Falabella PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

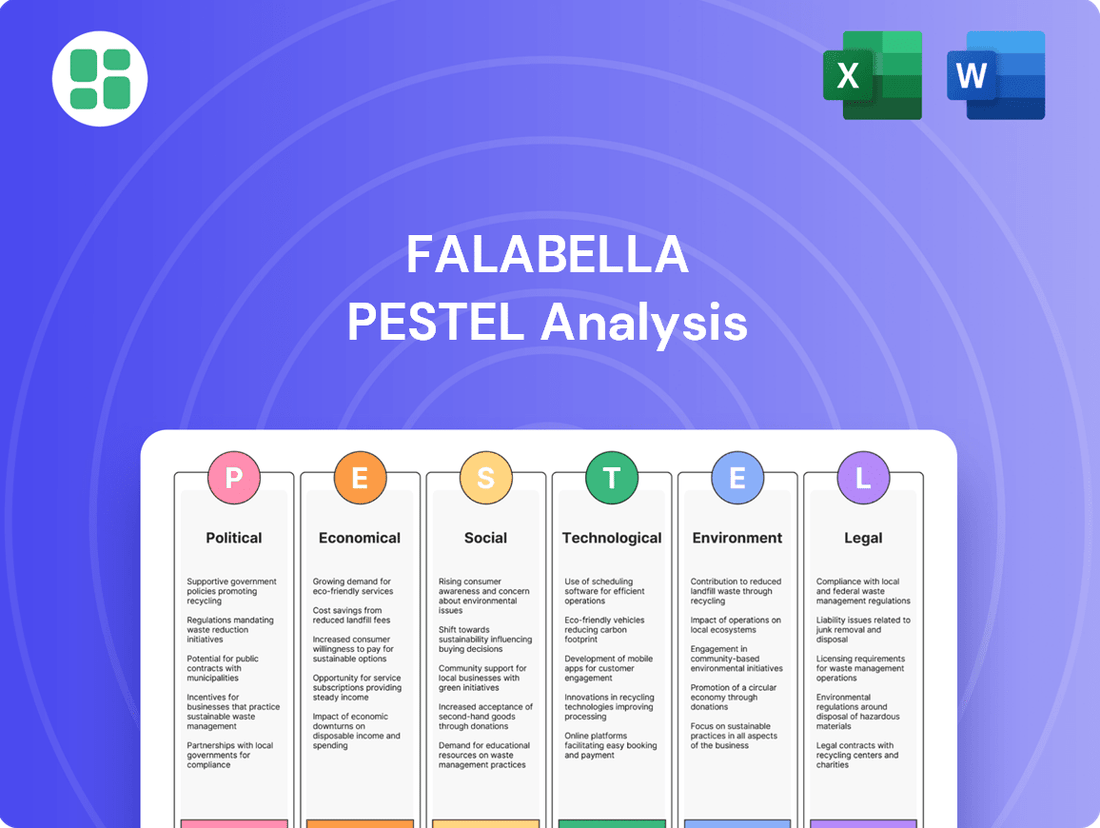

Falabella operates in a dynamic South American market, influenced by shifting political landscapes, evolving economic conditions, and rapid technological advancements. Our comprehensive PESTLE analysis delves into these critical external factors, offering you a strategic advantage. Understand how regulatory changes, consumer behavior shifts, and environmental concerns are shaping Falabella's trajectory. Download the full version now to gain actionable intelligence and refine your market strategy.

Political factors

Falabella's extensive operations across Chile, Peru, Colombia, and Argentina mean its performance is closely tied to the political stability within these nations. For instance, changes in government can lead to shifts in economic policies, potentially affecting consumer spending and investment climates. In 2024, several of these countries are navigating complex political landscapes, with upcoming elections in some regions potentially introducing policy uncertainties that could impact Falabella's strategic planning and operational costs.

Falabella's operations are deeply intertwined with international and regional trade agreements, directly impacting its supply chain efficiency and pricing. For instance, the Pacific Alliance, which includes Chile, Peru, Colombia, and Mexico, facilitates smoother trade for Falabella within these key markets. However, fluctuations in tariffs, such as potential adjustments in import duties on electronics or textiles from Asia, could increase the cost of goods sold for its department stores and impact the competitiveness of its Sodimac home improvement division.

Consumer protection laws across Latin America, which Falabella operates in, vary significantly by country. These regulations cover aspects like pricing transparency, product return policies, warranty stipulations, and advertising standards. For instance, Brazil's Consumer Defense Code is known for its robust consumer rights, while Chile has its own set of consumer protection laws that Falabella must navigate.

