Falabella Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

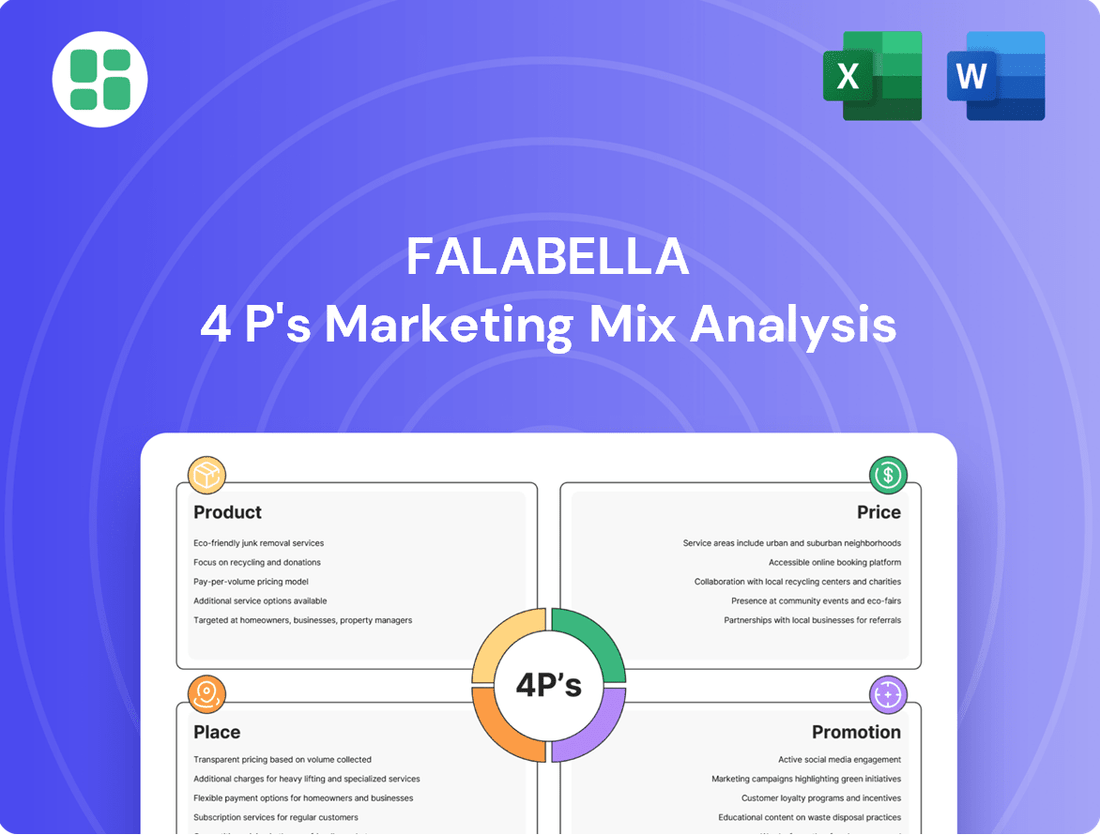

Falabella's marketing mix is a masterclass in retail strategy, blending diverse product offerings with competitive pricing and widespread accessibility. Their promotional efforts consistently reinforce brand loyalty and reach a broad customer base.

Dive deeper into the intricacies of Falabella's product assortment, pricing architecture, distribution channels, and promotional campaigns. This comprehensive analysis is your key to understanding their market dominance and unlocking actionable insights for your own business.

Gain instant access to a professionally crafted, editable 4Ps Marketing Mix analysis for Falabella. Save valuable time and elevate your strategic planning with this in-depth, ready-to-use resource.

Product

Falabella's diverse retail and service portfolio is a cornerstone of its marketing strategy. Through Falabella Retail, it offers a wide array of fashion, beauty, electronics, and home decor items. This broad product selection caters to numerous consumer preferences and lifestyle needs across Latin America.

