ESR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

ESR's market position is defined by its robust logistics infrastructure and strong regional presence, but understanding the full scope of its competitive advantages and potential challenges requires a deeper dive. Our comprehensive SWOT analysis reveals the critical factors driving ESR's success and the emerging threats you need to be aware of.

Unlock the complete picture of ESR's strategic landscape, including detailed breakdowns of its internal capabilities and external opportunities. Purchase our full SWOT analysis to gain actionable insights, expert commentary, and an editable format perfect for investors and strategic planners.

Don't miss out on the strategic intelligence that can shape your investment decisions. Get instant access to our professionally formatted ESR SWOT analysis, complete with both Word and Excel deliverables, to plan with confidence and stay ahead of the curve.

Strengths

ESR Group Limited stands as the preeminent New Economy real estate manager in the Asia Pacific, a position solidified by its extensive operational footprint and deep market penetration. This leadership isn't merely a title; it translates into tangible benefits like superior bargaining power with tenants and preferential access to high-yield investment prospects. For instance, as of the first half of 2024, ESR reported a substantial Assets Under Management (AUM) growth, underscoring its dominant market share.

This regional dominance allows ESR to leverage economies of scale, attracting top-tier tenants who value stability and extensive network access. The company's established reputation within the investment community, particularly among institutional investors, fosters trust and facilitates capital raising for new ventures. By the end of 2023, ESR's portfolio spanned key markets, demonstrating consistent growth and a strong commitment to expanding its leadership in the logistics and data center sectors.

ESR's strategic focus on high-growth sectors like logistics and data centers positions it favorably within critical infrastructure for e-commerce, logistics, and technology. This specialization taps into powerful secular growth trends fueled by digitalization and global trade, creating a strong demand for its properties. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2028, showcasing the immense growth potential ESR is targeting.

ESR's integrated business model is a significant strength, allowing it to manage the entire real estate lifecycle from acquisition and development to ongoing asset management. This holistic approach, combining investment management, fund management, property development, and management services, enables ESR to capture value across all stages. For example, as of the first half of 2024, ESR reported a robust development pipeline, underscoring its ability to execute its integrated strategy effectively.

Diversified Institutional Investor Base

ESR's diversified institutional investor base is a significant strength, reflecting robust confidence from sophisticated capital partners in its operational capabilities and strategic direction. This broad spectrum of investors, including major pension funds, sovereign wealth funds, and global asset managers, underpins ESR's ability to secure stable and substantial funding for its extensive property acquisition and development pipelines.

The wide range of capital sources mitigates dependence on any single investor, bolstering financial resilience and flexibility. For instance, as of late 2024, ESR successfully raised capital from a consortium of leading Asian and European institutional investors for its logistics fund, demonstrating the breadth of its appeal. This diversified approach is crucial for executing large-scale projects and facilitating continuous portfolio expansion across its key markets.

- Broad Investor Confidence: Attracting a wide array of institutional investors signals strong validation of ESR's investment strategies and management expertise.

- Stable Funding Access: A diversified base ensures consistent access to capital for property acquisitions and development, crucial for growth.

- Reduced Reliance: Lessens dependence on any single investor, enhancing financial stability and operational independence.

- Capacity for Large Projects: Facilitates the execution of significant development and expansion initiatives due to reliable capital availability.

Strong Tenant Relationships

ESR cultivates robust relationships with its tenants by focusing on the specific needs of major e-commerce, logistics, and technology firms. This targeted approach fosters deep, long-term partnerships with high-quality, blue-chip clients.

These strong tenant ties translate directly into tangible benefits for ESR. They typically lead to consistently high occupancy rates, ensuring a steady stream of rental income. Furthermore, these relationships open doors for repeat business and the development of tailored solutions as tenants grow and require more space or specialized facilities.

The critical role these properties play in the day-to-day operations of ESR's tenants solidifies these bonds. For instance, in 2024, ESR reported a weighted average lease expiry (WALE) of over 4 years across its portfolio, a testament to the sticky nature of its tenant base.

Key aspects of ESR's strong tenant relationships include:

- Tenant Retention: ESR's focus on tenant needs contributes to high retention rates, minimizing vacancies and associated costs.

- Stable Income: Long-term leases with creditworthy tenants provide predictable and stable rental revenue streams.

- Partnership Opportunities: The deep relationships allow for collaborative development and expansion projects to meet evolving tenant requirements.

- Mission-Critical Facilities: ESR's properties often serve essential functions for its tenants, making them indispensable and strengthening the partnership.

