Fabrinet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fabrinet Bundle

Fabrinet operates in a dynamic market, influenced by intense rivalry and the bargaining power of its customers. Understanding these forces is crucial for anyone looking to grasp their competitive landscape.

The complete report reveals the real forces shaping Fabrinet’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fabrinet's reliance on specialized optical, electro-mechanical, and electronic components grants suppliers considerable bargaining power. The niche nature of these critical, high-performance parts often means limited alternative sources, allowing suppliers to dictate terms. For instance, in 2024, the global semiconductor shortage highlighted how dependence on a few key chip manufacturers could significantly impact production timelines and costs for electronics manufacturers like Fabrinet.

Fabrinet faces significant costs when switching suppliers for its advanced optical components. These expenses can include the time and resources needed for re-qualification, potential re-engineering of its products, and the risk of production delays. For instance, in 2024, Fabrinet's reliance on specialized, high-performance optical modules, often with proprietary designs, means that transitioning to a new vendor can easily add months to development cycles and require substantial upfront investment in testing and validation.

In certain specialized high-tech component sectors, Fabrinet may encounter a restricted pool of suppliers possessing the necessary advanced technological know-how and manufacturing capacity. This limited supplier base, especially when a few entities hold significant market share, naturally elevates their leverage in negotiations with Fabrinet, as competitive pressures among these suppliers diminish.

Fabrinet's documented initiatives in supply chain responsibility underscore a proactive approach to managing these potentially powerful supplier relationships. For instance, in 2023, Fabrinet reported engaging with over 1,000 suppliers, with a significant portion of its direct material spend concentrated with a smaller group, highlighting the critical nature of these concentrated relationships.

Importance of Fabrinet to Suppliers

While suppliers of highly specialized optical components might possess leverage, Fabrinet's substantial purchasing power, especially in rapidly expanding sectors like datacom and AI, can also grant it considerable influence. For instance, in 2023, Fabrinet reported revenue of $2.4 billion, indicating a significant volume of component acquisition.

Fabrinet's strategic collaborations, such as its work with Aurora, highlight its role as a vital customer for providers of advanced components. This crucial customer status can effectively mitigate the bargaining power of these specialized suppliers.

The company's ability to secure key partnerships means that certain component providers may find Fabrinet indispensable, thus reducing their ability to dictate terms.

- Fabrinet's 2023 revenue reached $2.4 billion, showcasing significant purchasing volume.

- Partnerships with companies like Aurora can make Fabrinet a critical customer for component suppliers.

- High demand in datacom and AI applications strengthens Fabrinet's negotiating position with suppliers.

Potential for Supply Chain Disruptions

The potential for supply chain disruptions significantly bolsters supplier bargaining power. In 2024, global supply chains experienced considerable strain, leading to scarcity and increased costs for vital materials and components. This environment allows suppliers to dictate terms more forcefully.

Geopolitical events and persistent logistical challenges directly impact the availability and pricing of critical inputs for companies like Fabrinet. Navigating this complex procurement landscape requires strategic foresight and adaptability.

- Increased Material Costs: Reports from early 2024 indicated that the average cost of key electronic components used in optical networking equipment saw an increase of 5-10% due to these disruptions.

- Lead Time Volatility: Average lead times for critical semiconductors extended from 16-20 weeks in late 2023 to 20-24 weeks by mid-2024, impacting production schedules.

- Supplier Concentration: In certain specialized component markets, Fabrinet may rely on a limited number of suppliers, further concentrating power in their hands during periods of high demand or low supply.

Fabrinet's reliance on highly specialized optical and electro-mechanical components means suppliers of these niche parts often hold significant bargaining power. This is amplified when there are few alternative sources, allowing suppliers to influence terms and pricing. For instance, in 2024, the ongoing demand for advanced semiconductors and specialized optical modules, often with proprietary designs, meant that Fabrinet faced extended lead times and increased costs, with some component lead times stretching to 20-24 weeks.

