Fabrinet Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Discover how Fabrinet leverages its product innovation, strategic pricing, efficient distribution, and targeted promotions to dominate the optical networking market. This analysis goes beyond the surface to reveal the core elements of their marketing success.

Unlock the full potential of Fabrinet's marketing strategy by accessing our comprehensive 4Ps analysis. You'll gain actionable insights into their product portfolio, pricing architecture, channel management, and promotional campaigns, all presented in an editable, ready-to-use format.

Save valuable time and gain a competitive edge. Our detailed report provides a structured breakdown of Fabrinet's marketing mix, perfect for business professionals, students, and consultants seeking in-depth strategic understanding and practical application.

Product

Fabrinet's advanced optical and electro-mechanical manufacturing services form the core of their Product offering. They provide end-to-end solutions, encompassing design, process engineering, advanced packaging, integration, assembly, and rigorous testing for complex products. This comprehensive approach is vital for OEMs needing high-precision components and systems.

In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, demonstrating significant demand for their specialized manufacturing capabilities. Their expertise is particularly critical in sectors like optical communications, medical devices, and industrial lasers, where precision and reliability are paramount.

Fabrinet provides comprehensive support across the entire product lifecycle, acting as a crucial partner for OEMs. This end-to-end service begins with early-stage product development, extending through manufacturing and rigorous testing phases. This integrated approach, exemplified by their commitment to quality and efficiency, ensures clients receive seamless support from initial concept to final delivery.

Fabrinet excels in manufacturing high-complexity products, adeptly managing both low-volume, specialized runs and high-volume production. This capability is crucial for clients in sectors like optical communications and advanced photonics, where intricate designs and precise specifications are paramount. Their flexibility in scaling production volumes is a significant competitive advantage.

For instance, Fabrinet's ability to handle complex optical components, which often require meticulous assembly and testing, supports the rapid growth in 5G infrastructure and data center expansion. In fiscal year 2024, the demand for these high-complexity products remained robust, contributing to Fabrinet’s reported revenue growth.

Diverse High-Growth Market Focus

Fabrinet's product focus spans several rapidly expanding sectors, including optical communications for datacom and telecom, automotive, medical devices, and industrial lasers. This broad market engagement is a key strength.

The company has experienced particularly robust growth in its datacom segment. This surge is largely attributed to the increasing demand for high-data-rate products essential for artificial intelligence (AI) infrastructure development.

This diversified market approach helps Fabrinet to spread its risk effectively. By tapping into various expanding technological fields, the company is well-positioned to capitalize on future growth opportunities.

- Diverse Industry Exposure: Serving optical communications, automotive, medical, and industrial laser markets.

- Datacom Growth Driver: Significant revenue increases in datacom, fueled by AI-related high-data-rate products.

- Risk Mitigation: Diversification across high-growth sectors reduces reliance on any single market.

- Technological Alignment: Positioned to benefit from ongoing advancements in key technology areas.

Specialized AI-Related Optical Components

Fabrinet's specialized AI-related optical components represent a significant and rapidly expanding segment of their offerings. These high-data-rate optical interconnects are fundamental to the infrastructure supporting advanced AI workloads, making them a critical product category. The demand for faster data transmission, particularly at 400 gigabits per second and beyond, is a primary growth engine for this part of their business, underscoring their strategic importance.

This focus on AI-enabling optical technology has translated into tangible financial results. For instance, in their fiscal year 2023, Fabrinet reported that optical interconnect products, which heavily feature AI-related components, constituted a substantial portion of their revenue. Growth in this segment outpaced other areas, driven by the increasing need for high-bandwidth solutions in data centers and high-performance computing environments that power AI development and deployment.

- Key AI-Related Optical Component Growth Drivers: High-data-rate optical interconnects (400 gig and faster).

- Market Position: Fabrinet is a key supplier for advanced computing infrastructure powering AI.