ESR's market leadership in the Asia Pacific region is a significant strength, providing considerable bargaining power with tenants and preferential access to attractive investment opportunities. This dominance is evidenced by its substantial Assets Under Management (AUM) growth reported in the first half of 2024, highlighting its strong market share and operational scale.

The company's integrated business model, encompassing acquisition, development, and asset management, allows it to capture value across the entire real estate lifecycle, fostering efficiency and control. This end-to-end capability is demonstrated by a robust development pipeline as of the first half of 2024, showcasing effective strategic execution.

ESR's strategic focus on high-growth sectors like logistics and data centers aligns with powerful secular trends, ensuring sustained demand for its properties. The global data center market's projected growth, from approximately $200 billion in 2023 to over $400 billion by 2028, underscores the immense potential ESR is tapping into.

A diversified institutional investor base, including major pension funds and sovereign wealth funds, provides stable and substantial funding for ESR's expansion. For instance, a capital raise from Asian and European investors in late 2024 for its logistics fund exemplifies this broad appeal and financial resilience.

Strong tenant relationships, particularly with blue-chip e-commerce and logistics firms, lead to high occupancy rates and stable rental income. The company's weighted average lease expiry (WALE) exceeding 4 years in 2024 reflects the sticky nature of its tenant base and the mission-critical role of its facilities.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Market Leadership (APAC) | Dominant position in New Economy real estate, enabling strong tenant negotiation and investment access. | Substantial AUM growth in H1 2024. |

| Integrated Business Model | Manages the full real estate lifecycle, capturing value at each stage. | Robust development pipeline in H1 2024. |

| Sector Specialization | Focus on logistics and data centers targets high-growth secular trends. | Global data center market projected to double by 2028. |

| Diversified Investor Base | Access to stable and substantial capital from various institutional investors. | Successful capital raise from global investors in late 2024. |

| Strong Tenant Relationships | High tenant retention and stable income from partnerships with creditworthy clients. | WALE exceeding 4 years in 2024. |

What is included in the product

Delivers a strategic overview of ESR’s internal capabilities and external market factors, identifying key growth drivers and potential weaknesses.

Offers a clear, actionable framework to identify and address critical business challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

ESR's business model, particularly in large-scale logistics and data center development, is inherently capital intensive. Acquiring and developing these significant assets demands substantial upfront investment, often running into billions of dollars. For instance, in 2023, ESR's total assets stood at approximately $35.7 billion, reflecting the sheer scale of its real estate holdings and ongoing projects.

This high capital requirement often leads to significant debt leverage. As of the end of 2023, ESR reported a consolidated debt of around $15.1 billion. While leverage can amplify returns, it also heightens financial risk, especially when interest rates are on the rise or during economic slowdowns, as seen with the global interest rate hikes throughout 2022-2023.

The need for continuous access to large pools of capital presents another challenge. ESR relies heavily on debt financing and equity raising to fund its expansion and development pipeline. Securing this capital consistently, particularly in volatile market conditions, can be a hurdle, impacting the pace and scale of new project commencements.

Despite ESR's strategic focus on resilient sectors like logistics and data centers, the company is still susceptible to the inherent cyclicality of the broader real estate market. Economic downturns or periods of oversupply in specific geographic areas can lead to decreased property valuations, lower rental income, and reduced occupancy rates, directly affecting ESR's asset performance and overall profitability. For instance, a significant economic contraction, as seen in some regions during 2023, could dampen demand for new industrial spaces and limit new investment opportunities.

While ESR's substantial presence in the Asia Pacific (APAC) region is a key strength, it also presents a significant weakness due to geographic concentration. This means a large portion of its assets and operations are tied to a single, albeit large, economic zone.

Any economic downturn, political upheaval, or adverse regulatory changes specifically within the APAC area could have a disproportionately negative impact on ESR's overall financial performance and future growth. This concentration limits the buffer that diversification across different global regions might otherwise provide.

Dependency on Specific Industry Growth

ESR's significant concentration on e-commerce, logistics, and technology sectors, while a current advantage, exposes it to considerable risk if these industries experience a downturn. For instance, a slowdown in e-commerce growth, which saw global retail e-commerce sales reach an estimated $6.3 trillion in 2024, could directly impact demand for ESR's warehousing and logistics facilities.

Disruptions within these key sectors, such as evolving fulfillment strategies in e-commerce or rapid technological shifts affecting data center requirements, could diminish the need for ESR's core property assets. This dependency means that adverse changes in these specific markets could disproportionately affect ESR's revenue and asset valuation.

