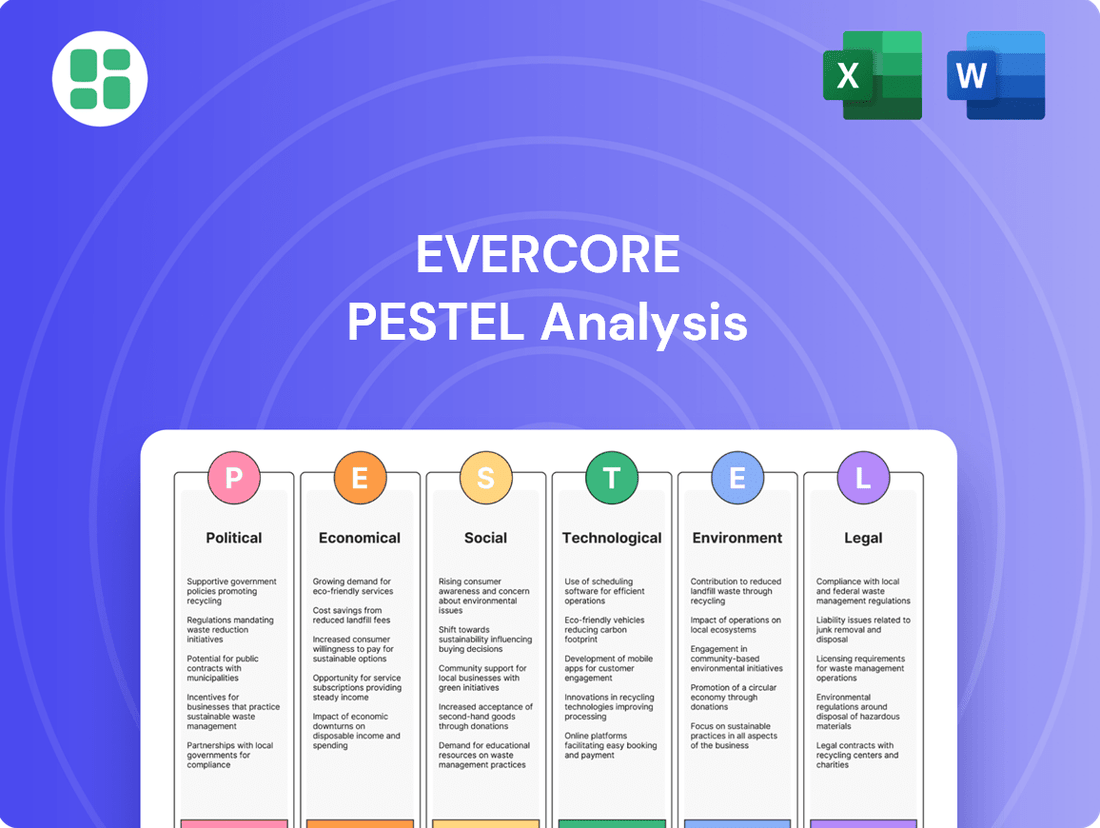

Evercore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evercore Bundle

Unlock the critical external factors shaping Evercore's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological disruptions, understand the forces that matter most. Equip yourself with actionable intelligence to refine your strategies and capitalize on opportunities. Download the full report now for an unparalleled competitive advantage.

Political factors

Government policy and regulatory shifts represent a critical political factor for Evercore. Changes in fiscal policy, such as the Biden administration's proposed corporate tax rate adjustments or potential infrastructure spending, directly impact corporate profitability and, by extension, M&A appetite. For example, a higher corporate tax rate could dampen deal volumes, while targeted stimulus might spur activity in specific sectors.

New administrations often bring evolving regulatory landscapes. For 2024 and into 2025, scrutiny on antitrust, particularly concerning large technology mergers, could influence deal approvals. Evercore's advisory role is directly affected, as regulatory hurdles can either create opportunities for specialized advice or pose significant challenges to transaction completion.

Trade policies and tariffs also play a crucial role. For instance, ongoing trade tensions, or potential shifts in import/export regulations, can create uncertainty for cross-border M&A, a significant area for Evercore. The Inflation Reduction Act of 2022, with its focus on green energy, is already reshaping investment priorities and M&A in that sector.

Global geopolitical instability, including ongoing conflicts and shifting trade alliances, significantly impacts financial markets and M&A activity. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East have contributed to increased market volatility throughout 2024, affecting investor confidence and deal valuations.

Evercore, advising a global clientele, must adeptly manage these risks. Heightened international tensions can lead to more stringent regulatory reviews of cross-border transactions, disruptions in global supply chains affecting target company performance, and in some cases, the outright cancellation of proposed mergers and acquisitions, as witnessed in several high-profile tech deals facing national security reviews in late 2024.

