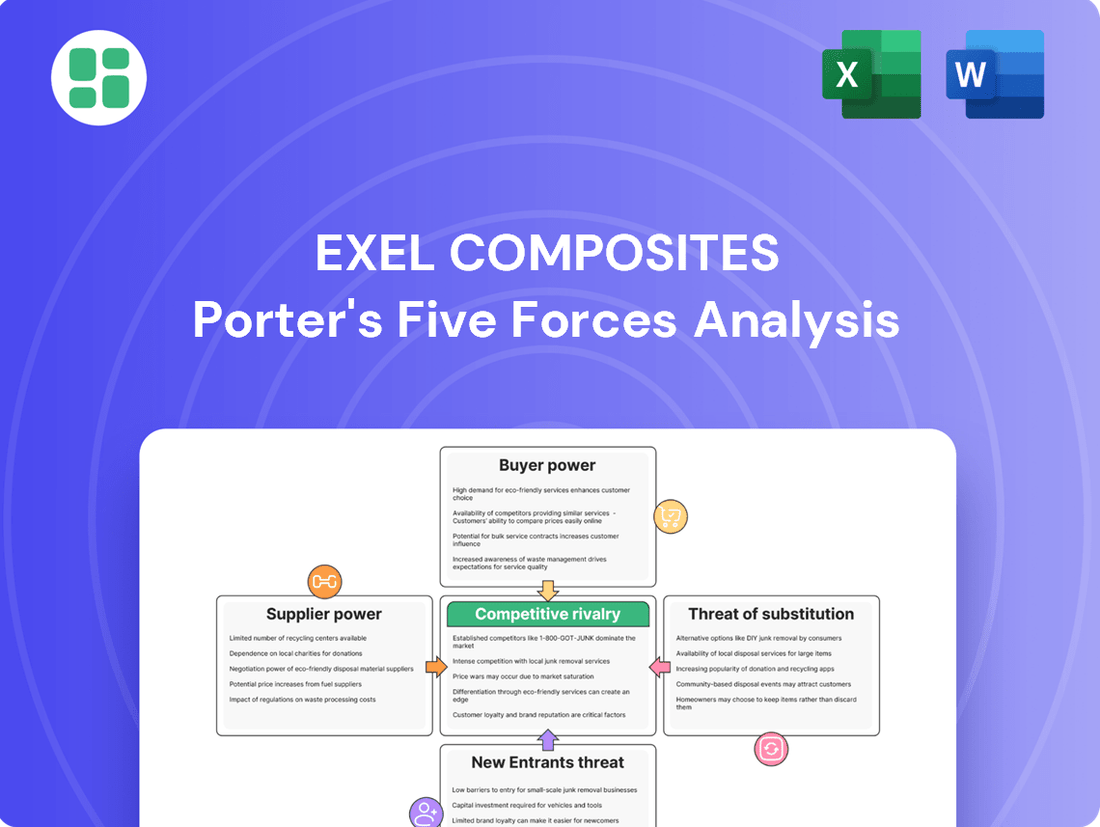

Exel Composites Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exel Composites Bundle

Exel Composites operates in an industry where the threat of new entrants is moderate, as specialized knowledge and capital investment are required. Buyer power is significant, particularly for large customers who can negotiate favorable terms. The intensity of rivalry among existing players is a key factor influencing Exel Composites's profitability.

The complete report reveals the real forces shaping Exel Composites’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Exel Composites' reliance on specialized raw materials like epoxy, polyester, vinyl ester resins, and high-performance glass, carbon, and aramid fibers is a key factor in supplier bargaining power. The unique technical specifications of these inputs mean only a limited number of suppliers can meet Exel's needs, giving them leverage.

The availability and cost of these advanced materials directly influence Exel's production expenses and the ultimate performance of its composite products. For instance, the global demand for carbon fiber, a critical component for many high-performance applications, has seen significant price fluctuations. Reports from early 2024 indicated that while supply chains were stabilizing, the cost of premium carbon fiber grades remained elevated due to sustained demand from aerospace and automotive sectors, directly impacting manufacturers like Exel.

