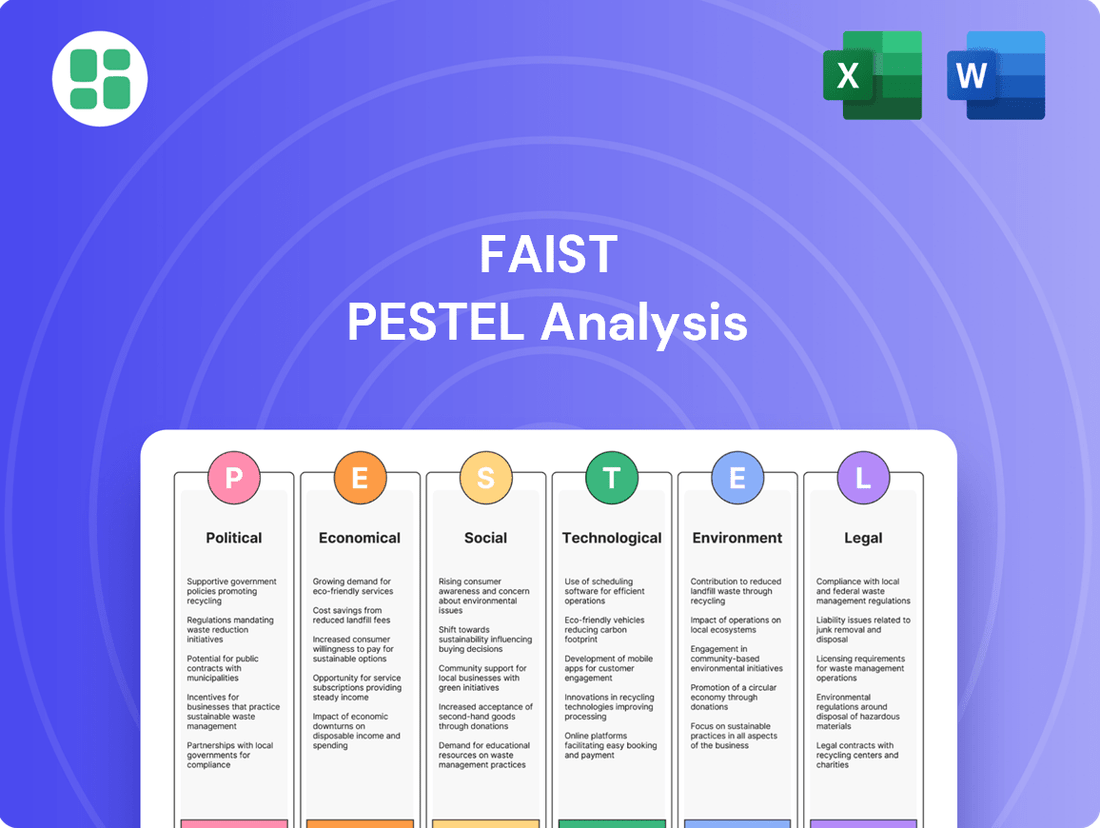

FAIST PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAIST Bundle

Unlock the hidden forces shaping FAIST's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Download the full report now and gain a critical competitive advantage.

Political factors

Governments globally are tightening industrial noise regulations, emphasizing worker safety and public health. For instance, the European Union's Directive 2003/10/EC, which sets minimum health and safety requirements for workers exposed to noise, continues to influence national legislation, with ongoing reviews and potential updates expected in the 2024-2025 period to align with evolving scientific understanding of noise impacts.

This increasing regulatory pressure necessitates greater investment in noise abatement technologies across various sectors. FAIST, as a provider of such solutions, finds its market expanding as industries scramble to meet compliance standards, a trend projected to continue as enforcement becomes more rigorous.

The global industrial noise control market was valued at approximately $6.5 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of around 5.5% through 2028, with regulatory compliance being a significant driver of this expansion.

Germany's 'new industrial policy agenda,' championed by Chancellor Scholz, is actively working to revitalize the manufacturing sector and encourage investment in key future industries. This strategic shift, which may include incentives like 'Made in Germany' bonuses, is designed to foster a more supportive ecosystem for German manufacturers.

For companies like FAIST Anlagenbau, a prominent player in industrial plant and equipment manufacturing, these policies could translate into a more robust domestic market. By stimulating industrial activity, the government's focus is likely to boost demand for FAIST's specialized engineering and construction services, particularly in areas aligned with the new industrial strategy.

