Falabella Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

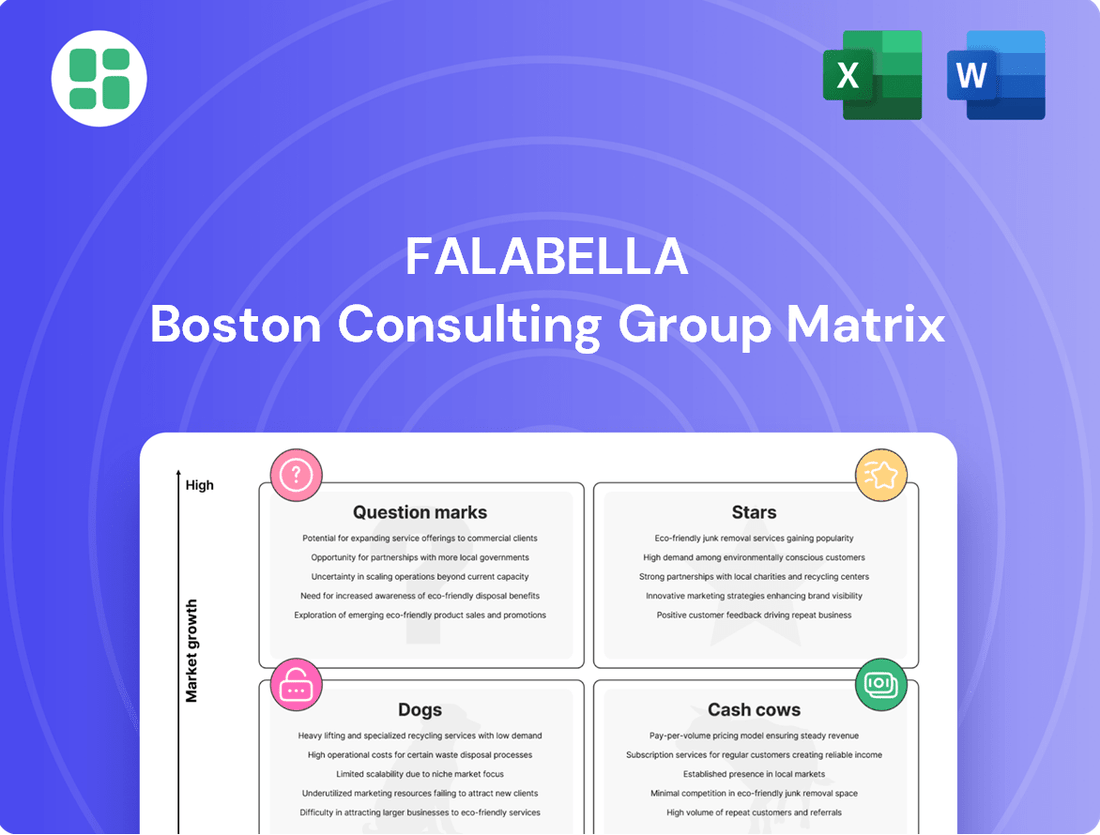

Curious about which products are fueling growth and which might be holding your business back? Our Falabella BCG Matrix preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the complete picture and gain actionable insights by purchasing the full Falabella BCG Matrix. This comprehensive report provides detailed quadrant analysis and data-driven recommendations to optimize your portfolio and drive strategic decision-making.

Don't miss out on the opportunity to understand Falabella's market performance at a deeper level. Invest in the full BCG Matrix today and equip yourself with the knowledge to navigate the competitive landscape with confidence.

Stars

Falabella.com, the company's e-commerce marketplace, is a significant growth driver. Its Gross Merchandise Volume (GMV) has seen substantial increases, fueled by a robust network of third-party sellers. This expansion highlights the platform's success in attracting and retaining sellers, contributing to its overall market presence.

This digital channel is a cornerstone of Falabella's omnichannel approach, demonstrating strong momentum and a clear commitment to digital evolution. The marketplace's performance is indicative of its ability to adapt to changing consumer behaviors and leverage technology for competitive advantage.

Falabella's strategic investments in technology and logistics infrastructure are crucial for its expansion. These investments are designed to enhance customer experience and operational efficiency, positioning Falabella.com to capitalize on the booming Latin American e-commerce sector, which is projected to continue its upward trajectory.