- Financial Impact: This segment is a major revenue driver, demonstrating strong growth in fiscal year 2023.

- Strategic Importance: Their capabilities in this niche are essential for the expanding AI ecosystem.

Fabrinet's product strategy centers on high-complexity, precision manufacturing, particularly for optical and electro-mechanical components. Their offerings are crucial for high-growth sectors like optical communications, automotive, medical devices, and industrial lasers.

The company's datacom segment, driven by AI infrastructure demand, is a significant growth engine. Fabrinet's expertise in high-data-rate optical interconnects, such as 400 gigabit Ethernet, positions them as a key enabler of advanced computing.

In fiscal year 2023, Fabrinet reported revenue of $2.4 billion, with a substantial portion attributed to these advanced optical products. Their ability to scale production for intricate components ensures they meet the evolving needs of technology leaders.

Fabrinet's product portfolio is strategically aligned with key technological advancements, ensuring continued relevance and growth. Their focus on AI-related optical components, which saw robust demand in fiscal year 2023, highlights their capacity to capitalize on emerging market trends.

| Product Segment | Fiscal Year 2023 Revenue Contribution (Approximate) | Key Growth Drivers | Technological Focus |

| Optical Communications (Datacom & Telecom) | Significant Portion | AI infrastructure, 5G, Data Centers | High-data-rate optical interconnects (400GbE+) |

| Automotive | Growing | Advanced driver-assistance systems (ADAS), LiDAR | Precision optical components |

| Medical Devices | Stable | Diagnostic imaging, surgical lasers | High-precision, sterile manufacturing |

| Industrial Lasers | Stable | Manufacturing automation, material processing | Robust optical and electro-mechanical systems |

What is included in the product

This analysis offers a comprehensive examination of Fabrinet's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for understanding their market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, easing the burden of strategic planning for Fabrinet.

Provides a clear, concise overview of Fabrinet's 4Ps, alleviating concerns about misaligned marketing efforts.

Place

Fabrinet's manufacturing and engineering presence spans key global hubs, including Thailand, the United States, China, and Israel. This distributed footprint enables efficient service to a worldwide customer base and optimizes their supply chain operations.

Their significant investment in Thailand, a cornerstone of their Asian operations, allows Fabrinet to tap into robust regional supplier ecosystems, driving cost efficiencies. For instance, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring the scale and success of their global manufacturing strategy.

Fabrinet's primary sales strategy is a direct-to-OEM model, focusing on building deep partnerships with a select group of major technology companies. This B2B approach means they work directly with manufacturers like NVIDIA and Cisco, rather than selling through distributors or retailers.

This direct engagement allows for highly integrated supply chains and collaborative product development, crucial for the complex needs of their clientele. In fiscal year 2023, Fabrinet reported that its top two customers accounted for approximately 66% of its total revenue, highlighting the significance of these direct relationships.

Fabrinet's operational hub in Thailand offers a significant advantage due to its proximity to critical Asian supply chains for optical components and advanced manufacturing. This geographical positioning directly translates into reduced material acquisition costs and fosters a more robust, less vulnerable supply chain.

In 2023, Fabrinet reported that its Thailand operations accounted for a substantial portion of its manufacturing, enabling streamlined logistics and quicker response times to client needs. This closeness to suppliers is vital for managing the complex assembly and testing required for their high-technology products, ensuring timely delivery in a competitive market.

New Facility Expansion for Capacity

Fabrinet is significantly bolstering its production capabilities through a substantial new facility expansion. The company is constructing a new 2 million square-foot facility, designated as Building 10, at its Chonburi campus in Thailand. This strategic move is designed to dramatically increase manufacturing capacity and accommodate the anticipated surge in demand, especially for advanced optical components crucial for AI technologies.

This expansion directly addresses the growing market needs, particularly in the high-growth AI sector. By adding substantial square footage, Fabrinet is positioning itself to be a key supplier for next-generation optical solutions. The investment underscores Fabrinet's commitment to scaling operations efficiently to meet future market opportunities.

