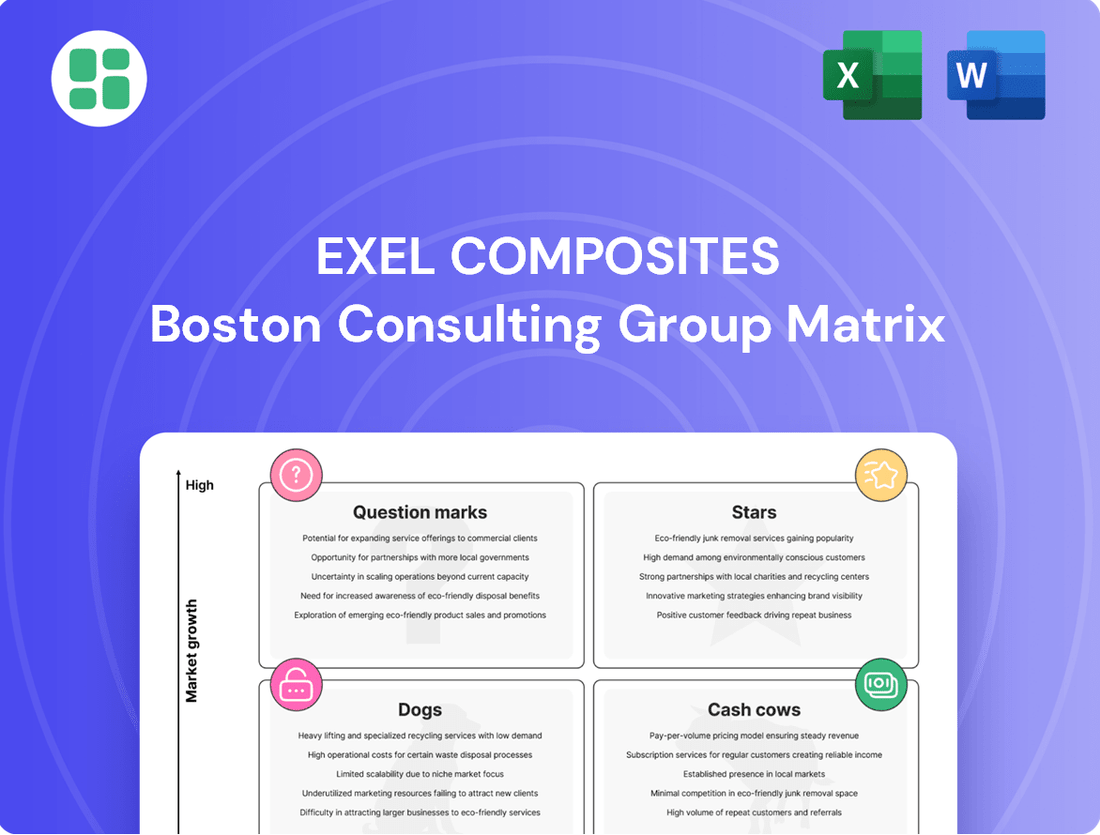

Exel Composites Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exel Composites Bundle

Curious about Exel Composites' market performance? Our BCG Matrix preview highlights key product categories, but the full report unlocks the complete picture. Understand where their offerings truly shine and where strategic shifts are needed.

Don't miss out on actionable insights! Purchase the full Exel Composites BCG Matrix to gain detailed quadrant analysis, identify growth opportunities, and make informed decisions for future success.

This is your chance to get a comprehensive understanding of Exel Composites' product portfolio. Invest in the complete BCG Matrix and equip yourself with the strategic clarity to navigate the competitive landscape.

Stars

Exel Composites is experiencing robust growth in the wind energy sector, particularly with its pultruded carbon fiber planks for spar caps. A recent EUR 10 million order from a major South Asian manufacturer, with production commencing in Q2 2025 and deliveries through 2026, underscores this strength. This positions Exel favorably within a market propelled by the increasing global demand for renewable energy solutions.

