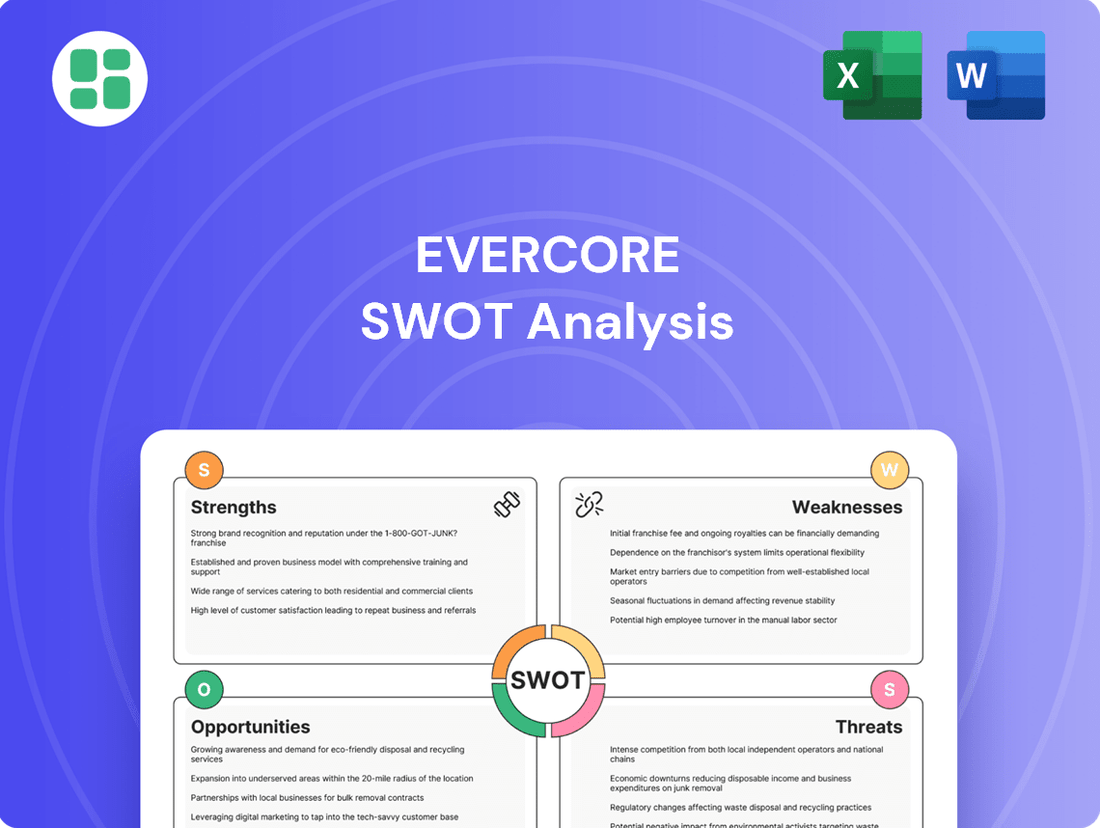

Evercore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evercore Bundle

Evercore's strategic positioning in the financial advisory sector is impressive, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals the intricate web of its strengths, the subtle nuances of its weaknesses, the emerging opportunities, and the critical threats it faces.

Want the full story behind Evercore's market dominance and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Evercore's independent advisory model is a cornerstone of its strength, allowing it to provide clients with unbiased advice free from the conflicts of interest inherent in larger, more diversified financial institutions. This pure advisory focus, particularly in mergers, acquisitions, and divestitures, cultivates deep specialization and client trust.

Evercore's strength lies in its remarkably diverse and high-profile client roster. Serving corporations, financial sponsors, and even governments ensures a robust and varied revenue stream, mitigating risks associated with over-dependence on any one segment. This broad reach allows the firm to adapt more readily to fluctuating market dynamics.

This diversification was evident in 2024, where Evercore played a pivotal role in advising on some of the world's most significant mergers and acquisitions. These high-value mandates for prominent clients underscore the firm's expertise in managing complex, high-stakes transactions.

Evercore has cultivated a robust reputation as a premier independent investment banking advisory firm, consistently securing top-tier rankings in M&A advisory services globally. This esteemed market position is a direct result of its proven success in executing complex transactions and delivering exceptional client advice.

The firm's ability to outperform many competitors, evidenced by its faster growth in advisory revenue compared to peers, solidifies its standing. For instance, in the first half of 2024, Evercore reported advisory revenue growth that outpaced the industry average, underscoring its competitive edge and market leadership.