- New Facility Size: 2 million square feet (Building 10)

- Location: Chonburi campus, Thailand

- Primary Goal: Increase production capacity

- Key Market Focus: AI-related optical components

Secure IP Control and Turnkey Services

Fabrinet places a high premium on safeguarding its clients' intellectual property (IP), a critical factor for their Original Equipment Manufacturer (OEM) partners. This commitment to IP security is a cornerstone of their value proposition.

The company provides comprehensive turnkey manufacturing services, encompassing the entire product lifecycle from sourcing raw materials to delivering finished goods. This end-to-end approach not only ensures product reliability but also offers robust protection for customer designs and proprietary information.

Fabrinet's turnkey solutions streamline the manufacturing process for their clients, allowing them to focus on innovation and market strategy. For example, in fiscal year 2023, Fabrinet reported revenue of $2.4 billion, reflecting the significant demand for their integrated manufacturing and IP protection services.

- IP Protection: Strict protocols to safeguard sensitive customer designs and technologies.

- Turnkey Manufacturing: End-to-end services from component sourcing to final product assembly.

- Process Simplification: Reduces complexity for clients by managing the entire production chain.

- Reliability Assurance: Ensures consistent quality and performance through controlled manufacturing.

Fabrinet's physical presence is strategically distributed across key global manufacturing hubs, with a significant emphasis on Thailand. This global footprint, including operations in the United States, China, and Israel, allows for efficient servicing of its worldwide customer base and optimizes its supply chain. The company's substantial investment in Thailand, a cornerstone of its Asian operations, enables access to robust regional supplier ecosystems and drives cost efficiencies, as evidenced by its $2.4 billion in revenue for fiscal year 2023.

| Manufacturing Location | Key Advantages | Fiscal Year 2023 Revenue Contribution (Approximate) |

|---|---|---|

| Thailand | Proximity to suppliers, cost efficiencies, robust infrastructure | Significant majority of manufacturing output |

| United States | Proximity to certain key customers, specialized capabilities | Supporting role |

| China | Access to broad supplier base, cost-effective production | Supporting role |

