to market conditions. | Sodimac Chile's profitability impacted by a slower construction market. |

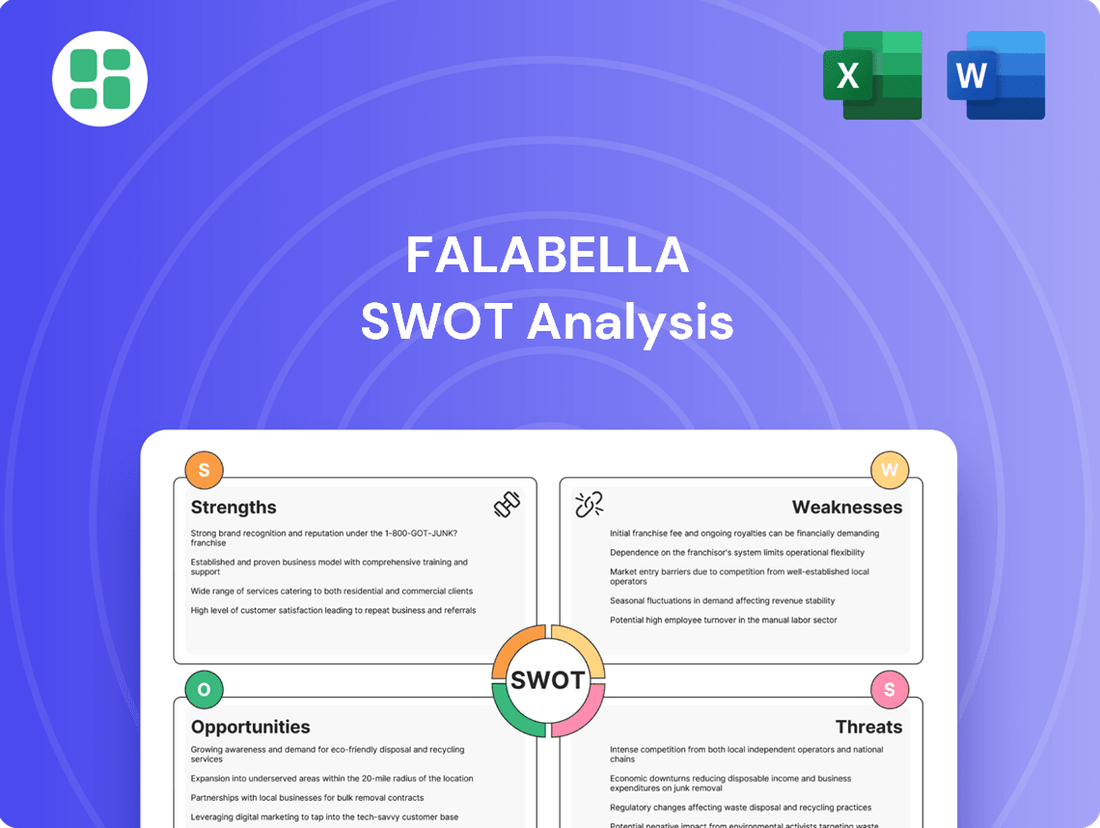

Same Document Delivered

Falabella SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at the Falabella brand's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors impacting Falabella's market position and future growth potential.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Falabella SWOT analysis, ready for your customization and strategic implementation.

Opportunities

Latin America's e-commerce market is booming, with projections indicating continued robust growth through 2025. This surge, coupled with the rise of social commerce, offers Falabella a prime opportunity to expand its digital footprint. For instance, e-commerce sales in the region were estimated to reach over $150 billion in 2023, a figure expected to climb significantly.

Falabella can capitalize on this by further investing in its online marketplace and logistics infrastructure, aiming to capture a greater share of this expanding market. By strengthening its digital capabilities, the company can enhance customer acquisition and retention in an increasingly competitive online landscape.

An enhanced omnichannel approach, seamlessly integrating online and in-store experiences, is also crucial. This strategy allows customers to browse online and pick up in-store, or vice versa, providing a more convenient and personalized shopping journey. Such integration is key to meeting evolving consumer expectations in 2024 and beyond.

Falabella can significantly boost its financial services by leveraging its massive retail customer base, especially in digital banking and credit. In 2024, the company is focused on expanding its loan portfolio and introducing new financial products to existing customers, aiming to capture a larger share of their financial needs.

This strategy is designed to capitalize on the strong brand loyalty and transaction history Falabella possesses. By offering tailored digital banking solutions and credit options, the company anticipates a substantial increase in cross-selling opportunities, driving revenue growth through enhanced customer financial engagement.

