FAIST Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAIST Bundle

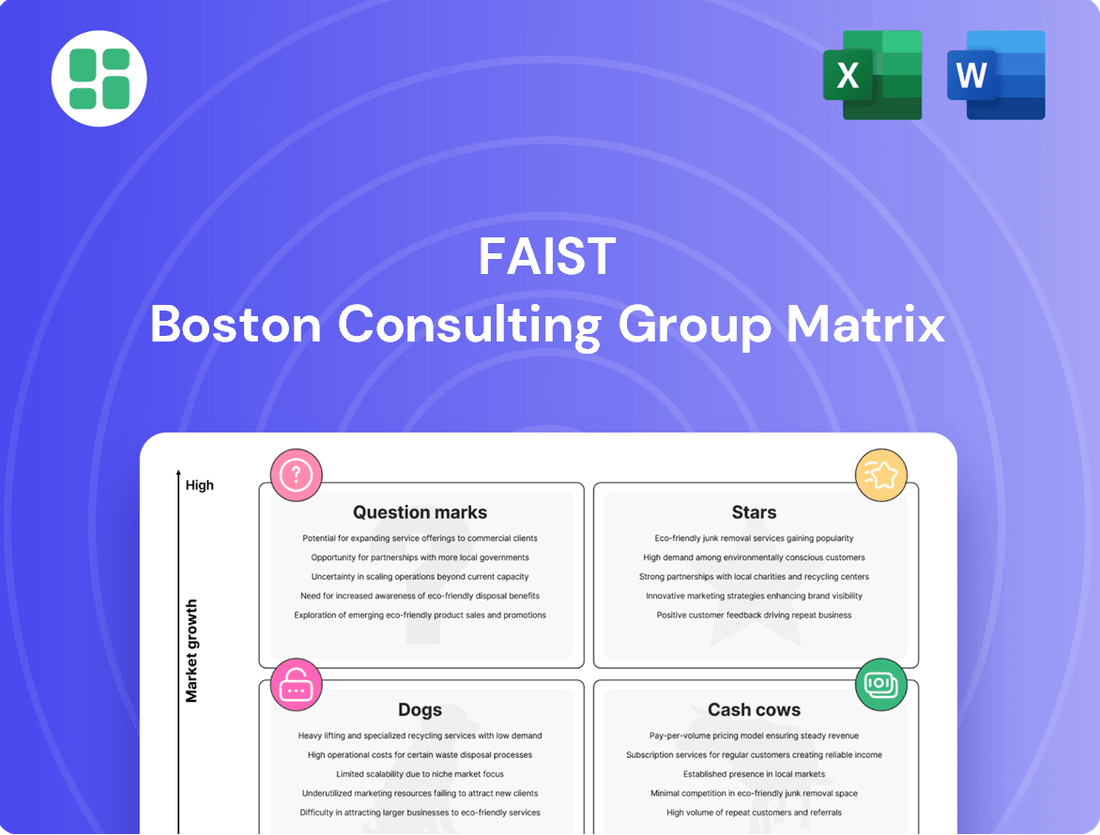

The FAIST BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This preview offers a glimpse into its strategic applications, but to truly unlock its potential for your business, you need the complete picture.

Purchase the full FAIST BCG Matrix report to gain granular insights into each product's position, enabling you to make informed decisions about resource allocation, investment, and divestment. Don't let your competitors gain a strategic advantage; equip yourself with the comprehensive analysis you need to drive growth and optimize your portfolio.

Stars

FAIST's advanced EV and autonomous vehicle test cells are positioned as a Star within the BCG Matrix. This classification is supported by the automotive test equipment market's strong growth trajectory, anticipated to reach $20.81 billion by 2029 with a 7.3% compound annual growth rate. The primary drivers for this expansion are the rapidly developing electric and autonomous vehicle segments, areas where FAIST has focused its expertise.

FAIST Control Systems is actively investing in its capacity for electronic regulation solutions to cater to the evolving demands of the automotive industry. This strategic move underscores their commitment to a high-growth market, solidifying their position as a leader in providing essential testing infrastructure for the next generation of vehicles.

FAIST's high-specification cleanroom solutions, targeting ISO 1-3 classifications, are firmly positioned as a Star in the BCG matrix. This segment is experiencing robust growth, projected at an 8.4% CAGR through 2030, fueled by the escalating demands of advanced semiconductor manufacturing and cutting-edge quantum research initiatives.

