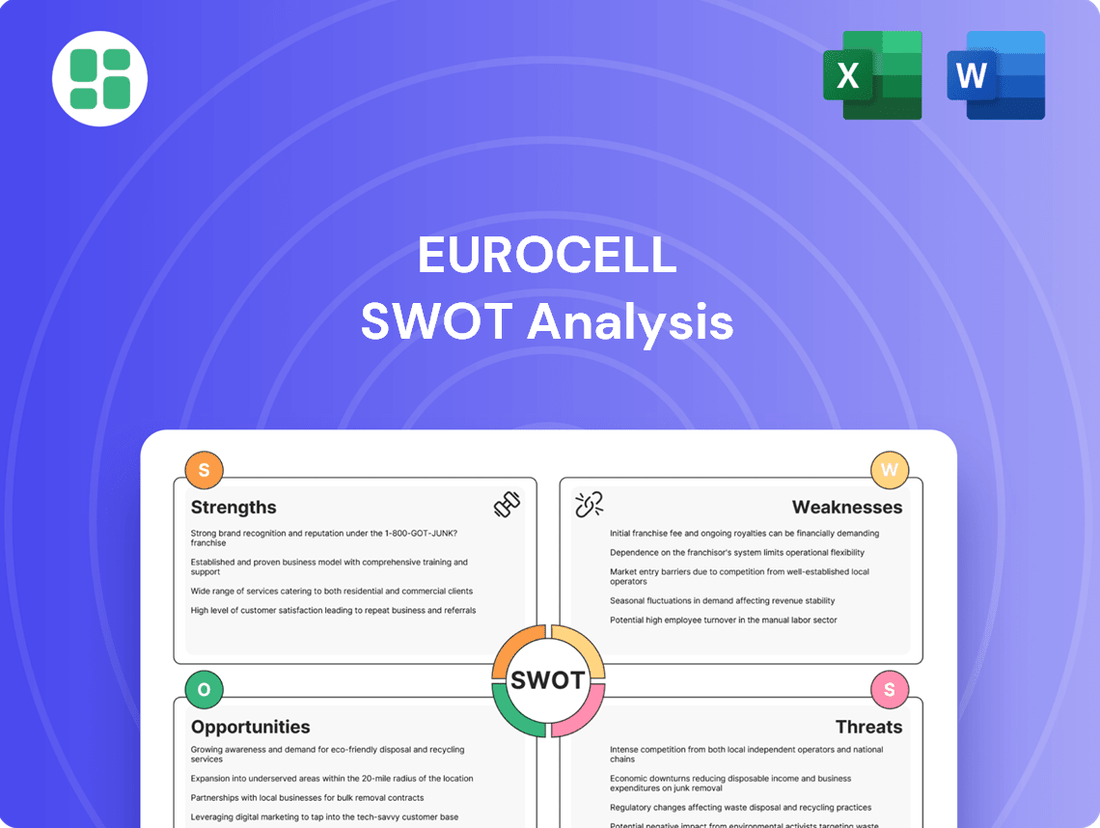

Eurocell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

Eurocell's market position is shaped by a blend of robust brand recognition and a strong distribution network, but also faces challenges from intense competition and evolving market demands. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the building materials sector.

Want the full story behind Eurocell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eurocell's integrated business model is a significant strength, covering manufacturing, distribution, and recycling of PVC products. This end-to-end control enhances supply chain resilience and quality assurance. For instance, their 2023 revenue of £276.3 million demonstrates the scale of operations powered by this integration.

Eurocell boasts a commanding market leadership position within the UK for PVC window, door, and roofline products, encompassing manufacturing, recycling, and distribution. This established dominance translates into significant competitive advantages, strong brand recognition, and deep-rooted relationships across the building and construction sector.

Eurocell showcased remarkable financial resilience in 2024, navigating a challenging market. Despite a modest dip in overall sales, the company achieved a substantial increase in adjusted profit before tax, reaching £20.5 million. This impressive feat was largely attributable to astute gross margin management and a successful reduction in input costs, underscoring Eurocell's robust operational efficiency and stringent cost control measures.

Strong Commitment to Sustainability and Recycling

Eurocell's significant commitment to sustainability is a key strength, underscored by its operation of the UK's largest PVC-U recycling facility. This closed-loop system not only integrates recycled materials into their product lines but also bolsters their Environmental, Social, and Governance (ESG) profile, meeting increasing market demands for eco-friendly practices.

