Eurocell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

Eurocell faces moderate competitive rivalry and a significant threat from substitute products, impacting its pricing power and market share. Understanding the influence of suppliers and buyers is crucial for navigating these challenges effectively.

The complete report reveals the real forces shaping Eurocell’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eurocell's profitability is directly tied to the cost of essential raw materials like PVC resins and various additives. These inputs are influenced by global commodity price swings, making them a significant factor in the company's financial performance.

In the first half of 2024, Eurocell demonstrated its ability to navigate these challenges by successfully lowering its input costs, including the price of PVC resin. This proactive management of expenses is crucial for maintaining healthy gross margins going forward.

Eurocell's integrated recycling capabilities, a core part of its business model, significantly diminish the bargaining power of its suppliers. By recycling old PVC window profiles into new products, Eurocell reduces its dependence on virgin raw materials.

This vertical integration means Eurocell can control a substantial portion of its material inputs. For instance, in 2024, the company continued to emphasize its commitment to sustainability through its recycling initiatives, which directly impacts its procurement strategy and supplier relationships.

Energy is a critical input for Eurocell, as manufacturing PVC products requires significant power. This makes energy price volatility a direct driver of production costs and a key factor in supplier influence. For instance, Eurocell reported benefiting from lower electricity costs in the first half of 2024, which would have temporarily softened the bargaining power of energy suppliers.

Specialized Equipment and Technology Providers

Suppliers of specialized extrusion machinery, recycling technology, and related industrial equipment wield considerable bargaining power. This is largely due to the niche nature and high capital investment required for these assets, meaning Eurocell has limited alternative suppliers. For instance, the cost of advanced extrusion lines can run into millions of pounds, making switching suppliers a significant financial undertaking.

Eurocell's strategic focus on enhancing operational efficiency and investing in its IT infrastructure further underscores its reliance on specialized technology vendors. This dependency can give these suppliers leverage in price negotiations and contract terms. The company's commitment to innovation means it often needs cutting-edge equipment, which is typically supplied by a select few market leaders.

- Niche Market: Suppliers of specialized extrusion machinery and recycling technology operate in a niche market, limiting Eurocell's options.

- Capital Intensity: The high cost of acquiring and maintaining specialized equipment makes it difficult for Eurocell to switch suppliers frequently.

- Technological Reliance: Eurocell's investments in IT and operational efficiency increase its dependence on technology providers, strengthening their bargaining position.

Labor Market Dynamics

While not traditional suppliers, the availability and cost of skilled labor significantly impact Eurocell's operational expenses. The UK construction sector, a key market for Eurocell, has been grappling with persistent labor shortages. For instance, in 2023, the Office for National Statistics reported that the construction industry alone had a deficit of approximately 45,000 workers. This scarcity can amplify the bargaining power of the workforce.

- Skilled Labor Shortages: The UK construction sector faces ongoing challenges in attracting and retaining skilled workers.

- Wage Pressures: Labor shortages can lead to increased wage demands from employees, impacting Eurocell's cost of goods sold.

- Impact on Operations: Difficulty in securing qualified personnel for manufacturing and distribution can affect production efficiency and delivery timelines.

- Industry-Wide Trend: This is not unique to Eurocell but reflects a broader trend across the UK manufacturing and construction industries.

Eurocell's bargaining power with suppliers is moderated by its integrated recycling operations, which reduce reliance on virgin PVC resin, a key raw material. However, the company faces significant supplier power from providers of specialized machinery and technology due to high switching costs and niche markets.

