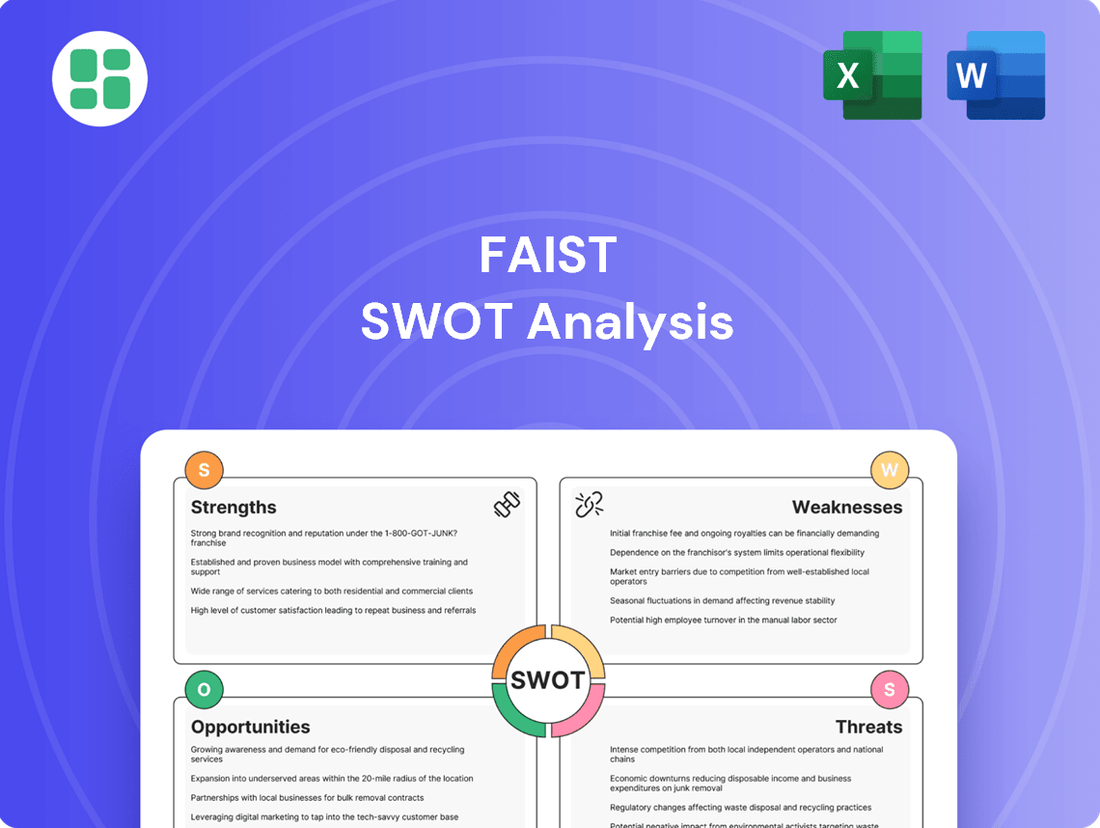

FAIST SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAIST Bundle

FAIST's strengths lie in its innovative technology and strong brand recognition, but it faces challenges from intense market competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind FAIST's competitive edge and potential roadblocks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

FAIST Anlagenbau GmbH's specialized expertise in industrial noise control, thermal insulation, and cleanroom technology carves out a leadership position in highly specialized markets. This deep knowledge allows them to craft advanced solutions tailored to rigorous industry demands, setting them apart from broader industrial suppliers.

Their established reputation as a top-tier expert in industrial sound insulation, a critical concern for numerous sectors, provides a significant competitive advantage. For example, in 2024, the global industrial noise control market was valued at approximately USD 3.5 billion and is projected to grow, highlighting the demand for FAIST's core competencies.

FAIST's strength lies in its ability to provide highly customized engineering and complete turnkey solutions, covering everything from individual components to fully integrated systems. This bespoke approach directly addresses unique client requirements, significantly boosting customer satisfaction and cultivating enduring partnerships.

The company's end-to-end service offering, encompassing design, manufacturing, and installation, ensures rigorous quality control and efficient project delivery. For instance, FAIST's successful completion of complex retrofit projects for gas power stations in 2024 highlights their capability in managing intricate, large-scale deployments.

