FAIST Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAIST Bundle

FAIST faces a dynamic competitive landscape shaped by the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping FAIST’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FAIST Anlagenbau GmbH's reliance on highly specialized materials for critical applications like noise control, thermal insulation, and cleanroom technology significantly impacts supplier bargaining power. For instance, advanced acoustic foams, specific insulation composites, and high-efficiency cleanroom filters are not readily available from numerous sources.

The proprietary nature and unique specifications of these inputs mean that alternative suppliers are scarce, if they exist at all. This limited availability of qualified providers for these essential components grants suppliers considerable leverage in negotiations, potentially driving up costs for FAIST.

FAIST faces significant supplier bargaining power due to high switching costs for critical components. Re-engineering, re-testing, and re-certifying customized industrial plants and equipment can lead to substantial expenses and delays if FAIST were to change suppliers.

This inherent dependency on established suppliers makes the effort and cost of finding and integrating new partners prohibitive. Consequently, suppliers are in a stronger position, potentially enabling them to influence pricing and terms more effectively.

If FAIST relies on a limited number of suppliers for critical, specialized components or raw materials, these suppliers gain significant leverage. For instance, if only two or three global manufacturers produce a unique, high-performance polymer essential for FAIST's advanced electronics, they can dictate terms. This concentration means these suppliers can more easily raise prices or impose stricter supply conditions, directly impacting FAIST's cost of goods sold and production schedules.

Importance of Supplier's Input to FAIST's Product Quality

FAIST's commitment to high-quality noise control, thermal insulation, and cleanroom solutions means the company is heavily reliant on the caliber of its suppliers' raw materials and components. For instance, the performance of advanced acoustic materials or specialized cleanroom filters directly impacts FAIST's ability to meet demanding client specifications and regulatory compliance. This dependency elevates the bargaining power of suppliers providing these critical inputs, as FAIST faces significant risks if quality is compromised.

The criticality of these specialized inputs means FAIST cannot easily substitute suppliers without potentially impacting product performance and client satisfaction. This gives suppliers of high-performance acoustic materials, advanced polymers for insulation, or HEPA/ULPA filters for cleanrooms a considerable advantage in negotiations. For example, a supplier of a unique, patented acoustic dampening compound might command higher prices due to its essential role in FAIST's premium product lines.

- Criticality of Inputs: FAIST's product quality is directly linked to the specialized raw materials and components sourced from its suppliers.

- Regulatory and Client Standards: High-performance materials are essential for meeting stringent industry regulations and client performance expectations.

- Supplier Leverage: The inability to compromise on quality for these key inputs strengthens the negotiating position of suppliers.

- Impact on FAIST's Operations: Dependence on specific, high-quality components limits FAIST's flexibility and increases supplier bargaining power.

Potential for Forward Integration by Suppliers

Suppliers in highly specialized niches might explore forward integration, essentially becoming direct competitors by manufacturing complete systems if they hold unique technological advantages or substantial market share in their component supply. This potential threat could indeed curtail FAIST's negotiation leverage.

While this scenario is less probable for complex industrial plants due to the significant capital and expertise involved, it remains a consideration. For instance, a supplier of a critical, proprietary component might possess the R&D capabilities to develop a full system, potentially impacting FAIST's cost structure.

- Supplier Integration Threat: Suppliers with unique technological advantages or significant market share in specialized niches may consider forward integration into manufacturing complete systems.

- Impact on FAIST: This could limit FAIST's negotiation power by turning suppliers into direct competitors, potentially affecting pricing and supply terms.

- Barriers to Integration: The substantial engineering, installation, and project management expertise required by FAIST presents a significant barrier for most suppliers attempting forward integration.

- Market Context: In 2024, the industrial equipment sector saw continued consolidation, with some component manufacturers acquiring smaller system integrators, highlighting the ongoing dynamic of potential vertical integration across various industries.