In the first half of 2024, Eurocell benefited from lower electricity costs, which temporarily reduced the influence of energy suppliers. Despite this, the ongoing shortage of skilled labor in the UK construction sector in 2023, affecting around 45,000 workers, continues to exert upward pressure on labor costs, indirectly impacting the company's operational expenses and supplier-like dynamics with its workforce.

| Factor | Impact on Eurocell | 2024 Data/Trend |

|---|---|---|

| Virgin PVC Resin | Moderate supplier power due to commodity pricing | Lower input costs, including PVC resin, achieved in H1 2024 |

| Specialized Machinery | High supplier power due to niche market and capital intensity | Continued investment in advanced equipment |

| Energy | Temporary reduction in supplier power | Benefited from lower electricity costs in H1 2024 |

| Skilled Labor | Increased bargaining power for labor | UK construction labor shortage estimated at 45,000 workers in 2023 |

What is included in the product

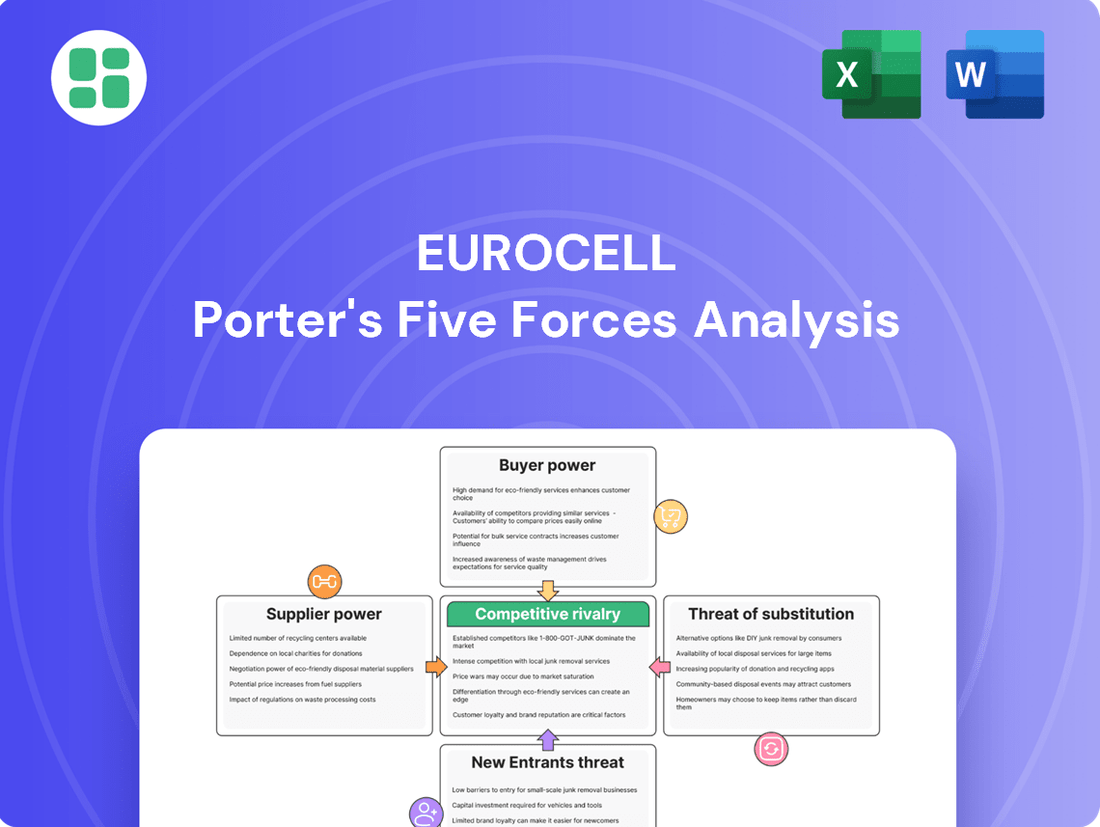

Eurocell's Porter's Five Forces analysis details the competitive intensity within the building products sector, examining supplier and buyer power, new entrant threats, and the availability of substitutes to understand Eurocell's strategic positioning.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Eurocell's customer base is quite spread out, with fabricators, installers, and specifiers all over the UK. This fragmentation means no single customer holds significant sway, as the company doesn't depend heavily on just a few big buyers. In 2023, Eurocell reported revenue of £272 million, underscoring the breadth of its market reach.