Falabella's strategic embrace of big data and AI presents a significant opportunity to deeply personalize customer interactions across its retail and financial services. By analyzing vast datasets, the company can tailor product recommendations, marketing campaigns, and even financial product offerings to individual preferences, boosting engagement and conversion rates.

AI's predictive capabilities can revolutionize inventory management by forecasting demand with greater accuracy, minimizing stockouts and overstock situations. This optimization, coupled with AI-powered targeted marketing, is projected to drive substantial increases in sales efficiency and customer acquisition costs savings, as seen with other major retailers reporting double-digit improvements in campaign ROI after AI implementation.

Ultimately, this enhanced personalization, driven by sophisticated data analytics and AI, is poised to foster stronger customer loyalty by creating more relevant and seamless shopping and financial management experiences. For instance, companies leveraging AI for customer service have reported a 15-20% increase in customer satisfaction scores, a metric Falabella can aim to replicate and surpass.

Sustainability and ESG Initiatives

Growing consumer and investor awareness regarding environmental, social, and governance (ESG) factors in Latin America presents a significant opportunity for Falabella. The company can leverage this trend by strengthening its sustainability commitments, appealing to a broader, more conscious customer base.

By integrating sustainable practices throughout its value chain, from ethical sourcing to energy-efficient store operations, Falabella can bolster its brand image. This focus can attract a segment of consumers increasingly prioritizing responsible businesses, potentially leading to enhanced customer loyalty and market share. For instance, as of early 2024, reports indicate a notable increase in consumer willingness to pay a premium for sustainable products in key Latin American markets where Falabella operates.

- Enhanced Brand Reputation: Aligning with ESG principles can significantly improve Falabella's public image and attract environmentally and socially conscious consumers.

- Attracting Socially Conscious Consumers: A strong sustainability narrative can resonate with a growing demographic that prioritizes ethical business practices in their purchasing decisions.

- Operational Efficiencies: Implementing sustainable practices, such as waste reduction and energy conservation, can lead to long-term cost savings and improved operational performance.

- Investor Appeal: Demonstrating robust ESG performance can attract a wider pool of investors, including those focused on sustainable and impact investing, potentially lowering the cost of capital.

Targeted Market Expansion

Falabella is strategically expanding its reach in 2025, with planned investments targeting new store openings and the revitalization of existing shopping centers. Key high-potential markets for this expansion include Chile, Peru, and Mexico. This initiative aims to capture growing consumer demand in these regions.

The company is specifically focusing on the growth of certain formats to leverage regional economic trends. For instance, the expansion of Sodimac in Mexico and Tottus in Peru is designed to solidify Falabella's leadership in segments experiencing robust demand. This targeted approach allows them to capitalize on specific market opportunities.

- Strategic Openings: Falabella plans new store openings and shopping center transformations in Chile, Peru, and Mexico for 2025.

- Format Focus: Expansion efforts prioritize Sodimac in Mexico and Tottus in Peru.

- Market Capitalization: These moves aim to leverage regional growth and consolidate leadership in high-demand segments.

Falabella can leverage the rapidly growing Latin American e-commerce market, projected to exceed $150 billion in sales by 2023 and continue its upward trajectory through 2025. This digital expansion, coupled with social commerce trends, allows for increased customer acquisition and retention. By enhancing its omnichannel strategy, integrating online and physical store experiences, Falabella can offer greater convenience and personalization, meeting evolving consumer expectations in 2024 and beyond.

Threats

A significant economic downturn or persistent high inflation across Latin America presents a substantial threat to Falabella. For instance, as of early 2024, several key markets like Chile and Peru have experienced elevated inflation rates, impacting consumer confidence and disposable income. This can directly translate to lower sales volumes for Falabella's diverse retail offerings.

Currency devaluations in these operating regions further exacerbate the situation, increasing the cost of imported goods and potentially impacting profit margins when repatriating earnings. For example, a weakening Chilean peso against the US dollar in late 2023 made imported inventory more expensive for retailers. This also strains Falabella's credit portfolio, as economic hardship can lead to higher default rates on consumer credit, a significant part of its business model.

Falabella faces a significant threat from specialized local retailers and nimble digital-native companies across Latin America, intensifying competition in both retail and financial services. This surge of agile competitors, including global e-commerce giants, is driving price wars and eroding profit margins, making it harder for Falabella to maintain its market share. For instance, the e-commerce penetration in Latin America reached approximately 10% in 2023, a figure expected to grow, with digital players often possessing lower overheads and greater flexibility.