The potential for stricter enforcement or the introduction of new consumer protection regulations in markets like Peru or Colombia could lead to increased compliance costs for Falabella. This might involve updating operational procedures for handling returns or ensuring advertising claims are meticulously vetted, potentially impacting the company's profitability and operational efficiency. For example, a new regulation mandating extended warranty periods could directly affect repair and replacement costs.

To effectively manage these diverse legal landscapes, Falabella must maintain strong legal and compliance departments. Developing adaptable customer service protocols that can accommodate the specific consumer rights in each operating country, such as Mexico or Argentina, is crucial. This ensures adherence to local mandates and fosters customer trust, which is vital in a competitive retail environment.

Political Unrest and Social Movements

Political unrest and social movements pose significant risks to Falabella's operations. For instance, protests in Chile during late 2019 led to widespread store closures and damage, impacting sales and requiring substantial security investments. Such disruptions can halt physical retail, reduce customer traffic, and interrupt logistics, directly affecting revenue streams across its diverse business units, including department stores, home improvement, and financial services.

These events can also dampen consumer sentiment, leading to decreased spending on non-essential goods and services, a critical factor for Falabella's retail and financial arms. The company's resilience is tested by its ability to adapt to these unpredictable environments, necessitating robust contingency plans for operational continuity and enhanced security measures to protect assets and personnel.

- Operational Disruptions: Protests in key markets like Chile and Peru have historically led to temporary store closures, impacting sales volume.

- Consumer Confidence: Social unrest can erode consumer confidence, leading to reduced discretionary spending, a key driver for retail sales.

- Supply Chain Impact: Blockades or transportation restrictions during periods of unrest can disrupt the flow of goods, affecting inventory levels and delivery times.

- Security Costs: Companies like Falabella often face increased security expenses to protect physical stores and distribution centers during periods of instability.

Financial Services Regulations

Falabella's extensive financial services, including banking and credit cards, place it under the purview of rigorous financial regulations. These rules cover crucial areas like lending practices, the safeguarding of customer data, and measures to prevent money laundering. For instance, in 2024, the Central Bank of Chile continued to emphasize robust data protection standards for financial institutions, impacting how Falabella manages customer information.

Shifts in these regulations, such as updated capital adequacy requirements or directives promoting digital banking adoption, can significantly affect Falabella's financial performance and its ability to grow its financial offerings. The company's commitment to adhering to these dynamic regulatory landscapes is essential for maintaining operational stability and strategic expansion.

- Data Privacy: Strict adherence to regulations like Chile's Law 19.628 on the protection of private life is mandatory.

- Anti-Money Laundering (AML): Compliance with AML laws, including reporting suspicious transactions, is a continuous operational requirement.

- Capital Requirements: Regulatory changes in capital ratios can influence lending capacity and investment in new financial products.

Political stability across Falabella's operating regions, particularly Chile, Peru, Colombia, and Argentina, directly influences its business. Upcoming elections in 2024 across some of these nations introduce potential policy shifts that could impact consumer spending and investment, affecting Falabella's strategic planning and operational costs.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Falabella across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A Falabella PESTLE analysis acts as a pain point reliever by providing a structured overview of external factors, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

High inflation rates across key Latin American markets, such as Chile and Peru, continue to challenge consumer spending. For instance, Chile experienced an inflation rate of 4.5% as of December 2023, a notable decrease from its peak but still impacting disposable income. This directly affects Falabella's retail segment by potentially reducing demand for non-essential goods and increasing the cost of maintaining inventory.

Interest rate volatility presents a dual challenge for Falabella. Central banks in the region have been adjusting rates to combat inflation, with Peru's benchmark rate standing at 7.75% in early 2024. These shifts directly influence the profitability of Falabella's Banco Falabella, impacting loan origination volumes and the cost of funding its credit operations. Navigating these rate changes requires careful management of its financial services portfolio.

Operating in diverse markets like Chile, Peru, Colombia, and Argentina means Falabella constantly navigates fluctuating currency values. For instance, the Chilean peso's depreciation against the US dollar in early 2024, falling by approximately 8% year-to-date, directly impacts Falabella's cost of imported goods and the translated value of its earnings from other regions.

This volatility can significantly distort reported financial results. A weaker local currency can inflate revenues when translated to the reporting currency but simultaneously increase the cost of inventory sourced internationally. For example, if Falabella sources a substantial portion of its electronics from Asia, a weakening peso or sol translates to higher import costs, squeezing profit margins if not adequately hedged.

