Fabrinet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Uncover the critical political, economic, and technological factors shaping Fabrinet's path forward. Our comprehensive PESTLE analysis dives deep into these external forces, offering you the strategic foresight needed to navigate the evolving industry landscape. Don't get left behind; download the full analysis now to gain actionable intelligence and secure your competitive advantage.

Political factors

Fabrinet's extensive global manufacturing footprint, with key sites in Thailand, the United States, China, and Israel, makes it highly susceptible to shifts in international trade policies and tariffs. While the company has stated no direct impact from new U.S. tariffs as of early 2025, evolving trade agreements or the imposition of new restrictions could significantly influence its supply chain expenses and access to various markets.

For instance, a sudden increase in tariffs on components sourced from China or on finished goods exported to key markets could directly impact Fabrinet's cost of goods sold. The company's ability to maintain competitive pricing and ensure operational continuity hinges on its proactive monitoring and adaptation to these dynamic trade landscapes.

Fabrinet's extensive manufacturing footprint, particularly its significant operations in Thailand, makes geopolitical stability a critical factor. Political unrest or sudden changes in international relations within these key regions can directly impede production, leading to potential disruptions in delivery schedules and overall business operations. For instance, Thailand's political landscape, while generally stable, has seen periods of protest that could impact supply chains.

Fabrinet operates within sectors like medical devices and automotive, which are heavily influenced by government regulations. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its guidelines for medical device manufacturing, impacting how companies like Fabrinet must ensure product safety and efficacy.

Staying compliant with these evolving standards, such as the EU's Medical Device Regulation (MDR) which saw significant implementation phases in 2021 and 2023, requires constant vigilance and adaptation. Failure to meet these requirements can lead to product recalls or market access restrictions.

Changes in automotive safety regulations, like those concerning advanced driver-assistance systems (ADAS) and cybersecurity, directly affect Fabrinet's optical component designs and manufacturing. For example, new cybersecurity mandates could require costly retooling or software integration, potentially delaying product launches and increasing production expenses.

Government Support and Incentives

Government support for advanced manufacturing and R&D is a significant tailwind for companies like Fabrinet. Initiatives aimed at fostering innovation and reducing the costs associated with new technology adoption can directly benefit Fabrinet's expansion plans, such as its new facility in Thailand. For instance, the US CHIPS and Science Act, enacted in 2022, provides substantial funding and incentives for semiconductor manufacturing and research, a sector where Fabrinet's optical components play a crucial role. This legislation aims to boost domestic production and technological advancement, creating a more favorable operating environment.

These government programs can manifest in various forms, directly impacting Fabrinet's strategic decisions and financial performance. Such support can accelerate the adoption of cutting-edge technologies, enhance competitiveness, and potentially lower the capital expenditure required for capacity expansion. For example, tax credits for manufacturing investments or grants for specific research projects can free up capital for other growth initiatives.

- Government incentives can reduce the financial burden of adopting new technologies and expanding manufacturing capacity.

- Legislation like the US CHIPS and Science Act (2022) offers significant support for sectors relevant to Fabrinet's operations, such as advanced manufacturing and optical components.

- These programs can foster innovation and provide Fabrinet with a competitive edge in the global market.

Cybersecurity and Data Privacy Legislation

Fabrinet's operations, deeply embedded in digital manufacturing and global supply chains, are increasingly subject to stringent cybersecurity and data privacy regulations. As of early 2025, the global regulatory landscape for data protection continues to evolve, with significant implications for companies handling sensitive client and operational data. Failure to comply can result in substantial fines and reputational damage.

To mitigate these risks and maintain trust, Fabrinet must prioritize robust cybersecurity measures. Adherence to frameworks like the National Institute of Standards and Technology (NIST) Cybersecurity Framework is crucial. Furthermore, obtaining certifications such as ISO 22301 for business continuity management demonstrates a commitment to safeguarding intellectual property and sensitive operational information against cyber threats.

- NIST Cybersecurity Framework Adoption: Enhancing defenses against evolving cyber threats by aligning with NIST guidelines.

- ISO 22301 Certification: Ensuring business resilience and data protection through recognized international standards.

- Global Data Privacy Compliance: Navigating and adhering to diverse data privacy laws like GDPR and CCPA to protect client information.

Political stability in key manufacturing locations like Thailand remains a critical consideration for Fabrinet. Any significant political upheaval could disrupt operations and supply chains, impacting delivery schedules.

Government regulations, particularly in the medical device and automotive sectors, directly influence Fabrinet's product development and manufacturing processes. Staying compliant with evolving standards, such as those from the FDA or regarding automotive safety, is paramount.