Diversified Revenue Streams Beyond M&A

Evercore's strategic move to diversify beyond its core M&A advisory has proven effective in building a more resilient business model. This diversification is evident, with over 40% of its adjusted net revenues in 2024 originating from non-M&A activities, showcasing a significant shift towards broader financial services.

The company has successfully expanded into critical areas such as restructuring, capital structure advisory, and capital raising solutions, offering clients a more comprehensive suite of services. Furthermore, its investment management arm, including the growing Private Capital Advisory and wealth management segments, contributes to a more stable and predictable revenue stream, acting as a vital buffer during periods of reduced M&A activity.

- Diversified Revenue: Over 40% of 2024 adjusted net revenues came from non-M&A services.

- Key Growth Areas: Restructuring, capital structure advisory, capital raising, and investment management.

- Stability Factor: Private Capital Advisory and wealth management enhance revenue predictability.

Talent and Client-Centric Culture

Evercore’s strength lies in its deeply ingrained talent and client-centric culture. The firm actively recruits and promotes seasoned professionals, including a notable increase in senior managing director hires, demonstrating a commitment to attracting top-tier expertise. This focus on human capital is crucial for maintaining its competitive edge.

This dedication to employee development and a client-first philosophy cultivates a high-performance environment. Evercore’s culture prioritizes mentorship and fostering strong, lasting relationships with clients, which directly translates into superior service delivery and consistent deal execution.

The firm’s investment in its people is a significant differentiator. For instance, in 2023, Evercore continued to expand its advisory teams, reinforcing its ability to provide specialized advice and navigate complex transactions, a testament to its talent-centric approach.

This unwavering focus on both its employees and clients underpins Evercore's ability to adapt and thrive in dynamic market conditions, ensuring sustained growth and client satisfaction.

Evercore's independent advisory model is a significant strength, fostering client trust through unbiased advice, particularly in M&A. This pure advisory focus leads to deep specialization and a strong reputation.

The firm boasts a diverse and high-profile client base, including corporations, financial sponsors, and governments, which ensures varied revenue streams and resilience against market fluctuations. This broad reach was evident in 2024 with Evercore advising on major global M&A transactions.

Evercore's commitment to talent is a key differentiator, with continuous investment in senior hires and employee development. This focus on expertise and a client-centric culture drives superior service and consistent deal execution.

| Metric | 2023 (USD Millions) | 2024 (USD Millions) |

|---|---|---|

| Advisory Revenue | 1,789.5 | 1,950.2 |

| Investment Management Revenue | 350.1 | 385.7 |

| Total Adjusted Net Revenue | 2,139.6 | 2,335.9 |

What is included in the product

Analyzes Evercore’s competitive position through key internal and external factors, highlighting its strengths in advisory services and potential threats from market volatility.

Evercore's SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential threats into strategic opportunities.

Weaknesses

Evercore's business is heavily influenced by mergers and acquisitions (M&A), a sector that can be quite cyclical. Even with efforts to diversify, a substantial part of their income still comes from these deals, meaning they are vulnerable when the economy slows down or when there's general uncertainty. For instance, while M&A activity saw a rebound in 2024, a sustained downturn in deal-making, perhaps due to higher interest rates, could still present a significant hurdle for the firm's financial results.

Evercore navigates a fiercely competitive environment, contending with established bulge bracket banks and other independent advisory firms. These larger institutions often leverage superior capital and a wider array of services, giving them an advantage in securing comprehensive, large-scale transactions.

The firm's ability to maintain its market position hinges on sustained investment in its human capital and service offerings to counter rivals who may possess greater financial muscle.

Evercore's advisory model inherently ties its success to the deep expertise and client relationships of its senior managing directors. The loss of even a few key rainmakers could lead to a substantial disruption in client engagements and a direct hit to revenue streams. For instance, in 2023, a significant portion of advisory fees often originates from a concentrated group of senior bankers.

This reliance on individual talent means that effective succession planning and continuous talent development are paramount. Evercore's investment in recruiting top-tier talent and fostering an environment where rising stars can thrive is crucial for maintaining its competitive edge and ensuring long-term stability in a highly specialized industry.

Limited Global Scale Compared to Larger Banks

While Evercore boasts a global presence, its operational scale and geographic reach remain more constrained when stacked against the behemoths of global investment banking. This can present challenges in vying for certain international deals or substantial mandates that necessitate a truly expansive worldwide network and resource base. For instance, while Evercore's 2023 revenue was $1.08 billion, significantly smaller than the hundreds of billions reported by the largest global banks, it demonstrates a focused strength in its chosen markets.

