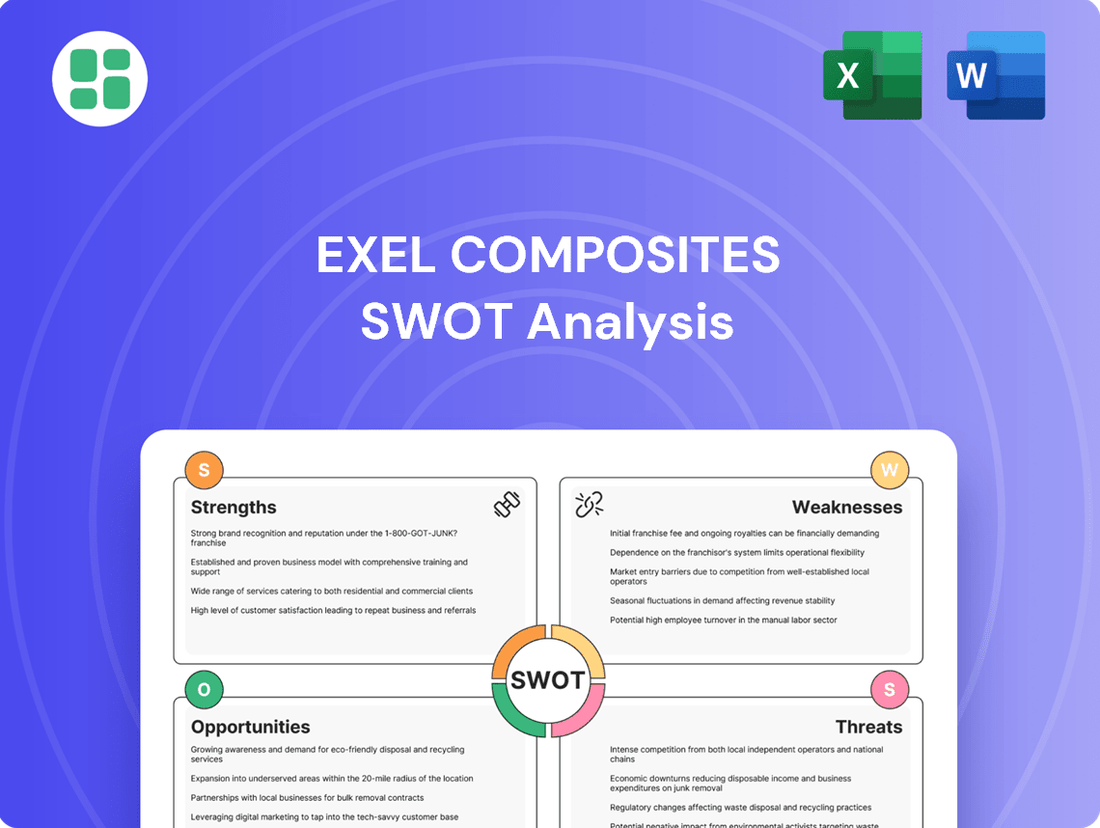

Exel Composites SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exel Composites Bundle

Exel Composites leverages its strong technological expertise and established market presence as key strengths, but faces challenges from intense competition and evolving material demands. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their position.

Want the full story behind Exel Composites' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Exel Composites stands out as a technology leader, particularly in pultrusion, a process for creating composite materials with continuous profiles. They are recognized as one of the world's largest manufacturers of composite profiles and tubes, showcasing their significant market presence and manufacturing scale.

Their deep expertise in pultrusion and pullwinding technologies is a core strength, enabling the creation of products that are not only lightweight but also exceptionally strong and durable. This specialized knowledge translates directly into a competitive edge in the composites industry.

For instance, in 2023, Exel Composites reported net sales of €327.2 million, demonstrating their substantial operational capacity and market reach, which is underpinned by their technological prowess.

Exel Composites truly shines with its ability to craft custom-engineered composite solutions. These aren't off-the-shelf products; they're specifically designed to boost performance and sustainability for their clients, a key differentiator in today's market.

Their deep well of R&D expertise, combined with a genuinely collaborative spirit, allows them to pioneer innovative products. This bespoke approach means they can precisely meet unique customer requirements, solidifying their position as a go-to partner for specialized composite needs.