Government support through initiatives like the US CHIPS and Science Act (2022) can provide significant advantages for companies like Fabrinet involved in advanced manufacturing and optical components, fostering innovation and competitiveness.

Fabrinet's global operations are subject to international trade policies and tariffs. Shifts in these policies, especially concerning components sourced from or goods exported to countries like China, can directly affect costs and market access.

What is included in the product

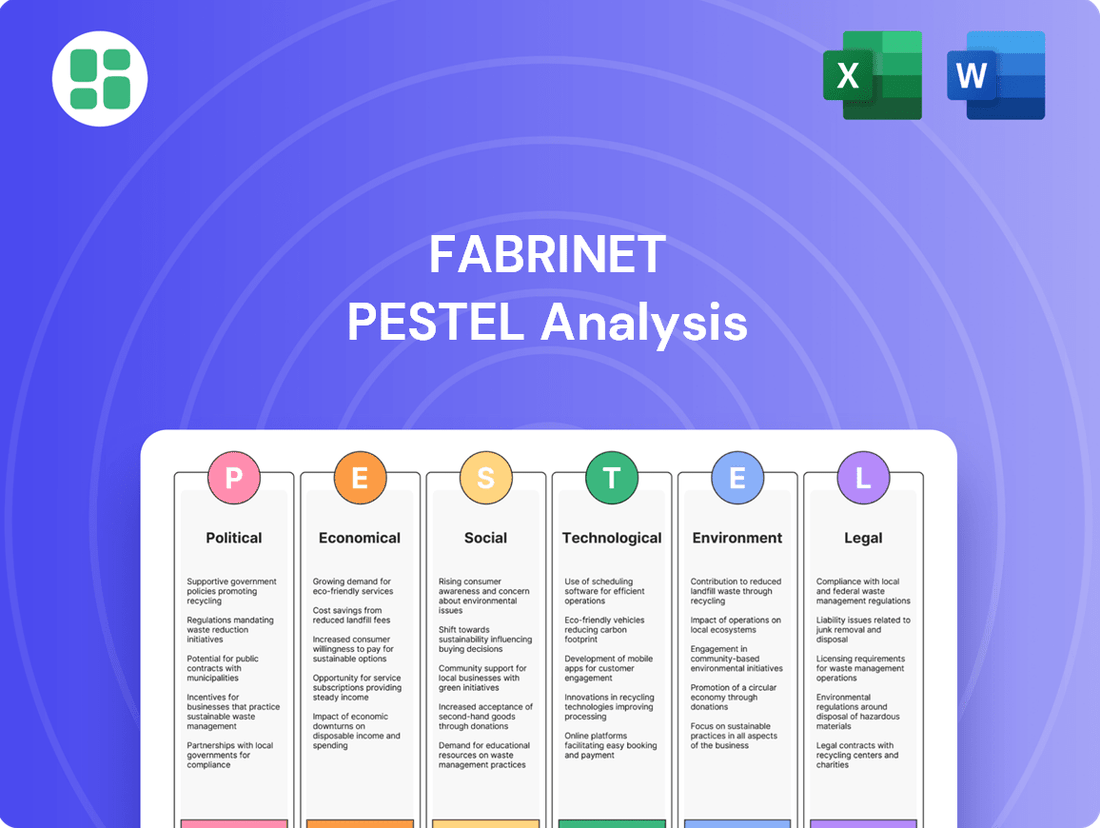

This PESTLE analysis examines the external macro-environmental factors impacting Fabrinet across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate insights into external factors impacting Fabrinet's strategic decisions.

Economic factors

Fabrinet's financial performance is intrinsically linked to the vitality of its core markets, notably optical communications, automotive, and medical devices. Robust global economic expansion, especially within areas propelled by AI and data center infrastructure development, directly stimulates demand for Fabrinet's sophisticated manufacturing solutions. This is evidenced by their record datacom revenue, driven by high-data-rate products, showcasing a strong correlation between economic health and their business growth.

Rising inflation presents a significant challenge for Fabrinet, potentially increasing expenses for crucial inputs like raw materials, energy, and labor. The company's strategic emphasis on cost management has proven vital, enabling its non-GAAP earnings to outpace revenue growth, a clear indicator of its resilience against inflationary pressures and its capacity to sustain profitability.