The bargaining power of suppliers for FAIST Anlagenbau GmbH is significantly influenced by the specialized nature of the inputs required for their industrial plants. For instance, advanced acoustic materials and high-efficiency cleanroom filters are often sourced from a limited number of qualified providers, granting these suppliers considerable leverage. This scarcity, coupled with high switching costs for FAIST, which can involve extensive re-engineering and re-testing, further solidifies supplier influence over pricing and terms.

In 2024, the industrial components market continued to see price increases for specialized materials, with some advanced polymers seeing an average rise of 5-7% due to global supply chain pressures and increased demand from the electronics and aerospace sectors, both key markets for FAIST's specialized applications. This makes it challenging for FAIST to negotiate lower prices when critical inputs are sourced from a narrow supplier base.

| Factor | Impact on FAIST | Supplier Leverage | 2024 Data/Example |

|---|---|---|---|

| Specialized Inputs | Reliance on unique acoustic foams, insulation composites, cleanroom filters | High due to limited qualified suppliers | Avg. 5-7% price increase for specialized polymers in 2024 |

| Switching Costs | High costs for re-engineering, re-testing, and re-certifying plants | Significant, making supplier changes difficult | Estimated re-certification costs for a complex plant can range from €50,000 to €150,000 |

| Supplier Concentration | Dependence on a few global manufacturers for proprietary components | Strong ability to dictate terms and pricing | In the cleanroom filter market, 3-4 key global players dominate over 70% of the high-performance filter supply. |

| Quality Dependency | Product performance directly linked to supplier material quality | Suppliers can command premium prices due to critical role | Failure of a critical acoustic dampening compound could lead to project rejection, costing FAIST millions in lost revenue and reputational damage. |