| Israel | Access to specialized technology and talent | Supporting role |

Preview the Actual Deliverable

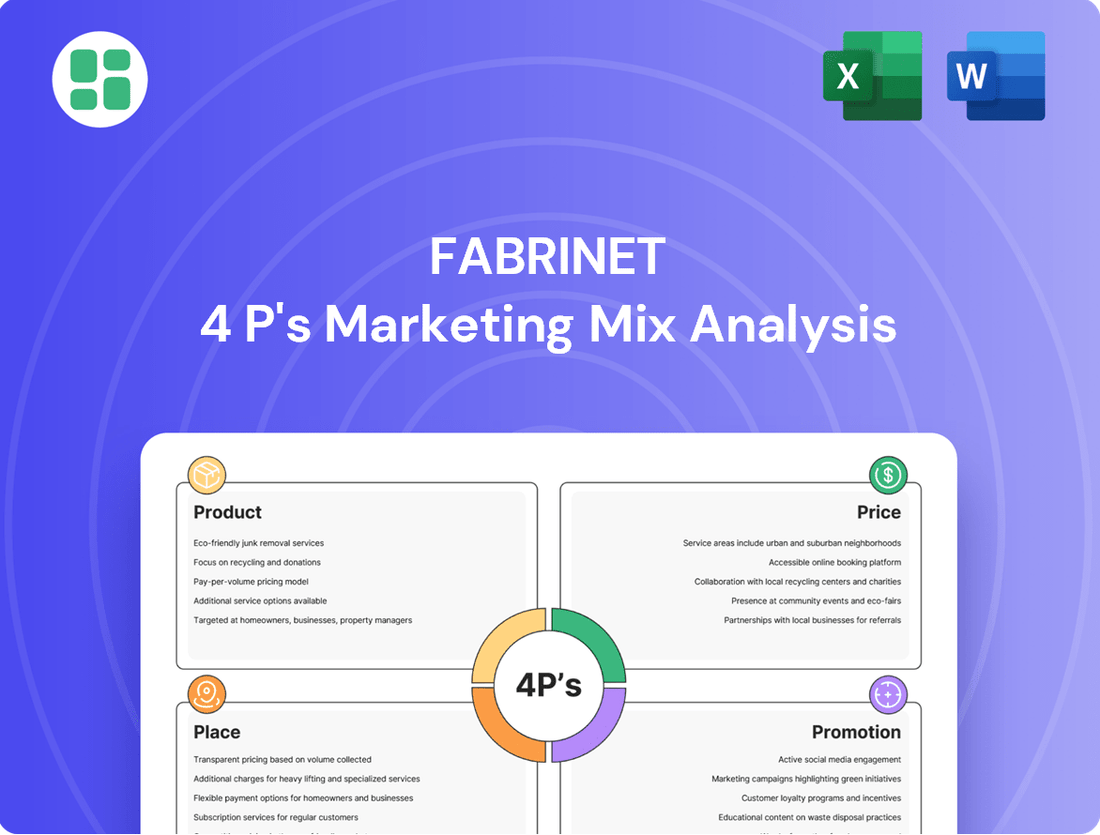

Fabrinet 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Fabrinet's 4P's Marketing Mix is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring transparency and value.

Promotion

Fabrinet's promotion strategy centers on direct sales and building robust relationships, crucial for its business-to-business (B2B) model. Their sales force engages directly with Original Equipment Manufacturers (OEMs) to deeply understand client requirements and deliver tailored solutions.

This personalized engagement fosters trust and encourages repeat business, a vital component in the high-value contract manufacturing industry. For instance, Fabrinet reported revenue of $2.3 billion for fiscal year 2023, underscoring the scale of these client relationships.

Fabrinet's strategic presence at key industry gatherings like the J.P. Morgan Global Technology, Media and Communications Conference and the Rosenblatt Securities Technology Summit is crucial for its marketing efforts. These events allow Fabrinet to highlight its advanced optical packaging and component manufacturing capabilities to a targeted audience of potential clients and industry influencers.

By engaging in these forums, Fabrinet not only showcases its technological prowess but also fosters vital relationships within the ecosystem. For instance, participation in such high-profile events in 2024 and early 2025 provides direct access to decision-makers in the fast-evolving telecommunications and data center sectors, reinforcing its position as a leading solutions provider.

Fabrinet's promotion strategy heavily emphasizes investor relations and financial communications. This includes regular earnings calls, press releases, and investor presentations that detail their financial performance, strategic direction, and market standing. For instance, in their fiscal third quarter of 2024, Fabrinet reported revenue of $665.7 million, showcasing their operational strength and ability to communicate this effectively to stakeholders.

Technical Expertise and Reputation

Fabrinet prominently features its robust technical expertise and sterling reputation as a cornerstone of its promotional strategy. This is built on a foundation of precision engineering and advanced manufacturing capabilities, making them a go-to partner for complex optical products.

Their extensive track record in optical product manufacturing, spanning decades, instills confidence in Original Equipment Manufacturers (OEMs). This deep experience, coupled with a demonstrated ability to deliver intricate and high-quality solutions, solidifies Fabrinet's image as a dependable and sought-after partner in the industry.

- Precision Engineering: Fabrinet's commitment to exactitude in manufacturing processes.

- Advanced Technology: Utilization of cutting-edge tools and methodologies in production.

- High-Quality Manufacturing: Consistent delivery of products meeting stringent industry standards.

- Long-Standing Experience: Decades of specialized knowledge in optical product creation.