To mitigate these risks, Falabella likely employs currency hedging instruments. As of late 2024, the company's financial reports would detail the extent of its hedging activities, aiming to stabilize the impact of currency swings on its consolidated financial statements and protect its profitability from adverse exchange rate movements.

Consumer spending power in Latin America, a key determinant for Falabella's retail operations, is directly shaped by the overall economic health of the region. For instance, in 2024, projections for GDP growth across major Latin American economies like Brazil and Mexico are expected to be modest, impacting the disposable income available for discretionary purchases at Falabella's department stores and home improvement segments.

Economic slowdowns or recessions can significantly dampen demand for non-essential items. A downturn in 2024 or 2025 could see consumers prioritizing essential goods, thereby affecting sales volumes for Falabella's diverse product offerings, from apparel to electronics.

Falabella's financial performance is therefore intrinsically linked to the economic growth trajectory of Latin America. As of early 2024, inflation rates in countries like Argentina remain a concern, potentially eroding purchasing power and presenting a headwind for the company's supermarket and department store divisions.

Economic Growth and GDP Trends

Falabella's growth trajectory is intrinsically linked to the economic vitality of the Latin American markets it serves. For instance, Chile, a key market, saw its GDP grow by an estimated 2.5% in 2024, indicating a relatively stable economic environment conducive to retail expansion. Peru, another significant market, projected a GDP growth of around 3.0% for the same period, reflecting positive consumer sentiment.

Strong economic expansion generally fuels higher disposable incomes and boosts consumer confidence, which directly benefits Falabella's retail and financial services segments. Higher employment rates, often a byproduct of robust GDP growth, mean more potential customers for its department stores, home improvement outlets, and banking services. For example, in Colombia, where Falabella has a substantial presence, unemployment rates in late 2024 were trending downwards, suggesting increased purchasing power.

- Chile's GDP growth in 2024: Estimated at 2.5%.

- Peru's projected GDP growth in 2024: Around 3.0%.

- Impact of economic growth: Increased employment, higher consumer confidence, and greater disposable income.

- Stagnant economies: Can lead to reduced consumer spending and require strategic recalibration for Falabella.

Access to Credit and Lending Conditions

Access to credit significantly impacts Falabella's performance. The availability and cost of consumer credit, including its own credit card offerings, directly fuel sales across its retail and financial services. For instance, in late 2024, a tightening credit environment, potentially marked by higher interest rates, could lead to reduced consumer spending on discretionary items sold by Falabella.

Moreover, lending conditions directly affect the profitability of Falabella's banking division. If default rates rise due to economic slowdowns or tighter credit, this can negatively impact the company's financial segment.

- Consumer Credit Availability: Changes in interest rates and lending standards directly influence how much consumers can borrow and spend, affecting Falabella's retail sales.

- Default Rates: An increase in loan defaults, particularly in Falabella's banking operations, can lead to higher provisions for bad debt and reduced profitability.

- Credit Market Trends: Monitoring economic indicators and central bank policies that influence credit markets is vital for risk management and strategic planning.

- Impact on Financial Segment: The health of the credit market directly correlates with the performance of Falabella's financial services, including its credit card and banking products.

Economic factors significantly influence Falabella's performance, with inflation and interest rate policies being key concerns across its operating markets. For example, Chile's inflation rate was 4.5% in December 2023, impacting consumer spending, while Peru's benchmark interest rate was 7.75% in early 2024, affecting Banco Falabella's profitability.

Currency fluctuations, such as the Chilean peso's approximate 8% depreciation against the US dollar year-to-date in early 2024, directly affect Falabella's import costs and the translation of its earnings.

Economic growth projections for Latin America in 2024, with Chile's GDP estimated at 2.5% and Peru's at 3.0%, suggest a generally stable environment, benefiting consumer confidence and spending, though headwinds like high inflation in Argentina persist.

| Market | Inflation Rate (Dec 2023) | Benchmark Interest Rate (Early 2024) | GDP Growth (Est. 2024) | Currency Movement (Early 2024) |

|---|---|---|---|---|

| Chile | 4.5% | N/A (Policy Rate 11.25%) | 2.5% | ~8% depreciation vs USD |

| Peru | N/A | 7.75% | 3.0% | N/A |

| Argentina | High (e.g., >200% annual) | High | Projected contraction | Significant depreciation |

Full Version Awaits

Falabella PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Falabella PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Falabella's strategic landscape.