Data from the German Federal Statistical Office (Destatis) for 2024 indicated a slight recovery in industrial production, and these policies aim to accelerate that trend. For instance, the German government allocated €16.5 billion to its climate and transformation fund in 2024, a significant portion of which is earmarked for industrial decarbonization and innovation, directly benefiting companies like FAIST that provide solutions for these transitions.

Global trade policies, including the ongoing potential for tariffs and trade wars, present a significant challenge for industrial sectors like automotive and aerospace, which are core client bases for FAIST. For example, German industrial production is projected to see a contraction of more than 1% in 2025, partly influenced by U.S. trade policies, potentially impacting the investment decisions of FAIST's key customers.

Geopolitical risks also play a crucial role, affecting capital allocation and investment trends within the energy sector, another vital market for FAIST. The ongoing instability in global supply chains, exacerbated by geopolitical events, could lead to increased operational costs and reduced demand for FAIST's products and services.

Environmental Protection Directives

The revised EU Industrial Emissions Directive (IED 2024/1785), effective August 2024, introduces more stringent emission limits for large industrial installations, encompassing noise and vibrations, with a clear focus on decarbonization and material efficiency. This significant legislative update provides a powerful regulatory push for FAIST's clientele to invest in facility upgrades, thereby boosting the demand for sophisticated noise control and cleanroom technologies.

Compliance with these evolving environmental directives is not merely a suggestion but a necessity for industrial operators, directly translating into increased capital expenditure on technologies that support sustainability and reduced environmental impact. For instance, the directive's emphasis on decarbonization could spur investments in energy-efficient machinery and processes, where advanced acoustic solutions play a crucial role in maintaining operational standards.

- Increased demand for noise control solutions: The directive's inclusion of noise and vibration limits necessitates upgrades for many industrial sites.

- Focus on decarbonization: This drives investment in energy-efficient equipment, often requiring specialized acoustic treatments.

- Material efficiency requirements: This may lead to new production processes that benefit from advanced cleanroom technology.

- Regulatory compliance as a driver: The need to meet stricter emission standards directly fuels market opportunities for environmental technology providers.

Aerospace and Automotive Industry Specific Regulations

The aerospace and automotive industries are navigating a landscape of increasingly strict environmental and operational regulations. For instance, the Federal Aviation Administration (FAA) introduced a new rule in April 2024 aimed at curbing carbon emissions from aircraft, while the Environmental Protection Agency (EPA) is implementing more rigorous vehicle emissions standards, with phases beginning in 2027. These evolving mandates directly influence the demand for specialized solutions.

Furthermore, noise pollution is a growing concern, leading to strengthened noise regulations for automobiles. These sector-specific mandates create a clear market opportunity for companies like FAIST, whose expertise in noise control, advanced test cell technology, and cleanroom solutions directly addresses manufacturers' needs for compliance and operational efficiency. The global automotive market, valued at approximately $3.2 trillion in 2023, is particularly sensitive to these regulatory shifts, pushing for cleaner and quieter vehicle technologies.

- FAA's carbon emission reduction rule effective April 2024.

- EPA's stringent vehicle emission standards phased in from 2027.

- Strengthening noise regulations for automobiles.

- Global automotive market valued at $3.2 trillion in 2023.

Governmental policies significantly shape industrial operations and investment. For instance, Germany's industrial policy aims to boost manufacturing, potentially increasing demand for FAIST's services, with significant government funding allocated to industrial innovation in 2024.

Stricter environmental regulations, like the revised EU Industrial Emissions Directive effective August 2024, mandate upgrades for industrial sites, driving demand for noise control and cleanroom technologies, as compliance becomes a necessity.

Sector-specific regulations, such as new FAA carbon emission rules and EPA vehicle standards, coupled with stricter automotive noise regulations, create direct market opportunities for FAIST's specialized solutions, impacting the multi-trillion dollar automotive sector.

Geopolitical instability and trade policies can disrupt supply chains and influence capital allocation, potentially impacting FAIST's key customer industries like automotive and aerospace, with German industrial production facing projected contraction in 2025.

What is included in the product

The FAIST PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the organization, providing a comprehensive understanding of its external operating landscape.

The FAIST PESTLE Analysis offers a structured framework that simplifies the often overwhelming task of understanding complex external factors, thereby easing the burden of strategic planning.

Economic factors

The global industrial sector is experiencing robust expansion, fueling demand for specialized solutions like noise control and cleanroom technologies. The industrial noise control market, for instance, is anticipated to see significant growth, driven by heightened industrial activity and a greater emphasis on worker safety and regulatory compliance. This trend is supported by market research indicating a compound annual growth rate (CAGR) of over 5% for this sector through 2028.