Further expanding its reach, Falabella operates Sodimac, a leading provider of home improvement products, and Tottus, a supermarket chain offering essential grocery items. This multi-format approach ensures Falabella captures a significant share of household spending.

Complementing its retail offerings, Banco Falabella provides comprehensive financial services, including banking and credit cards. This integration of financial services enhances customer loyalty and offers a one-stop solution for consumers. In 2024, Falabella continued to leverage this diversified model, aiming to strengthen its market position by meeting a wide spectrum of customer needs.

Falabella's commitment to omnichannel integration is a cornerstone of its marketing strategy. The company ensures products are readily available across its physical stores and digital touchpoints, such as falabella.com. This unified approach aims to create a fluid customer journey, bridging the gap between online browsing and in-store purchasing.

The integration extends to its various brands, including Falabella, Sodimac, and Tottus, on a central platform. While specialized sites cater to specific needs like home improvement or groceries, the overarching goal is a consistent and convenient shopping experience. This strategy is crucial in the evolving retail landscape, where customer expectations demand seamless channel transitions.

In 2024, Falabella continued to invest in its digital infrastructure to support this omnichannel vision. While specific figures for omnichannel integration spending are not publicly detailed, the company's overall digital transformation efforts, which saw significant capital allocation in prior years, directly bolster this capability. This focus is vital for maintaining market share against increasingly digital-native competitors.

Falabella's third-party marketplace is a key growth driver, significantly boosting its Gross Merchandise Volume (GMV). This expansion strategy allows the company to curate a vast selection of products by partnering with over 450 brands and more than 20,000 sellers.

This approach not only broadens the available product assortment but also ensures customers have access to a wider array of quality goods. By leveraging these external partnerships, Falabella enhances customer choice and drives growth through a more diverse and appealing offering.

Private Label and Exclusive Brands

Falabella enhances its product assortment with a robust collection of 74 exclusive brands and 45 private label brands, primarily within its Falabella Retail division. This strategic approach allows the company to stand out from competitors by offering unique products tailored to distinct customer tastes.

These proprietary brands are crucial for building customer loyalty and increasing the perceived value of Falabella's offerings. For instance, in 2023, private label sales across the retail sector often represent a significant portion of a company's revenue, sometimes exceeding 20% for well-established programs, directly contributing to higher profit margins due to controlled production costs.

The development and promotion of these private and exclusive brands are key components of Falabella's 'Product' strategy within the 4Ps. This focus fosters a sense of ownership and exclusivity, encouraging repeat purchases and strengthening the overall brand ecosystem.

- Brand Portfolio: 74 exclusive brands and 45 private label brands.

- Strategic Importance: Differentiates Falabella from competitors and meets specific customer needs.

- Customer Impact: Builds loyalty and enhances perceived value.

- Financial Contribution: Private labels often yield higher margins and significant revenue contribution.

Financial Innovation

Falabella is significantly innovating its financial services, particularly through Banco Falabella's expansion into Mexico. This move goes beyond traditional retail by introducing a broader suite of financial products.

The company is actively exploring new offerings such as debit accounts, savings solutions, and investment products. This diversification strategy aims to capture a larger market share and build new revenue streams, moving beyond its core credit card business.

This expansion is particularly strategic in markets like Mexico, which exhibit low banking penetration rates. By offering accessible financial tools, Falabella aims to tap into this underserved market.

- Product Expansion: Moving beyond credit cards to debit, savings, and investment products.

- Geographic Focus: Significant expansion efforts are underway in Mexico.

- Market Opportunity: Targeting markets with low banking penetration.

- Revenue Diversification: Aiming to build new income streams beyond retail.

Falabella's product strategy is characterized by its extensive and diversified brand portfolio, encompassing both exclusive and private label brands. This approach is central to differentiating itself in competitive markets and catering to specific consumer preferences.

The company boasts 74 exclusive brands and 45 private label brands, primarily within its Falabella Retail division. These proprietary offerings are designed to foster customer loyalty and enhance the perceived value of its merchandise, often contributing to higher profit margins due to controlled production costs.

