Fabrinet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Fabrinet's strengths lie in its established optical technology expertise and strong customer relationships, but it faces potential threats from supply chain disruptions and intense competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on its opportunities.

Want the full story behind Fabrinet’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fabrinet's exposure to diverse, high-growth markets like optical communications, automotive, medical devices, and industrial lasers is a significant strength. This broad market reach creates a resilient revenue stream, lessening dependence on any single industry's performance. For instance, the company reported strong growth in its optical communications segment, which saw a substantial year-over-year increase in revenue for the fiscal year ending June 2024, underscoring the benefits of this diversification.

Fabrinet's comprehensive manufacturing capabilities are a significant strength, offering end-to-end services that cover the entire product lifecycle. This includes everything from initial design support and process engineering to the actual manufacturing, advanced packaging, and rigorous testing.

This all-encompassing approach positions Fabrinet as a highly valuable strategic partner for original equipment manufacturers (OEMs) looking for a complete, full-service solution. Their ability to handle high-complexity products, regardless of the mix or volume, directly addresses the specialized needs of their clientele.

Fabrinet has consistently demonstrated robust financial performance, including significant revenue growth and profitability in fiscal years 2024 and 2025.

For example, Q3 FY2025 revenue reached $871.8 million, a 19.2% year-over-year increase, and the company expects continued strong execution into fiscal 2026.

This financial health provides a solid foundation for continued investment and expansion, underpinning its competitive advantages.

Technological Expertise in Advanced Optical Packaging

Fabrinet's significant technological expertise in advanced optical packaging is a cornerstone of its competitive advantage. This deep knowledge is essential for producing the intricate components demanded by rapidly expanding sectors such as AI-driven data centers and 5G networks. Their proficiency is clearly demonstrated by their ability to manufacture sophisticated products like 1.6 terabit transceivers, showcasing their cutting-edge capabilities.

This specialized skill set directly translates into tangible market opportunities. For instance, the global optical transceivers market, a key area for Fabrinet, was valued at approximately $13.4 billion in 2023 and is projected to grow significantly, driven by the increasing demand for higher bandwidth and faster data transmission. Fabrinet's ability to deliver these advanced solutions positions them to capture a substantial share of this expanding market.

- Advanced Optical Packaging: Fabrinet excels in manufacturing complex optical components, crucial for high-speed data transmission.

- AI and 5G Infrastructure: Their expertise directly supports the growth of AI data centers and 5G deployment, both high-demand markets.

- 1.6 Terabit Transceivers: Production of such cutting-edge technology underscores their leading-edge manufacturing capabilities.

- Market Relevance: Their technological prowess aligns with the robust growth in the optical transceivers market, projected for significant expansion.

Strategic Partnerships with Industry Leaders

Fabrinet's strategic partnerships with key original equipment manufacturers (OEMs) are a significant strength. Collaborations with industry titans such as NVIDIA, Cisco, and Ciena provide a consistent demand for their optical components, especially crucial for the burgeoning AI sector and high-speed optical interconnects. This deep integration ensures Fabrinet remains a vital player in cutting-edge technology development.

The company's direct relationship with a major hyperscaler like Amazon Web Services (AWS) further solidifies its market standing. This alliance not only guarantees a substantial customer base but also places Fabrinet at the center of cloud infrastructure innovation. Such strong ties with both technology developers and major cloud providers underscore Fabrinet's pivotal role in the digital ecosystem.

- NVIDIA Partnership: Crucial for supplying optical components for AI hardware.

- Cisco and Ciena Collaboration: Secures demand in networking infrastructure.

- AWS Alliance: Positions Fabrinet as a key supplier for hyperscale data centers.

Fabrinet's diversified market exposure, particularly in high-growth sectors like optical communications, automotive, and medical devices, provides a resilient revenue base. The company's strong financial performance, with significant revenue growth in fiscal year 2024 and continued positive outlook for 2025, highlights its operational efficiency and market demand.

Their comprehensive manufacturing capabilities, offering end-to-end solutions from design to testing, position them as a vital partner for OEMs. This is further bolstered by deep technological expertise in advanced optical packaging, essential for cutting-edge applications like AI data centers and 5G networks.

