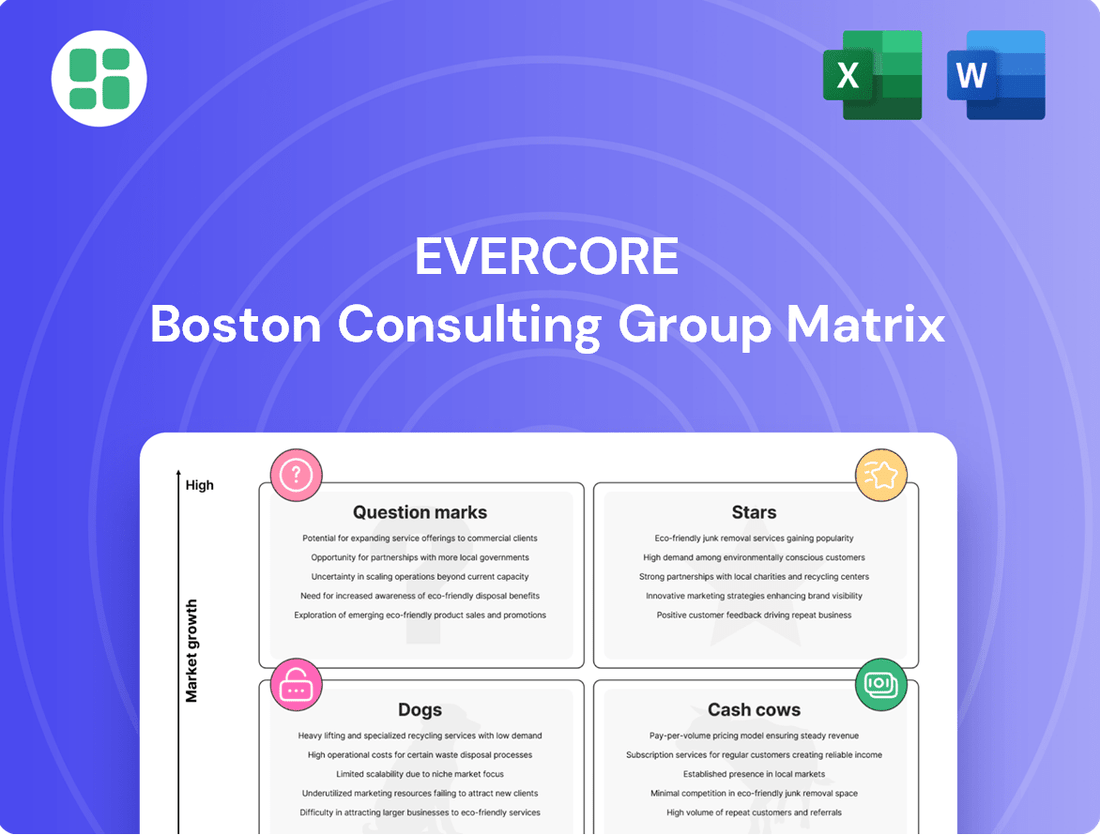

Evercore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evercore Bundle

Unlock the strategic potential of the Evercore BCG Matrix, a powerful tool to analyze your product portfolio's performance. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or require careful consideration (Question Marks).

This preview offers a glimpse into the insights you'll gain. For a comprehensive understanding of your company's market position and actionable strategies, purchase the full Evercore BCG Matrix report today.

Equip yourself with the complete BCG Matrix to make informed decisions about resource allocation and future investments. Gain a clear roadmap to optimize your product mix and achieve sustainable growth.

Stars

Evercore's Private Capital Advisory (PCA) and Private Funds Group (PFG) are powerhouses in the financial advisory space, demonstrating exceptional performance with record results in 2024. They are undisputed leaders in the secondary market, holding the coveted #1 market share for both GP-led and LP-led transactions. This success is happening within a dynamic private capital market that continues its rapid expansion, with projections indicating robust growth extending through 2025 and beyond.

Evercore stands out as a premier advisor for large-cap mergers and acquisitions, especially within financial services. The firm secured the top spot in financial advisor league tables for M&A by value in the first half of 2025, underscoring its market leadership.

The firm’s prowess is evident in its consistent involvement in substantial global M&A transactions. Evercore advised on three of the seven largest deals in 2024 and four of the ten largest year-to-date as of the second quarter of 2025, demonstrating its capacity to handle significant mandates.

This strong track record positions Evercore favorably to capitalize on the projected rebound and continued expansion of the overall M&A market throughout 2025, offering strategic guidance to clients navigating complex transactions.