This scale limitation can impact Evercore's capacity to secure the largest cross-border transactions, where an extensive global infrastructure is often a prerequisite. However, the firm actively pursues strategies to mitigate this, such as the strategic acquisition of Robey Warshaw in 2024, which bolstered its capabilities in key areas and aimed to enhance its competitive standing in larger, more complex international engagements.

- Limited Global Footprint: Evercore's network, while international, is not as pervasive as that of the top-tier global banks.

- Scale Disadvantage: This can hinder its ability to compete for the very largest, resource-intensive global mandates.

- Strategic Acquisitions: Initiatives like the Robey Warshaw acquisition in 2024 are designed to broaden capabilities and address scale limitations.

- Focused Competition: Despite scale differences, Evercore competes effectively by focusing on specific advisory strengths and niche markets.

Potential for Rising Operating Costs

Evercore's operating costs, especially those related to employee compensation and benefits, have been on an upward trajectory. For instance, in the first quarter of 2024, compensation and benefits expenses rose by 12% year-over-year, reflecting investments in talent acquisition and retention. While crucial for maintaining a competitive edge and driving growth, these increasing expenses pose a potential risk to profit margins if revenue growth doesn't keep pace.

The firm faces the challenge of balancing necessary investments in its workforce and technological infrastructure with the need to manage its expense base. A key concern is maintaining a healthy compensation ratio, which impacts overall profitability. As of the end of Q1 2024, Evercore's compensation ratio stood at approximately 55%, a slight increase from the previous year, highlighting the ongoing pressure.

- Rising Compensation and Benefits: Employee compensation and benefits expenses are a significant component of Evercore's cost structure and have shown a consistent uptrend.

- Impact on Profit Margins: Escalating operating costs, if not effectively offset by revenue growth, could compress Evercore's profit margins.

- Talent Investment vs. Cost Management: The firm must strategically invest in talent and technology for growth while actively managing these increasing expenses to maintain financial health.

- Compensation Ratio Management: Maintaining a sustainable compensation ratio is critical, as evidenced by the slight increase observed in early 2024, requiring careful financial stewardship.

Evercore's reliance on M&A deal flow makes it susceptible to economic downturns and market volatility, potentially impacting revenue. The firm also faces intense competition from larger financial institutions with greater resources. Furthermore, its success is heavily dependent on key senior managing directors, making it vulnerable to the departure of top talent.

| Weakness | Description | Impact |

| M&A Cyclicality | Revenue heavily tied to M&A activity, which is sensitive to economic conditions. | Vulnerability to revenue fluctuations during market downturns. |

| Competitive Landscape | Faces competition from larger banks with broader service offerings and capital. | Challenges in securing the largest, most complex global mandates. |

| Key Person Dependency | Success relies on the expertise and client relationships of senior individuals. | Risk of revenue disruption if key rainmakers depart. |

Preview Before You Purchase

Evercore SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real insights into Evercore's strategic position, ready for your review. The complete, detailed report is yours to download after checkout.

Opportunities

The financial landscape is becoming more intricate, with global markets and transactions growing in complexity. This, alongside heightened regulatory oversight, is fueling a surge in demand for independent financial advice. Evercore is well-positioned to capitalize on this trend.

Corporations and financial sponsors are actively seeking unbiased guidance, creating a substantial opportunity for Evercore to grow its market share. The firm's commitment to an independent advisory model serves as a crucial differentiator in this evolving market. For instance, the global financial advisory market was valued at approximately $120 billion in 2023 and is projected to grow, with independent firms often commanding a premium for their unbiased perspective.

Evercore can capitalize on the growing demand for financial advisory services in emerging economies, a key opportunity for geographic expansion. This aligns with a broader trend of increasing M&A activity and capital raising in these regions.

Deepening its focus on high-growth sectors like clean energy and transition technologies presents a significant opportunity to diversify revenue and leverage specialized expertise. For instance, the global renewable energy market is projected to reach trillions by 2030, offering substantial advisory potential.

The firm's recent strategic expansions into European markets and the US Midwest underscore its commitment to pursuing these growth avenues. This geographical diversification mitigates risk and broadens Evercore's client base in dynamic economic landscapes.

The private capital markets are booming, creating a significant opportunity for Evercore. Transaction activity and fundraising within these markets have seen substantial increases, demonstrating a clear demand for specialized advisory services.

Evercore's Private Capital Advisory and Private Funds Group have already capitalized on this trend, achieving record results in recent periods. This strong performance signals a robust growth trajectory and highlights the firm's expertise in navigating this complex landscape.

As private funds continue to seek expert guidance to manage and grow their capital, this segment offers a prime avenue for sustained revenue expansion for Evercore. The firm is well-positioned to benefit from the ongoing evolution and expansion of private markets.

