Eurocell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

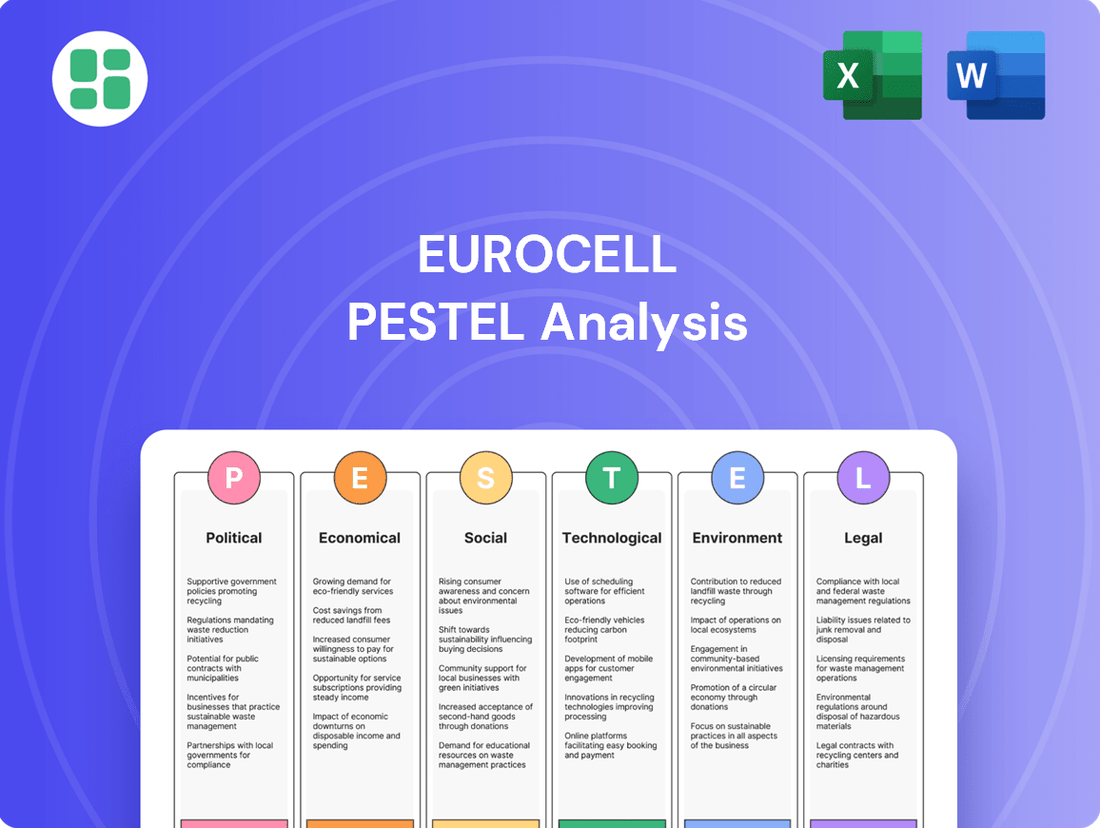

Navigate the complex external environment impacting Eurocell with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operational landscape and future trajectory. This expertly crafted report provides actionable intelligence vital for strategic planning and competitive advantage. Download the full PESTLE analysis now and unlock critical insights to inform your decisions.

Political factors

The UK government's commitment to building 1.5 million new homes by the mid-2020s directly boosts demand for construction materials, a key market for Eurocell. This policy aims to address housing shortages across the nation.

However, persistent planning system delays and land availability issues could impede the realization of these ambitious housing goals, potentially dampening the growth trajectory of the construction materials sector.

Following a general election, any new administration is anticipated to prioritize housebuilding and infrastructure investment, offering a degree of future predictability for companies like Eurocell operating within the construction supply chain.

The Building Safety Act 2025, implemented in the UK, is significantly reshaping the construction landscape with its stringent new regulations. This legislation mandates comprehensive safety case reports and elevates fire safety standards across all new and existing high-rise buildings, directly impacting material suppliers like Eurocell.

These enhanced safety requirements are expected to fuel a greater demand for premium, fire-resistant building materials. Eurocell will need to ensure its products meet these elevated specifications, potentially requiring more extensive and costly testing. The industry-wide push for improved safety will inevitably lead to shifts in product design and the sourcing of raw materials.