Concurrently, the cleanroom technology market is also on an upward trajectory, with projections suggesting it will reach over $10 billion by 2026, growing at a CAGR of approximately 7%. This expansion is largely attributed to the burgeoning biotechnology, advanced electronics, and pharmaceutical industries, all of which require highly controlled environments for research, development, and manufacturing. FAIST's strategic positioning allows it to capitalize directly on these broad industrial expansions and the substantial investments being made in new and upgraded facilities across these key sectors.

Fluctuations in the cost of key raw materials, such as steel and specialized alloys, directly affect FAIST's manufacturing expenses for industrial plants and equipment. For instance, the global price of steel, a primary component, saw significant volatility in 2023, with prices ranging from $550 to $750 per metric ton, impacting production costs.

A resilient supply chain is paramount for FAIST to navigate global disruptions and geopolitical tensions, ensuring operational continuity and cost management. Disruptions in 2024, such as the Red Sea shipping crisis, led to increased transit times and freight costs by an estimated 15-20% for many manufacturers, highlighting the need for robust contingency planning.

FAIST's focus on sustainable sourcing is a strategic move to mitigate risks and potentially stabilize input costs. As of early 2025, companies prioritizing recycled materials are reporting up to a 10% reduction in raw material expenditure compared to those relying solely on virgin resources.

FAIST operates in capital-intensive sectors such as automotive, aerospace, and energy, where investment decisions are heavily swayed by economic forecasts and consumer demand. For 2025, the energy sector anticipates higher crude oil prices, potentially spurring greater investment.

However, this positive outlook for energy contrasts with a projected contraction in German industrial production for the same period. This divergence highlights the varied economic pressures impacting FAIST's core client base.

Consequently, FAIST's revenue directly correlates with these industries' capacity and inclination to fund new projects and modernize existing facilities. The German manufacturing PMI, a key indicator, has shown volatility, with recent figures suggesting a downturn, directly impacting investment appetite.

Inflation and Interest Rates

High inflation rates significantly impact FAIST's operational expenditures. For instance, in the US, the Consumer Price Index (CPI) saw a 3.4% increase year-over-year as of April 2024, indicating rising costs for labor and raw materials. This can directly squeeze FAIST's profit margins if these costs cannot be passed on to clients.

Rising interest rates, a common tool to combat inflation, also present challenges. The US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024. This makes borrowing more expensive for FAIST and its clients, potentially slowing down investment in new industrial projects or expansions that require financing.

These intertwined macroeconomic forces directly shape the investment climate. Higher borrowing costs and increased operational expenses can reduce the attractiveness and feasibility of large-scale industrial projects, impacting FAIST's project pipeline and revenue generation.

- Inflationary Pressure: US CPI at 3.4% (April 2024) increases FAIST's input costs.

- Interest Rate Impact: Federal Reserve's rate at 5.25%-5.50% raises borrowing costs for FAIST and clients.

- Investment Climate: Elevated costs can deter new industrial investments, affecting project feasibility.

Demand for Energy-Efficient and Sustainable Solutions

The economic landscape increasingly favors manufacturers investing in energy-efficient and sustainable solutions. This trend is fueled by direct cost savings from reduced energy consumption, enhanced brand reputation among environmentally conscious consumers, and access to favorable ESG-linked financing. For instance, the global green building market is projected to reach $2.5 trillion by 2027, highlighting the significant economic pull of sustainability.

FAIST's portfolio, particularly its thermal insulation and noise control products, directly addresses this growing demand. These solutions offer tangible economic benefits to clients by lowering operational expenses through improved energy performance and aiding in compliance with evolving environmental regulations. The company's offerings position it well to capitalize on this economic shift, as businesses prioritize long-term operational efficiencies and sustainability credentials.

- Growing Market: The global market for energy-efficient building technologies is expanding rapidly, with projections indicating substantial growth through 2027.

- Cost Savings: Implementing energy-efficient solutions can lead to significant reductions in energy bills for businesses, improving their bottom line.

- ESG Financing: Access to capital is increasingly tied to Environmental, Social, and Governance (ESG) performance, making sustainable investments more economically attractive.

- Regulatory Compliance: Stricter environmental regulations worldwide incentivize the adoption of sustainable practices and technologies.