The costs associated with switching suppliers for these critical, high-performance components are substantial for Fabrinet. These can include extensive re-qualification processes, potential product re-engineering, and the risk of significant production delays, sometimes adding months to development cycles.

Fabrinet's substantial purchasing volume, evidenced by its $2.4 billion in revenue in 2023, can mitigate supplier power, especially in high-growth sectors like datacom and AI. However, this is balanced by the concentration of its supply base, where a smaller group of suppliers accounts for a significant portion of direct material spend, as noted in their 2023 supplier engagement reports.

| Factor | Impact on Fabrinet | 2024 Data/Observation |

|---|---|---|

| Supplier Specialization | High dependence on niche, advanced components | Limited alternative sources for proprietary optical modules |

| Switching Costs | Significant expenses and delays in changing suppliers | Months added to development cycles, extensive re-qualification needed |

| Supplier Concentration | Reliance on a few key providers for critical parts | Concentrated spend with a smaller group of suppliers |

| Market Demand | High demand in datacom/AI strengthens Fabrinet's position | $2.4 billion revenue in 2023 indicates large purchasing volume |

| Supply Chain Disruptions | Increased material costs and lead time volatility | Component costs up 5-10%; semiconductor lead times 20-24 weeks |

What is included in the product

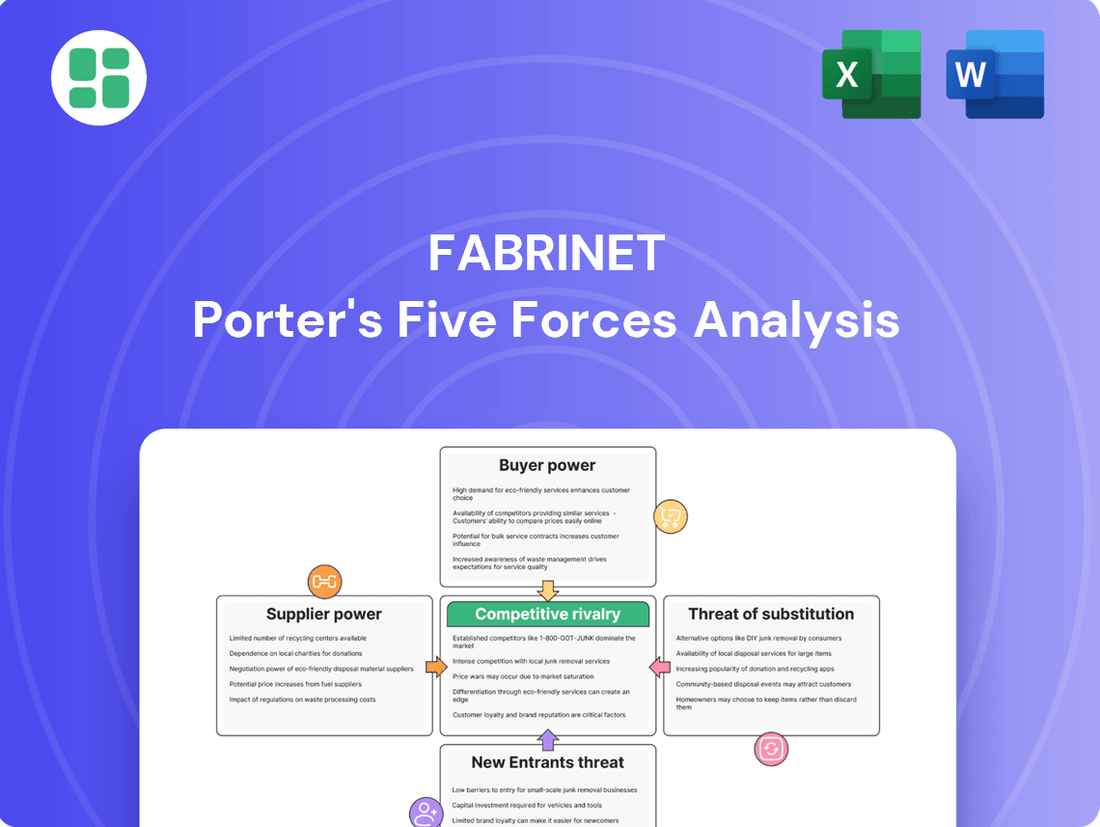

This analysis unpacks the competitive forces shaping Fabrinet's optical communication components and equipment market, assessing supplier and buyer power, threat of new entrants and substitutes, and the intensity of rivalry.