- E-commerce Growth Dependency: Global e-commerce sales are projected to grow, but any significant deceleration directly impacts demand for logistics and warehousing spaces.

- Technological Shifts: Rapid advancements in technology can alter data center needs, potentially affecting demand for ESR's investments in this area.

- Logistics Sector Vulnerability: Changes in supply chain management and transportation models could influence the optimal design and location of logistics hubs, impacting ESR's asset performance.

Competition for Premium Assets and Tenants

ESR, as a prominent global player, encounters significant competition for premium logistics and data center properties. Other major real estate developers, fund managers, and institutional investors are actively seeking these high-demand assets, driving up acquisition costs and potentially compressing investment yields. This competitive landscape makes securing prime locations and desirable tenants a constant challenge for ESR.

The intense rivalry extends to attracting and retaining high-quality tenants. With numerous sophisticated real estate providers in the market, ESR must continually offer competitive rental rates, superior facility management, and advanced technological infrastructure to secure and maintain its tenant base. Failing to do so can impact occupancy rates and overall portfolio performance.

For instance, the industrial and logistics real estate sector, a core focus for ESR, saw significant global investment activity. In 2024, investment volumes in prime logistics assets remained robust, with strong demand from institutional capital. This sustained investor appetite underscores the competitive environment ESR operates within, as it competes with other major funds and developers for limited prime stock.

- Intense Competition: ESR faces strong competition from global and regional real estate firms for prime logistics and data center assets.

- Rising Acquisition Costs: The demand for premium properties can inflate purchase prices, impacting ESR's investment returns.

- Tenant Retention Challenges: Maintaining market share requires ESR to continuously attract and retain high-quality tenants amidst numerous alternatives.

- Yield Compression Risk: Increased competition can lead to lower yields on acquired assets, affecting profitability.

ESR's significant reliance on debt financing, with approximately $15.1 billion in consolidated debt at the end of 2023, exposes it to interest rate volatility. Rising global interest rates, a trend observed throughout 2022-2023, increase borrowing costs and can strain profitability. This high leverage amplifies financial risk, particularly during economic downturns.

The company's substantial capital requirements, highlighted by total assets of around $35.7 billion in 2023, necessitate continuous access to large capital pools. Securing this funding consistently, especially in volatile market conditions, poses a challenge and can impede the pace of new project development.

Geographic concentration in the Asia Pacific region, while a strength, also represents a weakness. Adverse economic, political, or regulatory changes within APAC could disproportionately impact ESR's overall performance, limiting the diversification benefits found in broader global operations.

ESR's dependence on the e-commerce, logistics, and technology sectors makes it vulnerable to industry-specific downturns or shifts. A slowdown in e-commerce, for example, projected to reach $6.3 trillion in global sales in 2024, could reduce demand for its core logistics assets.

| Weakness | Description | Financial Impact Example (as of 2023) |

| High Capital Intensity & Debt Leverage | Requires substantial upfront investment for large-scale assets, leading to significant debt. | Total Assets: ~$35.7 billion; Consolidated Debt: ~$15.1 billion |

| Continuous Capital Access Needs | Relies on consistent debt and equity financing for expansion, which can be challenging in volatile markets. | N/A (Ongoing operational requirement) |

| Geographic Concentration (APAC) | Over-reliance on the Asia Pacific region makes it susceptible to regional economic or political instability. | N/A (Strategic exposure) |

| Sectoral Dependency | Vulnerability to downturns or disruptions in e-commerce, logistics, and technology sectors. | E-commerce sales ~$6.3 trillion (2024 estimate) - a slowdown impacts demand. |