Banco Falabella is making substantial strides in its digital banking services, evident in its aggressive expansion of digital card and checking account openings, which saw considerable year-over-year growth in 2024. This digital focus is a cornerstone of their strategy to capture a larger share of the burgeoning fintech market in Latin America.

The bank's strategic roadmap includes a diversification of its product suite and a planned entry into new markets, with Mexico being a key target, pending regulatory approvals. This expansion into Mexico, a significant market, is anticipated to further bolster Banco Falabella's digital growth trajectory.

This intensified investment in digital financial services is directly aligning Banco Falabella with the high-growth fintech sector, positioning these digital offerings as a primary engine for the company's future expansion and revenue generation.

Sodimac, Falabella's home improvement division, is demonstrating significant growth potential in Mexico, with plans for new store openings and a strategic focus on market expansion. This push into Mexico is particularly noteworthy as the construction sector in Chile faces some headwinds.

The company's deliberate expansion into Mexico positions Sodimac as a rising star within the Falabella portfolio. In 2023, Falabella reported that its Home Improvement segment, primarily Sodimac, saw a 4.8% increase in sales, with Mexico being a key contributor to this growth.

Mallplaza's Expansion and Modernization

Mallplaza, Falabella's significant presence in the shopping center sector, is strategically expanding and modernizing its portfolio. This involves both enhancing existing brownfield sites through renovations and expansions, and pursuing new acquisitions, with a particular emphasis on strengthening its foothold in Peru. These initiatives are geared towards transforming traditional malls into vibrant urban lifestyle centers, thereby aiming to boost customer engagement and revenue generation.

The company's approach to developing malls into comprehensive lifestyle hubs, complete with a wider array of services, signals a robust growth trajectory for its real estate division. This strategy is designed to attract more visitors and improve overall profitability. For instance, in 2023, Mallplaza reported significant investment in renovations and expansions across its Latin American properties, contributing to a notable increase in visitor numbers and sales per square meter in key locations.

- Focus on Brownfield Projects: Mallplaza is actively investing in remodeling and expanding its current mall properties to enhance their appeal and functionality.

- Strategic Acquisitions: The company is pursuing new acquisitions, particularly to consolidate its market position in Peru, indicating a targeted growth strategy.

- Urban Lifestyle Hub Transformation: There's a clear emphasis on evolving malls into integrated urban lifestyle destinations, broadening their service offerings beyond traditional retail.

- Financial Performance Impact: These expansion and modernization efforts are aimed at increasing foot traffic and boosting profitability, with 2023 data showing positive trends in sales per square meter in upgraded locations.

Tottus Supermarkets in Peru

Tottus, Falabella's supermarket division, is a shining example of a star in the BCG matrix, particularly within the Peruvian market. The company has been actively pursuing expansion, with plans to open new stores throughout Peru to capture a larger share of the consumer market. This strategic growth is crucial, as Peru represents a significant contributor to Falabella's overall financial health, impacting both its regional revenue and EBITDA figures.

The consistent upward trajectory of Tottus in Peru underscores its star status. For instance, in 2023, Falabella reported that its Chilean operations, which include supermarkets, generated 39.6% of its total revenue, with Peru being a substantial part of this. Tottus's focus on market penetration and customer acquisition in this key territory solidifies its position as a high-growth, high-market-share entity within the supermarket sector.

- Strong Performance: Tottus continues to show robust sales growth in Peru.

- Expansion Strategy: New store openings are a key part of Tottus's plan to increase its footprint.

- Market Significance: Peru is a vital market for Falabella, contributing significantly to its financial results.

- Star Classification: Tottus's consistent growth and market leadership in Peru justify its star rating.

Tottus, Falabella's supermarket division, is a prime example of a Star in the BCG matrix, particularly within the Peruvian market. The company has been actively pursuing expansion, with plans to open new stores throughout Peru to capture a larger share of the consumer market. This strategic growth is crucial, as Peru represents a significant contributor to Falabella's overall financial health, impacting both its regional revenue and EBITDA figures.

The consistent upward trajectory of Tottus in Peru solidifies its star status. For instance, in 2023, Falabella reported that its Chilean operations, which include supermarkets, generated 39.6% of its total revenue, with Peru being a substantial part of this. Tottus's focus on market penetration and customer acquisition in this key territory positions it as a high-growth, high-market-share entity within the supermarket sector.

