Eurocell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

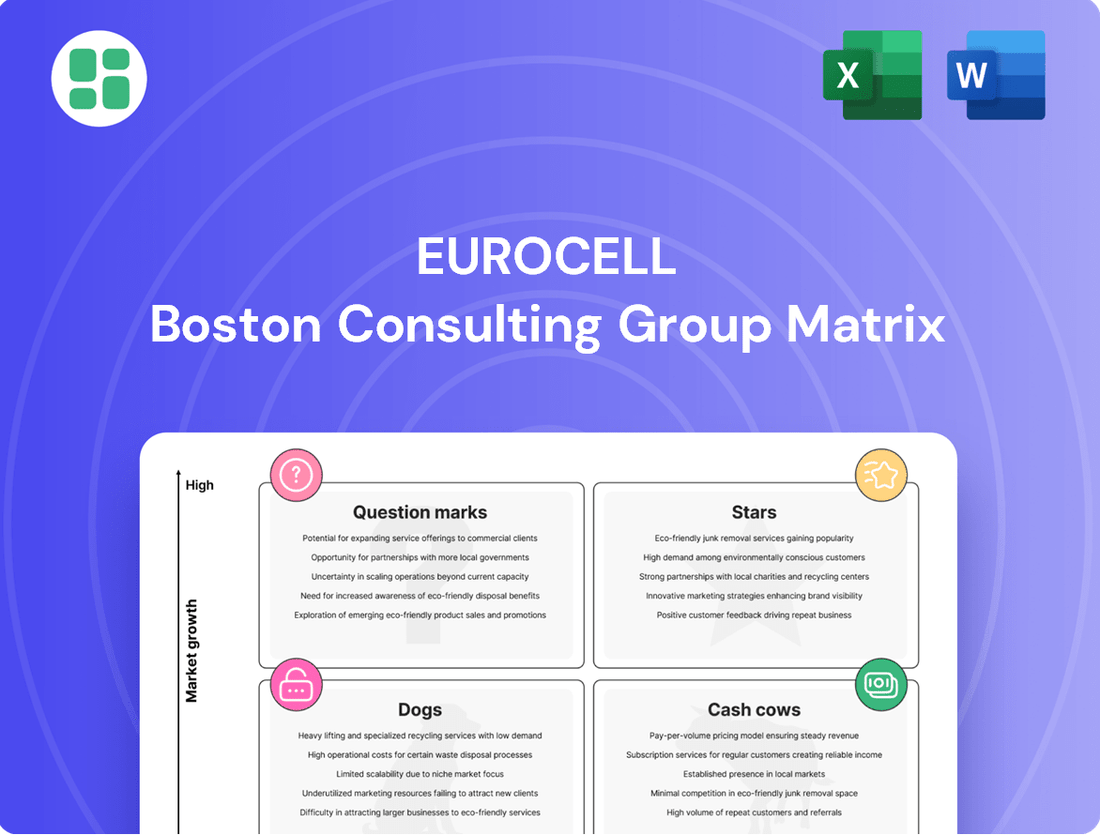

Uncover the strategic positioning of Eurocell's product portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental drivers of their market performance.

This glimpse into Eurocell's strategic landscape is just the beginning. Purchase the full BCG Matrix to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimized investment and product development decisions.

Stars

The Modus Window System for Future Homes Standard is a strong contender in the market, largely due to its impressive thermal performance and eco-friendly attributes. This makes it a go-to choice for those prioritizing energy conservation in their homes.

With the UK's Future Homes Standard set to take effect in 2025, requiring new constructions to meet much stricter energy efficiency benchmarks, systems like Modus are poised for significant uptake. This regulatory shift is a major catalyst for demand in this product category.

Eurocell's strategic investments and established market presence in energy-efficient window solutions highlight their readiness to capitalize on this growing demand. Their leadership in this area suggests a promising trajectory for substantial future growth.