The UK's legally binding target to achieve Net Zero emissions by 2050, with interim goals for public sector buildings, is a significant political driver. This translates into policies that favor sustainable construction and energy-efficient products, creating a positive landscape for Eurocell's PVC offerings, especially those incorporating recycled materials. For instance, the government's Green Homes Grant scheme, although subject to review, aimed to boost energy efficiency retrofits.

Eurocell's alignment with these decarbonisation objectives and its provision of solutions for energy-efficient homes position it favorably. The political emphasis on green building standards, such as the Future Homes Standard which mandates higher energy efficiency for new builds, and circular economy principles directly bolsters Eurocell's recycling initiatives. In 2023, the UK government announced plans to invest £4 billion in green energy projects, underscoring the commitment to this sector.

Political Stability and Election Impact

The UK's General Election in 2024 introduced a period of political uncertainty, leading private investors to pause and observe, which consequently delayed some government infrastructure and construction projects. Eurocell specifically highlighted these challenging trading conditions in its H1 2024 performance, noting the election as an exacerbating factor.

However, this short-term volatility is expected to subside as the new government clarifies its policy direction. A decisive and stable political landscape, coupled with clear strategic planning for the construction sector, could reignite investor confidence and stimulate market activity in the medium term.

- Election Impact: The 2024 UK General Election caused a 'wait-and-see' attitude among private investors, impacting market sentiment.

- Delayed Spending: Government spending plans within the construction sector experienced delays due to the electoral period.

- Eurocell's Performance: Eurocell's H1 2024 results cited the election as a contributing factor to difficult trading conditions.

- Medium-Term Outlook: A new government's clear policy framework is anticipated to boost confidence and drive growth in the construction industry.

Infrastructure Spending and Public Sector Investment

Government investment in infrastructure and public sector projects, including health and education, is projected to see an increase in 2025, following some project delays experienced in 2024. This sustained public capital expenditure is anticipated to create a consistent demand for construction materials, acting as a buffer against potential slowdowns in private sector activity and supporting the broader UK construction market’s recovery.

Eurocell, a key supplier within the construction sector, is positioned to gain from this ongoing public investment. For example, the UK government’s Autumn Statement 2023 outlined plans for significant capital investment, with departmental spending on infrastructure expected to remain robust. This translates to a more predictable demand for products like those Eurocell offers, particularly in sectors like social housing, schools, and healthcare facilities.

- Increased Public Capital Expenditure: Government spending on public infrastructure and services is set to rise in 2025, offering a stable demand base.

- Support for Construction Materials: This public investment directly benefits suppliers of construction materials, including PVC-U extrusions and building products, by ensuring continued orders.

- Mitigation of Private Sector Fluctuations: Public sector projects can help offset any volatility or downturns experienced in the private construction market, providing a more resilient revenue stream for companies like Eurocell.

- Contribution to Market Recovery: Sustained public sector investment is a vital component in the overall health and recovery of the UK construction industry.

The UK's commitment to Net Zero by 2050, with interim targets, drives policies favoring sustainable and energy-efficient building products, benefiting Eurocell's PVC offerings, particularly those with recycled content. The Future Homes Standard, mandating higher energy efficiency for new builds, and circular economy principles directly support Eurocell's recycling initiatives, aligning with government investment in green energy projects, such as the £4 billion announced in 2023.

The Building Safety Act 2025 imposes stricter regulations, increasing demand for premium, fire-resistant materials and potentially requiring enhanced testing for suppliers like Eurocell. Government investment in infrastructure and public sector projects, including health and education, is projected to rise in 2025, providing a stable demand for construction materials and offsetting potential private sector slowdowns.

The 2024 UK General Election led to a temporary pause in private investment and delayed some government projects, impacting Eurocell's H1 2024 performance. However, a clear policy direction from the new government is expected to restore investor confidence and stimulate market activity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Eurocell, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clean, summarized version of the full Eurocell PESTLE analysis provides a quick reference to external factors, easing the burden of recalling complex data during strategic discussions.

Economic factors

The UK economy navigated a period of slow growth throughout 2024, with expectations for a mild recovery in 2025. This trajectory has been significantly shaped by ongoing inflationary pressures and elevated interest rates, which have continued to influence consumer and business spending.