Tottus's strong performance in Peru, characterized by robust sales growth and strategic new store openings, underscores its star classification. The supermarket chain's significant contribution to Falabella's overall financial results, especially within the vital Peruvian market, confirms its status as a key driver of the company's success.

| Business Unit | BCG Category | Key Market | 2023 Revenue Contribution (Segment) | Growth Driver |

| Tottus (Supermarkets) | Star | Peru | Substantial portion of Chile's 39.6% total revenue | Market penetration, new store openings, customer acquisition |

What is included in the product

The Falabella BCG Matrix analyzes its business units based on market share and growth, guiding investment and divestment strategies.

The Falabella BCG Matrix offers a clear, visual representation of your product portfolio, alleviating the pain of strategic uncertainty by identifying areas for investment or divestment.

Cash Cows

Falabella Retail's department stores in Chile are a classic Cash Cow. They hold a substantial market share in a mature sector, consistently generating robust revenue and showing stable financial health.

In 2024, these Chilean department stores have been a significant driver of Falabella's overall performance. Despite ongoing economic adjustments, they've reported impressive same-store sales growth, a testament to their enduring customer loyalty and operational effectiveness.

The CMR credit card, operated by Promotora CMR, is a cornerstone of Falabella's financial services, consistently generating significant cash flow. In 2024, Falabella reported that its financial services division, heavily influenced by CMR credit cards, contributed substantially to overall revenue, with active customer numbers remaining robust, exceeding 6 million across its operations.

This business unit benefits from a high volume of digital transactions, a trend that accelerated in recent years and continues to drive efficiency and profitability. The focus remains on nurturing customer loyalty through its established programs and leveraging this deep engagement to ensure a steady and predictable revenue stream for Falabella.

Sodimac in Chile, a key component of Falabella's portfolio, stands as a robust Cash Cow. Despite some headwinds in the broader construction industry, its operations are characterized by a dominant market share and significant cash generation.

The company is actively pursuing operational efficiencies to solidify its leadership in the home improvement sector. This focus ensures its continued contribution to Falabella's overall profitability.

In 2024, Sodimac Chile demonstrated resilience, with its home improvement segment consistently delivering strong performance. For instance, its sales in the first half of 2024 remained a significant contributor to Falabella's retail division, underscoring its mature and reliable cash-generating capabilities.

Mallplaza's Established Shopping Centers in Chile

Mallplaza's established shopping centers in Chile represent mature, cash-generating assets within the Falabella portfolio. These prime locations consistently attract high foot traffic, translating into reliable rental income and a steady cash flow. In 2024, these centers continue to be the bedrock of Mallplaza's revenue generation.

- Stable Revenue Streams: These Chilean malls are known for their consistent rental income, contributing significantly to Falabella's overall financial health.

- Market Dominance: Their established presence and prime locations give them a competitive edge, ensuring sustained customer engagement.

- Focus on Monetization: Future investments are geared towards enhancing existing infrastructure and optimizing the physical retail experience rather than rapid expansion.

Falabella's Omnichannel Logistics Network

Falabella's robust omnichannel logistics network is a prime example of a cash cow within its BCG Matrix. This established infrastructure is key to efficiently fulfilling orders and achieving a high percentage of fast deliveries, directly translating into reduced operational costs and boosted customer satisfaction.

This mature logistical capability underpins all of Falabella's retail segments, ensuring cost-effective operations across the board. In 2023, Falabella reported a significant portion of its sales originating from its online channels, underscoring the critical role of its logistics in supporting this growth. The network's ability to optimize inventory management and delivery speed directly contributes to the company's overall profitability.

- Established Logistics Infrastructure: Falabella's extensive network of distribution centers and last-mile delivery capabilities are a significant asset.

- High Percentage of Fast Deliveries: The company prioritizes speed in order fulfillment, a key driver of customer loyalty and repeat business.

- Operational Efficiency: Optimized inventory management and streamlined delivery processes reduce waste and lower operational costs.

- Support for All Retail Segments: The logistics network effectively serves both online and in-store sales, creating a seamless customer experience.