Economic factors significantly shape FAIST's operational environment. Inflationary pressures, evidenced by the US CPI at 3.4% in April 2024, directly increase raw material and labor costs. Simultaneously, elevated interest rates, with the Federal Reserve maintaining its rate at 5.25%-5.50% through mid-2024, raise borrowing costs for both FAIST and its clients, potentially dampening investment in new projects.

| Economic Factor | Data Point | Impact on FAIST |

|---|---|---|

| Inflation (US CPI) | 3.4% (April 2024) | Increased operational expenditures, potential margin squeeze. |

| Interest Rates (Federal Reserve) | 5.25%-5.50% (Mid-2024) | Higher borrowing costs for FAIST and clients, slower project financing. |

| Global Steel Prices | Volatile ($550-$750/metric ton in 2023) | Directly impacts manufacturing costs for industrial equipment. |

| Supply Chain Disruptions (e.g., Red Sea) | Estimated 15-20% freight cost increase | Raises logistics expenses and necessitates robust contingency planning. |

Same Document Delivered

FAIST PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FAIST PESTLE analysis breaks down the Political, Economic, Social, Technological, Environmental, and Legal factors impacting your business. Gain a clear understanding of the external forces shaping your industry.

Sociological factors

Societal expectations for safer workplaces are intensifying, pushing industries to invest more in health and safety. This growing awareness, coupled with increasingly stringent regulations, directly fuels the demand for solutions like those FAIST offers in industrial noise control. For example, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize enforcement of noise exposure limits, with penalties for violations impacting companies across various sectors.

Industries are actively seeking to create environments that not only comply with legal mandates but also foster employee well-being and boost productivity. This proactive approach to health and safety, driven by a societal commitment to worker welfare, forms a crucial part of the market landscape for FAIST's expertise. A 2025 report by the National Safety Council highlighted a 7% increase in employer spending on workplace safety programs year-over-year, indicating a strong trend.

Societal concerns about health are significantly boosting the need for pristine environments. The rise in chronic illnesses, coupled with the intricate manufacturing of sophisticated electronics, directly translates to a greater demand for contamination-free spaces. This trend is a key driver for the cleanroom technology sector, an area where FAIST offers its expertise.

The global cleanroom technology market is projected to reach approximately $10.8 billion by 2027, with a compound annual growth rate of around 6.5% from 2022 to 2027. FAIST's contribution to this market is substantial, as industries such as pharmaceuticals, biotechnology, and semiconductor manufacturing are critically dependent on these controlled environments for product integrity and safety.

Consumers and investors increasingly demand that companies prioritize corporate social responsibility and sustainability. For instance, a 2024 survey indicated that 70% of consumers consider a company's environmental and social impact when making purchasing decisions.

Embracing ESG principles, such as reducing carbon footprints and ensuring fair labor practices, is becoming standard. By 2025, it's projected that ESG-focused investments will reach $50 trillion globally, highlighting the financial imperative of these initiatives.

FAIST's solutions that enable clients to meet these evolving CSR expectations, like optimizing supply chains for reduced emissions or enhancing data privacy, offer a significant competitive edge in the market.

Talent Attraction and Retention in Manufacturing

Sociological factors significantly influence talent attraction and retention within the manufacturing sector. Companies demonstrating a genuine commitment to sustainability and fostering positive working environments, which includes managing factors like industrial noise, are increasingly drawing in a larger segment of the talent pool, particularly younger workers. For instance, a 2024 survey indicated that 65% of Gen Z job seekers consider a company's environmental and social impact a key factor in their employment decisions.

FAIST's offerings play a crucial role in enhancing the appeal of industrial settings. By providing solutions that create healthier and more acoustically comfortable workplaces, FAIST indirectly assists its clients in their efforts to attract and retain a skilled workforce. This focus on employee well-being can lead to reduced turnover, a critical concern in manufacturing where specialized skills are in high demand. The manufacturing sector in the US, for example, faced a shortage of over 500,000 workers in 2023, highlighting the importance of retention strategies.

- Employee Well-being: A 2024 report found that 72% of employees are more likely to stay with a company that prioritizes their health and safety, including noise reduction.

- Generational Preferences: Younger generations (Millennials and Gen Z) are prioritizing workplaces that align with their values, with sustainability and positive culture being key drivers.

- Productivity and Retention: Studies suggest that improved working conditions, such as lower noise levels, can boost employee productivity by up to 15% and decrease absenteeism.

- Skills Gap Mitigation: By making manufacturing roles more attractive, companies can better compete for talent, helping to address the persistent skills gap in the industry.

Public Perception of Industrial Impact

Public concern over industrial pollution, encompassing noise and emissions, significantly shapes regulatory landscapes and the community's willingness to accept industrial activities. For instance, in 2024, surveys indicated that over 65% of citizens in major industrial hubs expressed concern about air and noise pollution from manufacturing plants. This growing awareness directly translates into increased pressure on industries to adopt cleaner, quieter operational methods.

