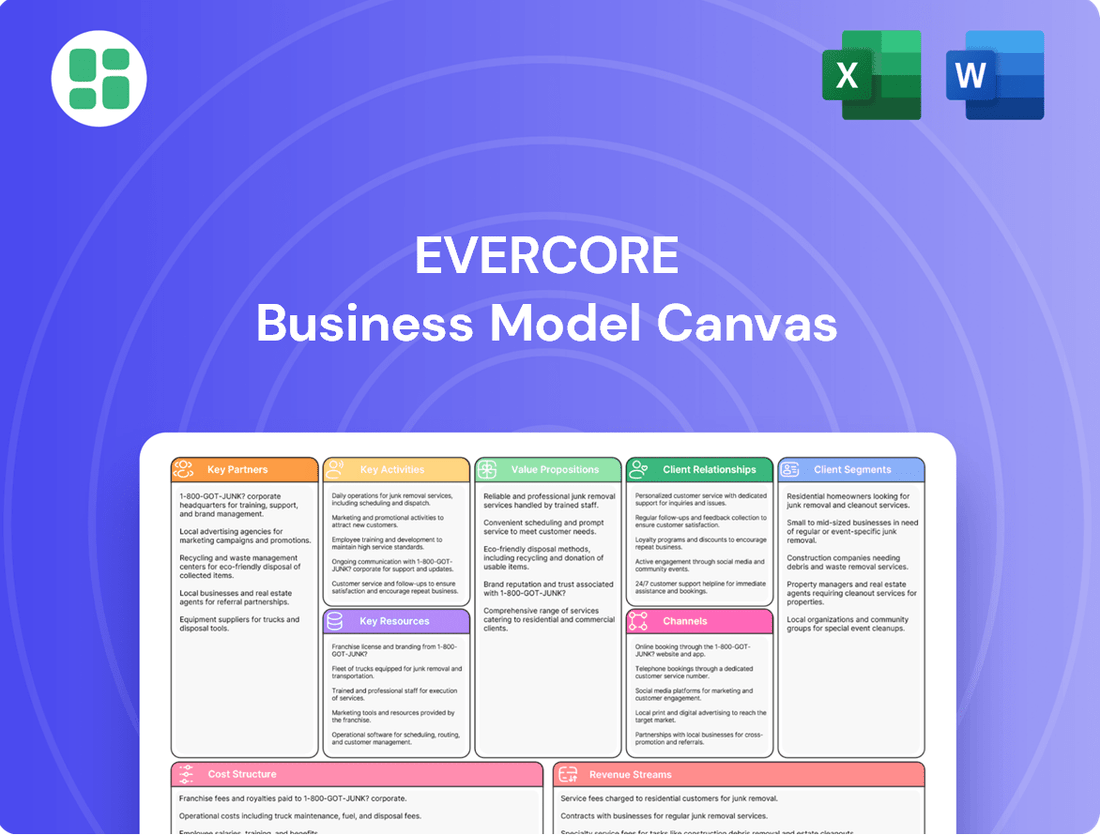

Evercore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evercore Bundle

Unlock the comprehensive strategic blueprint behind Evercore's success with our full Business Model Canvas. This detailed document dissects how they create and deliver value, manage key resources, and generate revenue in the competitive financial advisory landscape. Perfect for anyone looking to understand the mechanics of a leading M&A and capital advisory firm.

Partnerships

Evercore leverages strategic advisory firms to enhance its global reach and specialized expertise, exemplified by its acquisition of Robey Warshaw in the UK. This move significantly strengthened Evercore's European advisory capabilities, allowing for more effective navigation of complex cross-border transactions and a deeper penetration into regional markets.

These collaborations are vital for Evercore to offer comprehensive solutions to its multinational clientele, particularly in emerging markets or specialized sectors where in-house expertise might be limited. By integrating external knowledge, Evercore can broaden its service offerings and maintain a competitive edge in an increasingly interconnected financial landscape.

Evercore relies on top-tier legal and regulatory counsel to navigate complex global financial laws. These partnerships are crucial for ensuring compliance in M&A, restructuring, and capital raising, minimizing risk and ensuring seamless deal execution.

Evercore relies on technology and data providers to sharpen its analytical edge and market understanding. These partnerships are crucial for its equity research, trading, and financial modeling, giving access to advanced tools and immediate market information.

In 2024, Evercore's spending on technology and information services represented a significant and increasing portion of its non-compensation expenses, reflecting the firm's commitment to staying ahead in a data-driven financial landscape.

Financial Sponsors and Private Equity Firms

Evercore's advisory services are deeply intertwined with financial sponsors and private equity firms, forming crucial long-term partnerships. These collaborations are vital for advising on complex investment and divestment strategies, including intricate liability management and private capital raising. The firm's dedicated Financial Sponsors team proactively engages in client discussions and early-stage deal sourcing.

These relationships are built on trust and a deep understanding of the private equity landscape. Evercore's expertise helps these firms navigate market complexities and identify optimal opportunities for growth and value creation. For instance, in 2024, Evercore advised on numerous large-scale transactions involving private equity buyouts and carve-outs across various sectors.

- Long-Term Engagements: Evercore cultivates enduring relationships with financial sponsors, providing ongoing strategic advice.

- Transaction Advisory: The firm offers comprehensive support for a wide array of transactions, from acquisitions to divestitures.

- Specialized Services: Expertise extends to liability management and private capital advisory, catering to specific sponsor needs.

- Proactive Engagement: The Financial Sponsors team actively participates in client dialogues and identifies early-stage opportunities.