Furthermore, Falabella is actively expanding its financial product offerings through Banco Falabella, notably with its entry into Mexico. This strategic move includes the introduction of debit accounts, savings solutions, and investment products, aiming to tap into markets with lower banking penetration and diversify revenue streams beyond its traditional retail operations.

| Brand Type | Number of Brands | Strategic Role | Customer Benefit |

|---|---|---|---|

| Exclusive Brands | 74 | Differentiation, unique offerings | Access to distinct styles and products |

| Private Label Brands | 45 | Margin enhancement, loyalty building | Value for money, consistent quality |

| Financial Services (New) | Expanding portfolio (e.g., debit, savings) | Revenue diversification, market penetration | Comprehensive financial solutions |

What is included in the product

This analysis provides a comprehensive breakdown of Falabella's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples.

It's designed for professionals seeking to understand Falabella's market positioning and competitive advantages, offering actionable insights for strategic planning.

Simplifies the complex Falabella 4P's marketing mix into actionable insights, alleviating the pain of overwhelming data for faster strategic decision-making.

Place

Falabella's extensive physical store network is a cornerstone of its marketing mix, boasting over 535 stores and 47 shopping centers across seven Latin American countries. This significant footprint, covering markets like Chile, Peru, Colombia, and Mexico, ensures broad customer reach and accessibility.

The company is actively investing in this physical infrastructure, with plans to open 15 new stores in 2025. These expansions and modernizations underscore a commitment to maintaining and enhancing its physical presence as a key differentiator.

Falabella's digital presence, anchored by falabella.com, acts as a nexus for its extensive product range, with dedicated e-commerce sites for Sodimac and Tottus further broadening online accessibility. These robust platforms are fundamental to Falabella's omnichannel approach, ensuring customers can easily discover and purchase a vast array of goods. In 2024, Falabella reported significant growth in its digital sales, which now represent a substantial portion of its overall revenue, underscoring the critical role these platforms play in its market strategy and customer engagement.

Falabella excels in integrated omnichannel distribution, blending its physical stores with robust online capabilities for a smooth customer experience. A significant portion, over 50%, of their online sales are fulfilled through the popular 'Click & Collect' service, demonstrating strong customer adoption of this hybrid model.

The company prioritizes efficient logistics, with a target of delivering 60% of online orders within a swift 48-hour timeframe. This focus on speed and convenience across all touchpoints is central to their marketing strategy.

Strategic Distribution Center Investments

Falabella's strategic distribution center investments are a cornerstone of its 'Place' strategy, directly impacting its ability to fulfill customer orders efficiently. The company is channeling significant capital into modernizing its logistics network, with a notable focus on Colombia.

These investments are critical for enhancing inventory management and ensuring prompt delivery, which are key differentiators in the competitive retail landscape. By optimizing its distribution capabilities, Falabella aims to reduce lead times and improve the overall customer experience.

- $38 million allocated in 2024 for logistics infrastructure upgrades.

- $650 million planned investment for 2025, underscoring a long-term commitment to supply chain enhancement.

- Colombia identified as a key region for these strategic distribution center expansions and capacity optimizations.

- Improved efficiency in inventory management and timely product delivery across its operational footprint.

Mallplaza as Urban Lifestyle Hubs

Mallplaza, Falabella's real estate division, is actively repositioning its shopping centers beyond traditional retail spaces to become vibrant urban lifestyle hubs. This strategic pivot is designed to enrich the customer journey within physical stores, thereby driving higher footfall and establishing these locations as central points for community engagement and diverse consumer activities.

This evolution involves a significant expansion of service offerings and the modernization of existing facilities. For instance, by late 2024, Mallplaza was expected to have completed renovations and expansions across several key locations, integrating more experiential elements such as co-working spaces, enhanced food and beverage zones, and entertainment options to cater to evolving consumer demands.

- Increased Experiential Offerings: Mallplaza is integrating services like co-working spaces and advanced entertainment zones to boost dwell time and customer engagement.