While the cost of raw materials has begun to stabilize, these prices remain higher than pre-pandemic benchmarks. This persistent elevation directly impacts the overall expense of construction projects, a key sector for companies like Eurocell.

In response, Eurocell has prioritized robust cost management strategies. The company has also aimed to leverage any available reductions in input pricing to safeguard its profitability in this challenging economic environment.

Elevated interest rates, with the Bank of England base rate holding at 5.25% through late 2024 and into early 2025, have significantly dampened consumer confidence. This cautious sentiment has directly constrained private sector investment and slowed activity in the housing market, notably impacting the repair, maintenance, and improvement (RMI) sector and new build housing.

This environment of subdued consumer spending led to weaker sales volumes for companies like Eurocell in the first half of 2024. For instance, Eurocell reported a 12% decrease in revenue for H1 2024 compared to the previous year, directly attributing this to the challenging economic climate and reduced demand in key markets.

However, forecasts suggest a gradual improvement in economic and financial conditions throughout 2025. This anticipated rebound in economic activity is expected to foster a recovery in consumer and business confidence, potentially leading to increased spending and a boost for sectors like home improvement.

The UK construction sector is anticipated to see a recovery in 2025, moving past a projected downturn in 2024. This rebound is expected to lift overall industry output, with particular growth foreseen in new housing projects and the repair, maintenance, and improvement (RMI) segments. For instance, the Office for Budget Responsibility (OBR) forecasts a 1.1% contraction in construction output for 2024, followed by a 1.5% expansion in 2025.

While the new housing market is showing tentative signs of recovery from a subdued start, the RMI sector continues to experience a slower pace of activity. Eurocell's business is directly influenced by these trends, and its strategic focus is designed to capitalize on the anticipated upswing in the broader market.

Housing Market Activity

The UK's residential construction sector, encompassing new homes and repair, maintenance, and improvement (RMI) work, is a major driver of demand for Eurocell's products. This sector's health is intrinsically linked to the company's performance.

Current housing market dynamics are characterized by persistent housing shortages and strong underlying demand, though affordability remains a significant hurdle for many. These factors create a complex environment for construction activity.

Following a dip in new-build housing starts during 2024, projections for 2025 indicate an upturn. This anticipated growth is expected to be fueled by a recovery in investor sentiment and the implementation of more supportive economic policies.

- Housing Demand: The UK faces a structural deficit in housing supply, with ongoing demand from a growing population.

- Affordability Concerns: Rising interest rates and inflation have impacted housing affordability, potentially slowing down transaction volumes.

- New Build Forecast: While 2024 saw a slowdown, the Office for Budget Responsibility (OBR) forecasts a modest recovery in housing investment and construction output in 2025.

- RMI Market: The repair, maintenance, and improvement sector often acts as a buffer, with homeowners investing in existing properties when new purchases are challenging.

Input Costs and Pricing Pressure

Input costs for construction materials like glass, cement, and steel, while showing some stabilization, continue to exert pressure. Labor market tightness further complicates this by impacting tender prices. Eurocell has navigated this by facing competitive pressure on its selling prices within its branch network and managing overhead cost inflation.

The company's profitability in 2024 hinges on its capacity to actively manage its gross margin and capitalize on any potential reductions in input costs. For instance, in early 2024, while some commodity prices saw slight dips, the overall cost of steel and cement remained elevated compared to pre-pandemic levels, impacting project bids.

- Persistent Material Costs: Despite stabilization, key construction materials like glass, cement, and steel remain at elevated price points, influencing overall project budgets.

- Labor Market Impact: Constraints in the labor market continue to drive up tender prices, adding another layer of cost pressure on construction projects.

- Eurocell's Pricing Strategy: The company has experienced competitive pressure on selling prices in its branch network, necessitating careful management of overhead inflation.

- Margin Management Crucial: Proactive gross margin management and the ability to benefit from reduced input costs are identified as critical factors for Eurocell's profitability in 2024.

The UK's economic landscape in 2024 and early 2025 is marked by subdued growth, influenced by persistent inflation and high interest rates, impacting consumer spending and investment. While input costs have stabilized, they remain elevated, directly affecting construction project expenses.