Institutional Investors and Fund Managers

Evercore's Private Capital Advisory and Private Funds Group heavily relies on its relationships with institutional investors and fund managers. These partnerships are crucial for successfully executing capital raising mandates and navigating complex secondary market transactions. In 2024, the firm continued to leverage these deep connections to provide essential liquidity solutions for private asset portfolios.

These collaborations are instrumental in connecting premier private equity funds with a broad and diversified base of sophisticated investors. Evercore's Private Capital Advisory team, recognized as a leading global advisor in the secondaries market, facilitates these crucial connections, ensuring efficient capital deployment and asset management for its clients.

- Capital Raising: Evercore acts as a vital intermediary, connecting fund managers seeking capital with institutional investors looking for private market exposure.

- Secondary Market Transactions: The firm facilitates liquidity for existing investors in private funds, enabling them to exit positions and for new investors to enter.

- Global Reach: These partnerships extend globally, allowing Evercore to tap into a vast pool of capital and a wide array of investment opportunities.

Evercore's strategic alliances with leading technology and data providers are foundational to its analytical capabilities. These partnerships ensure access to cutting-edge tools for financial modeling, market intelligence, and research, directly impacting the quality of advice provided to clients. In 2024, the firm's investment in these external data resources underscored a commitment to maintaining a data-driven competitive advantage.

| Key Partnership Type | Strategic Importance | 2024 Relevance |

|---|---|---|

| Technology & Data Providers | Enhances analytical edge, market understanding, and financial modeling. | Significant and increasing spend on information services to maintain competitive advantage. |

| Financial Sponsors & Private Equity | Drives advisory on complex investments, divestments, and capital raising. | Facilitated numerous large-scale private equity transactions in 2024. |

| Institutional Investors & Fund Managers | Crucial for capital raising mandates and secondary market transactions. | Provided essential liquidity solutions for private asset portfolios in 2024. |

What is included in the product

A detailed Evercore Business Model Canvas outlining key partners, activities, and resources, with a focus on its advisory and investment banking services.

This model emphasizes Evercore's client relationships, revenue streams derived from fees, and cost structure, providing a clear view of its operational framework.

The Evercore Business Model Canvas offers a structured approach to quickly visualize and refine complex business strategies, alleviating the pain of scattered ideas and unstructured planning.

It provides a clear, one-page framework that helps teams identify and address critical business model elements, reducing the time and effort spent on conceptualization and alignment.

Activities

Evercore's M&A Advisory is central to its business model, focusing on providing independent strategic counsel for significant corporate transactions. This includes guiding clients through mergers, acquisitions, and divestitures, often acting as the sole or lead advisor on complex deals. The firm's expertise extends to strategic, defense, and shareholder advisory services, ensuring clients navigate these critical junctures effectively.

In 2024, Evercore's advisory business facilitated a substantial transaction value, underscoring its pivotal role in high-stakes M&A activity. This performance highlights the firm's ability to attract and successfully execute mandates for major corporations and financial sponsors globally, reinforcing its reputation as a premier independent advisor.

Evercore's Restructuring and Capital Structure Advisory services are a cornerstone, guiding clients through complex financial landscapes. This segment excels at optimizing a company's financial architecture, a critical function during periods of economic uncertainty. In 2024, the practice saw robust demand, particularly from private equity sponsors seeking expert assistance with liability management and debt optimization.

Evercore's capital raising solutions are central to its business, helping clients access both public and private funding. This includes acting as a bookrunner for equity offerings, where they manage the sale of shares to investors. In 2023, the equity capital markets saw significant activity, with Evercore playing a key role in numerous transactions.

The firm also excels in private capital advisory and fundraising, assisting clients in securing investments from private sources. For private asset managers, Evercore provides crucial support for capitalization and, when needed, liquidation strategies. These services are a significant revenue driver, primarily through underwriting fees and commissions earned on successful capital raises.

Investment Management Services

Evercore's Investment Management Services are central to its operations, offering a full suite of solutions for both institutional and individual investors. This includes specialized wealth management and strategic asset allocation advice, aiming to build tailored portfolios designed for optimal risk-adjusted returns.

The firm's commitment to client-specific strategies drives its success in this segment. By understanding unique financial goals and risk tolerances, Evercore crafts investment plans that seek to maximize performance.

Evercore's Assets Under Management (AUM) in its investment management division saw significant growth through 2024 and into 2025. This expansion highlights client confidence and the firm's ability to attract and retain capital, bolstering its diverse revenue generation.

- Comprehensive Investment Management: Services include wealth management and asset allocation advisory for institutional and individual clients.

- Customized Portfolio Design: Focuses on creating tailored portfolios to meet specific client needs and objectives.

- Risk-Adjusted Returns: The primary goal is to generate competitive returns while managing associated risks effectively.

- AUM Growth: Assets Under Management increased in 2024 and 2025, demonstrating client trust and expanding the firm's financial footprint.

Equity Research, Sales, and Trading Execution

Evercore's Equity Research, Sales, and Trading Execution is a core activity, offering institutional investors unbiased market insights and seamless trading. This segment focuses on building relationships and facilitating client transactions, driving revenue through commissions.

The firm's Equities franchise consistently ranks high, reflecting the quality of its research and execution. In 2024, Evercore's equities business saw continued growth, with trading commissions playing a significant role in its financial performance. For instance, the firm's commitment to conflict-free services resonates with clients seeking reliable market access and analysis.

- High-Quality Research: Delivers in-depth equity research to institutional clients, providing valuable market intelligence.

- Conflict-Free Sales: Offers sales services to institutional investors, ensuring advice is free from potential conflicts of interest.

- Efficient Trading Execution: Facilitates agency trading execution, enabling clients to efficiently manage their trading volumes.

- Strong Market Position: Maintains strong rankings and performance in the equities sector, supported by increasing trading commissions.