The company's strategic investment in a new factory in India is a critical factor in capitalizing on this high-growth application. This expansion not only facilitates meeting current demand but also solidifies Exel Composites' leadership role in supplying essential components for the burgeoning wind energy industry.

Exel Composites is making significant strides in the advanced composites sector, particularly with its involvement in airship manufacturing. The company's partnership with Flying Whales, a French-Canadian airship maker, highlights this focus. Exel is set to supply carbon fiber composite tubes for what will be the world's largest airship.

This collaboration is a strong indicator of Exel's position in a burgeoning and innovative aerospace market. It follows an earlier research and development phase, marking a crucial shift towards commercial production, with deliveries expected to commence in the third quarter of 2025. This niche application showcases the critical role advanced composites play in high-growth, high-tech industries.

Exel Composites is seeing impressive growth in the transportation sector, with revenues climbing 38% year-over-year in Q1 2025. This surge is fueled by the rising demand for lighter, stronger composite materials in vehicles, particularly electric buses, to boost efficiency and performance.

The company's ability to provide custom-engineered composite profiles is a key differentiator, positioning lightweighting solutions as a star performer in their business portfolio. This segment benefits from a strong market position combined with substantial growth potential.

High-Performance Industrial Solutions

The High-Performance Industrial Solutions segment within Exel Composites' BCG Matrix represents a strategic focus on niche applications with substantial growth prospects. This unit leverages Exel's advanced pultrusion and pull-winding technologies to deliver custom solutions for challenging industrial environments, aiming for market leadership in these selected segments.

Exel Composites' Industrial Solutions Business Unit (ISBU) is strategically positioned to capitalize on high-growth industrial applications. Their commitment to developing bespoke solutions, often utilizing their core pultrusion and pull-winding expertise, targets sectors where performance and reliability are paramount. This strategic alignment, supported by their global presence and dedicated R&D, aims to solidify their leadership in these specialized markets.

- Targeted Growth: ISBU concentrates on specific industrial applications identified for significant growth, indicating a proactive market strategy.

- Technological Edge: The business unit leverages Exel's proprietary pultrusion and pull-winding technologies to create advanced, custom solutions.

- Market Leadership Aspiration: The strategy is geared towards achieving or maintaining a high market share within these chosen high-potential application areas.

- R&D and Global Reach: Exel's investment in research and development, coupled with its international operational footprint, underpins its competitive advantage in these industrial sectors.

Sustainability-Driven Composite Innovations

Exel Composites is making significant strides in sustainability, which is a key driver for their growth. Their commitment to developing composite solutions that save resources and help combat climate change positions them well in today's environmentally focused market.

This focus translates into tangible benefits for their customers. By concentrating on reducing product weight, enhancing energy efficiency, and lowering overall lifetime costs, Exel is aligning with major global sustainability trends. This strategic direction is fueling demand for their advanced, eco-friendly composite products, allowing them to take a leading role in the industry.

- Resource Efficiency: Exel's composites contribute to lighter-weight designs, reducing fuel consumption in transportation sectors. For example, their solutions can reduce vehicle weight by up to 30%, leading to significant energy savings over a product's lifecycle.

- Climate Change Mitigation: Innovations in composites can offer alternatives to traditional materials that have a higher carbon footprint. Exel's efforts in developing sustainable materials are crucial for industries aiming to meet their decarbonization targets.

- Cost Reduction: Beyond initial material costs, Exel's durable and efficient composite solutions often lead to lower maintenance and operational expenses, enhancing total cost of ownership for their clients.

- Market Demand: With growing consumer and regulatory pressure for sustainable products, Exel's eco-friendly offerings are increasingly sought after, creating a strong competitive advantage.

Stars in Exel Composites' portfolio represent business areas with high market share and high growth potential. The company's advancements in wind energy, particularly pultruded carbon fiber planks for spar caps, exemplify this. Exel's recent EUR 10 million order for these components, with deliveries extending into 2026, highlights its strong position in this expanding renewable energy market.