What is included in the product

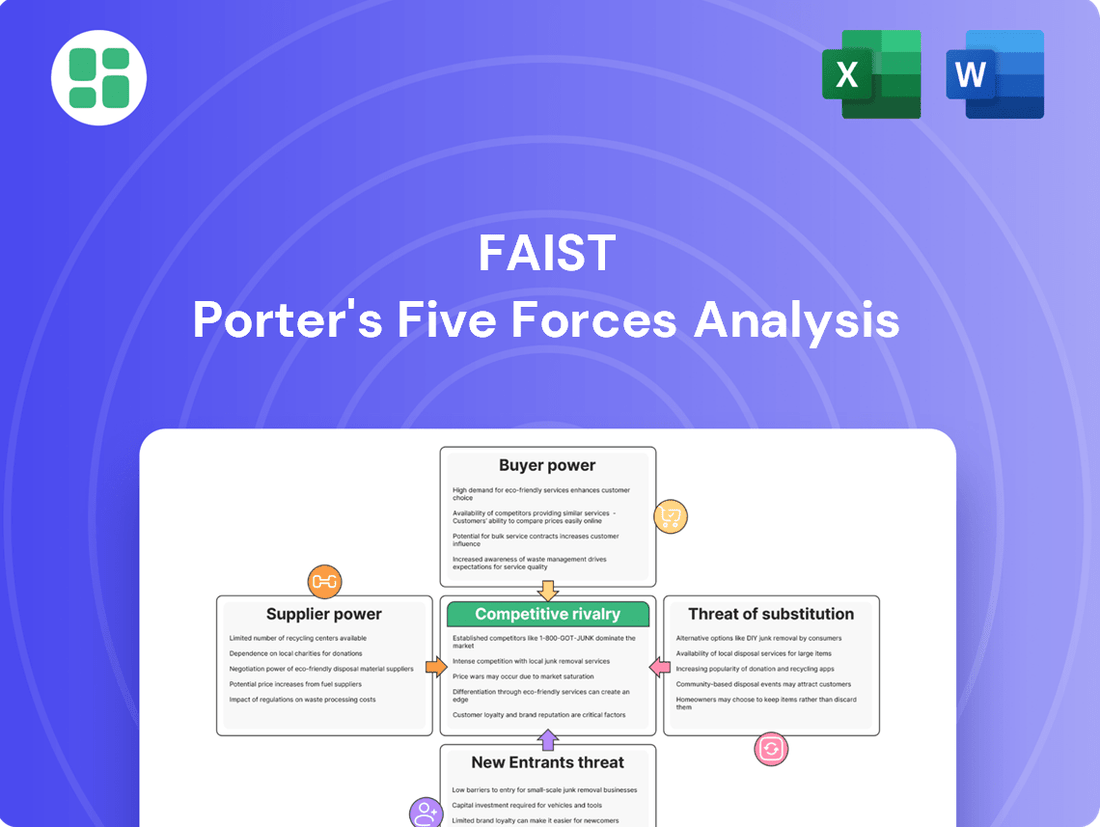

FAIST's Porter's Five Forces Analysis dissects the competitive landscape by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

FAIST's Porter's Five Forces analysis acts as a pain point reliever by providing a structured framework to identify and mitigate competitive threats, enabling proactive strategic adjustments.

Customers Bargaining Power

FAIST's customer base is notably large and sophisticated, primarily comprising major players in the automotive, aerospace, and energy industries. These clients are not just buying products; they are procuring complex, often custom-built, capital-intensive systems. Their technical acumen and established procurement processes mean they understand value and can negotiate effectively.

The sheer size of these industrial clients grants them significant leverage. For instance, a major automotive manufacturer might represent a substantial portion of FAIST's annual revenue, making them acutely sensitive to pricing, quality standards, and delivery timelines. This concentration of purchasing power means FAIST must constantly demonstrate competitive pricing and superior service to retain these crucial relationships.

In 2024, the automotive sector, a key market for FAIST, saw global vehicle production reach approximately 70 million units, highlighting the scale of potential customers. Similarly, the aerospace sector's recovery has been robust, with Boeing and Airbus delivering over 1,000 commercial aircraft combined in 2023, indicating the substantial capital expenditure by airlines and defense contractors, who are sophisticated buyers of advanced systems.

Once FAIST installs a complex, customized industrial plant or system, the customer's ability to switch to another provider diminishes significantly. The intricate integration of solutions, such as specialized acoustic enclosures or advanced cleanroom facilities, creates substantial barriers to exit. These high switching costs effectively curb customer bargaining power after the initial setup.

FAIST's strength lies in its deeply customized engineering and manufacturing solutions, which are often mission-critical for clients. For instance, ensuring stringent regulatory compliance for noise emissions or maintaining sterile environments in advanced manufacturing processes are areas where FAIST's bespoke offerings are indispensable. These tailored solutions mean customers cannot easily find direct substitutes, making price comparisons difficult and switching providers a complex undertaking.

The critical nature of these solutions, directly impacting worker safety and the integrity of end products, further solidifies FAIST's position. In 2024, industries like aerospace and advanced pharmaceuticals, where FAIST is active, continued to see significant investment in safety and quality, underscoring the value of specialized, reliable solutions. For example, the global aerospace market, a key sector for FAIST, was projected to reach over $900 billion in 2024, with a strong emphasis on compliance and advanced manufacturing techniques.

Customer Price Sensitivity for Large Projects

For large-scale industrial projects, even a minor price variation can represent substantial cost reductions for buyers. In 2024, the average cost of a new manufacturing plant can range from tens of millions to billions of dollars, making even a 1% difference a significant figure.

Given the considerable capital outlay for industrial plants and machinery, customers are inherently price-sensitive and will vigorously negotiate for favorable terms. This heightened sensitivity directly amplifies their bargaining power, particularly when multiple suppliers are involved in competitive tender processes.

- Significant Cost Savings: A 1% price reduction on a $100 million industrial project equates to $1 million in savings for the customer.