Falabella is exposed to the risk of unfavorable regulatory shifts impacting its financial services, consumer protection standards, and tax structures across its various operating regions. For instance, potential changes in lending regulations or data privacy laws in Chile or Peru could directly affect its banking and fintech operations. The company's extensive presence means it must continually adapt to evolving legal frameworks in each country.

Cybersecurity Risks

Falabella’s extensive reliance on digital platforms for both its retail operations and financial services, such as its credit card offerings, exposes it to significant cybersecurity risks. The increasing sophistication of cyber-attacks, including ransomware and phishing attempts, poses a constant threat to its systems and customer data.

A successful cyber-attack or data breach could result in substantial financial losses due to remediation costs, regulatory fines, and potential lawsuits. For instance, the average cost of a data breach in Latin America reached $3.39 million in 2023, according to IBM's Cost of a Data Breach Report. Such incidents also carry the severe risk of reputational damage, leading to a significant erosion of customer trust, which is paramount in the retail and financial sectors.

- Vulnerability to Sophisticated Cyber-Attacks: Falabella’s digital infrastructure is a prime target for advanced cyber threats.

- Financial and Reputational Impact: Data breaches can lead to millions in losses and severely damage customer confidence.

- Ensuring System Integrity: Continuous investment in robust security measures is crucial to protect sensitive customer information and maintain operational continuity.

Supply Chain Disruptions and Rising Costs

Global and regional supply chain vulnerabilities remain a significant concern for Falabella. For instance, the ongoing geopolitical tensions and shipping container shortages experienced throughout 2024 continued to inflate freight costs, with some reports indicating a 20-30% increase in certain routes compared to pre-pandemic levels. These disruptions directly impact Falabella's ability to maintain optimal inventory levels and can force price adjustments, affecting consumer purchasing power.

Rising logistics and raw material costs present a continuous threat to Falabella's operational efficiency and profitability. The price of key commodities used in manufacturing apparel and home goods, such as cotton and plastics, saw fluctuations in late 2024 and early 2025, with some raw material prices increasing by as much as 15% year-over-year. This directly impacts Falabella's cost of goods sold and necessitates careful management of pricing strategies across its various retail formats.

- Supply Chain Volatility: Continued disruptions in global shipping and logistics, as seen in 2024, can lead to extended lead times for inventory.

- Increased Input Costs: Rising prices for raw materials and transportation in 2024-2025 directly affect Falabella's cost of goods sold.

- Inventory Management Challenges: Shortages and delays can result in missed sales opportunities and increased holding costs for available stock.

- Pricing Pressures: The need to absorb or pass on higher costs can impact Falabella's competitive pricing and profit margins.

Intensified competition from both local specialists and global digital players poses a significant threat, as these agile entities often have lower overheads and can engage in aggressive pricing. For instance, e-commerce penetration in Latin America continued its upward trend in 2024, with digital-native companies capturing market share and challenging Falabella's established presence.

Economic instability, including high inflation and currency devaluations across key Latin American markets, directly impacts consumer spending power and increases operational costs for Falabella. For example, persistent inflation in countries like Argentina and Peru in early 2024 eroded consumer purchasing power, while currency fluctuations made imported goods more expensive.

Falabella faces considerable risk from evolving regulatory landscapes and the ever-present threat of sophisticated cyber-attacks on its extensive digital platforms. Regulatory changes in financial services could impact its banking operations, and a data breach, which cost an average of $3.39 million in Latin America in 2023, could lead to severe financial and reputational damage.

Supply chain disruptions and rising logistics costs remain a persistent threat, as seen with increased freight costs in 2024 due to geopolitical tensions. Furthermore, fluctuations in raw material prices, with some increasing by up to 15% year-over-year in early 2025, directly impact Falabella's cost of goods sold and necessitate careful pricing strategies.

| Threat Category | Specific Risk | Impact on Falabella | Example Data (2023-2025) |

|---|---|---|---|

| Competition | Digital-Native Challengers | Market share erosion, price wars | E-commerce penetration ~10% in LatAm (2023), growing |

| Economic Factors | Inflation/Devaluation | Reduced consumer spending, increased import costs | Elevated inflation in Chile/Peru (early 2024), currency weakening (late 2023) |

| Operational Risks | Cybersecurity Breach | Financial loss, reputational damage | Average data breach cost in LatAm: $3.39M (2023) |

| Supply Chain | Logistics Costs/Raw Materials | Higher COGS, inventory issues | Freight costs up 20-30% (2024), raw material prices up ~15% (early 2025) |

SWOT Analysis Data Sources

This Falabella SWOT analysis is built on a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the retail and financial services sectors.