ESR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

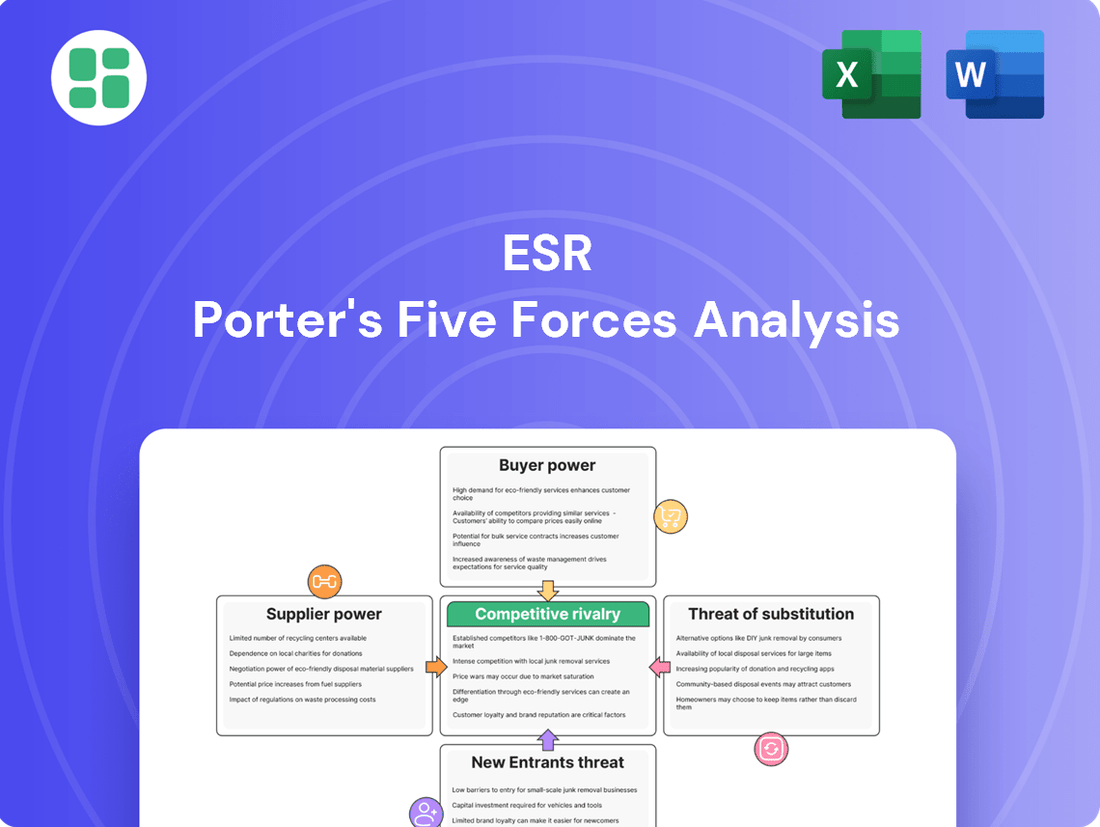

Understanding the competitive landscape is crucial for any business, and ESR is no exception. Porter's Five Forces analysis provides a powerful framework to dissect the industry's dynamics, revealing the underlying pressures that shape profitability and strategic choices.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ESR’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of landowners and construction companies is substantial, especially for desirable locations and unique projects like data centers. In 2024, the cost of prime industrial land in key Asia Pacific markets, such as Singapore and Sydney, continued to climb, with some reports indicating increases of 5-10% year-over-year for strategically positioned sites, directly impacting development budgets.

Furthermore, the specialized nature of constructing facilities for logistics and data centers, demanding advanced technological integration and specific engineering skills, narrows the field of capable contractors. This limited pool of qualified construction firms in 2024 allowed them to command higher prices and favorable contract terms, thereby enhancing their leverage in negotiations.