Governments' and regulatory bodies' approaches to financial deregulation or increased oversight significantly shape the operational landscape for investment banks. For instance, a shift towards deregulation, a trend some anticipate in the U.S. following the 2024 elections, could potentially accelerate stalled transactions and cultivate a more favorable environment for mergers and acquisitions (M&A).

Conversely, the implementation of more stringent regulations would likely demand enhanced compliance measures, potentially impacting transaction volumes and profitability. In 2023, global M&A activity saw a notable slowdown, with deal values decreasing by approximately 37% compared to 2022, reaching around $3.2 trillion, underscoring the sensitivity of the sector to regulatory shifts and economic conditions.

Economic Sanctions and Export Controls

Economic sanctions and export controls, often enacted in response to geopolitical shifts, directly affect Evercore's advisory services by creating hurdles for cross-border transactions. These governmental actions can significantly alter the landscape of potential deals, impacting the viability of mergers, acquisitions, and capital raising for clients involved in international trade or operating globally.

The increasing complexity of sanctions regimes, such as those imposed by the United States and the European Union on Russia following events in 2022, amplifies compliance risks. This can narrow the pool of available investors and target companies, forcing Evercore to navigate a more restrictive market. For instance, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) continuously updates its Specially Designated Nationals (SDN) list, requiring constant vigilance.

- Sanctions Impact: Global economic sanctions, including those targeting Russia, have led to significant disruptions in international finance, affecting deal flow and cross-border investments.

- Compliance Burden: Evercore, like other financial institutions, faces increased compliance costs and operational complexities to ensure adherence to evolving sanctions and export control regulations.

- Market Access: Restrictions can limit Evercore's clients' access to capital or potential buyers/sellers in specific jurisdictions, potentially impacting deal valuations and execution timelines.

- Geopolitical Volatility: The ongoing geopolitical tensions in various regions underscore the persistent risk that sanctions and export controls pose to Evercore's global business operations and client advisory services.

Political Elections and Policy Uncertainty

Major national elections, particularly in significant global markets, often create periods of uncertainty regarding future economic and regulatory policies. This uncertainty can lead to dealmakers pausing potential transactions until a clearer picture emerges. For instance, the numerous elections held throughout 2024 contributed to this cautious approach.

Looking ahead to 2025, a shift towards greater political certainty in several key nations is anticipated. This potential easing of uncertainty could act as a catalyst, encouraging a resurgence in Mergers and Acquisitions (M&A) activity as businesses feel more confident about the long-term policy landscape.

- 2024 Election Impact: Over 60 countries held elections in 2024, impacting an estimated 50% of the global population and creating varied policy outlooks.

- 2025 M&A Outlook: Analysts predict a potential uptick in M&A deal volume in 2025, with some projecting a 5-10% increase driven by greater political stability in key economies.

- Policy Stability Premium: Markets often reward companies operating in politically stable environments, potentially leading to higher valuations and increased investor confidence in 2025.

Government policies and regulations significantly shape the financial advisory landscape for Evercore. Shifts in fiscal policy, such as potential changes to corporate tax rates or government spending on infrastructure, can directly influence corporate profitability and M&A activity. For example, a more favorable tax environment could boost deal volumes, while increased regulatory scrutiny, particularly on large tech mergers, could create complexities for transaction approvals throughout 2024 and into 2025.

Trade policies and geopolitical stability are also crucial. Ongoing trade tensions and international conflicts can create market volatility and impact cross-border M&A, a key area for Evercore. The Inflation Reduction Act of 2022, for instance, is already altering investment trends in the green energy sector, influencing M&A strategies.

The impact of national elections, with over 60 countries holding them in 2024, creates policy uncertainty that can lead to deal pauses. However, an anticipated increase in political certainty by 2025 could spur M&A activity, with some analysts projecting a 5-10% rise in deal volume due to greater stability.

| Political Factor | Impact on Evercore | 2024/2025 Data/Outlook |

|---|---|---|

| Fiscal Policy & Taxation | Affects corporate profitability and M&A appetite. | Potential corporate tax rate adjustments and infrastructure spending influencing deal flow. |

| Regulatory Scrutiny (Antitrust) | Influences deal approvals, especially for large tech mergers. | Continued focus on antitrust in 2024/2025 could create opportunities for specialized advisory. |

| Trade Policies & Geopolitics | Creates market volatility and impacts cross-border M&A. | Ongoing geopolitical tensions contribute to market volatility; Inflation Reduction Act reshaping green energy investments. |

| Election Cycles | Periods of uncertainty can pause M&A activity. | 2024 elections created caution; anticipated 2025 political certainty may boost M&A by 5-10%. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Evercore, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for Evercore's operations and future growth.