In 2024, the residential repair, maintenance, and improvement (RMI) and new build housing sectors have seen subdued volumes. This downturn, driven by macroeconomic uncertainty and a more cautious consumer spending environment, has notably amplified the bargaining power of customers.

With increased price sensitivity, customers are actively comparing offers and seeking the best value. This trend puts pressure on companies like Eurocell to remain competitive on pricing to secure sales in a challenging market.

Eurocell aims to differentiate its PVC window, door, and roofline systems by offering a broad product range and integrated solutions. This strategy helps them stand out in a competitive market.

By providing value-added services through its extensive nationwide branch network, Eurocell can reduce customers' inclination to switch. This service component, combined with product quality, can mitigate the bargaining power of customers who might otherwise focus solely on price.

Switching Costs for Fabricators and Installers

For fabricators and installers, the decision to switch suppliers can incur significant expenses. These costs might include retooling manufacturing equipment to accommodate new materials or designs, retraining staff on new processes, or reorganizing existing supply chain logistics to integrate a different vendor. These are tangible barriers that can make a change less appealing.

These switching costs can act as a moderating factor on the bargaining power of fabricators and installers. When a business has invested heavily in machinery or training specific to a supplier like Eurocell, the cost and effort required to transition elsewhere can be substantial. This deep integration can therefore somewhat limit their ability to demand lower prices or more favorable terms.

- Retooling Expenses: Fabricators may need to purchase new dies, molds, or specialized machinery if a new supplier uses different material specifications or manufacturing techniques.

- Training Investment: Employees might require new training to operate different equipment or work with alternative product lines, representing a human capital cost.

- Logistical Adjustments: Changes in supplier relationships can necessitate renegotiating transport contracts, updating inventory management systems, and potentially altering warehouse layouts.

Customer Sophistication and Information Availability

Customers, especially significant fabricators and specifiers in the building materials sector, possess a high degree of market knowledge. They are well-versed in prevailing prices, available product substitutes, and the track record of various suppliers. This heightened transparency directly translates into stronger negotiation leverage for them.

In 2024, the building materials market continued to see an influx of digital tools and platforms that provide price comparisons and product reviews. For instance, industry-specific portals often aggregate data, allowing buyers to quickly assess competitive offerings. This readily available information significantly reduces information asymmetry, a key factor in bargaining power.

- Informed Buyers: Customers can easily access pricing data and competitor information, enabling them to negotiate from a position of strength.

- Product Alternatives: The availability of multiple product options and substitutes means customers can switch suppliers if demands are not met, pressuring existing providers.

- Supplier Performance Transparency: Online reviews and industry ratings offer insights into supplier reliability and quality, further empowering customer choice and negotiation.

The bargaining power of customers for Eurocell is influenced by market conditions and their own knowledge. While Eurocell's broad customer base in 2023, contributing to its £272 million revenue, suggests a degree of customer fragmentation, the economic climate of 2024 has shifted dynamics. The subdued volumes in residential RMI and new build sectors due to macroeconomic uncertainty have made customers more price-sensitive, increasing their leverage.

Customers' market knowledge is high, with easy access to price comparisons and product reviews through digital platforms, further empowering their negotiation. This transparency, coupled with the availability of substitutes, allows customers to exert more pressure on suppliers like Eurocell to offer competitive pricing and favorable terms.

However, switching costs for fabricators and installers, such as retooling expenses and training investments, can mitigate this power. These embedded costs create a degree of stickiness, making customers less likely to switch suppliers purely based on price, thereby moderating their overall bargaining influence.

| Factor | Impact on Eurocell | 2023/2024 Context |

|---|---|---|

| Customer Fragmentation | Lowers individual customer power | Broad customer base contributed to £272m revenue in 2023. |

| Market Conditions | Increases customer power | Subdued volumes in 2024 due to economic uncertainty heightened price sensitivity. |

| Customer Knowledge | Increases customer power | Digital platforms provide easy price comparison and product reviews. |

| Switching Costs | Decreases customer power | Retooling, training, and logistical adjustments create barriers to switching. |

What You See Is What You Get

Eurocell Porter's Five Forces Analysis

This preview showcases the complete Eurocell Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document you see here immediately after purchase. No placeholders or sample content; what you preview is precisely what you'll download, ready for immediate use in your strategic planning. This comprehensive analysis, covering all five forces impacting Eurocell, is delivered in its final form, eliminating any uncertainty.