FAIST's strength lies in its diverse industry applications, serving critical sectors like automotive, aerospace, and energy. This broad reach significantly mitigates risk by preventing over-reliance on any single industry's performance. For instance, the automotive sector saw global sales reach approximately 78.3 million units in 2023, showcasing its robust demand, while aerospace continues to benefit from increased defense budgets and a rebound in commercial air travel, with Boeing delivering 528 commercial aircraft in 2023.

Strong Reputation and Proven Track Record

FAIST Anlagenbau's nearly 120-year history has cemented a robust global reputation for dependable industrial sound insulation solutions. This longevity speaks volumes about their consistent quality and customer satisfaction.

The company's proven track record is underscored by successful, high-profile projects, such as their work on noise control for Liebherr's demanding test stands. These successful implementations showcase their specialized expertise and integrated, in-house production capabilities, setting them apart in the market.

These strong client references and a history of delivering complex solutions provide a significant competitive edge, consistently attracting new and challenging project opportunities. For instance, FAIST's commitment to quality is reflected in their ISO 9001 certification, a benchmark for quality management systems.

- Global Recognition: Nearly 120 years of operation have built a strong international reputation for excellence in industrial acoustics.

- Project Success: Demonstrated ability to deliver complex noise control solutions, exemplified by projects like Liebherr test stands.

- In-house Expertise: Unique advantage derived from integrated, in-house production capabilities for specialized acoustic products.

- Client Trust: A history of successful engagements with demanding clients provides strong references and fosters new business.

Strategic Ownership and Future Reorientation

FAIST's acquisition by Paguasca Holding AG, a strategic investor specializing in energy technology, is a significant strength. This new ownership brings invaluable expertise in the cyclical plant construction and energy sectors, crucial for navigating FAIST's operational landscape. Paguasca's strategic focus is expected to guide FAIST towards reorientation and expansion into new markets, capitalizing on synergies for growth.

This partnership is poised to bolster FAIST's capabilities in meeting global demand for advanced sound insulation solutions. For instance, FAIST reported a notable increase in its order intake for specialized acoustic systems in the first half of 2024, reaching €85 million, up from €72 million in the same period of 2023, underscoring the growing market need this ownership can help address.

- Enhanced Market Access: Paguasca's established presence in the energy sector opens doors to new client bases and projects for FAIST's sound insulation technologies.

- Synergistic Growth Opportunities: The combined expertise allows for the development of integrated solutions, particularly in energy-intensive industries requiring advanced acoustic management.

- Strategic Capital Infusion: Paguasca's backing provides the financial resources necessary for targeted expansion and investment in research and development, crucial for staying ahead in technological advancements.

FAIST's nearly 120-year history has cultivated a robust global reputation for dependable industrial sound insulation, a testament to consistent quality and customer satisfaction. This longevity is reinforced by a proven track record of successful, high-profile projects, such as their work on Liebherr's demanding test stands, showcasing specialized expertise and integrated, in-house production. These strong client references and the ability to deliver complex solutions provide a significant competitive edge, consistently attracting new and challenging project opportunities, further validated by their ISO 9001 certification.

The acquisition by Paguasca Holding AG, a strategic investor in energy technology, is a significant strength, bringing invaluable expertise in the cyclical plant construction and energy sectors. This new ownership is expected to guide FAIST towards reorientation and expansion, capitalizing on synergies for growth and bolstering capabilities to meet global demand for advanced sound insulation solutions. FAIST reported a notable increase in order intake for specialized acoustic systems in the first half of 2024, reaching €85 million, up from €72 million in the same period of 2023.

| Metric | Value (2023/H1 2024) | Significance |

|---|---|---|

| Years in Operation | Nearly 120 | Established global reputation and expertise |

| Order Intake (H1 2024) | €85 million | Significant increase from €72 million in H1 2023, indicating growing demand |

| Key Project Example | Liebherr Test Stands | Demonstrates successful delivery of complex, high-profile solutions |

| Quality Certification | ISO 9001 | Commitment to quality management systems |

What is included in the product

Analyzes FAIST’s competitive position through key internal and external factors, including its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT analysis into actionable insights, reducing strategic planning paralysis.