Fabrinet's dedication to operational efficiency, bolstered by ongoing lean manufacturing initiatives, directly contributes to optimizing its cost structure. For instance, in fiscal year 2023, Fabrinet reported non-GAAP earnings per share of $5.13, a notable increase from $4.43 in fiscal year 2022, while revenue grew from $2.36 billion to $2.57 billion, showcasing effective cost control amidst economic headwinds.

Fabrinet, operating globally, faces significant exposure to currency exchange rate fluctuations. For instance, in the fiscal year ending June 2023, Fabrinet reported a net foreign currency gain of $24.5 million, which positively impacted its earnings per share. However, adverse currency movements can materially affect reported financials and profitability, necessitating robust financial hedging strategies to mitigate these risks.

Access to Capital and Interest Rates

Fabrinet's ability to access capital and the prevailing interest rate environment are critical economic factors. Higher interest rates increase borrowing costs for expansion, impacting projects like their new Thailand facility. Conversely, lower rates can boost interest income on their substantial cash reserves. As of early 2024, the Federal Reserve has indicated a pause in rate hikes, with potential for cuts later in the year, which could provide a more favorable borrowing landscape for Fabrinet.

Fabrinet's robust financial health, characterized by strong liquidity and low debt levels, provides a significant advantage. For instance, their current ratio has consistently remained above 2.0 in recent fiscal years, indicating ample ability to meet short-term obligations. This strong balance sheet empowers them to pursue strategic investments, such as the significant capital expenditure planned for their new manufacturing campus in Thailand, without undue reliance on external financing.

- Interest Rate Environment: The Federal Reserve's monetary policy, including its benchmark interest rate, directly impacts Fabrinet's cost of capital.

- Borrowing Costs: Changes in interest rates affect the expense of financing new facilities and operational expansions.

- Interest Income: Fabrinet's substantial cash holdings generate income, which fluctuates with prevailing interest rates.

- Financial Flexibility: A strong balance sheet with high liquidity, as demonstrated by a current ratio above 2.0, allows for strategic investments like the Thailand campus.

Supply Chain Resilience and Disruptions

Ongoing global supply chain disruptions continue to present significant economic challenges, impacting industries worldwide. Fabrinet, as a provider of optical components and subsystems, is directly exposed to these risks, which can translate into higher costs for essential parts and materials. These disruptions also have the potential to delay production schedules, affecting the company's ability to meet customer demand promptly.

Fabrinet's strategic approach to managing and mitigating these supply chain vulnerabilities is paramount for ensuring operational stability and customer satisfaction. Proactive measures in supply chain management, such as diversifying suppliers and building robust inventory levels, are key to navigating these turbulent economic conditions.

- Increased Costs: The average cost of shipping a 40-foot container globally saw a significant increase in early 2024 compared to pre-pandemic levels, impacting raw material acquisition for electronics manufacturers.

- Production Delays: A 2024 survey indicated that over 60% of manufacturing firms experienced production delays due to component shortages, a persistent issue stemming from earlier disruptions.

- Fabrinet's Mitigation: Fabrinet's investment in dual-sourcing strategies for critical components aims to reduce reliance on single suppliers, thereby enhancing resilience against localized disruptions.

Fabrinet's revenue streams are closely tied to global economic growth, particularly in sectors like AI and data centers which drive demand for optical communications. The company's ability to manage rising inflation, as seen in its non-GAAP earnings outpacing revenue growth in fiscal year 2023, highlights its operational efficiency. Currency fluctuations, however, present a variable factor, as evidenced by a $24.5 million net foreign currency gain in fiscal year 2023.

The interest rate environment directly impacts Fabrinet's cost of capital and income from its substantial cash reserves. While higher rates increase borrowing costs for projects like its new Thailand facility, potential rate cuts in 2024 could offer a more favorable financing landscape. Fabrinet's strong liquidity, with a current ratio consistently above 2.0, provides significant financial flexibility for strategic investments.

Supply chain disruptions remain a persistent economic challenge, leading to increased costs and potential production delays for components. Fabrinet's mitigation strategies, including dual-sourcing critical parts, are crucial for maintaining operational stability and meeting customer demand amidst these global economic headwinds.

| Economic Factor | Impact on Fabrinet | Supporting Data (FY23/Early 2024) |

|---|---|---|

| Global Economic Growth | Drives demand for optical components in AI/data centers. | Record datacom revenue driven by high-data-rate products. |

| Inflation | Increases input costs (materials, labor). | Non-GAAP EPS ($5.13) outpaced revenue growth ($2.57B vs $2.36B). |

| Currency Exchange Rates | Affects reported financials and profitability. | Net foreign currency gain of $24.5M in FY23. |

| Interest Rates | Impacts borrowing costs and interest income. | Fed indicated potential rate cuts later in 2024. |

| Supply Chain Disruptions | Leads to higher costs and production delays. | Increased container shipping costs and component shortages reported by manufacturers. |

Preview Before You Purchase

Fabrinet PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fabrinet PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a deep dive into the external forces shaping Fabrinet's strategic landscape.