The Bank of England's base rate holding at 5.25% through late 2024 and into early 2025 has dampened consumer confidence and slowed the housing market. This led to weaker sales volumes for Eurocell, with a 12% revenue decrease in H1 2024.

Forecasts for 2025 indicate a gradual economic recovery, potentially boosting consumer confidence and demand in sectors like home improvement. The construction sector, predicted to contract by 1.1% in 2024 according to the OBR, is expected to expand by 1.5% in 2025.

Despite a structural housing shortage, affordability concerns persist, impacting transaction volumes. While new-build housing starts are expected to rebound in 2025, the repair, maintenance, and improvement (RMI) sector continues a slower recovery.

| Economic Factor | 2024 Outlook | 2025 Outlook | Impact on Eurocell |

|---|---|---|---|

| GDP Growth | Slow Growth | Mild Recovery | Influences overall demand for building products. |

| Inflation | Persistent | Gradual Easing Expected | Affects input costs and consumer purchasing power. |

| Interest Rates (BoE Base Rate) | 5.25% (holding) | Expected to remain elevated, potential for gradual reduction | Dampens housing market activity and consumer spending. |

| Construction Output | -1.1% (OBR forecast) | +1.5% (OBR forecast) | Directly impacts demand for Eurocell's products in new builds and RMI. |

| Housing Market | Subdued, affordability concerns | Tentative recovery, persistent shortage | Affects sales volumes in new housing and RMI sectors. |

Same Document Delivered

Eurocell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eurocell PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You’ll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Consumer caution due to economic uncertainty and adverse weather conditions in early 2024 has led to a slowdown in home improvement spending, affecting Eurocell's performance in the residential RMI sector. For instance, the Office for National Statistics reported that construction output in Great Britain decreased by 0.3% in the first quarter of 2024 compared to the previous quarter, with new housing and private new housing being particularly affected.

However, the UK's aging housing stock presents a sustained opportunity for repair and maintenance work, a segment Eurocell is positioned to address. By 2025, it's estimated that over 80% of the UK's housing stock will be over 20 years old, necessitating ongoing upkeep and upgrades, which bodes well for companies like Eurocell.

Eurocell is actively adapting to shifting consumer preferences by focusing on growth areas such as garden rooms and enhancing sales strategies for windows and doors, aiming to capitalize on evolving homeowner demands for both functional and aesthetic enhancements.

Demographic trends are significantly altering the UK's housing landscape. For instance, first-time buyers are increasingly entering the market in their thirties and forties, a shift from previous generations. This, coupled with a growing preference for multi-generational living and homes designed for an ageing population, is changing what people are looking for in properties.

These evolving needs directly impact the construction and renovation sectors. There's a rising demand for flexible living spaces, properties designed for accessibility, and more affordable new homes. Eurocell's product offerings, such as uPVC windows and doors, are well-positioned to meet these demands, offering solutions for adaptable layouts and energy efficiency, which are key considerations for both younger buyers and those with specific accessibility requirements.

The fundamental challenge of housing supply not keeping pace with demand persists. In 2024, the UK continued to face a significant housing deficit, with new build completions often falling short of government targets. For example, while the government aimed for 300,000 new homes annually, recent figures from the Department for Levelling Up, Housing and Communities indicated completions were still below this ambitious goal, creating a sustained need for renovation and new construction.

Customers and stakeholders are increasingly prioritizing environmental, social, and governance (ESG) factors, which directly fuels demand for sustainable building materials. This trend is reshaping purchasing decisions across the industry.

Eurocell's significant investment in PVC-U recycling, aiming to incorporate a high percentage of recycled content into its product lines, positions it favorably. For instance, in 2024, Eurocell reported that over 50% of the PVC-U used in its extrusion processes was recycled material, a figure they aim to increase further by 2025.

This focus on eco-friendly practices provides Eurocell with a distinct competitive edge. As the market increasingly rewards companies demonstrating responsible manufacturing, Eurocell's commitment to circular economy principles resonates strongly with environmentally conscious consumers and businesses.

Workforce Skills Shortages

The construction sector, a key market for Eurocell, grapples with persistent workforce skills shortages. Estimates suggest around 38,000 vacancies exist, compounded by a substantial portion of the current workforce nearing retirement age in the coming years.