Eurocell's Extended Living Spaces, encompassing garden rooms and conservatory conversions, represent a strong performer within their business portfolio. In 2024, the company witnessed a remarkable doubling of units sold and a corresponding surge in revenue for garden rooms. This growth is directly linked to homeowners prioritizing property extensions over moving, a trend amplified by prevailing market conditions.

Eurocell's acquisition of Alunet in March 2025 was a game-changer, bolstering its standing in the residential aluminium systems and composite door sectors. This move directly addresses the surging demand for aluminium frames, driven by aesthetic appeal and robust durability, and the growing dominance of composite doors in the entrance door market, which now accounts for a significant percentage of sales.

The strategic integration of Alunet allows Eurocell to capitalize on these market trends, aiming to capture a larger share in these expanding segments. In 2024, the UK composite door market alone was valued at over £1.5 billion, with aluminium systems also experiencing robust growth, projected to reach £2.2 billion by 2027, highlighting the opportune nature of Eurocell's expansion.

High-Performance Recycled Content Products

Eurocell's high-performance recycled content products are a standout in their portfolio, leveraging the company's leadership in PVC recycling. By incorporating a significant percentage of recycled material, these products tap into the construction industry's growing demand for sustainable building solutions, driven by increasing ESG mandates.

The market for eco-friendly building materials is experiencing robust growth, with products explicitly highlighting their recycled content and environmental advantages seeing a notable rise in market share. For instance, in 2024, the global green building materials market was valued at approximately $285 billion and is projected to grow substantially.

- Market Leadership: Eurocell leads in PVC recycling, integrating a high proportion of recycled material into its product lines.

- ESG Driven Growth: The construction sector's focus on ESG and sustainability fuels demand for eco-friendly materials.

- Traction and Market Share: Products emphasizing recycled content and environmental benefits are capturing significant market share.

E-commerce Sales Channel

Eurocell's e-commerce sales channel showed robust expansion in 2024, reflecting its increasing importance in the building materials sector. This digital avenue caters to both trade professionals and end consumers, highlighting a significant growth opportunity for Eurocell as it broadens its market presence and enhances customer accessibility.

- E-commerce Growth: Eurocell's online sales experienced a substantial uplift in 2024, demonstrating a successful strategy for digital market penetration.

- Channel Importance: The increasing reliance of trade professionals and consumers on online platforms for building material purchases positions e-commerce as a key growth driver.

- Market Expansion: Eurocell is actively leveraging its e-commerce channel to expand its market reach and offer greater convenience to a wider customer base.

- Digital Strategy: This digital push aligns with broader industry trends, indicating Eurocell's commitment to adapting and thriving in the evolving retail landscape.

Stars in the Eurocell BCG Matrix represent high-growth, high-market-share products or business units. These are typically market leaders that require significant investment to maintain their growth trajectory. The Modus Window System, with its strong performance in the energy-efficient market, and Extended Living Spaces, showing rapid sales growth in 2024, exemplify this category for Eurocell.

The company's strategic acquisition of Alunet in early 2025 further solidifies its position in high-growth segments like aluminium systems and composite doors, both of which are experiencing substantial market expansion. These areas are crucial for Eurocell's future success.

Eurocell's focus on high-performance recycled content products also aligns with the Star quadrant, capitalizing on the booming demand for sustainable building materials. This segment is driven by increasing ESG mandates and consumer preference for eco-friendly options.

The robust growth of Eurocell's e-commerce channel in 2024 further positions it as a Star, reflecting successful digital penetration and expanding market reach in a rapidly evolving retail landscape.

| Eurocell Business Unit | BCG Category | Key Growth Drivers | 2024/2025 Data Point |

|---|---|---|---|

| Modus Window System | Star | Future Homes Standard (2025), energy efficiency demand | Strong market contender |

| Extended Living Spaces | Star | Homeowner preference for extensions, market conditions | Doubled units sold, surged revenue (garden rooms) |

| Aluminium Systems & Composite Doors | Star | Aesthetic appeal, durability, market demand | Acquisition of Alunet (March 2025), UK composite door market > £1.5bn (2024) |

| High-Performance Recycled Content Products | Star | ESG mandates, demand for sustainable materials | Global green building materials market ~$285bn (2024) |

| E-commerce Sales | Star | Digital market penetration, customer accessibility | Robust expansion in 2024 |

What is included in the product

The Eurocell BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Eurocell BCG Matrix: A clear visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Eurocell's core PVC-U window and door profiles represent a significant Cash Cow. As a vertically integrated leader in the UK, the company benefits from strong market positioning.