Sociological factors

Fabrinet's commitment to workforce development is crucial, especially in advanced manufacturing. Their Temporary Technician Academy, which saw expansion in 2024, boasts a remarkable 100% hiring rate for its graduates, directly addressing the skills gap. This proactive approach ensures a steady supply of qualified personnel for their precision optical and electro-mechanical operations.

Fabrinet places a strong emphasis on employee wellbeing and engagement, recognizing its direct impact on operational success, particularly in high-precision manufacturing. The company’s ‘Wellness Wave’ initiative, launched in 2023, aims to promote physical and mental health among its workforce. This focus has been recognized through awards such as the Thai Health Literate Workplace award.

Further bolstering engagement, Fabrinet offers programs like ‘English for Work’ language training, which not only enhances communication skills but also supports career development. These initiatives contribute to a positive and supportive work environment, crucial for retaining skilled talent and maintaining the high standards required in their complex manufacturing processes.

Fabrinet's dedication to corporate social responsibility is evident in its 2024 Corporate Responsibility Report, which outlines initiatives in ethical business conduct, environmental care, and community engagement. This focus is crucial as stakeholders increasingly prioritize companies demonstrating accountability and positive societal impact.

The company's CSR efforts directly influence its brand image, attracting customers, investors, and talent who seek alignment with responsible corporate values. By actively addressing social and environmental concerns, Fabrinet strengthens its social license to operate and builds trust in the marketplace.

Community Engagement and Local Impact

Fabrinet actively engages with its local communities, demonstrating a commitment to social responsibility that extends beyond its core business operations. The company's long-standing support for initiatives like providing homes for disadvantaged youth and offering health check-ups for seniors highlights its dedication to improving quality of life in its operating regions.

These community partnerships are not just philanthropic gestures; they foster stronger local relationships and enhance Fabrinet's social license to operate. For instance, in fiscal year 2023, Fabrinet's community investment programs directly benefited thousands of individuals, reinforcing its positive local impact and brand reputation.

- Community Investment: Fabrinet's commitment to local welfare, including support for vulnerable youth and elderly health services.

- Social Impact: The company's efforts create tangible benefits for communities, strengthening its societal contribution.

- Relationship Building: Engagement fosters goodwill and robust local ties, crucial for sustainable operations.

- Reputation Enhancement: Positive social impact bolsters Fabrinet's image among stakeholders and the public.

Evolving Consumer Demand and Industry Trends

Fabrinet's growth, though rooted in business-to-business relationships, is significantly shaped by shifts in consumer demand for cutting-edge technologies. For instance, the burgeoning market for 5G connectivity and advanced data centers, driven by consumer reliance on seamless online experiences, directly fuels the need for Fabrinet's optical components. The automotive sector's rapid embrace of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) also translates into increased demand for the sophisticated optical and electro-mechanical solutions Fabrinet provides to its automotive OEM clients, influencing their product development priorities.

This evolving consumer landscape necessitates continuous innovation from Fabrinet's customers, impacting Fabrinet's own product mix and research and development focus. The increasing global adoption of AI and machine learning, largely consumer-driven, requires more powerful and efficient data processing, thereby boosting demand for the high-performance optical transceivers that Fabrinet manufactures.

- Consumer demand for faster internet speeds fuels the expansion of optical networks, a core market for Fabrinet.

- The rapid growth of the electric vehicle market increases the need for advanced automotive electronics, including optical components.

- Advancements in medical diagnostics, often driven by consumer expectations for better healthcare, require sophisticated optical systems.

- The proliferation of data-intensive applications like streaming and cloud computing, popular with consumers, necessitates robust optical infrastructure.

Fabrinet's workforce development is a key sociological factor, especially given the need for skilled labor in advanced manufacturing. The company's Temporary Technician Academy, which expanded in 2024, has a remarkable 100% hiring rate for its graduates, directly addressing the skills gap in precision optical and electro-mechanical operations.

Employee wellbeing and engagement are paramount for Fabrinet, impacting operational success. Their 'Wellness Wave' initiative, launched in 2023, promotes physical and mental health, earning them recognition like the Thai Health Literate Workplace award. Additionally, programs like 'English for Work' training enhance communication and career development, fostering a supportive environment crucial for talent retention.