Instantly gauge competitive intensity with a visualized breakdown of Fabrinet's industry landscape, reducing the pain of complex market analysis.

Customers Bargaining Power

Fabrinet's customer base is highly concentrated, with a few large original equipment manufacturers (OEMs) driving a significant portion of its revenue. This reliance on a small number of major clients grants these customers considerable leverage. For example, in fiscal year 2024, NVIDIA alone represented 35% of Fabrinet's total revenue, and Cisco contributed another 13%.

Fabrinet's deep involvement in design support and process engineering for its Original Equipment Manufacturer (OEM) clients means customers are integral to product development. This close partnership, while fostering loyalty, also empowers these clients to dictate specific features, quality standards, and delivery timelines, thereby increasing their bargaining power.

For Original Equipment Manufacturers (OEMs), the decision to switch from a trusted and established manufacturing partner like Fabrinet, particularly for intricate optical and electro-mechanical products, is far from trivial. The process involves substantial re-qualification expenses, the risk of product launch delays, and potential impacts on product performance, all of which contribute to significant switching costs.

These high switching costs effectively temper the bargaining power of Fabrinet's customers. When the financial and operational hurdles to changing suppliers are considerable, customers are less inclined to exert pressure on pricing or terms, recognizing that a transition is a complex and costly undertaking.

Customer Sophistication and Industry Knowledge

Fabrinet's customers are highly sophisticated Original Equipment Manufacturers (OEMs) operating in demanding sectors like optical communications, automotive, and medical devices. This deep industry knowledge means they understand market pricing and performance benchmarks intimately.

These clients often possess robust internal engineering teams, allowing them to critically assess Fabrinet's offerings and negotiate effectively on price, quality, and technical specifications. Their informed perspective significantly influences the bargaining power they hold.

- Sophisticated Clientele: Fabrinet serves major OEMs in high-tech industries.

- Informed Negotiations: Customers leverage deep industry knowledge to press for better terms.

- Internal Capabilities: Strong engineering teams empower customers to scrutinize and challenge specifications.

- Market Awareness: Customers are aware of competitive pricing and technological alternatives.

Demand Fluctuations and Inventory Management

Demand fluctuations in end markets significantly impact customer bargaining power. For instance, the telecom sector experienced inventory adjustments throughout 2024, which can lead customers to negotiate for better terms or postpone orders. Fabrinet's reliance on the health of these customer markets means that downturns can translate into increased pressure on pricing and contract conditions.

These market dynamics directly affect Fabrinet's operational flexibility. While the datacom segment showed robust growth, declines in other areas can prompt customers to leverage their position. This is particularly true when customers face their own inventory challenges or anticipate slower demand, forcing them to seek concessions from their suppliers like Fabrinet.

- Demand Volatility: Telecom sector inventory adjustments in 2024 created a more challenging environment for suppliers.

- Customer Leverage: Declines in specific market segments allow customers to negotiate more favorable pricing and payment terms.

- Market Interdependence: Fabrinet's financial performance is closely linked to the stability and growth prospects of its customers' industries.

Fabrinet's customer bargaining power is influenced by its concentrated customer base, with major OEMs like NVIDIA (35% of FY24 revenue) and Cisco (13% of FY24 revenue) holding significant sway. Their deep integration into Fabrinet's design and manufacturing processes, coupled with high switching costs for complex products, helps mitigate this power. However, sophisticated customers, aware of market pricing and possessing strong internal engineering, can still negotiate effectively, especially during market downturns that impact demand.

| Customer Concentration (FY24) | Key Customer | Revenue Contribution |

|---|---|---|

| High | NVIDIA | 35% |

| High | Cisco | 13% |

| Moderate | Other OEMs | 52% |

Full Version Awaits

Fabrinet Porter's Five Forces Analysis

This preview showcases the complete Fabrinet Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the optical networking industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring transparency and immediate utility. You can confidently expect to download this comprehensive report, ready for your strategic planning and business insights, without any alterations or missing sections.