Preview the Actual Deliverable

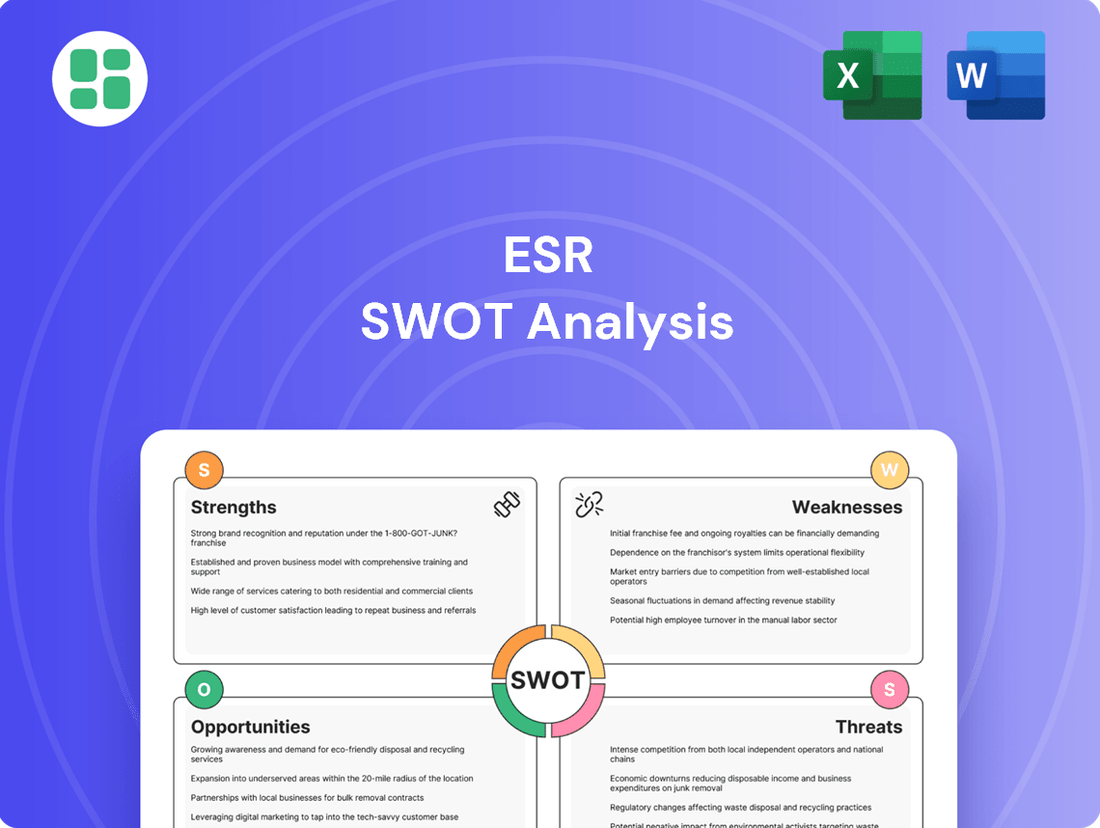

ESR SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The ongoing surge in digital transformation and e-commerce is a significant advantage for ESR. This trend fuels demand for their logistics and data center services, as more businesses and consumers rely on online platforms and cloud infrastructure. For instance, global e-commerce sales are projected to reach over $7 trillion by 2025, a substantial increase from recent years, directly benefiting ESR's core operations.

The surge in AI and advanced technologies is creating a massive need for data centers. ESR is set to benefit by building facilities capable of handling the high power and cooling demands of AI workloads, drawing in new tech clients.

ESR's established strength in the Asia-Pacific region presents a significant opportunity for expansion into its emerging markets. Countries like Vietnam, Indonesia, and the Philippines are witnessing robust industrial growth and increasing urbanization, creating a strong demand for modern logistics and data center facilities. For instance, Vietnam's manufacturing sector has seen consistent growth, with foreign direct investment inflows reaching an estimated $36.6 billion in 2023, signaling ample room for ESR's development pipeline.

Sustainability and ESG-Driven Investments

The increasing focus on sustainability and Environmental, Social, and Governance (ESG) principles presents a significant growth avenue for ESR. Investor and tenant preferences are shifting towards properties that demonstrate environmental responsibility and social impact. This trend is underscored by the fact that sustainable real estate investments are projected to grow substantially, with global ESG real estate investment expected to reach trillions by 2025, driven by regulatory pressures and investor demand for climate-resilient assets.

By actively pursuing green building certifications, integrating renewable energy sources, and adopting sustainable operational practices, ESR can elevate its asset valuations. This strategic approach not only appeals to a growing pool of ESG-focused capital but also aligns with the corporate sustainability objectives of its tenant base. Such initiatives are crucial for market differentiation and long-term value creation in the evolving real estate landscape.

Key opportunities within this domain include:

- Enhanced Asset Value: Properties with strong ESG credentials often command higher rental yields and capital appreciation.

- Access to ESG Capital: A growing segment of institutional investors specifically allocates capital to ESG-compliant real estate.

- Tenant Attraction and Retention: Demonstrating commitment to sustainability can attract and retain tenants with similar corporate values.

- Risk Mitigation: Proactive adoption of sustainable practices can reduce operational costs and mitigate risks associated with climate change and regulatory changes.