The transportation sector also showcases star performance, with Exel Composites reporting a 38% year-over-year revenue increase in Q1 2025. This growth is primarily driven by the demand for lightweight composite materials in electric buses, crucial for enhancing efficiency and performance.

Exel Composites' involvement in the airship manufacturing sector, supplying carbon fiber composite tubes for Flying Whales' large airship, further solidifies its star status. With deliveries slated to begin in Q3 2025, this venture taps into an innovative and high-growth aerospace niche.

| Business Area | Market Share | Growth Potential | Key Drivers | Recent Performance/Outlook |

|---|---|---|---|---|

| Wind Energy Composites | High | High | Renewable energy demand, lightweighting needs | EUR 10 million order, Q2 2025 production start |

| Transportation Composites | High | High | Electric vehicle adoption, fuel efficiency regulations | 38% YoY revenue growth (Q1 2025) |

| Airship Composites | High | High | Aerospace innovation, new transport solutions | Supply agreement with Flying Whales, Q3 2025 deliveries |

What is included in the product

Exel Composites BCG Matrix analyzes products based on market share and growth, offering strategic guidance for investment decisions.

Quickly identify underperforming business units, easing the pain of resource misallocation.

Cash Cows

Exel Composites' standard construction and infrastructure profiles are solid cash cows. These products benefit from a mature market where their pultrusion technology provides a distinct edge. The company saw continued positive revenue development in these segments during Q1 2025, underscoring their reliable cash flow generation.

Exel Composites' established telecommunications components represent a classic Cash Cow. This mature sector demands dependable, long-lasting parts, and Exel's deep-rooted expertise and efficient production methods have secured them a significant market share. These standard products consistently generate stable revenue with minimal need for additional investment in marketing or development.

Exel Composites' core business revolves around pultruded tubes and laminates, a segment that functions as a Cash Cow within their BCG Matrix. This foundational segment leverages pultrusion and pull-winding technologies to produce composite profiles and tubes, serving a broad array of industries.

The consistent demand across these diverse applications translates into a significant market share for Exel in established sectors. This strong market position ensures a steady and reliable generation of cash flow, underpinning the company's financial stability.

Mature Electrical Industry Insulators and Components

Exel Composites offers advanced composite solutions, including insulators and other critical components, for the demanding electrical industry. These products are recognized for their exceptional durability and high performance, which have solidified Exel's market position.

As mature offerings, Exel's electrical industry components likely exhibit high market penetration. Their established presence and proven benefits contribute to a stable demand, translating into consistent cash flow generation for the company. While growth prospects may be modest, the consistent demand ensures these products act as reliable cash cows.

- Market Position: Exel's composite insulators and components hold a strong position in the electrical sector due to their inherent durability and performance advantages.

- Cash Flow Generation: These mature products are expected to generate stable and predictable cash flows, benefiting from high market penetration and consistent demand.

- Growth Prospects: While not high-growth areas, the essential nature of these components in the electrical infrastructure ensures continued, albeit stable, demand.

- Industry Relevance: Exel's solutions are vital for power transmission and distribution, highlighting their importance in maintaining electrical grids.

Industrial Cleaning and Maintenance Equipment

Industrial Cleaning and Maintenance Equipment is a classic Cash Cow for Exel Composites. This segment benefits from Exel's strong market position, leveraging the inherent advantages of composite materials like durability and light weight. The demand here is steady, generating reliable profits that can fund other business areas.

Exel Composites' offerings in this sector are well-established. For instance, by 2024, the global industrial cleaning equipment market was valued at approximately $35 billion, with maintenance equipment adding significantly to this. Exel's composite solutions are ideal for the harsh environments these machines often operate in, contributing to their high market share.

- Mature Market: The demand for industrial cleaning and maintenance equipment is stable and predictable.