Falabella's department stores in Chile are a classic Cash Cow, holding substantial market share in a mature sector and consistently generating robust revenue. In 2024, these stores reported impressive same-store sales growth, highlighting enduring customer loyalty. The CMR credit card, a cornerstone of Falabella's financial services, also consistently generates significant cash flow, with active customer numbers remaining robust in 2024.

| Business Unit | Market Position | Cash Flow Generation | 2024 Performance Highlight |

| Chilean Department Stores | High Market Share, Mature Sector | Strong & Stable | Impressive same-store sales growth |

| Promotora CMR (Credit Cards) | Dominant in Financial Services | Significant & Consistent | Substantial contribution to financial services revenue |

What You See Is What You Get

Falabella BCG Matrix

The Falabella BCG Matrix preview you're seeing is the complete, unwatermarked document you will receive upon purchase. This means you're getting the exact strategic analysis, ready for immediate application in your business planning. No surprises, just a professionally formatted report designed to provide clear insights into Falabella's product portfolio.

Dogs

Some traditional department stores, especially those in regions experiencing reduced customer visits or facing stiff competition, are showing signs of underperformance. For instance, in 2024, several department store chains reported declining same-store sales in their non-metropolitan locations, with some areas seeing drops of over 5% year-over-year.

These specific locations often exhibit low growth potential and a shrinking market share, necessitating a thorough review of their operational strategies or even consideration for divestment. In 2023, a significant number of these underperforming stores contributed to a disproportionate amount of operating expenses for major retailers, acting as cash traps.

Certain real estate assets within Falabella's portfolio might be classified as dogs if they don't directly contribute to the company's core retail operations or are situated in less dynamic markets. These could represent properties with a low market share in slow-growing real estate sectors, effectively immobilizing capital without yielding substantial returns.

Falabella's strategic initiatives, particularly its focus on consolidating and optimizing its real estate footprint, indicate a potential divestment from these non-strategic holdings. For instance, reports from late 2023 and early 2024 highlighted Falabella's ongoing efforts to streamline its physical store network, which could include shedding underperforming or extraneous property assets.

Falabella's legacy IT systems and infrastructure can be viewed as a 'Dog' in the BCG matrix. These systems, while functional, are often outdated and inefficient, requiring substantial ongoing maintenance costs. For instance, in 2024, many retailers reported that up to 70% of their IT budget was allocated to maintaining legacy systems, leaving less for innovation.

These legacy systems may not offer significant returns on investment in terms of enabling new digital capabilities or providing a competitive edge. Falabella's commitment to digital transformation means that continued reliance on older IT infrastructure could divert crucial resources away from growth initiatives, hindering agility and future development.

Small, Niche Retail Formats with Limited Scalability

Within Falabella's diverse retail landscape, certain small, niche formats might be categorized as dogs if they exhibit limited market traction and operate within low-growth segments. These specialized ventures, by their very nature, often face challenges in achieving economies of scale, which can directly impact their profitability and competitive positioning. For instance, a small, highly specialized home decor boutique that Falabella might operate, catering to a very specific aesthetic, could fall into this category if its sales growth has been stagnant and its market share remains minimal.

Such formats can struggle to generate sufficient revenue to cover operational costs and justify further investment, especially when compared to Falabella's more dominant brands. Their inherent lack of scalability means that expanding their reach or increasing their efficiency is often difficult and costly. In 2023, for example, retail segments with less than 2% annual growth were generally considered mature or declining, making it challenging for niche players to thrive without significant differentiation or a strong value proposition.

These underperforming formats present strategic dilemmas for Falabella. They may require significant capital infusion to revitalize or could be candidates for divestiture to free up resources for more promising ventures. The decision often hinges on a detailed analysis of their potential for turnaround versus the opportunity cost of retaining them.

- Limited Market Share: Formats with a market share below 5% in their specific niche, especially if that niche is experiencing slow growth.

- Low Revenue Growth: Exhibits an annual revenue growth rate below the inflation rate or the overall market average. For example, if the average retail sales growth in a particular region was 4% in 2024, a dog format might be growing at less than 2%.

- Profitability Concerns: Consistent operating losses or a profit margin significantly lower than the company's average, indicating an inability to achieve cost efficiencies.

- Lack of Scalability: Business models that cannot easily expand their customer base or operational footprint without disproportionately high costs.

