Fabrinet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

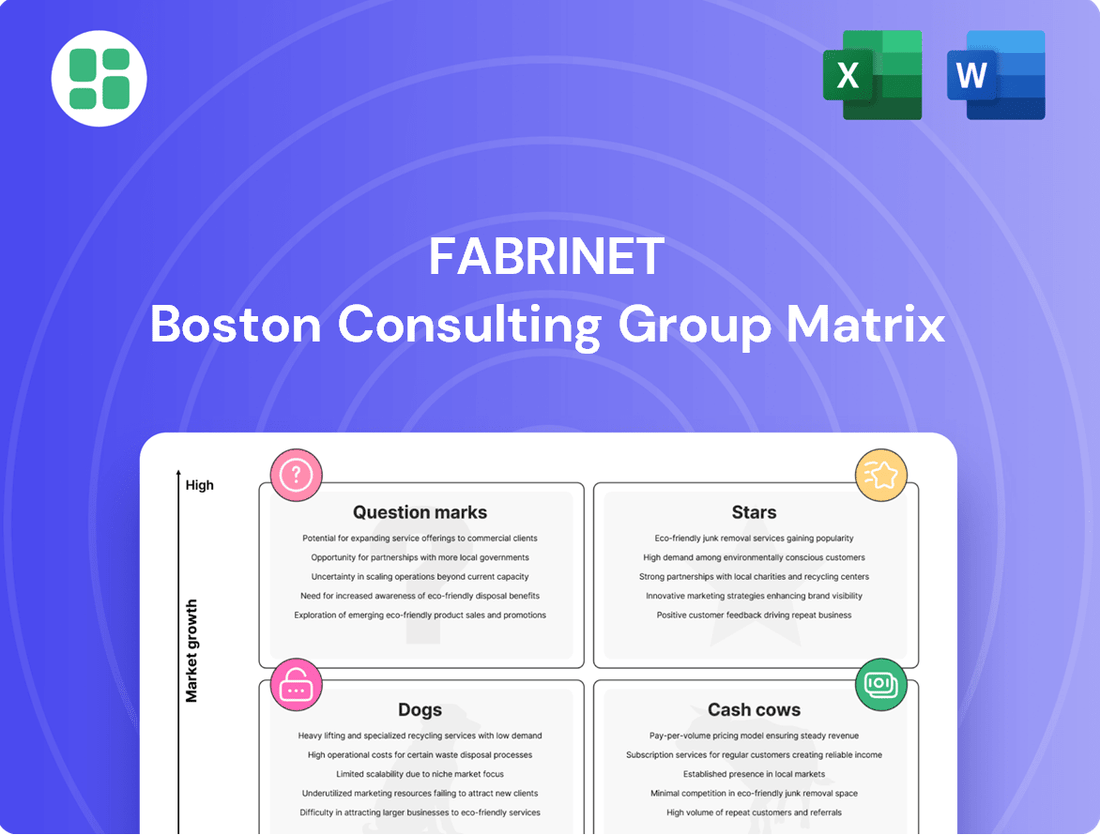

Fabrinet's position within the BCG Matrix reveals a dynamic portfolio, with some segments likely acting as robust Cash Cows while others may be emerging Stars or potential Question Marks. Understanding these placements is crucial for informed resource allocation and future growth strategies.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. It provides a detailed quadrant-by-quadrant breakdown, actionable insights, and a clear roadmap to optimize Fabrinet's product portfolio for sustained success.

Stars

High-Speed AI/Data Center Optical Transceivers are a major growth engine for Fabrinet, with products like 800 gig and the upcoming 1.6 Terabit transceivers fueling this expansion. The company is well-positioned due to the robust demand for optical interconnects critical for AI infrastructure, highlighted by its collaboration with Amazon.

Fabrinet's crucial role as a supplier to major players like Nvidia for their data center needs demonstrates its substantial market share in this fast-growing sector. In fiscal year 2023, Fabrinet saw its optical business revenue increase by 16% to $2.1 billion, largely driven by demand in data centers.

Fabrinet's optical components for 5G infrastructure are positioned as a Stars in the BCG matrix. The company has experienced a significant rebound in its telecom revenue, largely fueled by worldwide investments in expanding 5G networks. This segment, which began showing positive revenue growth in Q1 FY2025 and saw a substantial increase in Q3 FY2025, highlights Fabrinet's crucial role in supplying essential parts for advanced communication systems.