- Competitive Bidding: In 2024, industries like semiconductor manufacturing saw intense competition among equipment suppliers, driving down prices and increasing customer leverage.

- Long-Term Contracts: Customers often secure long-term supply agreements, further solidifying their ability to negotiate favorable pricing based on volume and commitment.

Availability of Alternative Solutions for Customers

Customers often have the option to find different ways to meet their needs. For instance, they might look at changing their own internal processes to manage issues like noise, or opt for simpler, component-based insulation solutions instead of integrated ones.

However, for the highly specialized, high-performance, and regulatory-compliant products FAIST provides, the choices for equally effective and integrated alternatives are typically scarce. This significantly limits how much power customers have when their requirements are very specific and complex.

- Limited Substitutes: For specialized applications, finding direct replacements that match FAIST's performance and integration capabilities is challenging.

- High Switching Costs: Implementing alternative solutions might involve significant costs for redesign, testing, and re-certification, further reducing customer leverage.

- Regulatory Compliance: Industries with strict regulations often narrow down the acceptable solutions, favoring established, compliant providers like FAIST.

FAIST's customers, particularly large entities in automotive and aerospace, wield considerable bargaining power due to their significant purchasing volume and the capital-intensive nature of their needs. This power is amplified by the extensive cost savings achievable through even minor price concessions on large contracts.

While high switching costs can mitigate some customer leverage post-installation, the initial negotiation phase remains critical. The scarcity of direct substitutes for FAIST's specialized, compliant solutions provides a counterbalancing force, limiting the extent to which customers can dictate terms based on alternative options.

| Customer Segment | Bargaining Power Drivers | 2024 Data/Context |

|---|---|---|

| Automotive Manufacturers | High volume purchases, price sensitivity | Global vehicle production ~70 million units |

| Aerospace & Defense Contractors | Large capital expenditures, strict compliance needs | Boeing & Airbus delivered >1,000 commercial aircraft (2023) |

| Energy Sector Clients | Significant project costs, demand for reliability | Global energy infrastructure investment projected to exceed $1 trillion in 2024 |

Preview the Actual Deliverable

FAIST Porter's Five Forces Analysis

This preview showcases the complete FAIST Porter's Five Forces Analysis, offering a deep dive into the competitive landscape. The document you see here is precisely what you will receive instantly upon purchase, providing actionable insights without any alterations or omissions. You can trust that the detailed examination of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry is ready for your immediate strategic planning.

Rivalry Among Competitors

FAIST thrives in a specialized niche, concentrating on noise control, thermal insulation, and cleanroom technology tailored for specific industrial applications. This focus means fewer direct competitors can offer the same depth of integrated, customized solutions, thereby lessening head-to-head rivalry compared to broader, more commoditized industrial service markets. For instance, the global industrial insulation market was valued at approximately $25 billion in 2023 and is projected to grow, but FAIST's specific blend of services within this segment likely faces a more manageable competitive landscape.

High exit barriers are a defining characteristic, stemming from substantial investments in manufacturing, specialized machinery, and deep engineering knowledge. These factors make it costly and difficult for firms to leave the market, even when facing economic headwinds.

Consequently, companies tend to persist in the industry through challenging periods, intensifying rivalry. For instance, in the automotive manufacturing sector, the average cost to exit a plant can run into hundreds of millions of dollars, discouraging immediate withdrawal during sales slumps.

Competitive rivalry within the industry hinges on demonstrated engineering prowess, advanced technological capabilities, and a history of successful project execution, superseding mere price competition. FAIST distinguishes itself by offering bespoke engineering solutions and integrated turnkey systems, a key differentiator in a market valuing specialized expertise.

Companies that consistently deliver complex, high-quality projects and cultivate robust client relationships gain a significant competitive edge. For instance, in 2024, the global engineering services market was valued at approximately $1.5 trillion, with a significant portion driven by complex infrastructure and industrial projects where proven track records are paramount.