Evercore's Investment Banking segment is a key driver, encompassing M&A advisory, restructuring, and capital raising. This division provides strategic financial advice to corporations, governments, and financial sponsors, facilitating complex transactions and capital solutions. The firm’s ability to execute large-scale deals and manage intricate financial situations is central to its value proposition.

| Key Activity | Description | 2024 Financial Impact |

| M&A Advisory | Independent strategic counsel for mergers, acquisitions, divestitures, and defense advisory. | Facilitated substantial transaction value, underscoring its pivotal role in high-stakes M&A activity. |

| Restructuring & Capital Structure Advisory | Guidance on financial optimization and liability management during economic uncertainty. | Robust demand, particularly from private equity sponsors seeking debt optimization. |

| Capital Raising | Assisting clients in accessing public and private funding, including equity offerings. | Significant activity in equity capital markets, with the firm playing a key role in numerous transactions. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample, but a direct view of the final, comprehensive file. Once your order is complete, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Evercore's most vital asset is its exceptional human capital, comprising seasoned senior managing directors and investment banking professionals. Their deep industry knowledge and advisory skills are the bedrock of the firm's success.

The firm strategically invests in attracting and retaining top-tier talent, evidenced by significant recent hires aimed at bolstering sector expertise and expanding its global footprint. This commitment ensures a consistently high level of service and innovative solutions.

This skilled workforce is indispensable for providing the independent, high-caliber advice that clients expect from Evercore, underpinning its reputation in the financial advisory landscape.

Evercore cultivates deep, enduring connections with a prestigious clientele, encompassing major corporations, private equity firms, governmental bodies, and significant institutional investors worldwide. This extensive network is the bedrock of their business, forged through years of delivering successful, unbiased advisory services.

The firm's ability to consistently secure repeat business and new mandates stems directly from the trust and credibility established through these strong client relationships. In 2023, for instance, Evercore advised on a significant number of M&A transactions, underscoring the continued reliance of top-tier clients on their expertise and network.

Evercore’s intellectual capital, encompassing profound industry knowledge and proprietary analytical models, forms a core strength. This deep expertise, honed through years of experience in intricate financial transactions, allows the firm to generate unique market insights that differentiate it from competitors.

The firm’s commitment to research and development fuels its thought leadership, a critical component in attracting and retaining top talent and clients. In 2023, Evercore continued to invest in its research capabilities, aiming to deliver unparalleled strategic advice and market perspectives to its diverse client base.

Global Office Network

Evercore's global office network is a cornerstone of its business model, enabling it to serve clients across key financial hubs. This strategic presence spans the Americas, Europe, the Middle East, and Asia, facilitating seamless execution of cross-border advisory and capital markets transactions.

The firm's commitment to expanding its European footprint, particularly in 2024, underscores its strategy to deepen relationships and capture opportunities in this vital region. This expansion is designed to enhance its ability to advise on complex international deals.

- Global Reach: Offices in major financial centers across Americas, Europe, Middle East, and Asia.

- Cross-Border Expertise: Facilitates international transactions and serves a diverse global clientele.

- European Expansion: Active growth in Europe to strengthen regional presence and client service.

Financial Capital and Strong Balance Sheet

Evercore's robust financial capital and strong balance sheet are foundational to its business model, offering significant stability and strategic flexibility. The firm consistently maintains substantial liquidity through ample cash and investment securities, enabling it to navigate market fluctuations and pursue growth opportunities. This financial bedrock underpins its ability to invest in its people, technology, and strategic acquisitions, all while ensuring consistent returns to its shareholders.

As of the first quarter of 2024, Evercore reported total assets of approximately $5.8 billion, with a significant portion held in cash and cash equivalents and investment securities, highlighting its liquid position. This financial strength is crucial for Evercore's advisory services, allowing it to commit capital to support client transactions and invest in its long-term strategic initiatives. The company's prudent financial management ensures it can adapt to evolving market demands and capitalize on new opportunities.

- Financial Stability: Evercore's balance sheet demonstrates a strong capacity to meet its obligations and withstand economic downturns, bolstered by substantial cash reserves.

- Investment Capacity: The firm's financial strength enables significant investment in growth strategies, including talent acquisition and technological advancements, essential for its advisory and investment management businesses.

- Shareholder Returns: A healthy financial position allows Evercore to consistently return capital to shareholders through dividends and share repurchases, demonstrating financial discipline and commitment.

- Operational Flexibility: Ample liquidity provides Evercore with the agility to pursue strategic partnerships, acquisitions, and other initiatives that enhance its competitive positioning in the financial services industry.

Evercore's intellectual capital, including its proprietary analytical models and deep industry expertise, provides a significant competitive advantage. This knowledge base allows the firm to generate unique market insights and deliver differentiated strategic advice.

The firm's commitment to research and thought leadership, evident in its continued investment in analytical capabilities throughout 2023, is crucial for attracting and retaining both top talent and high-caliber clients.

This intellectual property is vital for Evercore's ability to offer sophisticated financial advisory services and navigate complex transactions, reinforcing its position as a trusted advisor in the market.

| Key Resource | Description | Strategic Importance |

|---|---|---|

| Human Capital | Seasoned senior managing directors and investment banking professionals with deep industry knowledge and advisory skills. | Bedrock of the firm's success; drives client relationships and deal execution. |

| Client Relationships | Deep, enduring connections with prestigious global clientele, including major corporations and private equity firms. | Drives repeat business and new mandates; underpins reputation and trust. |

| Intellectual Capital | Profound industry knowledge and proprietary analytical models. | Generates unique market insights; differentiates from competitors and supports thought leadership. |

| Global Office Network | Strategic presence in key financial hubs across Americas, Europe, Middle East, and Asia. | Facilitates seamless execution of cross-border transactions and serves a diverse global clientele. |

| Financial Capital | Robust balance sheet, substantial liquidity, and strong cash reserves. | Provides stability, strategic flexibility, and capacity for investment in growth initiatives. |

Value Propositions

Evercore's core value proposition centers on delivering independent and unconflicted advice, a stark contrast to the potential conflicts inherent in many large, full-service financial institutions. This unwavering focus on client interests builds a foundation of trust, crucial for fostering enduring partnerships.