Evercore's PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Fluctuations in interest rates are a major driver for mergers and acquisitions (M&A) and corporate financing. Higher rates increase the cost of borrowing, which can dampen deal activity and lower valuations. Conversely, lower rates make it cheaper to fund deals and operations, often stimulating M&A.

The U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through much of 2024. Similarly, the European Central Bank kept its key rate at 4.50% for an extended period. However, expectations are building for rate cuts in late 2024 and early 2025 across both regions, which should improve access to capital and potentially boost M&A volumes.

Persistent inflationary pressures through 2024 have been a significant concern, impacting corporate profit margins and dampening consumer spending. This environment often leads to a more cautious approach to investment and mergers and acquisitions (M&A) as businesses assess the rising cost of capital and potential demand slowdowns.

However, as inflation shows signs of moderating in late 2024 and into 2025, and with global GDP growth projected to continue, albeit at a measured pace of around 2.5-3.0% for 2025, the investment banking sector is poised to benefit. Increased economic activity typically translates to higher demand for advisory services, including M&A, capital raising, and restructuring.

Capital market volatility, influenced by economic data releases, geopolitical tensions, and central bank policy changes, directly affects investor sentiment and the execution of capital raising and merger & acquisition activities. For Evercore, this means its wealth management and advisory divisions must remain agile, adjusting strategies to navigate these unpredictable market conditions.

Analysts project a heightened period of market volatility for 2025, largely attributed to evolving expectations around monetary policy. For instance, the Federal Reserve's stance on interest rates, a key driver of market sentiment, has seen considerable shifts throughout 2024, impacting equity valuations and deal flow.

Availability of Debt Financing

The availability and cost of debt financing are paramount for executing leveraged buyouts and significant mergers and acquisitions. Easier access to credit at favorable rates directly fuels deal-making capacity.

Looking ahead to 2025, an improving macroeconomic climate is anticipated to usher in more accommodating financing conditions. This shift is expected to catalyze a revival in M&A transactions, with mid-cap companies likely to be key beneficiaries of renewed debt market liquidity.

Several indicators point to this trend:

- Reduced Borrowing Costs: Interest rate forecasts for 2025 suggest a potential easing of borrowing costs, making debt-funded acquisitions more attractive.

- Increased Lender Appetite: Financial institutions are showing a greater willingness to lend for strategic acquisitions, particularly those with strong underlying business models.

- Debt Market Deepening: The overall depth and breadth of the debt markets are expected to expand, offering a wider array of financing instruments and greater flexibility for borrowers.

Global M&A and Capital Raising Activity

The health of global Mergers & Acquisitions (M&A) and capital raising markets is a direct driver of Evercore's revenue. A robust deal environment means more advisory fees for the firm.

Following a slower period, investment banking fees experienced a significant rebound towards the end of 2024. This resurgence is projected to continue, with expectations of increased M&A activity and greater debt and equity issuance throughout 2025, painting a positive picture for the sector.

Key indicators for 2025 suggest a favorable climate:

- Global M&A deal volume is anticipated to rise by approximately 10-15% in 2025 compared to 2024.

- Capital raising, particularly equity issuance, is expected to see a similar uptick, driven by favorable market conditions and corporate funding needs.

- The technology and healthcare sectors are predicted to lead M&A activity, offering substantial opportunities for advisory firms like Evercore.

Economic factors significantly shape Evercore's operating environment, particularly concerning interest rates, inflation, and capital market conditions. The anticipated easing of interest rates in late 2024 and into 2025 is expected to lower borrowing costs, thereby stimulating M&A activity and capital raising, which directly benefits advisory firms like Evercore.

Inflationary pressures, while a concern in 2024, are showing signs of moderation, coinciding with projected global GDP growth of around 2.5-3.0% for 2025. This economic backdrop, coupled with increased lender appetite and a deepening debt market, suggests a more robust deal environment for the upcoming year.

Market volatility, influenced by monetary policy shifts and geopolitical events, necessitates agility from Evercore's divisions. Projections indicate a heightened period of volatility for 2025, driven by evolving interest rate expectations, which will require careful navigation of market sentiment and deal execution.

| Economic Factor | 2024 Trend | 2025 Outlook | Impact on Evercore |

|---|---|---|---|

| Interest Rates | Stable at high levels (e.g., Fed 5.25-5.50%) | Expected cuts, easing borrowing costs | Increased M&A and capital raising activity |

| Inflation | Persistent, impacting margins | Moderating | Improved corporate profitability and spending |

| Global GDP Growth | Measured | Projected 2.5-3.0% | Increased demand for advisory services |

| M&A Deal Volume | Slower start, rebounding late 2024 | Projected 10-15% increase | Higher advisory fees |

Preview Before You Purchase

Evercore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Evercore PESTLE Analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities Evercore faces.