Fabrinet's strategic push into the automotive sector, especially with LIDAR and electric vehicle charging infrastructure, marks a significant expansion into a high-growth market. This focus is already yielding impressive results.

In the first quarter of fiscal year 2025, Fabrinet's automotive revenue surpassed the $100 million milestone for the first time, demonstrating substantial market penetration and demand for their optical solutions.

The automotive optical lens market, a critical component for advanced driver-assistance systems (ADAS) and the development of autonomous driving technologies, is anticipated to experience robust growth extending through 2033, underscoring the strategic importance of Fabrinet's current investments.

Precision Optical Components for Hyperscale Data Centers

Fabrinet’s precision optical components for hyperscale data centers are a clear Star in the BCG matrix. Their expertise in manufacturing high-complexity optical modules for major cloud providers, like those powering the massive expansion of digital infrastructure, secures a significant market share. This capability directly addresses the escalating need for higher bandwidth solutions, a trend that shows no signs of slowing down.

The demand for these components is fueled by the relentless growth of cloud computing and AI workloads. For instance, hyperscale data centers are projected to consume approximately 1,000 terawatt-hours of electricity annually by 2026, underscoring the sheer scale of their operations and the critical role of efficient optical networking. Fabrinet's ability to deliver these essential parts positions them strongly in this burgeoning market.

- High Market Share: Fabrinet is a key supplier to major cloud hyperscalers.

- High Growth Market: The hyperscale data center market is experiencing rapid expansion driven by AI and data growth.

- Technological Complexity: Fabrinet excels in producing advanced, high-complexity optical components.

- Foundational Capability: Their manufacturing prowess supports the ongoing demand for high-bandwidth solutions.

Customized Optical Packaging for Next-Gen Communications

Fabrinet's expertise in customized optical packaging for next-generation communications is a key strength, enabling them to serve the rapidly expanding optical communications sector. This advanced integration capability allows them to manufacture complex components, solidifying their market leadership as technology advances.

Their ability to support the entire product lifecycle, from design to high-volume production, positions Fabrinet as a critical partner for innovation in this space. For instance, in the fiscal year 2023, Fabrinet reported revenue of $2.3 billion, with a significant portion driven by their advanced optical packaging solutions.

- Market Dominance: Fabrinet's specialized optical packaging caters to the growing demand for higher bandwidth and faster data transmission in 5G networks and data centers.

- Technological Edge: Their proficiency in integrating advanced optical components ensures they remain at the forefront of next-generation communication technologies.

- Lifecycle Support: Offering end-to-end services from R&D to mass production provides a competitive advantage and fosters strong customer loyalty.

Fabrinet's optical components for 5G infrastructure are positioned as Stars in the BCG matrix. The company has seen a significant rebound in its telecom revenue, largely fueled by worldwide investments in expanding 5G networks. This segment, which began showing positive revenue growth in Q1 FY2025 and saw a substantial increase in Q3 FY2025, highlights Fabrinet's crucial role in supplying essential parts for advanced communication systems.

Fabrinet's precision optical components for hyperscale data centers are a clear Star in the BCG matrix. Their expertise in manufacturing high-complexity optical modules for major cloud providers, like those powering the massive expansion of digital infrastructure, secures a significant market share. This capability directly addresses the escalating need for higher bandwidth solutions, a trend that shows no signs of slowing down.

The demand for these components is fueled by the relentless growth of cloud computing and AI workloads. For instance, hyperscale data centers are projected to consume approximately 1,000 terawatt-hours of electricity annually by 2026, underscoring the sheer scale of their operations and the critical role of efficient optical networking. Fabrinet's ability to deliver these essential parts positions them strongly in this burgeoning market.

Fabrinet's strategic push into the automotive sector, especially with LIDAR and electric vehicle charging infrastructure, marks a significant expansion into a high-growth market. This focus is already yielding impressive results, with automotive revenue surpassing the $100 million milestone for the first time in Q1 FY2025. The automotive optical lens market is anticipated to experience robust growth extending through 2033, underscoring the strategic importance of Fabrinet's current investments.

| Segment | BCG Category | Key Drivers | FY2023 Revenue (approx.) | Growth Outlook |

| High-Speed AI/Data Center Optical Transceivers | Star | AI workloads, cloud expansion, 800G/1.6T demand | $2.1 billion (Optical Business) | High |

| 5G Infrastructure Optical Components | Star | Global 5G network buildouts, increased capex | Significant rebound in telecom revenue | High |

| Automotive Optical Components (LIDAR, EV) | Star | ADAS adoption, autonomous driving, EV growth | Over $100 million (Q1 FY2025) | High (through 2033) |

What is included in the product

Fabrinet's BCG Matrix analysis identifies units for investment, divestment, or maintenance based on market share and growth.