Rivalry Among Competitors

The UK residential windows and doors market, a sector where Eurocell is a significant player, is characterized by its high fragmentation. This means there are many companies competing, making it a crowded space for any single firm.

This intense competition stems from the sheer number of participants, including both large manufacturers and smaller, regional suppliers. For instance, the PVC window and door segment alone features hundreds of fabricators and installers across the United Kingdom, each vying for customer attention and contracts.

Eurocell, therefore, navigates a landscape where market share is constantly contested. The fragmentation implies that pricing pressures can be significant, as numerous alternatives are readily available to consumers and trade customers alike.

Eurocell faces significant competitive rivalry, particularly as some of its PVC products can be seen as commodities. This perception often translates into intense price-based competition within the market.

The company's own Half Year Report 2024 highlighted this challenge, noting considerable competitive pressure on selling prices across its branch network. This indicates that maintaining margins requires constant attention to cost management and product differentiation.

Despite a challenging 2024 for the UK construction sector, with new housing starts potentially falling below 200,000 units, a significant recovery is on the horizon. Forecasts for 2025 suggest a rebound, with industry bodies anticipating a return to pre-pandemic levels of activity, potentially boosting new housing starts to around 220,000 units.

This anticipated market growth in 2025, especially within the private housing segment, is likely to intensify competitive rivalry. As demand increases, existing players will aim to capture a larger share, and new entrants may be attracted, leading to a more aggressive market landscape for companies like Eurocell.

Strategic Initiatives and Investment by Competitors

Competitors are actively investing in enhancing their product portfolios and expanding their reach. This is evident in their efforts to bolster distribution channels and integrate sustainability practices, aiming to capture greater market share. For instance, in 2024, several key players in the fenestration industry announced significant R&D budgets focused on developing more energy-efficient and recyclable materials.

The growing preference for aluminum in window and door systems highlights the dynamic competitive landscape. Rivals are pushing innovation in this area, with new aluminum product launches frequently appearing. This trend suggests a direct response to market demand and a strategic move to differentiate offerings. For example, a major competitor reported a 15% increase in their aluminum product sales in the first half of 2024, directly challenging established UPVC market dominance.

- Competitor Investment Focus: Product development, distribution expansion, and sustainability initiatives are key areas of investment for rivals.

- Market Trend: Aluminum Adoption: The increasing popularity of aluminum in fenestration signals active product innovation and competitive pressure.

- Impact on Eurocell: These competitor actions necessitate continuous innovation and strategic adaptation by Eurocell to maintain its competitive standing.

Established Brand and Distribution Network

Eurocell benefits from a well-recognized brand and a widespread distribution network, boasting over 200 branches across the UK. This established presence and existing customer loyalty create a formidable barrier for emerging competitors. It's a significant hurdle for new entrants to match Eurocell's reach and build similar levels of trust and accessibility quickly.

This extensive infrastructure translates into a substantial competitive advantage. For instance, in 2024, Eurocell's ability to service a broad geographical area efficiently likely contributed to its market position. The cost and time required to replicate such a nationwide footprint are considerable deterrents to new players.

- Established Brand Recognition: Eurocell's brand is a key asset, fostering customer trust and preference.

- Nationwide Distribution Network: Over 200 branches provide unparalleled market coverage and accessibility.

- High Barrier to Entry: Replicating this extensive network and brand loyalty is a significant challenge for new entrants.

- Customer Relationships: Long-standing relationships built through this network offer a competitive edge.