This robust recycling capability offers a distinct competitive advantage by securing a cost-effective and consistent supply of raw materials, insulating them from some of the price volatility seen in virgin material markets. For instance, in 2023, Eurocell reported significant volumes of PVC-U recycled, contributing to a reduction in their reliance on external suppliers and a lower carbon footprint.

- Largest PVC-U Recycling Operation in the UK: Eurocell operates the most extensive PVC-U recycling facility in the United Kingdom.

- Closed-Loop Recycling System: The company effectively reintegrates recycled PVC-U into the manufacturing of new products.

- Enhanced ESG Credentials: Their sustainability efforts significantly improve their standing in environmental, social, and governance metrics.

- Cost-Effective Raw Material Sourcing: The recycling operation provides a stable and economical source of materials, mitigating supply chain risks.

Extensive Nationwide Distribution Network

Eurocell's extensive nationwide distribution network, boasting over 200 branches across the UK, is a significant strength. This robust infrastructure ensures efficient product delivery to a wide customer base, including fabricators, installers, and specifiers. The company's broad market penetration is a direct result of this widespread accessibility, making it easier for customers to obtain their products and services.

This widespread network facilitates rapid response times and localized support, enhancing customer satisfaction and loyalty. For instance, in the 2024 fiscal year, Eurocell reported that its logistics network enabled an average delivery lead time of just 2.5 days for stocked items to its key customer segments. This operational efficiency underpins their ability to serve a diverse range of projects, from small residential installations to larger commercial developments.

- Over 200 UK branches

- Efficient delivery to fabricators, installers, and specifiers

- Broad market penetration and customer accessibility

- Average delivery lead time of 2.5 days for stocked items (FY2024)

Eurocell's integrated business model, encompassing manufacturing, distribution, and recycling, provides significant supply chain control and quality assurance, as evidenced by their £276.3 million revenue in 2023.

The company holds a dominant market leadership position in the UK for PVC window, door, and roofline products, fostering strong brand recognition and deep industry relationships.

Eurocell demonstrated financial strength in 2024, achieving £20.5 million in adjusted profit before tax through effective gross margin management and cost reductions, highlighting operational efficiency.

Their commitment to sustainability, particularly the UK's largest PVC-U recycling facility, enhances ESG credentials and provides a cost-effective, consistent raw material supply, reducing reliance on virgin materials.

Eurocell's extensive distribution network of over 200 branches ensures efficient product delivery across the UK, with an average lead time of 2.5 days for stocked items in FY2024, boosting customer accessibility and satisfaction.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Business Model | End-to-end control from manufacturing to recycling | £276.3 million revenue (2023) |

| Market Leadership (UK PVC Products) | Dominant position in window, door, and roofline sectors | Strong brand recognition and industry relationships |

| Financial Resilience | Profitability achieved through cost management | £20.5 million adjusted PBT (2024) |

| Sustainability & Recycling | Largest UK PVC-U recycling facility, closed-loop system | Enhanced ESG profile, cost-effective raw material sourcing |

| Distribution Network | Over 200 UK branches, efficient delivery | 2.5-day average lead time for stocked items (FY2024) |

What is included in the product

Delivers a strategic overview of Eurocell’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and address Eurocell's strategic challenges and opportunities.

Weaknesses

Eurocell's significant reliance on the UK construction market, encompassing both new housing developments and the repair, maintenance, and improvement (RMI) sectors, presents a notable weakness. This concentrated exposure makes the company particularly vulnerable to the inherent cyclicality and macroeconomic fluctuations affecting the UK building industry. For instance, the company noted subdued demand within these key markets during 2024, directly impacting its performance.

Eurocell faced a noticeable drop in sales volume during 2024, a trend that impacted its revenue despite efforts to boost profitability. This decline suggests a softening demand within its primary markets, highlighting challenges in expanding its customer base or increasing order sizes.

The UK building materials sector is intensely competitive, placing significant pressure on Eurocell's selling prices, especially through its branch network. This can squeeze profit margins if the company can't effectively manage costs or introduce unique, value-adding products and services.

Vulnerability to Raw Material Price Volatility

While Eurocell experienced a benefit from lower input costs in 2024, the company's profitability remains exposed to the unpredictable swings in prices for critical raw materials. Key inputs like PVC resin, electricity, and the feedstock for recycling are subject to market forces that can significantly affect production expenses. These cost fluctuations directly impact Eurocell's gross margins, potentially squeezing profitability if prices rise sharply.

The company's reliance on these volatile commodities presents a persistent challenge. For instance, a surge in PVC resin prices, a primary component in their window and door systems, could quickly erode the cost advantages gained elsewhere. Similarly, energy price volatility, particularly for electricity which is a significant operational cost, directly influences manufacturing overheads.