Suppliers of advanced technology and specialized equipment for data centers, like cooling systems and power infrastructure, wield significant influence. These are often niche markets with few providers, and the essential nature of their products for dependable operations limits ESR's alternatives. For instance, specialized server rack manufacturers might only have a handful of global competitors, allowing them to dictate terms.

Financial capital providers, such as banks and institutional investors, hold considerable sway over ESR. The real estate industry's capital-intensive nature means that securing favorable financing is paramount for growth and operations. For instance, in 2024, the average interest rate for commercial real estate loans in many developed markets hovered around 6-8%, directly influencing ESR's cost of capital.

Labor and Specialized Talent

The availability of skilled labor in sectors like construction, property management, and especially specialized data center operations significantly influences supplier power. A scarcity of qualified professionals, particularly in booming markets, can drive up wages and increase recruitment expenses. For instance, the demand for data center engineers and experienced real estate investment managers has been on the rise, impacting labor costs.

The bargaining power of suppliers in the context of labor and specialized talent can be illustrated by several key factors:

- Talent Shortages: In 2024, the technology sector, including data center operations, continued to face a shortage of specialized engineers, with some reports indicating a deficit of over 1 million cybersecurity professionals globally, a skill set often overlapping with data center security and management.

- Wage Inflation: As demand for these specialized skills outpaces supply, companies often resort to offering higher salaries and more attractive benefits packages to attract and retain talent, thereby increasing operational costs.

- Geographic Concentration: The concentration of specialized talent in specific geographic hubs can further empower suppliers in those regions, as companies compete for a limited pool of qualified individuals.

- Unionization: In certain construction and operational roles, the presence of strong labor unions can also amplify the bargaining power of workers, leading to negotiated wage increases and improved working conditions.

Regulatory and Permitting Bodies

Government agencies and regulatory bodies, while not typical suppliers, wield significant power over industries requiring permits and approvals. Their ability to grant or deny access to land use and development can dramatically influence project timelines and overall costs. For instance, in 2024, navigating the complex permitting processes in Southeast Asian countries like Vietnam and Indonesia often added 15-20% to development budgets due to extended review periods and compliance requirements.

The stringent requirements imposed by these bodies can act as a substantial barrier, directly impacting a company's ability to operate or expand. Delays in obtaining essential permits, such as environmental impact assessments or construction licenses, can lead to escalating expenses and missed market opportunities. In 2023, a major infrastructure project in India faced a six-month delay due to unforeseen regulatory hurdles, resulting in an estimated cost overrun of INR 500 crore (approximately $60 million USD).

Successfully managing these relationships requires specialized expertise, particularly in diverse markets like the Asia Pacific region. Companies often invest heavily in legal and compliance teams to navigate these intricate landscapes. The bargaining power of these regulatory entities is evident when they enforce new environmental standards or safety regulations, forcing companies to incur significant capital expenditures to comply, thereby increasing operational costs.

- Regulatory Delays: In 2024, the average time to secure building permits in major Australian cities increased by 10% compared to 2023, impacting construction timelines.

- Compliance Costs: Companies in the renewable energy sector in Europe faced an average 5% increase in project costs in 2023 due to new EU environmental compliance mandates.

- Market Access Bottlenecks: The stringent import licensing procedures in certain South American markets can add up to 30 days to product launch schedules, affecting market penetration strategies.

Suppliers can significantly impact a company's profitability and operational efficiency through their pricing power and the availability of essential goods or services. In 2024, the real estate sector, particularly for specialized developments like data centers, saw suppliers of critical materials and components exert considerable influence due to supply chain disruptions and high demand.

The bargaining power of suppliers is amplified when there are few alternatives, the supplied product is crucial, and switching costs are high. This was evident in 2024 with specialized construction materials and advanced technology components for logistics and data center facilities, where a limited number of providers could dictate terms and pricing. For instance, the cost of high-performance cooling systems for data centers saw an average increase of 8-12% in 2024 due to specialized manufacturing processes and global demand.