Rivalry Among Competitors

Fabrinet thrives in a highly specialized niche, focusing on advanced optical packaging and precision manufacturing for intricate products. This specialization naturally narrows the field of direct competitors capable of matching its comprehensive capabilities across the entire product lifecycle.

The company’s commitment to handling high-complexity products, regardless of mix or volume, is a key differentiator. For instance, in its fiscal year 2023, Fabrinet reported revenue of $2.4 billion, underscoring its significant market presence within this demanding sector.

Fabrinet operates in a market with significant established competitors, even within its specialized areas of optical components and electronic manufacturing services (EMS). This means the company isn't operating in a vacuum; it contends with well-known entities that have a strong market presence and often long-standing customer relationships.

Key players like Lumentum, Finisar, NeoPhotonics, and Broadcom are prominent in the optical networking sector, directly challenging Fabrinet's core business. Furthermore, in the broader EMS space, companies such as Corning, Benchmark Electronics, Celestica, Sanmina-SCI, Jabil Circuit, and Venture Corporation Limited represent formidable competition, offering similar manufacturing capabilities and serving a wide range of industries.

For instance, in 2023, the global EMS market was valued at approximately $700 billion, highlighting the sheer scale and intense competition within the broader sector Fabrinet participates in. Similarly, the optical components market, while more specialized, still sees substantial revenue generation by its leading players, underscoring the competitive pressures Fabrinet faces to secure and maintain its market share.

The optical communications market, especially the datacom segment fueled by AI and the insatiable demand for high-speed data centers, is witnessing robust expansion. This surge in demand presents a significant opportunity for companies like Fabrinet.

Fabrinet itself saw its datacom revenue skyrocket by over 120% in fiscal year 2024. A key driver of this impressive growth was the increasing adoption of 800-gig products, specifically designed to support the computationally intensive needs of AI applications.

While rapid market growth often acts as a buffer against intense rivalry, the sheer attractiveness and profitability of the AI-driven datacom market can paradoxically intensify competition. Established players and new entrants alike are likely to aggressively pursue market share in these high-growth, lucrative segments.

Differentiation Through Expertise and Scale

Fabrinet stands out by leveraging its deep expertise in optical and electro-mechanical technologies, coupled with robust process engineering. This specialization allows them to tackle complex manufacturing challenges that many competitors cannot match.

The company's significant global manufacturing presence, with facilities strategically located in Thailand, the United States, China, and Israel, provides a substantial scale advantage. This broad footprint enables efficient production and supply chain management, crucial for serving a diverse customer base.

Fabrinet's commitment to growth is evident in its ongoing expansion, including a recent investment in a new 2-million-square-foot facility. This expansion not only bolsters their capacity but also serves as a significant barrier to entry for smaller, less-resourced rivals seeking to compete on scale and technological sophistication.

- Advanced Capabilities: Expertise in optical and electro-mechanical manufacturing.

- Global Footprint: Manufacturing sites in Thailand, USA, China, and Israel.

- Scalability: Expansion into a 2-million-square-foot facility enhances capacity.

- Competitive Barrier: Scale and expertise create significant challenges for smaller competitors.

Price Competition and Margin Pressures

Even with its specialized focus, Fabrinet operates in an industry where price competition can be a significant factor, particularly for higher-volume components or when certain market segments experience downturns. This pressure can impact gross and operating margins, as securing large original equipment manufacturer (OEM) contracts often necessitates competitive pricing strategies.

Fabrinet's ability to maintain consistent profitability underscores the importance of its rigorous cost management practices. These efforts are essential for navigating the inherent margin pressures within the electronics manufacturing services (EMS) sector, especially when balancing the need for large-scale production with efficient supply chain operations.