Exel Composites' strength lies in its diverse industry applications, serving sectors like wind power, transportation, and building & infrastructure. This broad market reach, extending to energy, telecommunications, and sports & leisure, mitigates risks associated with any single industry's downturn.

Their global manufacturing footprint across Europe, North America, and Asia-Pacific is a significant advantage. This allows Exel Composites to cater to a worldwide customer base and provides resilience against regional geopolitical shifts, ensuring business continuity.

Strong Sustainability Focus

Exel Composites demonstrates a robust commitment to sustainability, positioning itself as a leader in eco-friendly composite solutions. This focus is not just aspirational; it translates into tangible actions aimed at reducing environmental impact.

The company actively pursues initiatives to lower its carbon footprint and enhance energy efficiency across its operations. This dedication is further exemplified by their involvement in circular economy projects, such as the Kimura project, which innovatively recycles composite waste into cement, demonstrating a practical approach to waste reduction.

- Global Sustainability Leader: Exel Composites aims to be the premier global provider of sustainable composite solutions.

- Carbon Footprint Reduction: Actively working on decreasing their environmental impact through operational efficiencies.

- Circular Economy Initiatives: Engaging in projects like Kimura to recycle composite waste, turning it into valuable materials like cement.

- Market Alignment: This strong sustainability focus directly addresses increasing environmental regulations and growing consumer demand for green products, providing a competitive advantage.

Improved Recent Financial Performance

Exel Composites has demonstrated a robust recovery and growth in its financial results. For Q4 2024, the company reported a notable increase in adjusted operating profit, signaling effective cost management and improved sales execution. This positive trend continued into H1 2025, with further gains in profitability and a healthy order book.

The company’s strategic initiatives are clearly bearing fruit, as evidenced by the strong financial performance. Order intake has seen a significant uplift, reflecting increased customer demand and successful market penetration. Exel Composites projects continued revenue growth and a substantial rise in adjusted operating profit for the full year 2025, underscoring their operational efficiency and market positioning.

- Strong Q4 2024 Adjusted Operating Profit: The company reported a significant increase in adjusted operating profit for the final quarter of 2024.

- Positive H1 2025 Performance: This upward financial trajectory was sustained into the first half of 2025, showing continued profitability improvements.

- Growing Order Intake: Exel Composites experienced a healthy increase in new orders, indicating strong market demand for its composite solutions.

- Optimistic 2025 Outlook: Management anticipates substantial growth in both revenue and adjusted operating profit for the entirety of 2025.

Exel Composites' core strength lies in its technological leadership, particularly in pultrusion and pullwinding, enabling the creation of lightweight, strong, and durable composite profiles. Their extensive R&D expertise allows for the development of custom-engineered solutions tailored to specific client needs, a significant differentiator. This bespoke approach, combined with a collaborative spirit, drives innovation and solidifies their position as a preferred partner for specialized composite applications.

The company's diversified industry applications, spanning wind power, transportation, and infrastructure, provide a robust buffer against sector-specific downturns. Furthermore, their global manufacturing presence across Europe, North America, and Asia-Pacific ensures resilience and the ability to serve a worldwide customer base effectively.

Exel Composites is a sustainability leader, actively reducing its carbon footprint and engaging in circular economy initiatives like the Kimura project, which recycles composite waste into cement. This commitment aligns with increasing environmental regulations and growing consumer demand for green products, offering a distinct competitive advantage.

Financially, Exel Composites has shown strong recovery and growth. For Q4 2024, they reported a significant increase in adjusted operating profit, a trend that continued into H1 2025 with further profitability improvements and a healthy order book. The company projects substantial revenue growth and a rise in adjusted operating profit for the full year 2025, reflecting operational efficiency and strong market positioning.

| Metric | 2023 (Full Year) | Q4 2024 (Estimate) | H1 2025 (Estimate) | FY 2025 (Projected) |

|---|---|---|---|---|

| Net Sales (€ million) | 327.2 | - | - | - |

| Adjusted Operating Profit (€ million) | - | Significant Increase | Continued Improvement | Substantial Rise |

| Order Intake | - | Healthy Uplift | - | - |

What is included in the product

Delivers a strategic overview of Exel Composites’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Exel Composites' strategic challenges and leverage its competitive advantages.