Financial institutions, as suppliers of capital, also wield significant power. In 2024, rising interest rates in many developed economies, averaging 5-7% for commercial real estate loans, directly impacted companies' cost of capital and expansion plans, demonstrating their leverage.

| Supplier Type | 2024 Impact Factor | Example Data/Trend |

|---|---|---|

| Landowners/Developers | High (Prime Locations) | 5-10% increase in prime industrial land costs in APAC markets. |

| Specialized Contractors | High (Niche Skills) | Commanded higher prices for data center construction due to limited qualified firms. |

| Technology Component Providers | High (Essential & Niche) | 8-12% price increase for high-performance data center cooling systems. |

| Financial Institutions | Moderate to High (Capital Access) | Commercial real estate loan rates averaged 5-7% in developed markets. |

What is included in the product

Analyzes the five competitive forces—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and industry rivalry—to understand ESR's industry structure and profitability potential.

Pinpoint and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling targeted strategic adjustments.

Customers Bargaining Power

E-commerce and logistics giants, ESR's core clientele, wield considerable influence. Their sheer size and substantial space needs allow them to negotiate favorable terms, often requesting tailored property designs and cutting-edge infrastructure for their operations.

These large tenants frequently commit to extended lease agreements, further solidifying their bargaining position. For instance, in 2024, major logistics players continued to expand their footprint across Asia Pacific, seeking prime locations that can support efficient last-mile delivery networks.

However, the robust demand for contemporary logistics facilities and data centers throughout the Asia Pacific region, especially for high-quality, well-located assets, acts as a counterbalancing force. This strong market appetite for ESR's properties helps to temper the bargaining power of even the largest tenants.

Technology companies, particularly hyperscale cloud providers and major enterprises, represent a powerful customer segment for data center operators. These clients possess highly specific and often customized infrastructure demands, stemming from their complex IT operations and the mission-critical nature of their services. Their substantial space requirements and stringent uptime needs translate directly into significant bargaining power during lease negotiations.

The sheer scale of these technology tenants allows them to negotiate favorable terms, often driving down pricing for data center space and associated services. For instance, in 2024, a single large enterprise or cloud provider could occupy hundreds of thousands of square feet, representing a substantial portion of a data center's capacity. This concentration of demand from a few key players empowers them to secure competitive pricing and robust service level agreements, as data center providers vie for their business.

Institutional investors, like pension funds and endowments, hold substantial sway over fund managers such as ESR. These investors can shift vast sums of capital, seeking the best performance and lowest fees across a global landscape of fund management options. In 2024, the average management fee charged by private equity funds, a segment relevant to real asset portfolios, hovered around 1.5%, presenting a benchmark for competitive pressure.

Diversified Tenant Base

ESR's diversified tenant base significantly mitigates customer bargaining power. With tenants spread across various industries and geographic locations, the company avoids over-reliance on any single customer segment. This broadens the revenue base, making it harder for any one tenant to exert substantial influence.

For instance, as of the first half of 2024, ESR reported a strong occupancy rate of 97.2% across its logistics portfolio, with its top 10 tenants representing only 21.7% of its total rental income. This wide distribution of clients, from e-commerce giants to manufacturing firms, means that the loss or negotiation leverage of one tenant has a limited impact on the overall business.

- Diversification Reduces Dependence: ESR's strategy of leasing to a wide array of businesses, including those in fast-moving consumer goods, retail, and technology sectors, prevents any single industry from dictating terms.

- Geographic Spread Limits Leverage: Operating across Asia Pacific, Europe, and the United States means that local market conditions or tenant issues in one region are less likely to affect the entire group.

- Stable Revenue Generation: The broad tenant mix contributes to a more predictable and stable revenue stream, enhancing ESR's financial resilience and reducing the bargaining power of individual customers.