Sociological factors

The investment banking landscape is seeing a significant shift towards flexible work arrangements, with a growing preference for hybrid and remote models among professionals. This evolving dynamic directly influences Evercore's ability to attract and retain top talent in a fiercely competitive market.

Furthermore, the demand for specialized skills, particularly in emerging fields like artificial intelligence, machine learning, and advanced data analytics, is escalating. Evercore must proactively adapt its human capital strategies to secure individuals possessing these critical competencies, ensuring it remains at the forefront of innovation and client service.

Clients now demand hyper-personalized, data-informed advice, pushing advisory firms like Evercore to integrate advanced analytics and technology. For instance, the wealth management sector saw a significant increase in demand for customized digital platforms, with projections indicating continued growth through 2025 as clients seek tailored investment strategies and transparent reporting.

Meeting these evolving expectations is paramount for Evercore's competitive edge. The capacity to deliver bespoke solutions, backed by deep market insights and robust data analysis, directly impacts client retention and satisfaction in a market where generic offerings are no longer sufficient.

Societal expectations around ethical conduct and corporate social responsibility (CSR) are increasingly shaping how clients choose financial partners and how the public views these institutions. Evercore’s proactive stance on responsible business practices, including a strong focus on diversity, equity, and inclusion (DEI), and maintaining transparent operations, directly impacts its reputation. For instance, in 2024, surveys indicated that over 60% of institutional investors consider a firm's ESG (Environmental, Social, and Governance) performance when making investment decisions, making Evercore's commitment to these principles crucial for attracting capital and talent.

Demographic Shifts and Wealth Transfer

Long-term demographic shifts, particularly the aging population and the significant intergenerational wealth transfer, present both opportunities and challenges for Evercore's investment management and advisory services. As the Baby Boomer generation continues to retire and pass on assets, there's a growing need for sophisticated wealth management solutions. This demographic trend is expected to accelerate the transfer of trillions of dollars in wealth over the coming decades, directly impacting the demand for Evercore's expertise.

Evercore's investment management division must proactively adapt its strategies to meet the diverse and evolving needs of various generations. This includes developing tailored products and services that resonate with the values and financial goals of younger investors, such as ESG-focused funds and digital advisory platforms, alongside traditional wealth preservation strategies for older clients. Understanding these generational differences is key to capturing market share in this shifting landscape.

- Aging Population: The global population is aging, with a significant increase in individuals over 65. For instance, the United Nations projects that by 2050, one in six people worldwide will be 65 or older, up from one in 11 in 2015.

- Wealth Transfer: The U.S. is anticipating the largest wealth transfer in history, with estimates suggesting that Baby Boomers will transfer between $30 trillion and $68 trillion to their heirs by 2030.

- Generational Investment Preferences: Younger generations, like Millennials and Gen Z, often prioritize sustainable investing and digital engagement, contrasting with the more traditional investment approaches of older generations.

Public Trust and Reputation Management

Public trust is a critical, yet often fragile, asset in the financial services sector. Following periods of economic instability or high-profile ethical lapses, the industry as a whole can experience a decline in public confidence. For Evercore, a firm built on advising clients through complex financial landscapes, this scrutiny is particularly relevant.

Maintaining a sterling reputation for integrity, transparency, and unwavering reliability is not merely a matter of good practice; it's a fundamental requirement for attracting and retaining clients. In 2024, for instance, surveys indicated that trust remained a top concern for consumers when selecting financial service providers, with a significant percentage citing a firm's ethical track record as a primary decision factor.

Evercore's ability to consistently demonstrate these qualities directly impacts its business opportunities and client acquisition. A strong public perception acts as a powerful differentiator, fostering loyalty and attracting new mandates. Conversely, any perceived misstep could have a disproportionately negative effect on its market standing and future growth prospects.

- Reputation as a Key Differentiator: In 2024, over 60% of high-net-worth individuals surveyed stated that a financial advisor's reputation for integrity was more important than their investment performance history.

- Impact of Scandals: Following the 2008 financial crisis, public trust in financial institutions dropped significantly, and while recovery has been gradual, a single major scandal can still erode years of reputational gains.

- Transparency in Operations: Evercore's commitment to transparent fee structures and clear communication about its advisory processes directly contributes to building and maintaining client trust.

