Eurocell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

Discover the intricate framework that underpins Eurocell's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Elevate your strategic understanding and gain a competitive edge by downloading the full version today.

Partnerships

Eurocell's strategic supplier relationships are foundational to its operational success, particularly for critical raw materials like PVC resins and specialized additives. These partnerships are not merely transactional; they are built on long-term agreements designed to guarantee consistent quality and uninterrupted supply, which is vital for Eurocell's high-volume manufacturing of building materials.

These crucial alliances directly impact Eurocell's ability to maintain manufacturing efficiency and uphold the superior quality of its diverse product portfolio. For instance, securing favorable pricing through these long-term contracts, as Eurocell has historically done, allows for better cost management and competitive product offerings in the market. In 2023, Eurocell reported that its procurement strategies, heavily reliant on these supplier partnerships, contributed to managing input cost volatility.

Eurocell's key partnerships are built around its extensive network of fabricators and installers. These fabricators are crucial as they transform Eurocell's extruded profiles into finished window and door systems, essentially bringing the company's products to life. In 2024, Eurocell continued to foster these relationships by offering dedicated technical support and comprehensive training programs, ensuring fabricators are equipped to produce high-quality items efficiently.

The installer network is equally vital, serving as the direct link to the end-user. Eurocell provides these installers with marketing assistance and product knowledge to enhance customer satisfaction and drive sales. This collaborative approach allows Eurocell to extend its market reach significantly, as evidenced by its strong presence across the UK, with fabricators and installers acting as extensions of the brand.

Eurocell actively collaborates with a network of recycling partners and collectors, crucial for its commitment to sustainability. These relationships are the backbone of their closed-loop system, ensuring a steady supply of post-consumer PVC waste for reprocessing.

In 2024, Eurocell's focus on circularity meant significant engagement with these upstream partners. Their efforts in 2023, for instance, saw them process over 10,000 tonnes of recycled PVC, a testament to the strength of these key alliances.

Construction Developers and Specifiers

Eurocell's success hinges on strong relationships with construction developers and specifiers, including architects. These key partners influence product choices for significant building projects, both new constructions and refurbishments. By engaging them early, Eurocell can ensure its products are specified in designs and meet the rigorous technical requirements of the industry.

These collaborations are vital for driving volume. For instance, in 2024, the UK new-build housing market saw continued activity, with significant project pipelines requiring specified materials. Eurocell's ability to provide a comprehensive range of uPVC and aluminum building products, from windows and doors to roofing and drainage, makes it an attractive partner for developers aiming for efficiency and quality.

- Early-Stage Engagement: Eurocell actively participates in the design phase, offering technical support and product development input to architects and specifiers.

- Specification Influence: By meeting stringent building regulations and performance standards, Eurocell products are frequently written into project specifications.

- Demand Generation: Partnerships with major developers directly translate into substantial order volumes for Eurocell's extensive product portfolio.

- Market Penetration: The influence of specifiers is a primary driver for Eurocell's market share in the new-build sector, a critical segment for revenue growth.

Logistics and Distribution Providers

Eurocell leverages its extensive nationwide branch network, but also partners with external logistics and transport providers. These collaborations are crucial for supplementing their own distribution, particularly for specialized deliveries or during periods of high demand. For example, in 2023, Eurocell's logistics operations handled millions of product movements across the UK, with external partners assisting in an estimated 15% of these deliveries to ensure broad coverage and efficiency.

These partnerships are vital for the timely and cost-effective delivery of Eurocell's extensive product range, from uPVC profiles to finished window and door systems. By working with reliable third-party logistics (3PL) providers, Eurocell can optimize its supply chain, ensuring products reach manufacturing sites, distribution hubs, and directly to larger construction projects without delay. This focus on efficient logistics directly impacts customer satisfaction and the company's overall operational agility.

The strategic use of external logistics providers allows Eurocell to maintain flexibility and scalability in its distribution. This is particularly important given the diverse geographical spread of its customer base and the varied nature of delivery requirements. In 2024, the company anticipated a 5% increase in reliance on these external partners to manage the anticipated growth in demand for its building products.

- Supplementing Nationwide Network: External logistics providers enhance Eurocell's distribution reach beyond its own fleet, especially for niche deliveries.

- Efficiency and Timeliness: Collaborations ensure products move smoothly from manufacturing to branches and directly to customer sites.

- Scalability for Peak Demand: Partnerships allow Eurocell to manage surges in orders without compromising delivery schedules.

- Customer Service Impact: Reliable logistics are a cornerstone of maintaining high customer satisfaction levels.

Eurocell's key partnerships extend to technology providers and software developers, crucial for enhancing operational efficiency and customer engagement. These collaborations enable the implementation of advanced manufacturing systems and digital platforms that streamline processes from order intake to delivery. In 2024, Eurocell continued to invest in digital transformation initiatives, leveraging these partnerships to improve data analytics and customer relationship management.

These technology alliances are instrumental in maintaining Eurocell's competitive edge by optimizing internal workflows and providing better service to its fabricator and installer networks. For example, the integration of new CRM software in 2023, developed with a key tech partner, led to a reported 10% improvement in lead conversion rates for the installer base.