- Fabrinet's gross margin for the fiscal year ended June 30, 2023, was 14.5%, demonstrating its ability to manage costs effectively.

- The company's operating margin for the same period stood at 8.2%, reflecting the ongoing efforts to maintain profitability amidst competitive pressures.

- Securing contracts with major OEMs, a key revenue driver for Fabrinet, often involves negotiation that can influence pricing and subsequent margin levels.

Fabrinet faces significant competitive rivalry due to its specialized niche in optical packaging and precision manufacturing. While its advanced capabilities act as a barrier, established players like Lumentum and Broadcom, along with broader EMS providers such as Jabil Circuit, present formidable competition. The booming datacom market, driven by AI, intensifies this rivalry as companies vie for market share in high-growth segments.

| Key Competitors | Primary Market Focus | 2023 Revenue (Approximate) |

| Lumentum | Optical networking components | $1.7 billion |

| Broadcom | Semiconductors, infrastructure software | $35.8 billion |

| Jabil Circuit | Diversified EMS | $33.7 billion |

| Corning | Optical fiber, display technologies | $11.0 billion |

SSubstitutes Threaten

A significant threat to Fabrinet's business model comes from Original Equipment Manufacturers (OEMs) developing their own in-house advanced optical packaging and precision manufacturing capabilities. This potential for vertical integration by customers, particularly larger ones, represents a direct substitute for Fabrinet's outsourced services.

While Fabrinet's economies of scale and specialized expertise often make outsourcing the more economical choice, strategic considerations or the desire for tighter control over proprietary technologies could drive some OEMs to build their own manufacturing capacity. For instance, a major telecom equipment provider might invest in internal capabilities to secure a critical component's supply chain, even if it's initially more expensive.

However, Fabrinet's integrated approach, offering end-to-end solutions from design support to high-volume production and testing, significantly diminishes the appeal of this in-house substitute. By managing the complexities of advanced manufacturing and supply chain logistics, Fabrinet provides a compelling value proposition that is difficult for many OEMs to replicate efficiently.

The threat of substitutes for Fabrinet's core manufacturing technologies is amplified by the rapid evolution of optical and electronic manufacturing. New processes or materials could emerge, potentially bypassing the need for Fabrinet's current expertise. For instance, advancements in photonic integrated circuits (PICs) could eventually consolidate functionalities currently requiring discrete optical components, a core area for Fabrinet.

The standardization of components poses a threat if Fabrinet's complex, custom parts become widely available as off-the-shelf items. This could diminish the value of their specialized design and precision manufacturing. For example, if advanced optical components, previously requiring intricate assembly, were to become mass-produced with high uniformity, customers might opt for these cheaper alternatives.

However, Fabrinet's strategic focus on high-complexity, low-to-high volume products inherently counters this threat. Their business model thrives on tailoring solutions for intricate needs, not on competing with commoditized parts. The increasing demand for higher data rates, driven by AI and 5G technologies, often necessitates bespoke optical and photonic solutions that are far from being standardized.

Shifting Customer Business Models

Changes in how customers, particularly Original Equipment Manufacturers (OEMs), structure their businesses can introduce substitute threats. For instance, if OEMs increasingly opt for highly integrated modules from a single provider rather than sourcing discrete components, this could reduce the demand for Fabrinet's specialized contract manufacturing services. This shift could be driven by a desire for simpler supply chains or faster product development cycles.

Fabrinet's strategy of offering comprehensive, end-to-end manufacturing services, from optical components to complex electromechanical systems, is designed to mitigate this risk. By providing a broader suite of capabilities, Fabrinet aims to remain an indispensable partner even as customer business models evolve. For example, in 2023, Fabrinet reported that its optical communications segment, which serves many OEMs, continued to show strong growth, indicating its ability to adapt to customer needs.

- Integrated Solutions: OEMs moving towards single-vendor integrated modules reduce the need for specialized component manufacturing.