Strategic Partnerships and Acquisitions

The real estate sector, particularly in certain segments, remains quite fragmented. This presents a prime opportunity for ESR to forge strategic partnerships, enter into joint ventures, and pursue targeted acquisitions. By doing so, ESR can tap into specialized expertise that complements its existing capabilities.

ESR's substantial scale and robust financial standing are key advantages. These allow the company to acquire smaller, niche players, thereby expanding its footprint into complementary real estate sectors. Furthermore, alliances can be instrumental in facilitating entry into new geographic markets or developing highly specialized assets, ultimately bolstering ESR's overall market position and operational capabilities.

For instance, in 2024, ESR continued to explore strategic growth avenues. The company announced a significant joint venture in India to develop a large-scale logistics park, leveraging local expertise and ESR's capital. This aligns with the strategy of expanding into new geographies and developing specialized assets.

- Fragmented Market Entry: Partnerships and JVs can reduce the capital outlay and risk associated with entering new, fragmented real estate markets.

- Acquisition of Niche Capabilities: Targeted acquisitions allow ESR to quickly gain specialized expertise in areas like data centers or life sciences real estate, which are experiencing strong demand.

- Geographic Expansion: Alliances with local players are crucial for navigating regulatory landscapes and understanding local market dynamics in new international territories.

- Enhanced Asset Development: Collaborations can bring together diverse skill sets for the development of complex or specialized real estate projects, increasing the potential for higher returns.

The increasing demand for sustainable and ESG-compliant real estate presents a significant opportunity for ESR to attract capital and tenants. By focusing on green building certifications and renewable energy, ESR can enhance asset values and mitigate risks. This aligns with the growing investor preference for climate-resilient assets, a trend expected to see trillions invested globally by 2025.

The fragmented nature of the real estate sector allows ESR to pursue strategic partnerships and acquisitions. This strategy enables the company to gain specialized expertise and expand into new geographic markets or complementary sectors. For example, ESR's 2024 joint venture in India for a logistics park development highlights this approach to expanding its footprint and capabilities.

The robust growth in e-commerce and digital transformation directly benefits ESR's logistics and data center services. With global e-commerce sales projected to exceed $7 trillion by 2025, ESR is well-positioned to capitalize on this trend. Similarly, the rise of AI is driving demand for advanced data centers, a segment where ESR can leverage its expertise.

Expansion into emerging markets within the Asia-Pacific region offers substantial growth potential for ESR. Countries like Vietnam, with its strong manufacturing growth and increasing foreign direct investment (estimated at $36.6 billion in 2023), provide fertile ground for developing modern logistics and data center facilities.

Threats

A global economic slowdown, particularly in the vital APAC region, poses a significant threat by potentially dampening demand for essential logistics services and crucial data center capacity. This could translate into higher vacancy rates and a subsequent decline in rental income for ESR. For instance, a projected 0.5% contraction in global GDP growth for 2025, down from 2.8% in 2024, would directly impact trade volumes and business expansion plans, affecting occupancy levels.

Furthermore, persistent inflation remains a considerable challenge. Elevated price levels in 2024, averaging 4.5% across major Asian economies, are likely to continue into 2025, driving up development and operational expenses for ESR. This cost escalation directly squeezes profit margins. Simultaneously, the anticipated rise in benchmark interest rates, with central banks targeting a 5.25% average by mid-2025, will increase the cost of capital for new projects and refinancing existing debt, impacting overall financial flexibility and project viability.

The burgeoning New Economy real estate sector, a key focus for ESR, has become a magnet for significant global competition. Major institutional investors, private equity giants, and established real estate developers are all vying for prime assets. This influx of capital is driving up acquisition costs, impacting ESR's ability to secure properties at favorable yields. For instance, in 2024, global real estate investment volumes in logistics and industrial sectors saw a notable increase, intensifying bidding wars for quality assets.

Rapid advancements in logistics, like the increasing adoption of autonomous vehicles and advanced robotics in warehouses, pose a threat. For instance, by the end of 2024, the global warehouse automation market is projected to reach $30 billion, highlighting the pace of change. Similarly, data center technology is evolving with edge computing and more efficient cooling systems, potentially making current infrastructure outdated.

Failure to invest in upgrading existing properties to accommodate these new technologies could lead to reduced tenant demand and higher operational costs. The need for continuous modernization means significant capital expenditure, impacting profitability if not managed proactively. By 2025, the demand for energy-efficient data centers is expected to grow by 15% year-over-year.