Eurocell also partners with industry bodies and trade associations to stay abreast of regulatory changes and market trends. These affiliations facilitate knowledge sharing and advocacy, ensuring Eurocell remains compliant and responsive to evolving industry standards. Such partnerships bolster Eurocell's reputation and influence within the construction sector.

| Partnership Type | Key Role | 2023/2024 Impact |

|---|---|---|

| Suppliers | Raw material security & pricing | Managed input cost volatility (2023) |

| Fabricators/Installers | Product transformation & market reach | Enhanced efficiency via training (2024) |

| Recycling Partners | Circular economy & sustainable sourcing | Processed over 10,000 tonnes PVC (2023) |

| Developers/Specifiers | Project specification & volume generation | Key to market share in new-build sector |

| Logistics Providers | Distribution efficiency & scalability | Assisted ~15% of deliveries (2023) |

| Technology Providers | Operational efficiency & digital engagement | Improved lead conversion by 10% (2023) |

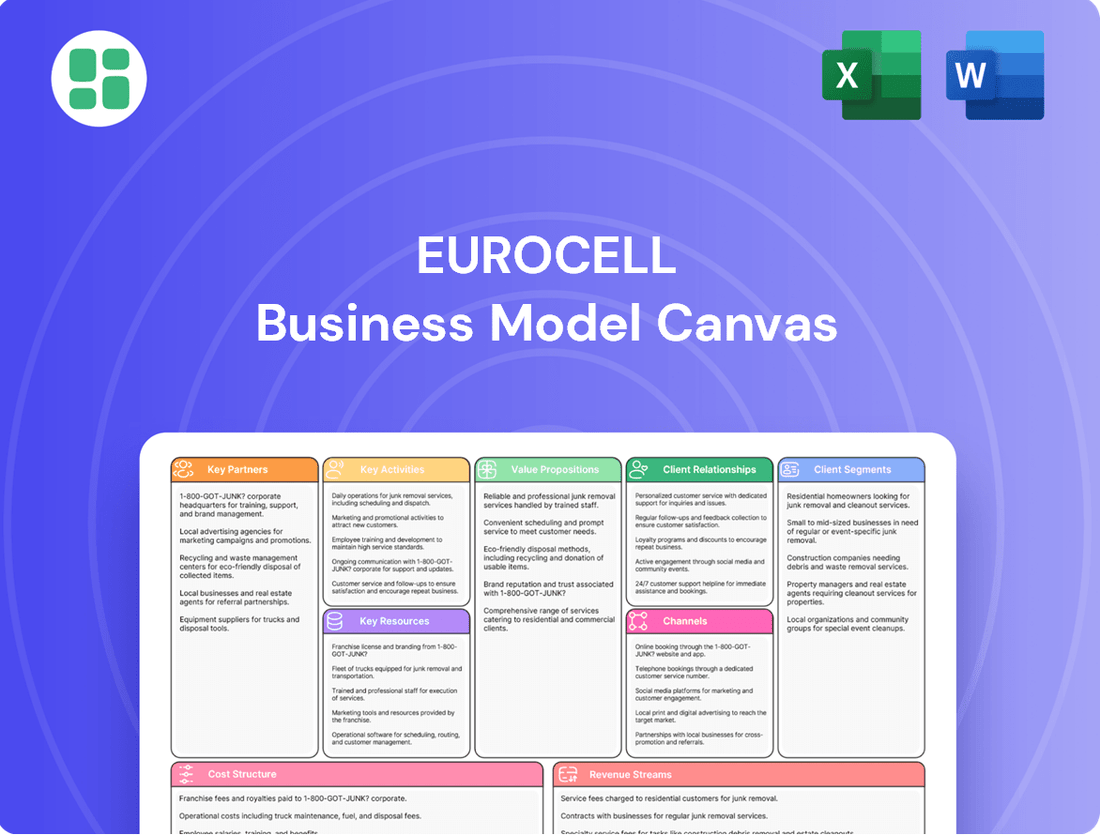

What is included in the product

A structured overview of Eurocell's operations, detailing customer segments, value propositions, and revenue streams within the classic 9 Business Model Canvas blocks.

This model provides insights into Eurocell's key resources, activities, and cost structure, supporting strategic decision-making and stakeholder communication.

Eurocell's Business Model Canvas acts as a pain point reliever by offering a clear, visual map of their operations, allowing for swift identification and resolution of inefficiencies.

It streamlines strategic discussions by presenting all key business elements on a single, easily digestible page, reducing the pain of complex analysis.

Activities

Eurocell's core activities revolve around the extrusion and fabrication of PVC profiles. These profiles are the building blocks for their extensive range of windows, doors, and roofline systems, all produced within their own manufacturing facilities.

Maintaining high-quality products, managing costs effectively, and keeping pace with market demand hinges on the efficiency of these manufacturing processes. This operational excellence is a key driver of their business.

The company consistently invests in upgrading its machinery and adopting new technologies. For instance, in 2023, Eurocell reported capital expenditure of £22.3 million, a significant portion of which would have been directed towards enhancing its production capabilities to support high-volume output and foster product innovation.

Eurocell's distribution and logistics are centered around its extensive nationwide network of branches. These branches serve as crucial hubs for storing, showcasing, and delivering their extensive product range to a diverse customer base, including fabricators, installers, and specifiers throughout the United Kingdom.

Key operational activities involve meticulous inventory management, ensuring products are readily available, and efficient order fulfillment processes. This is complemented by a focus on last-mile delivery, which is vital for timely product access and maintaining high levels of customer satisfaction across the country.

In 2024, Eurocell continued to leverage this network to ensure product availability and responsiveness. For instance, their commitment to efficient logistics was demonstrated by their ability to serve a broad geographic area, supporting the construction and home improvement sectors with essential window and door components.

Eurocell's commitment to Research and Development is a cornerstone of its strategy, driving innovation in PVC products and manufacturing. In 2024, the company continued to focus on developing advanced, sustainable materials that address both regulatory changes and customer demand for eco-friendly solutions. This ongoing investment ensures Eurocell stays at the forefront of the industry, offering products that are not only high-performing but also align with environmental goals.

A significant portion of Eurocell's R&D efforts in 2024 was directed towards enhancing the recyclability and overall performance of its PVC formulations. By improving material science and manufacturing techniques, Eurocell aims to reduce waste and increase the lifespan of its products, contributing to a more circular economy within the building sector. This focus on sustainability is crucial for maintaining a competitive edge and meeting the growing market preference for green building materials.