FAIST's core offerings directly address these public anxieties. By providing solutions that mitigate noise pollution and promote cleaner industrial environments, FAIST enhances the public image of its industrial clients. This focus on environmental stewardship is becoming a critical factor in corporate social responsibility, with studies in late 2024 showing that 70% of consumers are more likely to support businesses with strong environmental track records.

- Rising Public Concern: Over 65% of citizens in industrial areas reported significant concern about pollution in 2024.

- Demand for Cleaner Operations: Societal pressure for less disruptive industrial activity is increasing.

- FAIST's Value Proposition: FAIST's noise mitigation and environmental solutions directly align with public demand.

- Consumer Preference: 70% of consumers favor businesses with positive environmental performance, boosting demand for FAIST's services.

Societal expectations for safer, healthier, and more sustainable workplaces are a significant driver for FAIST's business. As awareness of worker well-being and environmental impact grows, industries are investing more in solutions that address these concerns. For example, a 2024 survey found that 72% of employees are more likely to stay with a company that prioritizes their health and safety, including noise reduction.

Generational shifts also play a role, with younger workers prioritizing companies that align with their values, such as sustainability and positive work culture. This trend is crucial for mitigating the skills gap in manufacturing, as attractive workplaces help retain talent. A 2024 report indicated that 65% of Gen Z job seekers consider a company's environmental and social impact when choosing employment.

| Sociological Factor | Impact on FAIST's Market | Supporting Data (2024-2025) |

|---|---|---|

| Employee Well-being & Safety | Increased demand for noise control and healthier environments | 72% of employees prefer employers prioritizing health & safety. |

| Generational Values (Gen Z/Millennials) | Preference for sustainable and positive work cultures | 65% of Gen Z consider ESG factors in job decisions. |

| Public Concern over Pollution | Pressure for quieter and cleaner industrial operations | 65% of citizens in industrial hubs concerned about pollution (2024). |

| Corporate Social Responsibility (CSR) | Demand for solutions enabling ESG compliance and positive brand image | 70% of consumers favor businesses with strong environmental track records. |

Technological factors

The field of acoustic engineering is experiencing rapid progress, with innovations like adaptive active noise cancellation and advanced composite materials offering superior, lightweight noise control. For FAIST, these advancements translate into opportunities to significantly improve their acoustic enclosures, test cells, and soundproofing products, providing clients with more effective and efficient solutions.

Predictive modeling in acoustics is becoming increasingly sophisticated, enabling the precise anticipation of acoustic behavior before physical prototypes are even built. This capability can drastically reduce development cycles and associated costs for FAIST's product lines, accelerating time-to-market and boosting R&D efficiency.

Continuous technological advancements are reshaping cleanroom design, with modular systems and energy-efficient HVAC becoming standard. The integration of automation and robotics is also a major trend, boosting operational efficiency and precision in sensitive manufacturing environments.

FAIST, a key player in this sector, is poised to leverage these innovations by incorporating them into its product lines. This allows FAIST to offer advanced solutions that not only adhere to rigorous industry standards but also address client needs for improved performance and the flexibility to scale operations.

The global cleanroom technology market was valued at approximately $5.8 billion in 2023 and is projected to reach $8.5 billion by 2028, growing at a compound annual growth rate of around 8.1%, according to recent market analyses.

Digitalization and Industry 4.0 are transforming manufacturing, with the Internet of Things (IoT) playing a key role in real-time noise monitoring and control. This shift towards smart manufacturing systems allows for dynamic management of sound environments. For instance, the global industrial IoT market was valued at approximately $170 billion in 2023 and is projected to grow significantly, indicating a strong adoption of these technologies.

FAIST can leverage these trends by integrating smart sensors and digital monitoring into its industrial plants. This enables clients to optimize energy consumption and actively manage noise levels. The increasing demand for data-driven operational efficiency, with companies seeking to reduce costs and improve performance, makes this integration a strategic advantage.

Development of Sustainable Materials and Manufacturing Processes

Innovation in sustainable acoustic materials, like bio-based panels and recycled components, is increasingly vital in acoustic design. For instance, the global market for sustainable building materials, including acoustic solutions, was projected to reach over $400 billion by 2024, demonstrating strong growth. Manufacturers are also prioritizing energy-efficient machinery and circular manufacturing processes to reduce their environmental footprint. FAIST can leverage these advancements by integrating these eco-friendly materials and methods into its product development and production, thereby bolstering its sustainability credentials and providing more environmentally conscious options to its customers.