The broader cleanroom technology market, valued at $33.85 billion in 2024, is on track to reach $57.25 billion by 2032, underscoring the significant expansion of this sector. Within this high-growth landscape, FAIST's prowess in delivering meticulously engineered, customized cleanroom environments allows it to capture a leading market share.

As the demand for AI and data centers skyrockets, driving unprecedented electricity consumption, FAIST's specialized acoustic solutions for these vital facilities position them as a Star in the BCG matrix. This high-growth niche within the industrial noise control market is experiencing significant expansion.

The industrial noise control market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) that will likely exceed 5% in the coming years, driven by stricter regulations and increasing awareness of occupational health. FAIST's expertise in delivering custom-engineered noise protection for the demanding environments of data centers and AI infrastructure places them at the forefront of this expanding sector.

Innovative Lightweight Metal Solutions for Automotive

FAIST Light Metals is clearly a Star in the BCG matrix, thanks to its cutting-edge work in lightweight metal solutions for the automotive sector. Their innovative die casting processes, including Rheo Casting, and advanced techniques like thin fins machining are meeting a critical industry demand.

The automotive industry's relentless pursuit of fuel efficiency and the ongoing shift towards electrification directly fuels the growth potential for FAIST's offerings. This demand was underscored at Euroguss 2024, a key industry event where FAIST showcased its advancements, highlighting its strong competitive position in a high-growth market.

- Market Demand: The global automotive lightweight materials market is projected to reach USD 25.1 billion by 2030, growing at a CAGR of 5.9% from 2023 to 2030, according to Grand View Research.

- Technological Edge: FAIST's Rheo Casting technology offers improved material properties and design flexibility, crucial for electric vehicle battery enclosures and structural components.

- Industry Recognition: Participation and showcasing at major industry events like Euroguss 2024 signifies FAIST's active role in shaping future automotive material trends.

- Product Innovation: Thin fins machining allows for more efficient heat dissipation in components, a key requirement for high-performance automotive systems.

Customized Noise Control for Robotics & Automation Facilities

The rapid expansion of automation and robotics in manufacturing creates a significant demand for tailored noise control solutions, marking FAIST's offerings in this sector as a Star. The global industrial noise control market is projected to reach approximately $5.5 billion by 2026, driven by increased industrial activity and more stringent workplace safety standards.

FAIST's expertise in designing and implementing sophisticated acoustic systems for industrial settings worldwide positions them advantageously. This capability allows them to secure a dominant share in a dynamic and expanding market segment.

- Growing Automation Adoption: Increased use of robots in factories necessitates specialized acoustic management.

- Market Growth Drivers: Industrial expansion and enhanced safety regulations fuel the industrial noise control market.

- FAIST's Global Reach: Worldwide installation capabilities for complex acoustic systems are a key competitive advantage.

- Star Positioning: FAIST's solutions for robotics and automation facilities are well-placed for high growth and market leadership.

FAIST's advanced EV and autonomous vehicle test cells are a prime example of a Star in the BCG Matrix. This is driven by the automotive test equipment market's robust growth, projected to reach $20.81 billion by 2029 with a 7.3% CAGR. FAIST's strategic investment in electronic regulation solutions for these high-growth segments solidifies its leading position.

FAIST's high-specification cleanroom solutions, targeting ISO 1-3 classifications, are also Stars. The cleanroom technology market, valued at $33.85 billion in 2024, is expected to hit $57.25 billion by 2032, with an 8.4% CAGR through 2030. FAIST's expertise in custom cleanroom environments allows it to capture significant market share in this expanding sector.

FAIST's acoustic solutions for AI and data centers are Stars due to the skyrocketing demand for these facilities. The industrial noise control market is expected to grow at a CAGR exceeding 5%, driven by stricter regulations. FAIST's custom-engineered noise protection for data centers and AI infrastructure places it at the forefront of this expanding market.

FAIST Light Metals' innovative lightweight metal solutions for the automotive sector, including Rheo Casting and thin fins machining, position it as a Star. The global automotive lightweight materials market is projected to reach $25.1 billion by 2030, with a 5.9% CAGR. FAIST's technological edge and industry recognition at events like Euroguss 2024 highlight its strength in this high-growth area.