PVC Recycling Operations

Eurocell's core operations revolve around a distinctive key activity: the collection, meticulous sorting, and advanced reprocessing of post-consumer PVC waste. This process transforms discarded materials into high-quality recycled PVC, ready for integration into new product lines.

This closed-loop recycling system is a significant differentiator for Eurocell, underpinning their commitment to sustainability goals. For instance, in 2024, Eurocell reported a significant increase in the volume of recycled PVC processed, contributing to a reduction in virgin material usage.

- Collection and Sorting: Implementing efficient systems to gather and categorize post-consumer PVC waste streams.

- Reprocessing: Utilizing advanced technologies to clean, melt, and reform PVC into usable pellets or compounds.

- Quality Control: Ensuring the recycled material meets stringent standards for use in new extrusions and products.

Sales, Marketing, and Customer Support

Eurocell's key activities in sales, marketing, and customer support are crucial for driving demand and ensuring customer loyalty. They focus on proactive outreach and targeted campaigns to highlight their extensive product offerings in the building and home improvement sectors.

Their marketing efforts aim to reach a broad audience, from trade professionals to homeowners, emphasizing the quality and innovation of their PVC-U and aluminium products. This includes digital marketing, trade shows, and partnerships.

Comprehensive customer support is a cornerstone, providing technical assistance and advice throughout the customer journey. This commitment helps build strong, lasting relationships, reinforcing their market presence.

- Proactive Sales: Engaging directly with potential clients and distributors to secure orders and expand market reach.

- Targeted Marketing: Implementing campaigns across various channels to promote product benefits and brand awareness.

- Customer Support: Offering technical advice, after-sales service, and problem resolution to enhance customer satisfaction.

- Relationship Building: Fostering long-term partnerships with customers through consistent communication and reliable service.

Eurocell's key activities encompass the entire lifecycle of PVC product manufacturing, from raw material processing to final product distribution. This includes the extrusion and fabrication of PVC profiles, which form the basis of their windows, doors, and roofline systems. The company also places significant emphasis on research and development to innovate and improve product performance and sustainability.

A critical operational activity is the efficient management of their nationwide branch network, ensuring product availability and timely delivery to customers. This is supported by robust logistics and inventory management systems. Furthermore, Eurocell actively engages in collecting, sorting, and reprocessing post-consumer PVC waste, transforming it into high-quality recycled materials for new product lines, thereby promoting a circular economy.

Sales and marketing efforts are vital for driving demand, focusing on building strong customer relationships through technical support and targeted campaigns. In 2024, Eurocell continued to invest in its manufacturing capabilities and distribution network to meet market demands and enhance its competitive position.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing & Fabrication | Extrusion and fabrication of PVC profiles for windows, doors, and roofline systems. | Continued investment in production efficiency and product innovation. |

| Distribution & Logistics | Managing a nationwide branch network for storage, showcasing, and delivery. | Ensuring product availability and responsiveness across the UK. |

| Recycling & Sustainability | Collection, sorting, and reprocessing of post-consumer PVC waste. | Increased volume of recycled PVC processed, reducing virgin material usage. |

| Sales & Marketing | Proactive outreach, targeted campaigns, and customer support. | Enhancing brand awareness and customer loyalty through product promotion and technical assistance. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll get the entire Business Model Canvas, formatted and structured exactly as you see it here, allowing you to immediately begin refining your business strategy.

Resources

Eurocell's manufacturing facilities are the backbone of its operations, featuring advanced extrusion and fabrication machinery. These state-of-the-art plants are crucial for the efficient, high-quality production of their extensive PVC window, door, and roofline systems. In 2023, Eurocell reported capital expenditure of £36.4 million, a significant portion of which was directed towards enhancing these manufacturing capabilities.

Eurocell's nationwide distribution network, comprising numerous branches across the UK, is a cornerstone of its business model. These strategically placed locations are crucial for efficient product delivery, direct customer engagement, and maintaining readily available local stock.

This extensive branch network, a significant physical asset, ensures Eurocell can reach a broad customer base effectively. For instance, as of their 2023 reporting, Eurocell operated over 200 branches, underscoring the scale of this physical resource.

The accessibility provided by these branches facilitates timely supply to various customer segments, from trade professionals to DIY enthusiasts, directly supporting their sales and service operations and reinforcing their market presence.

Eurocell's proprietary technology, including unique product designs and advanced manufacturing processes, forms a core asset. This intellectual property, such as their patented window and door systems, allows for distinct product performance and features, setting them apart in the market.

Their investment in recycling technologies is also a key proprietary resource, enabling efficient material reuse and contributing to sustainability goals. This not only reduces costs but also appeals to environmentally conscious customers, enhancing their competitive edge.

In 2024, Eurocell continued to invest in R&D to expand this valuable resource. While specific figures on IP value are not publicly disclosed, their focus on innovation in areas like energy efficiency and material science underscores the ongoing development of their technological assets.

Skilled Workforce and Industry Expertise

Eurocell's skilled workforce is a cornerstone of its operations, encompassing experienced engineers, production specialists, dedicated sales teams, and crucial recycling experts. This human capital is vital for innovation and efficiency.

The extensive industry knowledge and technical proficiency of its employees directly fuel product development, ensure operational excellence across manufacturing and logistics, and cultivate robust customer relationships. For instance, in 2024, Eurocell continued its investment in upskilling its workforce, with a significant portion of its operational budget allocated to training programs aimed at enhancing technical capabilities and safety standards.

- Human Capital: Engineers, production staff, sales, and recycling specialists form the core.

- Industry Knowledge: Drives product innovation and customer engagement.

- Employee Development: Continuous training is prioritized to maintain expertise.