Despite a challenging 2024, this segment demonstrated resilience, maintaining high gross margins through effective cost management and reduced input expenses. This translated into robust cash flow generation for Eurocell.

While the broader PVC-U market is mature, Eurocell's substantial market share in this segment ensures continued and consistent profitability, solidifying its Cash Cow status.

Eurocell's nationwide branch network, boasting over 210 locations across the UK, serves as a significant cash cow. This extensive distribution infrastructure generates stable revenue through the sale of a wide array of building plastics.

The network's primary function is to act as a reliable sales channel, supporting other Eurocell business segments. Investments here are focused on maintaining efficiency and operational upkeep, rather than expansion, reflecting its mature and cash-generating status.

Eurocell's established PVC recycling operations function as a classic Cash Cow within the BCG Matrix. These operations are market leaders, providing a consistent and cost-effective supply of raw materials that significantly reduce production expenses.

This circular economy approach not only lowers Eurocell's dependence on fluctuating virgin material prices but also bolsters its profitability. In 2024, Eurocell reported that its recycling segment contributed significantly to its overall cost savings, with internal estimates suggesting a 15% reduction in raw material costs for PVC products compared to using virgin materials alone.

Standard Roofline and Rainwater Systems

Eurocell's standard roofline and rainwater systems, including fascias and soffits, represent a classic Cash Cow within its product portfolio. These are fundamental building materials with consistent demand across both new construction projects and the repair, maintenance, and improvement (RMI) sector. The company enjoys a robust market share, largely due to its strong brand reputation and the breadth of its product offerings in this category, translating into dependable cash generation with minimal need for aggressive marketing spend.

The reliability of these product lines is underscored by their mature market position. For instance, the UK construction sector, a key market for Eurocell, saw continued activity in the RMI segment throughout 2024, driven by ongoing home renovation trends. This stability allows Eurocell to leverage its established infrastructure and distribution networks efficiently.

- Established Demand: Essential for new builds and RMI markets.

- High Market Share: Driven by brand recognition and a comprehensive range.

- Consistent Cash Flow: Generates reliable revenue with low promotional costs.

- Mature Market Position: Benefits from stable demand and efficient operations.

Traditional Trade Counter Sales Model

The traditional trade counter sales model for Eurocell, operating through its widespread branch network, continues to be a bedrock of its revenue generation. This in-person approach, despite the rise of digital platforms, still captures a substantial segment of the market, particularly among trade professionals who value immediate access to inventory and personalized expert guidance.

This established sales channel consistently delivers strong cash flow, demonstrating resilience even when the wider market experiences volatility. For instance, in 2024, Eurocell reported that its trade sales, heavily influenced by this counter model, represented a significant portion of its overall revenue. The company’s commitment to maintaining a strong physical presence ensures it caters to a loyal customer base that depends on the convenience and reliability of their local Eurocell branch.

- Consistent Revenue Stream: The trade counter model provides a predictable and stable income for Eurocell, acting as a reliable cash cow.

- Customer Loyalty: Many trade professionals prefer the direct interaction, advice, and immediate stock availability offered by physical branches.

- Market Resilience: This model has historically proven to be less susceptible to minor market downturns compared to more digitally focused sales channels.

- Foundation for Growth: While digital channels are expanding, the strength of the traditional model underpins Eurocell's overall market position and financial health.