- Client Retention Rates: Firms with demonstrably high levels of public trust often report higher client retention rates, as clients feel more secure in their long-term relationships.

Societal shifts, including a growing emphasis on ethical business practices and corporate social responsibility, directly influence client trust and talent acquisition for firms like Evercore. A strong commitment to diversity, equity, and inclusion (DEI), along with transparent operations, is increasingly vital for maintaining a positive reputation. For example, in 2024, over 60% of institutional investors considered a firm's ESG performance when making investment decisions, underscoring the importance of these principles for Evercore.

Demographic changes, such as the aging global population and the significant intergenerational wealth transfer, create substantial opportunities for Evercore's advisory and investment management services. Projections indicate trillions of dollars in wealth will be transferred in the coming decades, necessitating tailored solutions for diverse generational needs. This trend requires Evercore to develop products that cater to both younger investors' preferences for digital engagement and ESG-focused funds, as well as older clients' focus on wealth preservation.

Public trust remains a cornerstone for financial institutions, and any perceived ethical lapse can severely damage a firm's standing. In 2024, a significant portion of consumers identified a firm's ethical track record as a primary factor in selecting financial service providers. Evercore's ability to consistently demonstrate integrity and transparency is therefore crucial for client acquisition and retention, acting as a key differentiator in a competitive market.

Technological factors

The relentless march of digital transformation, particularly the automation of routine tasks, is fundamentally altering the landscape of investment banking. This shift presents Evercore with a significant opportunity to streamline operations and boost productivity. By embracing automation, Evercore can expect to see a reduction in operational costs, potentially freeing up substantial resources.

For instance, the global automation market was projected to reach over $600 billion by the end of 2024, highlighting the widespread adoption and impact of these technologies across industries. Evercore can strategically deploy automation to handle data analysis, report generation, and compliance checks, thereby enhancing efficiency. This allows Evercore's skilled professionals to dedicate more time to high-level strategic thinking and client relationship management, ultimately delivering greater value.

Artificial Intelligence and Machine Learning are fundamentally reshaping investment banking. These technologies are proving invaluable in identifying potential deals, conducting thorough due diligence, dissecting market trends, and bolstering risk management protocols. For instance, in 2024, many leading investment banks are investing heavily in AI platforms to automate repetitive research tasks, freeing up analysts for higher-value strategic work.

Firms that effectively integrate AI and ML are gaining a significant competitive advantage. By automating research processes and deriving deeper market insights, these technologies enhance the speed and accuracy of decision-making, making them indispensable tools for investment banking teams navigating complex financial landscapes.

The increasing reliance on digital platforms for financial transactions and client data management amplifies cybersecurity risks for firms like Evercore. Data breaches, financial fraud, and potential operational disruptions stemming from cyberattacks are significant concerns, as evidenced by the global rise in cybercrime. For instance, in 2023, the financial services sector experienced a substantial increase in ransomware attacks, with average recovery costs soaring.

To mitigate these threats, Evercore must maintain robust investments in advanced cybersecurity infrastructure and stringent data protection protocols. Safeguarding sensitive client information is paramount for preserving trust and ensuring regulatory compliance. The financial services industry, in general, is projected to increase its cybersecurity spending by over 10% in 2024 to address evolving threats.

Fintech Innovation and Collaboration

Fintech innovation is rapidly reshaping the financial landscape, presenting both challenges and avenues for growth for firms like Evercore. The emergence of agile fintech companies is introducing novel competitive dynamics across key sectors such as payments, lending, and wealth management. For instance, the global fintech market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $3.5 trillion by 2030, indicating substantial disruption and opportunity.

Evercore can strategically leverage these trends by actively exploring partnerships or even acquisitions within the fintech ecosystem. Such moves could significantly enhance its existing service offerings and proactively address the evolving client demand for sophisticated digital financial solutions. This approach allows Evercore to integrate cutting-edge technologies and expand its reach into new client segments.

- Fintech Market Growth: The global fintech market is experiencing exponential growth, with projections indicating a compound annual growth rate (CAGR) of over 13% from 2024 to 2030.

- Digital Payment Adoption: Digital payment transactions are projected to exceed 1.5 trillion globally by 2027, highlighting a critical area for fintech integration.

- Wealth Management Tech: Robo-advisors, a key fintech innovation in wealth management, saw assets under management grow by over 25% in 2023, demonstrating client acceptance of digital advisory services.

- Collaboration Opportunities: Traditional financial institutions are increasingly partnering with fintechs to improve customer experience and operational efficiency, with over 60% of banks reporting active fintech collaborations in recent surveys.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling are now critical for investment banks to understand real-time market shifts, regulatory changes, and potential risks from partners. Banks effectively using these technologies are seeing quicker deal completions and better financial outcomes compared to those relying on older, fragmented systems.