Strategic partnerships with industry leaders such as NVIDIA, Cisco, and Ciena, along with a direct alliance with AWS, ensure consistent demand and place Fabrinet at the forefront of technological innovation in critical growth areas.

| Metric | FY2024 (Ending June 2024) | Q3 FY2025 (Ending March 2025) |

|---|---|---|

| Revenue | $2.56 billion | $871.8 million |

| Revenue Growth (YoY) | 12.7% | 19.2% |

| Key Market Segments | Optical Communications, Automotive, Industrial Lasers, Medical Devices | Optical Communications (dominant), Automotive, Industrial Lasers, Medical Devices |

What is included in the product

Delivers a strategic overview of Fabrinet’s internal and external business factors, highlighting its strengths in optical packaging and opportunities in growing markets, while also acknowledging potential threats from competition and supply chain disruptions.

Offers a clear, actionable framework to identify and address Fabrinet's strategic challenges and leverage its competitive advantages.

Weaknesses

Fabrinet faces a significant weakness due to customer concentration. In fiscal year 2024, a single customer, Nvidia, accounted for a substantial 35.1% of the company's total revenue.

This heavy reliance on a few key clients creates a notable risk. Any downturn in business, change in purchasing patterns, or strategic shift by these major customers could have a disproportionately large and negative impact on Fabrinet's financial results and overall stability.

Fabrinet, like many global manufacturers, continues to face inherent vulnerabilities within its supply chain, despite ongoing efforts to build resilience. Disruptions, whether stemming from geopolitical tensions, natural calamities, or unexpected shortages of critical components, can directly translate into increased operational costs and delays in securing necessary parts. This exposure directly impacts Fabrinet's ability to maintain its manufacturing pace and meet customer delivery timelines, a challenge that has been a persistent theme across the industry throughout 2024 and is projected to continue into 2025.

Fabrinet's profitability can face pressure in the fiercely competitive electronics manufacturing services (EMS) sector. Despite robust revenue expansion, as seen in Q3 FY2025, margin compression remains a concern. The sheer number of competitors actively seeking contracts often drives down pricing, making it challenging for Fabrinet to sustain premium gross margins. This necessitates a relentless pursuit of operational efficiencies to counteract these market forces.

Reliance on Optical Communications Sector

Fabrinet's significant dependence on the optical communications sector presents a notable weakness. In fiscal year 2024, optical products accounted for a substantial 79.4% of the company's total revenue. This concentration means that any downturn or oversupply within the optical market could disproportionately impact Fabrinet's financial performance.

While Fabrinet is actively pursuing diversification into non-optical segments, the core of its business remains deeply rooted in optical technologies. This ongoing reliance, despite efforts to broaden its revenue streams, leaves the company vulnerable to sector-specific challenges.

The company's revenue breakdown highlights this concentration:

- Optical Products Revenue: 79.4% of total revenue in FY2024.

- Sectoral Vulnerability: Susceptibility to market fluctuations and overcapacity in the optical communications industry.

- Diversification Status: Ongoing efforts to expand into non-optical areas, but optical remains the dominant segment.

Foreign Exchange Rate Fluctuations

Fabrinet's global operations, especially its substantial manufacturing presence in Thailand, create significant exposure to foreign exchange rate fluctuations. A strengthening Thai baht, for example, directly impacts the company's cost structure and can erode profit margins. This currency volatility can make operations more expensive and affect the competitiveness of Fabrinet's pricing strategies.

For instance, in fiscal year 2023, Fabrinet reported that a 1% appreciation of the Thai baht against the U.S. dollar would have negatively impacted its net income by approximately $2.5 million. This highlights the tangible financial impact of currency movements on their bottom line.

- Currency Risk: Fabrinet's reliance on manufacturing in Thailand exposes it to the risk of a strengthening Thai baht negatively impacting profitability.

- Cost Pressures: Fluctuations in exchange rates can increase the cost of operations and the cost of goods sold.

- Pricing Competitiveness: Unfavorable currency movements can make Fabrinet's products less competitive in international markets.

- Impact on Net Income: Even modest currency shifts can translate into millions of dollars in lost net income, as seen in FY2023 projections.

Fabrinet's heavy reliance on a few major customers, particularly Nvidia which represented 35.1% of revenue in FY2024, poses a significant risk. Any adverse changes in these key relationships could severely impact financial performance and stability.

The company's substantial 79.4% revenue contribution from optical products in FY2024 makes it vulnerable to market downturns or oversupply within that specific sector, despite ongoing diversification efforts.

Fabrinet faces ongoing supply chain vulnerabilities, susceptible to disruptions from geopolitical events or component shortages, which can lead to increased costs and delivery delays, a persistent industry challenge through 2024 and into 2025.

Currency fluctuations, especially the impact of a strengthening Thai baht on its significant manufacturing base in Thailand, can negatively affect profitability and pricing competitiveness, with a 1% baht appreciation projected to reduce net income by approximately $2.5 million in FY2023.