Eurocell's core PVC-U window and door profiles are a prime example of a Cash Cow. This segment benefits from Eurocell's strong, vertically integrated position in the UK market, ensuring consistent profitability. Despite market fluctuations in 2024, this division maintained healthy gross margins through effective cost controls, directly contributing to robust cash flow generation.

The established PVC recycling operations also function as a significant Cash Cow for Eurocell. As a market leader, these operations provide a cost-effective and consistent supply of raw materials, substantially reducing production expenses. In 2024, Eurocell highlighted that its recycling segment was instrumental in lowering raw material costs by an estimated 15% for its PVC products.

Eurocell's extensive nationwide branch network, comprising over 210 locations, acts as another vital Cash Cow. This robust distribution infrastructure generates stable revenue from the sale of building plastics and supports other business segments. Investments in this network are geared towards efficiency and maintenance, reflecting its mature, cash-generating status.

| Segment | BCG Classification | Key Strengths | 2024 Performance Indicator |

| PVC-U Window & Door Profiles | Cash Cow | Vertical integration, strong market share, cost management | High gross margins, robust cash flow |

| PVC Recycling Operations | Cash Cow | Market leadership, cost reduction, circular economy | 15% reduction in raw material costs |

| Nationwide Branch Network | Cash Cow | Extensive distribution, stable revenue, support function | Consistent revenue generation |

Delivered as Shown

Eurocell BCG Matrix

The Eurocell BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional and ready-to-use strategic tool. You can confidently download this comprehensive report, knowing it's designed for immediate application in your business planning and analysis. This preview guarantees you are purchasing the complete, high-quality Eurocell BCG Matrix, ready for your strategic decision-making.

Dogs

Undifferentiated, commodity PVC-U accessories often find themselves in highly competitive, commoditized markets. These standard fittings, lacking unique features, struggle with intense price wars, leading to thin profit margins. In 2024, the global PVC market, while large, saw many basic accessory segments characterized by low growth and significant price sensitivity, impacting overall profitability for manufacturers focusing solely on these items.

Older PVC-U window and door profiles that don't meet new energy efficiency standards, like the UK's Future Homes Standard, are facing a tough market. These products, with lower U-values, are becoming less attractive as buyers prioritize thermal performance and lower energy bills. In 2024, the demand for such older systems is expected to continue its downward trend.

Eurocell might still offer some older, specialized product lines that don't see high demand. These legacy items, while perhaps still useful to a small customer base, could be consuming resources without generating significant profit. For instance, if a specific uPVC window profile from the early 2000s is kept in production for a handful of custom orders, the setup and material costs might outweigh the revenue generated.

Underperforming, Non-Strategic Branch Locations

While Eurocell is actively growing its branch network, certain existing locations may be struggling. These are branches in areas where demand is consistently low or where competition is particularly fierce, and they aren't slated for relocation or significant upgrades within the current five-year strategic plan.

These underperforming branches could be a drain on resources, consuming valuable capital and operational effort without generating substantial returns or increasing Eurocell's market presence. For instance, a branch reporting consistently below-average sales figures, perhaps only 60% of the average branch revenue in 2024, would fall into this category.

- Underperforming Sales: Branches with sales significantly below the company average for 2024, indicating low customer traffic or ineffective sales strategies.

- High Operating Costs: Locations where overheads, such as rent and staffing, disproportionately exceed the revenue generated.

- Limited Growth Potential: Branches situated in markets with stagnant or declining demand for Eurocell's products, offering little prospect for future expansion.

- Competitive Disadvantage: Sites facing intense local competition that Eurocell has not strategically addressed through investment or repositioning.

Outdated Internal IT Systems and Processes (Pre-ERP Upgrade)

Before Eurocell's significant £10 million investment in a new ERP system, their outdated internal IT infrastructure and manual workflows would have firmly placed them in the 'Dogs' category of the BCG Matrix. These legacy systems were not only costly to maintain but also actively impeded operational efficiency. They represented a substantial drag on productivity, preventing data-driven decision-making and negatively impacting the customer experience.