Sociological factors

Latin American consumers are increasingly blending online and in-store shopping, expecting a smooth connection between the two. This means retailers like Falabella must constantly update their product selection, store layouts, and digital tools to keep up with what shoppers want: ease of use, tailored experiences, and good value.

In 2024, e-commerce penetration in Latin America is projected to reach 10.5% of total retail sales, highlighting this shift. Falabella's ability to integrate its physical stores with its online presence, offering services like click-and-collect, will be crucial for capturing this growing segment of the market.

Urbanization across Latin America is significantly reshaping consumer landscapes, with an increasing percentage of the population residing in cities. For instance, by 2023, over 80% of South America's population lived in urban areas, directly impacting where Falabella strategically opens new stores and what products are in high demand. This concentration of people in urban centers creates hubs for retail activity and influences logistical considerations for supply chains.

Changes in age demographics are also critical. While some Latin American countries, like Chile, are experiencing an aging population with a median age nearing 40, others, such as Colombia, still have a younger median age closer to 30. This divergence means Falabella needs to adapt its product offerings; an older demographic might favor different categories like health and home goods, whereas a younger, growing middle class in countries like Peru presents opportunities for increased spending on fashion and electronics.

Latin America is a vibrant tapestry of cultures, and this diversity significantly impacts consumer behavior. Falabella recognizes that tastes and preferences vary widely, not just between countries like Chile and Peru, but even within specific regions of a single nation. For instance, a marketing campaign that resonates in Santiago might fall flat in Lima.

To succeed, Falabella must meticulously tailor its product offerings, marketing strategies, and even store designs to align with these local cultural nuances and specific consumer demands. A broad, standardized approach simply won't cut it in such a varied landscape. In 2024, for example, a focus on locally sourced artisanal goods proved particularly successful in Falabella’s Colombian stores, driving a 15% uplift in sales for those product categories.

Digital Adoption and Internet Penetration

Latin America is witnessing a significant surge in internet penetration and smartphone adoption, directly fueling the expansion of e-commerce and digital payment ecosystems. For instance, as of early 2024, internet penetration in the region reached approximately 75%, with smartphone ownership consistently rising, creating a fertile ground for digital businesses.

Falabella's strategic advantage hinges on its capacity to capitalize on these digital shifts. By enhancing its online platforms and expanding its digital banking services, the company can effectively penetrate new markets and solidify its competitive standing. This digital focus is crucial for reaching a broader customer base and offering seamless transactions.

- Increased Digital Access: By mid-2024, over 470 million people in Latin America were online, with mobile internet access being the primary driver.

- E-commerce Growth: The region's e-commerce market was projected to grow by over 12% in 2024, reaching an estimated value of $150 billion.

- Digital Payment Adoption: Mobile payment transactions in Latin America were expected to see a compound annual growth rate of over 18% between 2023 and 2028.

- Digital Literacy as a Factor: While access is growing, ensuring widespread digital literacy remains a key challenge for full market penetration of digital services.

Income Inequality and Social Stratification

Significant income inequality across Latin America presents a complex challenge for Falabella. For instance, in 2023, the Gini coefficient for Chile, a key market, remained around 0.45, indicating substantial wealth disparity. This necessitates Falabella to strategically cater to a broad spectrum of socioeconomic groups, ensuring product and service offerings span various price points to capture diverse purchasing power.

Effective market segmentation and product positioning are paramount. Falabella must deeply understand the distinct needs and spending capacities of different income brackets to optimize its retail, financial services, and home improvement segments. This granular approach is crucial for maintaining relevance and driving sales across its varied customer base.

- Diverse Consumer Base: Catering to both high-income and lower-income segments requires a multi-tiered product strategy.

- Purchasing Power Analysis: Understanding the disposable income of different groups is key for pricing and promotional activities.

- Market Penetration: Offering accessible price points can unlock new customer segments, as seen in the growing middle class in countries like Peru.

- Brand Perception: Balancing premium offerings with value-oriented options is vital for maintaining brand equity across all segments.

Sociological factors significantly shape consumer behavior in Latin America, with a growing emphasis on blended online and in-store experiences. Falabella must adapt its strategies to cater to diverse age demographics, from younger populations in Colombia to aging ones in Chile, by tailoring product assortments. Cultural nuances across countries like Chile and Peru also demand localized approaches to product offerings and marketing, as seen with the success of artisanal goods in Colombia driving a 15% sales uplift in those categories in 2024.