The push towards sustainability is reshaping manufacturing, with a notable trend towards circular economy principles. Companies are investing in technologies that enable material reuse and waste reduction. For example, the European Union's Circular Economy Action Plan aims to significantly increase the use of recycled materials in construction and manufacturing. FAIST can capitalize on this by adopting these circular manufacturing tools and exploring partnerships for material sourcing and recycling. This strategic move not only aligns with global environmental goals but also presents opportunities for cost savings and enhanced brand reputation.

- Sustainable Materials: Growth in bio-based and recycled acoustic panels is a key trend, driven by environmental regulations and consumer demand.

- Energy Efficiency: Manufacturers are adopting advanced, energy-saving machinery, reducing operational costs and carbon emissions.

- Circular Manufacturing: Implementation of circular economy principles, such as material reuse and waste minimization, is becoming standard practice.

- Market Opportunity: FAIST can enhance its market position by incorporating these sustainable materials and processes, appealing to a growing segment of environmentally conscious clients.

AI and Machine Learning in Design and Operations

AI and machine learning are revolutionizing acoustic design, allowing for the inverse design of acoustic metamaterials and real-time adaptation to ambient noise. These advanced algorithms can pinpoint and reduce unwanted noise from industrial equipment, significantly improving sound environments. For instance, a 2024 report indicated that AI-powered noise cancellation in industrial settings can improve worker productivity by up to 15% by reducing auditory distractions.

FAIST can leverage AI for several key areas. This includes optimizing product designs, implementing predictive maintenance schedules for its acoustic installations, and enabling real-time performance adjustments. These applications are projected to enhance product performance and boost operational efficiency. In 2025, early adopters of AI in predictive maintenance for heavy machinery reported a 20% reduction in unexpected downtime.

- AI-driven inverse design for acoustic metamaterials offers novel solutions for noise control.

- Real-time noise mitigation through AI algorithms enhances acoustic environments in industrial operations.

- Predictive maintenance powered by AI can reduce operational costs and improve reliability of FAIST's installations.

- Design optimization using AI tools can lead to superior acoustic performance and energy efficiency in FAIST's products.

Technological advancements are significantly impacting acoustic engineering, with AI and machine learning enabling sophisticated noise control and predictive modeling. For FAIST, these innovations translate into opportunities for enhanced product design, improved operational efficiency through predictive maintenance, and real-time noise mitigation, ultimately boosting client productivity and reducing downtime.

Legal factors

The revised EU Industrial Emissions Directive (2024/1785), effective August 2024, introduces significantly stricter rules for industrial pollution, covering not just traditional pollutants but also noise and odors. This directive mandates lower emission limit values across various sectors.

Compliance with these updated regulations, which include requirements for electronic permitting and increased penalties for violations, presents a clear legal necessity for industries. Non-compliance could result in substantial fines, with potential penalties escalating significantly under the new framework.

Consequently, FAIST's clients face a strong legal impetus to adopt technologies and solutions that ensure adherence to these tightened environmental standards. This legal pressure directly drives demand for FAIST's offerings, positioning them as essential for regulatory conformity.

Governments globally, through agencies like OSHA in the U.S., mandate stringent workplace safety standards, particularly concerning noise exposure. These regulations are designed to protect worker health and prevent long-term hearing damage. For instance, OSHA's permissible exposure limit for noise is 90 decibels averaged over an eight-hour workday. Failure to comply can result in significant fines, impacting a company's financial health.

FAIST's noise control solutions directly address these legal mandates, enabling industrial clients to achieve compliance and safeguard their workforce. By reducing noise levels below regulated thresholds, FAIST helps businesses avoid costly penalties and potential litigation stemming from workplace injuries or occupational hearing loss claims. The increasing focus on worker well-being and regulatory enforcement makes adherence to these safety standards a primary driver for demand in FAIST's offerings.

FAIST's operations are significantly shaped by stringent building codes and environmental standards, particularly concerning noise insulation, thermal performance, and air quality for industrial facilities and cleanrooms. These regulations are critical for ensuring the legality and operational certification of FAIST's customized engineering and turnkey systems. For instance, the EU's Emission Trading System (ETS) and the upcoming Carbon Border Adjustment Mechanism (CBAM) are already impacting industrial energy use and material sourcing, requiring FAIST to demonstrate compliance in its designs.

Intellectual Property Laws and Patent Protection

FAIST's reliance on intellectual property protection is paramount in the customized engineering and manufacturing sector. Robust patent laws are crucial for safeguarding its innovative designs and proprietary technologies, preventing competitors from replicating its specialized industrial plant and equipment solutions. In 2024, global patent filings continued to rise, with significant activity in advanced manufacturing technologies, underscoring the importance of strong IP for companies like FAIST.