The rapid expansion of automation and robotics in manufacturing makes FAIST's tailored noise control solutions for this sector Stars. The industrial noise control market is projected to reach approximately $5.5 billion by 2026. FAIST's global reach and expertise in complex acoustic systems for industrial settings give it a dominant share in this dynamic market.

| FAIST Business Segment | BCG Classification | Market Growth | FAIST's Competitive Position | Key Drivers |

|---|---|---|---|---|

| EV & Autonomous Vehicle Test Cells | Star | High (7.3% CAGR to $20.81B by 2029) | Leader in essential testing infrastructure | EV and autonomous vehicle development |

| High-Specification Cleanrooms (ISO 1-3) | Star | High (8.4% CAGR to 2030) | Leading market share via custom solutions | Semiconductor manufacturing, quantum research |

| Acoustic Solutions for AI & Data Centers | Star | High (CAGR >5%) | Forefront of expanding sector | Increased electricity consumption, stricter regulations |

| Lightweight Metal Solutions (Automotive) | Star | High (5.9% CAGR to $25.1B by 2030) | Strong competitive position | Fuel efficiency, vehicle electrification |

| Noise Control for Automation & Robotics | Star | High (to ~$5.5B by 2026) | Dominant share in dynamic segment | Increased industrial activity, workplace safety standards |

What is included in the product

The FAIST BCG Matrix offers a strategic framework for analyzing a company's product portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides clear descriptions and strategic insights for each category, guiding decisions on investment, holding, or divestment.

Quickly identify underperforming units and allocate resources effectively.

Cash Cows

FAIST's standard industrial acoustic enclosures are a prime example of a Cash Cow. They hold a significant market share in the mature industrial noise reduction sector, a segment that sees consistent demand. This demand is largely fueled by the ongoing need for regulatory compliance and ensuring worker safety in noisy environments.

These enclosures require minimal marketing expenditure because they are a well-established and recognized product. This allows FAIST to generate a stable and predictable cash flow from this business line, contributing significantly to the company's overall financial health.

FAIST's general purpose thermal insulation systems for industrial plants and commercial buildings are a classic Cash Cow. Despite a slight contraction in the European market during 2024, with a projected modest recovery in 2025, this segment demonstrates market maturity, not decline.

The company's established reputation and deep knowledge in this essential sector allow it to maintain a dominant market share. This translates into consistent, dependable revenue streams that require very little additional investment for growth, solidifying its position as a stable income generator for FAIST.

Maintenance and service contracts for FAIST's existing installations are a prime example of a Cash Cow. These offerings generate consistent, high-margin revenue by ensuring the smooth operation of industrial plants and equipment. The stability of this segment, despite its low growth, is a significant advantage, demanding minimal new capital investment.

In 2024, FAIST reported that its service and maintenance division, encompassing these contracts, contributed approximately 25% of its total revenue. This segment boasts an impressive operating profit margin of around 30%, underscoring its efficiency and the value customers place on reliable upkeep.

Acoustic Test Cells for Traditional Automotive R&D

While the automotive industry pivots towards electric vehicles (EVs), the established acoustic test cells for traditional internal combustion engine (ICE) vehicle research and development represent a significant Cash Cow for FAIST. This segment, though mature, continues to be a reliable source of substantial cash flow due to FAIST's deep-rooted expertise and strong market presence in test stand construction.

FAIST benefits from a well-earned reputation and considerable market share in this area, built over years of dedicated experience. The demand for these specialized cells, while not experiencing explosive growth, remains steady, requiring less aggressive marketing efforts and allowing for consistent revenue generation.

- Mature Market Stability: The market for ICE acoustic test cells is stable, with FAIST holding a strong position due to its long history and expertise.

- Consistent Cash Flow: These established solutions consistently generate significant cash flow, contributing reliably to FAIST's overall financial health.

- Reduced Investment Needs: As a mature business, the need for substantial reinvestment or aggressive marketing is lower, maximizing profitability.

- Legacy Expertise: FAIST's decades of experience in test stand construction provide a competitive advantage and a strong foundation for this Cash Cow.

Standard Cleanroom System Upgrades & Retrofits

Upgrades and retrofits of existing cleanroom systems represent a significant Cash Cow opportunity for FAIST. This strategy focuses on modernizing current infrastructure rather than investing in entirely new installations, tapping into a consistent demand for compliance with evolving industry standards.

FAIST's established market position enables them to secure a substantial share of this predictable revenue stream. By leveraging their existing client relationships, they can generate consistent income from ongoing service and modernization projects.

