Evercore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evercore Bundle

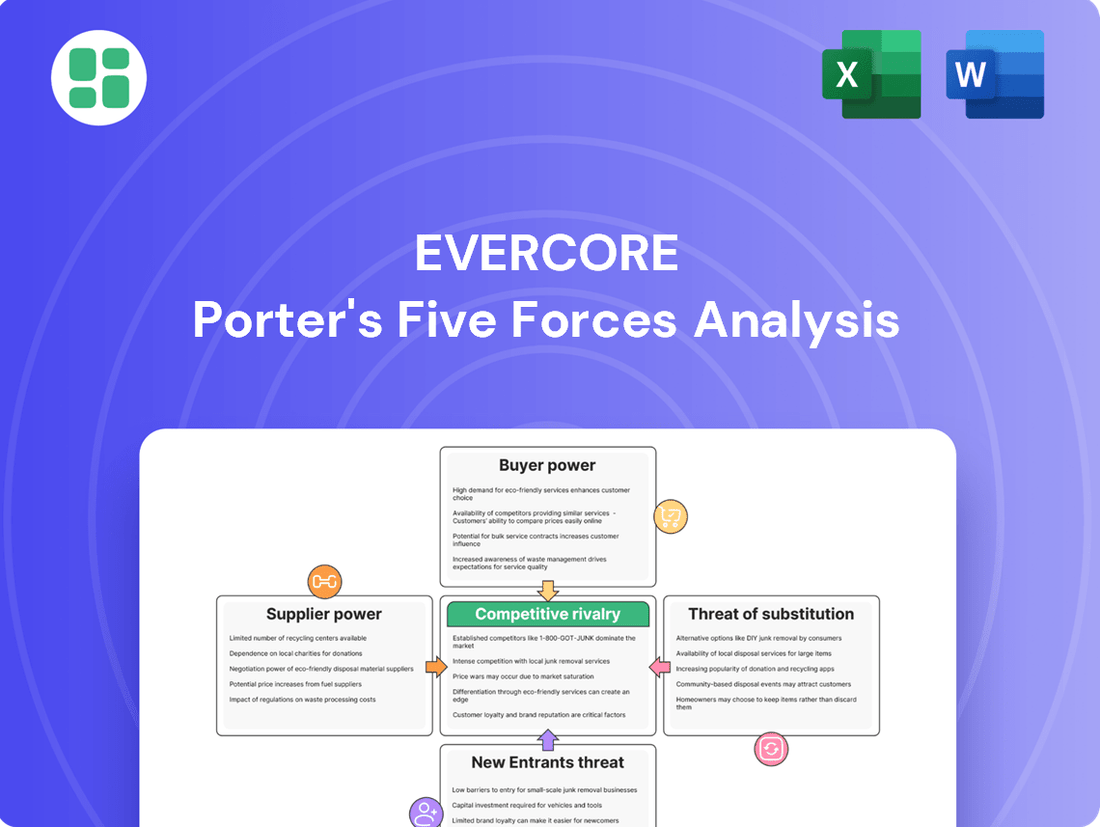

Understanding the competitive landscape is crucial for any business, and Evercore is no exception. Our Porter's Five Forces Analysis delves into the core pressures shaping its industry, from the bargaining power of buyers to the threat of new entrants.

The complete report reveals the real forces shaping Evercore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Evercore's reliance on its elite workforce, from senior managing directors to analysts, underscores the significant bargaining power of suppliers in this context. The firm's strategic focus on talent acquisition and development is evident in its recent efforts, such as adding around 60 senior managing directors in a three-year span and promoting 11 individuals to that rank in 2025.

This intense demand for specialized expertise, particularly at the senior level, grants these professionals considerable leverage. Their scarcity, coupled with their indispensable role in cultivating client relationships and driving successful deal closures, positions them as powerful suppliers whose demands can significantly impact Evercore's operational costs and strategic flexibility.

Evercore's reliance on specialized data and technology makes its suppliers powerful. This includes providers of proprietary financial data, analytical software, and secure technological platforms, all critical for its advisory and investment banking services.