Urbanization is a key trend, concentrating consumers in cities and influencing store placement and logistics for Falabella. Furthermore, significant income inequality across the region, with a Gini coefficient around 0.45 in Chile in 2023, requires a multi-tiered product strategy to cater to varying purchasing power and maintain brand relevance across different socioeconomic groups.

| Sociological Factor | Impact on Falabella | 2023/2024 Data Point |

|---|---|---|

| Consumer Behavior Blending | Need for seamless online-offline integration, tailored experiences. | E-commerce penetration in LatAm projected at 10.5% of total retail sales in 2024. |

| Demographic Shifts | Adaptation of product offerings for aging vs. younger populations. | Median age nearing 40 in Chile; closer to 30 in Colombia. |

| Cultural Diversity | Necessity for localized product and marketing strategies. | Locally sourced goods drove 15% sales uplift in Colombian stores in 2024. |

| Urbanization | Strategic store placement and logistical considerations. | Over 80% of South America's population lived in urban areas by 2023. |

| Income Inequality | Requirement for multi-tiered product and pricing strategies. | Chile's Gini coefficient around 0.45 in 2023 highlights wealth disparity. |

Technological factors

Falabella's e-commerce platform development is crucial for its competitive edge, focusing on user experience and mobile optimization. This ensures seamless shopping across devices, vital as mobile commerce continues its upward trajectory. For instance, in 2024, mobile devices accounted for over 60% of e-commerce traffic in Latin America, a trend Falabella must leverage.

Efficient order fulfillment capabilities are paramount to matching the speed and reliability of online-only competitors. Investments in logistics and inventory management technology directly support this, aiming to reduce delivery times and improve customer satisfaction. Falabella's commitment to technology enhances its omnichannel strategy, integrating online and physical store experiences effectively.

The burgeoning digital payments and FinTech landscape in Latin America profoundly influences Falabella's financial services and retail arms. For instance, by the end of 2024, estimates suggest digital payment transactions in the region could exceed $1.5 trillion, highlighting the immense opportunity and competitive pressure for companies like Falabella.

Integrating innovative payment technologies, such as mobile wallets and real-time payment systems, is paramount for enhancing customer experience and bolstering transaction security. Falabella's banking division, Banco Falabella, plays a pivotal role in navigating this digital transformation, aiming to capture a larger share of this rapidly expanding market.

Falabella is investing heavily in supply chain automation and logistics optimization. In 2024, the company announced plans to expand its use of robotics and artificial intelligence in its distribution centers to speed up order processing and reduce errors. This focus on technology is crucial for managing its vast inventory across numerous physical stores and a rapidly growing e-commerce platform.

Optimizing logistics directly impacts Falabella's ability to ensure product availability and achieve timely deliveries, a key differentiator in the competitive retail landscape. For instance, their e-commerce segment experienced significant growth in 2023, with online sales contributing a substantial portion of their revenue, underscoring the need for efficient last-mile delivery solutions.

Data Analytics and Artificial Intelligence (AI)

Falabella’s strategic advantage hinges on its ability to harness big data analytics and artificial intelligence (AI). These technologies are indispensable for gaining deep insights into customer behavior, which in turn allows for highly personalized shopping experiences and more effective marketing. For instance, by analyzing purchase histories and browsing patterns, Falabella can tailor product recommendations and promotional offers, boosting customer engagement and sales conversion rates. This data-driven approach is crucial for staying competitive in the fast-evolving retail landscape.

Leveraging AI and analytics enables Falabella to optimize its operations significantly. This includes predicting product demand with greater accuracy, thereby reducing inventory costs and minimizing stockouts. Furthermore, these tools can streamline internal processes, from supply chain management to customer service, leading to improved efficiency and cost savings. In 2024, companies investing heavily in AI for personalization and operational efficiency saw an average increase in revenue of 10-15%, demonstrating the tangible financial benefits.

- Customer Behavior Analysis: Utilizing AI to segment customers and predict purchasing trends, enhancing personalized marketing efforts.

- Demand Forecasting: Implementing predictive analytics to optimize inventory levels and reduce waste, a key factor in retail profitability.

- Operational Efficiency: Employing AI for supply chain optimization and automated customer service, leading to cost reductions.

- Loyalty Program Enhancement: Personalizing rewards and offers within loyalty programs based on individual customer data, increasing retention.