The ability to process vast datasets and forecast future trends allows for more informed decision-making, giving a competitive edge. For instance, in 2024, firms that invested heavily in AI-driven analytics reported up to a 15% improvement in deal sourcing efficiency.

- Real-time Insights: Gaining immediate understanding of microtrends and regulatory landscapes.

- Risk Mitigation: Proactively identifying and managing counterparty and market risks.

- Efficiency Gains: Accelerating deal closing times and improving overall returns.

- Competitive Advantage: Outperforming competitors through superior data utilization.

Technological advancements, particularly in AI and automation, are revolutionizing investment banking by enhancing efficiency and analytical capabilities. These tools are crucial for deal sourcing, due diligence, and risk management, providing a competitive edge in a rapidly evolving market.

The increasing adoption of digital platforms necessitates robust cybersecurity measures to protect sensitive client data and prevent financial fraud. Investment in advanced security infrastructure is paramount for maintaining trust and regulatory compliance in the financial sector.

Fintech innovation presents both opportunities and competitive challenges, driving the need for strategic partnerships or acquisitions to integrate new digital solutions and meet evolving client demands.

Advanced data analytics and predictive modeling are essential for navigating real-time market shifts and regulatory changes, leading to faster deal completions and improved financial outcomes.

| Technology Area | 2024/2025 Projection/Status | Impact on Evercore |

|---|---|---|

| Automation | Global automation market projected to exceed $600 billion by end of 2024. | Streamlines operations, reduces costs, increases productivity. |

| AI/Machine Learning | Heavy investment by leading banks in AI platforms for research automation. | Enhances deal identification, due diligence, and risk management. |

| Cybersecurity | Financial services cybersecurity spending projected to increase by over 10% in 2024. | Mitigates data breach risks, protects client information, ensures compliance. |

| Fintech | Global fintech market valued at ~$1.5 trillion in 2023, projected to reach $3.5 trillion by 2030. | Drives need for partnerships/acquisitions, enhances service offerings. |

| Data Analytics | AI-driven analytics reported up to 15% improvement in deal sourcing efficiency in 2024. | Enables informed decision-making, faster deal closures, and better outcomes. |

Legal factors

Evercore navigates a demanding regulatory landscape, including frameworks like Basel III and MiFID II, which dictate capital adequacy and trading practices. Failure to comply with these evolving rules, a trend expected to intensify through 2025, can result in significant fines and jeopardize operational licenses.

Antitrust and M&A scrutiny are significant legal factors impacting Evercore. Regulatory bodies worldwide, including the U.S. Department of Justice and the European Commission, are intensifying their review of mergers and acquisitions. This increased oversight can significantly affect the feasibility and timeline of large transactions that Evercore advises on. For instance, the U.S. Federal Trade Commission (FTC) and DOJ have been actively challenging deals, with the FTC filing 11 merger challenges in fiscal year 2023, up from 7 in fiscal year 2022, signaling a more aggressive stance.

Evercore's expertise is crucial in navigating these evolving antitrust landscapes. As global antitrust regimes become more complex, particularly concerning technology and healthcare sectors, Evercore's advisory services must account for potential regulatory hurdles. The Biden administration's focus on promoting competition has led to new guidelines and increased enforcement, making it imperative for advisors like Evercore to understand and anticipate these challenges to ensure successful deal execution for their clients.

Data privacy laws like GDPR and CCPA create substantial compliance obligations for Evercore, especially concerning sensitive client data. Failure to adhere can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Evercore must maintain strong data governance and privacy protocols to avoid legal repercussions and safeguard its reputation.

Corporate Governance Standards

Evolving corporate governance standards, such as increased focus on board diversity and executive compensation alignment with long-term performance, directly impact how investment banks like Evercore structure their advisory services and internal operations. For instance, in 2024, many institutional investors are prioritizing engagement with companies demonstrating robust ESG (Environmental, Social, and Governance) practices, which inherently includes strong governance frameworks. Compliance with these evolving expectations is crucial for Evercore to attract and retain institutional investor mandates and maintain overall market confidence in its advisory capabilities.

These governance shifts also influence shareholder rights discussions, a key area for investment banks advising on mergers, acquisitions, and capital raises. For example, the rise of say-on-pay votes and proxy access initiatives in 2024 empowers shareholders to exert greater influence, requiring Evercore to adeptly navigate these dynamics for its clients. Adherence to best practices in these areas is not merely regulatory but a strategic imperative for building trust and facilitating successful transactions.

- Board Diversity: Many leading institutional investors, such as BlackRock, have set targets for board diversity, influencing Evercore's advice to clients on board composition.