- High Market Share: Exel Composites enjoys a strong position due to its advanced composite components.

- Consistent Cash Generation: This segment provides reliable revenue streams with minimal need for reinvestment in growth.

- Durability and Lightweighting: Composite materials offer superior performance in demanding industrial applications.

Exel Composites' standard construction and infrastructure profiles are solid cash cows, benefiting from mature markets where their pultrusion technology provides a distinct edge. The company saw continued positive revenue development in these segments during Q1 2025, underscoring their reliable cash flow generation. These established products consistently generate stable revenue with minimal need for additional investment in marketing or development.

The consistent demand across diverse applications translates into a significant market share for Exel in established sectors, ensuring a steady and reliable generation of cash flow that underpins the company's financial stability. While growth prospects may be modest, the consistent demand ensures these products act as reliable cash cows.

| Segment | BCG Category | Key Characteristics | 2024 Data Insight |

| Construction & Infrastructure Profiles | Cash Cow | Mature market, pultrusion advantage, stable demand. | Continued positive revenue development in Q1 2025. |

| Telecommunications Components | Cash Cow | Dependable, long-lasting parts, high market share. | Minimal need for additional investment, stable revenue. |

| Electrical Industry Components | Cash Cow | Exceptional durability, high performance, vital for grids. | High market penetration, stable demand, consistent cash flow. |

| Industrial Cleaning & Maintenance Equipment | Cash Cow | Strong market position, durable and lightweight composites. | Global industrial cleaning equipment market valued ~$35B in 2024. |

Preview = Final Product

Exel Composites BCG Matrix

The Exel Composites BCG Matrix you are previewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a ready-to-use strategic analysis for informed decision-making. You can confidently use this preview as a direct representation of the professional-grade report you’ll download, enabling immediate application in your business planning and competitive strategy.

Dogs

The decommissioning of Exel Composites' factory in Oudenaarde, Belgium, finalized by March 2025, signifies the exit from a financially draining segment. This move highlights a business unit characterized by low market share and minimal growth, effectively acting as a cash drain rather than a contributor to profitability.

This divestment aligns with a strategy to shed underperforming assets, likely reflecting a product or geographic focus that no longer offered competitive advantages or sufficient returns. Such actions are typical for units classified as Dogs within the BCG matrix, where investment is minimized to conserve resources.

Exel Composites' decision to cease pultrusion operations at its Runcorn, UK facility in autumn 2023 aligns with a strategy of divesting underperforming assets. This move strongly suggests that these operations represented a Question Mark or a Dog in the BCG Matrix, likely facing low market share within a slow-growing or declining market segment.

Commoditized standard profiles, like basic fiberglass or carbon fiber extrusions, often find themselves in the Dogs quadrant of the BCG matrix. These products are highly standardized, meaning there's little to distinguish one supplier's offering from another's, leading to intense price wars. For instance, in 2024, the global market for standard composite profiles saw significant price erosion, with some basic profiles experiencing a year-over-year decline of up to 15% in average selling price due to oversupply and limited innovation.

These low-margin, low-differentiation products typically operate in mature or declining markets where growth is minimal. Companies with a significant portion of their portfolio in commoditized standard profiles may struggle to generate substantial returns on investment. In 2024, reports indicated that companies heavily reliant on these types of products saw their profit margins shrink, with some operating at single-digit percentages, making it challenging to fund future research and development or expansion efforts.

Niche Products for Declining Markets

Niche Products for Declining Markets, often referred to as Dogs in the BCG Matrix, represent composite solutions tailored for specific, shrinking markets. These could be products designed for industries facing technological obsolescence or significant shifts in consumer demand. For example, if Exel Composites had a product line specifically for traditional cathode ray tube (CRT) displays, this would likely fall into the Dog category as the market for CRTs has drastically declined with the rise of LCD and OLED technology.