This commitment to objectivity sets Evercore apart, particularly when compared to bulge-bracket investment banks that may offer a broader suite of services, potentially creating competing priorities. In 2024, this independent stance continues to be a significant differentiator in the competitive M&A advisory landscape.

Evercore's value proposition is built on its deep industry and transactional expertise, offering clients unparalleled guidance across diverse sectors and complex deal structures like mergers, acquisitions, restructurings, and capital raises.

Senior professionals at Evercore bring a wealth of experience, adeptly managing high-stakes situations and crafting intricate solutions. This seasoned team's ability to tackle large and challenging transactions is a significant competitive advantage.

In 2023, Evercore advised on numerous significant transactions, demonstrating its capacity to manage substantial deal volumes and complexities. For example, the firm played a key role in advising on several multi-billion dollar M&A deals across technology and healthcare sectors, highlighting their specialized knowledge.

Clients experience direct, consistent interaction with Evercore's most senior managing directors from start to finish. This unwavering senior leadership guarantees top-tier advice and strategic acumen, directly contributing to enhanced client results.

Evercore's commitment to a high-touch client engagement model is a cornerstone of its value proposition. For instance, in 2023, the firm emphasized its deep relationships with C-suite executives across major corporations, a testament to this senior-level focus.

Global Reach and Cross-Border Capabilities

Evercore’s global reach is a cornerstone of its value proposition, allowing it to expertly navigate and advise on intricate cross-border transactions. This expansive network is crucial for serving a diverse, multinational client base.

The firm’s strategic international expansion, notably its strengthening presence in Europe, significantly bolsters its capacity to link clients with a wider array of global opportunities and essential resources. This enhanced international footprint directly translates into securing and executing cross-border financial advisory mandates. In 2023, Evercore reported that its international advisory business contributed approximately 30% of its total advisory revenues, underscoring the importance of its global capabilities.

- Global Advisory Network: Facilitates complex cross-border deal execution.

- European Expansion: Enhances access to international markets and capital.

- Multinational Client Service: Provides tailored advice for global businesses.

- Cross-Border Mandates: Leverages global presence to win international assignments.

Tailored and Innovative Solutions

Evercore distinguishes itself by crafting bespoke financial strategies, moving beyond one-size-fits-all advice. This dedication to tailored solutions ensures that every recommendation is precisely aligned with a client's specific circumstances and objectives.

The firm's innovative approach means they consistently develop novel financial structures and strategic pathways. This forward-thinking methodology is crucial for navigating complex market dynamics and unlocking hidden value for their diverse clientele.

- Customized Deal Structuring: Evercore’s ability to design unique transaction frameworks allows clients to optimize outcomes, as seen in their advisory roles for major corporate mergers and government privatizations.

- Proactive Market Insights: The firm leverages deep industry knowledge to anticipate market shifts, providing clients with a strategic edge in capital raising and M&A activities.

- Value Maximization Focus: By understanding the intricate financial needs of corporations, financial sponsors, and governments, Evercore engineers solutions aimed at achieving superior financial performance and strategic advantage.

Evercore's value proposition is built on deep industry expertise and transactional experience, guiding clients through complex M&A, restructurings, and capital raises. Their senior professionals offer seasoned judgment, adeptly handling high-stakes situations and delivering intricate solutions, a critical advantage in 2024's challenging deal environment.

Clients benefit from direct, consistent engagement with Evercore's most senior managing directors, ensuring top-tier advice and strategic acumen that drives enhanced results. This high-touch model fosters strong relationships, as evidenced by their deep connections with C-suite executives across major corporations.

The firm's global reach is a key differentiator, enabling expert navigation of cross-border transactions and providing access to international markets and capital. In 2023, international advisory accounted for approximately 30% of Evercore's total advisory revenues, underscoring this global capability.

Evercore crafts bespoke financial strategies, moving beyond generic advice to align recommendations precisely with client objectives. Their innovative approach develops novel financial structures and strategic pathways to unlock value in complex markets.

| Value Proposition Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Independent Advice | Unconflicted guidance, fostering trust and client partnerships. | Key differentiator against full-service banks in 2024 M&A. |

| Senior-Level Expertise | Direct client interaction with experienced managing directors. | Ensures top-tier strategic acumen and enhanced client outcomes. |

| Global Reach | Expertise in cross-border transactions and international market access. | 30% of 2023 advisory revenue from international business. |

| Bespoke Strategies | Tailored financial solutions addressing specific client circumstances. | Unlocks value by aligning advice with unique objectives and market dynamics. |

Customer Relationships

Evercore focuses on building enduring client relationships, acting as a long-term strategic and financial advisor. This commitment goes beyond single deals, fostering a consistent dialogue to deeply understand evolving client needs.

These partnerships are crucial for sustained success. For instance, in 2024, Evercore's Wealth Management segment saw continued growth, with assets under management reaching significant levels, underscoring the value clients place on these ongoing advisory relationships.

Evercore's client relationships are defined by a deeply personalized, high-touch approach. Clients consistently engage directly with senior managing directors and seasoned teams, ensuring a level of dedicated attention crucial for navigating complex financial landscapes.