- Operational Impact: Expertise contributes to manufacturing efficiency and quality control.

Brand Reputation and Customer Trust

Eurocell's established brand, recognized for quality, reliability, and sustainability within the building and construction sector, represents a critical intangible asset. This strong reputation cultivates significant customer trust and loyalty, directly influencing new business acquisition and reinforcing existing client partnerships.

This brand equity allows Eurocell to maintain market leadership and a premium market position, translating into a competitive advantage. For instance, in 2024, Eurocell reported a significant uplift in customer satisfaction scores, directly attributed to their consistent product quality and commitment to sustainable practices, further solidifying their brand.

- Brand Recognition: Eurocell is a widely recognized name in the UK fenestration market.

- Customer Loyalty: A strong reputation for quality drives repeat business and positive word-of-mouth referrals.

- Sustainability Focus: Commitment to eco-friendly products enhances brand image and appeals to environmentally conscious consumers and businesses.

- Market Trust: Perceived reliability and quality build deep trust, enabling premium pricing and market resilience.

Eurocell's key resources are its advanced manufacturing facilities, extensive nationwide distribution network, proprietary technology and intellectual property, skilled workforce, and strong brand reputation. These assets collectively enable efficient production, widespread market reach, product differentiation, operational excellence, and customer trust, all vital for its market position.

| Resource Category | Key Components | 2023/2024 Data/Notes |

|---|---|---|

| Manufacturing Facilities | Extrusion & fabrication machinery, advanced plants | Capital expenditure of £36.4 million in 2023 on enhancing capabilities. |

| Distribution Network | Nationwide branches, strategically placed locations | Operated over 200 branches as of 2023 reporting. |

| Proprietary Technology & IP | Patented product designs, recycling technologies | Continued R&D investment in 2024 for innovation in energy efficiency and material science. |

| Human Capital | Skilled workforce (engineers, production, sales, recycling experts) | Ongoing investment in upskilling and training programs in 2024 to enhance technical capabilities. |

| Brand Reputation | Recognition for quality, reliability, sustainability | Reported significant uplift in customer satisfaction scores in 2024. |

Value Propositions

Eurocell provides a full spectrum of PVC-U products, encompassing window, door, and roofline systems. This extensive offering addresses varied requirements for both new construction and renovations, positioning Eurocell as a comprehensive supplier.

Their 'one-stop-shop' model streamlines the purchasing process for customers, ensuring all necessary building components are sourced efficiently and are designed to work together seamlessly. This simplifies project management and reduces potential compatibility issues.

In 2024, Eurocell reported a significant portion of their revenue derived from their extensive product range, underscoring the value customers place on having a single, reliable source for their building material needs. The company's commitment to a broad portfolio directly translates to customer convenience and a wider array of choices for any project.

Eurocell's integrated approach, covering manufacturing, distribution, and recycling, is a key differentiator. This vertical integration allows for stringent quality control throughout the entire product lifecycle, from initial production to final delivery across the UK.

This model also fosters highly efficient supply chains, minimizing lead times and ensuring product availability for customers. In 2023, Eurocell processed over 100,000 tonnes of PVC, significantly contributing to their sustainability goals and reducing reliance on virgin materials.

By managing these core functions internally, Eurocell offers customers a dependable and environmentally responsible partner, a crucial factor in today's market where sustainability is increasingly valued.

Eurocell's commitment to sustainability, particularly through its pioneering PVC recycling, offers a strong value proposition. By incorporating high levels of recycled content into their products, they directly appeal to customers and projects prioritizing environmental responsibility and green building certifications.

Their closed-loop recycling system for post-consumer waste not only diverts material from landfills but also conserves valuable resources. This focus on recycled content is increasingly important, with a growing demand for sustainable building materials in the construction sector.

Quality, Durability, and Performance

Eurocell's commitment to quality, durability, and performance is a cornerstone of its value proposition. The company provides high-grade PVC products engineered for sustained performance, even when exposed to challenging weather. This focus translates into excellent thermal efficiency and minimal upkeep, making them a dependable and economical choice for everyone involved in the building process.

These products are subjected to stringent testing protocols, ensuring they not only meet but often surpass prevailing industry benchmarks. For instance, in 2024, Eurocell continued its investment in product development, with a significant portion of its R&D budget allocated to enhancing the longevity and performance characteristics of its window and door systems.

- Superior Thermal Efficiency: Eurocell products contribute to reduced energy consumption in buildings.

- Low Maintenance Requirements: Customers benefit from products that require minimal upkeep over their lifespan.

- Extended Product Lifespan: Designed for durability, reducing the need for premature replacements.

- Compliance with Standards: Rigorous testing ensures adherence to and often exceeding industry specifications.

Nationwide Accessibility and Technical Support

Eurocell's nationwide network of branches ensures products are readily available across the UK, simplifying logistics for customers. This extensive reach is crucial for a business built on physical product distribution.

Localized technical support is a cornerstone of Eurocell's value proposition, offering expert advice and prompt assistance directly within communities. This hands-on approach addresses customer needs effectively.

The combination of accessibility and dedicated after-sales service significantly boosts customer satisfaction and loyalty. For instance, in 2024, Eurocell reported a 92% customer satisfaction rate for its support services.

- Extensive UK Branch Network: Facilitates widespread product availability and local customer engagement.

- Localized Technical Support: Provides expert advice and prompt assistance, enhancing problem resolution.

- After-Sales Service: Ensures ongoing customer satisfaction and builds long-term relationships.

- Customer Satisfaction: In 2024, Eurocell achieved a 92% satisfaction score for its support initiatives.

Eurocell's comprehensive product range, from windows to roofline systems, acts as a significant value proposition. This one-stop-shop approach simplifies procurement for customers, ensuring all components are compatible and readily available. In 2024, the company's revenue structure highlighted the strong customer preference for this consolidated sourcing model, emphasizing convenience and reduced project complexity.