These shortages directly affect Eurocell's customers by potentially delaying projects and increasing labor costs. Political initiatives, including commitments to vocational training and apprenticeships by various parties, aim to mitigate this by upskilling current workers and attracting new talent to the industry.

- 38,000 estimated vacancies in the construction industry.

- Significant number of experienced workers set to retire soon.

- Impact on project timelines and costs for customers.

- Government focus on vocational training and apprenticeships.

Changing Lifestyle and Product Adoption

Evolving lifestyle trends are significantly impacting consumer demand for home improvement products. The surge in popularity of garden rooms and extensions, driven by a desire for more living space and remote working needs, creates substantial growth avenues for companies like Eurocell. For instance, the UK market for home extensions and renovations saw continued strength through 2024, with many homeowners investing in creating dedicated outdoor living areas.

Furthermore, the increasing integration of smart home technology is reshaping consumer expectations. Preferences are shifting towards products offering automation, enhanced security, and energy management capabilities. This trend is particularly evident in the window and door sector, where smart windows and doors with features like automated ventilation and integrated sensors are gaining traction, reflecting a desire for greater comfort and efficiency in the home environment.

Eurocell's strategic focus on developing and marketing products that align with these evolving lifestyle preferences is crucial for capturing these emerging market segments. The company's investment in innovative solutions designed to meet the demand for both expanded living spaces and smart home integration positions it to capitalize on these societal shifts.

Shifting demographic trends, such as an aging population and a growing preference for multi-generational living, are influencing housing design and renovation needs. First-time buyers entering the market later in life also impact the types of properties and features sought after. These evolving preferences directly translate into demand for adaptable, accessible, and energy-efficient home improvements, areas where Eurocell's product range can offer solutions.

Technological factors

Eurocell's commitment to advanced PVC-U recycling is a significant technological advantage. Operating the UK's largest PVC-U recycling facility, they utilize sophisticated closed-loop systems. This technology transforms old window frames and manufacturing scrap into valuable raw materials for new products.

This technological capability directly impacts their product composition. In 2023, Eurocell achieved a 32% recycled PVC-U content in their extrusions, a figure they aim to boost to 40% by 2030. This focus on recycled content not only reduces environmental impact but also bolsters their position within the growing circular economy movement.

The window and door sector is experiencing a surge in smart technology integration, with innovations like remote locking, voice activation, and advanced energy management becoming increasingly common. These smart features significantly boost user convenience, optimize energy consumption, and elevate home comfort, driving substantial market growth.

Market research indicates a strong upward trend, with the global smart windows market expected to reach approximately $10.6 billion by 2027, growing at a CAGR of around 15.1% from 2022. This presents a clear opportunity for companies like Eurocell to adapt.

To remain competitive and capitalize on the expanding smart home ecosystem, Eurocell must consider integrating or offering compatible smart window and door solutions. This strategic move will address the growing consumer demand for technologically advanced building materials and tap into the lucrative smart home market.

Technological advancements in material science are significantly boosting the performance of products like those Eurocell offers. This means better thermal insulation, improved soundproofing, and increased durability, all crucial for modern building standards.

For PVC products specifically, innovations are focused on profile design and material composition. Think about advancements like low-emissivity (Low-E) glass coatings and thermal break construction, which are making windows and doors far more energy-efficient. Eurocell's capacity to deliver products that meet or surpass these demanding energy efficiency regulations, such as those outlined by the UK's Building Regulations Part L, provides a distinct competitive edge in the market.

Digitalisation and E-commerce Adoption

The construction sector's embrace of digital tools like Building Information Modelling (BIM) and AI is driving significant efficiency and cost savings. For Eurocell, this digital shift is also evident in its sales channels, with the company experiencing a notable uplift in e-commerce revenue during 2024.

Eurocell anticipates continued growth in its online sales throughout 2025, underscoring the strategic importance of digital platforms. These platforms are crucial for expanding market reach and optimizing operational processes.

- Digitalisation enhances efficiency and reduces costs in construction through technologies like BIM and AI.

- Eurocell reported increased e-commerce sales in 2024, indicating a growing reliance on digital channels.

- The company is confident in further e-commerce progress for 2025, highlighting its strategic focus.