Fabrinet's corporate social responsibility, detailed in their 2024 report, underscores ethical conduct and community engagement. This focus is vital as stakeholders increasingly value companies with strong accountability and positive societal impact, influencing brand image and attracting talent. Their community investments, such as supporting disadvantaged youth and providing health check-ups for seniors, directly benefited thousands in fiscal year 2023, reinforcing their local impact and reputation.

Shifts in consumer demand for cutting-edge technologies significantly shape Fabrinet's growth. The demand for 5G connectivity and advanced data centers, driven by consumer reliance on seamless online experiences, fuels the need for Fabrinet's optical components. Similarly, the automotive sector's rapid adoption of EVs and ADAS increases demand for Fabrinet's sophisticated solutions, influencing their product development priorities.

| Sociological Factor | Fabrinet Initiative/Impact | Data/Year |

|---|---|---|

| Workforce Development | Temporary Technician Academy | 100% hiring rate (2024) |

| Employee Wellbeing | 'Wellness Wave' initiative | Launched 2023, Thai Health Literate Workplace award |

| Community Engagement | Support for youth and elderly | Benefited thousands (FY2023) |

| Consumer Demand Influence | 5G, EVs, AI | Drives demand for optical and electro-mechanical components |

Technological factors

Fabrinet is experiencing robust growth driven by the insatiable demand for high-speed optical interconnects, particularly from the rapid build-out of AI-related data centers. The company reported a record $727.7 million in datacom revenue for the third quarter of fiscal year 2024, a testament to its leading position as a contract manufacturer in this booming sector.

This surge in datacom revenue is largely attributed to Fabrinet's high-data-rate products, essential for powering the complex computations and massive data transfers required by artificial intelligence. Continued advancements in 5G deployment and the ongoing expansion of fiber optic networks globally are expected to sustain this strong demand for Fabrinet's specialized optical solutions.

Fabrinet's mastery of precision manufacturing, particularly in advanced optical packaging and electro-mechanical services, is a significant technological advantage. This expertise is crucial for producing sophisticated components required by emerging high-growth sectors.

For instance, the automotive LiDAR market, a key area for Fabrinet, saw significant investment and development throughout 2024. Companies are pushing for higher resolution and longer-range sensors, demanding increasingly precise manufacturing capabilities. Fabrinet's ability to deliver these advanced optical solutions positions it well to capitalize on this demand.

Similarly, the medical device industry relies heavily on precision manufacturing for miniaturization and reliability. As medical technology advances, the need for highly accurate, custom-manufactured components for diagnostic and therapeutic devices will only grow, directly benefiting Fabrinet's core competencies.

Fabrinet operates within sectors like medical devices, where the integration of automation and Industry 4.0 is rapidly advancing. This includes the adoption of technologies like generative AI in manufacturing, aiming to boost precision and output.

The company's commitment to lean manufacturing, evident in projects that streamline operations, directly supports these technological shifts. These initiatives not only cut expenses but also enhance overall efficiency and environmental responsibility, crucial for staying competitive in a technologically evolving landscape.

Research and Development Investment by OEMs

Fabrinet's strategic partnerships with Original Equipment Manufacturers (OEMs) are significantly bolstered by the OEMs' substantial investments in research and development. For instance, major automotive OEMs are projected to spend over $100 billion globally on autonomous vehicle technology development through 2025, a trend directly benefiting Fabrinet's service offerings.

Fabrinet's comprehensive support, spanning the entire product lifecycle from initial design and prototyping to rigorous testing and high-volume manufacturing, positions it as a critical enabler for these OEM innovations. This end-to-end capability is particularly crucial for bringing cutting-edge technologies like advanced LiDAR units and specialized hardware kits for autonomous driving systems to market efficiently.

- OEM R&D Spending: Global automotive OEM investment in autonomous and electric vehicle technologies is expected to exceed $300 billion by 2026, creating substantial demand for advanced manufacturing partners.

- LiDAR Market Growth: The automotive LiDAR market alone is anticipated to reach $15 billion by 2030, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving features.

- Fabrinet's Role: Fabrinet's expertise in optical packaging and precision manufacturing is vital for producing the complex components required for these next-generation automotive systems.

Cybersecurity in Manufacturing Operations

The increasing interconnectedness of manufacturing operations, often referred to as Industry 4.0, presents significant cybersecurity challenges. This heightened connectivity, while boosting efficiency, also expands the attack surface for malicious actors. For companies like Fabrinet, safeguarding sensitive data and ensuring operational continuity against these evolving threats is paramount.