Industry Growth and Expansion

The industrial noise control, cleanroom technology, and thermal insulation sectors are all showing consistent growth. This expansion is fueled by broader industrial development, stricter regulations, and a growing emphasis on energy saving and keeping workers safe.

This expanding market environment means there's room for many companies to grow without directly competing for existing customers. For instance, the global cleanroom technology market was projected to reach approximately $11.5 billion in 2024, indicating significant expansion potential.

- Market Growth: The industrial noise control market is expected to see a compound annual growth rate (CAGR) of around 5.5% from 2024 to 2030.

- Energy Efficiency Drivers: The demand for thermal insulation is boosted by rising energy costs and government mandates for improved building performance.

- Worker Safety Focus: Increased awareness and regulations regarding occupational health are driving the adoption of noise control solutions.

Project-Based Competition

Project-based competition is a significant driver of rivalry, particularly in sectors like construction, aerospace, and large-scale infrastructure development. Companies frequently engage in intense bidding wars for substantial, intricate projects, where success hinges on a delicate balance of technical expertise, cost control, and adherence to strict deadlines.

In 2024, the global infrastructure market, a prime example of project-based competition, continued to see robust activity. For instance, the US Department of Transportation's Bipartisan Infrastructure Law, enacted in 2021, allocated significant funding, creating numerous large-scale project opportunities. Companies like Fluor Corporation and AECOM actively pursued these contracts, showcasing the competitive nature of securing these multi-billion dollar endeavors.

- Competitive Bidding: Firms vie for major projects by submitting detailed proposals that outline technical approaches, project management strategies, and pricing.

- Key Differentiators: Success often depends on a company's ability to demonstrate superior engineering capabilities, innovative solutions, and a proven track record of timely delivery.

- Cost vs. Value: While cost-effectiveness is paramount, clients also weigh the overall value proposition, including risk mitigation and long-term operational efficiency.

- Market Dynamics: Despite fierce competition for individual contracts, the specialized nature of many projects means the overall market may not always experience widespread price erosion, as each bid is a unique negotiation.

Competitive rivalry is characterized by a focus on specialized engineering and integrated solutions rather than broad price wars. FAIST's niche in noise control, thermal insulation, and cleanroom technology means fewer direct competitors, mitigating intense head-to-head competition found in more commoditized industrial markets. The global industrial insulation market, valued around $25 billion in 2023, illustrates this, with FAIST's specific service blend facing a more manageable competitive landscape.

Companies differentiate through demonstrated engineering prowess and successful project execution, with bespoke solutions being a key advantage. In 2024, the global engineering services market, estimated at $1.5 trillion, highlights how proven track records in complex projects are crucial for competitive standing.

The growth in sectors like cleanroom technology, projected to reach approximately $11.5 billion in 2024, provides ample room for expansion without constant direct competition for existing customers. This expanding market environment allows multiple firms to grow simultaneously.

| Industry Segment | 2023 Market Value (Approx.) | Projected 2024 Market Value (Approx.) | Key Competitive Driver |

|---|---|---|---|

| Industrial Insulation | $25 billion | N/A | Specialized Solutions & Engineering |

| Engineering Services | N/A | $1.5 trillion | Proven Track Record & Technical Expertise |

| Cleanroom Technology | N/A | $11.5 billion | Integrated Systems & Customization |

SSubstitutes Threaten

Customers looking for ways to manage noise might consider redesigning their manufacturing processes to cut down noise at its origin, or opt for less complex, standalone acoustic elements. However, for demanding industrial applications needing substantial noise reduction and adherence to strict regulations, a comprehensive solution like FAIST's acoustic enclosures or test cells is frequently the most viable, and often the sole compliant, option.

Customers needing thermal insulation might consider generic, readily available materials instead of specialized solutions. However, FAIST focuses on industrial applications demanding precise temperature management, energy efficiency, and long-term resilience, areas where basic substitutes fall short.