Certain Less Profitable International Ventures

Falabella's ventures in certain less profitable international markets, particularly those with limited market share or facing strong local competition, would likely be classified as Dogs within the BCG Matrix. These operations often generate low returns and demand significant investment for minimal growth potential.

For instance, Falabella's presence in markets like Peru, while historically important, has seen increased competition affecting profitability. In 2023, while the company reported overall growth, specific regional performance can be mixed, with some international segments requiring careful management due to lower profitability compared to core markets like Chile.

- Low Market Share: Operations in smaller Latin American countries might struggle to achieve the dominant market share seen in Chile or Peru.

- Intense Local Competition: Emerging or established local retailers can pose a significant threat, limiting Falabella's ability to capture substantial market share.

- Disproportionate Investment: These ventures may require substantial capital for marketing, logistics, and inventory, yielding returns that do not justify the outlay.

- Limited Growth Prospects: The overall economic conditions or market saturation in these specific international locations may present very constrained opportunities for future expansion or increased profitability.

Falabella's "Dogs" represent business units or assets with low market share in low-growth industries. These often require significant investment to maintain but yield minimal returns, acting as cash drains. For example, certain underperforming physical store locations, especially those in non-metropolitan areas, can be classified as dogs if they show declining sales and low growth potential.

These units consume resources without contributing substantially to overall profitability or growth. In 2024, reports indicated that some legacy IT systems, while operational, were consuming a large portion of IT budgets for maintenance, diverting funds from innovation and digital transformation efforts.

Similarly, small, niche retail formats that have failed to gain significant market traction or demonstrate robust revenue growth can also be categorized as dogs. These ventures often struggle with economies of scale and may present profitability concerns, making them candidates for divestment or strategic overhaul.

Falabella's ventures in less profitable international markets with intense local competition and limited growth prospects also fit the dog classification. These operations may require disproportionate investment for meager returns, highlighting the need for careful portfolio management and strategic pruning of underperforming assets.

| Business Unit/Asset Type | Market Share | Industry Growth Rate | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Underperforming Physical Stores (Non-Metropolitan) | Low (<5%) | Low (<2% annually) | Low/Negative | Divestment or Optimization |

| Legacy IT Systems | N/A (Internal) | N/A (Internal) | High Maintenance Costs, Low ROI | Modernization or Replacement |

| Niche Retail Formats | Low (<5% in niche) | Low (<3% annually) | Low/Stagnant | Revitalization or Divestment |

| Certain International Operations | Low (<10% in market) | Low (<4% annually) | Low/Volatile | Strategic Review or Exit |

Question Marks

Falabella's recent launch of IKEA stores in Colombia positions them within the home furnishings sector, a segment with considerable growth potential. These new ventures are characteristic of Question Marks in the BCG matrix, requiring significant investment to capture market share in a rapidly expanding industry.

As of early 2024, the Colombian home furnishings market is showing robust expansion, with projections indicating continued growth driven by urbanization and rising disposable incomes. Falabella's strategic move with IKEA aims to capitalize on this trend, though initial market penetration is expected to be low, necessitating ongoing capital infusion to foster development.

Falabella's e-commerce marketplace, while a strong performer, faces a question mark with the acceleration of its third-party seller growth. This segment shows promising potential, evidenced by a 10% year-over-year increase in Gross Merchandise Volume (GMV) in 2024.

However, its future market share and profitability hinge on sustained investment. Falabella must continue to focus on onboarding new sellers, providing robust support, and optimizing its platform to effectively challenge established e-commerce giants.

Banco Falabella's strategic move to diversify its digital product offerings in Mexico, including pursuing authorization to operate as a SOFIPO (Sociedad Financiera Popular), places it squarely in the question mark quadrant of the BCG matrix. This initiative targets a high-growth market for financial services, a sector experiencing significant digital adoption in Mexico.

While Mexico's fintech landscape is booming, with projections indicating continued expansion in digital payments and lending throughout 2024 and beyond, Falabella's current market penetration in these nascent digital product categories is likely minimal. For instance, the digital banking sector in Mexico saw a substantial increase in user adoption, with reports suggesting over 70% of the adult population engaged with digital financial services by late 2023, a figure expected to climb. This necessitates substantial investment to build brand awareness, develop robust digital infrastructure, and acquire customers in a competitive environment.