Fabrinet's commitment to bolstering its cybersecurity posture is a critical technological factor. By aligning its protocols with established standards such as NIST (National Institute of Standards and Technology), the company demonstrates a proactive approach to mitigating cyber risks. This strategic focus is vital for protecting proprietary designs, maintaining the integrity of production processes, and securing its complex global supply chain.

- Increased Connectivity Risks: The trend towards smart factories and IoT integration in manufacturing inherently increases vulnerability to cyberattacks.

- NIST Standards Adoption: Fabrinet's adherence to NIST cybersecurity frameworks provides a robust baseline for defending against sophisticated threats.

- Intellectual Property Protection: Strong cybersecurity measures are essential to prevent the theft of valuable R&D and design information.

- Operational Resilience: Protecting manufacturing systems from disruption ensures uninterrupted production and supply chain reliability, a key concern for Fabrinet's clients.

Technological advancements are a core driver for Fabrinet, particularly in the burgeoning AI and high-speed networking sectors. The company's expertise in advanced optical packaging and precision manufacturing is critical for producing the sophisticated components needed for these rapidly evolving fields.

Fabrinet is well-positioned to benefit from ongoing innovation in areas like automotive LiDAR, where demand for higher resolution and longer-range sensors is increasing. Similarly, the medical device industry's push for miniaturization and reliability directly aligns with Fabrinet's core manufacturing competencies.

The company's adoption of Industry 4.0 principles, including automation and potentially generative AI in manufacturing, aims to enhance precision and output. This technological integration, coupled with a focus on lean manufacturing, improves efficiency and supports Fabrinet's competitive edge.

Fabrinet's robust cybersecurity measures, including adherence to NIST standards, are crucial for protecting intellectual property and ensuring operational resilience in an increasingly connected manufacturing environment.

| Technology Area | Key Trend/Demand Driver | Fabrinet's Relevance/Contribution |

|---|---|---|

| Optical Interconnects & AI Data Centers | Massive data transfer for AI computations; build-out of high-speed networks. | Record datacom revenue ($727.7M in Q3 FY24) driven by high-data-rate products. |

| Automotive LiDAR | Demand for higher resolution and longer-range sensors for ADAS and autonomous driving. | Precision manufacturing expertise for complex optical components. |

| Medical Devices | Need for miniaturization, reliability, and custom-manufactured components. | Core competencies in precision manufacturing for advanced medical technologies. |

| Industry 4.0 & Automation | Integration of smart factory technologies, IoT, and AI in manufacturing. | Adoption of automation and lean manufacturing for enhanced precision and efficiency. |

| Cybersecurity | Increased risks from interconnected operations; need for data and IP protection. | Adherence to NIST standards to mitigate cyber threats and ensure operational continuity. |

Legal factors

Fabrinet's reliance on proprietary technology and its role as a contract manufacturer for OEMs makes intellectual property (IP) protection a cornerstone of its operations. Strong legal frameworks are essential to shield its own innovations and the sensitive IP of its clients, thereby maintaining a competitive edge and encouraging ongoing investment in research and development.

In 2024, the global IP market continued to see significant activity, with patent filings and litigation playing a key role in technology sectors where Fabrinet operates. For instance, the optical networking and semiconductor industries, where Fabrinet is a major player, frequently involve complex IP landscapes and potential disputes, underscoring the need for robust legal safeguards.

Fabrinet's global operations, spanning Thailand, the United States, China, and Israel, necessitate strict adherence to varied labor and employment laws. These regulations dictate everything from minimum wages and working hours to employee benefits and union rights, making compliance a cornerstone of their operational strategy.

Failure to comply with these diverse legal frameworks could result in significant penalties, operational disruptions, and reputational damage. Maintaining their Labor Management Excellence Award underscores Fabrinet's commitment to robust labor practices, which are directly influenced by these legal requirements.

Fabrinet's operations, particularly in supplying components for medical devices and automotive systems, place it under intense scrutiny regarding product liability and safety regulations. Failure to adhere to these standards can lead to significant legal repercussions and damage to its brand. For instance, in 2023, the automotive industry alone saw an estimated $20 billion in recall costs, highlighting the financial impact of safety failures.

Environmental Compliance Laws

Fabrinet operates under a stringent framework of environmental compliance laws, necessitating careful management of manufacturing waste, air emissions, and water usage. The company's dedication to environmental stewardship is evident in its proactive approach to these regulations.

In 2024, Fabrinet continued to enhance its waste recycling programs, aiming to divert a greater percentage of production waste from landfills. This focus on sustainable practices is crucial for maintaining compliance and mitigating environmental impact.