These products typically demonstrate both a low market share and a negative or stagnant growth rate. This combination makes them cash traps, meaning they consume resources without generating significant returns or future potential. In 2024, companies often face the challenge of managing such product lines, deciding whether to divest, harvest, or attempt a turnaround, though the latter is less common for true Dogs.

- Low Market Share: These niche products have not captured a significant portion of their shrinking market.

- Negative or Stagnant Growth: The overall market for these products is contracting or showing no signs of expansion.

- Cash Traps: They require ongoing investment for maintenance but offer little prospect of future growth or profit.

- Strategic Decision: Companies must carefully consider divesting or phasing out these products to reallocate resources to more promising areas.

Underperforming Legacy Product Lines

Exel Composites might have some older product lines that aren't performing as well as their newer, more specialized offerings. These could be products that were once popular but now face stiff competition or have declining demand. They likely have a small slice of the market and aren't expected to grow much in the future.

These underperforming legacy product lines are often characterized by lower profit margins and require significant resources for maintenance or updates. For instance, if a specific composite material used in an older application is becoming obsolete or expensive to source, it directly impacts profitability. In 2023, Exel Composites reported a net sales decrease of 10.3% to EUR 271.2 million, partly due to a challenging market environment impacting certain product segments.

- Low Market Share: Legacy products typically hold a small percentage of the overall market compared to newer, innovative solutions.

- Minimal Growth Potential: These lines often operate in mature or declining markets, offering little opportunity for expansion.

- Resource Drain: Maintaining and supporting these products can divert capital, R&D, and management attention from more promising ventures.

- Strategic Misalignment: They may not fit with Exel's current strategy of focusing on high-performance, custom-engineered composite solutions.

Dogs in the BCG matrix represent business units or products with low market share in slow-growing or declining industries. These are often commoditized products or those serving niche, shrinking markets. Exel Composites' decision to exit certain operations, like the Oudenaarde factory, and the challenges in standard profile markets in 2024, with up to 15% price erosion, exemplify this category. Such units are typically cash traps, consuming resources without generating substantial returns.

These legacy product lines, like those for obsolete technologies, face declining demand and low market share. They are often resource drains, diverting capital from more promising ventures, and may not align with a company's strategic focus on innovation. For instance, Exel Composites' 10.3% net sales decrease in 2023 was partly attributed to challenging market conditions affecting specific product segments.

Companies must strategically manage these Dog products, often by divesting or phasing them out to reallocate resources effectively. This allows for a greater focus on high-growth potential areas, ensuring the company's overall health and competitive positioning. In 2024, profit margins for companies heavily reliant on commoditized products shrunk, with some operating at single-digit percentages.

| Product Type | Market Growth | Market Share | Profitability | Strategic Implication |

|---|---|---|---|---|

| Commoditized Standard Profiles | Slow/Declining | Low | Low/Eroding | Divest or Minimize Investment |

| Niche Products for Declining Markets | Negative/Stagnant | Low | Low/Cash Trap | Divest or Harvest |

| Underperforming Legacy Product Lines | Mature/Declining | Low | Low/Resource Drain | Divest or Phase Out |

Question Marks

Exel Composites is seeing a surge in interest and activity within the defense sector, pointing to a promising high-growth market for their advanced composite materials. This area represents a significant opportunity, driven by the demand for lightweight, durable, and high-performance solutions in military applications.

Despite this growing potential, Exel Composites' current market share in this specialized and often regulated defense industry is likely modest. This positions defense applications as a question mark in their BCG matrix, necessitating substantial investment to build a strong foothold and competitive advantage.

Exel Composites' Indian operations, while gaining traction in the wind energy sector, are poised for significant expansion into other industrial segments. This strategic move into new geographic markets within India, beyond wind, presents a substantial growth avenue. Despite the vast potential, Exel currently holds a relatively small share across these diverse industrial applications.