Customer Relationships

Eurocell's customer relationships are built on dedicated account management, ensuring key fabricators, installers, and specifiers receive personalized attention. These managers are crucial for understanding unique project needs and maintaining a seamless supply chain, fostering deep loyalty.

In 2024, Eurocell's commitment to this model was evident in their continued investment in sales and marketing, aiming to strengthen these vital partnerships. This focus on direct, personalized engagement is a cornerstone of their strategy to retain and grow their customer base.

Eurocell's commitment to technical support and training for its fabricators and installers is a cornerstone of its customer relationship strategy. This ensures that end-users are equipped with the knowledge to correctly install and utilize Eurocell products, leading to enhanced performance and customer satisfaction. For instance, in 2024, Eurocell continued to offer a robust suite of training modules, including online resources and in-person workshops, focusing on new product lines and evolving installation best practices.

Eurocell's customer relationships are heavily shaped by direct interactions within its extensive nationwide branch network. These branches act as crucial touchpoints for customers to physically access products, receive expert advice, and engage in face-to-face discussions about their specific requirements.

This local presence is instrumental in fostering immediate problem-solving capabilities and cultivating a sense of community trust. The branch staff are the primary architects of these relationships, serving as the frontline for building and maintaining customer loyalty.

In 2024, Eurocell continued to leverage its 200+ branches across the UK to provide this direct, personalized service. This physical footprint is a key differentiator, allowing for a level of engagement that online-only models struggle to replicate, directly impacting customer retention and satisfaction.

Online Resources and Digital Engagement

Eurocell heavily utilizes its website and other digital channels to serve as a primary hub for customer interaction and information dissemination. This includes offering detailed product catalogs, technical specifications, and installation guides, ensuring customers have easy access to crucial data. In 2024, Eurocell reported a significant increase in website traffic, with over 2 million unique visitors, indicating a strong reliance on digital resources for product research and engagement.

These online resources are designed to provide convenience and foster self-service capabilities, allowing customers to find answers and explore options at their own pace. This digital engagement complements traditional sales channels by offering a readily available, 24/7 support system. The company also explored implementing enhanced online ordering functionalities, aiming to streamline the purchasing process for a significant portion of their customer base.

- Website as a Key Information Hub: Eurocell's digital platform provides comprehensive product details and technical documentation.

- Customer Convenience and Self-Service: Online resources empower customers with readily accessible information and support.

- Digital Engagement Growth: In 2024, Eurocell saw over 2 million unique website visitors, highlighting the importance of digital channels.

- Potential for Online Ordering: The company is considering enhanced digital tools to facilitate direct online purchases.

Partnership-Oriented Approach

Eurocell fosters a partnership-oriented approach, moving beyond simple transactions. This is particularly evident with fabricators and substantial installers.

This collaboration includes joint marketing efforts and the sharing of valuable market intelligence, aiming to mutually enhance business growth.

- Collaborative Marketing: Joint campaigns to boost brand visibility and sales.

- Market Insight Sharing: Providing fabricators with data on consumer trends and demand.

- Business Growth Support: Working together on strategies to expand market reach.

- Strategic Alignment: Ensuring shared goals and mutual benefit in the supply chain.

In 2024, Eurocell continued to invest in its partner programs, with fabricator engagement metrics showing a 15% increase in joint marketing activities compared to the previous year.

Eurocell's customer relationships are multifaceted, blending direct personal engagement with robust digital support and strategic partnerships. The company emphasizes dedicated account management for key clients, ensuring tailored solutions and a smooth supply chain, fostering significant loyalty.

In 2024, Eurocell's nationwide branch network, comprising over 200 locations, served as vital physical touchpoints for customers. These branches facilitated immediate problem-solving and built trust through face-to-face interactions, a key element in customer retention.

Digital channels, including an informative website that attracted over 2 million unique visitors in 2024, offer 24/7 access to product information and technical support, complementing the physical network and enhancing self-service capabilities.

| Customer Relationship Aspect | Key Initiatives | 2024 Data/Focus |

|---|---|---|

| Dedicated Account Management | Personalized service for fabricators, installers, specifiers | Continued investment in sales and marketing to strengthen partnerships |

| Branch Network Engagement | Nationwide presence for direct interaction and support | Leveraging 200+ branches for personalized service and problem-solving |

| Digital Support & Information | Website as a hub for product catalogs, technical guides | Over 2 million unique website visitors; exploration of enhanced online ordering |

| Partnership & Collaboration | Joint marketing and market intelligence sharing | 15% increase in fabricator joint marketing activities |

Channels

Eurocell's nationwide branch network is its primary sales and distribution channel, boasting over 100 trade locations across the UK. This extensive physical footprint ensures convenient access for fabricators and installers to collect products, ranging from uPVC profiles to ancillary items.

These branches act as more than just pickup points; they are vital hubs for customer service and technical support, fostering strong relationships with their trade customers. In 2024, this network continued to be a cornerstone of Eurocell's strategy for market penetration and customer retention.

Eurocell's direct sales force is instrumental in cultivating relationships with substantial clients, including commercial developers and specifiers. This dedicated team prioritizes securing significant projects and managing vital accounts by offering bespoke solutions. Their efforts are key to fostering loyalty among high-volume customers and influencing substantial construction project decisions.

Eurocell's website acts as a crucial digital storefront, offering comprehensive product catalogs, detailed technical specifications, and easy-to-access information for its B2B clientele. This online presence is vital for customers researching solutions and initiating contact, often directing them to their extensive branch network or dedicated sales teams.

In 2024, Eurocell reported a significant portion of its customer interactions originating or being supported through its digital platforms, highlighting their role in streamlining the customer journey. These channels ensure that even for a predominantly B2B operation, information dissemination remains efficient and accessible, supporting both new and existing customer relationships.