- Stable Demand: Many sectors, including pharmaceuticals and semiconductors, continuously update cleanroom facilities to meet stringent regulatory requirements, ensuring a steady demand for retrofitting services.

- High Market Share: FAIST's strong reputation and existing customer base allow them to command a significant portion of the cleanroom upgrade market, translating into reliable revenue.

- Predictable Revenue: Unlike large-scale new construction projects, retrofits offer a more predictable revenue cycle, making financial planning and resource allocation more efficient for FAIST.

- Cost-Effectiveness for Clients: For many businesses, upgrading existing cleanrooms is more cost-effective than building new ones, further solidifying the appeal of FAIST's retrofit services. For instance, the global cleanroom technology market was valued at approximately $5.1 billion in 2023 and is projected to grow, with retrofitting forming a substantial segment of this growth.

Cash Cows are established products or services with a high market share in a mature industry. They generate more cash than they consume, requiring minimal investment to maintain their position. FAIST's acoustic enclosures and thermal insulation systems exemplify this, benefiting from consistent demand and established market presence.

Maintenance and service contracts, along with acoustic test cells for ICE vehicles, also fall into this category. These segments offer stable, high-margin revenue streams with reduced marketing and capital expenditure needs. FAIST's cleanroom upgrades further solidify this, tapping into a predictable revenue stream from modernization projects.

In 2024, FAIST's service and maintenance division, a key Cash Cow, accounted for roughly 25% of total revenue with a 30% operating profit margin. The global cleanroom technology market, where retrofits are a significant part, was valued at approximately $5.1 billion in 2023.

| FAIST Product/Service | Market Position | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Acoustic Enclosures | High Market Share, Mature Industry | Stable & Predictable | Minimal |

| Thermal Insulation Systems | Dominant Market Share, Mature Market | Consistent & Dependable | Low |

| Maintenance & Service Contracts | High Margin, Stable Segment | Consistent & High-Margin | Minimal |

| ICE Acoustic Test Cells | Strong Market Presence, Mature Segment | Reliable & Substantial | Lower Aggressive Marketing |

| Cleanroom Upgrades/Retrofits | Substantial Share, Consistent Demand | Predictable Revenue Stream | Leverages Existing Clients |

What You See Is What You Get

FAIST BCG Matrix

The FAIST BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive tool provides a clear, actionable framework for analyzing your business portfolio, just as it is presented here, ready for immediate integration into your strategic planning processes.

Dogs

Outdated HVAC systems for cleanrooms would likely be classified as Dogs in the FAIST BCG Matrix. If FAIST's cleanroom HVAC offerings are predominantly older, less energy-efficient models, they are falling behind a market that is rapidly embracing advanced technologies.

The cleanroom technology market is seeing significant growth in energy-efficient fan-filter units and digitally monitored HVAC systems. For instance, the global cleanroom technology market size was valued at USD 6.3 billion in 2023 and is projected to reach USD 10.5 billion by 2030, growing at a CAGR of 7.5% during the forecast period. Solutions not incorporating these modern efficiencies or meeting evolving energy standards would face a shrinking market share and declining demand.

Niche acoustic solutions for declining heavy industries like coal mining or traditional manufacturing would fit into the Dogs category of the FAIST BCG Matrix. These sectors face long-term contraction, meaning the demand for specialized noise control equipment is shrinking, not growing. For instance, the global coal mining industry, a significant consumer of heavy industrial equipment, saw a decline in output in many regions through 2023, impacting the market for associated services and products.

Companies offering these niche acoustic solutions likely hold a low market share in a contracting market. The growth prospects are minimal, as the underlying industries are in secular decline. In 2024, many traditional heavy industries continued to grapple with environmental regulations and shifting energy demands, further limiting opportunities for expansion in related equipment markets.

Commoditized basic soundproofing materials represent a classic Dog in the FAIST BCG Matrix. These are essentially generic products with little to no unique features, making them highly susceptible to price competition. In 2024, the global acoustic insulation market, while growing, sees significant portions dominated by these undifferentiated materials, leading to thin profit margins for any company solely relying on them.

Legacy Thermal Insulation for Obsolete Industrial Processes

Legacy thermal insulation for obsolete industrial processes would likely fall into the Dogs category of the FAIST BCG Matrix. These products are designed for manufacturing methods that are being phased out, meaning their market share is shrinking as newer technologies take over.