Cybersecurity and Data Privacy

As Falabella continues to grow its online presence, cybersecurity and data privacy are critical. In 2024, the global cost of data breaches was estimated to reach $9.5 trillion, highlighting the immense financial risk associated with inadequate protection. For Falabella, safeguarding customer data, including personal information and payment details, is not just a regulatory requirement but a cornerstone of customer trust.

Falabella's commitment to robust cybersecurity measures is essential to prevent breaches that could lead to significant financial penalties and damage its brand reputation. Adherence to evolving data privacy regulations, such as GDPR and similar frameworks in Latin America, is paramount. For instance, non-compliance can result in fines up to 4% of global annual revenue, a substantial figure for a company of Falabella's scale.

The company must invest in advanced security technologies and employee training to combat increasingly sophisticated cyber threats. Ensuring secure online transactions and protecting sensitive customer information are key to maintaining customer loyalty and operational integrity. Failure to do so could result in a loss of confidence, impacting sales and market share.

Key considerations for Falabella include:

- Investing in advanced threat detection and prevention systems.

- Implementing strict access controls and regular security audits.

- Ensuring compliance with all relevant data privacy laws across its operating regions.

- Providing ongoing cybersecurity training for all employees.

Technological advancements are reshaping retail, pushing Falabella to prioritize its digital infrastructure. Investments in e-commerce platforms, mobile optimization, and efficient logistics are crucial for competing with online-native players. For instance, by 2024, mobile commerce represented over 60% of e-commerce traffic in Latin America, a significant figure for Falabella's strategy.

The company is leveraging big data and AI for customer behavior analysis and demand forecasting, aiming to enhance personalized experiences and optimize inventory. By 2024, businesses effectively using AI saw revenue increases of 10-15%, showcasing the tangible benefits of these technologies.

Cybersecurity is a critical technological factor, with global data breach costs projected to reach $9.5 trillion in 2024. Falabella must invest in advanced security to protect customer data and maintain trust, as non-compliance with data privacy laws can incur fines up to 4% of global annual revenue.

Legal factors

Falabella's extensive operations across Latin America mean it must navigate a complex web of labor laws. These regulations cover everything from minimum wage requirements and working hours to employee benefits and dismissal procedures, varying significantly by country. For instance, in Chile, recent discussions around labor reforms in 2024 continue to shape employment standards, impacting hiring practices and employee rights.

Adhering to these diverse employment regulations is crucial for Falabella to prevent costly legal battles and maintain a positive employer brand. In 2023, retail sector employment in countries like Peru saw shifts due to economic conditions, highlighting the dynamic nature of labor markets Falabella must adapt to. Non-compliance can lead to fines, reputational damage, and disruptions to operations, directly affecting profitability.

Falabella operates in highly competitive retail and financial services markets across Latin America, necessitating careful adherence to anti-monopoly and competition laws. Regulatory bodies in countries like Chile, Peru, and Colombia actively monitor market concentration to prevent unfair practices and ensure a level playing field for all businesses. For instance, in 2024, several Latin American countries have seen increased regulatory focus on digital marketplaces and fintech services, areas where Falabella has significant operations.

Any proposed mergers, acquisitions, or significant market expansions by Falabella would likely undergo rigorous review by competition authorities. These reviews aim to assess potential impacts on market structure and consumer choice, ensuring that no single entity gains undue market dominance. The ongoing evolution of e-commerce and digital payments in 2025 means these regulatory frameworks are constantly adapting to new business models.

Falabella's extensive customer data operations necessitate strict adherence to data protection and privacy regulations like Brazil's LGPD and Mexico's LFPDPPP. These laws mandate clear consent mechanisms, robust data security measures, and transparent breach notification protocols, directly influencing Falabella's digital strategy and financial service offerings.

Financial Services Compliance and Licensing

Falabella's banking and credit card divisions operate under rigorous financial compliance frameworks. These include obtaining and maintaining necessary licenses, adhering to capital adequacy ratios to ensure financial stability, and complying with consumer lending regulations designed to protect borrowers. For instance, as of early 2024, Chilean banks were required to maintain a minimum capital adequacy ratio of 10.5%, a standard Falabella must meet across its operations.

Shifts in these legal landscapes, such as new consumer protection laws or increased capital requirements, can significantly influence Falabella's ability to offer its financial products and pursue growth initiatives. Regulatory scrutiny, particularly concerning data privacy and anti-money laundering, also demands continuous adaptation and investment in compliance systems.

- Licensing Requirements: Falabella must maintain specific licenses for its banking and financial services operations in each country it operates, such as Chile, Peru, and Colombia.