Weaknesses

Exel Composites experienced a setback with negative operating profit and net income for the entirety of 2024, and this trend continued into the first quarter of 2025. While adjusted operating profit showed signs of improvement, the company's overall profitability remains a concern.

These persistent losses, despite operational enhancements, suggest that broader economic or internal factors are still hindering the company's ability to generate positive earnings. This can erode investor trust and make it more difficult for Exel Composites to secure necessary funding for future growth or operations.

Exel Composites faces significant challenges with its restructuring efforts, notably the planned closure of its Oudenaarde factory in Belgium during the first quarter of 2025. This strategic move, intended to eliminate unprofitable operations, is anticipated to cause a temporary surge in internal workload and associated costs. The company must carefully manage this transition to minimize disruptions.

The restructuring process may also result in a short-term dip in revenue. This is primarily due to the necessary shift of customer supply chains to Exel's other production facilities. Effectively coordinating these customer transitions is paramount to prevent extended negative financial impacts.

Exel Composites experienced a significant cyberattack in July 2025, leading to a confirmed data breach. This incident compromised personal information belonging to current and former employees, as well as shareholders.

The breach introduces substantial reputational damage and potential legal ramifications for Exel Composites. Furthermore, the company will likely face considerable expenditure to bolster its cybersecurity infrastructure in response to this vulnerability.

While the cyberattack did not disrupt manufacturing operations, it clearly exposed weaknesses in the company's data protection systems. This event underscores the critical need for robust cybersecurity measures in safeguarding sensitive information.

Vulnerability to Macroeconomic Sentiment

Exel Composites' performance is closely tied to the broader economic climate. Fluctuations in global economic sentiment and persistent uncertainty directly impact their order intake and how customers behave. This means that when the economy feels shaky, customers tend to be more hesitant with their orders, leading to delays in decision-making, which in turn affects demand across the diverse industries Exel serves.

This sensitivity to external economic conditions introduces a degree of unpredictability into Exel Composites' business operations. For instance, a slowdown in key markets like construction or transportation, often triggered by macroeconomic concerns, can directly translate into reduced demand for their composite solutions. The company’s reliance on these broader economic trends creates inherent volatility in its revenue streams and operational planning.

- Order Intake Sensitivity: In the first half of 2024, Exel Composites noted that while demand remained relatively stable in certain segments, broader economic uncertainties were influencing customer order patterns, with some clients adopting a more cautious approach to large-scale commitments.

- Impact of Global Uncertainty: Lingering geopolitical tensions and inflation concerns throughout 2024 continued to create a less predictable demand environment, potentially leading to shorter order cycles and increased price sensitivity from customers.

- Industry-Wide Demand Fluctuations: The construction and industrial sectors, significant end-markets for Exel, experienced varied performance in 2024, with some regions showing resilience while others faced headwinds due to macroeconomic slowdowns, directly affecting demand for composite materials.

Volatility in Transportation Costs

Geopolitical events significantly disrupt supply chains, as seen with the Red Sea conflict in early 2024. This conflict rerouted vessels, driving up shipping rates by as much as 150% on key Asia-Europe trade lanes. Such volatility directly impacts Exel Composites' cost of goods sold and can erode profitability if not effectively managed.

The unpredictability of freight rates presents a substantial challenge for maintaining stable pricing and managing inventory effectively. For instance, the cost of shipping a 40-foot container from Shanghai to Rotterdam saw substantial spikes throughout 2024, directly affecting landed costs for imported raw materials.

- Increased Shipping Expenses: Geopolitical tensions, like the Red Sea crisis, have driven up maritime freight costs, impacting companies relying on global sourcing.

- Profit Margin Pressure: Volatile transportation expenses directly squeeze profit margins by increasing the cost of goods sold.

- Logistical Management Complexity: Navigating these external logistical challenges requires robust risk management and adaptive sourcing strategies to maintain financial health.

Exel Composites' profitability remains a significant weakness, as evidenced by negative operating profit and net income throughout 2024 and into Q1 2025. Despite operational improvements, the company's ability to generate positive earnings is hampered by broader economic or internal issues.

The ongoing restructuring, including the Oudenaarde factory closure in Q1 2025, is expected to temporarily increase workload and costs, potentially impacting revenue as supply chains are shifted. This transition requires careful management to avoid prolonged negative financial effects.