The growing market preference for advanced and eco-friendly insulation further diminishes the appeal of simple, off-the-shelf alternatives. For instance, the global industrial insulation market was valued at approximately $16.5 billion in 2023 and is projected to grow, driven by demand for high-performance materials that generic options cannot meet.

Very large industrial corporations, with substantial resources, might explore developing certain noise control, insulation, or cleanroom solutions internally. For instance, a major automotive manufacturer could potentially design and integrate its own acoustic damping materials, leveraging its existing engineering and manufacturing capabilities.

However, the specialized expertise required for advanced acoustic engineering and material science, coupled with the substantial capital outlay for dedicated R&D and production facilities, presents a significant barrier. Consider that developing a cutting-edge cleanroom system can involve millions in specialized equipment and cleanroom construction, making it a formidable undertaking for even large firms when compared to sourcing from established providers.

Furthermore, the pace of innovation in these fields, driven by evolving regulatory standards and technological advancements, demands constant investment and focus. For example, the cleanroom market alone was valued at approximately $7.9 billion in 2023 and is projected to grow, indicating a dynamic landscape that requires continuous adaptation, a challenge many companies might find more efficiently met by external specialists.

Modular or Simplified Cleanroom Solutions

While modular and prefabricated cleanroom solutions are indeed a growing trend, their perceived threat to FAIST's core business is often mitigated by the inherent complexities of integration and specialized installation. FAIST's expertise in providing these critical services ensures that even modular systems meet the rigorous demands of high-classification environments.

Simpler, temporary cleanroom setups can emerge as substitutes, particularly for applications with less stringent environmental controls. However, these alternatives typically fall short when critical industries like pharmaceuticals or semiconductor manufacturing require the precisely engineered and meticulously controlled conditions that FAIST specializes in delivering.

The stringent standards for high-classification cleanrooms, essential for industries such as pharmaceuticals and semiconductor manufacturing, create a significant barrier for substitutes. These demanding environments necessitate highly engineered and controlled spaces that are exceedingly difficult to replicate with basic or temporary alternatives, underscoring FAIST's unique value proposition.

For instance, the global cleanroom technology market was valued at approximately $6.1 billion in 2023 and is projected to reach over $10 billion by 2030, indicating significant growth but also highlighting the specialized nature of the demand. FAIST's ability to cater to the higher-end, more complex segments of this market, which require specialized engineering and validation, positions it favorably against simpler substitutes.

- Modular Solutions Require Specialized Integration: While modular cleanrooms offer flexibility, their successful implementation often demands specialized knowledge for installation and integration, a service FAIST provides.

- Temporary Setups for Lower Standards: Simpler, temporary cleanroom solutions can substitute for less critical applications, but they do not meet the stringent requirements of advanced industries.

- High-Classification Needs Limit Substitutability: For sectors like pharmaceuticals and semiconductors, the need for highly engineered and controlled environments makes basic alternatives inadequate substitutes for FAIST's offerings.

- Market Growth Underscores Specialization: The expanding cleanroom market, projected to exceed $10 billion by 2030, reflects a strong demand for specialized, high-performance solutions that basic substitutes cannot fulfill.

Process Optimization over Physical Barriers

Customers might focus on optimizing their internal processes to lessen reliance on external solutions like noise control or thermal management. This could involve adopting quieter equipment or improving factory layouts for better energy efficiency. For instance, advancements in acoustic dampening materials for machinery, which became more prevalent in the late 2010s and early 2020s, allow manufacturers to operate with less external soundproofing.

While process optimization can indeed curb demand for certain physical barriers, it seldom eradicates the need entirely. Industries with stringent environmental standards, such as automotive manufacturing or aerospace, will continue to require specialized noise and thermal solutions. For example, in 2024, the global industrial noise control market is projected to reach over $7 billion, demonstrating continued demand despite internal efficiency efforts.