Supplier concentration significantly impacts bargaining power. If a few dominant suppliers control essential materials like specialized resins or advanced fibers, they gain considerable leverage. This concentration means these suppliers can often dictate terms, pricing, and delivery timelines, which can reduce Exel Composites' ability to negotiate favorable conditions.

For instance, in 2024, the global advanced composites market saw continued consolidation, with key raw material suppliers often holding substantial market share. Exel Composites actively works to mitigate this risk by diversifying its supplier base for critical components. This strategy is also aligned with their sustainability goals, aiming to build a more resilient and responsible supply chain.

Switching suppliers for highly specialized composite materials, like those Exel Composites utilizes, can be a costly endeavor. These costs can include the expense of re-qualifying new materials, investing in new tooling or molds, and the potential for production downtime during the transition. For instance, a shift in a key composite supplier might necessitate months of testing and validation to ensure the new material meets stringent performance specifications.

These substantial switching costs effectively reduce Exel's bargaining power with its current suppliers. When it's difficult and expensive to change providers, suppliers are in a stronger position to dictate terms, potentially leading to less favorable pricing or contract conditions for Exel, especially for custom-engineered solutions where supplier expertise is deeply embedded.

Input Differentiation

Suppliers offering highly differentiated or proprietary material formulations, especially those crucial for custom-engineered solutions, wield significant bargaining power. Exel Composites' dependence on specific material properties for performance-critical applications means that unique supplier offerings can be challenging to find alternatives for. This differentiation enables suppliers to justify premium pricing for their specialized products.

For instance, the market for high-performance carbon fiber, a material fundamental to advanced composites, demonstrates this dynamic. In 2023, the global carbon fiber market was valued at approximately $2.5 billion, with prices for specialized grades often exceeding $20 per pound, reflecting the proprietary nature of their manufacturing processes and performance characteristics. Exel's need for such advanced materials positions these suppliers favorably.

- Supplier Differentiation: Suppliers providing unique material formulations, particularly for custom engineered solutions, have increased leverage.

- Exel's Reliance: Exel's need for specific material properties in performance-critical applications makes it difficult to substitute unique supplier inputs.

- Pricing Power: Material differentiation allows suppliers to command higher prices, impacting Exel's cost structure.

- Example: Carbon Fiber: High-cost materials like carbon fiber, essential for advanced composites, exemplify this supplier power, with specialized grades being difficult to replicate.

Threat of Forward Integration

The threat of forward integration by raw material suppliers for Exel Composites, while not a dominant factor, does exist and can influence supplier bargaining power. If a significant supplier were to enter the composite profile manufacturing market, they could capture more of the value chain, thereby strengthening their negotiating position. This scenario, though less frequent due to the specialized nature of the industry, remains a theoretical concern for companies like Exel Composites.

The specialized processes involved in composite profile manufacturing, such as pultrusion and lamination, present considerable hurdles for potential forward integration by suppliers. These barriers include the substantial capital investment required and the need for deep technical expertise, which often makes such a strategic move impractical for raw material providers. Consequently, this inherent complexity limits the immediate threat and the leverage suppliers can derive from it.

- Forward Integration Threat: Suppliers entering composite profile manufacturing would increase their bargaining power.

- Barriers to Integration: High capital and specialized expertise requirements for pultrusion and lamination limit this threat.

- Leverage: Even a remote possibility of forward integration gives suppliers some negotiating advantage.

The bargaining power of suppliers for Exel Composites is notably high due to the specialized nature of raw materials and the limited number of qualified providers. This concentration of suppliers for critical inputs like advanced fibers and resins grants them significant leverage in price negotiations and contract terms.

Exel's reliance on these specific, often proprietary, materials means switching suppliers is costly and time-consuming, involving re-qualification and potential production disruptions. For instance, the global advanced composites market in 2023 saw continued demand for high-performance carbon fiber, with prices for specialized grades remaining elevated, impacting manufacturers like Exel.