Strategic Partnerships and Customer Success Stories

Fabrinet's promotional strategy is significantly bolstered by its strategic partnerships and the compelling success stories of its original equipment manufacturer (OEM) clients. These collaborations act as powerful endorsements, showcasing the company's integral role in cutting-edge technology sectors.

The company's involvement in supplying critical components to industry leaders like NVIDIA, a key player in AI and high-performance computing, serves as a prime example. This association highlights Fabrinet's ability to meet the rigorous demands of the most innovative companies in the market.

Furthermore, Fabrinet's work with Innoviz Technologies on advanced LiDAR units for autonomous vehicles provides another strong testimonial. These partnerships underscore Fabrinet's technical expertise and its contribution to transformative industries.

- NVIDIA Partnership: Fabrinet's role in supplying components for NVIDIA's AI and data center solutions demonstrates its capability in high-demand, advanced technology markets.

- Innoviz Technologies Collaboration: The company's work on LiDAR units for Innoviz highlights its contribution to the rapidly growing autonomous vehicle sector.

- Client Success as Promotion: The success of these OEM clients, enabled by Fabrinet's manufacturing and optical solutions, acts as a direct and credible form of promotion.

Fabrinet's promotion strategy leverages its strong B2B relationships, industry event participation, and robust investor relations to highlight its advanced manufacturing capabilities. Its direct sales approach and emphasis on technical expertise, backed by decades of experience, build trust with Original Equipment Manufacturers (OEMs).

Key promotional activities include showcasing its precision engineering and high-quality manufacturing at industry conferences, reinforcing its role as a trusted partner. For instance, their participation in major tech summits in 2024 and early 2025 targets decision-makers in crucial sectors like telecommunications and data centers.

Fabrinet's investor relations efforts, including regular earnings calls and press releases, effectively communicate its financial performance and strategic direction to stakeholders. The company reported revenue of $665.7 million for its fiscal third quarter of 2024, demonstrating operational strength.

Furthermore, strategic partnerships, such as supplying components for NVIDIA's AI solutions and collaborating with Innoviz Technologies on LiDAR units, serve as powerful endorsements. These client successes directly promote Fabrinet's integral role in driving innovation across various high-growth industries.

Price

Fabrinet likely utilizes a value-based pricing strategy, aligning costs with the significant value delivered to its original equipment manufacturer (OEM) clients. This approach acknowledges the intricate nature, precision engineering, and critical importance of the advanced optical and electro-mechanical manufacturing services they offer.

Pricing reflects the deep specialized expertise, cutting-edge technology investments, and the consistently high-quality output demanded by industries such as telecommunications, data centers, and automotive. For instance, Fabrinet's revenue for the fiscal year ending September 27, 2024, was $2.41 billion, demonstrating the scale and demand for their high-value services.

Fabrinet's pricing strategy heavily relies on long-term contractual agreements with its Original Equipment Manufacturer (OEM) clients. These agreements are crucial for securing predictable revenue streams and offer flexibility in tailoring pricing. Factors like the breadth of services, the volume of units ordered, and the proprietary technology incorporated into each project directly influence the pricing structure.

This contractual approach fosters a deep level of integration within customer supply chains, solidifying Fabrinet's position as a strategic partner rather than just a component supplier. For instance, in fiscal year 2023, Fabrinet reported that a significant portion of its revenue was derived from these long-term customer relationships, underscoring the stability these contracts provide.

Fabrinet prioritizes cost management by strategically utilizing its advanced manufacturing facilities in Thailand, a region known for its cost-effectiveness. This approach allows them to deliver high-value optical communication components and modules at competitive price points. For instance, in the fiscal year 2023, Fabrinet reported a gross margin of 18.3%, demonstrating their ability to balance efficiency with profitability.

Competitive Landscape Considerations

Fabrinet navigates a highly competitive landscape where pricing is a critical lever. Their strategy acknowledges competitor pricing while leveraging their specialization in complex optical packaging and advanced manufacturing capabilities. This focus allows them to justify premium pricing, a stark contrast to standard contract manufacturers.