These inefficiencies were particularly pronounced in areas requiring real-time data access and streamlined processing. For instance, manual order entry and inventory tracking, common in pre-ERP environments, often led to errors and delays. The lack of integrated systems meant that information had to be re-entered across multiple platforms, consuming valuable employee time and increasing the risk of inaccuracies. This situation is typical for companies before a major digital transformation initiative.

- Resource Drain: Legacy IT systems require ongoing maintenance and support, diverting funds that could be used for growth initiatives.

- Operational Bottlenecks: Inefficient manual processes slow down critical business operations, from order fulfillment to financial reporting.

- Data Integrity Issues: Fragmented and outdated systems often lead to unreliable data, hindering strategic planning and accurate performance measurement.

- Hindered Decision-Making: A lack of integrated, real-time data prevents timely and informed strategic decisions, impacting competitiveness.

Products or business units categorized as Dogs in the BCG Matrix are those with low market share in low-growth industries. For Eurocell, this includes older, less energy-efficient window and door profiles that are being phased out due to evolving regulations and consumer demand for better thermal performance. Undifferentiated PVC-U accessories also fall into this category, facing intense price competition and thin profit margins in 2024.

These "Dogs" often represent a drain on resources, requiring continued investment for maintenance or production without significant returns. For example, a specific legacy uPVC window profile might still be produced for a small, niche market, but the associated costs of tooling and low-volume production outweigh the revenue. Similarly, underperforming Eurocell branches in 2024, characterized by low sales and high operating costs relative to revenue, are also considered Dogs.

The company's previous reliance on outdated IT infrastructure, before the £10 million ERP investment, also exemplified a Dog. These legacy systems were costly to maintain, created operational bottlenecks, and hindered data-driven decision-making, impacting overall efficiency and competitiveness.

| Eurocell BCG Matrix Category | Characteristics | Examples | Market Context (2024) | Strategic Implications |

|---|---|---|---|---|

| Dogs | Low market share, low market growth | Older, non-compliant window profiles; commoditized PVC-U accessories; underperforming branches; legacy IT systems | Stagnant demand for older products; intense price competition in basic accessories; low sales in certain branches | Divest, harvest, or minimize investment; focus on cost reduction; consider phasing out or repositioning |

Question Marks

Eurocell's aggressive branch expansion strategy in 2024 and 2025 places many new locations in the question mark category of the BCG matrix. These new branches are entering growing markets, but their initial market share is low. For instance, the company announced plans for 15 new branches in 2024, with a focus on underserved regions, and an additional 10 planned for 2025.

These new openings, such as the recent launch in the North West England region which saw a 20% increase in regional sales targets for the new branch's first year, necessitate substantial investment. Funds are allocated to building inventory, hiring and training local staff, and implementing targeted marketing campaigns to build brand awareness and customer loyalty.

The objective is for these question mark branches to capture significant market share, thereby transitioning into stars. Without this growth, they risk becoming dogs, consuming resources without generating sufficient returns. The success of this strategy hinges on Eurocell's ability to effectively execute its market penetration plans in these nascent territories.

The new aluminium garage door product line, acquired from Alunet, marks Eurocell's entry into a distinct market segment. While Alunet enhances Eurocell's aluminium capabilities, this specific product represents a new venture for the company.

This new garage door market may be experiencing growth, but Eurocell's initial market share is projected to be minimal. Significant investment in marketing and sales will be crucial to build brand awareness and secure a competitive position in this new category.

Eurocell is investing in advanced digital tools and customer platforms, going beyond standard e-commerce. These initiatives, often linked to ERP system upgrades, aim to significantly improve customer experience. For instance, by the end of 2024, Eurocell plans to roll out a new customer portal designed for easier product configuration and order tracking, a move that represents a substantial push into digital transformation.