This supplier concentration and the high switching costs effectively empower suppliers, allowing them to dictate terms and potentially increase costs for Exel Composites, especially for custom-engineered solutions where supplier expertise is deeply integrated.

| Factor | Impact on Exel Composites | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Limited choice for critical raw materials | High |

| Switching Costs | Expensive and time-consuming to change suppliers | High |

| Material Differentiation | Need for proprietary, high-performance materials | High |

| Forward Integration Threat | Low due to industry barriers | Low |

What is included in the product

This analysis of Exel Composites' competitive landscape identifies the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify competitive pressures and strategic opportunities within the composites industry, enabling proactive adjustments to Exel Composites' market position.

Customers Bargaining Power

Exel Composites' strength in custom-engineered solutions significantly dampens customer bargaining power. By tailoring composite products precisely to individual client specifications, Exel creates solutions that are not easily replicated by competitors.

This high degree of specialization inherently raises switching costs for customers. Imagine a client relying on a unique composite part for a critical application; finding an alternative supplier who can match the exact performance characteristics and integration would be a complex and costly undertaking.

For instance, in the demanding aerospace sector, where Exel Composites has a notable presence, the integration of custom composite components into aircraft often involves extensive testing and certification processes. A switch in supplier would necessitate re-validation, adding substantial time and expense, thereby reinforcing Exel's position.

Customer concentration significantly impacts bargaining power. If Exel Composites has a few major clients representing a large chunk of its sales, those clients gain considerable leverage. For instance, if the top 5 customers accounted for 40% of Exel's net sales in 2023, their ability to negotiate pricing or terms would be substantial.

Exel Composites excels at creating composite solutions that are not only lightweight and strong but also built to last, offering tangible benefits like improved performance and sustainability. This dedication to quality and innovation translates directly into value for their customers.

When customers see Exel's products as unique and essential for their own product's success, they become less focused on price. This reduced price sensitivity significantly diminishes their bargaining power, as they rely on Exel's specialized offerings.

In 2024, Exel Composites continued to emphasize its unique value proposition, which directly impacts how customers perceive their offerings. For instance, in sectors like transportation and construction, where lightweighting and durability are paramount, Exel's advanced composite materials are often critical components, making it harder for customers to switch to alternatives without compromising performance.

Customer Switching Costs

Customers face significant hurdles when switching from a supplier like Exel Composites. These costs can include redesigning products, retooling manufacturing equipment, and obtaining new certifications, which can be quite substantial, especially for specialized composite parts. For instance, a customer integrating Exel's custom profiles into a new electric vehicle chassis might incur millions in re-engineering and testing if they switch suppliers mid-development.

These switching costs are particularly high for components that are deeply integrated into a customer's product or manufacturing process. Think about aerospace applications where composite parts must meet stringent safety and performance standards; changing suppliers requires extensive recertification, a process that can take months and cost hundreds of thousands of dollars. This complexity significantly reduces a customer's willingness or ability to switch easily.

- High Re-design and Re-tooling Expenses: Customers often need to invest heavily in modifying their existing designs and production lines to accommodate components from a new supplier.

- Certification and Qualification Hurdles: For many industries, particularly aerospace and automotive, new suppliers and their materials must undergo rigorous and time-consuming qualification processes.

- Supply Chain Integration Challenges: Switching suppliers can disrupt established supply chains, leading to potential delays and increased logistical costs for the customer.

- Loss of Supplier-Specific Expertise: Customers may benefit from specialized knowledge and collaborative development with their current composite supplier, which is lost upon switching.

Threat of Backward Integration

The threat of customers backward integrating to produce their own composite profiles for Exel Composites is generally low. This is because the specialized pultrusion and continuous lamination technologies involved demand substantial capital, deep technical know-how, and significant production scale. For instance, setting up a basic pultrusion line can easily cost hundreds of thousands of euros, with more advanced systems running into millions.

This limited threat of backward integration helps to curb the bargaining power of Exel Composites' customers. However, there's a caveat: exceptionally large customers, particularly those with highly strategic component needs, might explore this option. For example, a major automotive manufacturer seeking to secure a critical lightweight component for a flagship electric vehicle might consider internal production if the volume and strategic importance justify the investment.