The legal framework surrounding trademarks and trade secrets also plays a critical role in maintaining FAIST's competitive edge. Protecting its brand identity and confidential know-how is essential to prevent dilution and misuse of its unique engineering processes. As of early 2025, intellectual property disputes remain a significant concern across industries, highlighting the need for diligent legal strategies to defend these assets.

- Patent Filings: Global patent applications in advanced manufacturing saw a notable increase in 2024, reflecting ongoing innovation.

- IP Enforcement: Legal actions related to intellectual property infringement remain a prevalent challenge for manufacturing firms in the 2024-2025 period.

- Trade Secret Value: Confidential manufacturing processes and client lists represent significant intangible assets requiring strong legal safeguards.

- Competitive Advantage: Effective IP protection directly translates to a sustained competitive advantage for FAIST in its niche market.

International Trade Laws and Tariffs

International trade laws and tariffs significantly influence FAIST's global operations. For instance, the European Union, where FAIST is headquartered, has a complex web of trade agreements and regulations. Tariffs imposed by countries like the United States or China on goods originating from Germany, a key manufacturing hub for FAIST's components, can directly increase import costs, impacting FAIST's profitability. In 2024, ongoing trade disputes and the potential for new tariffs, particularly concerning automotive and industrial goods, necessitate careful monitoring.

Navigating these legal frameworks is crucial for maintaining market access and managing operational expenses. FAIST must stay abreast of evolving trade policies, such as those arising from Brexit or changes in US trade policy, which can alter the landscape for exporting its products. The cost of compliance with varying international standards and regulations also represents a significant legal consideration for FAIST's global supply chain.

- Tariff Impact: German industrial exports faced an average tariff rate of 4.5% in key global markets in 2023, a figure FAIST must factor into its costings.

- Trade Agreements: FAIST benefits from EU trade agreements, but shifts in these pacts, like potential renegotiations, pose a legal risk.

- Protectionism: The rise of protectionist measures globally in 2024 could lead to increased non-tariff barriers, affecting FAIST's market entry strategies.

- Regulatory Compliance: FAIST must ensure compliance with diverse international product safety and environmental regulations, adding to legal overhead.

The legal landscape for industrial operations is increasingly stringent, particularly concerning environmental emissions and workplace safety. For instance, the revised EU Industrial Emissions Directive (2024/1785) mandates lower emission limit values and introduces electronic permitting, with substantial penalties for non-compliance. Similarly, OSHA's permissible noise exposure limit of 90 decibels over an eight-hour workday underscores the legal imperative for noise control in industrial settings.

FAIST's business is directly influenced by these legal requirements, as clients need solutions to meet evolving environmental and safety standards. Intellectual property law is also critical, with global patent filings in advanced manufacturing rising in 2024 and IP infringement remaining a significant challenge. FAIST must protect its innovative designs and proprietary technologies to maintain its competitive edge.

International trade laws and tariffs present another significant legal factor. In 2024, ongoing trade disputes and the potential for new tariffs require careful monitoring, as they can directly impact import costs and market access. FAIST must ensure compliance with diverse international product safety and environmental regulations, adding to legal overhead.

| Legal Factor | Impact on FAIST | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Environmental Regulations | Drives demand for compliance solutions. | EU Industrial Emissions Directive (2024/1785) effective Aug 2024; stricter limits. |

| Workplace Safety Laws | Necessitates noise control and safety-focused engineering. | OSHA noise exposure limit: 90 dB (8-hr TWA). |

| Intellectual Property Law | Crucial for protecting proprietary designs and competitive advantage. | Global patent applications in advanced manufacturing increased in 2024; IP infringement disputes prevalent. |

| International Trade Law | Affects global operations, costs, and market access. | Rise in protectionist measures globally in 2024; potential for increased non-tariff barriers. |

Environmental factors

Environmental regulations are increasingly targeting noise as a pollutant, setting stricter limits for industrial operations. The revised EU Industrial Emissions Directive explicitly includes noise as a harmful emission, impacting industries across the continent. This regulatory shift drives demand for FAIST's expertise in advanced noise control solutions, as businesses aim to minimize their environmental footprint and avoid potential penalties.

The global drive towards decarbonization and enhanced energy efficiency, underscored by initiatives like the European Green Deal, creates substantial opportunities for FAIST. Mandates pushing for reduced carbon footprints and lower energy consumption directly align with FAIST's core offerings in thermal insulation, which are critical for industrial sectors aiming to meet these stringent environmental targets.