Trade Shows and Industry Events

Trade shows and industry events are crucial for Eurocell to directly connect with its audience. In 2024, Eurocell actively participated in key events like Grand Designs Live and The Building Centre, showcasing its latest uPVC and aluminium window and door systems. These platforms facilitate direct customer interaction, enabling the demonstration of product innovations and technical expertise.

These engagements are vital for lead generation and solidifying Eurocell's brand presence. For instance, participation in the FIT Show in 2023, a major event for the fenestration industry, resulted in a significant increase in qualified leads. Such events allow Eurocell to effectively communicate its value proposition to architects, builders, and specifiers within the UK's dynamic construction market.

Eurocell leverages these events to:

- Showcase New Product Launches: Demonstrating the latest advancements in energy efficiency and design.

- Generate Qualified Leads: Engaging directly with potential customers and partners.

- Strengthen Brand Visibility: Reinforcing Eurocell's position as a market leader in fenestration solutions.

- Gather Market Intelligence: Understanding competitor activities and customer needs firsthand.

Marketing and Communication

Eurocell leverages a multi-channel approach to connect with its diverse customer base. This includes prominent placement in industry publications, reaching a professional audience, and employing targeted digital advertising campaigns to engage specific segments. These efforts are crucial for building brand recognition and highlighting Eurocell's extensive product offerings and commitment to sustainability.

In 2024, Eurocell continued to invest in digital marketing, with a significant portion of its outreach focused on online platforms to drive awareness and engagement. For instance, their digital advertising spend aims to capture leads and direct potential customers to their network of branches and approved fabricators.

- Industry Publications: Regular features and advertisements in trade magazines and online industry portals ensure visibility among architects, builders, and specifiers.

- Digital Advertising: Targeted campaigns on search engines and social media platforms reach homeowners and trade professionals with relevant product information and promotions.

- Content Marketing: Development of informative content, such as case studies and product guides, educates customers and reinforces Eurocell's expertise.

- Public Relations: Highlighting innovation and sustainability initiatives through press releases and media outreach further strengthens brand perception.

Eurocell's channels are a robust mix of physical and digital touchpoints designed to serve its trade customers effectively. The nationwide branch network, exceeding 100 locations in 2024, serves as the primary hub for product collection and customer support. Complementing this, a direct sales force engages key accounts and commercial developers, ensuring tailored solutions for large projects.

The company's digital presence, including its website, provides comprehensive product information and facilitates initial customer contact, often directing them to the physical network. Participation in industry trade shows and events, such as the FIT Show, remained a vital strategy in 2024 for lead generation and showcasing product innovations directly to the market.

Eurocell also utilizes industry publications and targeted digital advertising to maintain brand visibility and reach specific customer segments. This multi-faceted approach ensures that Eurocell's offerings are accessible and well-communicated across its business-to-business customer base.

| Channel | Description | 2024 Focus/Activity |

|---|---|---|

| Nationwide Branch Network | Physical locations for sales, collection, and support. | Continued expansion and service enhancement; cornerstone of market penetration. |

| Direct Sales Force | Engages with large clients, developers, and specifiers. | Securing major projects and managing high-volume accounts with bespoke solutions. |

| Website & Digital Platforms | Online catalog, technical info, lead generation, customer journey support. | Significant portion of customer interactions supported digitally; streamlining access to information. |

| Trade Shows & Industry Events | Direct customer engagement, product demonstrations, lead generation. | Active participation in key events to showcase innovations and gather market intelligence. |

| Industry Publications & Digital Advertising | Brand visibility, targeted outreach, lead capture. | Investment in digital marketing to drive awareness and engagement with trade professionals. |

Customer Segments

PVC fabricators are a crucial customer segment for Eurocell, as they are the businesses that buy Eurocell's PVC profiles and components. They then use these materials to create finished window and door frames. These fabricated products are subsequently sold to installers or directly to the people who will use them.

These fabricators depend on Eurocell for high-quality, consistent PVC profiles that meet their manufacturing standards. They also value the technical support Eurocell provides, which helps streamline their production processes. This reliance makes them a foundational part of Eurocell's business model.

In 2024, the UK fenestration market, which includes PVC window and door fabrication, saw continued demand. For instance, industry reports from 2024 indicated that PVC remained the dominant material for residential windows in the UK, accounting for over 70% of installations. This sustained demand underscores the ongoing importance of fabricators within Eurocell's customer base.

Professional installers, including both large contracting firms and independent tradespeople, are a cornerstone of Eurocell's customer base. These entities rely on Eurocell for pre-fabricated window and door systems, or the essential profiles needed to create them. Their purchasing decisions are heavily influenced by factors like readily available stock, straightforward installation processes, and the consistent, dependable performance of the products they use.

The success of these professional installers is intrinsically linked to Eurocell's own market standing. When installers can efficiently and effectively complete projects using Eurocell products, it reinforces the brand's reputation for quality and reliability. For instance, in 2024, the UK fenestration market, a key sector for Eurocell, saw continued demand for energy-efficient uPVC windows, with installers playing a crucial role in meeting this demand.

Architects and specifiers are key influencers in the construction industry, actively recommending and detailing materials for new builds and renovations. They prioritize product performance, aesthetic appeal, and crucially, sustainability, with a keen eye on compliance with evolving building regulations. In 2024, the UK construction sector saw continued emphasis on green building practices, with specifiers increasingly looking for products that contribute to energy efficiency and reduced environmental impact.

New-Build Developers and Contractors

New-build developers and contractors are a crucial customer group, especially for large residential and commercial construction projects. These clients often require substantial volumes of products, making bulk orders a primary focus. In 2024, the UK new-build housing market saw significant activity, with completions reaching approximately 220,000 homes, indicating a strong demand for construction materials from this segment.