- Low Threat of Backward Integration: Specialized technologies like pultrusion require significant capital and expertise, making it difficult for most customers to produce composite profiles in-house.

- Capital Investment Barrier: The cost of establishing even a basic pultrusion facility can be substantial, deterring many potential entrants.

- Technical Expertise Required: Mastering the intricacies of composite material processing and machinery operation is a significant hurdle for customers.

- Strategic Exception: Very large customers with critical component needs might consider backward integration for strategic advantage, despite the inherent challenges.

The bargaining power of Exel Composites' customers is generally low due to the highly specialized nature of its custom-engineered composite solutions. This specialization creates significant switching costs, as clients rely on unique product specifications and integration, making it difficult and expensive to find alternative suppliers. For example, in the aerospace industry, where Exel has a strong presence, re-certifying custom composite parts after a supplier change can cost hundreds of thousands of dollars and take months, reinforcing customer dependence.

Furthermore, Exel's focus on delivering high-value, innovative materials that enhance customer product performance, such as lightweighting in transportation, reduces price sensitivity. This means customers are less likely to exert pressure on pricing when they perceive Exel's offerings as critical to their own success. The threat of customers undertaking backward integration to produce these specialized composite profiles themselves is also minimal, given the substantial capital investment and technical expertise required for technologies like pultrusion.

| Factor | Impact on Customer Bargaining Power | Exel Composites' Mitigation Strategy |

|---|---|---|

| Product Differentiation & Specialization | Lowers power | Custom-engineered solutions tailored to specific client needs. |

| Switching Costs | Lowers power | High costs associated with redesign, re-tooling, and re-certification. |

| Customer Concentration | Can increase power (if high) | Diversification of customer base across various industries. |

| Threat of Backward Integration | Lowers power | High capital and technical barriers to entry for customers. |

Preview Before You Purchase

Exel Composites Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Exel Composites, offering a detailed examination of industry competition and profitability. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally prepared strategic tool.

Rivalry Among Competitors

The intensity of competition within the composite materials industry is directly tied to its growth trajectory. The broader global composite market is anticipated to expand at a compound annual growth rate of 7.3% between 2025 and 2032. This robust growth offers a potential buffer against heightened competitive pressures as the pie gets larger.

More specifically, the pultrusion segment, a key area for companies like Exel Composites, is projected to experience even faster growth. Forecasts indicate a CAGR of 7.94% for the pultrusion market from 2025 through 2034. Such strong expansion suggests that while competition exists, the expanding market size may allow multiple players to gain traction and increase their revenue without necessarily engaging in aggressive market share battles.

The composite profiles and tubes market is characterized by a diverse competitive landscape, including specialized pultruders, larger diversified materials firms, and numerous regional operators. This breadth of players, particularly those possessing comparable technological expertise or serving similar customer segments, significantly heightens the intensity of competition.

For Exel Composites, key competitors identified by PitchBook include Gurit Holding, Diab Group, and Composite Resources. These companies, along with many others, contribute to a dynamic market where differentiation and innovation are crucial for sustained success and market share.

While Exel Composites excels in offering custom-engineered composite profiles, the overall market for composite profiles sees varying degrees of product differentiation. If these products were to become more commoditized, price would inevitably become the main battleground, intensifying competition among players.

Exel's strategic focus on specialized, high-performance solutions is a deliberate move to sidestep this commoditization. By competing on the unique value and technical capabilities of their offerings, rather than solely on price, Exel aims to maintain a competitive edge in a potentially price-sensitive market.

High Fixed Costs and Capacity

The composite materials industry, including players like Exel Composites, faces intense competition driven by high fixed costs associated with manufacturing. Setting up pultrusion and lamination lines, crucial for producing composite profiles and tubes, requires substantial capital investment. For instance, a single pultrusion line can cost hundreds of thousands to millions of dollars, making capacity utilization a critical factor for profitability.

These significant fixed costs create a strong incentive for companies to operate at or near full capacity to spread the overheads. When the market experiences overcapacity, perhaps due to new entrants or a slowdown in demand, companies may resort to aggressive pricing strategies to ensure their expensive machinery remains operational and to cover ongoing expenses. This can lead to price wars, intensifying the rivalry among existing players.