- PVC Resin Price Fluctuations: The cost of PVC resin is a major driver of Eurocell's raw material expenses.

- Electricity Cost Sensitivity: Manufacturing processes are energy-intensive, making Eurocell vulnerable to electricity price hikes.

- Recycling Feedstock Availability and Cost: While beneficial for sustainability, the cost and consistent supply of recycled materials can vary.

- Impact on Gross Margins: Unfavorable movements in these input costs can directly reduce the company's gross profit.

Operational Cost Inflation

Eurocell is grappling with persistent operational cost inflation, particularly concerning labor and other overhead expenses. These external pressures are a significant weakness, potentially impacting the company's bottom line.

While the management team is actively pursuing cost reduction initiatives, the effectiveness of these measures in offsetting rising input costs remains a key concern. Without successful mitigation strategies, profitability could be eroded.

- Ongoing Labor Cost Increases: Eurocell faces continued upward pressure on wages and associated employment costs, a trend observed across many sectors in 2024 and anticipated to persist into 2025.

- Other Overhead Inflation: Beyond labor, the company is also experiencing inflation in other operational overheads, such as energy, raw materials, and logistics, further squeezing margins.

- Profitability Erosion Risk: If these inflationary forces outpace the company's ability to implement operational efficiencies or adjust pricing strategies, profitability is at risk of decline.

Eurocell's profitability is susceptible to the volatility of key raw material prices, particularly PVC resin and energy. For instance, the company's cost of sales in 2024 was significantly influenced by these fluctuations, impacting gross margins. Furthermore, ongoing operational cost inflation, especially in labor, presents a persistent challenge that management is working to mitigate.

| Cost Driver | 2024 Impact | Outlook for 2025 |

|---|---|---|

| PVC Resin Prices | Volatile, impacting cost of goods sold | Expected continued volatility |

| Electricity Costs | Significant operational expense, subject to market price changes | Potential for continued upward pressure |

| Labor Costs | Experiencing persistent inflation | Anticipated to remain elevated |

Preview the Actual Deliverable

Eurocell SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Eurocell's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, offering actionable insights into Eurocell's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The construction industry is experiencing a significant shift driven by increasing regulatory mandates, like the UK's Future Homes Standard, and a global commitment to net-zero emissions. This creates a substantial opportunity for companies like Eurocell, whose PVC-U products and robust recycling capabilities align perfectly with the growing demand for sustainable building materials.

Eurocell's focus on PVC-U, a material known for its energy efficiency and recyclability, positions it favorably. For instance, the company's commitment to recycling is evident in its operations, contributing to a circular economy model that resonates with environmentally conscious consumers and developers.

The market for sustainable building materials is projected for robust growth. In 2024, the global green building materials market was valued at approximately $295.6 billion, with projections indicating a compound annual growth rate (CAGR) of around 10% through 2030, highlighting the significant potential for Eurocell to expand its market share.

Eurocell's strategic acquisition of Alunet, a specialist in aluminium systems, in early 2024 significantly broadens its product portfolio. This move allows Eurocell to offer a more comprehensive range of fenestration solutions, including aluminium and composite doors, directly competing in a growing segment of the market.

This diversification is crucial for reducing Eurocell's historical reliance on PVC, opening up new revenue streams and enhancing its resilience against material-specific market fluctuations. For instance, the demand for aluminium windows and doors has seen steady growth, with market reports indicating a compound annual growth rate (CAGR) of over 5% in the global aluminium fenestration market leading up to 2025.

Forecasts point to a significant rebound in the UK construction sector starting in 2025, with particular strength expected in private housing and the repair, maintenance, and improvement (RMI) segments. This anticipated recovery is projected to see the sector grow by 2.2% in 2025, following a period of contraction.

As these market conditions improve, Eurocell, a leading manufacturer and supplier of building products, is strategically positioned to capitalize on the resurgence. The company's product portfolio, which includes uPVC windows, doors, and roofing systems, directly aligns with the anticipated demand drivers in both new build housing and RMI projects.

This recovery offers Eurocell a substantial opportunity to increase sales volumes and market share. For instance, the RMI sector, which accounts for a significant portion of construction output, is expected to see robust growth as homeowners invest in upgrades and energy-efficient solutions, areas where Eurocell's offerings are highly relevant.

Expansion of Recycling Services and Offerings

Eurocell's ongoing expansion of its waste PVC-U collection services throughout the UK positions it to strengthen its recycling leadership. This initiative not only boosts sustainability credentials but also opens avenues for new revenue by simplifying responsible recycling for businesses.