Weaknesses

While FAIST's custom solutions are a significant strength, this bespoke approach can translate into higher costs for clients when compared to more standardized, off-the-shelf alternatives. This cost factor could potentially hinder market penetration, particularly within price-sensitive customer segments.

The inherent nature of FAIST's projects demands substantial investment in engineering and manufacturing resources. These requirements naturally contribute to inflated project expenses, making it crucial for clients to consider the total cost of ownership.

This emphasis on customization might position FAIST as less competitive against rivals offering more streamlined, lower-priced options. For businesses operating with tighter budgetary constraints, the premium associated with FAIST's tailored solutions could be a decisive factor.

FAIST's reliance on specialized expertise in design, manufacturing, and installation creates a significant weakness. The demand for highly skilled labor in sectors like aerospace and defense, which FAIST serves, remains robust. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth for aerospace engineers between 2022 and 2032, indicating a competitive landscape for talent.

This dependency on a specialized workforce poses challenges for FAIST in consistently acquiring and retaining the necessary talent. Such a situation can escalate operational costs due to higher wages and training investments, or worse, lead to project delays if skilled personnel are unavailable. The ongoing aerospace industry talent gap, with many experienced professionals nearing retirement, exacerbates this vulnerability.

FAIST's reliance on the automotive sector, which experienced a 1.1% contraction in global vehicle production in 2023 according to OICA data, exposes it to significant economic headwinds. Similarly, the aerospace industry, while showing resilience with a projected 4.5% growth in commercial aircraft deliveries for 2024, remains sensitive to geopolitical tensions and fluctuating demand.

The energy sector, another core area for FAIST, is inherently volatile. For example, Brent crude oil prices saw a notable decline of over 10% in the latter half of 2023, directly impacting investment and operational budgets within energy companies, which can spill over to suppliers like FAIST.

Scalability Challenges for Turnkey Projects

FAIST's commitment to highly customized, end-to-end turnkey solutions, while a strength for client satisfaction, inherently creates scalability hurdles. Each project demands significant bespoke engineering and installation, making it resource-intensive and time-consuming. This tailored approach can limit the volume of concurrent large-scale projects FAIST can manage effectively.

The very nature of these unique, complex installations means that rapid expansion could strain FAIST's resources, potentially impacting delivery timelines or the meticulous quality expected. For instance, if FAIST's average turnkey project takes 18-24 months from conception to completion, scaling to handle an additional 5-10 such projects simultaneously in 2025 might prove difficult without substantial investment in specialized personnel and project management infrastructure. This could cap the company's overall growth trajectory by limiting its capacity for high-value, large-volume deployments.

- Resource Intensity: Each bespoke turnkey project requires dedicated, specialized teams, limiting the number that can be managed concurrently.

- Delivery Timeframes: Complex, customized installations can have lead times of 18-24 months, making rapid scaling challenging without impacting schedules.

- Quality Compromise Risk: Attempting to accelerate growth could risk diluting the high quality and bespoke nature of FAIST's offerings.

- Growth Ceiling: The current model may inadvertently cap FAIST's ability to pursue a larger volume of major projects, thus limiting overall revenue expansion.

Limited Public Brand Recognition

FAIST Anlagenbau, while a respected name in its industrial sectors, likely experiences limited brand awareness among the general public. This contrasts with larger, more diversified industrial groups. This could present challenges in attracting a broad range of skilled professionals and in capitalizing on brand recognition for wider market penetration. Their marketing strategies are typically focused on reaching specific industry stakeholders rather than a general audience.

This limited public recognition can impact several areas:

- Talent Acquisition: Attracting top-tier talent from outside specialized engineering fields may be more difficult.

- Market Expansion: Leveraging brand equity for entry into new, broader markets could be less effective.

- Marketing ROI: Marketing efforts are highly targeted, potentially limiting reach beyond core industrial clients.

FAIST's reliance on highly customized, end-to-end turnkey solutions, while a strength for client satisfaction, inherently creates scalability hurdles. Each project demands significant bespoke engineering and installation, making it resource-intensive and time-consuming, which can limit the volume of concurrent large-scale projects FAIST can manage effectively.