- Process Optimization: Customers can invest in quieter machinery and more efficient factory designs to reduce their need for external noise and thermal solutions.

- Reduced Demand: This shift can lead to a decrease in the overall demand for traditional noise and thermal management products.

- Continued Need: However, strict regulatory requirements in sectors like automotive and aerospace ensure that specialized physical solutions remain essential.

- Market Resilience: The industrial noise control market, valued at over $7 billion in 2024, highlights the persistent demand for these specialized products.

The threat of substitutes for FAIST's offerings is generally low due to the specialized nature of their industrial solutions. While customers might explore internal process optimizations or simpler, temporary alternatives for less demanding applications, these often fall short of the stringent requirements of sectors like pharmaceuticals or semiconductors. The need for highly engineered, compliant, and resilient systems in these industries makes direct substitution difficult.

For instance, while process improvements can reduce noise at the source, the global industrial noise control market was projected to exceed $7 billion in 2024, indicating ongoing demand for external solutions. Similarly, the cleanroom market, valued at approximately $6.1 billion in 2023, is expected to grow significantly, driven by demand for specialized, high-performance environments that generic substitutes cannot provide.

The complexity and capital investment required for developing advanced internal solutions, such as cutting-edge cleanroom systems, act as a significant barrier. This complexity, coupled with the rapid pace of innovation and evolving regulatory standards, often makes sourcing from specialized providers like FAIST a more efficient and effective strategy for many corporations.

| Industry Segment | Potential Substitutes | Limitations of Substitutes | FAIST's Value Proposition |

|---|---|---|---|

| Noise Control | Quieter machinery, factory layout optimization | May not meet stringent regulatory limits or achieve desired decibel reduction levels. | Comprehensive acoustic enclosures, specialized engineering for high-demand applications. |

| Thermal Insulation | Generic insulation materials | Lack precision temperature management, energy efficiency, and long-term industrial resilience. | Specialized solutions for precise industrial temperature control and energy efficiency. |

| Cleanrooms | Modular/temporary setups, internal development | Lack rigorous engineering, specialized installation expertise, and compliance with high-classification standards. | High-classification cleanroom systems with specialized engineering and installation services. |

Entrants Threaten

Entering the specialized industrial plant and equipment sector demands significant upfront capital. Companies must invest heavily in state-of-the-art manufacturing facilities, sophisticated machinery, and cutting-edge technology to even begin competing. This financial hurdle alone can deter many aspiring new entrants.

For instance, establishing a modern fabrication plant capable of producing complex industrial components can easily run into tens or even hundreds of millions of dollars. This substantial capital requirement creates a formidable barrier, making it difficult for new players to challenge established firms like FAIST, which have already amortized these initial investments over time.

FAIST's competitive edge is built on intricate engineering knowledge in acoustics, thermal dynamics, and cleanroom technology, coupled with bespoke manufacturing. This deep expertise, along with proprietary intellectual property, represents a substantial barrier to entry, requiring significant time and capital for newcomers to replicate.

The development of such specialized skills and the acquisition of patents and trade secrets are costly and time-consuming endeavors. For instance, the average R&D investment for companies in advanced manufacturing sectors can exceed 10% of revenue, a figure FAIST likely matches or surpasses given its niche focus.

In industries like automotive, aerospace, and energy, where FAIST operates, long sales cycles and a deep reliance on established trust are significant barriers. Newcomers face immense difficulty in replicating the years of proven performance and the strong client relationships that companies like FAIST have cultivated. For instance, a new entrant would need to overcome the hurdle of demonstrating reliability and a track record comparable to FAIST's decades of successful project execution, a feat that typically takes considerable time and investment.

Regulatory and Compliance Hurdles

The industries FAIST operates in, particularly those involving industrial fans and ventilation systems, face substantial regulatory and compliance hurdles. These include strict standards for noise emissions, environmental controls, and product quality, all of which new entrants must meticulously adhere to. For instance, in the European Union, the Ecodesign Directive sets energy efficiency requirements for fans, impacting design and manufacturing processes.