- Supply Chain Simplification: Customers may consolidate suppliers to streamline operations, potentially bypassing Fabrinet for certain services.

- Fabrinet's Mitigation: Offering end-to-end services, including optical, electromechanical, and complex system assembly, addresses this by providing a more comprehensive value proposition.

- Market Adaptation: Fabrinet's continued success in segments like optical communications highlights its capacity to align with evolving OEM strategies.

Cost-Performance Trade-offs of Substitutes

The threat of substitutes for Fabrinet's services is relatively low, primarily because any potential substitute must present a compelling cost-performance trade-off. For customers in sectors like optical communications, where precision and reliability are paramount, cheaper but less capable alternatives are generally not a practical consideration. Fabrinet's core strength is its ability to deliver high-quality, dependable, and exact manufacturing solutions, making it difficult for substitutes to match this value proposition.

For instance, in the complex world of optical networking components, even a slight deviation in performance can lead to significant system failures. This necessitates manufacturing partners who can consistently meet stringent specifications. Fabrinet's established reputation and advanced capabilities in this area create a high barrier for substitutes that cannot guarantee equivalent performance levels, despite potentially lower costs.

- High Performance Requirements: Industries served by Fabrinet, such as optical communications and advanced electronics, demand exceptional precision and reliability, limiting the appeal of lower-performing substitutes.

- Cost-Performance Balance: Substitutes must offer a superior cost-performance ratio to attract Fabrinet's discerning clientele, a difficult feat given the company's specialized capabilities.

- Fabrinet's Value Proposition: Fabrinet differentiates itself through high-quality, precise, and reliable manufacturing, which is not easily replicated by less specialized or lower-cost alternatives.

The threat of substitutes for Fabrinet's advanced optical and precision manufacturing services is generally considered low. This is largely due to the highly specialized nature of their work and the stringent performance requirements of their clients in sectors like optical communications and advanced electronics.

Potential substitutes, such as OEMs developing in-house capabilities or the emergence of standardized, off-the-shelf components, are often hindered by the complexity and customisation inherent in Fabrinet's offerings. For instance, the increasing demand for higher data rates in 5G and AI applications necessitates bespoke optical solutions that are difficult to commoditize.

Fabrinet's integrated, end-to-end service model, encompassing everything from design support to high-volume production and testing, provides a significant barrier to substitutes. This comprehensive approach makes it challenging for customers to replicate Fabrinet's value proposition internally or through simpler alternatives.

In fiscal year 2023, Fabrinet's optical communications segment, a key area for its services, demonstrated robust growth, underscoring its ability to meet evolving customer needs and maintain a competitive edge against potential substitutes.

| Industry Segment | FY2023 Revenue (USD Million) | Growth vs. FY2022 | Key Substitute Threats Addressed |

|---|---|---|---|

| Optical Communications | 2,489.5 | +12.5% | OEM vertical integration, commoditization of components |

| Other (e.g., Medical, Aerospace) | 214.8 | +8.2% | In-house specialized manufacturing, alternative material processes |

Entrants Threaten

High capital investment requirements act as a significant barrier to entry in the advanced optical packaging and precision manufacturing sector. Fabrinet's own substantial investments, like its 2-million-square-foot Building 10, underscore the need for advanced facilities, specialized machinery, and stringent cleanroom environments. These substantial financial outlays deter many potential new competitors from entering the market.

Fabrinet's reliance on highly specialized technical expertise in optical, electro-mechanical, and electronic engineering, coupled with intricate process engineering, presents a formidable barrier to new entrants. Developing a workforce with this depth of knowledge and proprietary know-how is a multi-year endeavor, making it difficult for newcomers to compete. Fabrinet actively cultivates this advantage through its talent pipeline development programs, further solidifying its position.

Fabrinet's deep, long-term relationships with Original Equipment Manufacturers (OEMs) significantly deter new entrants. These collaborations span the entire product lifecycle, fostering trust through consistent reliability and performance, making it difficult for newcomers to gain traction.