Evercore stands out with its substantial team focused on activist defense, making them a key player in navigating shareholder activism. Throughout 2024, they were involved in some of the most significant activist defense campaigns on Wall Street, underscoring their active engagement in this critical area.

This specialized advisory service consistently secures high-profile mandates, a testament to Evercore's deep expertise and strong reputation in the field. Their prominent market share within this specialized, yet highly sought-after, segment of corporate finance solidifies their position as a Star performer.

European M&A and Strategic Advisory Expansion

Evercore's strategic acquisition of Robey Warshaw, a prominent UK-based advisory firm, is a clear indicator of a Star strategy. This move significantly enhances Evercore's European, Middle Eastern, and African (EMEA) market presence and advisory capabilities. The firm is targeting this growing and strategically vital region to increase its market share and better serve its multinational clientele.

This expansion into EMEA is particularly noteworthy given the region's robust M&A activity. In 2023, EMEA announced M&A deals reached approximately $1.2 trillion, highlighting the significant opportunities available. Evercore's investment aims to capitalize on this momentum, leveraging Robey Warshaw's established network and expertise.

- Enhanced European Footprint: Robey Warshaw's London base provides Evercore with a stronger foothold in a key financial hub.

- EMEA Growth Focus: The acquisition directly addresses Evercore's ambition to capture a larger share of the burgeoning EMEA advisory market.

- Client Service Expansion: This strategic move allows Evercore to offer more comprehensive support to its global and regional clients operating within EMEA.

- Competitive Positioning: By integrating Robey Warshaw, Evercore strengthens its competitive stance against other major advisory firms in the region.

Investment Banking Advisory in Resurgent Markets

Evercore's investment banking advisory segment is demonstrating significant strength, evidenced by a substantial increase in advisory fees during the first half of 2025. This surge in revenue points to a resurgent market for mergers, acquisitions, and other strategic transactions.

The firm's positioning for continued success is bolstered by a notable uptick in CEO confidence, a key indicator of future deal activity. Furthermore, the debt and equity issuance markets are showing increased receptiveness, creating a favorable environment for advisory services.

- Advisory Fees: Experienced a significant increase in Q1 and Q2 2025, indicating robust demand for advisory services.

- Market Trends: Capitalizing on improving market trends, including rising CEO confidence and more open debt and equity markets.

- Star Status: Broad advisory strength in a recovering and growing market solidifies its Star position within the BCG Matrix.

Evercore's performance in the private capital advisory and M&A sectors solidifies its Star status. The firm's #1 market share in GP-led and LP-led transactions in 2024, coupled with its leading position in financial services M&A advisory for the first half of 2025, highlights its dominance. The strategic acquisition of Robey Warshaw further enhances its European presence, tapping into a region with approximately $1.2 trillion in announced M&A deals in 2023.

| Segment | 2024/H1 2025 Performance | Market Position | Strategic Rationale |

|---|---|---|---|

| Private Capital Advisory | Record results, #1 market share in GP/LP-led transactions | Star | Capitalizing on expanding private capital market |

| M&A Advisory (Financial Services) | #1 in league tables by value (H1 2025) | Star | Advising on significant global deals (3 of top 7 in 2024) |

| EMEA Expansion (Robey Warshaw) | Enhanced European presence | Star Potential | Targeting $1.2T EMEA M&A market |

| Activist Defense | Involved in significant campaigns (2024) | Star | Deep expertise in a critical corporate finance niche |

What is included in the product

The Evercore BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions.

The Evercore BCG Matrix provides a clear, visual snapshot of your portfolio, alleviating the pain of uncertainty about where to allocate resources.

Cash Cows

Evercore's core M&A advisory services are its bedrock, consistently delivering robust revenue. These offerings, honed over years and deeply integrated with a loyal client base, are the firm's primary cash cows. Their enduring strength stems from Evercore's independent advisory model and a reputation built on trust and expertise, allowing for consistently high profit margins even when deal volumes naturally ebb and flow.

Evercore's Restructuring and Capital Structure Advisory is a true cash cow, consistently landing roles in the most complex financial situations. Their expertise in navigating distressed companies and advising creditors ensures a steady stream of high-margin fees.

In 2024, Evercore advised on several high-profile restructuring mandates, including the Chapter 11 filing of a major retail chain and the complex debt restructuring for a global manufacturing firm. These deals highlight their dominance in a market segment that demands deep financial acumen and a proven track record.

Evercore's Wealth Management segment stands out as a robust Cash Cow. By the end of 2024, it boasted $13.9 billion in assets under management, a figure that continued its upward trajectory into 2025, demonstrating consistent revenue generation.