- Waste Reduction Targets: Fabrinet has set ambitious targets for reducing hazardous waste generation per unit of production, aiming for a 5% year-over-year improvement in 2024.

- Emissions Monitoring: The company regularly monitors and reports on air emissions from its manufacturing facilities, ensuring adherence to national and international standards.

- Resource Efficiency: Fabrinet is investing in technologies to improve water and energy efficiency, aligning with regulatory pressures to conserve natural resources.

International Trade and Export Control Laws

Fabrinet's extensive global operations, serving customers and sourcing components worldwide, demand rigorous compliance with international trade and export control regulations. Navigating these intricate legal frameworks, which include sanctions and trade restrictions, is paramount for maintaining operational continuity and avoiding significant financial penalties. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export control measures impacting various technology sectors, requiring companies like Fabrinet to meticulously screen transactions.

Failure to adhere to these laws can result in severe consequences, including hefty fines, loss of export privileges, and damage to corporate reputation. Fabrinet's commitment to compliance ensures that its sophisticated optical products and components can be legally supplied to its diverse international clientele. The company's proactive approach involves continuous monitoring of evolving trade policies and sanctions lists, such as those updated by the Office of Foreign Assets Control (OFAC) in the United States.

- Global Trade Compliance: Fabrinet must navigate a complex web of international trade agreements and customs regulations across numerous countries.

- Export Control Adherence: Strict adherence to export control laws, including those related to dual-use technologies, is critical for Fabrinet's product distribution.

- Sanctions Screening: The company must implement robust processes to screen customers and transactions against global sanctions lists to prevent violations.

- Regulatory Changes: Fabrinet needs to stay abreast of frequent updates to trade policies and export regulations from bodies like the BIS and OFAC to ensure ongoing compliance.

Fabrinet's global operations necessitate strict adherence to varied labor and employment laws across its manufacturing sites in Thailand, the United States, China, and Israel. These regulations cover minimum wages, working hours, benefits, and union rights, making compliance a critical operational factor. The company's recognition with a Labor Management Excellence Award in 2023 highlights its dedication to robust labor practices, directly influenced by these legal mandates.

Product liability and safety regulations are paramount for Fabrinet, especially given its role in supplying components for medical devices and automotive systems. Non-compliance can lead to severe legal repercussions and brand damage, as evidenced by the automotive industry's estimated $20 billion in recall costs in 2023 due to safety failures.

Fabrinet must navigate a complex landscape of international trade and export control regulations, including sanctions and trade restrictions, to ensure legal product distribution. In 2023, agencies like the U.S. Bureau of Industry and Security (BIS) continued to enforce export controls impacting technology sectors, requiring meticulous transaction screening.

| Legal Factor | Impact on Fabrinet | 2023-2024 Data/Trend |

|---|---|---|

| Intellectual Property (IP) Protection | Shields proprietary technology and client IP, crucial for competitive edge. | Continued high activity in patent filings and litigation in optical networking and semiconductor sectors. |

| Labor and Employment Laws | Dictates operational standards for wages, hours, benefits, and union rights globally. | Fabrinet maintained its Labor Management Excellence Award in 2023, reflecting strong compliance. |

| Product Liability and Safety | Mandates adherence to standards for medical devices and automotive components. | Automotive industry recall costs reached an estimated $20 billion in 2023, emphasizing the financial risk of non-compliance. |

| International Trade and Export Controls | Governs global operations, sourcing, and product distribution, requiring sanctions screening. | BIS enforcement in 2023 highlighted the need for meticulous screening against evolving trade policies and sanctions lists. |

Environmental factors

Fabrinet, as a key player in advanced optical packaging and components manufacturing, relies heavily on a consistent supply of raw materials like specialty chemicals, metals, and rare earth elements. The increasing global focus on resource scarcity, particularly for materials like silicon and certain precious metals used in their processes, poses a significant environmental challenge. For instance, the International Energy Agency's 2024 reports highlight growing demand for critical minerals essential for electronics, which could impact availability and pricing for Fabrinet.

Fabrinet actively pursues waste management and recycling, notably through expanded waste recycling donations, underscoring its commitment to environmental stewardship. These programs not only minimize ecological footprints but also align with circular economy ideals, promoting resource efficiency.

By optimizing resource utilization and decreasing disposal costs, these initiatives offer tangible financial benefits, contributing to Fabrinet's operational efficiency. For instance, in fiscal year 2023, Fabrinet reported a reduction in waste generation by 5% compared to the previous year, with over 70% of its operational waste being recycled or repurposed.