The competitive rivalry within the UK fenestration market remains intense, driven by a fragmented industry structure and consistent competitor investment in product development and distribution. Eurocell faces particular pressure on pricing for its commodity-like PVC products, as evidenced by its Half Year Report 2024 noting competitive selling price pressures. Despite a challenging 2024 for UK construction, forecasts for 2025 anticipate a market rebound, which is expected to further intensify competition as companies vie for increased market share.

| Metric | Eurocell's Position | Competitor Activity | Impact |

| Market Fragmentation | Significant player in a crowded market | Numerous small and large competitors | Intense price competition |

| Product Perception | Some PVC products viewed as commodities | Innovation in aluminum products | Need for differentiation and cost management |

| 2024 Performance Insight | Competitive pressure on selling prices | R&D investment in energy-efficient materials by rivals | Margin management is crucial |

| 2025 Market Outlook | Anticipated market growth | Competitors aiming to capture increased share | Potential for heightened rivalry |

SSubstitutes Threaten

The threat of substitutes for Eurocell's uPVC windows and doors is primarily driven by alternative materials such as aluminum, timber, and composites. Aluminum, in particular, is increasingly popular, especially in the premium and new-build sectors, due to its slender profiles and modern aesthetic. In 2023, the UK market for aluminum windows and doors saw continued growth, with many consumers opting for this material over uPVC for its design advantages.

Substitutes like timber and aluminum offer distinct performance and aesthetic advantages, challenging PVC's market position. Timber, for instance, appeals to customers seeking a traditional, natural look, while aluminum provides sleek, contemporary designs favored in modern architecture.

These material differences directly impact customer choice and architectural trends, creating a significant threat to PVC's market share. For example, in 2024, the global market for wood windows and doors saw continued demand, particularly in the premium and heritage building sectors, demonstrating the enduring appeal of natural materials.

Growing environmental awareness and a push towards sustainable construction practices could increase the appeal of certain alternative materials perceived as more eco-friendly. For instance, the global green building materials market was valued at approximately $297.1 billion in 2023 and is projected to reach $797.9 billion by 2030, demonstrating a significant shift in demand. This trend poses a potential threat to PVC-based products if alternatives like timber or recycled composites gain substantial traction due to their environmental profiles.

However, Eurocell's strong recycling credentials for PVC help counter this threat. In 2023, Eurocell reported processing over 100,000 tonnes of PVC waste, diverting it from landfill and incorporating it into new products. This commitment to a circular economy makes their offerings more competitive against less sustainable alternatives, mitigating the impact of evolving environmental preferences.

Cost-Performance Trade-offs

Customers often face a critical decision, balancing the upfront cost of window and door materials against their projected long-term performance. This cost-performance trade-off is a significant factor in the threat of substitutes.

While uPVC, Eurocell's primary material, typically presents a lower initial purchase price, other materials like aluminum or timber offer distinct value propositions. For instance, aluminum windows, while potentially more expensive initially, may appeal to certain customers due to their slim profiles and enhanced durability, especially in commercial applications or high-wind areas. Timber, though premium, can offer aesthetic advantages and a perceived higher-end finish.

The decision hinges on a customer's priorities. For a homeowner focused on immediate affordability and good thermal insulation, uPVC remains highly attractive. However, for a developer prioritizing longevity, minimal maintenance, and a specific aesthetic, aluminum or even composite materials might be preferred, despite a higher entry cost. In 2023, the global window and door market saw continued demand for uPVC products, but growth in aluminum systems, particularly in the premium and commercial segments, highlighted this ongoing trade-off.

- Cost vs. Longevity: Customers evaluate initial expenditure against expected lifespan and resistance to environmental factors.

- Maintenance Requirements: The ongoing effort and cost associated with upkeep vary significantly between materials like uPVC, aluminum, and timber.

- Energy Efficiency: Performance in thermal insulation is a key consideration, influencing long-term running costs for heating and cooling.

- Aesthetic and Functional Preferences: Design, slimness of profiles, and specific performance needs (e.g., soundproofing, security) drive material selection beyond pure cost.