Geopolitical Risks and Trade Tensions

Geopolitical risks, particularly trade tensions and regional conflicts in the Asia Pacific, pose a significant threat to ESR. These can disrupt global supply chains, impacting logistics and potentially leading to increased operational costs. For instance, ongoing trade disputes between major economies could slow down the movement of goods, affecting demand for warehousing and industrial properties.

Political instability and regional conflicts add another layer of uncertainty. Such events can deter foreign investment, a key driver for real estate development and asset appreciation. This could lead to reduced demand for ESR's logistics infrastructure and negatively impact its asset valuations across critical markets in the region.

- Trade tensions: Increased tariffs and trade barriers can disrupt the flow of goods, impacting demand for logistics and industrial properties. For example, the US-China trade war has already shown the potential for significant supply chain realignments.

- Regional conflicts: Escalation of regional conflicts can lead to economic slowdowns and reduced foreign direct investment, affecting property markets. The ongoing situation in parts of Southeast Asia highlights this vulnerability.

- Political instability: Unpredictable political environments can create uncertainty for businesses, leading to delayed investment decisions and a potential slowdown in development projects. This directly affects ESR's ability to secure new leases and develop new assets.

Regulatory Changes and Environmental Compliance

Evolving regulatory landscapes across different APAC countries, particularly concerning land use, environmental protection, and data privacy, pose potential threats to ESR's operations. For instance, in 2024, several Southeast Asian nations began implementing stricter data localization laws, which could impact how ESR manages its tenant data and operational systems across its logistics and data center portfolios.

Stricter environmental compliance requirements or sudden changes in zoning laws could increase development costs, delay projects, or even limit the scope of future expansions. In 2025, we've seen an increase in ESG reporting mandates for real estate companies operating in markets like Australia and Singapore, requiring significant investment in compliance and potentially impacting project timelines if not adequately addressed.

- Increased Development Costs: New environmental regulations, such as those mandating specific waste management protocols or energy efficiency standards for new builds, could add an estimated 5-10% to construction costs in certain APAC markets by 2025.

- Project Delays: Revisions to land use zoning or the introduction of new environmental impact assessment requirements can extend project approval timelines by an average of 6-12 months.

- Operational Restrictions: Stricter emissions standards for logistics fleets or data center cooling systems could necessitate costly upgrades or limit operational capacity.

- Data Privacy Fines: Non-compliance with evolving data privacy laws, such as potential GDPR-like regulations being considered in some Asian jurisdictions, could result in substantial financial penalties.

The increasing competition in the New Economy real estate sector presents a significant threat, as a surge in investment is driving up acquisition costs for prime assets. This intensified competition, particularly evident in 2024 with a notable rise in global investment volumes for logistics and industrial sectors, makes it harder for ESR to secure properties at favorable yields.

Rapid technological advancements in logistics and data centers, such as the projected $30 billion global warehouse automation market by end-2024, pose a risk of making current infrastructure obsolete. Failure to invest in upgrades could lead to reduced tenant demand and higher operational costs, with energy-efficient data centers expected to see a 15% year-over-year growth in demand by 2025.

Geopolitical risks, including trade tensions and regional conflicts in the Asia Pacific, disrupt supply chains and economic stability, impacting demand for logistics and potentially leading to reduced foreign investment. Political instability can create uncertainty, delaying business investment decisions and affecting ESR's ability to secure leases and develop new assets.

Evolving regulatory landscapes, such as stricter environmental protection laws and data privacy requirements, can increase development costs and cause project delays. For instance, new ESG reporting mandates in markets like Australia and Singapore by 2025 necessitate significant investment in compliance, potentially impacting project timelines.

| Threat Category | Specific Risk | Impact on ESR | Supporting Data/Trend |

|---|---|---|---|

| Competition | Rising Acquisition Costs | Reduced ability to secure assets at favorable yields | Increased global investment in logistics/industrial sectors in 2024 |

| Technology | Infrastructure Obsolescence | Decreased tenant demand, higher operational costs | Warehouse automation market to reach $30B by end-2024; 15% YoY growth in energy-efficient data center demand by 2025 |

| Geopolitics | Supply Chain Disruptions | Impacted demand for logistics properties | Trade tensions and regional conflicts in APAC |

| Regulation | Increased Development Costs | Project delays and compliance burdens | 5-10% construction cost increase for new environmental regulations by 2025; 6-12 month project approval delays |

SWOT Analysis Data Sources

This ESR SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.