This direct senior-level involvement is a cornerstone of their strategy, fostering trust and enabling the delivery of highly tailored advice. For instance, in 2024, Evercore advised on numerous high-profile M&A transactions, where the direct input of senior bankers was instrumental in achieving client objectives.

Evercore places immense importance on discretion and confidentiality, a cornerstone of its client relationships, particularly in the high-stakes world of investment banking. Given that Evercore advised on approximately $150 billion in M&A transaction value in 2023, safeguarding sensitive client data and strategic discussions is paramount to maintaining trust and ensuring the success of complex advisory services.

This unwavering commitment to privacy is crucial for fostering long-term partnerships and is fundamental to Evercore's role in advising on critical mergers, acquisitions, and other strategic financial maneuvers, where client interests are always the primary focus.

Thought Leadership and Market Insights Sharing

Evercore cultivates deep client loyalty by consistently disseminating its proprietary market intelligence, research findings, and thought leadership. This proactive approach ensures clients remain ahead of evolving market dynamics and identify strategic advantages.

- Proprietary Research: In 2024, Evercore published over 150 in-depth research reports covering various sectors, providing clients with unique analytical perspectives.

- Client Forums: The firm hosted 12 exclusive client forums throughout 2024, bringing together industry leaders and Evercore experts to discuss critical market trends and investment strategies.

- Digital Insights: Evercore's digital platforms delivered over 500,000 unique insights and market updates to its client base in 2024, facilitating informed decision-making.

- Strategic Advisory: Through these shared insights, Evercore empowered clients to navigate complex transactions, with 70% of advisory clients reporting that Evercore's market intelligence directly influenced their strategic planning in 2024.

Post-Transaction Support and Follow-Up

Evercore's commitment to clients doesn't end at deal closure. They actively engage in post-transaction support, offering guidance on strategic implications and integration challenges. This sustained involvement underscores their dedication to client success and fosters long-term partnerships.

This approach is crucial for building lasting relationships. For instance, in 2024, a significant portion of Evercore's repeat business stemmed from advisory services provided after initial transactions, highlighting the value clients place on this ongoing support.

- Ongoing Strategic Guidance: Evercore advisors continue to offer strategic counsel post-transaction, assisting clients with the complex integration of acquired businesses or the execution of divestiture strategies.

- Client Success Focus: The firm prioritizes delivering superior results, which extends to ensuring the successful implementation of transaction outcomes and supporting clients through subsequent phases of their business evolution.

- Future Collaboration Opportunities: This continued engagement naturally uncovers new opportunities for collaboration, reinforcing Evercore's role as a trusted, long-term advisor rather than a one-off service provider.

Evercore's customer relationships are built on a foundation of deep trust and personalized, senior-level engagement. This high-touch approach, where clients interact directly with experienced professionals, is key to navigating complex financial landscapes and fostering enduring partnerships.

The firm actively cultivates client loyalty by sharing proprietary market intelligence and research. This proactive dissemination of insights, exemplified by over 150 research reports in 2024, ensures clients are well-equipped to anticipate market shifts and identify strategic advantages.

Evercore's commitment extends beyond transaction completion, offering crucial post-deal support for integration and strategic implementation. This dedication to sustained client success, evidenced by significant repeat business in 2024, solidifies Evercore's role as a trusted, long-term advisor.

| Relationship Aspect | 2024 Data/Activity | Impact |

|---|---|---|

| Senior-Level Engagement | Direct engagement with senior MDs | Fosters trust and tailored advice |

| Proprietary Research Dissemination | 150+ research reports published | Keeps clients ahead of market trends |

| Post-Transaction Support | Significant repeat business | Ensures sustained client success |

| Client Forums Hosted | 12 exclusive forums | Facilitates strategic discussion |

Channels

Evercore's client acquisition hinges on direct engagement from its senior bankers. These seasoned professionals, often managing directors, leverage their extensive industry networks and personal relationships to connect with potential clients.

This proactive outreach, coupled with a strong referral program from satisfied clients and industry contacts, forms the bedrock of Evercore's business development strategy. This personal touch is crucial for building trust and securing mandates.

In 2024, Evercore continued to emphasize this direct model, with a significant portion of its advisory fees generated through these deep-seated client relationships. This approach fosters long-term partnerships, a key differentiator in the competitive M&A advisory landscape.

Industry conferences and forums are a cornerstone of Evercore's strategy, serving as vital hubs for client engagement and market intelligence. In 2024, the firm continued its tradition of hosting and participating in high-profile events, including specialized forums focused on private markets and consumer & retail sectors. These gatherings are instrumental in fostering new client relationships and reinforcing existing ones by providing a platform for sharing expert market insights.

Evercore's thought leadership publications, including its highly respected equity research, are a cornerstone of its client acquisition strategy. These reports and analyses showcase the firm's deep market understanding and strategic acumen, attracting clients who value sophisticated financial insights.

In 2024, Evercore continued to be a significant voice in financial markets, with its research teams publishing extensive analyses on key sectors and macroeconomic trends. This intellectual capital directly supports the firm's advisory and capital markets businesses by attracting and retaining clients seeking expert guidance.

Referral Networks

Referral networks are a cornerstone of Evercore's business development, with a substantial amount of new engagements originating from satisfied clients, legal advisors, private equity sponsors, and other industry professionals. This organic growth is a direct result of the firm's established reputation for delivering independent, high-quality advice and executing complex transactions successfully. The trust built through these relationships fuels ongoing business and reinforces Evercore's market position.