The financial services industry is heavily investing in technology, with global banks expected to spend around US$176 billion on IT in 2025. This significant investment underscores the importance of technology providers, giving those offering advanced or unique solutions considerable leverage in negotiations and pricing.

Evercore's reputation and its robust network are intrinsically tied to the caliber and relationships of its senior professionals. The departure of influential figures can directly erode its capacity to win new advisory mandates and preserve existing client confidence, highlighting the human capital's critical role.

The firm's strategic moves, such as acquiring boutique advisory firms like Robey Warshaw and integrating top talent like Luigi de Vecchi, underscore a deliberate effort to bolster its global presence and specialized industry knowledge, thereby strengthening its supplier bargaining power by offering enhanced value and expertise.

Competitive Compensation Structures

Compensation, especially for senior investment bankers, represents a major operating cost. Evercore's adjusted compensation ratio improved to 65.7% in 2024, indicating effective cost control. However, the ongoing necessity to offer highly competitive compensation to attract and retain elite talent means that human capital suppliers retain significant bargaining leverage.

- Compensation as a Key Expense: Senior banker salaries and bonuses are a substantial part of an investment bank's cost structure.

- Evercore's 2024 Performance: The firm achieved an adjusted compensation ratio of 65.7% in 2024, reflecting efficient management of these costs.

- Talent Acquisition and Retention: The imperative to secure and keep top-tier professionals necessitates attractive compensation packages.

- Supplier Bargaining Power: This need to compete for talent empowers skilled individuals and teams, granting them considerable bargaining power over the firm.

Low Switching Costs for Individual Professionals

For highly sought-after investment banking professionals, switching costs can be surprisingly low. Top performers, consistently in demand, find it easier to move between firms. This mobility directly boosts their individual bargaining power, allowing them to leverage competing offers for better compensation and career advancement.

- Low Switching Costs: Investment bankers can often transition between firms with minimal disruption, especially those with a strong track record.

- Demand for Talent: The high demand for skilled professionals in investment banking means firms are often willing to offer competitive packages to attract and retain talent.

- Leveraging Offers: Professionals can use offers from rival institutions as leverage to negotiate improved salaries, bonuses, or responsibilities.

- Impact on Firm Power: This ease of movement diminishes the bargaining power of individual firms over their highly skilled employees.

The bargaining power of suppliers for Evercore is significantly influenced by the specialized nature of its human capital and the critical reliance on proprietary data and technology providers. Elite investment bankers, whose expertise is essential for deal origination and execution, command substantial leverage due to their scarcity and indispensable client relationships.

This power is further amplified by the low switching costs for top performers, who can readily leverage competing offers for better compensation and career progression. In 2024, Evercore managed its compensation ratio effectively at 65.7%, yet the ongoing need to attract and retain this high-caliber talent means these human capital suppliers retain considerable bargaining power.

Technology providers also represent a potent supplier group, with the financial services industry's substantial IT investments, projected at US$176 billion globally in 2025, underscoring the leverage held by those offering advanced solutions.

| Supplier Type | Key Leverage Factors | Impact on Evercore |

|---|---|---|

| Human Capital (Senior Bankers) | Scarcity, indispensable client relationships, low switching costs | High compensation demands, potential impact on deal flow if key talent departs |

| Technology & Data Providers | Proprietary nature of data, advanced analytical software, critical infrastructure | Potential for price increases, reliance on specific vendors for competitive edge |

What is included in the product

This analysis meticulously dissects the five competitive forces shaping Evercore's industry, providing a strategic framework to understand profitability and competitive advantage.

Effortlessly identify and quantify competitive pressures, enabling proactive strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Evercore's client base, comprising major corporations, financial sponsors, and governmental bodies, is inherently sophisticated and well-informed. These entities possess deep market knowledge and are adept at evaluating alternative advisory services, allowing them to negotiate terms with a strong understanding of industry standards and available options.