Switching Costs for Tenants

For existing tenants, the cost and disruption associated with relocating a logistics operation or migrating a data center can be significant. This inherent switching cost can diminish their immediate bargaining power once a lease agreement is in place with ESR.

However, when considering new leases or lease renewals, tenants will diligently compare ESR's offerings against competitors. Key evaluation factors include price, strategic location, and the quality of services provided.

- High Relocation Costs: Moving a complex logistics setup or a data center involves substantial expenses and operational downtime, acting as a deterrent for tenants to switch providers.

- Tenant Comparison: For new agreements, tenants actively benchmark ESR's rental rates, facility locations, and service packages against those of rival real estate providers.

- Market Dynamics: In 2024, the industrial and logistics real estate market saw continued demand, but also increasing scrutiny on lease terms by large corporate tenants seeking cost efficiencies.

Customers, particularly large e-commerce and technology firms, possess significant bargaining power due to their substantial space requirements and the critical nature of ESR's facilities. These clients can negotiate favorable terms, including pricing and customization, especially when dealing with hyperscale data center needs or extensive logistics footprints.

The concentration of demand from a few major players, such as cloud providers occupying hundreds of thousands of square feet in 2024, allows them to secure competitive pricing and robust service level agreements. This power is further amplified by the high switching costs associated with relocating complex operations.

However, ESR's diversified tenant base, with a 97.2% logistics portfolio occupancy in H1 2024 and top 10 tenants representing only 21.7% of rental income, effectively dilutes individual customer leverage. This broad client spread across industries and geographies enhances ESR's resilience against concentrated bargaining power.

| Customer Segment | Bargaining Power Factors | ESR Mitigation Strategy |

|---|---|---|

| E-commerce & Logistics Giants | Large space needs, extended leases, demand for tailored designs | Diversified tenant base, high market demand for quality assets |

| Technology Companies (Hyperscalers) | Specific infrastructure demands, mission-critical needs, large footprint | Tenant diversification, high switching costs for existing tenants |

| Institutional Investors | Ability to shift capital, focus on fees and performance | Strong property performance, broad investor appeal |

What You See Is What You Get

ESR Porter's Five Forces Analysis

This preview showcases the complete ESR Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the electronics retail sector. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, providing actionable insights into industry rivalry, buyer bargaining power, supplier power, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for your immediate use, ensuring no surprises and full value.

Rivalry Among Competitors

The Asia Pacific real estate market, especially for logistics and data centers, features a blend of global giants, regional experts, and local builders. This fragmentation, while present in certain niches, is giving way to consolidation, with major entities like ESR actively acquiring and merging. This dynamic intensifies the battle for top-tier properties, desirable tenants, and investment from institutions.

The burgeoning e-commerce and digital transformation trends across Asia Pacific are a significant driver for logistics and data center real estate. This expansion, while potentially easing rivalry by growing the market, simultaneously attracts substantial new capital and development activity. For instance, the Asia Pacific data center market was projected to reach $116.4 billion by 2027, indicating a massive influx of investment.

This heightened interest intensifies the competition for prime land and construction resources, making the speed of development a crucial factor in securing market share. Companies that can quickly acquire sites and erect facilities are better positioned to capitalize on the rapidly escalating demand, thereby outmaneuvering slower competitors in this dynamic new economy sector.

The real estate sector, particularly for large-scale logistics and industrial properties like those ESR focuses on, demands substantial capital. Acquiring land and funding construction projects often run into hundreds of millions, creating a significant barrier for new entrants. This capital intensity means that competition is fierce among established players like ESR, who are constantly vying for prime investment opportunities and strategic alliances to secure the necessary funding for expansion. For instance, in 2024, major real estate investment trusts (REITs) continued to raise significant capital through debt and equity markets to fuel their development pipelines, underscoring the importance of financial muscle.