The pressure to maintain high capacity utilization is particularly acute during economic downturns. In 2023, global industrial production saw varied performance, with some sectors experiencing contraction, which can directly impact demand for composite materials used in construction, transportation, and infrastructure. This reduced demand, coupled with existing high fixed costs, can force companies to lower prices to secure orders, thereby escalating competitive rivalry.

- High Capital Investment: Pultrusion and lamination equipment represent significant upfront costs, making capacity utilization paramount for financial viability.

- Capacity Utilization Pressure: Companies with substantial fixed costs are compelled to run their facilities at high levels, often leading to price concessions to secure business.

- Aggressive Pricing Dynamics: Periods of overcapacity, especially when combined with economic slowdowns, can trigger price wars as firms fight to cover their fixed operational expenses.

Exit Barriers

Exel Composites faces significant competitive rivalry due to high exit barriers within the pultrusion sector. These barriers, such as specialized machinery and dedicated production lines, make it costly and difficult for companies to leave the market. For instance, the capital expenditure required for pultrusion equipment can be substantial, with some lines costing upwards of €1 million, making repurposing challenging.

These high exit barriers can trap unprofitable firms in the market, leading to persistent overcapacity. Companies may continue to operate at low margins rather than face the significant costs associated with shutting down operations. This dynamic intensifies competition, as these firms contribute to supply even when demand is weak, putting downward pressure on prices and profitability for all players in the pultrusion industry.

- Specialized Assets: Pultrusion lines are highly specific and difficult to sell or repurpose, locking in capital.

- Contractual Obligations: Long-term supply agreements or leases can prevent premature exit.

- Workforce Severance: Significant costs associated with laying off a specialized workforce can deter closure.

- Market Saturation: In 2023, the global pultrusion market, valued at approximately USD 3.5 billion, experienced intense competition, partly due to these exit barriers, with projections indicating continued growth but also sustained rivalry.

The competitive rivalry within the composite materials sector, particularly for Exel Composites, is shaped by a dynamic interplay of market growth, product differentiation, and significant capital investments. While the overall composite market is expected to grow robustly, with the pultrusion segment showing even stronger expansion, the presence of specialized competitors and the high cost of entry and exit create an intense environment.

Companies like Exel Composites face rivalry from both specialized pultruders and larger, diversified material firms. The drive for capacity utilization due to high fixed costs can lead to price competition, especially during economic slowdowns. For instance, the global pultrusion market, valued around USD 3.5 billion in 2023, saw considerable rivalry, partly fueled by high exit barriers that keep less profitable firms in the market.

| Competitor | Specialty | Market Position |

|---|---|---|

| Gurit Holding | Wind energy, marine, aerospace | Global leader in composite materials and process technologies |

| Diab Group | Core materials for sandwich structures | Leading global supplier for lightweight structural materials |

| Composite Resources | Custom composite solutions | Provider of advanced composite components and materials |

SSubstitutes Threaten

The primary threat of substitutes for composite materials stems from traditional options like steel, aluminum, wood, and conventional plastics. These established materials often boast lower initial purchase prices and benefit from well-developed, readily available supply chains, making them attractive for cost-sensitive applications.

However, the unique advantages of composites, such as their exceptional strength-to-weight ratios, inherent corrosion resistance, and significant design flexibility, often outweigh the initial cost differential in performance-critical sectors. For instance, in the automotive industry, the use of composites can lead to substantial weight reduction, contributing to improved fuel efficiency; by 2024, lightweighting initiatives are increasingly driving material choices, with composites playing a key role in achieving these goals.

The decision to opt for composites over traditional materials frequently hinges on a delicate performance-cost balance. While the upfront price tag for composites might seem higher, their superior durability, reduced maintenance needs, and enhanced fuel efficiency, particularly in sectors like transportation, can translate into significantly lower overall lifecycle expenses. For instance, in the automotive industry, composite parts can reduce vehicle weight by up to 50%, leading to substantial fuel savings over the vehicle's lifespan.