The Fabrinet BCG Matrix offers a clear, one-page overview to strategically position business units, relieving the pain of unclear portfolio management.

Cash Cows

Fabrinet's established optical transceivers, such as 400ZR for Data Center Interconnects (DCI), are prime examples of cash cows within their product portfolio. These products operate in a mature market segment where demand is consistent and Fabrinet enjoys a significant market share.

The 400ZR segment, while not the newest technology, continues to be a vital revenue driver, generating predictable and stable cash flows for Fabrinet. This stability is a hallmark of a cash cow, providing a reliable financial base.

Despite the ongoing development of next-generation optical technologies, the enduring requirement for dependable and high-performing components like the 400ZR ensures their continued relevance and profitability. This sustained demand solidifies their cash cow status.

Fabrinet's high-volume manufacturing of optical amplifiers and modules stands as a solid Cash Cow. These essential components for optical networks, boasting deep market penetration, consistently generate substantial revenue. In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, with a significant portion attributable to these mature product lines.

Fabrinet's precision electro-mechanical manufacturing services, extending beyond their optical focus, are a prime example of a cash cow. These operations, benefiting from established expertise and deep relationships with original equipment manufacturers (OEMs) across diverse sectors, consistently deliver strong, predictable revenue streams.

The mature stage of many applications within this segment means that capital expenditure and marketing investment are relatively low. This allows Fabrinet to maximize profitability and generate substantial, reliable cash flow, contributing significantly to the company's overall financial health.

Industrial Laser Components for Core Applications

Fabrinet's industrial laser components for core applications like cutting, welding, and marking function as a cash cow within its business portfolio. These are established markets with predictable demand, allowing Fabrinet to capitalize on its existing market position and manufacturing efficiencies for consistent earnings.

The mature nature of these applications means they require minimal new capital investment, unlike emerging or high-growth laser technologies. This steady cash flow generation is crucial for funding other areas of Fabrinet's business. For instance, the global industrial laser market was valued at approximately $16.5 billion in 2023 and is projected to reach $24.7 billion by 2028, with core applications forming a significant portion of this. Fabrinet's established presence in these segments ensures a stable revenue stream.

- Mature Market Demand: Consistent need for laser components in established industrial processes like cutting, welding, and marking.

- High Market Share & Efficiency: Fabrinet leverages its strong market position and optimized production to generate reliable profits.

- Low Investment Requirement: These foundational products demand less reinvestment compared to rapidly evolving laser technologies.

- Stable Cash Flow: Provides a dependable source of revenue to support other business segments and R&D initiatives.

Supply Chain Management and Process Engineering Services

Fabrinet's robust supply chain management and process engineering services act as significant cash cows within their business model. These offerings, honed over years of partnership with original equipment manufacturers (OEMs), generate a predictable and stable revenue stream. The company's deep-seated expertise and established client relationships minimize the need for substantial new investments, allowing these segments to consistently contribute to profitability.

These services are crucial for optimizing client operations, ensuring efficiency and cost-effectiveness. For instance, Fabrinet's ability to manage complex global supply chains for optical components and modules directly impacts their customers' bottom line. In fiscal year 2023, Fabrinet reported total revenue of $2.4 billion, with a significant portion attributable to these foundational services that underpin their OEM relationships.

- Stable Revenue Generation: Supply chain and process engineering services provide consistent cash flow due to long-standing OEM partnerships.

- Low Investment Requirements: Leveraging existing expertise and infrastructure minimizes the need for new capital expenditure in these areas.

- Client Operational Efficiency: These services directly enhance client cost-effectiveness and operational performance, solidifying their value.

- Profitability Contribution: The predictable nature of these cash cows supports Fabrinet's overall financial health and investment capacity.