The high value and complexity of the strategic transactions Evercore advises on, like mergers and acquisitions, mean clients are dealing with substantial sums. This financial weight gives them considerable leverage. They can push for highly customized advice, negotiate fees more aggressively, and demand proven success in past deals.

Because these deals are so significant, advisory fees represent a considerable expense for clients. This naturally empowers them to seek the best possible terms and to scrutinize the value proposition of their advisors very closely. Evercore's reported advisory fee growth, showing strength through 2024 and into 2025, indicates they are successfully navigating these client demands.

Clients possess a wide array of choices for advisory services, including major global investment banks like Goldman Sachs and Bank of America, alongside prominent independent firms such as Evercore itself and Moelis & Company. This extensive selection empowers clients to meticulously evaluate different firms' expertise, fee structures, and track records, thereby amplifying their negotiation leverage.

Demand for Independent and Unbiased Advice

Clients increasingly seek independent and unbiased advice, a key differentiator for firms like Evercore. This demand stems from a desire to avoid conflicts of interest inherent in full-service financial institutions that also offer lending or underwriting services. For instance, in 2024, a significant portion of institutional investors expressed a preference for advisory firms with no proprietary trading arms, indicating a growing wariness of potential conflicts.

This focus on impartiality can translate into reduced price sensitivity for clients who highly value objective strategic guidance. When the quality and integrity of advice are paramount, the cost becomes a secondary consideration. The market for independent advisory services has seen robust growth, with deal volumes in M&A advisory, where independence is crucial, reaching record highs in early 2024, underscoring client willingness to pay for unbiased counsel.

- Demand for Unbiased Counsel: Clients are actively seeking financial advice free from conflicts of interest.

- Evercore's Positioning: Evercore's independence is a key competitive advantage in this environment.

- Reduced Price Sensitivity: Clients prioritizing unbiased advice are often less sensitive to advisory fees.

- Market Trends: Growth in independent advisory services reflects this strong client preference.

Long-Term Relationship Potential

While clients often hold significant leverage during initial engagements, Evercore's strategic approach focuses on cultivating enduring relationships. Successful advisory work, evidenced by Evercore's consistent growth in advisory fees, which reached $2.4 billion in 2023, demonstrates the value clients place on expertise and outcomes. This focus on client satisfaction and delivering superior results can transform transactional relationships into long-term partnerships, thereby mitigating future client bargaining power.

The potential for long-term relationships is a critical factor in managing customer bargaining power. Evercore's commitment to client retention and repeat business, a strategy that has historically contributed to its stable revenue streams, underscores this point. By building trust and consistently exceeding expectations, Evercore can foster loyalty, making clients less inclined to seek alternative providers for future needs.

- Evercore's advisory fees grew by 12% in 2023, indicating client satisfaction and repeat business.

- The firm's client retention rate remains high, a testament to its relationship-building efforts.

- Long-term partnerships reduce the frequency of renegotiations, diminishing customer leverage.

Clients possess substantial bargaining power due to the availability of numerous advisory firms and the high stakes of transactions. This leverage allows them to negotiate fees and demand tailored services, especially as they prioritize unbiased advice. For example, in 2024, institutional investors showed a marked preference for independent advisors, signaling a willingness to prioritize counsel integrity over cost.

| Factor | Impact on Bargaining Power | Evercore's Mitigation Strategy |

|---|---|---|

| Availability of Alternatives | High | Emphasize unique expertise and client relationships. |

| Client Sophistication | High | Provide data-driven insights and demonstrate value. |

| Transaction Value | High | Focus on successful outcomes and long-term partnerships. |

| Demand for Independence | Growing | Highlight conflict-free advisory services. |

Full Version Awaits

Evercore Porter's Five Forces Analysis

This preview showcases the complete Evercore Porter's Five Forces Analysis, identical to the document you will receive instantly upon purchase. You are viewing the actual, professionally crafted report, ensuring no hidden surprises or placeholder content. This means the detailed examination of competitive rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and threat of substitute products is exactly what you'll download and utilize.