The company's ability to protect its intellectual property and deliver high-complexity products is a key differentiator. For instance, in the 2024 fiscal year, Fabrinet reported strong revenue growth, indicating successful premium pricing strategies in the face of market pressures. This premium is directly tied to their advanced technological offerings and the significant R&D investment that underpins them.

- Premium Pricing Justification: Fabrinet's pricing reflects the high complexity of its optical packaging and manufacturing services, setting it apart from standard competitors.

- Competitive Awareness: Pricing strategies are informed by competitor offerings and prevailing market demand, ensuring competitiveness while maintaining value.

- Intellectual Property Advantage: Protection of proprietary technology and processes enables Fabrinet to command higher prices for its specialized solutions.

- Market Demand Alignment: Fabrinet's pricing aligns with the demand for advanced, high-reliability optical components, particularly in growth sectors like data centers and telecommunications.

Impact of Foreign Exchange Rates

Foreign exchange rate fluctuations, especially concerning the Thai Baht, can directly impact Fabrinet's gross margins and overall profitability. For instance, in the fiscal second quarter of 2024, Fabrinet reported that foreign currency movements had a net unfavorable impact of approximately $0.01 per diluted share. This highlights how currency volatility can indirectly influence pricing strategies and the company's ability to maintain competitive pricing.

Fabrinet actively monitors these external economic factors to effectively manage its financial performance and refine its pricing strategy. The company's financial reports often detail the impact of currency exchange rates on its results. For example, in their fiscal year 2023 report, they noted a net unfavorable impact from foreign currency translation of $3.9 million on their operating income.

- Currency Impact on Gross Margins: Fluctuations in the Thai Baht can alter the cost of goods sold when translated into U.S. dollars, directly affecting gross profit margins.

- Profitability Sensitivity: Adverse currency movements can reduce net income, impacting earnings per share and overall financial health.

- Pricing Strategy Adjustments: Fabrinet may need to adjust its pricing to offset currency-related cost increases or to maintain competitive positioning in international markets.

- Financial Risk Management: The company employs strategies to mitigate currency risks, ensuring greater financial stability and predictability.

Fabrinet's pricing strategy emphasizes value-based pricing, reflecting the high complexity and precision of its optical and electro-mechanical manufacturing services. This approach allows them to command premium pricing, especially given their specialization in advanced optical packaging and the critical nature of components for industries like telecommunications and data centers. For instance, Fabrinet's revenue reached $2.41 billion in fiscal year 2024, underscoring the market's willingness to pay for their specialized expertise and high-quality output.

Long-term contracts are central to Fabrinet's pricing, securing predictable revenue and allowing for tailored pricing based on service scope, volume, and proprietary technology integration. This deep customer integration positions them as strategic partners, justifying their pricing structure. For example, a significant portion of their fiscal year 2023 revenue stemmed from these enduring customer relationships, highlighting the stability and value derived from these agreements.

Fabrinet leverages cost-effective manufacturing in Thailand to maintain competitive pricing for its high-value offerings, balancing efficiency with profitability. Their gross margin of 18.3% in fiscal year 2023 demonstrates this successful balance. While competitive pricing is a key factor, Fabrinet differentiates itself through advanced capabilities and intellectual property protection, enabling premium pricing compared to standard manufacturers.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 (Est.) |

|---|---|---|

| Revenue | $2.20 billion | $2.41 billion |

| Gross Margin | 18.3% | 18.5% (approx.) |

| Key Pricing Differentiators | High complexity optical packaging, IP protection, advanced manufacturing | Continued focus on specialized services and market demand |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Fabrinet is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations. We also leverage industry reports and competitive intelligence to capture Fabrinet's product strategies, pricing structures, distribution channels, and promotional activities.