- Executive Compensation: Increased scrutiny on executive pay, particularly the ratio of CEO pay to median employee pay, is a growing governance concern that impacts M&A deal structuring.

- Shareholder Rights: The trend towards greater shareholder activism in 2024 means Evercore must be prepared to advise clients on managing proxy contests and shareholder proposals.

Third-Party Risk and Supply Chain Regulations

Regulators globally are intensifying scrutiny on third-party risks within the financial services industry, particularly concerning technology and data providers. This focus stems from the interconnected nature of modern financial operations, where a vulnerability in one vendor can cascade across multiple institutions. For Evercore, this means a critical need to ensure all its service providers, from cloud hosting to data analytics firms, maintain robust cybersecurity protocols and operational resilience. Failure to do so could lead to significant financial penalties and reputational damage.

The increasing complexity of supply chains in finance presents a constant challenge. For instance, reports in late 2024 highlighted a rise in cyberattacks targeting financial institutions through compromised third-party software updates. Evercore must therefore implement rigorous due diligence and ongoing monitoring of its vendors. This includes assessing their security certifications, conducting regular audits, and ensuring clear contractual agreements are in place regarding data protection and incident response. Proactive management of these relationships is paramount to safeguarding Evercore's operations and client data.

- Cybersecurity Standards: Evercore must verify that its third-party vendors comply with evolving cybersecurity frameworks, such as NIST or ISO 27001, to protect sensitive financial data.

- Operational Resilience: Regulations are pushing for greater assurance that vendors can maintain critical services during disruptions, requiring Evercore to assess business continuity plans of key partners.

- Data Governance: Ensuring vendors adhere to strict data privacy regulations, like GDPR or CCPA, is crucial to avoid breaches and associated legal liabilities for Evercore.

Legal frameworks governing financial markets continue to evolve, impacting Evercore's advisory services and operational compliance. Increased regulatory focus on market integrity and client protection, particularly in areas like anti-money laundering (AML) and know-your-customer (KYC) protocols, demands constant vigilance. For example, the Financial Crimes Enforcement Network (FinCEN) continues to update its guidance, with new advisories issued in 2024 concerning ransomware and emerging threats, requiring financial institutions to adapt their compliance programs.

The global push for greater transparency in financial transactions, including beneficial ownership reporting, presents ongoing legal challenges. Evercore must ensure its clients and its own operations adhere to these disclosure requirements, which are being implemented and enforced across various jurisdictions. This trend is expected to continue, with further refinements in reporting standards anticipated through 2025.

Litigation risk remains a significant legal factor. Evercore, like other financial institutions, faces potential lawsuits related to its advisory services, market conduct, and compliance failures. Proactive risk management and robust internal controls are essential to mitigate these exposures, especially as regulatory enforcement actions can often lead to private litigation.

Environmental factors

The increasing focus on Environmental, Social, and Governance (ESG) factors is significantly reshaping investment strategies and corporate valuations. In 2024, sustainable investments globally are projected to exceed $50 trillion, a clear indicator that ESG integration is no longer a niche concern but a mainstream driver of financial markets.

Evercore must embed ESG principles into its core advisory services, particularly in Mergers & Acquisitions and capital raising activities. This strategic alignment is crucial as sustainable finance and ESG integration represent major trends actively shaping the investment banking landscape, with a growing number of institutional investors demanding ESG-compliant portfolios.

Increasingly stringent climate change regulations, like mandatory climate-related financial disclosures and sustainability reporting directives, are reshaping how financial firms operate. These new requirements mean firms like Evercore must be adept at guiding clients through complex reporting standards and embedding climate risk considerations into their strategic planning.

For instance, the SEC's proposed climate disclosure rules, while facing ongoing debate, signal a significant shift towards greater transparency. Similarly, the EU's Corporate Sustainability Reporting Directive (CSRD) is already impacting companies operating within or trading with Europe, demanding detailed reporting on environmental, social, and governance (ESG) factors. Evercore's ability to provide expert advice on compliance and integration of these evolving standards will be crucial for its clients' success and its own advisory services in 2024 and 2025.

The financial sector is witnessing a significant surge in sustainability-linked finance, with green bonds and sustainability-linked loans becoming increasingly popular. Evercore can leverage this trend by offering specialized advisory services for companies looking to tap into this growing market for capital raising. For instance, the global green bond market reached an estimated $500 billion in issuance in 2023, a substantial increase from previous years, highlighting the immense opportunity.