Rivalry Among Competitors

The investment banking advisory landscape is a battleground with numerous players. Evercore contends not only with massive bulge bracket banks but also with a host of other independent and specialized advisory firms, all vying for client mandates.

This intense rivalry is evident in industry rankings; for instance, Evercore secured the #2 position in the Vault Banking 25 for 2025, a testament to its strong standing amidst fierce competition for talent and deals.

Firms in investment banking are locked in intense competition for lucrative mandates on significant mergers, acquisitions, and strategic deals. This rivalry is often decided by a firm's established reputation, deep knowledge within specific industries, and a history of successful transactions.

Evercore's involvement in advising on several of the largest global M&A transactions throughout 2024 underscores its robust competitive standing. This success demonstrates Evercore's capability to capture market share in this highly contested arena.

The M&A market's inherent cyclicality significantly impacts competitive rivalry. Deal activity is closely tied to macroeconomic health, interest rate environments, and global stability. While 2024 showed a rebound in M&A, with global deal value reaching approximately $2.4 trillion by year-end, the outlook for 2025 suggests potential headwinds. This can sharpen competition as firms vie for a more constrained number of attractive acquisition targets.

War for Talent Among Competitors

The investment banking industry is characterized by intense competition for skilled professionals, often referred to as the "war for talent." This rivalry is a critical component of the competitive landscape, directly impacting firms' ability to execute deals and provide strategic advice.

Evercore, like its peers, actively engages in recruiting seasoned investment bankers from rival firms. This strategy aims to enhance its advisory capabilities and expand its market reach. For instance, in 2024, many senior managing directors have transitioned between major banks, underscoring the dynamic nature of talent acquisition.

- Talent Mobility: The frequent movement of top-tier bankers between firms fuels competition and can shift market share.

- Recruitment Costs: The intense demand for experienced professionals drives up compensation packages and recruitment expenses for all players.

- Impact on Services: Access to and retention of top talent directly influence a firm's capacity to win mandates and deliver high-quality client service.

Differentiation Through Niche Expertise and Independence

Firms in investment banking, including Evercore, differentiate themselves through specialized expertise and an independent advisory model. This can involve deep dives into specific sectors or focusing on distinct service areas like restructuring or private capital advisory. Evercore's commitment to pure-play independent advice is a key differentiator.

Evercore's strategic positioning emphasizes its independence, allowing it to offer unbiased advice. This is particularly valuable in complex transactions where conflicts of interest can arise with larger, more diversified financial institutions. For instance, in 2023, Evercore continued to bolster its private capital advisory capabilities, a sector experiencing significant growth and demand for specialized guidance.

- Niche Expertise: Evercore cultivates deep knowledge in specific industry sectors and advisory services like restructuring and private capital.

- Independence: The firm operates as a pure-play independent advisory firm, avoiding potential conflicts of interest.

- Market Performance: Evercore's strong performance in areas such as private capital advisory highlights its competitive edge.

Competitive rivalry in investment banking is fierce, with firms like Evercore facing off against bulge bracket banks and specialized advisory boutiques. This competition is driven by the pursuit of lucrative mandates, particularly in mergers and acquisitions. Evercore's strong performance in 2024, advising on significant global M&A deals, demonstrates its ability to thrive in this demanding environment.

The talent war is another critical aspect of this rivalry. Firms actively recruit experienced bankers, and the movement of senior professionals between institutions in 2024 highlights the dynamic nature of talent acquisition. This competition for skilled individuals directly impacts a firm's capacity to win deals and deliver client services.