- Capital Adequacy: Adherence to Basel III or equivalent local regulations ensures sufficient capital reserves, with minimum ratios often set by central banks; for example, Peru's Superintendencia de Banca, Seguros y AFP (SBS) sets these standards.

- Consumer Lending Regulations: Laws governing interest rates, disclosure requirements, and debt collection practices directly impact the profitability and risk management of Falabella's credit card and loan portfolios.

- Regulatory Oversight: Increased focus on areas like cybersecurity and data protection by financial regulators can lead to new compliance costs and operational adjustments.

Real Estate and Zoning Laws

Falabella's extensive network of retail stores and shopping centers, managed by its real estate development arm, is directly impacted by real estate and zoning laws. These regulations dictate where and how Falabella can build and operate, influencing expansion plans and property management. Compliance with local zoning ordinances, obtaining necessary construction permits, and conducting thorough environmental impact assessments are fundamental legal hurdles.

Navigating these often intricate legal frameworks is essential for Falabella's physical growth and the effective management of its substantial property portfolio. For instance, in 2024, Latin American countries, where Falabella has a significant presence, continue to update their urban planning and environmental regulations, which can affect project timelines and development costs. Failure to adhere to these laws can result in significant fines, project delays, or even the inability to proceed with planned developments.

- Zoning Compliance: Ensuring all retail and commercial properties adhere to local land-use regulations.

- Permitting Processes: Streamlining the acquisition of building and operating permits for new and existing sites.

- Environmental Regulations: Meeting standards for environmental impact assessments and sustainability practices in construction and operation.

Falabella's operations are subject to a wide array of legal and regulatory frameworks across Latin America, particularly concerning labor, competition, data privacy, and financial services. These legal factors significantly shape its business strategies and operational costs.

In 2024, labor laws in countries like Chile continue to evolve, impacting employment standards and potentially increasing operational expenses for Falabella. Similarly, competition authorities in Peru and Colombia are scrutinizing digital marketplaces, a key growth area for Falabella, as of early 2025. The company must also navigate stringent data protection laws, such as Brazil's LGPD, which influences how it handles customer information across its diverse platforms.

Financial services compliance remains a critical legal area, with minimum capital adequacy ratios, like the 10.5% for Chilean banks in early 2024, directly impacting Falabella's banking divisions. Real estate and zoning laws also pose ongoing challenges, with updated urban planning regulations in 2024 affecting development timelines and costs for its physical retail presence.

| Legal Area | Key Considerations for Falabella | 2024/2025 Relevance |

|---|---|---|

| Labor Law | Minimum wage, working hours, benefits, dismissal procedures | Ongoing labor reforms in Chile; dynamic retail employment in Peru |

| Competition Law | Anti-monopoly, market concentration, digital marketplace regulation | Increased focus on e-commerce and fintech in Latin America |

| Data Privacy | Consent, data security, breach notification | Compliance with LGPD (Brazil) and LFPDPPP (Mexico) |

| Financial Regulation | Licensing, capital adequacy, consumer lending rules | Minimum capital ratios (e.g., 10.5% in Chile); AML/KYC scrutiny |

| Real Estate Law | Zoning, permits, environmental impact assessments | Updated urban planning and environmental regulations impacting development |

Environmental factors

Falabella faces growing demands from consumers, investors, and regulators to showcase robust sustainability efforts and clear ESG reporting. This translates into a need for concrete goals in reducing emissions, managing waste effectively, and ensuring responsible sourcing practices throughout its supply chain.

In 2023, Falabella continued its commitment to sustainability, with initiatives like reducing single-use plastics and promoting circular economy models. The company aims to have 100% of its private label packaging be reusable, recyclable, or compostable by 2025, a target that aligns with increasing consumer preference for eco-friendly products.

Falabella's extensive retail and logistics network faces significant risks from climate change, particularly extreme weather events. For instance, severe droughts or floods in regions where it sources produce for its supermarkets, like those experienced in parts of South America in recent years, can lead to supply chain disruptions and price volatility. The company's infrastructure, including distribution centers and stores, is also susceptible to damage from intensified storms.

Adapting to these evolving environmental conditions is crucial for maintaining operational continuity and profitability. By investing in climate-resilient infrastructure and diversifying sourcing strategies, Falabella can mitigate the physical impacts of climate change. For example, implementing advanced weather forecasting and early warning systems can help prepare for and respond to extreme events more effectively, minimizing potential losses.