Establishing the necessary credibility and integration with major OEMs in sectors like optical communications, automotive, and medical devices is a substantial hurdle for any new competitor. For instance, Fabrinet's role in supplying critical optical components for 5G infrastructure requires a proven track record that takes years to build.

Regulatory Hurdles and Certifications

Fabrinet operates in sectors like medical devices and automotive, which are heavily regulated. New companies entering these markets must navigate complex compliance landscapes and secure numerous certifications. For instance, obtaining FDA approval for medical devices can take years and millions of dollars, a significant barrier that Fabrinet has already overcome.

These regulatory hurdles and the associated costs create a substantial entry barrier. Fabrinet’s established compliance infrastructure and quality management systems, built over years of operation, provide a competitive advantage. In 2023, the global medical device market was valued at over $500 billion, underscoring the immense regulatory burden for new players.

New entrants must also invest heavily in quality control and assurance processes to meet industry standards. This includes:

- ISO 13485 certification for medical devices.

- IATF 16949 certification for automotive suppliers.

- Extensive testing and validation protocols.

- Ongoing audits and compliance monitoring.

Economies of Scale and Experience Curve

Fabrinet's substantial manufacturing scale and deep-seated experience in intricate production processes create formidable barriers to entry. These economies of scale translate into significant cost advantages that aspiring competitors would struggle to match. The company's accumulated know-how, often referred to as the experience curve, further enhances its efficiency and product quality, making it challenging for newcomers to achieve comparable operational excellence.

New entrants would face immense difficulty in replicating Fabrinet's ability to manufacture highly complex products across a diverse range of mixes and volumes. This flexibility, honed over years, requires substantial investment in specialized equipment, skilled labor, and robust supply chain management, all of which are difficult and costly for a new player to establish quickly.

- Economies of Scale: Fabrinet leverages its large-scale manufacturing to drive down per-unit costs, a benefit new entrants would need years and massive investment to achieve.

- Experience Curve: Decades of experience in complex optical packaging and manufacturing processes have optimized Fabrinet's production, leading to higher yields and lower defect rates compared to less experienced competitors.

- Product Complexity and Flexibility: Fabrinet's demonstrated capability to produce intricate products in any mix and volume presents a significant hurdle for new entrants lacking the necessary technological expertise and operational agility.

The threat of new entrants for Fabrinet is generally low due to substantial barriers. High capital investment for advanced facilities and specialized machinery, like Fabrinet's extensive manufacturing footprint, deters many. Furthermore, the need for deep technical expertise in optical and electro-mechanical engineering, combined with long-standing relationships with major OEMs, makes it incredibly difficult for newcomers to establish credibility and compete effectively. Regulatory hurdles in sectors like medical devices, requiring extensive certifications and compliance, add another significant layer of difficulty.

These barriers are reinforced by Fabrinet's economies of scale and experience curve advantages, allowing for cost efficiencies and higher yields that new entrants would struggle to match. The company's demonstrated flexibility in producing complex products across diverse mixes and volumes requires significant upfront investment in technology and operations, which is a considerable challenge for any aspiring competitor.

| Barrier Type | Description | Fabrinet's Advantage |

| Capital Requirements | Significant investment in advanced facilities and specialized machinery. | Fabrinet has established large-scale, state-of-the-art manufacturing capabilities. |

| Technical Expertise | Need for specialized knowledge in optical, electro-mechanical, and process engineering. | Decades of accumulated know-how and a highly skilled workforce. |

| Customer Relationships | Building trust and integration with major OEMs. | Long-term, deep collaborations with key industry players. |

| Regulatory Compliance | Navigating complex certifications and approvals in regulated industries. | Established compliance infrastructure and quality management systems. |

| Economies of Scale & Experience | Achieving cost efficiencies and optimized production processes. | Leveraging large-scale manufacturing and the experience curve for higher yields and lower costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fabrinet is built upon a foundation of comprehensive data, including Fabrinet's SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research reports from leading firms and analysis of competitor financial statements to provide a robust understanding of the competitive landscape.