This business unit thrives on stable, recurring fees derived from its growing assets under management. Operating within a mature market, it offers predictable income streams, making it a reliable contributor to Evercore's overall financial health.

Equity Research and Sales & Agency Trading

Evercore ISI, the firm's equities division, stands as a prime example of a cash cow within the Evercore BCG Matrix. It's consistently recognized as the top independent firm for equity research, a position it has held for years, demonstrating sustained market leadership. In 2023, this franchise achieved its strongest performance since 2016, underscoring its robust and stable revenue generation capabilities.

This business model thrives on its content-led platform and deep relationships with institutional clients, translating into predictable commission and related revenues. Its established market dominance in equity research places it in a mature but high-share segment, ensuring a reliable income stream.

- Top-Ranked Independent Equity Research: Evercore ISI has secured the top spot for independent equity research multiple years running.

- Best Performance Since 2016: The equities franchise achieved its most significant performance in 2023, building on previous successes.

- Consistent Revenue Generation: The content-led platform and strong institutional client base ensure steady commission and related revenues.

- Mature Market Leadership: Its established market leadership in equity research represents a stable, high-share segment.

Private Capital Markets & Debt Advisory

Evercore's Private Capital Markets & Debt Advisory team is a significant player, offering tailored solutions for corporations and financial sponsors seeking private capital. This division capitalizes on Evercore's deep understanding of private markets, facilitating crucial capital raises.

The team's established presence within the private capital ecosystem contributes to a steady stream of fees. This segment, while mature, continues to evolve, allowing Evercore to maintain a strong market share.

- Growing Advisory Role: Evercore's Private Capital Markets & Debt Advisory team is increasingly recognized for its expertise in guiding clients through the complexities of private capital solutions.

- Essential Capital Solutions: The firm provides vital access to private debt and equity, supporting corporate growth and financial sponsor transactions.

- Market Share & Fee Generation: A substantial market share in this established yet dynamic sector ensures consistent fee income for Evercore.

- Evolving Landscape: The team's ability to adapt to the changing dynamics of private markets underpins its continued success and relevance.

Evercore's M&A advisory, restructuring, wealth management, and equity research divisions all function as significant cash cows. These areas demonstrate consistent revenue generation and strong market positioning, contributing reliably to the firm's financial stability. Their mature market presence and established client relationships ensure predictable income streams, making them the bedrock of Evercore's business model.

| Business Segment | Cash Cow Status | Key Drivers | 2024 Data/Insights |

|---|---|---|---|

| M&A Advisory | Primary Cash Cow | Independent advisory model, strong client relationships, reputation for expertise | Consistently robust revenue, high profit margins |

| Restructuring & Capital Structure Advisory | Strong Cash Cow | Expertise in complex financial situations, advising distressed companies and creditors | Steady stream of high-margin fees from mandates like major retail chain Chapter 11 and global manufacturing firm debt restructuring |

| Wealth Management | Robust Cash Cow | Stable, recurring fees from growing assets under management | $13.9 billion in assets under management by end of 2024, with continued upward trajectory |

| Evercore ISI (Equities) | Prime Cash Cow | Top-ranked independent equity research, content-led platform, institutional client relationships | Strongest performance since 2016 in 2023, ensuring steady commission and related revenues |

| Private Capital Markets & Debt Advisory | Significant Cash Cow | Tailored solutions for private capital raises, deep understanding of private markets | Substantial market share in an established yet dynamic sector, ensuring consistent fee income |

Delivered as Shown

Evercore BCG Matrix

The Evercore BCG Matrix preview you are viewing is the identical, fully rendered document you will receive upon purchase. This means no watermarks or placeholder text will be present in the final download, ensuring you get a complete and professional strategic analysis tool. You can confidently expect the same high-quality, data-driven insights and clear formatting that is essential for effective business planning and decision-making. This preview accurately represents the actionable intelligence you'll gain to assess your business portfolio and guide future investments.

Dogs

Undifferentiated, small-cap underwriting engagements represent a segment where Evercore may see lower profitability. While Evercore participated in many underwriting deals, their underwriting fees saw a slight dip in Q1 2025 and remained flat year-to-date through Q2 2025, indicating a challenging environment for fee generation in this area.

Engagements where Evercore isn't the lead bookrunner or doesn't offer a distinct advantage in the small-cap or commoditized underwriting spaces can lead to diminished returns. These types of deals might only break even, or worse, consume valuable resources without offering substantial growth opportunities for the firm.

Evercore's strategic focus on EMEA expansion contrasts with its continued reliance on the US, which accounts for roughly 75% of its revenue as of early 2024. This highlights a relatively smaller footprint in many international markets.