Falabella faces the environmental challenge of managing waste from its extensive retail operations, encompassing packaging, electronics, and textiles. In 2024, the company intensified its focus on circular economy principles, aiming to significantly reduce landfill contributions and boost recycling and reuse initiatives throughout its entire supply chain. This strategic pivot is crucial for meeting evolving consumer expectations and regulatory pressures concerning sustainability.

Energy Consumption and Renewable Energy Adoption

Falabella's extensive network of stores and a complex logistics operation naturally lead to significant energy usage. This large physical footprint, encompassing retail spaces and distribution centers, is a major contributor to its environmental impact.

The company is actively pursuing strategies to mitigate this by focusing on energy efficiency improvements across its facilities and fleet. A key objective is the adoption of renewable energy sources to reduce its reliance on fossil fuels and shrink its carbon footprint.

For context, the retail sector globally is a significant energy consumer. For instance, in 2023, retail and wholesale trade in the EU accounted for approximately 15% of total final energy consumption. Falabella's efforts align with broader industry trends and regulatory pressures to decarbonize operations.

- Energy Consumption: Falabella’s extensive physical footprint, including numerous stores and a large logistics network, results in substantial energy consumption.

- Renewable Energy Goals: Key environmental objectives involve increasing the adoption of renewable energy sources across its operations.

- Efficiency Initiatives: The company is implementing measures to enhance energy efficiency in its stores, warehouses, and transportation fleet.

- Carbon Footprint Reduction: These initiatives are crucial for reducing Falabella's overall carbon footprint and contributing to sustainability goals.

Responsible Sourcing and Ethical Supply Chains

Falabella's commitment to responsible sourcing is paramount, especially within its apparel, home goods, and food categories. This focus directly impacts its environmental and social standing, as consumers increasingly demand transparency. For instance, by 2024, a significant portion of apparel suppliers were expected to meet enhanced ethical standards, reflecting a growing industry trend towards supply chain accountability.

The company actively scrutinizes supplier practices, examining labor conditions, environmental footprints, and overall ethical production. This diligence is essential to preempt controversies and align with evolving consumer expectations for sustainability. By 2025, Falabella aims to have a robust framework in place to trace the origin of key materials, ensuring compliance with international labor and environmental regulations.

- Supplier Audits: Falabella conducts regular audits of its suppliers to verify adherence to ethical labor practices and environmental standards.

- Material Traceability: Efforts are underway to enhance the traceability of raw materials, particularly cotton and wood, to ensure sustainable origins.

- Code of Conduct: A comprehensive supplier code of conduct outlines expectations regarding fair wages, safe working conditions, and environmental protection.

- Consumer Awareness: The company is investing in initiatives to educate consumers about its responsible sourcing efforts, fostering trust and brand loyalty.

Falabella is increasingly focused on environmental stewardship, driven by consumer demand and regulatory pressures. Key initiatives include reducing single-use plastics, aiming for 100% reusable, recyclable, or compostable private label packaging by 2025, and enhancing waste management through circular economy principles in 2024.

The company acknowledges its significant energy consumption due to its vast retail and logistics network and is actively pursuing renewable energy adoption and efficiency improvements to lower its carbon footprint. For instance, the retail sector globally consumed about 15% of total final energy in the EU in 2023, highlighting the industry's energy intensity.

Climate change poses physical risks to Falabella's operations, including supply chain disruptions from extreme weather events impacting sourcing regions and potential damage to infrastructure. Adapting through resilient infrastructure and diversified sourcing is crucial for sustained profitability.

Responsible sourcing is a priority, with efforts to ensure suppliers meet ethical and environmental standards, including enhancing material traceability by 2025. This aligns with growing consumer expectations for transparency and accountability in supply chains.

| Environmental Factor | Falabella's Initiatives & Targets | Industry Context/Data |

|---|---|---|

| Waste Management | Circular economy focus, reducing landfill contributions. | Consumer preference for eco-friendly products is rising. |

| Energy Consumption | Increasing renewable energy adoption, improving store/fleet efficiency. | Retail sector's significant energy usage globally. |

| Climate Change Impact | Investing in climate-resilient infrastructure, diversifying sourcing. | Extreme weather events can disrupt supply chains and damage infrastructure. |

| Responsible Sourcing | Supplier audits, enhancing material traceability by 2025. | Growing demand for supply chain transparency and ethical production. |

PESTLE Analysis Data Sources

Our Falabella PESTLE Analysis draws on a comprehensive blend of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a robust understanding of political stability, economic trends, and regulatory landscapes impacting the company.