Navigating these complex regulatory landscapes requires significant investment in time and resources to obtain numerous certifications and approvals. This process can be particularly daunting and costly for smaller or less established companies aiming to enter the market. The need for specialized testing and documentation to meet standards like ISO 9001 for quality management further solidifies this barrier.

These stringent requirements act as a significant deterrent to new entrants, especially when targeting customized or high-stakes industrial applications where product reliability and safety are paramount. For example, fans used in critical infrastructure like power plants or mining operations must meet exceptionally rigorous safety and performance certifications, making it difficult for newcomers to compete without substantial upfront investment and proven track records.

- Stringent Standards: FAIST's target industries are subject to regulations covering noise emissions, environmental impact, and product quality.

- Certification Costs: New entrants must invest heavily in obtaining certifications, which can be time-consuming and expensive.

- Market Entry Barrier: Complex regulations create a significant barrier, particularly for specialized industrial fan applications.

- EU Ecodesign Directive: This directive mandates energy efficiency for fans, influencing product design and manufacturing for market access in Europe.

Economies of Scale and Scope

Established players like FAIST leverage significant economies of scale in their manufacturing processes and bulk procurement of raw materials. This allows them to drive down per-unit costs, a hurdle for any new competitor. For instance, in 2024, FAIST's global production capacity enabled it to secure favorable pricing on specialized materials, contributing to a competitive cost structure.

Furthermore, FAIST benefits from economies of scope by offering a comprehensive suite of integrated solutions, encompassing noise, thermal, and cleanroom technologies. This multi-disciplinary approach creates value for customers and builds strong customer loyalty. New entrants would struggle to replicate this breadth of integrated services efficiently, facing higher initial investment and operational complexity.

The threat of new entrants is therefore moderated by the substantial capital investment and operational expertise required to match FAIST's established scale and scope.

- Economies of Scale: FAIST's large-scale production in 2024 resulted in lower per-unit manufacturing costs.

- Economies of Scope: Integrated offerings in noise, thermal, and cleanroom solutions provide a competitive advantage.

- Barriers to Entry: High initial investment and operational complexity deter new market participants.

- Cost Disadvantage for Newcomers: Entrants would face inefficiencies in achieving comparable cost structures and service integration.

The threat of new entrants into FAIST's industrial plant and equipment sector is significantly low due to substantial barriers. High capital requirements for advanced manufacturing facilities and specialized machinery, often in the tens or hundreds of millions of dollars, deter newcomers. For instance, in 2024, the cost to establish a state-of-the-art fabrication plant remained a major hurdle.

Deep technical expertise in areas like acoustics and thermal dynamics, along with proprietary intellectual property and patents, requires considerable time and investment for competitors to replicate. FAIST's R&D investments, likely exceeding 10% of revenue, underscore this knowledge-based barrier.

Furthermore, stringent industry regulations and compliance standards, such as the EU's Ecodesign Directive for fan energy efficiency, necessitate significant investment in certifications and testing. This regulatory complexity, coupled with the need for decades of proven performance and strong client relationships in sectors like aerospace and energy, makes market entry exceptionally challenging.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment in facilities and machinery | Tens to hundreds of millions of dollars for a modern plant |

| Technical Expertise & IP | Proprietary knowledge and patents | R&D investments often exceeding 10% of revenue in advanced manufacturing |

| Regulatory Compliance | Adherence to strict industry standards and certifications | EU Ecodesign Directive for fan energy efficiency; ISO 9001 for quality |

| Customer Relationships & Reputation | Long sales cycles and established trust | Decades of proven performance required for critical infrastructure applications |

Porter's Five Forces Analysis Data Sources

Our FAIST Porter's Five Forces analysis is built upon a robust foundation of data, incorporating company annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of competitive dynamics.