Smaller, legacy international offices not aligned with current European growth plans or future APAC ambitions might face challenges in capturing substantial market share. These operations could potentially become cash traps if they don't contribute to evolving strategic goals.

Evercore's investment funds portfolio, a component of its Other Revenue, net, experienced a substantial 75% decline year-over-year in the first quarter of 2025. This sharp drop is directly attributable to the underperformance of these funds.

Given this trend, the investment funds portfolio can be classified as a Dog within the Evercore BCG Matrix framework. It represents a capital-intensive area that is not contributing effectively to overall returns and is not a strategic focus for the firm's core advisory services.

Generic, Commoditized Debt Capital Markets Advisory

In the realm of debt capital markets advisory, services that are generic and lack specialized expertise or significant scale can be classified as Dogs within the Evercore BCG Matrix. These offerings often compete on price rather than value, facing intense competition from larger universal banks with broader platforms and deeper resources.

Without a distinct competitive advantage or substantial market share in these commoditized areas, such advisory services are likely to experience low growth and generate minimal returns. For instance, in 2024, the global debt capital markets advisory sector saw significant consolidation, with firms struggling to differentiate themselves in standard debt issuance mandates.

- Low Differentiation: Generic debt advisory services often struggle to stand out in a crowded market.

- Intense Competition: Larger financial institutions with extensive networks and capabilities pose a significant challenge.

- Limited Pricing Power: Commoditized services typically result in lower fees and profit margins.

- Subdued Growth Prospects: Without unique selling propositions, attracting new business and expanding market share becomes difficult.

Advisory for Very Small, Non-Strategic Deals

Evercore's strategic focus on large, complex transactions is the engine behind its substantial advisory fee growth. In 2024, the firm continued to prioritize these high-value engagements, which typically command higher advisory fees and allow Evercore to deploy its specialized expertise effectively.

For very small or highly undifferentiated deals, Evercore's involvement might not align with its core strengths, potentially leading to lower profit margins. Such engagements could be viewed as "distractions" if they divert significant resources without a commensurate financial return or strategic benefit.

Consider these points regarding very small, non-strategic deals:

- Resource Allocation: Very small deals may consume disproportionate advisory resources, impacting the profitability of the advisory segment.

- Strategic Fit: Engagements lacking strategic differentiation might not fully leverage Evercore's premier advisory capabilities.

- Fee Compression: Smaller transaction sizes often lead to fee compression, reducing the overall financial contribution.

The investment funds portfolio, experiencing a significant 75% year-over-year decline in Q1 2025 due to underperformance, clearly fits the 'Dog' category. This segment demands capital but yields poor returns, diverting focus from Evercore's core advisory services.

Similarly, generic debt capital markets advisory services, facing intense competition and lacking differentiation, also fall into the 'Dog' quadrant. These offerings struggle with low growth and minimal returns, as evidenced by market consolidation in 2024 for standard debt issuance mandates.

Very small or undifferentiated underwriting engagements, particularly those where Evercore is not the lead bookrunner, can also be classified as Dogs. These deals consume resources without offering substantial growth or leveraging Evercore's premier capabilities, leading to diminished returns.

Evercore's underwriting fees saw a slight dip in Q1 2025 and remained flat year-to-date through Q2 2025, underscoring the challenges in generating fees from these less strategic underwriting activities.

Question Marks

Evercore's strategic vision includes a measured expansion into the Asia-Pacific (APAC) region, aiming to selectively build its presence. This suggests that while the company sees potential, its current market share in these diverse economies is likely minimal, especially when contrasted with its established position in the US.

The APAC region, characterized by rapid economic development and a growing financial services sector, presents a significant opportunity. For instance, the Asian Development Bank projected a 4.9% GDP growth for developing Asia in 2024, highlighting the region's dynamism.

To transition from a Question Mark to a Star in these markets, Evercore would need substantial investment to gain traction and compete effectively. This aligns with the BCG Matrix principle, where new ventures with low market share in high-growth industries require significant capital infusion to achieve market leadership.

The investment banking sector is rapidly embracing digital transformation, with a pronounced shift towards AI, advanced automation, and regulatory technology (RegTech). These technologies are proving crucial for enhancing deal origination and strengthening risk management frameworks. In 2024, the global financial technology market, encompassing these areas, was projected to reach hundreds of billions of dollars, indicating substantial growth potential.

Evercore is actively navigating this technological evolution, likely developing or already possessing initial capabilities to guide clients through the adoption of these cutting-edge technologies. This strategic focus positions them to capitalize on the increasing demand for digital advisory services within the financial industry.