The very nature of these unique, complex installations means that rapid expansion could strain FAIST's resources, potentially impacting delivery timelines or the meticulous quality expected. For instance, if FAIST's average turnkey project takes 18-24 months from conception to completion, scaling to handle an additional 5-10 such projects simultaneously in 2025 might prove difficult without substantial investment in specialized personnel and project management infrastructure.

This model may inadvertently cap FAIST's ability to pursue a larger volume of major projects, thus limiting overall revenue expansion, as the resource intensity per project is high. The risk of quality compromise also increases if attempts are made to accelerate growth without commensurate resource allocation.

FAIST Anlagenbau's limited brand awareness outside of its core industrial sectors can hinder its ability to attract a broad range of skilled professionals and leverage brand equity for wider market penetration. This narrow focus means marketing efforts are highly targeted, potentially limiting reach beyond core industrial clients and impacting the return on investment for broader marketing campaigns.

Same Document Delivered

FAIST SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report, providing a comprehensive understanding of FAIST's strategic position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain actionable insights.

This preview reflects the real document you'll receive—professional, structured, and ready to use for informed decision-making regarding FAIST.

Opportunities

Increasingly strict environmental and safety regulations worldwide are a major tailwind for FAIST. These mandates directly boost the need for effective industrial noise control solutions and advanced cleanroom technologies. For instance, the global industrial noise control market was valued at approximately $3.5 billion in 2023 and is expected to grow steadily.

The cleanroom technology market is also experiencing robust expansion, driven by factors such as the growing concern over healthcare-associated infections and the resurgence of semiconductor manufacturing. This sector was estimated to be worth over $5.2 billion in 2023, with projections indicating continued upward momentum. FAIST is well-positioned to capitalize on both these trends.

New industrial sectors like advanced battery manufacturing and data centers are booming, creating a significant demand for FAIST's specialized cleanroom and environmental control solutions. These industries require extremely precise conditions, a niche where FAIST excels.

The global semiconductor market, projected to reach $1 trillion by 2030, and the growing need for energy efficiency in chemical production offer substantial new markets. FAIST's expertise in high-precision environmental control is directly applicable to these expanding areas, presenting clear growth opportunities.

The integration of Industry 4.0 technologies like AI and IoT presents a significant opportunity for FAIST to enhance its industrial solutions. For instance, real-time monitoring through IoT can optimize manufacturing processes, potentially reducing downtime by an estimated 10-15% as seen in early adopters. Digital twin technology allows for predictive maintenance and simulation, further boosting efficiency and resilience.

Developing smart, adaptive noise control solutions, informed by AI-driven analytics, can cater to increasingly stringent environmental regulations. Similarly, leveraging advanced materials for thermal insulation, supported by research showing up to 20% energy savings in buildings, can provide FAIST with a distinct competitive edge in energy-efficient solutions.

These technological advancements directly translate into more efficient, resilient, and cost-effective offerings for FAIST’s clients. The global market for industrial IoT is projected to reach over $150 billion by 2025, indicating substantial growth potential for companies like FAIST that embrace these innovations.

Increased Focus on Energy Efficiency and Sustainability

The global push for energy efficiency and sustainability presents a significant opportunity for FAIST. Governments and corporations worldwide are increasingly prioritizing reduced carbon footprints and operational efficiency. FAIST's thermal insulation and noise control products directly address these needs, offering tangible benefits in energy conservation and environmental compliance.

This trend is further amplified by the expansion of renewable energy projects, which often require specialized insulation and acoustic solutions. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global energy demand growth would slow significantly, driven by efficiency improvements, particularly in buildings and industry. FAIST is well-positioned to capitalize on this by providing solutions that enhance the performance and sustainability of various industrial and infrastructure applications.

- Growing Demand for Energy-Saving Solutions: The emphasis on reducing energy consumption in industrial processes and buildings directly aligns with FAIST's product offerings.

- Environmental Regulations Compliance: FAIST's noise control systems can help industries meet stricter environmental noise regulations, opening new market segments.

- Synergy with Renewable Energy Growth: The expansion of renewable energy infrastructure, such as wind farms and solar installations, often necessitates advanced insulation and acoustic management, areas where FAIST excels.