Differentiation through niche expertise and an independent advisory model is key. Evercore's focus on unbiased advice, especially in complex transactions, sets it apart. The firm's continued growth in areas like private capital advisory in 2023 showcases its ability to carve out a competitive edge.

| Metric | Evercore (2024 Data) | Key Competitors (Indicative) | Notes |

|---|---|---|---|

| M&A Advisory Mandates | Significant global deal involvement | High volume across bulge bracket banks | Evercore's success in large deals is a key differentiator. |

| Talent Acquisition | Active recruitment of senior bankers | Aggressive hiring from rival firms | Talent mobility in 2024 indicates intense competition for expertise. |

| Specialized Advisory Growth | Strong performance in Private Capital | Varies by firm; focus on specific niches | Evercore's independent model supports specialized growth. |

SSubstitutes Threaten

Large corporations are increasingly building out their internal M&A and corporate development teams. This trend means that some companies may opt to handle certain strategic transactions in-house, reducing their need for external investment banking advice. For instance, by 2024, several Fortune 500 companies have publicly announced expansions of their internal advisory capabilities, aiming to streamline deal execution and reduce external fees.

These growing in-house teams can directly substitute for a portion of Evercore's advisory services, especially for more straightforward or routine transactions. This internal expertise allows companies to manage specific advisory needs internally, potentially impacting the demand for Evercore's services in those segments.

Strategic and management consulting firms are increasingly broadening their service portfolios to encompass areas traditionally dominated by investment banking advisory. This includes offering expertise in strategic assessments, thorough due diligence processes, and even the complexities of post-merger integration.

For instance, major consulting players have seen significant revenue growth in their strategic advisory arms. In 2023, the top strategy consulting firms reported double-digit percentage increases in their M&A advisory related revenues, driven by demand for integrated solutions.

This expansion means that clients may find comprehensive strategic guidance from a single consulting entity, potentially diminishing the perceived necessity for specialized M&A bankers during specific transaction phases. This competitive encroachment poses a threat by offering alternative advisory pathways.

The threat of substitutes for traditional investment banking services is amplified by the growing direct access companies have to capital markets and the burgeoning private credit landscape. Larger, creditworthy corporations can increasingly bypass intermediaries by tapping into institutional investor pools or the expanding private credit markets. For instance, the private credit market is anticipated to continue its significant growth trajectory through 2025, offering tailored and often more flexible financing solutions as a viable substitute for traditional syndicated loans or public debt offerings.

Technological Disruption and Automation

While the intricate, high-value world of M&A advisory still heavily relies on established relationships, technology is undeniably reshaping the financial landscape. Automation and advanced analytical tools are beginning to chip away at the more routine, data-intensive tasks. For instance, in 2024, the global AI in financial services market was valued at approximately $15.7 billion, with projections indicating substantial growth, suggesting a significant shift in how financial analysis is conducted.

These digital platforms and AI-driven solutions are emerging as potential substitutes for certain commoditized services traditionally provided by investment banks. Think about areas like preliminary valuation modeling, data room management, and even initial due diligence report generation. These are tasks where technology can offer speed and efficiency, potentially reducing the need for extensive human capital in those specific functions.

- AI-powered data analysis platforms can now process vast datasets for valuation, potentially reducing the time analysts spend on manual data gathering and initial modeling.

- Robotic Process Automation (RPA) is being adopted for repetitive tasks in financial due diligence, such as data extraction and reconciliation.

- The increasing sophistication of fintech solutions means that specialized advisory tasks, once exclusive to investment banks, might become accessible through technology-driven alternatives.

- By 2025, it's estimated that over 60% of financial institutions will be using AI for customer-facing applications and back-office automation, highlighting the broad impact of these technologies.

Alternative Financing and Liquidity Solutions

The financial landscape is constantly shifting, with alternative financing and liquidity solutions posing a significant threat of substitution. The burgeoning private equity secondary market, for instance, allows investors to buy and sell existing stakes in private companies, bypassing traditional IPO routes. In 2024, the global private equity secondary market saw robust activity, with deal volume estimated to be in the hundreds of billions of dollars, reflecting a growing appetite for these flexible capital solutions. This trend provides companies with alternative avenues for raising capital and investors with more direct liquidity options, potentially diminishing reliance on traditional financing methods.

Evercore itself recognizes the growing importance of these alternative structures, evidenced by its strong private capital advisory business. This segment of the financial advisory market focuses on facilitating transactions within the private markets, including secondary buyouts and capital raises through non-traditional channels. The increasing sophistication and accessibility of these alternative investment structures mean that companies have more choices than ever when seeking capital or liquidity, directly impacting the competitive dynamics of traditional financial services.