Fabrinet's established optical transceivers, such as 400ZR for Data Center Interconnects (DCI), are prime examples of cash cows within their product portfolio. These products operate in a mature market segment where demand is consistent and Fabrinet enjoys a significant market share, generating predictable and stable cash flows. Despite ongoing development of next-generation technologies, the enduring requirement for dependable components like 400ZR ensures their continued relevance and profitability, solidifying their cash cow status.

| Product/Service | BCG Category | Key Characteristics | Fiscal Year 2023 Revenue Contribution (Estimated) | Market Trend Relevance |

| 400ZR Optical Transceivers | Cash Cow | Mature market, high demand, significant market share, stable cash flow. | Substantial | Continued need for DCI solutions. |

| Optical Amplifiers & Modules | Cash Cow | Deep market penetration, high-volume manufacturing, consistent revenue driver. | Significant portion of $2.4 billion total revenue. | Essential for existing optical networks. |

| Precision Electro-mechanical Services | Cash Cow | Established expertise, deep OEM relationships, predictable revenue streams, low investment. | Strong | Diverse sector applications with stable demand. |

| Industrial Laser Components | Cash Cow | Mature markets (cutting, welding, marking), efficient production, low reinvestment. | Consistent contributor | Core industrial applications drive predictable demand. |

| Supply Chain & Process Engineering | Cash Cow | Long-standing OEM partnerships, minimal new investment, client operational efficiency. | Reliable | Underpins OEM relationships and operational stability. |

Preview = Final Product

Fabrinet BCG Matrix

The Fabrinet BCG Matrix preview you're examining is the identical, fully polished document you'll receive upon purchase. This means you're seeing the complete, unwatermarked analysis, ready for immediate strategic application without any additional edits or surprises. The report is designed for professional use, offering clear insights into Fabrinet's product portfolio performance.

Dogs

Legacy low-speed optical components represent older technology that is being replaced by faster, more advanced solutions. Fabrinet's involvement in these products likely means a shrinking market share and declining demand as new high-speed standards dominate the telecommunications landscape.

These older product lines may no longer be profitable or strategic for Fabrinet. They could be consuming valuable resources, such as manufacturing capacity and research and development efforts, without yielding significant returns. Companies often consider divesting or discontinuing such assets to focus on more promising growth areas.

Fabrinet's Non-Strategic, Low-Volume, Low-Complexity Assemblies represent manufacturing services or product lines that aren't experiencing high growth or holding a significant market share. These segments are typically characterized by their simplicity or very limited production quantities.

These could include older contracts or specialized products that don't fit with Fabrinet's primary strategy of focusing on more intricate, high-value offerings. For instance, a small, specialized component assembly with a history of minimal orders might fall here, unlike their core optical communication modules. Such areas can consume resources and capital without generating substantial profits, potentially hindering investment in more promising ventures.

Fabrinet's products can be significantly impacted when major customers decide to bring manufacturing in-house. This often happens due to industry consolidation, where larger players absorb smaller ones and streamline operations, or due to strategic shifts where companies want greater control over their supply chains. For Fabrinet, this means a direct hit to demand for those specific product lines.

When key customers insource, Fabrinet faces a double whammy: a reduced market share for those offerings and diminished growth prospects. Imagine a scenario where a significant portion of your revenue for a particular product comes from one or two large clients who then decide to build their own factories. This leaves Fabrinet with a smaller piece of a potentially shrinking pie for that segment.

For instance, in the optical communications sector, which is a core area for Fabrinet, such customer-driven insourcing can be a real concern. If a major telecom equipment manufacturer, facing increased competition and seeking cost efficiencies, decides to vertically integrate its optical transceiver production, Fabrinet could see a sharp decline in orders for those components. This situation highlights the need for proactive management to avoid these product lines becoming cash traps.

Components for Stagnant Industrial Sensor Markets

Within Fabrinet's broader industrial sensor business, certain segments might be classified as Dogs if they are experiencing technological stagnation or are highly commoditized. These are areas where growth is minimal, and competition is fierce, often driving down prices and profitability. For Fabrinet, if their market share in these specific mature sensor applications is low, it signals limited future potential and a need to reconsider investment.

Investing in these stagnant industrial sensor markets would likely result in poor returns for Fabrinet. For instance, if a particular type of sensor has seen minimal innovation over the past decade and is now primarily sold based on price, Fabrinet's resources might be better allocated elsewhere. The global industrial sensor market, while substantial, is diverse, and not all segments offer the same growth opportunities.

- Low Growth Potential: Mature sensor technologies often exhibit single-digit or even flat year-over-year growth.