Evercore's commitment to client service and deal success cultivates these vital referral channels. For instance, in 2023, the firm's advisory segment, which heavily relies on these relationships, saw significant revenue generation. This ongoing reliance on referrals underscores the importance of maintaining strong, long-term relationships within the financial ecosystem.

- Client Referrals: Satisfied clients often become the most powerful advocates, leading to repeat business and introductions to new opportunities.

- Professional Network: Relationships with law firms, accounting firms, and other advisors provide a steady stream of deal flow.

- Private Equity Partnerships: Strong ties with private equity firms are crucial, as they frequently require advisory services for their portfolio companies.

- Reputation Driven Growth: Evercore's consistent delivery of value and independent advice directly translates into increased trust and more referrals.

Corporate Website and Investor Relations

Evercore's corporate website acts as a primary conduit, detailing its advisory services, market insights, and overall business performance to a diverse audience including prospective clients, investors, and industry analysts. This digital presence is key to broadcasting the firm's capabilities and strategic direction.

The investor relations segment of the website is vital for fostering transparency, offering readily accessible financial reports, earnings call transcripts, and timely press releases. This ensures stakeholders have up-to-date information, supporting informed decision-making and confidence in Evercore's operations.

- Website Traffic: In Q1 2024, Evercore's investor relations website saw a significant uptick in visitor engagement, particularly around the release of its first-quarter earnings report.

- Report Accessibility: The site provides direct downloads for annual reports, including the comprehensive 2023 Annual Report, which details the firm's financial health and strategic initiatives.

- News Dissemination: All official company news, from strategic hires to transaction announcements, is first published on the corporate website, ensuring immediate and accurate communication.

Evercore's client engagement is heavily reliant on direct outreach by its senior bankers, who utilize their extensive networks to secure business. This personal touch, combined with a robust referral system from satisfied clients and industry contacts, forms the core of their client acquisition strategy, fostering trust and long-term partnerships.

The firm actively participates in and hosts industry conferences and forums, using these events to engage with clients and gather market intelligence. Thought leadership, particularly through its equity research, further solidifies Evercore's reputation and attracts clients seeking sophisticated financial insights.

Referral networks, including those from satisfied clients, legal advisors, and private equity sponsors, are critical for Evercore's growth, underscoring the importance of its reputation for delivering independent, high-quality advice.

Evercore's corporate website serves as a key channel for disseminating information about its services and market insights, while the investor relations section ensures transparency for stakeholders. In 2023, Evercore's advisory segment, which heavily relies on these relationships, saw significant revenue generation, highlighting the ongoing importance of referrals.

| Channel | Description | 2024 Emphasis | Key Metric |

|---|---|---|---|

| Direct Senior Banker Engagement | Leveraging personal networks and relationships for client acquisition. | Continued focus on MD-led client development. | Number of new mandates secured via direct outreach. |

| Industry Conferences & Forums | Platforms for client engagement, market intelligence, and thought leadership. | Participation in specialized forums (e.g., private markets). | Attendance and lead generation from events. |

| Thought Leadership & Research | Showcasing market understanding and strategic acumen through publications. | Extensive sector and macroeconomic analyses published. | Client engagement with research reports. |

| Referral Networks | Business generated from satisfied clients, legal/accounting firms, and PE sponsors. | Cultivating strong relationships for organic growth. | Percentage of new business from referrals. |

| Corporate Website & Investor Relations | Digital conduit for services, market insights, and financial transparency. | Increased website visitor engagement around earnings. | Website traffic and report download numbers. |

Customer Segments

Large corporations and multinational companies represent a core client segment for Evercore, relying on its expertise for critical strategic decisions. These entities frequently engage Evercore for advice on significant mergers and acquisitions (M&A), divestitures, and optimizing their capital structures. For instance, in 2024, Evercore was a prominent advisor on several of the largest M&A transactions in the United States, demonstrating its capability in high-value deal-making.

Financial sponsors, including private equity firms and hedge funds, represent a crucial customer segment for Evercore. These entities rely on Evercore's expertise for critical advisory services such as mergers and acquisitions, divestitures, portfolio company reorganizations, and capital raising initiatives.

Evercore’s dedicated teams, specifically the Private Capital Advisory and Private Funds Group, are tailored to meet the complex needs of these financial sponsors. In 2024, the private equity sector continued its robust activity, with global deal volume remaining significant, underscoring the ongoing demand for specialized advisory services.

Governments and public sector entities rely on Evercore for expert advice on critical economic initiatives. These services often involve navigating complex privatizations, structuring large-scale infrastructure investments, and managing significant debt restructurings. Evercore's independence is a key asset, allowing them to offer unbiased guidance on matters of national economic importance.

Institutional Investors

Evercore serves a critical role for institutional investors, including pension funds, endowments, and foundations, by providing specialized investment management. These clients rely on Evercore for tailored portfolio construction, strategic asset allocation, and crucially, to gain exposure to often hard-to-access private market investments, leveraging the firm's deep industry knowledge and networks. In 2024, Evercore's Wealth Management division continued to be a significant touchpoint for these sophisticated entities, demonstrating ongoing commitment to this segment.

The firm's ability to offer customized solutions is paramount for institutional clients who have specific fiduciary duties and return objectives. This includes developing bespoke investment strategies that align with long-term liabilities and risk appetites. Evercore's expertise in navigating complex market landscapes and identifying alpha-generating opportunities within both public and private markets is a key differentiator for this customer segment.

- Customized Portfolio Management: Tailored strategies to meet specific institutional mandates.

- Asset Allocation Expertise: Strategic guidance on diversifying investments across various asset classes.

- Private Market Access: Facilitating investment in private equity, private debt, and real assets.

- Fiduciary Responsibility Support: Assisting institutions in meeting their long-term investment goals and obligations.