- Foot Traffic Growth Targets: The strategy aims to see a 10-15% increase in average daily foot traffic in modernized malls by the end of 2025.

- Investment in Modernization: Significant capital investments, projected at over $50 million for 2024-2025, are being allocated to upgrade infrastructure and amenities across its portfolio.

- Diversification of Revenue Streams: Beyond retail rent, Mallplaza is exploring revenue from services, events, and non-traditional retail partnerships.

Falabella's 'Place' strategy is a multi-faceted approach, leveraging both its extensive physical retail network and its growing digital infrastructure. The company's commitment to enhancing its omnichannel capabilities is evident in its strategic investments in logistics and the evolution of its shopping centers into lifestyle hubs.

| Aspect | Key Initiatives/Data | Impact/Goal |

|---|---|---|

| Physical Stores | Over 535 stores; plans for 15 new stores in 2025 | Broad customer reach and accessibility |

| E-commerce | Falabella.com, Sodimac, Tottus dedicated sites; significant digital sales growth in 2024 | Enhanced online accessibility and customer engagement |

| Omnichannel Fulfillment | Over 50% of online sales via 'Click & Collect' | Seamless customer experience, hybrid model adoption |

| Logistics Infrastructure | $38 million invested in 2024; $650 million planned for 2025 | Improved inventory management, timely delivery (target 60% within 48 hours) |

| Shopping Centers (Mallplaza) | Repositioning as lifestyle hubs; renovations by late 2024 | Increased footfall (target 10-15% growth by end of 2025), enhanced customer journey |

What You Preview Is What You Download

Falabella 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Falabella 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring you know exactly what you're getting.

Promotion

Falabella's omnichannel advertising strategy, powered by its Fmedia retail media platform, is a significant driver of growth. This integrated approach allows brands to connect with customers seamlessly across both online and in-store touchpoints.

In 2024, Fmedia demonstrated its effectiveness, with over 3,000 brands utilizing sponsored product placements. These brands experienced substantial sales uplifts, with reported increases exceeding 30%, highlighting the platform's ability to convert engagement into revenue for its partners.

Falabella leverages data-driven insights to foster deeper customer engagement, ensuring brands resonate with their target audiences. This strategic use of information allows for highly relevant promotional messaging, directly impacting sales effectiveness. For example, in 2024, companies utilizing advanced customer analytics reported an average uplift of 15% in conversion rates for targeted campaigns.

The Fmedia platform exemplifies this commitment, focusing on maximizing brand visibility and reaching the most receptive customers. By pinpointing the right audience at the opportune moment, Falabella and its brand partners can significantly boost sales performance. This precision marketing approach is crucial in today's competitive landscape, where personalized experiences drive loyalty and revenue.

Falabella's CMR Puntos loyalty program is a cornerstone of its marketing strategy, boasting over 20.6 million users. This extensive reach highlights its effectiveness in fostering customer retention and driving engagement across Falabella's broad retail and financial services ecosystem.

The program incentivizes repeat business by offering valuable benefits, encouraging customers to consolidate their spending within Falabella's various offerings. This integrated approach strengthens customer loyalty and provides a competitive edge.

Falabella is actively enhancing the CMR Puntos redemption experience, aiming to double the number of new customers utilizing their accumulated points in physical stores. This initiative is designed to further boost in-store traffic and reinforce the program's value proposition.

Digital Marketing and Brand Building

Falabella significantly ramps up its digital marketing to boost online traffic and customer interaction, channeling substantial funds into technology to fuel its e-commerce expansion. This digital push is crucial for reaching a wider audience and enhancing the customer journey.

The company strategically utilizes the strong recognition of its flagship brands, such as Falabella, Sodimac, and Tottus, to lower the cost of acquiring new customers and attract more organic visitors. This brand leverage is key to building a loyal customer base.

This integrated digital and brand-building approach is designed to yield better returns on marketing expenditures. For instance, in 2023, Falabella reported a notable increase in digital sales, contributing a significant portion to its overall revenue, underscoring the effectiveness of these investments.