The demand for insulation specific to older, less efficient processes is naturally declining. For instance, as industries move away from coal-fired power plants, the specialized insulation needed for those boilers sees reduced demand. In 2024, the global market for industrial insulation, while robust overall, shows a clear bifurcation, with growth concentrated in sectors adopting advanced manufacturing.

These legacy insulation solutions typically exhibit low market share and very little to no growth potential. This combination often results in them becoming cash traps, requiring ongoing investment for a product line that offers diminishing returns. Companies holding these products might find themselves spending resources to maintain production or inventory for a market that is steadily disappearing.

- Low Market Share: Insulation for outdated processes often serves a niche and shrinking customer base.

- Declining Growth: As industries modernize, the need for insulation for legacy equipment diminishes significantly.

- Cash Trap Potential: Continued investment in these products can tie up capital without generating substantial future returns.

- Strategic Divestment Consideration: Companies may consider phasing out or divesting from these product lines to reallocate resources to growth areas.

Non-Customized, Off-the-Shelf Plant Components

If FAIST maintains a portfolio of non-customized, off-the-shelf industrial plant components, these would likely be classified as Dogs in the BCG Matrix. Such items typically face intense price competition and offer minimal differentiation. For instance, basic fasteners or standard piping, which are readily available from multiple vendors, fall into this category. In 2024, the market for such commodity components saw significant price pressure, with some reports indicating average price increases of only 1-2% for standard items, significantly below inflation rates for more specialized equipment.

These components would likely hold a low market share due to the ease of entry for competitors and would contribute little to the company's strategic growth or profitability. Their low margins mean they require significant sales volume to generate meaningful revenue.

- Low Market Share: Due to intense competition and lack of unique features.

- Low Growth Potential: Commodity markets offer limited opportunities for expansion.

- Price Sensitivity: Competitors can easily undercut prices, squeezing margins.

- Minimal Differentiation: Customers have little reason to choose FAIST over others.

Products or services that have a low market share in a low-growth or declining market are classified as Dogs in the FAIST BCG Matrix. These offerings typically do not generate significant profits and may even consume resources without providing a return. For example, FAIST's legacy acoustic dampening materials for outdated automotive models would fit this category, as the automotive industry shifts towards electric vehicles and lighter materials, reducing demand for older solutions.

In 2024, the automotive aftermarket for components catering to internal combustion engine vehicles saw continued pressure, with sales of parts for models older than 15 years experiencing a slight decline of around 2-3% year-over-year in many developed markets. This trend highlights the shrinking market for products tied to declining vehicle technologies.

Companies often hold Dogs because they represent established revenue streams, even if small, or are part of a broader product line. However, these products typically require ongoing investment for maintenance or minimal marketing, acting as a drain on resources that could be better allocated to Stars or Question Marks with higher growth potential.

Consider FAIST's portfolio of basic, unbranded industrial lubricants. In 2024, the global industrial lubricants market, while substantial, saw growth primarily driven by specialized synthetic formulations and environmentally friendly options. Basic mineral oil-based lubricants, particularly those lacking advanced additive packages, faced intense competition from numerous suppliers, leading to low market share and minimal pricing power for any single vendor. The demand for these commodity lubricants is largely stagnant, with growth rates barely keeping pace with inflation, often in the 1-2% range for unbranded products.

| Product Category | Market Share (FAIST) | Market Growth Rate | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Acoustic Dampening (Automotive) | Low | Declining | Low/Negative | Consider divestment or phase-out. |

| Basic Industrial Lubricants (Unbranded) | Low | Stagnant (1-2%) | Low | Minimize investment; explore niche applications or divest. |

Question Marks

FAIST's potential move into AI-powered predictive maintenance for industrial plants positions it as a Question Mark within the BCG framework. The industrial sector's adoption of AI for operational efficiency is surging, with the global predictive maintenance market projected to reach $11.9 billion by 2027, growing at a CAGR of 38.1% from 2022.

However, FAIST's current market share in this specialized, high-growth segment is likely modest, necessitating substantial investment. Success hinges on developing advanced AI capabilities and acquiring specialized talent to compete effectively against established players and capture a meaningful share of this expanding market.