Innovation in Building Solutions

The threat of substitutes for Eurocell is amplified by continuous innovation in the broader building solutions market. New construction methods like modular building and advanced cladding materials offer alternatives that go beyond just window and door frames, potentially reducing demand for Eurocell's core products.

Furthermore, PVC panels themselves are increasingly recognized as adaptable substitutes for conventional wall coverings. This means that even within the PVC product category, there are evolving alternatives that could capture market share from traditional window and door applications.

For instance, the global modular construction market was valued at approximately USD 150 billion in 2023 and is projected to grow significantly. This growth indicates a rising acceptance of alternative building methods that may incorporate fewer traditional window and door systems, or utilize integrated facade solutions.

- Broader Building Solutions: Innovations like modular construction and advanced cladding offer alternatives to traditional building components.

- PVC Panel Versatility: PVC panels are emerging as substitutes for traditional wall coverings, impacting material choices in construction.

- Market Trends: The growing modular construction market, valued at around USD 150 billion in 2023, highlights a shift towards alternative building methods.

The threat of substitutes for Eurocell's uPVC products is significant, driven by materials like aluminum and timber, which offer distinct aesthetic and performance benefits. While uPVC remains popular for its cost-effectiveness and thermal insulation, the growing demand for sleek, modern designs favors aluminum, particularly in new-build and premium sectors. Timber continues to appeal to those seeking natural aesthetics, especially in heritage projects.

Environmental considerations are also shaping material preferences, with a growing market for sustainable building materials. This trend could benefit alternatives perceived as more eco-friendly, although Eurocell's strong PVC recycling program, processing over 100,000 tonnes in 2023, helps to mitigate this. The cost-performance trade-off remains a key factor, with customers weighing initial outlay against long-term durability and maintenance.

Innovations in broader building solutions, such as modular construction, also present a threat by potentially reducing the reliance on traditional window and door systems. The global modular construction market, valued at approximately $150 billion in 2023, underscores this shift towards alternative building methods.

| Substitute Material | Key Advantages | Potential Impact on Eurocell |

|---|---|---|

| Aluminum | Slim profiles, modern aesthetics, durability | Increased competition in premium and new-build segments |

| Timber | Natural appearance, heritage appeal | Demand in specific architectural niches |

| Composites | Customizable aesthetics, potentially enhanced performance | Emerging alternative with varied value propositions |

| Alternative Building Methods (e.g., Modular Construction) | Integrated facade solutions, reduced reliance on traditional components | Potential reduction in demand for standalone window/door systems |

Entrants Threaten

The significant capital outlay needed to establish a presence in the PVC manufacturing, distribution, and recycling sector presents a formidable barrier to entry. Companies must invest heavily in advanced extrusion machinery, sophisticated production lines, and a robust distribution infrastructure, including extensive warehousing and logistics networks.

For instance, setting up a modern PVC extrusion plant can easily cost tens of millions of pounds, not to mention the ongoing investment in technology and operational capacity. This high initial financial commitment deters many potential competitors from entering the market, thereby protecting existing players like Eurocell.

Established players like Eurocell leverage significant economies of scale in manufacturing, purchasing raw materials, and managing their distribution networks. This allows them to produce goods at a lower cost per unit compared to smaller operations. For instance, in 2023, Eurocell reported revenue of £240 million, indicating a substantial operational footprint that new entrants would find difficult to match immediately.

The experience curve also plays a crucial role; as Eurocell has produced PVC-U extrusions for decades, its manufacturing processes are highly optimized, leading to greater efficiency and reduced waste. This accumulated knowledge translates into cost advantages that are hard for newcomers to replicate quickly, as building such expertise requires substantial time and investment.

Eurocell benefits from a robust nationwide network of branches, a significant asset that new entrants would struggle to replicate. This established infrastructure, coupled with deep-rooted relationships with fabricators, installers, and specifiers across the UK, creates a formidable barrier to entry.