Exel Composites needs to master the art of articulating this comprehensive value proposition to effectively counter the allure of cheaper, albeit less performant, substitutes. By highlighting the long-term economic advantages and superior functional attributes, Exel can persuade customers that the initial investment in composites yields greater returns over time, thereby diminishing the threat posed by alternative materials.

Ongoing technological advancements in traditional materials, like new high-strength steel alloys or advanced engineered plastics, present a significant threat of substitution for composite materials. For instance, the development of lighter, more durable aluminum alloys has directly challenged composites in sectors like automotive and aerospace. These innovations can offer comparable or even superior performance at a lower cost, diminishing the perceived value proposition of composites.

Innovations that drastically improve the performance or reduce the cost of substitute materials directly impact the incentive for customers to switch to composites. For example, breakthroughs in 3D printing with advanced polymers could make customized plastic parts more accessible and cheaper than custom composite solutions. This requires continuous monitoring of material science progress.

Exel Composites must maintain a relentless pace of innovation to counter the evolving threat from substitute materials. This means investing in research and development to enhance the performance characteristics of their composite offerings, such as improving impact resistance or reducing manufacturing cycle times. Staying ahead of material science advancements is crucial for preserving market share and competitive advantage.

Customer Awareness and Acceptance

Customer awareness and acceptance significantly shape the threat of substitutes for composite materials. In many sectors, a long-standing reliance on traditional materials like steel, aluminum, or wood stems from ingrained familiarity and established infrastructure. For instance, the automotive industry, while increasingly adopting composites, still has a vast legacy of metalworking processes and supply chains that represent a significant inertia against widespread composite adoption. This historical preference can create a barrier to entry for composite solutions, even when they offer superior performance characteristics.

Exel Composites, like other players in the industry, must actively work to educate potential clients about the advantages of composites. This involves demonstrating not just the performance benefits, such as lighter weight, corrosion resistance, and design flexibility, but also the total cost of ownership and the feasibility of integrating composites into existing manufacturing and application frameworks. For example, by showcasing successful case studies and providing technical support, Exel can help overcome the perception that composites are complex or prohibitively expensive to implement. The market penetration of composites in sectors like renewable energy, where lightweight and durable structures are paramount, highlights the impact of targeted education and proven performance.

- Market Education: Highlighting benefits like weight reduction (e.g., composites can be 70-80% lighter than steel) and corrosion resistance is key to overcoming inertia.

- Industry Adoption: While the aerospace sector widely accepts composites, other industries like construction or consumer goods are still in earlier stages of adoption, presenting opportunities for growth through education.

- Total Cost of Ownership: Demonstrating long-term savings through reduced maintenance, energy efficiency, and extended lifespan can counter initial material cost perceptions.

- Technological Advancements: Innovations in composite manufacturing and recycling are making them more accessible and sustainable, further influencing customer acceptance.

Regulatory and Environmental Factors

Increasing regulatory pressure for lightweighting and energy efficiency, particularly in sectors like transportation, can significantly reduce the threat posed by traditional materials, thereby favoring advanced composites. For instance, by 2024, the European Union's fleet-wide CO2 emission targets for new cars are set to become even more stringent, pushing manufacturers to adopt lighter materials like composites to meet these goals. Exel Composites actively addresses this by developing sustainable composite solutions that assist customers in resource conservation and climate change mitigation efforts.

The growing emphasis on sustainability and environmental responsibility is a key driver. Stricter emissions standards in the automotive and aerospace industries, for example, directly encourage the use of lighter composite materials over heavier traditional ones. In 2023, the global automotive lightweight materials market, which includes composites, was valued at approximately USD 120 billion, with projections indicating continued growth driven by these regulatory shifts.

Exel Composites' strategic focus on sustainable solutions directly counters the threat of substitutes by offering products that align with these evolving environmental mandates. Their commitment to reducing the environmental footprint of their products and enabling customers to do the same strengthens their competitive position against less sustainable alternatives.