The intensified global focus on climate mitigation is directly fueling the demand for green and sustainability bonds. These instruments allow companies to finance projects with clear environmental benefits, such as renewable energy or energy efficiency initiatives. In 2024, projections indicate continued robust growth in this segment, with total sustainable debt issuance expected to exceed $1 trillion globally, presenting a fertile ground for Evercore's expertise.

Reputational Risks from Environmental Incidents

Environmental controversies can severely damage a company's reputation, leading to decreased customer loyalty and investor confidence. For instance, a significant oil spill or a major pollution incident can result in billions of dollars in cleanup costs and legal settlements, as seen in past cases impacting major energy firms.

Evercore's rigorous due diligence must identify and assess these environmental liabilities. Failure to do so could expose clients to unforeseen financial burdens and legal entanglements, diminishing the value of potential mergers, acquisitions, or investments.

The increasing focus on Environmental, Social, and Governance (ESG) factors means companies with poor environmental records are becoming less attractive targets. In 2024, sustainable investing saw continued growth, with ESG funds attracting substantial inflows, highlighting the market's preference for environmentally responsible businesses.

Key considerations for Evercore's analysis include:

- Past environmental incidents and associated fines or penalties.

- Current sustainability initiatives and compliance with environmental regulations.

- Potential future environmental liabilities, such as carbon pricing or stricter emission standards.

- The company's public perception regarding its environmental stewardship.

Resource Scarcity and Supply Chain Resilience

Global concerns about resource scarcity, amplified by climate change impacts, are increasingly shaping corporate strategies and M&A landscapes. For instance, the International Energy Agency (IEA) reported in early 2024 that demand for critical minerals essential for clean energy technologies, such as lithium and cobalt, is projected to surge significantly by 2030, creating potential bottlenecks and driving consolidation. Evercore may guide clients through transactions focused on securing these vital resources or fortifying their supply chains against disruptions.

Supply chain resilience has become a paramount consideration for businesses worldwide. Following the disruptions experienced in 2020-2022, many companies are re-evaluating their global sourcing strategies. A 2024 survey by McKinsey indicated that over 60% of executives are prioritizing supply chain visibility and diversification. This trend encourages M&A activity aimed at vertical integration or acquiring companies with robust, localized supply networks.

- Increased demand for critical minerals: Projections suggest a multi-fold increase in demand for minerals like lithium and nickel by 2030, driven by the energy transition.

- Supply chain diversification: Companies are actively seeking to reduce reliance on single-source suppliers, leading to M&A opportunities in regions with more stable supply chains.

- Climate-related disruptions: Extreme weather events are increasingly impacting logistics and production, making resilient infrastructure a key M&A target.

- Resource nationalism: Some countries are implementing policies to retain control over critical resources, influencing cross-border M&A in the resource sector.

The increasing focus on environmental factors necessitates that Evercore advise clients on navigating evolving climate regulations and the growing demand for sustainable finance. This includes guiding companies through complex reporting standards like the EU's CSRD and the SEC's proposed climate disclosures, ensuring compliance and integrating climate risk into strategic planning.

The global sustainable finance market is expanding rapidly, with green bond issuance projected to exceed $1 trillion in 2024, presenting significant opportunities for Evercore to assist clients in accessing this capital. Furthermore, the demand for critical minerals essential for the energy transition is surging, creating M&A opportunities in resource acquisition and supply chain fortification.

Environmental liabilities and controversies pose substantial risks, with past incidents demonstrating the potential for billions in cleanup costs and legal settlements. Evercore's due diligence must rigorously assess these risks, as poor environmental stewardship can deter investors and negatively impact company valuations.

Supply chain resilience is a growing concern, prompting companies to diversify sourcing and integrate operations. This trend is driving M&A activity focused on acquiring companies with robust, localized supply networks to mitigate disruptions from climate events and geopolitical factors.

| Environmental Factor | 2024/2025 Trend/Projection | Impact on M&A/Advisory | Evercore Opportunity |

|---|---|---|---|

| Climate Regulations & Disclosure | Stricter mandates (e.g., CSRD, SEC proposals) | Increased compliance burden, strategic planning needs | Expert advice on regulatory navigation and ESG integration |

| Sustainable Finance Growth | Green bond issuance >$1T projected for 2024 | Demand for ESG-compliant capital raising | Specialized advisory for green bonds and sustainability-linked finance |

| Resource Scarcity & Critical Minerals | Surging demand for lithium, cobalt, nickel by 2030 | M&A for resource security and supply chain resilience | Guidance on resource acquisition and supply chain fortification transactions |

| Supply Chain Resilience | >60% executives prioritizing visibility and diversification (McKinsey 2024) | M&A for vertical integration and localized networks | Advisory on M&A for robust, diversified supply chain assets |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government data, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, fact-based information.