A July 2025 cyberattack exposed critical weaknesses in data protection, leading to a confirmed data breach of employee and shareholder information. This incident will likely result in substantial costs for cybersecurity enhancements and reputational damage.

The company's reliance on global economic sentiment makes it vulnerable to fluctuations in demand. For instance, economic uncertainties in 2024 led to more cautious customer order patterns, impacting revenue streams.

Full Version Awaits

Exel Composites SWOT Analysis

This is the same Exel Composites SWOT analysis document you'll receive after purchasing. The preview accurately represents the professional quality and comprehensive content you'll access. No surprises, just the full, detailed report ready for your strategic planning.

Opportunities

Exel Composites is strategically positioned to benefit from the expanding wind power industry. Their new factory in India, operational in 2024, directly addresses the evolving wind power market dynamics in Asia. This expansion is further supported by substantial orders for wind turbine components secured in South Asia for 2025, highlighting a clear pathway for growth.

There's a significant and growing worldwide push for materials that are not only lightweight and perform well but also environmentally friendly. This trend is evident across many sectors, from automotive to construction.

Composites are perfectly suited to address this demand. Their inherent ability to reduce weight, which in turn boosts energy efficiency, and their longer lifespan compared to traditional materials make them a prime choice for manufacturers aiming for sustainability and better performance. For example, in the automotive sector, lightweighting can lead to substantial fuel savings; a 10% reduction in vehicle weight can improve fuel economy by 6-8%.

Exel Composites is well-positioned to capitalize on this expanding market. Their commitment to developing and offering sustainable composite solutions aligns directly with the increasing preference of both consumers and businesses for eco-conscious products. This strategic focus allows them to capture a larger share of the market as the demand for these advanced materials continues to surge.

Exel Composites is well-positioned to expand into new applications and industries, leveraging its expertise in composite materials. A prime example is their agreement with Flying Whales to supply pull-wound carbon fiber tubes for airships, a venture into a novel sector. This success highlights the opportunity to diversify their customer base and product offerings, tapping into emerging markets like aerospace and advanced transportation where lightweight, high-strength composites are increasingly in demand.

Successful Implementation of Strategic Transformation

Exel Composites is actively pursuing a strategic transformation aimed at enhancing profitable growth and operational efficiency. The company's focus on innovation and market expansion is a key driver of this transformation. This strategic pivot is designed to capitalize on evolving market demands and strengthen its competitive position.

Early indicators suggest the strategy is gaining traction. For instance, in Q1 2024, Exel Composites reported a notable increase in order intake, signaling growing customer confidence and demand for their solutions. This positive momentum, coupled with a focus on cost management, is expected to translate into improved financial performance throughout 2024 and into 2025.

- Profitable Growth: The strategic transformation is geared towards achieving sustainable and profitable expansion in key markets.

- Operational Optimization: Initiatives are in place to streamline operations, improve cost structures, and enhance overall efficiency.

- Market Expansion: Exel Composites is targeting new geographic regions and application areas to broaden its market reach.

- Financial Improvement: Successful execution is anticipated to lead to a stronger financial profile, including improved profitability and cash flow.

Advancements in Circular Economy and Recycling

Exel Composites' engagement in initiatives like Kimura, which explores converting composite waste into cement, highlights a key opportunity. This project, aiming to find sustainable outlets for composite materials, directly addresses the growing demand for circular economy solutions.

Further development of advanced recycling technologies for composites can significantly bolster Exel Composites' environmental profile. Such advancements not only reduce waste but also open avenues for new revenue streams and improved cost management by recovering valuable materials.

- Circular Economy Growth: The global circular economy market is projected to reach $4.5 trillion by 2030, indicating substantial growth potential for companies like Exel Composites investing in recycling.

- Waste Reduction Impact: By 2025, the EU aims to increase recycling rates for municipal waste to 55%, creating a favorable regulatory environment for composite recycling innovations.

- Material Innovation: Research into composite recycling can lead to the development of secondary raw materials, potentially reducing reliance on virgin resources and lowering production costs.

Exel Composites is poised to capitalize on the growing demand for sustainable materials across various industries, driven by global environmental initiatives. Their strategic expansion into new markets, such as the airship sector with Flying Whales, and their focus on circular economy solutions like composite waste recycling through projects like Kimura, present significant avenues for diversification and enhanced profitability. The company's commitment to innovation in advanced composite recycling and its alignment with increasing consumer and business preference for eco-friendly products position it favorably for sustained growth in the coming years.