- Digital Marketing Investment: Falabella's commitment to technology supports its e-commerce growth and digital engagement strategies.

- Brand Leverage: Utilizing core brands like Falabella, Sodimac, and Tottus helps reduce client acquisition costs and boost organic traffic.

- ROI Focus: The strategy aims for higher returns on marketing investment by optimizing digital channels and brand strength.

- E-commerce Growth: Digital sales showed a marked increase in 2023, highlighting the success of these initiatives.

Experiential Marketing and Physical Activations

Falabella leverages experiential marketing and physical activations to create memorable customer engagements, going beyond traditional digital advertising. In 2024, the company saw over 100,000 participants in its in-store activations, which included innovative AI-powered experiences and interactive contests.

These physical touchpoints are crucial for fostering deeper customer connections and reinforcing Falabella's brand identity in the real world. Such initiatives are particularly effective in sustaining commercial interest and driving sales momentum outside of major shopping periods.

- AI-Powered In-Store Experiences: Falabella integrates artificial intelligence to offer personalized and engaging customer interactions within its physical retail spaces.

- Interactive Contests and Events: The company hosts various in-store contests and events designed to drive foot traffic and encourage active participation.

- High Participant Engagement: In 2024, these activations successfully engaged over 100,000 individuals, demonstrating a strong resonance with the target audience.

- Sustained Commercial Momentum: Experiential marketing efforts are strategically employed to maintain sales activity and brand visibility throughout the year, not just during peak seasons.

Falabella's promotional strategy is multifaceted, encompassing a robust retail media platform (Fmedia), a large-scale loyalty program (CMR Puntos), significant digital marketing investment, and engaging experiential activations. Fmedia saw over 3,000 brands utilize sponsored placements in 2024, leading to sales uplifts exceeding 30% for those brands. The CMR Puntos program, with over 20.6 million users, is key to customer retention. In 2024, over 100,000 people participated in in-store activations, including AI-powered experiences.

| Promotional Tactic | Key Metric/Data Point | Impact/Outcome |

|---|---|---|

| Fmedia (Retail Media) | 3,000+ brands in 2024 | Sales uplifts >30% for participating brands |

| CMR Puntos Loyalty Program | 20.6 million+ users | Drives customer retention and ecosystem engagement |

| Digital Marketing | Significant investment in e-commerce | Increased digital sales contribution in 2023 |

| Experiential Marketing | 100,000+ participants in 2024 activations | Fosters deeper customer connections and brand identity |

Price

Falabella's pricing strategy centers on being competitive and value-oriented, aiming to provide a broad selection of quality goods at accessible price points. This dual focus is essential for capturing market share in Latin America, where consumers are highly sensitive to both price and product quality.

For instance, during the 2024 holiday season, Falabella reported a 10% increase in sales for its private label brands, which are often positioned at more attractive price points, demonstrating the success of its value proposition. This strategy is further supported by ongoing investments in supply chain and logistics, which enhance operational efficiencies and allow for more favorable pricing.

Falabella's strategic pricing for 2024-2025 is geared towards enhancing profitability, a key objective across all its divisions. This involves a deliberate approach to setting prices that not only reflects its market standing but also keenly considers competitor actions and fluctuating market demand.

The company is focusing on smarter inventory management and a reduction in the frequency of promotional sales. These initiatives are crucial for shoring up margins and ensuring that pricing strategies directly contribute to improved overall profitability, a trend expected to continue through 2025.

Banco Falabella is central to Falabella's pricing, offering credit cards and personal loans that influence customer purchasing power and loyalty. The company's strategic expansion, notably into Mexico, aims to broaden its financial product suite, providing customers with more competitive financing choices and a diversified portfolio of credit options.

The financial services division prioritizes growth in loan disbursements and enhanced profitability. As of the first quarter of 2024, Falabella's financial services segment reported a notable increase in its loan portfolio, contributing significantly to the overall group's revenue streams and demonstrating a clear focus on expanding credit offerings.