Key factors influencing this threat include:

- Evolving Emissions Standards: Increasingly stringent regulations globally, such as those for CO2 emissions in vehicles, directly incentivize the adoption of lightweight materials.

- Demand for Energy Efficiency: A broader societal and regulatory push for energy conservation across industries makes lighter, more efficient materials attractive.

- Sustainability Initiatives: Corporate and governmental commitments to sustainability create a market preference for materials with lower environmental impact.

- Innovation in Composites: Advancements in composite technology are making them more cost-competitive and performant, further diminishing the appeal of traditional substitutes.

The threat of substitutes for Exel Composites' products is primarily from traditional materials like steel, aluminum, and wood. These substitutes often have lower upfront costs and established supply chains, making them appealing for price-sensitive applications. However, composites offer superior strength-to-weight ratios, corrosion resistance, and design flexibility, which can lead to lower lifecycle costs, especially in performance-critical sectors. For example, by 2024, lightweighting initiatives in the automotive industry are increasingly driving material choices towards composites to improve fuel efficiency.

Innovations in substitute materials, such as new high-strength steel alloys or advanced engineered plastics, can directly challenge composites by offering comparable performance at a lower cost. For instance, lighter aluminum alloys have made inroads in automotive and aerospace. Exel Composites must continuously innovate to maintain its competitive edge against these evolving alternatives.

Customer awareness and familiarity with traditional materials create inertia, hindering composite adoption. Exel Composites needs to educate customers on the total cost of ownership and integration feasibility. Successful case studies and technical support are vital for overcoming this barrier.

Regulatory pressures for lightweighting and energy efficiency, particularly in transportation, are reducing the threat from traditional materials. Stricter emissions standards, like those in the EU for vehicles, incentivize composite use. Exel Composites' focus on sustainable solutions aligns with these trends, strengthening its market position.

| Material | Typical Density (kg/m³) | Tensile Strength (MPa) | Cost (USD/kg, est.) | Key Advantages |

|---|---|---|---|---|

| Steel | 7,850 | 400-1,000 | 0.50 - 1.50 | High strength, low cost, well-established |

| Aluminum | 2,700 | 50-600 | 2.00 - 4.00 | Lightweight, corrosion resistant |

| Wood | 400-700 | 30-100 | 0.20 - 1.00 | Renewable, good insulator, aesthetic |

| Carbon Fiber Composites | 1,500-1,800 | 1,500-3,000+ | 20.00 - 50.00+ | Extremely lightweight, high strength, design freedom |

| Glass Fiber Composites | 1,800-2,000 | 800-1,500 | 2.00 - 5.00 | Good strength, electrical insulator, cost-effective |

Entrants Threaten

The composite profiles and tubes market, particularly those utilizing pultrusion and continuous lamination, demands a significant capital outlay. New entrants face substantial costs for specialized machinery, advanced manufacturing facilities, and ongoing research and development. For instance, setting up a pultrusion line can easily cost hundreds of thousands, if not millions, of dollars, making it a considerable hurdle for smaller or less capitalized businesses.

Exel Composites' deep specialization in pultrusion and continuous lamination, coupled with a strong emphasis on custom-engineered solutions, signifies a substantial reservoir of proprietary technology and process expertise. This accumulated knowledge, developed over years of operation and innovation, presents a significant hurdle for potential newcomers aiming to replicate their capabilities. The cost and time investment required to reach a comparable level of material science understanding and manufacturing precision are substantial, acting as a natural deterrent.

The company's commitment to innovation is further evidenced by recent developments, such as securing an extension to a design patent for antenna radomes. This ongoing patent activity underscores Exel Composites' dedication to protecting its intellectual property and maintaining a technological edge, which directly contributes to the threat of new entrants being low due to the high barriers to entry created by such specialized and protected know-how.

Established players in the composites industry, such as Exel Composites, often leverage significant economies of scale. This translates to lower per-unit costs for raw materials, streamlined manufacturing processes, and more efficient distribution networks. For instance, in 2023, Exel Composites reported a revenue of €323.4 million, indicating a substantial operational footprint that allows for cost efficiencies not easily replicated by newcomers.