- Intense Price Competition: Commoditized sensors lead to pressure on margins, making profitability a challenge.

- Technological Obsolescence Risk: Stagnant markets are vulnerable to disruption by newer, more advanced technologies.

- Limited Differentiation: In these segments, products become largely interchangeable, hindering competitive advantage.

Underperforming Niche Medical Device Components

Fabrinet's portfolio might include certain niche medical device components that are struggling. These are products that haven't really taken off in terms of market adoption or are caught in a slow-growing part of the market with a lot of competition. Think of them as specialized parts for medical equipment that haven't found their big break.

Even though the overall medical device industry is doing well, Fabrinet could have specific product lines within this sector where they haven't managed to build a strong presence, and the market itself isn't growing quickly. These would be the 'Dogs' in their business. For instance, if a particular type of sensor component for a niche diagnostic tool isn't gaining traction and the market for that specific tool is stagnant, it fits this category.

These underperforming niche components typically don't offer much in terms of return on investment. For example, if a company has invested heavily in developing a component for a medical imaging device that only a small number of hospitals are adopting, and the market growth for that specific imaging technology is projected at a mere 2% annually, this would be a classic 'Dog' scenario.

- Underdeveloped Product Lines: Specific components for medical devices that have seen minimal market penetration.

- Intense Competition in Low-Growth Segments: Facing strong rivals in sub-markets that are not expanding rapidly.

- Low Return on Investment: These products are unlikely to generate significant profits or justify further substantial investment.

- Example Scenario: A component for a specialized surgical tool with less than 5% market share and a projected market growth rate of 3% annually would be classified as a 'Dog'.

Fabrinet's portfolio may include legacy optical components or niche industrial sensors that are in mature, low-growth markets. These segments often face intense price competition and a risk of technological obsolescence, leading to low profitability and limited future potential. Such product lines consume resources without generating substantial returns, potentially hindering investment in more promising areas.

These 'Dogs' in the BCG matrix represent areas where Fabrinet might have a low market share in slow-growing industries. For example, specific commoditized industrial sensors with minimal innovation over the past decade, experiencing single-digit growth, would fit this classification. Similarly, niche medical device components with low market penetration and slow annual growth rates, like a component for a specialized surgical tool with less than 5% market share and a 3% annual growth projection, are considered 'Dogs'.

Fabrinet's strategy likely involves minimizing investment in these 'Dog' segments, potentially divesting them to reallocate capital towards high-growth areas. Focusing resources on products with stronger market positions and higher growth prospects is crucial for overall company performance.

Question Marks

Fabrinet's expansion into advanced medical device manufacturing, particularly with components that incorporate AI, wearable tech, or 3D printing, places them in a high-growth arena where their market share is still taking shape. This segment is characterized by new product introductions and applications where gaining market traction is paramount, necessitating substantial investment to secure a competitive advantage.

These emerging medical technologies represent a classic 'question mark' in the BCG matrix. While the future potential is considerable, current returns are likely modest due to the early stage of market penetration and the significant capital required for research, development, and market education. For instance, the global AI in healthcare market was projected to reach $187.95 billion by 2030, indicating the vast opportunity but also the investment needed to capture a meaningful share.

Fabrinet's involvement in next-generation automotive sensors, moving beyond established LIDAR, positions them in a potentially high-growth but unproven market. Consider their manufacturing capabilities for advanced radar components or novel imaging technologies crucial for Level 4/5 autonomy. The automotive sensor market is projected to reach over $50 billion by 2030, with advanced radar and imaging expected to capture a significant portion of this growth.

Fabrinet's exploration into specialized markets like biotechnology and metrology suggests a strategic move towards high-growth potential sectors. These areas are characterized by rapid technological advancement and increasing demand for precision instrumentation, aligning with Fabrinet's core competencies in advanced optical manufacturing.

Within the BCG framework, these nascent ventures would likely be classified as Question Marks. Fabrinet is investing in these areas, aiming to capture a significant market share, but currently holds a relatively small position. For instance, the global biotechnology market was valued at approximately $530 billion in 2023 and is projected to grow substantially, while the metrology market is also experiencing robust expansion driven by industrial automation and quality control needs.

The success of these ventures hinges on substantial investment and effective market penetration strategies. Failure to gain traction or adapt to market dynamics could see these segments devolve into Dogs, requiring divestment or significant restructuring. Fabrinet's approach here is a classic example of balancing risk and reward in pursuit of future growth drivers.