- Digital platforms are key for Eurocell to access broader markets and streamline its operations.

Product Diversification and Manufacturing Process Enhancements

Eurocell's strategic product diversification, notably the acquisition of Alunet, significantly bolsters its presence in the composite door market and introduces aluminium garage doors, aligning with the increasing demand for aluminium fabrication. This move directly addresses a key technological shift in material preferences within the construction sector.

Ongoing capital investments are being channeled into enhancing manufacturing processes and optimizing operational structures. These investments are designed to yield greater efficiencies and elevate the customer experience throughout Eurocell's extensive manufacturing and distribution network.

These technological and process enhancements are crucial for maintaining Eurocell's competitive edge and ensuring its agility in responding to evolving market demands and technological advancements in the fenestration industry.

- Product Diversification: Acquisition of Alunet strengthens composite door offerings and adds aluminium garage doors, catering to market trends.

- Manufacturing Enhancements: Capital investment focuses on streamlining processes for increased efficiency and improved customer experience.

- Market Responsiveness: These initiatives ensure Eurocell remains competitive and adaptable to technological shifts in material demand.

Technological advancements are reshaping the fenestration industry, pushing for greater energy efficiency and smart integration. Eurocell's investment in advanced PVC-U recycling, evidenced by its UK's largest facility, directly addresses sustainability demands and enhances product composition, with recycled PVC-U content at 32% in 2023.

The rise of smart home technology presents a significant opportunity, with the global smart windows market projected to reach $10.6 billion by 2027. Eurocell's strategic product diversification, including the Alunet acquisition for composite and aluminium doors, aligns with material preference shifts and technological integration trends in construction.

Digitalization is also a key technological factor, with Eurocell experiencing increased e-commerce revenue in 2024 and anticipating further growth in 2025, highlighting the importance of digital platforms for market reach and operational efficiency. Ongoing capital investments in manufacturing processes are crucial for maintaining competitiveness and agility in this evolving technological landscape.

Legal factors

The Building Safety Act 2025 imposes significant new legal obligations across the construction sector, mandating more thorough testing of materials and elevated fire safety protocols. Eurocell, a key supplier of PVC building products, must meticulously ensure its offerings meet these enhanced standards, especially for applications like cladding and fire-retardant components.

Failure to comply with these stringent legal frameworks, which came into effect in early 2025, could severely restrict Eurocell's market access and damage its brand reputation, impacting its ability to secure new contracts within the UK construction industry.

UK environmental policy, including the ambitious Net Zero by 2050 target, places significant emphasis on boosting recycling rates and minimizing waste. This directly impacts companies like Eurocell, who must adapt their operational strategies to align with these national objectives.

Eurocell is actively pursuing higher percentages of recycled PVC-U content within its product lines and is committed to increasing the overall waste recycling rate across its operations. The company has set a specific goal to achieve 88% waste recycling by 2025, demonstrating a tangible commitment to circular economy principles.

Staying compliant with these evolving environmental regulations and proactively participating in waste management initiatives are crucial for Eurocell's long-term sustainability and its ability to maintain a competitive edge in the market.

Government reforms to the UK planning system, particularly those aimed at speeding up development and cutting red tape, could significantly impact the construction sector. For instance, the Levelling-up and Regeneration Act 2023 introduced measures intended to streamline processes, potentially leading to faster project approvals.

While these reforms might boost demand for Eurocell's products by accelerating new build projects, developers will simultaneously face enhanced scrutiny regarding environmental considerations. This means that while projects may move faster, they will likely need to adhere to more rigorous sustainability standards, a factor Eurocell must consider in its product development and marketing.

Eurocell needs to closely track evolving planning permissions and land use policies. For example, changes in designated development zones or updated building regulations, such as those concerning energy efficiency which saw revisions in 2023, could alter where and how quickly new residential and commercial projects, that utilize Eurocell's window and door systems, can proceed.

Energy Efficiency Standards for New Builds

The upcoming Future Homes Standard, slated for implementation in 2025, will mandate that new builds are zero-carbon ready, significantly increasing energy efficiency requirements for building components. This includes stringent performance criteria for windows and doors, potentially aligning with standards like Passivhaus or achieving an Energy Performance Certificate (EPC) C rating, alongside the integration of low-carbon heating solutions.