Differentiation and Value-Added Services

Competitive rivalry in the ESR sector goes far beyond mere price competition or geographic advantage. It increasingly hinges on the ability to offer integrated solutions and a suite of value-added services that cater to sophisticated tenant and investor needs. ESR's strategic advantage lies in its comprehensive, full-service model, which seamlessly combines property development, management, investment management, and fund management capabilities. This holistic approach allows ESR to capture greater value across the entire real estate lifecycle.

To effectively compete, other players must demonstrate a comparable or superior level of service integration and value creation. This means not only providing physical space but also offering financial expertise, asset management, and tailored solutions that attract and retain high-value tenants and institutional investors. For instance, in 2024, the demand for integrated logistics solutions, which include not just warehousing but also last-mile delivery coordination and technology integration, has significantly increased, rewarding providers who can offer these bundled services.

- Integrated Solutions: ESR's competitive edge is built on offering a complete package from development to fund management, a model increasingly sought after by sophisticated clients.

- Value-Added Services: Beyond basic property provision, services like investment management and fund management are crucial differentiators in attracting and retaining high-value tenants and investors.

- Tenant & Investor Retention: Competitors must match or surpass ESR's integrated offerings to secure and keep lucrative tenant and investor relationships in the current market.

- Market Trends: In 2024, the demand for bundled services like end-to-end logistics solutions, incorporating technology and last-mile capabilities, highlights the growing importance of integrated offerings for market competitiveness.

Geographic and Sectoral Focus

Competitive rivalry intensifies significantly in prime geographic locations and within high-growth sectors, such as the burgeoning data center market. ESR, by concentrating its efforts on these sought-after areas and leveraging its specialized knowledge, faces direct competition from other major real estate investment trusts (REITs) and developers targeting similar niches. This intense competition often drives strategic moves like acquisitions and alliances aimed at bolstering market position and operational capabilities.

The logistics and industrial real estate sector, where ESR primarily operates, saw significant investment activity in 2024. For instance, the global industrial and logistics real estate market was valued at approximately $7.6 trillion in 2023 and is projected to grow, indicating a highly contested landscape. Companies are actively pursuing expansion and consolidation to capture market share.

- Intense Competition in Prime Markets: Rivalry is particularly acute in desirable urban centers and key logistics corridors, where demand for modern warehousing and distribution facilities consistently outstrips supply.

- Sector-Specific Battles: The data center sector, a key growth area, is experiencing fierce competition as technology companies and REITs vie for prime locations and build out hyperscale facilities.

- Strategic Maneuvers: Companies like ESR engage in mergers, acquisitions, and joint ventures to expand their geographic reach, enhance their property portfolios, and gain a competitive edge in these dynamic markets.

Competitive rivalry in the logistics and data center real estate sectors is fierce, driven by high demand and significant capital inflows. ESR faces intense competition from global players and regional specialists vying for prime assets and development opportunities.

The market is characterized by a race for scale and integrated solutions, with companies like ESR differentiating themselves through comprehensive service offerings. This includes property development, investment management, and tailored solutions to attract and retain institutional investors and high-value tenants.

In 2024, the Asia Pacific data center market continued its rapid expansion, with significant investment pouring into new developments. This growth fuels competition for land, talent, and market share among established REITs and new entrants alike.

| Competitor Type | Key Focus Areas | Competitive Tactics |

|---|---|---|

| Global REITs | Large-scale logistics, prime urban locations | Acquisitions, portfolio expansion, capital raising |

| Regional Developers | Niche logistics, specific country markets | Local expertise, speed to market, strategic partnerships |

| Data Center Specialists | Hyperscale facilities, advanced technology infrastructure | Site acquisition, build-to-suit development, service integration |

SSubstitutes Threaten

Large e-commerce players and tech titans may choose to build their own logistics hubs or data centers, bypassing third-party providers like ESR. This move is often driven by a desire for greater control over mission-critical operations or to meet highly specialized needs. For instance, Amazon's extensive investment in its own fulfillment network showcases this trend, aiming to optimize delivery speeds and costs.