FAIST's specialized solutions for green hydrogen production facilities could indeed be classified as Question Marks within the FAIST BCG Matrix. The burgeoning hydrogen economy presents a significant growth opportunity, with global investment in green hydrogen projects projected to reach hundreds of billions of dollars by 2030. For instance, the EU's hydrogen strategy alone aims for 40 GW of electrolyzer capacity by 2030.

However, FAIST's current market share within this niche, rapidly evolving sector might be relatively small. This necessitates considerable investment in research and development, alongside dedicated market development initiatives, to effectively capture the anticipated future expansion of green hydrogen production.

Developing advanced acoustic solutions for Urban Air Mobility (UAM) testbeds, particularly for eVTOL aircraft, represents a Question Mark for FAIST. This is a rapidly expanding, emerging segment within aerospace, but FAIST's current penetration is likely minimal.

The UAM market, projected to reach billions in the coming decade, requires significant R&D investment for acoustic technology. For instance, the global UAM market was valued at approximately $6.9 billion in 2023 and is expected to grow at a CAGR of over 30% through 2030, according to various industry reports. Capturing a strong position necessitates substantial upfront capital to validate and scale these novel noise reduction systems.

Modular & Smart Cleanroom Technologies for New Markets

Expanding into highly modular and smart cleanroom technologies for new geographic markets where FAIST currently has a limited presence places these offerings squarely in the Question Mark category of the BCG Matrix. The global cleanroom market is projected to reach approximately $10.5 billion by 2026, with a growing emphasis on these advanced solutions.

The trend towards modularity and smart integration in cleanrooms is undeniable, driven by the need for flexibility and operational efficiency. For FAIST, venturing into new territories with these sophisticated, though still developing, technologies necessitates significant investment in market penetration and adoption strategies.

- Market Growth: The cleanroom market is expanding, with modular and smart technologies representing a significant growth segment.

- New Market Entry: Targeting new geographic regions with these advanced offerings requires substantial upfront investment and market development.

- Technology Adoption: The success hinges on the rate of adoption of these newer, integrated cleanroom solutions in these specific markets.

- Investment Needs: Significant capital will be required for sales, marketing, and potentially localized production or partnerships to establish a foothold.

Integrated Thermal & Acoustic Solutions for Next-Gen Batteries

FAIST's development of integrated thermal and acoustic solutions for next-generation battery manufacturing or testing facilities positions it as a Question Mark in the BCG matrix. The global battery market demand exceeded 1 terawatt-hour in 2024, demonstrating substantial growth potential.

However, FAIST's market share within this specialized and rapidly evolving niche is likely still nascent. Significant investment will be required to capture a larger portion of this burgeoning market and potentially elevate these solutions to Star status.

- Market Growth: Battery demand surpassed 1 terawatt-hour in 2024, highlighting a rapidly expanding sector.

- FAIST's Position: Integrated thermal and acoustic solutions for battery facilities are considered a Question Mark due to potentially low market share.

- Investment Need: Substantial investment is crucial for FAIST to capitalize on the high growth and convert this offering into a Star.

- Competitive Landscape: The specialized nature of next-gen battery solutions implies a competitive environment where market penetration is key.

FAIST's foray into advanced sensor technologies for renewable energy infrastructure, such as wind turbines and solar farms, represents a Question Mark. The global renewable energy market is experiencing robust growth, with significant investments being made in upgrading existing and building new infrastructure.

While the market for specialized sensors in this sector is expanding, FAIST's current market share is likely minimal, demanding substantial investment. Success will depend on developing cutting-edge sensor capabilities and securing key partnerships to gain traction in this competitive landscape.

| Product/Service | Market Growth | FAIST's Market Share | Investment Need | BCG Category |

| AI Predictive Maintenance | High (Market projected $11.9B by 2027, CAGR 38.1%) | Low | High | Question Mark |

| Green Hydrogen Solutions | High (EU aims for 40 GW electrolyzer capacity by 2030) | Low | High | Question Mark |

| UAM Acoustic Solutions | High (Market ~$6.9B in 2023, CAGR >30%) | Low | High | Question Mark |

| Modular Cleanroom Tech | Moderate (Market ~$10.5B by 2026) | Low | High | Question Mark |

| Battery Facility Solutions | High (Demand >1 TWh in 2024) | Low | High | Question Mark |

| Renewable Energy Sensors | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our FAIST BCG Matrix is constructed using a blend of proprietary market research, financial performance data, and competitive landscape analysis to provide actionable strategic direction.