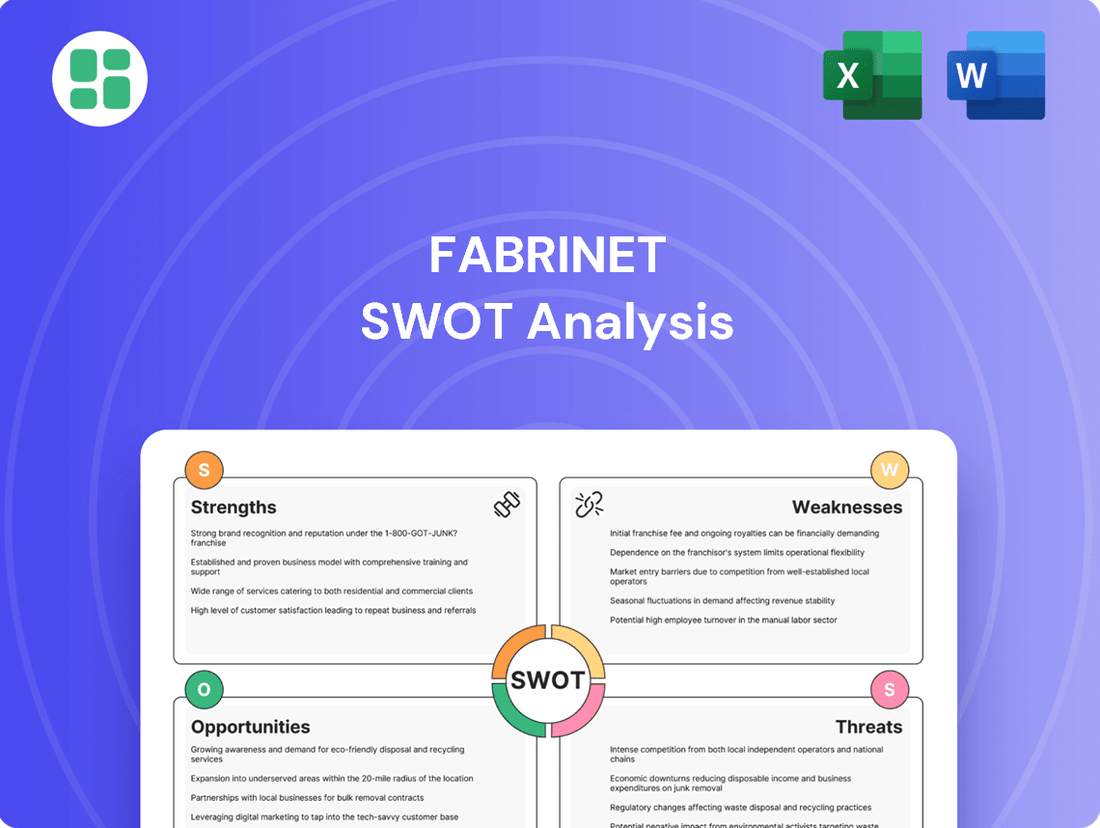

Preview Before You Purchase

Fabrinet SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fabrinet's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors influencing Fabrinet's market position and future growth potential.

Opportunities

The relentless expansion of AI data centers is fueling a substantial demand for advanced optical interconnects. Fabrinet is particularly well-positioned to benefit from the growing need for 1.6 terabit transceivers, an area where they have established a strong market presence.

This trend represents a significant avenue for Fabrinet to boost its datacom product revenue. The company is strategically aligning itself to capture a larger share of this rapidly expanding market.

Fabrinet is well-positioned to expand beyond its core optical communications business. The company can leverage its precision manufacturing expertise into high-growth sectors like semiconductor processing, biotechnology, and advanced materials. For instance, the global semiconductor manufacturing equipment market is projected to reach $137.6 billion by 2024, according to Mordor Intelligence, offering a significant opportunity for Fabrinet's advanced manufacturing capabilities.

Furthermore, increased outsourcing trends among Original Equipment Manufacturers (OEMs) in industrial laser and sensor markets present another avenue for growth. This strategic diversification not only strengthens Fabrinet's market resilience but also unlocks substantial new revenue streams by tapping into adjacent, high-demand industries.

Original equipment manufacturers (OEMs) are increasingly entrusting their production to specialized partners such as Fabrinet. This trend is driven by OEMs looking to optimize costs, boost operational efficiency, and leverage specialized manufacturing know-how. Fabrinet's ability to offer these advantages positions it well to benefit from this growing outsourcing movement.