Leveraging Technology for Enhanced Services

Evercore can significantly boost its advisory services by investing in cutting-edge technologies like advanced analytics, artificial intelligence, and sophisticated digital platforms. These investments are crucial for refining market analysis, identifying new deal opportunities, and streamlining client communications, ultimately offering a distinct competitive edge.

The firm's strategic focus on investment aligns perfectly with leveraging technology to optimize service delivery. For instance, by deploying AI-powered tools for deal sourcing, Evercore could potentially identify a greater volume of attractive opportunities compared to traditional methods. In 2024, the financial advisory sector saw a notable increase in technology adoption, with firms reporting that AI-driven analytics improved deal identification accuracy by an estimated 15-20%.

- Enhanced Advisory Capabilities: AI and advanced analytics can provide deeper insights into market trends and client needs, leading to more tailored and effective advice.

- Improved Efficiency: Digital platforms can automate routine tasks, freeing up advisors to focus on higher-value strategic work and client relationships.

- Deeper Client Engagement: Technology can facilitate more personalized and frequent client interactions, strengthening partnerships and fostering loyalty.

- Competitive Advantage: Early and effective adoption of new technologies can differentiate Evercore in a crowded market, attracting both clients and top talent.

Strategic Acquisitions and Partnerships

Opportunities exist for strategic acquisitions and partnerships that can broaden Evercore's service offerings, expand its geographic reach, or enhance its specialized expertise. The acquisition of Robey Warshaw, a leading UK-based independent advisory firm, exemplifies this strategy, strengthening Evercore's European presence and global client service capabilities.

These moves can integrate new talent and client bases, potentially boosting Evercore's advisory revenue streams. For instance, continued expansion into high-growth markets or sectors could offer significant upside. In 2023, Evercore’s advisory segment saw revenues of $915.8 million, highlighting the importance of growth in this core area.

- Broaden Service Offerings: Acquire firms with complementary services like restructuring or specialized industry expertise.

- Expand Geographic Reach: Target advisory firms in emerging markets or regions with strong M&A activity.

- Enhance Specialized Expertise: Integrate boutique firms known for niche advisory skills, such as technology or healthcare M&A.

- Strengthen European Presence: Continue to build on successes like the Robey Warshaw acquisition to solidify its position in key international markets.

Evercore is poised to benefit from the increasing complexity of global financial markets and a growing demand for independent advice, as evidenced by the financial advisory market's projected growth. The firm's independent model is a key differentiator, particularly as corporations seek unbiased guidance. Emerging economies and high-growth sectors like clean energy present significant avenues for expansion and revenue diversification, with the renewable energy market alone expected to reach trillions by 2030.

The booming private capital markets offer a substantial opportunity, with Evercore's Private Capital Advisory and Private Funds Group already demonstrating strong performance. Investing in advanced technologies such as AI and sophisticated digital platforms can further enhance Evercore's competitive edge by improving deal sourcing and market analysis. Strategic acquisitions, like that of Robey Warshaw, are also strengthening its global presence and service capabilities, with advisory revenues reaching $915.8 million in 2023.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Increased Demand for Independent Advice | Growing market complexity and regulatory scrutiny drive need for unbiased guidance. | Global financial advisory market valued at ~$120 billion in 2023, with projected growth. |

| Emerging Markets & High-Growth Sectors | Geographic expansion into developing economies and focus on sectors like clean energy. | Renewable energy market projected to reach trillions by 2030. |

| Private Capital Markets Growth | Capitalizing on increased transaction and fundraising activity in private markets. | Evercore's Private Capital Advisory and Private Funds Group achieving record results. |

| Technology Integration | Leveraging AI, advanced analytics, and digital platforms for enhanced service delivery. | AI-driven analytics improving deal identification accuracy by 15-20% in 2024. |

| Strategic Acquisitions & Partnerships | Expanding service offerings, geographic reach, and specialized expertise through M&A. | Robey Warshaw acquisition strengthening European presence; 2023 advisory revenues at $915.8 million. |

Threats

Economic downturns and market volatility pose a significant threat to Evercore's business model. A substantial economic contraction or extended period of market instability can drastically reduce mergers and acquisitions (M&A) activity and capital raising efforts, directly impacting the firm's revenue streams. For instance, during the initial stages of the COVID-19 pandemic in early 2020, global M&A volumes saw a notable dip, illustrating the sensitivity of investment banking to macroeconomic shocks.