Advanced Ultrafast and Solid-State Lasers for New Applications

Fabrinet's advanced ultrafast and solid-state lasers target emerging, high-growth industrial niches, such as specialized additive manufacturing and micro-processing. These areas represent a strategic push into markets demanding high precision and unique capabilities, where Fabrinet aims to build a significant market share from a nascent position.

The company's focus on these advanced laser technologies underscores a strategy to capture value in specialized applications. For instance, the market for ultrafast lasers in industrial applications, including semiconductor manufacturing and advanced materials processing, is projected for robust growth. By 2024, the global market for ultrafast lasers was estimated to be in the billions, with significant expansion anticipated in sectors leveraging these precise tools.

- Targeting Niche Growth: Fabrinet is concentrating on specific, high-potential industrial applications for its advanced lasers, moving beyond traditional markets.

- Strategic Market Entry: The company is working to establish a dominant position in these emerging niches, starting with a smaller market share.

- High-Growth Potential: These advanced laser applications are characterized by rapid growth and increasing demand for specialized technological solutions.

New Customer Programs Requiring Significant Ramp-Up

Fabrinet's new customer programs requiring significant ramp-up are positioned as potential Stars in the BCG Matrix. These initiatives, often involving advanced technologies like 1.6 Terabit transceivers, demand substantial upfront investment in setup and tooling. For instance, the ramp-up of these high-speed transceivers, though contingent on customer deployment schedules, represents a significant cash outflow in its initial stages.

These early-stage programs are characterized by high investment and uncertain returns, typical of Question Marks. Fabrinet's strategic focus is on nurturing these ventures, ensuring they have the resources for successful production scaling. The company's ability to manage these ramp-ups efficiently will be critical in converting these investments into future revenue streams.

- Early-stage investment: Significant cash is deployed for initial setup and tooling.

- Technological advancement: Programs often involve cutting-edge technologies like 1.6 Terabit transceivers.

- Customer dependency: Success and growth are tied to customer adoption and timelines.

- Potential for growth: These programs hold the promise of becoming future Stars if ramp-up is successful.

Fabrinet's ventures into advanced medical device manufacturing, particularly those incorporating AI or wearable technology, represent classic Question Marks. These are high-growth areas where Fabrinet is investing heavily to establish market share, but current returns are likely modest due to the early stage of market penetration.

Similarly, their expansion into next-generation automotive sensors and specialized markets like biotechnology and metrology are also Question Marks. These sectors offer substantial growth potential, but require significant capital for R&D and market entry, with success dependent on effective penetration strategies.

The company's focus on advanced ultrafast and solid-state lasers for niche industrial applications, such as specialized additive manufacturing, also falls into the Question Mark category. Fabrinet is aiming to build significant market share in these emerging areas, which are characterized by rapid technological advancement and increasing demand.

Fabrinet's new customer programs, especially those involving cutting-edge technologies like 1.6 Terabit transceivers, are early-stage investments that are essentially Question Marks. While they have the potential to become Stars, they currently require substantial upfront investment and their growth is tied to customer adoption timelines.

| Area | BCG Classification | Key Characteristics | Market Potential (Illustrative) | Fabrinet's Position |

| AI/Wearable Medical Devices | Question Mark | High growth, new technology, significant investment needed | Global AI in healthcare market projected to reach $187.95 billion by 2030 | Emerging, market share developing |

| Advanced Automotive Sensors | Question Mark | High growth, unproven market segments (advanced radar/imaging) | Automotive sensor market to exceed $50 billion by 2030 | Expanding capabilities beyond established LIDAR |

| Biotechnology & Metrology | Question Mark | High growth potential, precision instrumentation demand | Biotechnology market valued at ~$530 billion in 2023; Metrology market robust | Strategic move into specialized, high-demand sectors |

| Ultrafast & Solid-State Lasers | Question Mark | Niche industrial applications, high precision demand | Global ultrafast laser market in billions, with strong industrial growth | Targeting specialized additive manufacturing and micro-processing |

| New Customer Programs (e.g., 1.6 Tb Transceivers) | Question Mark | Early-stage, high upfront investment, customer-dependent | Growth contingent on customer deployment schedules | Significant ramp-up investment required |

BCG Matrix Data Sources

Our Fabrinet BCG Matrix leverages comprehensive data from financial reports, market research, and industry analysis to provide accurate strategic insights.