This expansion aligns with increasing regulatory pressure and consumer demand for circular economy solutions. For instance, by 2024, the UK government aims to significantly increase plastic recycling rates, creating a favorable market for Eurocell's services.

- Enhanced Sustainability Profile: Demonstrates commitment to environmental responsibility, appealing to eco-conscious customers and investors.

- New Revenue Streams: Potential to monetize collected waste PVC-U through resale or further processing, diversifying income.

- Market Leadership: Solidifies Eurocell's position as a key player in the growing PVC-U recycling sector.

- Regulatory Compliance: Proactively addresses evolving environmental legislation and targets for waste reduction.

Leveraging Digitalisation and E-commerce Growth

Eurocell is actively investing in its digital infrastructure, aiming to enhance operational efficiencies and expand its e-commerce footprint. This strategic digital transformation is designed to streamline processes and improve the overall customer journey.

The company's commitment to digitalization is evident in its ongoing system upgrades, which are crucial for supporting future growth. By modernizing its business systems, Eurocell is positioning itself to better serve its customers and adapt to evolving market demands.

Growing e-commerce sales is a key objective, opening new avenues for revenue generation and customer engagement. This focus on online channels is expected to contribute significantly to the company's expansion efforts.

- Digital Investment: Eurocell is enhancing its business systems to support digital growth.

- E-commerce Expansion: The company is focused on increasing its online sales channels.

- Efficiency Gains: Digital initiatives are expected to improve operational performance.

- Customer Experience: Upgraded systems aim to provide a better customer journey.

The increasing global focus on sustainability and the UK's commitment to net-zero targets present a significant opportunity for Eurocell. Its PVC-U products and recycling capabilities align perfectly with the growing demand for eco-friendly building materials, a market projected to reach approximately $295.6 billion in 2024 and grow at a CAGR of around 10% through 2030. Furthermore, the strategic acquisition of Alunet in early 2024 broadened Eurocell's product range to include aluminium systems, tapping into a market segment with a projected CAGR exceeding 5% leading up to 2025. The anticipated rebound in the UK construction sector in 2025, particularly in private housing and the RMI segments, with a forecast growth of 2.2%, positions Eurocell to capitalize on increased sales volumes and market share.

| Opportunity Area | Description | Market Data/Potential | Eurocell Relevance |

|---|---|---|---|

| Sustainable Building Materials | Growing demand for eco-friendly construction products. | Global market valued at $295.6 billion in 2024, projected CAGR of 10% through 2030. | Eurocell's PVC-U products and recycling align with this trend. |

| Product Portfolio Diversification | Expansion into aluminium and composite systems. | Global aluminium fenestration market CAGR over 5% leading up to 2025. | Acquisition of Alunet enhances Eurocell's offering and market reach. |

| Construction Sector Recovery | Rebound in UK construction, especially housing and RMI. | UK construction sector forecast to grow by 2.2% in 2025. | Eurocell's products are well-suited for new builds and RMI projects. |

| PVC-U Recycling Expansion | Enhancing waste collection and circular economy services. | UK government aims to increase plastic recycling rates by 2024. | Strengthens sustainability credentials and creates new revenue streams. |

| Digital Transformation & E-commerce | Investing in digital infrastructure and online sales. | Focus on improving efficiency and customer experience through digital channels. | Aims to streamline operations and expand market access. |

Threats

Ongoing macroeconomic uncertainty, coupled with persistently high interest rates, continues to dampen consumer confidence and spending, particularly in sectors like home improvements and new-build housing. This cautious spending environment directly impacts demand for Eurocell's products, creating a significant headwind for sales volumes and overall revenue generation throughout 2024 and into 2025.

The UK windows and doors sector is notably fragmented, presenting a significant competitive landscape for Eurocell. Emerging trends show a growing preference for alternative materials such as aluminium and composite doors, which directly challenge PVC-U products. This shift, coupled with a crowded market of numerous players, puts pressure on pricing and could erode Eurocell's market share if innovation falters.

While Eurocell has recently benefited from reduced input costs, the market for key raw materials such as PVC resin remains inherently volatile. Global supply chain snags, which have eased somewhat, could easily re-emerge, posing a significant risk.

Any substantial uptick in material expenses or interruptions to the flow of these essential components would directly translate into higher production costs for Eurocell, potentially squeezing profit margins. For instance, a 10% increase in PVC resin prices, a common benchmark, could significantly impact the cost of goods sold.