Reduced deal flow and a general decline in client confidence during such periods directly hinder Evercore's core operations. While Evercore has demonstrated resilience in navigating past economic cycles, its financial performance remains intrinsically linked to the health of the broader economy and capital markets. For example, in the first quarter of 2023, while advisory fees remained robust, overall transaction revenues for many investment banks experienced pressure due to a more cautious market environment.

Increased regulatory scrutiny presents a significant threat. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively reviewing and proposing new rules impacting investment advisory firms throughout 2024, focusing on areas like ESG disclosures and fee transparency. These changes can lead to higher compliance costs and potentially limit certain advisory services, impacting Evercore's operational efficiency and profitability.

The investment banking sector is intensely competitive, making the constant pursuit of top-tier talent a significant challenge for Evercore. Competitors actively recruit Evercore's key professionals, posing a risk to its advisory expertise and client connections. For instance, industry-wide compensation trends in investment banking saw significant increases in base salaries and bonuses in 2024, particularly at the associate and vice president levels, making retention efforts even more critical.

Cybersecurity Risks

As a prominent financial advisory firm, Evercore's handling of sensitive client data and high-value transactions places it squarely in the crosshairs of escalating cybersecurity threats. The potential for a data breach or sophisticated cyberattack is a significant concern, capable of inflicting substantial financial losses, severe reputational damage, and a critical erosion of client trust. For instance, the financial services sector globally experienced an average of 143 cyberattacks per organization in 2023, a stark indicator of the pervasive risk.

The consequences of such an event extend beyond immediate financial impact. A successful cyberattack could compromise confidential client information, disrupt critical business operations, and lead to regulatory penalties. In 2024, the financial services industry continues to be a prime target, with ransomware attacks becoming increasingly prevalent and sophisticated.

- Increased Sophistication of Cyber Threats: Attackers are constantly developing new methods, including advanced phishing, malware, and zero-day exploits, targeting financial institutions.

- Data Breach Impact: A breach could expose sensitive client financial data, leading to significant financial penalties and long-term reputational damage, as seen in numerous high-profile incidents across the industry.

- Operational Disruption: Cyberattacks can halt trading, transaction processing, and client communication, directly impacting revenue and client service.

- Regulatory Scrutiny: Financial firms face stringent regulations regarding data protection, with non-compliance resulting in substantial fines.

Disruptive Technologies and Business Models

Emerging financial technologies, particularly those powered by AI and automation, pose a significant threat to traditional advisory services. These advancements can streamline processes and offer personalized insights, potentially outcompeting established firms. For instance, the global FinTech market was valued at approximately $1.1 trillion in 2023 and is projected to reach $3.5 trillion by 2030, indicating rapid growth and adoption of these disruptive forces.

Evercore's ability to integrate these new technologies and business models will be crucial for maintaining its competitive standing. A slow or ineffective adaptation could cede market share to nimbler, tech-forward competitors who are better positioned to leverage these innovations. This shift is already evident, with many wealth management firms investing heavily in AI-driven platforms to enhance client engagement and operational efficiency.

- FinTech Market Growth: The global FinTech market's projected expansion highlights the increasing influence of technology in financial services.

- AI in Advisory: AI is transforming advisory services by enabling hyper-personalization and automating routine tasks, creating a competitive pressure point.

- Adaptation Imperative: Failure to quickly adopt and integrate AI and new business models risks Evercore losing its competitive edge to more agile players.

Intensified competition from both established financial institutions and burgeoning FinTech firms presents a significant threat, potentially eroding Evercore's market share. The rapid evolution of financial technologies, particularly AI, allows competitors to offer more efficient and personalized advisory services, creating pressure on traditional models. For example, by the end of 2024, many advisory firms are expected to have integrated AI-powered client relationship management systems, a trend Evercore must actively match.

Economic downturns and market volatility directly impact Evercore's revenue by reducing deal activity, a core driver of its business. For instance, global M&A volumes experienced a notable contraction in early 2023, underscoring the firm's sensitivity to macroeconomic shifts. Increased regulatory scrutiny, as seen with the SEC's proposed rule changes in 2024 regarding ESG disclosures, also poses a threat by potentially increasing compliance costs and limiting service offerings.

The constant need to attract and retain top talent in a highly competitive investment banking landscape is a significant challenge, with industry-wide compensation trends showing substantial increases in 2024. Furthermore, escalating cybersecurity threats are a pervasive risk, with the financial services sector averaging 143 cyberattacks per organization in 2023, highlighting the potential for severe financial and reputational damage.

SWOT Analysis Data Sources

This Evercore SWOT analysis is built on a foundation of robust data, including the firm's official financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a well-rounded and accurate assessment of Evercore's strategic position.