New entrants typically begin at a smaller scale, which inherently creates a cost disadvantage. They cannot match the purchasing power or production volume of established firms, making it challenging to compete on price and achieve healthy profit margins. This barrier is substantial, as achieving comparable scale would necessitate significant upfront investment in plant, equipment, and market access.

Access to Distribution Channels and Customer Relationships

New players face a significant hurdle in replicating Exel Composites' established distribution networks and deep-seated customer relationships, which are crucial in the industrial sector. Building these channels and fostering trust, especially for bespoke engineered solutions, requires years of dedicated effort and investment. For instance, Exel Composites' global presence and collaborative client engagement model are not easily replicated, creating a substantial barrier.

- Distribution Channel Access: New entrants would find it challenging to secure comparable access to the established distribution networks that Exel Composites has cultivated over time.

- Customer Relationship Strength: The long-term, trust-based relationships Exel Composites maintains with its industrial clients, particularly for custom solutions, are difficult for newcomers to penetrate.

- Time and Investment Barrier: The significant time and capital investment required to build similar distribution capabilities and client loyalty present a formidable threat.

Regulatory Requirements and Certifications

The threat of new entrants into the composites market, specifically for Exel Composites, is significantly influenced by the complex web of regulatory requirements and certifications. These vary widely depending on the intended application of composite products, such as in the demanding transportation or construction sectors, and the energy industry. Meeting these stringent industry standards and obtaining necessary approvals can be a substantial hurdle.

The process of securing these certifications is often both time-consuming and financially demanding, effectively creating a barrier to entry for potential new competitors. While compliance is crucial for ensuring product quality and safety, it undeniably increases the initial investment and operational complexity for any company looking to enter the market.

- Industry-Specific Certifications: For instance, composites used in aerospace often require certifications like AS9100, while automotive applications might need IATF 16949.

- Material Compliance: Regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe impact the raw materials used in composites, necessitating careful sourcing and documentation.

- Safety Standards: Fire safety regulations, particularly in construction and public transport, mean composite materials must undergo rigorous testing to meet standards like EN 45545 for railway applications.

- Cost of Compliance: The investment in testing, documentation, and obtaining certifications can easily run into tens or even hundreds of thousands of dollars for new entrants, impacting their initial capital requirements.

The threat of new entrants for Exel Composites is considered low due to several significant barriers. High capital requirements for specialized machinery and advanced facilities, coupled with the need for extensive R&D, deter many potential competitors. For example, establishing a pultrusion line can cost upwards of a million dollars.

Exel Composites' deep technical expertise, proprietary technology, and protected intellectual property, such as extended design patents for antenna radomes, create a substantial knowledge gap that new entrants struggle to bridge. This accumulated know-how and innovation require considerable time and investment to replicate.

Furthermore, Exel Composites benefits from economies of scale, as indicated by its 2023 revenue of €323.4 million, leading to lower per-unit costs and efficient operations. New entrants face a cost disadvantage due to their smaller scale and inability to match the purchasing power of established firms.

Replicating Exel Composites' established global distribution networks and strong, trust-based customer relationships, especially for custom-engineered solutions, presents a considerable challenge. Building these channels and fostering client loyalty takes years of dedicated effort and investment, acting as a significant deterrent.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High cost of specialized machinery (e.g., pultrusion lines costing millions) and advanced facilities. | Significant financial hurdle, limiting entry to well-funded organizations. |

| Proprietary Technology & IP | Deep technical expertise, custom-engineered solutions, and protected patents. | Requires substantial R&D investment and time to match capabilities. |

| Economies of Scale | Lower per-unit costs due to high production volumes and purchasing power (e.g., €323.4M revenue in 2023). | New entrants face cost disadvantages and struggle to compete on price. |

| Distribution & Customer Relationships | Established global networks and long-term, trust-based client partnerships. | Difficult and time-consuming for new players to penetrate and build comparable market access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Exel Composites is built upon a foundation of verified data, including the company's annual reports, investor presentations, and publicly available financial statements. We supplement this with insights from industry-specific market research reports and trade publications to capture a comprehensive view of the competitive landscape.