While this advisory niche represents a significant growth avenue, Evercore's current market share in AI and digital transformation consulting for finance may be relatively modest. Achieving leadership in this space will necessitate considerable strategic investment and focused development of specialized expertise.

Environmental, Social, and Governance (ESG) factors are reshaping investment banking, with a surge in demand for sustainable loans and green bonds. In 2024, the global green bond market reached an estimated $1 trillion, highlighting this significant growth trajectory.

Evercore is strategically positioning itself to capitalize on this trend by expanding its advisory services in sustainable finance and ESG. This proactive approach addresses growing client needs and evolving regulatory landscapes.

While Evercore's dedicated ESG advisory market share may still be developing, its potential in this high-growth sector is substantial. This places sustainable finance and ESG advisory offerings in the Question Mark quadrant of the BCG Matrix, indicating a need for focused investment to unlock future market leadership.

Targeted IPO Advisory in Emerging High-Growth Sectors

Targeted IPO advisory in emerging high-growth sectors, while a strategic move for future market share, represents a significant investment. For Evercore, this means dedicating resources to build specialized expertise in areas like AI-driven healthcare or sustainable energy tech. Despite a projected stronger IPO market in 2025, the firm's year-to-date underwriting fees were flat as of Q2 2025, indicating that these targeted efforts are still in the early stages of development and haven't yet translated into substantial revenue gains.

These initiatives are crucial for Evercore to establish a dominant presence in lucrative, rapidly expanding industries. The firm is likely investing in research, talent acquisition, and deal origination within these niches. The flat underwriting fees, therefore, reflect the upfront costs associated with building this capability rather than a lack of market opportunity.

- Strategic Investment: Targeting emerging high-growth sectors requires significant upfront investment in expertise and relationships.

- Market Share Ambition: These efforts are aimed at capturing future market share in lucrative, rapidly expanding industries.

- Early Stage Returns: Flat underwriting fees as of Q2 2025 suggest these initiatives are in their initial phase and haven't yielded substantial revenue yet.

- Long-Term Growth Driver: Success in these targeted areas is expected to be a key driver of future revenue and profitability for Evercore.

Expansion of Structured Capital Solutions

Evercore's strategic focus on expanding its structured capital solutions, alongside its established GP/LP advisory, aligns with the private capital market's strong growth. This expansion is crucial as investment banks develop innovative financing for infrastructure and private equity, creating opportunities for Evercore to capture market share in these burgeoning areas.

These new or enhanced structured capital solutions, while requiring upfront investment, are positioned as potential Stars within the BCG matrix. The private capital market saw significant deal activity, with global private equity fundraising reaching approximately $1.2 trillion in 2023, indicating a substantial runway for Evercore's growth initiatives.

- Focus on Infrastructure Financing: Evercore is building capabilities in financing future-facing infrastructure projects, a sector attracting considerable investment.

- Private Equity Convergence: The firm is enhancing its offerings at the intersection of private equity and other asset classes, creating new financing structures.

- Market Share Growth Potential: These expanded structured capital solutions represent high-growth areas where Evercore aims to increase its market presence beyond traditional advisory.

- Investment in Growth: While these initiatives consume capital, they are strategically positioned for future returns, mirroring the characteristics of Stars in a growth matrix.

Question Marks in Evercore's strategic framework represent areas with high growth potential but currently low market share. These are ventures where significant investment is required to gain traction and potentially become market leaders. The firm is actively exploring these opportunities, understanding that substantial capital allocation is key to transforming them into Stars.

The firm's expansion into the Asia-Pacific region, its development of digital transformation advisory services, and its growing focus on ESG advisory all fall into this category. These are all sectors experiencing robust growth, yet Evercore's current market penetration is still nascent, necessitating strategic investment to build a stronger competitive position.

Furthermore, Evercore's targeted IPO advisory in emerging high-growth sectors and its expansion of structured capital solutions also represent Question Marks. These initiatives require substantial upfront investment in expertise and resources to establish a foothold in rapidly evolving markets.

The challenge for Evercore is to judiciously allocate capital to these Question Marks, aiming to convert them into Stars through strategic execution and market penetration. Success in these areas will be critical for future revenue diversification and sustained competitive advantage.

| Strategic Area | Market Growth Potential | Current Market Share | Investment Required | BCG Classification |

| Asia-Pacific Expansion | High | Low | High | Question Mark |

| Digital Transformation Advisory | High | Low | High | Question Mark |

| ESG Advisory | High | Low | High | Question Mark |

| Targeted IPO Advisory (Emerging Sectors) | High | Low | High | Question Mark |

| Structured Capital Solutions | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.