Eurocell's product portfolio, which emphasizes thermal insulation and energy-saving characteristics, is strategically positioned to comply with these evolving and more rigorous regulatory mandates.

- Future Homes Standard (2025): Aims for zero-carbon ready new homes.

- Window & Door Requirements: Mandates higher energy performance, potentially Passivhaus or EPC C.

- Heating Systems: Requires the inclusion of low-carbon heating.

- Eurocell's Advantage: Products designed for thermal efficiency align with new standards.

Labour Laws and Apprenticeship Levy

Changes in UK labour laws, particularly those affecting the apprenticeship levy, directly influence the cost and availability of skilled workers for Eurocell and its network of fabricators and installers. For instance, the Apprenticeship Levy, introduced in 2017, requires employers with an annual pay bill over £3 million to pay 0.5% of their pay bill towards apprenticeships. This levy can be used to fund apprenticeship training, but its administration and the types of training it can cover are subject to ongoing policy discussions.

Political parties are actively proposing reforms to vocational training and apprenticeships as a means to combat persistent skills shortages within the construction industry. These proposals often focus on streamlining the apprenticeship system, increasing employer control over training content, and potentially adjusting the levy's scope or funding mechanisms. For example, reports from late 2023 and early 2024 have highlighted government commitments to expanding apprenticeship opportunities, with targets for increasing the number of starts, particularly in technical and skilled trades crucial for fenestration manufacturing and installation.

Eurocell must remain vigilant regarding these evolving labour laws and apprenticeship policies to ensure full compliance and to strategically support the development of a competent workforce. This includes adapting training programs to align with new apprenticeship standards and leveraging levy funds effectively. The success of the construction sector, and by extension Eurocell's business, is significantly tied to its ability to attract, train, and retain skilled labour, making proactive engagement with these legal and policy shifts essential.

Key considerations for Eurocell include:

- Apprenticeship Levy Utilization: Maximizing the use of the levy for relevant, high-quality training to build a skilled workforce.

- Policy Monitoring: Staying abreast of proposed reforms to vocational training and apprenticeship funding models.

- Skills Gap Analysis: Continuously assessing the skills needed for future operations and ensuring training aligns with industry demand.

- Industry Collaboration: Working with industry bodies and government to shape future apprenticeship frameworks.

The Building Safety Act 2025 and the Future Homes Standard, effective from 2025, impose stringent fire safety and energy efficiency requirements on new builds. Eurocell's product development must align with these mandates, potentially requiring enhanced fire-retardant materials and improved thermal performance for windows and doors, aiming for zero-carbon ready homes.

Environmental regulations are pushing for higher recycling rates, with Eurocell targeting 88% waste recycling by 2025 to align with the UK's Net Zero goals. Planning reforms, such as those in the Levelling-up and Regeneration Act 2023, aim to speed up development but may also increase scrutiny on sustainability, impacting project timelines and material choices.

Changes to the Apprenticeship Levy and ongoing discussions around vocational training reforms, highlighted in late 2023 and early 2024, directly affect Eurocell's ability to secure and train skilled labour for manufacturing and installation. Proactive engagement with these legal shifts is vital for maintaining a competent workforce and operational efficiency.

Environmental factors

Eurocell is proactively pursuing a Net Zero target by 2045, surpassing the UK's 2050 goal. In 2024, the company finalized its climate Transition Plan, which includes setting ambitious science-based emission reduction targets across Scope 1, 2, and 3 emissions. This commitment positions Eurocell as a leader in sustainable manufacturing.

Key initiatives driving this reduction include sourcing renewable electricity and implementing strategies to optimize natural gas consumption, thereby lowering their overall carbon footprint. These actions not only contribute to global environmental efforts but also bolster Eurocell's standing as a responsible corporate citizen.

Eurocell's commitment to a circular economy is evident in its fully integrated closed-loop recycling system for PVC-U. This system diverts waste from landfills, channeling it back into the production of new products. By 2025, Eurocell aims to achieve an impressive 88% recycling rate for its waste, demonstrating a strong focus on resource efficiency.