However, the significant capital outlay required for such in-house development, coupled with the inherent operational complexities and challenges in acquiring suitable land, often makes outsourcing a more financially prudent and strategically sound option for many companies. The sheer scale of investment needed for a new data center, potentially running into hundreds of millions of dollars, reinforces the attractiveness of leveraging existing infrastructure providers.

The threat of substitutes in logistics fulfillment is growing as retailers increasingly leverage existing store networks. For instance, many major retailers in 2024 are experimenting with or have fully implemented in-store pickup and local delivery services, effectively turning stores into mini-distribution hubs. This trend directly competes with the need for large, dedicated warehouses.

Furthermore, the rise of multi-story urban logistics facilities presents another substitute. These facilities, often located closer to end consumers, can offer faster delivery times and reduce reliance on traditional, sprawling warehouse complexes. While ESR is investing in urban logistics, the overall shift in retail strategies could alter the demand for their large-scale properties.

Public cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer compelling alternatives for data storage, potentially substituting demand for traditional co-location or dedicated data center space. As of early 2024, the global public cloud market is projected to reach over $600 billion, indicating significant customer migration.

Businesses can leverage these cloud platforms to store vast amounts of data without investing in and managing their own physical infrastructure. This shift can be particularly attractive for companies seeking scalability and cost-efficiency for their data storage needs.

However, the threat is somewhat mitigated by the continued growth of hybrid cloud models, where data centers and public clouds coexist. Furthermore, stringent data sovereignty regulations and the need for low-latency access for certain applications still necessitate on-premises or co-located data center solutions, limiting the complete substitution effect.

Repurposing Existing Structures

The threat of substitutes for ESR's modern logistics and industrial facilities can emerge from the repurposing of older, existing structures. For instance, vacant office buildings or underutilized retail spaces might be converted into logistics hubs or light industrial facilities. This repurposing offers a less capital-intensive alternative to developing new, purpose-built facilities, potentially attracting businesses seeking lower operational costs.

While these repurposed sites may not match the efficiency or technological capabilities of ESR's state-of-the-art properties, they can still serve as a viable substitute in specific market segments. For example, in regions with high land costs or limited availability of new development sites, such conversions could gain traction. This is particularly relevant as businesses increasingly seek flexible and cost-effective warehousing and distribution solutions.

ESR's strategic emphasis on developing and managing modern, Grade A facilities directly addresses and mitigates this threat. These advanced properties typically offer superior infrastructure, automation capabilities, and energy efficiency, providing a compelling value proposition that often outweighs the cost savings of repurposed buildings. For instance, ESR's commitment to sustainable development, as seen in its green building certifications, further differentiates its offerings.

- Repurposing of older industrial and commercial properties into logistics or light industrial spaces presents a substitute threat.

- This alternative can offer a lower-cost entry point for businesses compared to new, purpose-built facilities.

- ESR's focus on modern, Grade A facilities with advanced features and sustainability credentials helps to counter this threat by providing superior operational advantages.

Technological Advancements in Space Utilization

Innovations in warehousing technology, like advanced automation and robotics, are allowing businesses to store more goods in less physical space. For instance, automated storage and retrieval systems (AS/RS) can increase storage density by up to 80% compared to traditional methods.

Similarly, data center technology is achieving higher compute density, meaning less physical footprint is needed for the same processing power. This trend is crucial as global data center traffic is projected to grow significantly, with estimates suggesting it could reach over 295 exabytes per month by 2026.

- Increased Storage Density: Warehousing automation can boost storage capacity by up to 80%.

- Reduced Physical Footprint: Data center advancements allow for more computing power in smaller spaces.

- Slower Demand Growth: These technological efficiencies can temper the demand for new physical commercial space.