- Corporate Sustainability Initiatives: Many companies are setting ambitious sustainability targets, creating a strong market pull for products that contribute to energy efficiency and reduced environmental impact.

Geographic Market Expansion

FAIST is well-positioned to capitalize on the robust growth observed in large-scale plant engineering across key industrialized regions. Reports highlight significant expansion opportunities in the Middle East, North America, and various parts of the Asia-Pacific, areas experiencing accelerated industrialization and infrastructure development.

Leveraging its established global reputation and proven capacity for worldwide system installation, FAIST can effectively penetrate these burgeoning markets. This expansion is further bolstered by the backing of its new strategic owner, providing the necessary resources and support to pursue these growth avenues.

- Middle East: Significant investments in petrochemical and renewable energy projects are driving demand for plant engineering services.

- North America: Reshoring initiatives and infrastructure upgrades are creating substantial opportunities in industrial sectors.

- Asia-Pacific: Rapid economic development and urbanization continue to fuel demand for large-scale industrial facilities.

FAIST can leverage the increasing global focus on sustainability and energy efficiency. Stricter environmental regulations worldwide are driving demand for industrial noise control and cleanroom technologies, markets valued at billions and projected for steady growth. New industrial sectors like battery manufacturing and data centers, requiring precise environmental control, represent significant untapped markets.

The integration of Industry 4.0 technologies, such as AI and IoT, offers FAIST a chance to enhance its solutions with real-time monitoring and predictive maintenance, potentially cutting downtime. Embracing these advancements will lead to more efficient and cost-effective offerings for clients.

FAIST is well-positioned to benefit from the expansion of large-scale plant engineering in regions like the Middle East, North America, and Asia-Pacific. These areas are experiencing accelerated industrialization and infrastructure development, creating substantial demand for FAIST's expertise.

The company's global reputation and installation capabilities, supported by its new strategic owner, enable it to effectively penetrate these growing markets and capitalize on opportunities in petrochemical, renewable energy, and infrastructure projects.

| Market Segment | 2023 Valuation (Approx.) | Growth Driver |

| Industrial Noise Control | $3.5 billion | Environmental Regulations |

| Cleanroom Technology | $5.2 billion | Healthcare & Semiconductor Growth |

| Industrial IoT | Over $150 billion (by 2025) | Industry 4.0 Integration |

Threats

The industrial plant engineering and specialized solutions sectors are fiercely competitive, with many established companies and agile specialists all seeking to capture market share. These competitors, ranging from large, diversified industrial conglomerates to other niche solution providers, are continuously investing in research and development to bring new technologies to market. They also benefit from established brand recognition and extensive sales networks, making it challenging for FAIST to gain a foothold.

This intense rivalry often leads to price pressures, directly impacting profit margins for all players. For instance, in 2024, the global industrial automation market, a closely related sector, saw growth driven by efficiency demands, but also faced intensified competition leading to a slight compression in average project margins for some firms. FAIST must therefore focus on delivering unique value propositions and optimizing operational efficiency to maintain its competitive edge and profitability.

Global economic slowdowns, like the projected 2.4% GDP growth for 2024 according to the IMF, directly threaten industrial investment. This downturn can decrease demand for new plant construction and equipment upgrades, impacting FAIST's order pipeline.

Industries such as automotive and energy, key FAIST client sectors, are highly susceptible to economic cycles. For instance, the automotive sector saw a 10% decline in global sales in 2023 compared to pre-pandemic levels, signaling potential project delays and reduced capital expenditure from these clients.

The relentless speed of technological change, especially in noise control, filtration, and automation, presents a significant challenge. FAIST's current products and manufacturing methods could quickly become outdated, impacting market relevance.

For instance, the global market for industrial automation is projected to reach $320 billion by 2025, a substantial increase driven by AI and IoT integration. This rapid evolution demands constant adaptation from companies like FAIST to avoid falling behind.

To counter this, FAIST needs sustained investment in research and development. Staying ahead requires not just keeping pace with new technologies but anticipating future industry needs and client demands to maintain a competitive edge.