Dynamic Pricing in E-commerce

Falabella's extensive e-commerce presence, particularly with its marketplace model hosting numerous sellers, strongly indicates the use of dynamic pricing. This strategy allows for agile price adjustments in response to fluctuating market conditions. For instance, during peak shopping seasons like Black Friday 2024, prices could be optimized in real-time to maximize sales and revenue.

The platform's technological infrastructure is designed to manage a high volume of transactions and product listings, facilitating the sophisticated algorithms required for dynamic pricing. This enables Falabella to react swiftly to changes in consumer demand, competitor pricing, and even inventory levels across its diverse product categories.

- Competitive Environment: Thousands of sellers on Falabella's marketplace create a highly competitive landscape, driving the need for real-time price adjustments.

- Demand Responsiveness: Dynamic pricing allows Falabella to capitalize on increased demand by raising prices, and stimulate sales during slower periods by offering discounts.

- Inventory Management: Prices can be adjusted to clear excess stock or to reflect the scarcity of high-demand items, improving overall inventory turnover.

- Data-Driven Decisions: The implementation of dynamic pricing relies heavily on analyzing vast amounts of sales data, competitor pricing, and customer behavior to inform price changes.

Cost Reduction and Operational Efficiency Impact on

Falabella's commitment to cost reduction and operational efficiency significantly influences its pricing strategy and profitability. By streamlining operations and optimizing its supply chain, the company aims to offer more competitive prices to its customers. For instance, in 2023, Falabella reported efforts to improve logistics and inventory management, aiming to reduce operational expenses by a projected 5% by the end of 2024. This focus on efficiency is crucial for maintaining healthy profit margins in a competitive retail landscape.

Investments in technology are a cornerstone of Falabella's efficiency drive. These investments are designed to automate processes, enhance data analytics, and improve overall productivity across its various business units. Such advancements directly contribute to lowering the cost of goods sold and operational overhead. For example, the company's digital transformation initiatives, including upgrades to its e-commerce platform and warehouse automation, are expected to yield substantial cost savings, potentially allowing for more aggressive pricing or reinvestment in growth initiatives.

- Supply Chain Optimization: Falabella's ongoing investments in its logistics network aim to reduce delivery times and costs, a key factor in competitive pricing.

- Technology Integration: The company is actively adopting new technologies to automate processes and improve efficiency, with a focus on digital transformation initiatives.

- Operational Streamlining: Efforts to simplify organizational structures and improve internal workflows are designed to cut overhead and boost productivity.

- Margin Management: Enhanced operational efficiency directly supports Falabella's ability to maintain healthy profit margins while offering attractive prices to consumers.

Falabella's pricing strategy is multifaceted, balancing competitiveness with value to appeal to a broad customer base in Latin America. This approach is supported by its financial services arm, Banco Falabella, which influences purchasing power through credit offerings, and its extensive e-commerce marketplace, enabling dynamic pricing adjustments. The company's focus on operational efficiency and cost reduction, driven by supply chain optimization and technological integration, underpins its ability to offer attractive price points while aiming for enhanced profitability through 2025.

| Pricing Strategy Aspect | Key Initiatives/Data | Impact on Profitability |

|---|---|---|

| Value-Oriented Pricing | 10% sales increase in private label brands (2024 holiday season) | Drives volume and market share |

| Competitive Pricing | Ongoing market analysis and competitor monitoring (2024-2025) | Maintains market position |

| Dynamic Pricing (E-commerce) | Real-time adjustments during peak seasons (e.g., Black Friday 2024) | Maximizes revenue and sales |

| Financial Services Integration | Growth in loan disbursements (Q1 2024) | Enhances customer purchasing power and loyalty |

| Cost Reduction & Efficiency | Projected 5% reduction in operational expenses (by end of 2024) | Improves profit margins |

4P's Marketing Mix Analysis Data Sources

Our Falabella 4P's analysis leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside real-time e-commerce data and detailed industry reports. We also incorporate insights from competitive intelligence and public pricing information to ensure accuracy.