The threat of substitutes for ESR's modern logistics and industrial facilities can emerge from the repurposing of older, existing structures. For instance, vacant office buildings or underutilized retail spaces might be converted into logistics hubs or light industrial facilities, offering a less capital-intensive alternative to developing new, purpose-built facilities. While these repurposed sites may not match the efficiency of ESR's state-of-the-art properties, they can still serve as a viable substitute in specific market segments, particularly where land costs are high.

Innovations in warehousing technology, like advanced automation and robotics, are allowing businesses to store more goods in less physical space. For example, automated storage and retrieval systems (AS/RS) can increase storage density by up to 80% compared to traditional methods. Similarly, data center technology is achieving higher compute density, meaning less physical footprint is needed for the same processing power, a trend crucial as global data center traffic is projected to grow significantly.

| Substitute Type | Description | Impact on ESR | Example/Data Point (2024) |

|---|---|---|---|

| Repurposed Properties | Converting older buildings (offices, retail) into logistics/industrial use. | Offers lower-cost alternatives, potentially reducing demand for new builds. | High land costs in urban areas make conversion attractive for some businesses. |

| Warehousing Automation | Technologies increasing storage density (e.g., AS/RS). | Reduces the need for extensive physical warehouse space. | AS/RS can increase storage density by up to 80%. |

| Data Center Density | Achieving more computing power in smaller physical footprints. | Lowers demand for traditional co-location or dedicated data center space. | Global data center traffic projected to reach over 295 exabytes/month by 2026. |

Entrants Threaten

Entering the New Economy real estate sector, particularly for large-scale logistics and data center projects, demands substantial upfront capital. This includes significant outlays for land acquisition, sophisticated construction, and essential infrastructure development. For instance, in 2024, the cost of developing a modern logistics warehouse can easily run into tens of millions of dollars, while a hyperscale data center can require hundreds of millions.

These substantial capital requirements act as a formidable barrier to entry, naturally restricting the pool of potential new competitors. Success in this arena is heavily reliant on established access to extensive funding networks and strong relationships with institutional investors, making it difficult for smaller or less capitalized entities to compete.

Securing prime land in Asia Pacific is a major hurdle for new entrants in the industrial and logistics real estate sector. Scarcity, coupled with high acquisition costs and intricate zoning laws, makes it exceptionally difficult to find suitable development sites. For instance, in 2024, land prices in key logistics hubs across Southeast Asia saw significant increases, with some areas experiencing double-digit percentage jumps year-on-year, further exacerbating this challenge.

Established players like ESR possess a distinct advantage due to their extensive existing land banks and robust development pipelines. These companies have cultivated deep-rooted relationships with landowners and local government authorities over many years. This allows them to secure premium locations and navigate regulatory processes more efficiently than newcomers who lack these established networks and historical presence.

Developing and operating advanced logistics and data center facilities demands highly specialized expertise. This includes intricate knowledge of supply chain efficiency, sophisticated data center architecture, robust power management, and advanced cooling technologies. For instance, building a Tier IV data center, which requires 99.995% uptime, involves complex engineering and operational planning that takes years to master.

Newcomers often struggle to replicate the deep operational know-how and technical proficiency that established players like ESR have cultivated. These established firms benefit from experienced teams and a proven track record, making it challenging for new entrants to compete effectively on operational excellence and reliability. In 2024, the average cost to build a hyperscale data center exceeded $1 billion, a significant barrier to entry for those lacking established funding and expertise.

Brand Reputation and Tenant/Investor Relationships

ESR, a dominant force in Asia Pacific's New Economy real estate, leverages its robust brand reputation and deep-seated connections with major e-commerce, logistics, and tech firms. These established relationships, coupled with a strong track record with institutional investors, create a significant hurdle for new market entrants. Building comparable trust and securing a diverse tenant and investor base requires substantial time and capital investment.

For newcomers, the challenge lies in replicating ESR's established network effect. This involves more than just offering competitive pricing; it necessitates demonstrating consistent reliability and a proven ability to attract and retain high-caliber tenants. The difficulty in forging these crucial partnerships acts as a substantial barrier to entry.