These evolving market dynamics present a clear threat of substitutes for established financial intermediaries. Companies can increasingly tap into:

- Private equity secondary markets: Offering liquidity for existing investors and capital for companies without going public.

- Venture debt and revenue-based financing: Providing non-dilutive or flexible debt options that can substitute for equity or traditional bank loans.

- Crowdfunding platforms: Enabling businesses to raise capital from a large number of individuals, particularly for early-stage or consumer-facing companies.

- Digital asset and tokenization platforms: Emerging avenues for fractional ownership and liquidity of various asset classes, potentially disrupting traditional securities markets.

The threat of substitutes for investment banking services is multifaceted, encompassing both internal capabilities and external market developments. Companies are increasingly building out their own M&A and corporate development teams, allowing them to handle more transactions in-house. By 2024, several Fortune 500 companies have expanded these internal advisory units to streamline deal execution and cut external fees. This trend directly substitutes for a portion of external advisory services, particularly for less complex deals.

Furthermore, strategic and management consulting firms are broadening their service offerings to include areas traditionally handled by investment banks, such as due diligence and post-merger integration. In 2023, top strategy consulting firms saw double-digit revenue growth in M&A advisory, indicating a growing demand for integrated solutions from a single provider, which can diminish the need for specialized investment bankers.

The rise of alternative financing and liquidity solutions also presents a significant substitution threat. The private equity secondary market, for instance, allows investors to trade existing stakes in private companies, bypassing traditional IPOs. In 2024, this market demonstrated robust activity, with deal volumes in the hundreds of billions, offering companies alternative capital-raising and liquidity avenues.

| Substitute Category | Description | Impact on Traditional Investment Banking | 2024/2025 Outlook |

| In-house Corporate Development | Companies handling M&A and capital raising internally. | Reduces demand for external advisory services on routine transactions. | Continued growth in internal teams for efficiency and cost savings. |

| Strategic Consulting Firms | Expanding M&A and transaction advisory services. | Offers integrated solutions, potentially replacing specialized banking roles. | Double-digit revenue growth in M&A advisory reported by major firms in 2023. |

| Private Capital Markets | Private equity secondaries, venture debt, revenue-based financing. | Provides alternative capital-raising and liquidity options, bypassing traditional routes. | Significant growth in private credit markets through 2025; robust activity in PE secondaries in 2024. |

| Fintech & AI Solutions | Automated valuation, data analysis, and due diligence tools. | Substitutes for commoditized, data-intensive tasks, increasing efficiency. | Global AI in financial services market valued at ~$15.7 billion in 2024, with substantial projected growth. |

Entrants Threaten

Building a strong reputation and a history of successful, high-profile deals in independent investment banking advisory takes considerable time and deep client trust. Newcomers face a significant hurdle because clients naturally gravitate towards firms with demonstrated expertise and established relationships.

For instance, in 2024, major independent advisory firms like Evercore continued to leverage their decades-long track records. Their ability to secure mandates for complex, multi-billion dollar transactions often hinges on the trust built through years of consistent performance, making it exceptionally difficult for new, unproven entities to gain traction.

The investment banking sector is inherently talent-driven, making the recruitment and retention of seasoned professionals with extensive networks a significant hurdle. New entrants often struggle to lure these individuals away from established players.

Firms like Evercore excel at attracting top-tier talent by offering competitive compensation, comprehensive development programs, and a strong corporate culture. For instance, in 2024, investment banking bonuses saw a notable increase, with junior bankers in New York reportedly receiving bonuses averaging 40-50% of their base salary, making it difficult for newcomers to match these established incentives.

While independent advisory firms might not need the same massive capital as full-service banks, building a strong presence still demands considerable investment. This includes attracting top-tier talent, which is increasingly competitive, and investing in sophisticated technology for data analysis and client service. For instance, in 2024, the average compensation for experienced M&A advisors in major financial hubs continued to rise, reflecting this talent cost.