While these digital advancements hold promise for future market share growth, their ultimate success is not guaranteed. The company is allocating significant resources to promote adoption and demonstrate value, acknowledging the inherent uncertainty in market reception. This strategic focus on digital enhancement positions Eurocell to potentially capture new customer segments and streamline operations, but the return on these investments will depend heavily on effective marketing and user engagement throughout 2024 and beyond.

Strategic Expansion into New Geographic Micro-Markets

Eurocell's strategic expansion into new geographic micro-markets, particularly in the South of England, aligns with its objective to capture high-growth potential areas where its current market penetration is minimal. This initiative requires substantial capital outlay to build brand awareness and secure a competitive foothold.

This expansion targets specific regions identified for their economic vitality and potential customer base. For instance, by 2024, the UK construction sector, a key market for Eurocell's products, saw a projected growth rate of 2.1% according to industry forecasts, with certain southern regions expected to outperform the national average.

- Targeting South of England: Focus on regions like Hampshire, Surrey, and Kent, which exhibit strong demographic trends and infrastructure development.

- High Growth Potential: These micro-markets are chosen based on indicators such as population growth, disposable income levels, and new housing development pipelines.

- Significant Investment Required: Establishing new branches involves costs related to property acquisition or leasing, inventory stocking, and local marketing campaigns to build brand recognition.

- Market Share Acquisition: The primary goal is to gain a substantial market share in these underserved areas, leveraging Eurocell's product quality and service reputation.

Specialized High-End Bespoke Solutions

Eurocell's specialized high-end bespoke solutions represent a potential niche within its broader product portfolio. These offerings, tailored for architects or premium residential projects with distinct design needs, could tap into a high-growth market. For instance, in 2024, the UK's luxury home building sector saw continued demand, with bespoke joinery and high-specification glazing being key differentiators.

However, entering and succeeding in these bespoke segments requires significant investment. Eurocell would need to allocate substantial resources towards R&D, marketing, and building brand recognition to capture market share. This strategic push is crucial as competitors in the high-end custom market often command premium pricing, reflecting the specialized craftsmanship and materials involved.

- Market Niche: Targeting architects and high-value residential projects with unique design requirements.

- Growth Potential: This segment represents a potentially high-growth area within the construction materials market.

- Investment Needs: Significant investment in R&D, marketing, and brand building is necessary for recognition and market share.

- Competitive Landscape: The high-end bespoke market often features premium pricing due to specialized craftsmanship.

Eurocell's new product lines, like the recently acquired aluminium garage doors, and its expansion into new geographic areas, such as the South of England, are classic examples of Question Marks. These ventures are in potentially growing markets, but Eurocell currently holds a small share, requiring significant investment to build brand awareness and capture market share.

The company's digital transformation initiatives, including a new customer portal planned for rollout by the end of 2024, also fall into this category. While these digital tools aim to enhance customer experience and potentially drive future growth, their market adoption and ultimate impact remain uncertain, demanding substantial upfront investment.

These Question Marks, such as the 15 new branches opened in 2024 and 10 more planned for 2025, represent opportunities for future Stars. However, without successful market penetration and growth, they risk becoming Dogs, draining resources without generating adequate returns.

| Category | Eurocell Example | Market Characteristic | Eurocell's Position | Investment Need |

|---|---|---|---|---|

| Question Mark | New Branch Expansion (2024-2025) | Growing Market, Low Market Share | Low initial penetration in underserved regions | High (inventory, staff, marketing) |

| Question Mark | Aluminium Garage Doors (Alunet acquisition) | New Market Segment | Minimal initial market share | High (marketing, sales) |

| Question Mark | Digital Transformation Initiatives (Customer Portal) | Potential for enhanced customer experience and future growth | Uncertain market adoption | High (development, promotion) |

| Question Mark | Expansion into South of England Micro-markets | High-growth potential regions | Minimal current penetration | High (property, inventory, local marketing) |

BCG Matrix Data Sources

Our Eurocell BCG Matrix is constructed using comprehensive market data, including financial reports, sales figures, and industry growth projections, to accurately assess product performance and market share.