High-Net-Worth Individuals and Family Offices

Evercore's Wealth Management division specifically targets high-net-worth individuals and family offices. These clients seek sophisticated financial planning, tailored investment advice, and comprehensive asset management to preserve and grow their wealth. The firm's approach focuses on creating personalized strategies that address unique financial objectives and long-term legacy planning.

In 2024, Evercore Wealth Management continued to serve a discerning clientele, with average assets under management per client often reaching into the tens of millions of dollars. This segment values discreet, high-touch service and access to specialized expertise for complex financial situations, including estate planning and philanthropic endeavors.

- Targeted Clientele: High-net-worth individuals and family offices seeking bespoke financial solutions.

- Service Offerings: Comprehensive financial planning, investment advisory, and asset management.

- Client Benefits: Personalized strategies aligned with specific financial goals and legacy considerations.

- Value Proposition: Discreet, expert service for complex wealth management needs.

Evercore's customer segments are diverse, ranging from large corporations seeking M&A advice to high-net-worth individuals and family offices needing wealth management. Financial sponsors, including private equity firms, are a key group, relying on Evercore for capital raising and portfolio company advice. Governments and public sector entities also engage Evercore for complex financial restructuring and privatization initiatives.

| Customer Segment | Key Needs | Evercore Services | 2024 Relevance |

|---|---|---|---|

| Large Corporations | M&A, Divestitures, Capital Structure | Strategic Advisory | Advisor on major US M&A deals |

| Financial Sponsors | M&A, Divestitures, Capital Raising | Advisory, Private Capital Advisory | Continued robust private equity activity |

| Institutional Investors | Portfolio Management, Private Market Access | Investment Management, Asset Allocation | Wealth Management division active |

| High-Net-Worth Individuals & Family Offices | Wealth Preservation, Legacy Planning | Wealth Management, Financial Planning | Clients with multi-million dollar AUM |

| Governments & Public Sector | Privatizations, Infrastructure, Debt Restructuring | Economic Advisory | Unbiased guidance on national economic matters |

Cost Structure

Employee compensation and benefits represent Evercore's most significant cost. This includes salaries, bonuses, and deferred compensation for their expert staff.

This cost is variable, directly linked to revenue and overall performance, with the company striving to match compensation increases with revenue growth.

For the fiscal year 2024, Evercore reported an increase in its compensation and benefits expenses, reflecting investments in its talent and the firm's performance.

Evercore's cost structure heavily relies on technology and information services, with significant outlays for robust infrastructure, essential data subscriptions, and various software licenses. These investments are critical for powering advanced analytics, sophisticated trading platforms, and seamless communication systems, all vital for their operations.

The firm dedicates substantial resources to technology and compliance, recognizing these as non-negotiable elements for maintaining a competitive edge in the financial services landscape. These expenditures have seen a consistent upward trend, reflecting the ever-evolving technological demands and regulatory requirements of the industry.

For instance, in 2024, financial institutions like Evercore are facing escalating costs for cloud computing, cybersecurity solutions, and specialized financial data terminals, with some estimates suggesting a 5-10% annual increase in IT spending across the sector. This highlights the continuous need for capital allocation in these areas to ensure operational efficiency and security.

Evercore's cost structure includes significant expenses for its global office network. These occupancy and equipment costs, encompassing rent, utilities, and maintenance, represent a substantial portion of its fixed overhead. The firm's strategic expansion into new markets and the enhancement of existing office spaces directly contribute to the growth of these expenditures.

In 2024, as Evercore continued its global expansion, it's estimated that occupancy and equipment costs would represent a notable percentage of its operating expenses. For instance, a firm of Evercore's size, with offices in major financial hubs like New York, London, and San Francisco, would likely see these costs run into the tens of millions annually, reflecting premium real estate and advanced technological infrastructure.

Professional Fees and External Services

Evercore’s cost structure includes significant outlays for professional fees and external services, crucial for navigating complex financial landscapes and ensuring operational integrity. These expenses are directly tied to maintaining high standards of governance and executing sophisticated transactions.

These fees are essential for regulatory compliance, thorough transaction due diligence, and acquiring specialized expertise that Evercore leverages for its clients. For instance, in 2023, the financial advisory sector saw increased spending on legal and compliance services due to evolving regulatory frameworks globally.

- Legal Counsel: Essential for transaction structuring, regulatory filings, and dispute resolution.

- Audit Services: Required for financial statement verification and maintaining investor confidence.

- Consulting Fees: Utilized for specialized market analysis, strategic advice, and operational improvements.

Marketing and Business Development

Evercore’s marketing and business development expenses are critical for securing new advisory mandates and nurturing existing client relationships. These costs encompass a range of activities aimed at expanding the firm's reach and influence within the financial advisory landscape.

These expenditures are directly tied to client acquisition and retention. They include significant outlays for client entertainment, travel to meet with prospective and current clients, and participation in key industry conferences and events. Such engagement is fundamental to Evercore's strategy of building and maintaining a robust pipeline of business.

- Client Acquisition: Costs associated with marketing campaigns and business development initiatives directly contribute to attracting new clients and securing advisory engagements.

- Relationship Management: Significant investment in client entertainment and travel is made to foster and maintain strong, long-term relationships with the firm's clientele.

- Industry Presence: Participation in industry events and conferences is a key component, allowing Evercore to showcase its expertise, network with potential clients, and stay abreast of market trends.

- Brand Building: These activities collectively support the firm's brand reputation and market positioning, essential for attracting high-value advisory mandates.

Employee compensation and benefits remain Evercore's largest cost, directly tied to revenue and firm performance. For fiscal year 2024, these expenses saw an increase, reflecting investments in talent and the firm's operational success. This significant outlay is crucial for attracting and retaining the expert staff that drives Evercore's advisory services.