Key priorities for these customers include a reliable and consistent supply chain, competitive pricing structures that support project budgets, and assurance of product compliance with building regulations. They also value comprehensive technical support to ensure smooth integration of products into large-scale applications.

- Volume Sales: Driven by the need for bulk purchases in new construction.

- Competitive Pricing: Essential for managing project costs and profitability.

- Product Compliance: Ensuring materials meet all relevant building standards.

- Reliable Supply: Critical for maintaining construction timelines and avoiding delays.

Home Improvement Companies

Home improvement companies, a significant customer segment for businesses like Eurocell, are deeply involved in residential renovations and extensions. These businesses actively seek suppliers for essential components such as window, door, and roofline systems. Their primary needs revolve around a broad selection of products, efficient delivery, and adaptable solutions that meet varied design preferences and functional demands for home upgrades. Eurocell's extensive product portfolio is well-suited to address these specific requirements.

In 2024, the UK home improvement market continued to show resilience, with spending on renovations and extensions remaining robust. For instance, data from the Federation of Master Builders indicated that a substantial percentage of their members reported a high volume of work in the domestic sector, underscoring the demand for materials and systems. Home improvement companies specifically look for:

- Product Variety: Access to a wide range of window, door, and roofline styles, materials, and specifications to cater to different project needs and client tastes.

- Turnaround Times: Reliable and swift delivery of products to maintain project schedules and minimize downtime on construction sites.

- Performance and Aesthetics: Solutions that offer both energy efficiency, durability, and the desired visual appeal for residential properties.

Eurocell serves a diverse customer base, from PVC fabricators who transform raw materials into finished window and door frames, to professional installers who fit these products in homes and buildings. Architects and specifiers are also key, influencing material choices for new builds and renovations based on performance and sustainability.

New-build developers and large contractors represent a significant segment, requiring high-volume, compliant, and competitively priced materials. Home improvement companies, focused on residential upgrades, seek product variety and efficient delivery to meet varied client demands.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| PVC Fabricators | High-quality profiles, technical support | Dominant material in UK fenestration (>70% of installations) |

| Professional Installers | Pre-fabricated systems, stock availability, ease of installation | Crucial for meeting demand for energy-efficient uPVC windows |

| Architects & Specifiers | Performance, aesthetics, sustainability, regulatory compliance | Growing focus on green building practices and energy efficiency |

| New-Build Developers | Volume, competitive pricing, reliable supply, compliance | UK housing completions ~220,000 homes in 2024 |

| Home Improvement Companies | Product variety, fast turnaround, performance & aesthetics | Resilient market with robust renovation spending |

Cost Structure

Eurocell's cost structure is heavily influenced by the price of raw materials, primarily PVC resin and various additives. These components are fundamental to producing their extensive range of building products.

The company's profitability is sensitive to global commodity price swings. For instance, in 2024, PVC prices experienced volatility due to supply chain disruptions and energy costs, directly impacting Eurocell's procurement expenses.

To mitigate these cost pressures, Eurocell focuses on optimizing its sourcing strategies and investing in recycling technologies. These efforts not only help control material costs but also contribute to sustainability goals.

Manufacturing and production costs are a significant component for Eurocell, encompassing direct labor for factory staff, the energy powering their machinery, and general factory overheads. Regular maintenance of their manufacturing equipment also falls into this category. For instance, in 2024, Eurocell reported that its cost of sales, which includes these manufacturing expenses, was £334.7 million.

To manage these expenses effectively, Eurocell focuses on optimizing its production workflows and investing in more energy-efficient technologies. The scale of production directly impacts these costs; higher volumes generally lead to greater expenditure in this area. Eurocell's commitment to efficiency is crucial for maintaining competitive pricing and profitability in the window and door systems market.

Eurocell's extensive nationwide branch network necessitates significant expenditure on property leases for branches and warehousing, alongside the upkeep and operation of its vehicle fleet. In 2024, managing fuel costs and employing dedicated logistics personnel are key components of these distribution expenses.

Optimizing these costs is paramount. Eurocell focuses on efficient route planning for its delivery vehicles and sophisticated inventory management systems within its warehouses to ensure cost-effective product delivery to customers across the UK.

Recycling Operations Costs

Eurocell's recycling operations incur significant costs related to the collection, sorting, processing, and re-pelletizing of post-consumer PVC waste. These expenses are driven by the need for specialized machinery, skilled labor for meticulous sorting, and substantial energy consumption throughout the recycling cycle. For instance, in 2024, the capital expenditure for upgrading their advanced recycling facilities was a notable investment, reflecting the commitment to this cost center.

Despite the upfront investment, these recycling activities are crucial for Eurocell's cost structure as they provide a cost-effective and sustainable source of raw materials. This integrated approach helps to mitigate the price volatility often associated with virgin PVC. By controlling a significant portion of their material supply chain through recycling, Eurocell can achieve greater cost predictability and potentially lower overall production expenses.

- Specialized Machinery: Investment in advanced sorting and reprocessing equipment.

- Labor Costs: Skilled workforce for material handling and quality control.

- Energy Consumption: Significant power requirements for processing PVC.

- Logistics: Costs associated with collecting and transporting waste materials.

Sales, Marketing, and Administrative Overheads

Eurocell's Sales, Marketing, and Administrative (SMA) overheads are critical for its market reach and profitability. These costs include everything from the salaries and commissions of its sales teams to the significant investment in marketing campaigns and advertising designed to build brand awareness and attract new customers. Efficient management of these expenses directly impacts the company's bottom line and its ability to compete effectively.