New Store Formats or Pilot Projects

Falabella's exploration of new store formats or pilot projects places them firmly in the question mark category of the BCG matrix. These initiatives, such as their recent focus on smaller, more digitally integrated formats in urban centers, represent investments in potentially high-growth areas. For instance, in 2024, Falabella has been actively testing smaller footprint stores designed for click-and-collect and localized inventory, aiming to capture evolving consumer shopping habits. These ventures require substantial capital for development and market testing, with their future success as stars yet to be determined.

The success of these pilot programs hinges on their ability to gain traction in nascent but promising market segments. Falabella's strategy involves closely monitoring key performance indicators like customer acquisition cost, conversion rates, and average transaction value within these new formats. By mid-2024, early data from some of these urban pilots indicated a promising, albeit still developing, customer uptake, particularly among younger demographics seeking convenience and omnichannel experiences.

- Testing smaller, digitally-enabled store formats in urban areas.

- Focus on capturing evolving consumer shopping habits and omnichannel integration.

- Significant capital investment required for development and market validation.

- Early 2024 data shows promising, though developing, customer adoption in pilot locations.

Integration of AI Tools for Customer Service and Productivity

Falabella's integration of AI tools for customer service and productivity is a significant investment in a high-growth area, aiming to boost efficiency and customer satisfaction. While the direct impact on market share is still developing, these advancements position Falabella for future competitive advantages. For instance, in 2024, many retail companies reported substantial improvements in response times and resolution rates after implementing AI-powered chatbots and virtual assistants, with some seeing up to a 30% reduction in customer wait times.

- AI-driven customer service enhancements

- Productivity gains for staff

- Indirect impact on current market share

- Strategic investment for future differentiation

Falabella's expansion into new markets, like the introduction of IKEA stores in Colombia, represents a classic question mark. These ventures demand substantial investment to gain traction in potentially high-growth sectors, but their future success as market leaders remains uncertain. Early 2024 data shows the Colombian home furnishings market is expanding, with Falabella aiming to capture a share through these new IKEA outlets.

The company's burgeoning e-commerce marketplace, despite a 10% year-over-year GMV increase in 2024, also fits the question mark profile. Continued investment is critical to onboard more sellers and enhance the platform to compete effectively against established players. Similarly, Banco Falabella's push into digital financial services in Mexico, including seeking SOFIPO authorization, requires significant capital to build brand awareness and customer base in a rapidly growing fintech landscape.

Falabella's strategic exploration of smaller, digitally integrated store formats in urban areas in 2024 also falls into the question mark category. These pilot programs, designed to adapt to changing consumer habits, necessitate considerable investment for development and market testing, with early 2024 data indicating promising, though nascent, customer adoption.

The integration of AI tools for customer service and productivity is another significant investment in a high-growth area. While not directly impacting current market share, these advancements, which have shown up to a 30% reduction in customer wait times in other retail contexts during 2024, are strategic for future differentiation and competitive advantage.

| Initiative | Market Context (Early 2024) | Investment Need | Potential Outcome | Key Metric Example |

|---|---|---|---|---|

| IKEA Colombia Launch | Expanding home furnishings market | High | Market Leader (Star) or Divestment (Dog) | Market Share Growth |

| E-commerce Marketplace Growth | Competitive online retail | Sustained | Dominant Player (Star) or Stagnation (Cash Cow/Dog) | Gross Merchandise Volume (GMV) increase (10% YoY in 2024) |

| Digital Financial Services (Mexico) | Booming fintech sector | Substantial | Leading Digital Bank (Star) or Niche Player (Cash Cow) | Digital Service Adoption Rate |

| New Store Formats (Urban) | Evolving consumer shopping habits | Significant Capital for Testing | Successful New Channels (Star) or Unsuccessful Pilots (Dog) | Customer Acquisition Cost in Pilots |

| AI Integration | Technological advancement in retail | Ongoing | Enhanced Efficiency & Customer Loyalty (Star) or Lagging Competitor (Dog) | Customer Wait Time Reduction (up to 30% reported in industry in 2024) |

BCG Matrix Data Sources

Our Falabella BCG Matrix leverages internal sales data, market share reports, and competitor analysis to accurately position each business unit.