Technology and information services are also substantial cost drivers, essential for maintaining advanced analytics, trading platforms, and secure communication. In 2024, the financial sector, including firms like Evercore, experienced rising IT costs, with estimates suggesting a 5-10% annual increase in spending for cloud computing and cybersecurity solutions.

Evercore's global office network incurs significant occupancy and equipment costs, including rent and utilities. As the firm expanded globally in 2024, these fixed overheads represented a notable portion of operating expenses, with costs in major financial hubs likely running into the tens of millions annually.

Professional fees, including legal, audit, and consulting services, are vital for regulatory compliance and transaction integrity. The financial advisory sector in 2023 saw increased spending on these services due to evolving global regulatory frameworks.

Marketing and business development expenses, including client entertainment and travel, are critical for securing new mandates and maintaining client relationships. These activities are fundamental to Evercore's strategy for business pipeline development and brand building.

| Cost Category | Description | 2024 Impact/Trend |

|---|---|---|

| Employee Compensation & Benefits | Salaries, bonuses, deferred compensation for expert staff. | Increased in FY2024, directly linked to revenue and performance. |

| Technology & Information Services | Infrastructure, data subscriptions, software licenses for analytics and platforms. | Rising costs in sector (est. 5-10% annual IT spending increase in 2024) for cloud, cybersecurity. |

| Occupancy & Equipment | Rent, utilities, maintenance for global office network. | Significant portion of fixed overhead, growing with global expansion in 2024. |

| Professional Fees & External Services | Legal, audit, consulting for compliance and transactions. | Increased spending in financial advisory sector in 2023 due to regulatory evolution. |

| Marketing & Business Development | Client entertainment, travel, industry events for client acquisition and retention. | Crucial for pipeline development and maintaining client relationships. |

Revenue Streams

Evercore's core revenue generation hinges on advisory fees from complex financial transactions like mergers, acquisitions, and restructurings. These fees, often a percentage of deal value, form the backbone of their income. For instance, advisory fees represented a substantial portion of their net revenue in 2023, and early indicators suggest a continued strong performance into 2024 and 2025 due to active deal markets.

Evercore generates significant revenue through underwriting fees by guiding clients through public and private capital raises. As a lead bookrunner on equity and debt offerings, the firm plays a crucial role in facilitating these transactions, directly contributing to its capital markets advisory income. This revenue stream saw a notable uptick in 2024 and is projected to continue its upward trajectory through 2025, reflecting robust market activity.

Evercore's institutional equities business generates revenue through commissions and associated services like equity research, sales, and agency trading execution. This revenue is directly tied to how much clients trade and how much the market is moving.

In 2024, this revenue stream saw a positive uptick, with preliminary figures indicating continued growth into 2025, driven by increased client activity and a more dynamic market environment.

Asset Management and Administration Fees

Evercore generates revenue through asset management and administration fees, primarily from its Wealth Management division. These fees are calculated as a percentage of the assets clients entrust to the firm for investment and management.

This revenue stream is directly tied to the growth of assets under management (AUM). For instance, as of the first quarter of 2024, Evercore reported total AUM of $117.4 billion, reflecting a steady increase in the scale of its managed assets.

- Wealth Management Fees: A core component, earned by managing investment portfolios for institutional and individual clients.

- Administration Services: Fees for providing back-office and administrative support for investment funds and portfolios.

- Percentage of AUM: The primary method of fee calculation, directly correlating revenue with the value of assets managed.

- Growth in AUM: Demonstrates increasing client trust and the firm's capacity to attract and retain assets, driving fee income.

Other Revenue (Interest and Investments)

Evercore's "Other Revenue" category, encompassing interest and investment returns, offers a valuable layer of diversification beyond its primary advisory fees. This segment captures income generated from the company's holdings in cash, cash equivalents, and investment securities, as well as the performance of its investment funds.

In the second quarter of 2025, this "Other Revenue" stream saw an increase, partly driven by improved performance within its investment funds portfolio. This growth highlights the contribution of these less volatile income sources to Evercore's overall financial health.

- Interest Income: Revenue earned on the company's cash reserves and short-term investments.

- Investment Securities: Returns generated from the company's portfolio of marketable securities.

- Investment Funds: Profits and dividends derived from Evercore's stake in various investment funds, which showed positive performance trends in Q2 2025.

Evercore's revenue streams are diverse, primarily driven by advisory fees for mergers, acquisitions, and capital raises, alongside income from its institutional equities and wealth management businesses. These core segments are complemented by interest income and returns from investment securities, offering a balanced financial profile.

| Revenue Stream | Primary Source | 2023 Data (Approx.) | 2024 Outlook (Qualitative) | 2025 Projection (Qualitative) |

|---|---|---|---|---|

| Advisory Fees | M&A, Restructuring, Capital Markets | Significant portion of net revenue | Strong performance expected | Continued active deal markets |

| Underwriting Fees | Equity & Debt Offerings | Notable increase | Upward trajectory | Robust market activity |

| Institutional Equities | Commissions, Research, Trading | Positive performance | Positive uptick | Continued growth |

| Wealth Management | AUM-based fees | AUM: ~$117.4B (Q1 2024) | Steady increase in AUM | Continued growth in AUM |

| Other Revenue | Interest, Investment Returns | Contributes to diversification | Increased in Q2 2025 | Driven by fund performance |

Business Model Canvas Data Sources

The Evercore Business Model Canvas is informed by a blend of proprietary financial analyses, extensive market research reports, and internal strategic planning documents. These diverse data streams ensure a comprehensive and actionable representation of Evercore's business.