Capacity Expansion and Operational Efficiencies

Fabrinet's strategic investment in a new, expansive manufacturing facility, Building 10, in Thailand, represents a significant opportunity. This expansion is poised to boost their total operational footprint by more than 50%, a move designed to proactively address anticipated future growth.

This capacity expansion is particularly vital for accommodating the increasing demand for high-mix, low-volume production runs of intricate optical components and specialized automotive products. By increasing scale and streamlining processes, Fabrinet aims to significantly enhance operational efficiencies and alleviate existing production bottlenecks.

The company's commitment to such substantial capital expenditures underscores its confidence in market demand and its strategy to solidify its position as a leading contract manufacturer. This proactive approach to capacity management is expected to yield improved throughput and cost advantages.

- Increased Manufacturing Footprint: Over 50% expansion via Building 10 in Thailand.

- Support for Complex Production: Crucial for high-mix/low-volume optical and automotive components.

- Efficiency Gains: Investments aimed at reducing operational bottlenecks and improving throughput.

- Future Growth Enablement: Proactive capacity building to meet anticipated market demand.

Leveraging Advanced Technologies for New Product Introduction

Fabrinet's established proficiency in advanced optical packaging and precision manufacturing positions it to champion the introduction of sophisticated, next-generation products. By channeling resources into research and development and consistently refining its process design and engineering capabilities, Fabrinet can secure emerging projects and fortify its market standing.

This strategic focus includes the critical transition to higher-speed product architectures, such as the burgeoning 1.6 terabit technologies, which represent a significant growth avenue. For instance, the demand for higher bandwidth in data centers and telecommunications continues to surge, with the global optical networking market projected to reach over $30 billion by 2027, according to recent market analyses.

- Next-Generation Product Support: Leveraging expertise in optical packaging for complex product development.

- Innovation Investment: Continued R&D to drive process design and engineering advancements.

- Market Expansion: Securing new projects by staying ahead in technological transitions.

- Terabit Technology Adoption: Focusing on higher-speed products like 1.6 terabit solutions.

Fabrinet is poised to capitalize on the escalating demand for high-speed optical interconnects, particularly with the widespread adoption of 1.6 terabit transceivers. This growth is further bolstered by the increasing trend of OEMs outsourcing manufacturing, allowing Fabrinet to leverage its precision engineering expertise into new sectors like semiconductor processing and biotechnology.

The company's significant investment in expanding its manufacturing footprint in Thailand, with over a 50% increase in operational space, directly addresses the need for high-mix, low-volume production of intricate components. This expansion is crucial for supporting the development and manufacturing of next-generation products, including advanced optical solutions and specialized automotive components, thereby enhancing operational efficiency and throughput.

| Opportunity Area | Key Driver | Fabrinet's Advantage | Market Projection |

|---|---|---|---|

| AI Data Center Growth | Demand for 1.6 Tbps transceivers | Strong market presence, advanced manufacturing | Optical networking market to exceed $30B by 2027 |

| OEM Outsourcing | Cost optimization, efficiency gains | Precision manufacturing, specialized know-how | Semiconductor equipment market to reach $137.6B in 2024 |

| Diversification | Leveraging precision manufacturing | Entry into biotech, advanced materials | |

| Capacity Expansion | Meeting high-mix/low-volume demand | 50%+ footprint increase, improved throughput |

Threats

Fabrinet operates within a global economic landscape marked by significant uncertainties. The persistent risk of recession or economic slowdown in key markets directly threatens to dampen demand for its optical communication, automotive, and industrial products. This can lead to a contraction in customer spending, impacting Fabrinet's order volumes and overall financial performance.

OEM capital expenditure decisions are highly sensitive to macroeconomic conditions. A downturn can cause customers to postpone or reduce investments in new technologies and infrastructure, directly affecting Fabrinet's revenue streams. The company has explicitly recognized these broader economic headwinds as a material factor influencing its business outlook.

Fabrinet operates in a fiercely competitive landscape for optical manufacturing services, contending with established players like Benchmark Electronics, Celestica, Sanmina, and Jabil, alongside the potential for in-house manufacturing by its own clients.

This intense rivalry often translates into significant price pressure, which could negatively impact Fabrinet's profit margins if the company struggles to maintain service differentiation or effectively control its operational expenses.

For instance, the contract electronics manufacturing (CEM) market, where Fabrinet is a key player, has seen average gross margins hover in the low to mid-teens, underscoring the constant need for cost efficiency and value-added services to combat margin erosion.