The company has ambitious targets for incorporating recycled materials, aiming for 40% recycled PVC-U in its products by 2030. This proactive approach to circularity not only minimizes the environmental footprint of PVC products but also positions Eurocell as an industry leader in sustainable manufacturing practices.

Consumers are increasingly seeking sustainable building materials, a trend that directly benefits Eurocell. For instance, the UK green building market was valued at an estimated £50 billion in 2023 and is projected to grow significantly. Eurocell's PVC products, especially those incorporating recycled materials and offering enhanced thermal insulation, align perfectly with this demand.

This focus on energy efficiency and recycled content helps customers lower their energy bills and reduce their environmental impact. Eurocell's commitment to developing low-carbon solutions positions it as a key player in the expanding green building sector, which is expected to see continued investment and policy support through 2025 and beyond.

Waste Management and Resource Efficiency

Eurocell is making significant strides in waste management and resource efficiency. The company has set ambitious targets, aiming to increase the percentage of waste recycled to 88% by 2025 and further to 93% by 2030. This commitment is supported by active collaboration with third-party sites to optimize material recovery processes.

A key element of Eurocell's strategy involves facilitating efficient PVC-U recycling for its trade customers. By offering collection services, Eurocell plays a vital role in promoting responsible waste handling throughout the construction supply chain. This not only minimizes environmental harm but also conserves valuable resources for future use.

- Waste Recycling Target: Aiming for 88% by 2025 and 93% by 2030.

- Partnerships: Collaborates with third-party sites for material recovery.

- Customer Services: Provides PVC-U collection services for trade customers.

- Environmental Impact: Focuses on minimizing harm and conserving resources.

Climate Change Impact on Operations and Supply Chain

Climate change poses a significant threat to Eurocell's operations, primarily through its impact on construction activity and supply chains. Extreme weather events, such as the prolonged wet weather experienced in H1 2024, directly affected sales by hindering site work and project timelines. This highlights the vulnerability of the construction sector to climatic shifts.

Beyond direct weather impacts, evolving climate policies and global responses can introduce volatility to material costs. For instance, increased demand for sustainable materials or carbon pricing mechanisms could affect the procurement of key inputs for Eurocell's products. This necessitates proactive and resilient supply chain management strategies.

- H1 2024 Sales Impact: Wet weather disruptions significantly affected Eurocell's sales performance in the first half of 2024, underscoring the operational sensitivity to climate-related events.

- Supply Chain Volatility: Global climate policies and the transition to greener economies can lead to price fluctuations and availability issues for raw materials essential to Eurocell's manufacturing processes.

- Adaptation Imperative: Eurocell must continue to develop and implement robust adaptation strategies to mitigate the risks associated with climate change, ensuring business continuity and cost stability.

Eurocell's environmental strategy is deeply integrated into its business model, focusing on achieving Net Zero by 2045 and setting science-based emission reduction targets for 2024. The company is actively enhancing its circular economy approach, aiming for an 88% waste recycling rate by 2025, with a significant portion of its products to contain 40% recycled PVC-U by 2030.

The growing demand for sustainable building materials, with the UK green building market valued at £50 billion in 2023, directly benefits Eurocell's product offerings. These include energy-efficient PVC products that align with consumer preferences for reduced environmental impact and lower energy bills.

However, Eurocell's operations are susceptible to climate-related disruptions, as evidenced by the impact of prolonged wet weather in H1 2024 on sales. Furthermore, evolving climate policies could introduce volatility in raw material costs, necessitating agile supply chain management.

| Environmental Factor | Eurocell's Action/Target | Relevant Data/Impact |

|---|---|---|

| Net Zero Target | Achieve by 2045 | UK's 2050 goal |

| Emissions Reduction | Science-based targets (Scope 1, 2, 3) finalized in 2024 | |

| Waste Recycling | 88% by 2025, 93% by 2030 | Focus on closed-loop PVC-U recycling |

| Recycled Content | 40% recycled PVC-U in products by 2030 | |

| Green Building Market | Aligns with consumer demand | UK market valued at £50 billion in 2023 |

| Climate Disruption | Impact on sales | H1 2024 sales affected by wet weather |

| Policy Impact | Potential material cost volatility | Due to evolving climate policies |

PESTLE Analysis Data Sources

Our Eurocell PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable industry research, and leading economic data providers. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental influences affecting the company.