The Indian industrial market is projected to grow at a robust pace, with various sectors like automotive, infrastructure, and consumer goods offering considerable opportunities for composite materials. For instance, the Indian automotive sector alone is expected to see a compound annual growth rate of over 10% in the coming years, creating demand for lightweight and durable composite solutions. Exel's current low market penetration in these areas signifies an untapped potential for market share acquisition.

Exel Composites' deep expertise in custom-engineered composite solutions makes them a natural fit to explore nascent technologies such as advanced robotics and emerging urban mobility concepts. These sectors represent significant growth potential, but Exel's initial market share will likely be minimal as they focus on prototyping and securing market adoption. This necessitates substantial ongoing investment in research and development.

Bio-based and Circular Economy Composites

Exel Composites' strategic focus on bio-based and circular economy composites positions them to capture a high-growth, future-oriented market. This includes dedicated research into bio-based resins and fibers, alongside robust circular economy initiatives.

While these innovative materials are vital for long-term sustainability and market differentiation, their immediate market share is likely to be low. This necessitates significant investment to scale production and gain traction.

- Market Potential: The global bio-composites market is projected to reach USD 40.1 billion by 2027, growing at a CAGR of 16.2%.

- Investment Needs: Scaling production of novel bio-based and recycled composites requires substantial capital expenditure for new manufacturing lines and R&D.

- Competitive Landscape: Early adoption and technological leadership in this segment can create a strong competitive advantage, but also attracts significant competition.

- Sustainability Drivers: Growing consumer demand for eco-friendly products and increasing regulatory pressure on waste reduction are key market enablers.

Advanced Composite Conductor Cores

Exel Composites is actively involved in developing composite conductor cores, a critical technology for modernizing electrical grids. This area shows significant growth potential as power infrastructure undergoes transformation.

While the market for these advanced cores is expanding, Exel's current market share in this specialized segment may be relatively small as the technology moves toward wider adoption.

- High Growth Potential: The global advanced conductor market, including composite core technologies, is projected to experience substantial growth, driven by the need for more efficient and reliable power transmission. For instance, the market for composite core conductors was valued at approximately USD 1.5 billion in 2023 and is expected to grow at a CAGR of over 6% through 2030.

- Technological Advancement: Exel's composite conductor cores offer advantages like lighter weight and higher conductivity compared to traditional aluminum conductors, facilitating upgrades to existing grid infrastructure and enabling higher power transfer capacities.

- Market Position: As a relatively new and specialized application, Exel's penetration into the advanced composite conductor core market is still developing. The company is focused on establishing its presence and capturing a larger share as demand for grid modernization intensifies.

The defense sector represents a high-growth opportunity for Exel Composites, driven by demand for advanced materials, yet their current market share is likely modest, requiring significant investment to build a strong position. Similarly, Exel's Indian operations are expanding into new industrial segments beyond wind energy, tapping into a robustly growing market where their penetration is currently low.

Emerging technologies like advanced robotics and urban mobility also present significant growth potential for Exel's custom solutions, but require substantial R&D investment due to minimal initial market share. The company's focus on bio-based and circular economy composites is a future-oriented strategy, but currently faces low market share, necessitating investment to scale production.

Exel's composite conductor cores for electrical grids are in a growing market, but their penetration is still developing as the technology gains wider adoption. These areas collectively represent question marks in Exel Composites' BCG matrix, demanding strategic investment to convert potential into market leadership.

| Business Area | Market Growth | Exel's Market Share | Investment Need |

| Defense Sector | High | Low | High |

| Indian Industrial (non-wind) | High | Low | Medium |

| Emerging Technologies (Robotics, Urban Mobility) | Very High | Very Low | Very High |

| Bio-based & Circular Composites | High | Low | High |

| Composite Conductor Cores | Medium-High | Low | Medium |

BCG Matrix Data Sources

Our Exel Composites BCG Matrix is constructed using robust market data, including financial reports, industry growth forecasts, and competitor analysis. This ensures a comprehensive and accurate representation of each business unit's market position and potential.