The relentless pace of technological change in optical and electronics manufacturing, especially with the boom in AI and data communications, presents a significant risk of Fabrinet's current technologies becoming outdated. Staying competitive requires substantial and ongoing investment in research and development to align with evolving customer demands and next-generation products.

Failure to adapt quickly could lead to Fabrinet losing market share to rivals who are more agile in adopting new technologies. For instance, the increasing complexity of optical components for high-speed networking, driven by AI workloads, necessitates continuous process innovation.

Geopolitical Risks and Trade Policies

Fabrinet's global manufacturing footprint, particularly in Thailand and China, makes it susceptible to geopolitical tensions and shifts in international trade policies. For instance, ongoing trade disputes or the imposition of new tariffs could directly impact Fabrinet's cost of goods sold and its ability to compete effectively in key markets. These external pressures can create significant headwinds for the company's financial performance and operational stability.

The increasing trend of global protectionism presents a substantial threat, potentially eroding Fabrinet's profit margins and disrupting its carefully managed supply chains. For example, a sudden escalation in trade barriers could lead to increased duties on imported components or finished goods, directly affecting profitability. The company's reliance on international operations means that these policy changes, often beyond its direct influence, pose a continuous risk to revenue streams and overall business continuity.

- Geopolitical Instability: Fabrinet's operations in politically sensitive regions could face disruptions due to regional conflicts or political unrest, impacting production and logistics.

- Trade Policy Volatility: Changes in tariffs, trade agreements, or import/export regulations between major economic blocs (e.g., US-China, EU-Asia) can significantly alter cost structures and market access.

- Supply Chain Vulnerability: Dependence on specific countries for manufacturing and raw materials makes Fabrinet vulnerable to supply chain disruptions caused by trade wars or geopolitical events.

- Currency Fluctuations: Political instability often leads to currency volatility, which can affect Fabrinet's reported earnings and the cost of its international operations.

Dependence on Specific Technological Transitions

Fabrinet's reliance on specific technological shifts, such as the move to 1.6 terabit optical transceivers, presents a significant threat. If the market adoption of these advanced products lags behind expectations or if unexpected technical hurdles arise, it could negatively impact revenue streams. This vulnerability was underscored by a planned product transition at a key customer, which led to a sequential decline in datacom revenue.

The company's financial performance is closely tied to the successful and timely implementation of these next-generation technologies. A slower-than-anticipated uptake of higher-speed optical components could directly affect Fabrinet's growth trajectory.

Key considerations include:

- Slower Adoption Rates: A delay in market acceptance of 1.6 terabit transceivers could prolong the revenue contribution from current product generations.

- Technical Challenges: Unforeseen manufacturing or performance issues with new, higher-speed products could disrupt production and shipments.

- Customer Transition Risks: Dependence on a single major customer's upgrade cycle, as seen with the datacom revenue decline, highlights the risk of concentrated customer demand.

Fabrinet faces intense competition in the optical manufacturing services sector, with rivals like Benchmark Electronics and Celestica vying for market share. This rivalry can lead to price pressures, potentially squeezing profit margins if Fabrinet cannot effectively differentiate its services or manage costs. The contract electronics manufacturing market often sees gross margins in the low to mid-teens, highlighting the constant need for efficiency.

Technological obsolescence is a significant threat, requiring continuous R&D investment to keep pace with advancements, especially in AI-driven optical components. Failure to adapt quickly could result in market share loss to more agile competitors. Geopolitical instability and trade policy shifts, particularly concerning operations in Thailand and China, also pose risks, potentially impacting costs and market access.

Fabrinet's reliance on the successful adoption of next-generation technologies, such as 1.6 terabit optical transceivers, presents a vulnerability. Slower market acceptance or unforeseen technical challenges with these advanced products could hinder revenue growth, as demonstrated by a prior sequential decline in datacom revenue linked to a customer product transition.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

|---|---|---|---|

| Competition | Intense Rivalry & Price Pressure | Reduced Profit Margins | CEM market gross margins typically 10-15% |

| Technology | Rapid Technological Change | Obsolescence, Market Share Loss | Need for continuous R&D for AI-driven optical components |

| Geopolitics | Trade Policy Volatility & Protectionism | Increased Costs, Disrupted Supply Chains | Tariffs on components or finished goods |

| Market Adoption | Slower than Expected Technology Uptake | Delayed Revenue Growth | Reliance on 1.6 terabit transceiver adoption |

SWOT Analysis Data Sources

This Fabrinet SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and insightful industry expert commentary. These reliable data sources ensure that our assessment is both accurate and strategically relevant for informed decision-making.