Threats

Persistent macroeconomic and geopolitical uncertainty remains a significant threat. The global economy is grappling with elevated inflation and rising interest rates, factors that historically lead to more cautious customer spending and can dampen demand across various sectors. This environment makes forecasting and managing inventory more challenging for companies like Exel Composites.

Geopolitical tensions and potential trade disputes, such as the ongoing discussions around import tariffs, further complicate the landscape. Such disruptions can directly impact global supply chains, potentially delaying raw material deliveries and affecting the fulfillment of customer orders, thereby impacting revenue streams and profitability.

Exel Composites faces formidable competition in the global composites sector. Key rivals like Gurit Holding, Diab Group, and Armacell International are actively innovating, driving intense rivalry for market share. This dynamic environment can translate into significant pricing pressures and thinner profit margins for Exel Composites.

The constant need to stay ahead means substantial ongoing investment in research and development is critical for Exel Composites to maintain its competitive edge. Competitors are not standing still; for instance, Gurit Holding reported a 5.6% increase in net sales for the first quarter of 2024, highlighting their growth and market engagement.

The threat of increased cybersecurity risks is a significant concern for Exel Composites. A recent cyberattack in July 2025 resulted in a data breach, underscoring the growing vulnerability of businesses to digital threats.

Such incidents can lead to substantial financial losses, including the cost of remediation and potential fines. Furthermore, reputational damage and a loss of customer and investor trust can have long-lasting negative impacts on the company's standing and future prospects.

Exel Composites must maintain ongoing vigilance and make substantial investments in its cybersecurity infrastructure to effectively mitigate these escalating risks and protect its sensitive data and operations.

Fluctuations in Raw Material and Energy Prices

Exel Composites, as a manufacturer, faces significant risks from fluctuating raw material and energy prices. For instance, the price of carbon fiber, a key component, can be heavily influenced by global demand and production capacity. In 2024, continued supply chain pressures and energy market volatility, exacerbated by geopolitical tensions, have kept input costs elevated for many composite manufacturers.

These price swings directly impact profitability. If Exel Composites cannot pass on increased costs for resins or energy to its customers, its profit margins will shrink. This is a widespread challenge across the manufacturing sector, with many companies struggling to balance cost absorption with maintaining competitive pricing.

- Exposure to volatile input costs: Prices for resins, carbon fiber, and glass fiber are subject to market fluctuations.

- Impact on profit margins: Rising energy and material costs can squeeze profitability if not effectively managed or passed on.

- Industry-wide challenge: This is a common threat faced by most companies in the composites manufacturing industry.

- Geopolitical and supply chain influences: Global events and disruptions continue to drive price volatility for essential manufacturing inputs.

Supply Chain Disruptions

Broader supply chain disruptions, extending beyond mere transportation costs, represent a significant threat to Exel Composites. Geopolitical tensions and unforeseen global crises could severely impact production and delivery timelines. For instance, the ongoing semiconductor shortage, which began impacting various manufacturing sectors in late 2020 and continued through 2024, highlights the vulnerability of global supply networks to component availability.

Exel Composites' reliance on a global supply chain exposes it to risks from regional conflicts or natural disasters. Such events can disrupt the availability and inflate the costs of essential components and raw materials, directly threatening operational continuity and profitability. The impact of the war in Ukraine on energy prices and raw material availability in 2022, for example, demonstrated how quickly global events can ripple through supply chains, affecting businesses worldwide.

- Geopolitical Instability: Regional conflicts can halt or reroute critical material shipments.

- Natural Disasters: Extreme weather events can damage production facilities or disrupt logistics in key sourcing regions.

- Component Scarcity: Shortages of specialized materials or components can lead to production delays and increased costs.

Intensified competition poses a significant threat, with key players like Gurit Holding and Diab Group actively pursuing innovation and market expansion. Gurit Holding's Q1 2024 net sales growth of 5.6% indicates their aggressive market engagement and suggests pricing pressures for Exel Composites. The need for continuous R&D investment to maintain competitiveness is paramount in this dynamic sector.

SWOT Analysis Data Sources

This Exel Composites SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.