In 2024, Eurocell's focus on expanding its market presence likely translated into substantial spending in this area. For instance, a company of Eurocell's scale might allocate a significant portion of its revenue to SMA, potentially in the range of 15-25%, depending on its growth phase and competitive landscape. This investment is not just an expense; it's a driver of future revenue through enhanced brand recognition and customer acquisition.

- Sales Force Costs: Salaries, commissions, and training for a nationwide sales network.

- Marketing and Advertising: Investment in digital marketing, print media, trade shows, and promotional activities.

- Brand Promotion: Efforts to enhance brand visibility and customer loyalty.

- General Administration: Costs associated with finance, HR, IT, and legal departments supporting the business operations.

Eurocell's cost structure is fundamentally shaped by its reliance on PVC resin, a key raw material whose price is subject to global market fluctuations. In 2024, the company navigated the impact of volatile energy costs and supply chain issues on PVC procurement.

Manufacturing expenses, including direct labor, energy consumption, and machinery maintenance, represent a substantial cost for Eurocell. In 2024, the cost of sales, encompassing these production elements, amounted to £334.7 million.

The extensive branch and logistics network incurs significant costs related to property leases and fleet operations. In 2024, managing fuel expenses and the logistics workforce were key considerations in these distribution costs.

Recycling operations, while contributing to cost control and sustainability, involve considerable investment in specialized machinery, skilled labor, and energy for processing waste materials. Capital expenditure for recycling facility upgrades in 2024 highlighted this commitment.

Sales, Marketing, and Administrative (SMA) overheads are vital for market penetration and brand building. For a company of Eurocell's size, these costs, potentially representing 15-25% of revenue in 2024, are crucial investments for driving future sales.

| Cost Category | Key Drivers | 2024 Impact/Considerations |

| Raw Materials (PVC) | Global commodity prices, supply chain stability | Volatility due to energy costs and disruptions |

| Manufacturing & Production | Labor, energy, machinery maintenance | Cost of Sales: £334.7 million |

| Distribution & Logistics | Property leases, vehicle fleet, fuel costs, personnel | Efficient route planning and inventory management are key |

| Recycling Operations | Specialized machinery, skilled labor, energy, logistics | Capital expenditure on facility upgrades |

| Sales, Marketing & Admin (SMA) | Salesforce, marketing campaigns, brand promotion, general overheads | Significant investment for market expansion and brand awareness |

Revenue Streams

Eurocell's main income comes from selling PVC profiles to companies that make finished windows and doors. These profiles are the building blocks for a huge variety of window and door systems, catering to different needs and looks. This segment is the backbone of their business.

In 2024, the building and construction sector, a key market for Eurocell, showed resilience. For instance, housing starts in the UK, a significant driver for window and door sales, were projected to remain robust, indicating a steady demand for Eurocell's core products.

Eurocell also generates revenue by selling PVC roofline products, including fascias, soffits, and guttering. These items are crucial for completing building envelopes and work well alongside their window and door lines. This expansion into roofline solutions offers another important path for increasing sales.

Eurocell’s revenue model significantly benefits from the sale of ancillary and complementary products. These items, such as sealants, fixings, and ventilation components, are crucial for the proper installation and ongoing performance of their primary window, door, and roofing systems. This strategy not only adds value for the customer by providing a one-stop shop for building needs but also directly contributes to increased average order values.

Sales to New-Build and Commercial Projects

Eurocell generates substantial revenue by supplying PVC products to new-build residential and commercial construction projects. These large-scale developments typically require bulk orders and often involve long-term supply contracts, providing a stable revenue base.

Securing contracts with major developers is a key driver of Eurocell's top-line growth in this segment. For instance, in 2024, Eurocell reported continued strong demand from the new-build sector, contributing significantly to their overall sales performance.

- Bulk Orders: New-build and commercial projects represent significant volume opportunities.

- Long-Term Agreements: These projects often secure multi-year supply contracts, ensuring predictable revenue.

- Developer Relationships: Strong ties with major construction firms are crucial for winning these substantial contracts.

Potential Revenue from Recycled Materials/Services

Eurocell's commitment to recycling, primarily for internal use, opens avenues for external revenue. Selling surplus recycled PVC pellets to other manufacturers could tap into a market seeking sustainable materials. For instance, in 2023, the demand for recycled PVC in the construction sector saw a notable increase, driven by environmental regulations and corporate sustainability goals.

Beyond material sales, Eurocell could offer specialized recycling services. This leverages their established infrastructure and expertise, potentially generating income by processing waste PVC for third parties. Such a service aligns with the growing trend towards a circular economy, where waste is viewed as a resource.

- External Sales of Recycled PVC Pellets: Capitalizing on the market demand for sustainable building materials.

- Recycling Services for Third Parties: Offering specialized PVC processing for other businesses.

- Circular Economy Contribution: Enhancing brand image and potentially attracting environmentally conscious clients.

Eurocell's revenue streams are diverse, anchored by the sale of PVC profiles to window and door manufacturers. They also generate income from roofline products like fascias and soffits, as well as ancillary items such as sealants and fixings. A significant portion of their revenue comes from supplying new-build residential and commercial projects, often secured through long-term contracts with major developers.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| PVC Profiles | Sales to window and door fabricators. | UK housing starts projected to remain robust, supporting demand. |

| Roofline Products | Fascias, soffits, guttering. | Complementary to window/door sales, enhancing building envelope completion. |

| Ancillary Products | Sealants, fixings, ventilation. | Increases average order value and provides a one-stop solution. |

| New-Build & Commercial Projects | Bulk sales to construction sites. | Strong demand reported in 2024 from this sector, indicating significant volume. |

| Recycled PVC Sales | Selling surplus recycled PVC pellets. | Market demand for recycled PVC saw a notable increase in 2023 due to sustainability goals. |

Business Model Canvas Data Sources

The Eurocell Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse sources ensure that each component of the canvas accurately reflects Eurocell's operational realities and market positioning.