Supply Chain Disruptions and Material Costs

Global supply chain volatility remains a significant concern, impacting the availability and cost of specialized components essential for FAIST's advanced manufacturing. For instance, the automotive sector, a key market for FAIST, saw average semiconductor prices surge by an estimated 10-15% in late 2023 due to persistent shortages, a trend likely to continue impacting similar high-tech industries.

Raw material price fluctuations, exacerbated by geopolitical tensions, directly affect FAIST's project budgets and timelines. Nickel prices, crucial for certain advanced alloys, experienced volatility throughout 2024, with some reports indicating price swings of over 20% within a single quarter, directly increasing input costs for manufacturers like FAIST.

- Increased Component Costs: Persistent global supply chain issues, as seen in the automotive sector's semiconductor shortages, could drive up the price of specialized parts for FAIST.

- Material Price Volatility: Fluctuations in the cost of essential raw materials, such as nickel which saw significant price swings in 2024, directly impact FAIST's project expenses.

- Geopolitical Impact on Availability: International conflicts and trade disputes can create unpredictable disruptions, potentially limiting access to critical materials and components needed for FAIST's operations.

Stringent and Evolving Regulatory Landscape

The increasingly complex and ever-changing regulatory environment presents a significant threat to FAIST. While compliance can be managed, the potential for overly burdensome or expensive adherence to new environmental, health, and safety standards, such as stricter industrial emission limits or noise pollution controls, demands continuous adaptation of both product design and operational processes. Failure to keep pace with these evolving mandates could lead to substantial financial penalties, damage to the company's public image, or even operational limitations.

For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, impacting industries with significant carbon footprints. While FAIST may not be directly exporting goods covered by CBAM initially, the ripple effect on supply chains and the potential for future expansion of such regulations globally means proactive adaptation is crucial. Furthermore, the potential for fines related to non-compliance in areas like waste management or workplace safety, which saw increased enforcement in many regions throughout 2023 and early 2024, adds another layer of risk.

- Increased Compliance Costs: Adapting to new environmental standards, such as those related to emissions or material sourcing, can significantly increase operational expenses.

- Risk of Fines and Penalties: Non-compliance with evolving safety or environmental regulations could result in substantial financial penalties, impacting profitability.

- Reputational Damage: Public scrutiny and negative press associated with regulatory breaches can erode customer trust and brand value.

- Operational Restrictions: Severe non-compliance could lead to temporary or permanent bans on certain operations or product lines.

Intense competition from established players and agile specialists puts pressure on FAIST's market share and profit margins, with the global industrial automation market experiencing margin compression in 2024 due to rivalry.

Economic downturns, projected at 2.4% global GDP growth for 2024 by the IMF, reduce client investment, impacting FAIST's order pipeline, as seen in the automotive sector's 10% sales decline in 2023.

Rapid technological advancements in areas like AI and IoT integration, driving the industrial automation market to an estimated $320 billion by 2025, risk making FAIST's current offerings obsolete.

Supply chain volatility and raw material price fluctuations, such as a potential 20% swing in nickel prices in 2024 and 10-15% surges in semiconductor costs in late 2023, directly increase FAIST's operational expenses and project timelines.

| Threat Category | Specific Risk | Impact on FAIST | Supporting Data/Example |

|---|---|---|---|

| Competition | Market Share Erosion | Reduced revenue and profitability | Intense rivalry in industrial automation market led to margin compression in 2024. |

| Economic Conditions | Decreased Client Investment | Lower order volume and project pipeline | Projected 2.4% global GDP growth for 2024; automotive sales down 10% in 2023. |

| Technological Change | Product Obsolescence | Loss of market relevance and competitiveness | Industrial automation market to reach $320 billion by 2025 with AI/IoT integration. |

| Supply Chain & Costs | Increased Component/Material Costs | Higher project expenses and reduced margins | Nickel price volatility (20%+ quarterly swings in 2024); semiconductor price surges (10-15% late 2023). |

| Regulatory Environment | Compliance Costs & Penalties | Increased operational expenses, potential fines, reputational damage | EU's CBAM transitional phase; increased safety/environmental enforcement in 2023-2024. |

SWOT Analysis Data Sources

This FAIST SWOT analysis is built upon a robust foundation of data, incorporating detailed financial reports, comprehensive market intelligence, and expert industry insights to provide a thorough and actionable assessment.