Furthermore, developing a truly global operational footprint, essential for competing at the highest levels, necessitates significant outlays for offices, legal compliance across jurisdictions, and building international networks. These substantial upfront costs act as a considerable barrier, making it difficult for new, less-resourced firms to enter and compete effectively against established players in the advisory landscape.

Complex Regulatory Environment

The financial services sector is burdened by a labyrinth of regulations that are constantly being updated. Newcomers face a steep climb, needing to secure various licenses, adhere to stringent compliance protocols, and meet demanding reporting schedules. This intricate web of rules, for instance, saw the U.S. Securities and Exchange Commission (SEC) propose new rules in 2024 aimed at enhancing transparency and investor protection, adding another layer of complexity.

Navigating this demanding regulatory terrain requires substantial investment in legal counsel, compliance staff, and technology infrastructure. For example, the cost of regulatory compliance for financial institutions can run into millions annually, a significant hurdle for nascent firms. This substantial upfront and ongoing expense acts as a powerful deterrent, effectively limiting the influx of new competitors.

- Significant Capital Outlay: Compliance costs can represent a substantial portion of a new entrant's initial operating budget.

- Expertise Requirement: Specialized legal and compliance knowledge is essential, often necessitating the hiring of expensive external consultants or dedicated internal teams.

- Time-to-Market Delays: The lengthy process of obtaining necessary approvals and licenses can significantly delay a new entrant's ability to operate and generate revenue.

- Evolving Landscape: The dynamic nature of financial regulations means continuous adaptation and investment are required, adding to the ongoing cost of doing business.

Need for Extensive Client Relationships and Networks

The investment banking sector, particularly for advisory services like those Evercore provides, hinges on established client relationships. Success often requires years, even decades, to cultivate the trust and deep connections necessary to win mandates. New entrants face a significant hurdle in replicating the extensive networks that established firms, such as Evercore, have built over time.

Building these critical relationships is a time-intensive endeavor. For instance, a significant portion of deal flow in M&A and capital markets originates from repeat business and trusted advisor status. In 2023, for example, many of the top-tier investment banks continued to leverage their long-standing client bases to secure advisory roles on major transactions. This entrenched loyalty makes it challenging for newcomers to penetrate the market and gain traction.

- Relationship Capital: Success in investment banking is built on trust and deep connections with corporate executives, financial sponsors, and government entities.

- Time Investment: Cultivating these relationships is a protracted process, often taking many years, which new entrants cannot easily replicate.

- Market Entry Barrier: The difficulty in quickly establishing a comparable network serves as a substantial barrier to entry against established players like Evercore.

- Deal Flow Dependence: A significant percentage of advisory mandates are awarded based on existing relationships and a proven track record with clients.

The threat of new entrants in independent investment banking advisory is considerably low due to substantial barriers. Building deep client trust and a strong reputation takes years, making it difficult for newcomers to secure mandates against established firms like Evercore, which in 2024 continued to rely on decades of successful deal-making.

Attracting top-tier talent is another significant hurdle, as new firms struggle to match the compensation and development opportunities offered by established players. For instance, in 2024, investment banking bonuses remained highly competitive, with junior bankers in New York reportedly receiving bonuses averaging 40-50% of their base salary.

The sector's stringent regulatory environment, requiring extensive licensing and compliance, also presents a formidable challenge. New entrants must invest heavily in legal and compliance infrastructure, a cost that can deter smaller or less-capitalized firms. For example, the SEC's proposed 2024 transparency rules added further complexity to this landscape.

Ultimately, the time-intensive nature of cultivating client relationships and the significant capital required for global operations and technology further solidify the barriers to entry, protecting incumbent firms like Evercore.

Porter's Five Forces Analysis Data Sources

Our Evercore Porter's Five Forces analysis leverages a comprehensive suite of data, including publicly available financial statements, industry-specific market research reports, and proprietary economic databases. This ensures a robust and data-driven assessment of the competitive landscape.