- Brand Strength: ESR's established reputation as Asia Pacific's largest New Economy real estate manager provides a significant competitive advantage.

- Relationship Capital: Existing ties with global e-commerce, logistics, and technology companies are difficult for new entrants to replicate.

- Investor Trust: Securing capital from institutional investors requires a proven track record, a barrier for new players.

- Network Effect: The interconnectedness of ESR's tenant and investor base creates a powerful, self-reinforcing advantage.

Regulatory and Permitting Hurdles

Navigating the diverse and often complex regulatory environments and obtaining necessary permits across multiple Asia Pacific jurisdictions presents a significant challenge for new entrants in the logistics sector. For instance, in 2024, the average time to obtain a business license in Vietnam could range from 15 to 30 days, while in Indonesia, it might extend to 45 days or more, depending on the specific permits required for warehousing and transportation.

Each country, and sometimes even each city, has unique building codes, environmental regulations, and land use policies that new logistics companies must meticulously adhere to. Failure to comply can lead to costly delays or outright rejection of operations. Established players, with their deep understanding and existing relationships, can often streamline these processes more effectively, giving them a distinct advantage.

The cost associated with compliance also acts as a barrier. For example, environmental impact assessments and adherence to specific emission standards for a fleet of trucks can add substantial upfront capital requirements. In 2024, the estimated cost for such assessments in major Southeast Asian ports could range from $5,000 to $20,000 per project.

- Regulatory Complexity: Asia Pacific presents a patchwork of differing regulations for logistics operations.

- Permitting Delays: Obtaining necessary permits can be time-consuming, with average business license processing times varying significantly by country.

- Compliance Costs: Adhering to building codes, environmental standards, and land use policies incurs substantial upfront expenses.

- Established Player Advantage: Incumbents leverage experience and resources to navigate these hurdles more efficiently.

The threat of new entrants in the New Economy real estate sector, particularly for large-scale logistics and data centers, is significantly mitigated by the immense capital required for development. These high upfront costs, encompassing land, construction, and infrastructure, can easily run into tens of millions for warehouses and hundreds of millions for data centers in 2024, effectively deterring many potential competitors.

Furthermore, established players like ESR benefit from deep-rooted relationships and extensive land banks, which are crucial for securing prime locations and navigating complex regulatory landscapes. This existing infrastructure and network provide a substantial competitive moat, making it exceedingly difficult for newcomers to gain a foothold and compete effectively.

The specialized expertise needed for developing and operating advanced facilities, from supply chain logistics to data center architecture, also presents a considerable barrier. New entrants often lack the years of experience and technical know-how that established firms possess, a gap that is difficult and costly to bridge quickly.

Finally, ESR's strong brand reputation and established network of tenants and investors create a powerful network effect. Building comparable trust and securing a diverse tenant and investor base requires substantial time and capital, further limiting the appeal and viability of new market entrants.

| Barrier to Entry | Description | 2024 Impact/Example |

| Capital Requirements | Substantial upfront investment for land, construction, and infrastructure. | Logistics warehouse: tens of millions; Hyperscale data center: hundreds of millions. |

| Land Acquisition | Scarcity and high costs in prime Asia Pacific locations. | Double-digit percentage increases in key Southeast Asian logistics hubs. |

| Expertise & Know-How | Specialized knowledge in logistics, data center design, and operations. | Building a Tier IV data center requires complex engineering and operational planning. |

| Brand & Relationships | Established reputation and strong ties with e-commerce, logistics, and tech firms. | Difficult for new entrants to replicate ESR's tenant and investor network. |

| Regulatory Navigation | Complexity and time involved in obtaining permits across diverse jurisdictions. | Permit processing can take 15-45+ days depending on the country. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, financial statements from key players, and regulatory filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.