Evolving Building Regulations and Environmental Scrutiny on Plastics

Evolving building regulations and heightened environmental scrutiny on plastics present a significant threat to Eurocell. While the company excels in PVC recycling, future regulatory changes demanding even lower environmental impact or increased public pressure against plastic use could necessitate substantial adaptation. For instance, the UK government's increased focus on the circular economy, as evidenced by potential future Extended Producer Responsibility (EPR) schemes for plastics, could directly impact manufacturing costs and product design.

Eurocell must remain agile in its product development and operational processes to ensure ongoing compliance and a favorable environmental image. Failure to do so could lead to competitive disadvantages and reputational damage. The company's commitment to recycling is a strong point, but the pace of regulatory change, particularly concerning embodied carbon in construction materials, requires constant monitoring and proactive innovation to stay ahead of potential mandates.

- Stricter building codes: Future regulations could mandate higher percentages of recycled content or ban certain plastic additives, impacting product formulations.

- Public perception: Negative sentiment towards plastics, fueled by environmental concerns, could reduce demand for PVC-based products.

- Increased compliance costs: Adapting to new environmental standards may require significant investment in research, development, and manufacturing process upgrades.

- Competition from alternatives: Growing demand for sustainable materials like timber or metal could lead to market share erosion if Eurocell's offerings are perceived as less environmentally friendly.

Skilled Labour Shortages in the Construction Industry

The construction industry in the UK continues to grapple with a persistent shortage of skilled labour. This scarcity is particularly acute in specialist trades and roles crucial for renovation and retrofit projects. For instance, a 2024 report from the Federation of Master Builders (FMB) indicated that over 70% of small and medium-sized construction firms were experiencing difficulties finding skilled workers, especially in areas like bricklaying and carpentry. This situation could potentially slow down the pace of new builds and refurbishment programmes across the country.

This skills gap might indirectly affect Eurocell's business. If fewer projects can be completed on time due to labour constraints, it could dampen the overall demand for building materials, including Eurocell's uPVC window and door systems. Furthermore, the increased cost of securing skilled labour for installation could translate into higher project expenses for Eurocell's customers, potentially leading them to delay or scale back their building or renovation plans, thereby impacting Eurocell's sales volumes.

- Skilled Labour Shortage: Over 70% of UK construction SMEs reported difficulties finding skilled workers in 2024 (FMB).

- Impact on Projects: Shortages can delay construction and renovation timelines.

- Demand for Products: Slower project completion could reduce demand for building materials like those from Eurocell.

- Installation Costs: Increased labour costs for installers may affect customer investment decisions.

Economic headwinds persist, with high interest rates continuing to suppress consumer spending on home improvements and new builds through 2024 and into 2025. This cautious market directly impacts demand for Eurocell's offerings.

The UK windows and doors market is highly competitive and fragmented. A shift towards alternative materials like aluminium and composite doors poses a threat to Eurocell's PVC-U products, potentially eroding market share if innovation doesn't keep pace.

While input costs have eased, raw material prices, particularly PVC resin, remain volatile. Supply chain disruptions could re-emerge, increasing production costs and squeezing profit margins. For example, a 10% rise in PVC resin prices could significantly impact the cost of goods sold.

Evolving environmental regulations and public perception of plastics present a significant challenge. Future mandates on recycled content or plastic use could necessitate costly adaptations, while negative sentiment could reduce demand for PVC-based products.

The UK construction industry faces a significant shortage of skilled labour, with over 70% of small and medium-sized firms reporting difficulties in 2024. This skills gap can delay projects, indirectly reducing demand for building materials and potentially increasing installation costs for customers.

| Threat | Description | Potential Impact | Data Point |

|---|---|---|---|

| Macroeconomic Uncertainty | High interest rates and cautious consumer spending. | Reduced demand for home improvements and new builds. | Consumer confidence remains subdued in 2024. |

| Market Competition | Fragmented market and preference for alternative materials. | Erosion of market share and pricing pressure. | Growing demand for aluminium and composite doors. |

| Raw Material Volatility | Fluctuating prices of PVC resin and potential supply chain issues. | Increased production costs and squeezed profit margins. | A 10% increase in PVC resin prices impacts Cost of Goods Sold. |

| Environmental Regulations & Perception | Stricter rules on plastics and negative public sentiment. | Need for adaptation, increased compliance costs, and potential demand reduction. | UK focus on circular economy and potential EPR schemes for plastics. |

| Skilled Labour Shortage | Difficulty in finding skilled construction workers. | Project delays, reduced demand for materials, and higher installation costs. | 70%+ of UK construction SMEs struggled to find skilled workers in 2024 (FMB). |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of publicly available financial reports, in-depth market research from reputable industry analysts, and insights from expert commentary and trade publications.