Fabrinet's commitment to reducing energy consumption and its carbon footprint is a critical environmental consideration. By focusing on operational efficiency through lean manufacturing, the company aims to optimize resource utilization, directly impacting its environmental performance and contributing to lower emissions.

In 2023, the manufacturing sector globally saw increased pressure to adopt sustainable practices. Fabrinet’s lean initiatives are designed to streamline processes, which can lead to a quantifiable reduction in energy use per unit produced. This focus aligns with broader industry trends and regulatory expectations for environmental responsibility.

Climate Change Impacts on Operations

Climate change presents significant physical risks that can directly impact Fabrinet's global operations. Extreme weather events, like intensified storms or prolonged droughts, have the potential to disrupt crucial supply chains, leading to delays in component delivery and affecting manufacturing schedules. This necessitates a proactive approach to operational continuity.

Fabrinet is actively investing in its business resilience to mitigate these environmental factors. The company's strategic decision to build a new, large manufacturing facility underscores its commitment to ensuring long-term operational stability. This expansion is designed to enhance capacity and potentially diversify production locations, thereby reducing reliance on any single vulnerable site.

For instance, the increasing frequency of severe weather events globally, as documented by various climate reports, highlights the importance of such investments. Fabrinet's forward-looking strategy aims to safeguard its manufacturing processes and supply chain integrity against these escalating climate-related challenges, ensuring it can continue to meet customer demand reliably.

- Supply Chain Disruption: Extreme weather events can cause significant delays and increased costs in transporting raw materials and finished goods.

- Operational Downtime: Physical damage to facilities from severe weather can lead to temporary or prolonged manufacturing stoppages.

- Resource Scarcity: Changes in climate can affect the availability of essential resources like water, impacting manufacturing processes.

- Increased Insurance Costs: The rising risk profile associated with climate change may lead to higher premiums for business insurance.

Regulatory and Stakeholder Pressure for Green Manufacturing

Fabrinet faces growing regulatory scrutiny and demand from stakeholders for more sustainable manufacturing. This push for green practices is evident across the industry, impacting supply chains and operational standards. Companies demonstrating strong environmental commitment are increasingly favored by investors and customers alike.

Fabrinet's commitment to environmental stewardship is highlighted in its Corporate Responsibility Report. The company has received recognition for its efforts, which bolsters its brand image. Meeting these sustainability expectations is crucial for maintaining a competitive edge in a market increasingly prioritizing eco-friendly operations.

- Growing ESG Investment: Global ESG (Environmental, Social, and Governance) assets are projected to reach $50 trillion by 2025, indicating a significant shift in investment priorities towards sustainable companies.

- Regulatory Trends: Many regions are implementing stricter environmental regulations, such as carbon pricing mechanisms and waste reduction mandates, directly influencing manufacturing processes.

- Consumer Preferences: Surveys in 2024 show that over 70% of consumers consider sustainability when making purchasing decisions, creating direct market pressure for greener products.

Fabrinet's environmental strategy focuses on resource efficiency and waste reduction, aiming to minimize its ecological footprint and align with circular economy principles. In fiscal year 2023, the company reported a 5% reduction in waste generation, with over 70% of its operational waste being recycled or repurposed, demonstrating tangible financial benefits through optimized resource utilization and decreased disposal costs.

The company is actively addressing climate change risks by investing in business resilience and operational continuity, particularly through the construction of a new manufacturing facility. This strategic expansion aims to enhance capacity and diversify production locations, mitigating the potential disruptions from increasingly frequent extreme weather events that could impact supply chains and manufacturing schedules.

Fabrinet faces growing stakeholder and regulatory pressure for sustainable manufacturing practices, a trend mirrored across the industry. With global ESG assets projected to reach $50 trillion by 2025, companies demonstrating strong environmental commitment, like Fabrinet's recognized efforts, are increasingly favored by investors and customers, enhancing brand image and competitive edge.

| Metric | FY2023 Performance | Target/Trend |

| Waste Reduction | 5% decrease YoY | Continued reduction |

| Waste Recycling Rate | >70% | Increase focus |

| ESG Investment Growth | Projected $50T by 2025 | Growing investor focus |

| Consumer Sustainability Preference | >70% (2024 surveys) | Market demand driver |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fabrinet is built on a comprehensive review of data from industry-specific market research reports, financial filings, and reputable technology publications. We meticulously gather information on regulatory changes, economic forecasts, and technological advancements impacting the optical networking sector.