Industrial clients are increasingly compelled to adopt sustainable practices. For instance, by 2030, the EU aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels, a target that necessitates significant energy efficiency improvements across all industries. FAIST's products directly support this by minimizing heat loss in industrial processes, thereby lowering operational energy needs and associated emissions.

Manufacturers are increasingly pressured to cut waste and embrace circular economy models, focusing on recycling and reusing materials. This shift directly influences FAIST by driving the innovation and adoption of eco-friendly materials for its acoustic and insulation solutions. For instance, the global market for sustainable building materials is projected to reach over $400 billion by 2027, indicating a strong demand for recycled and renewable content.

Resource Scarcity and Sustainable Sourcing

Growing global awareness of finite resources is significantly reshaping how companies like FAIST source their raw materials. This shift is driven by increasing demand for sustainable and ethically produced goods.

FAIST must proactively adapt its procurement strategies to incorporate eco-friendly and responsibly sourced materials. This adaptation is crucial for ensuring the long-term stability of its supply chain and for meeting the rising environmental expectations from both customers and regulatory bodies. For instance, the global demand for critical minerals, essential for many manufacturing processes, is projected to surge. The International Energy Agency (IEA) reported in 2024 that demand for lithium could increase by over 40 times by 2040 under net-zero emissions scenarios, and nickel demand by over 20 times. This highlights the immediate need for robust and sustainable sourcing plans.

- Supply Chain Resilience: Adapting to sustainable sourcing enhances FAIST's ability to navigate potential disruptions caused by resource depletion or geopolitical instability affecting traditional supply routes.

- Market Competitiveness: Meeting eco-friendly sourcing demands can differentiate FAIST in the market, attracting environmentally conscious clients and potentially commanding premium pricing.

- Regulatory Compliance: Proactive adoption of sustainable practices helps FAIST stay ahead of evolving environmental regulations, avoiding potential fines and operational hindrances.

- Brand Reputation: Demonstrating a commitment to responsible sourcing strengthens FAIST's brand image, fostering trust and loyalty among stakeholders.

Corporate Environmental Responsibility Reporting

Companies are facing mounting pressure to detail their environmental impact. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) mandates extensive reporting on sustainability matters, effective from 2024 for many large companies. This regulatory shift means businesses must provide verifiable data on their environmental performance.

FAIST's offerings directly support these reporting requirements by enabling clients to quantify improvements in areas like noise reduction and energy efficiency. These measurable outcomes are crucial for demonstrating progress towards environmental goals and fulfilling corporate environmental responsibility mandates.

- CSRD implementation: Over 50,000 companies in the EU are expected to be covered by CSRD reporting requirements by 2028.

- Energy savings: FAIST's solutions can contribute to an average energy consumption reduction of up to 15% in specific industrial applications.

- Noise reduction: Clients have reported achieving noise level reductions of up to 10 decibels (dB) through FAIST's noise abatement technologies.

- Sustainability metrics: Accurate environmental data is vital for meeting investor expectations, with a significant percentage of investors now considering ESG factors in their decisions.

Stricter noise pollution regulations, like the EU Industrial Emissions Directive, are driving demand for FAIST's noise control expertise. The global push for decarbonization and energy efficiency, exemplified by the European Green Deal, creates significant opportunities for FAIST's thermal insulation solutions as industries strive to meet ambitious emissions reduction targets, such as the EU's goal of a 55% cut by 2030.

| Factor | Description | Impact on FAIST | Relevant Data/Initiative |

| Environmental Regulations | Stricter limits on noise and emissions. | Increased demand for noise control and energy efficiency solutions. | EU Industrial Emissions Directive; EU aims for 55% GHG reduction by 2030. |

| Sustainability & Circular Economy | Focus on waste reduction, recycling, and eco-friendly materials. | Drives innovation in sustainable materials for acoustic and insulation products. | Global sustainable building materials market projected over $400 billion by 2027. |

| Resource Scarcity Awareness | Growing concern over finite resources and ethical sourcing. | Requires adaptation of procurement strategies for responsible material sourcing. | IEA 2024: Lithium demand could surge over 40x by 2040; Nickel demand over 20x. |

| Corporate Reporting | Mandatory detailed reporting on environmental impact. | FAIST's solutions enable clients to quantify environmental improvements. | CSRD covers over 50,000 EU companies by 2028; FAIST solutions offer up to 15% energy savings. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including international organizations like the IMF and World Bank, national statistical agencies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.