The capital investment and time required to build a comparable distribution and relationship network are substantial, making it difficult for newcomers to gain immediate traction. For instance, in 2023, Eurocell reported revenue of £278.1 million, underscoring the scale of operations supported by its extensive network.

Regulatory and Compliance Hurdles

The UK building and construction sector presents significant barriers to new entrants due to stringent regulatory and compliance demands. Navigating these complex legal frameworks, quality standards, and environmental mandates requires substantial investment in time and resources, deterring many potential competitors.

For instance, compliance with Building Regulations 2010, which cover aspects from structural safety to energy efficiency, necessitates thorough design approvals and site inspections. Furthermore, adherence to standards set by bodies like the British Standards Institution (BSI) is often crucial for market acceptance and competitive positioning.

- Regulatory Complexity: New entrants must understand and comply with a wide array of UK building codes and planning permissions.

- Quality and Safety Standards: Meeting rigorous quality assurance and health and safety requirements, such as those mandated by HSE, adds significant operational cost and expertise needs.

- Environmental Compliance: Growing emphasis on sustainability means new firms must also integrate environmental regulations, like waste management and emissions control, into their business models.

- Certification Processes: Obtaining necessary certifications and accreditations can be a lengthy and expensive process, acting as a substantial barrier to entry.

Brand Recognition and Customer Loyalty

Eurocell's established brand recognition and deep-rooted customer loyalty in the UK market present a significant hurdle for new entrants. Years of consistent product delivery and marketing have fostered a perception of reliability that new competitors must work hard to overcome.

Building comparable brand trust and loyalty would require substantial investment in marketing and sales initiatives. For instance, in 2024, the home improvement sector saw significant advertising spend, with major players allocating millions to maintain their market positions.

- Established Brand Equity: Eurocell benefits from decades of operation, creating strong brand recall.

- Customer Loyalty: Repeat business is driven by trust in Eurocell's quality and service.

- High Marketing Costs for Newcomers: Entrants face considerable expenditure to even approach Eurocell's brand awareness.

- Perceived Reliability: Customers often associate Eurocell with dependable products, a difficult perception to replicate.

The threat of new entrants into the PVC window and door market, particularly in the UK where Eurocell operates, is significantly mitigated by substantial barriers. These include the high capital investment required for manufacturing and distribution, the need to achieve economies of scale, and the complex regulatory landscape. Furthermore, established brand recognition and customer loyalty present a considerable challenge for any new player attempting to gain market share.

The financial commitment to establish a competitive presence is immense, with modern PVC extrusion plants costing tens of millions of pounds. Eurocell's 2023 revenue of £278.1 million highlights the scale of operations that new entrants must contend with. Building a nationwide distribution network comparable to Eurocell's also demands significant investment and time, further deterring potential competitors.

New entrants must also navigate stringent UK building regulations and quality standards, which require substantial expertise and investment. Eurocell's established brand equity, built over decades, and the loyalty it commands from fabricators and installers create a formidable competitive advantage that is difficult and costly for newcomers to overcome.

| Barrier Type | Description | Impact on New Entrants | Eurocell Advantage |

|---|---|---|---|

| Capital Requirements | High cost of machinery, infrastructure, and R&D. | Deters entry due to upfront investment needs. | Established operational scale and ongoing investment capacity. |

| Economies of Scale | Lower per-unit costs through large-scale production and purchasing. | New entrants start at a cost disadvantage. | Significant cost efficiencies from high production volumes (e.g., £278.1M revenue in 2023). |

| Regulatory Compliance | Adherence to building codes, safety, and environmental standards. | Requires significant time, expertise, and financial resources. | Proven track record of compliance and established processes. |

| Brand Recognition & Loyalty | Customer trust and established relationships. | Difficulty in gaining market acceptance and repeat business. | Decades of brand building and strong customer relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eurocell is built upon a foundation of official company filings, investor presentations, and industry-specific market research reports. We also incorporate data from reputable financial news outlets and trade publications to capture current market dynamics and competitive landscapes.