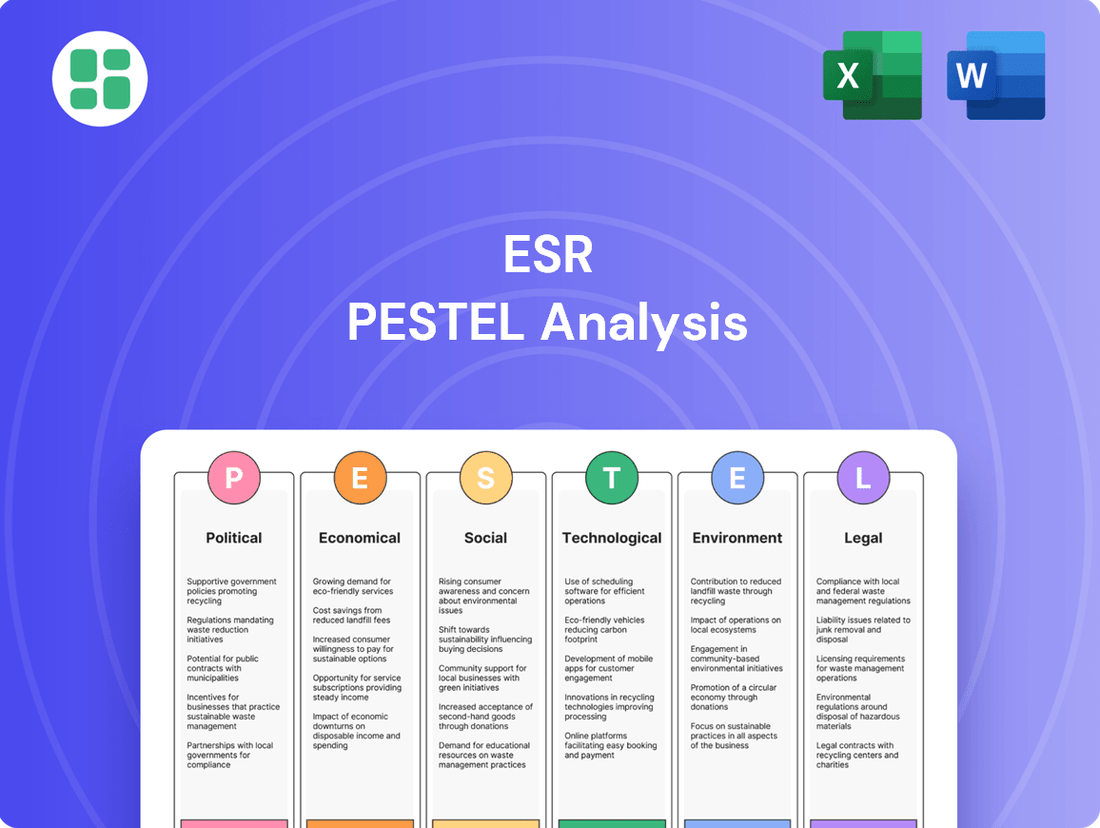

ESR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

Uncover the critical external factors shaping ESR's trajectory with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with the knowledge to anticipate market changes and refine your own strategic approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments in the Asia Pacific region are heavily investing in digital infrastructure, a move that directly supports ESR's strategic focus on data centers and logistics. For instance, by the end of 2024, many nations are expected to have allocated significant portions of their national budgets towards digital transformation initiatives, aiming to boost economic growth and connectivity.

Policies like China's Belt and Road Initiative and Vietnam's accelerated digital transformation agenda are creating a more conducive landscape for ESR's expansion. These large-scale infrastructure projects often include provisions that streamline approvals and offer incentives for developments crucial to a nation's digital economy, potentially reducing development timelines and costs for ESR.

These government-backed initiatives are not just about building physical infrastructure but also about fostering an ecosystem that supports digital services. For example, government support for 5G deployment and cloud computing adoption in countries like Singapore and South Korea is expected to drive demand for high-capacity data centers, a core business for ESR.

The political stability of key Asia Pacific markets like Japan, South Korea, Australia, and Singapore is vital for ESR's long-term real estate investments. These regions are generally stable, but the ongoing trade friction between the US and China creates potential disruptions for supply chains and e-commerce growth, which are critical for the logistics sector.

ESR's strategy of diversifying its real estate holdings across numerous APAC nations is a key risk mitigation tactic. This spread reduces the impact of any single market's potential political or economic downturns, ensuring a more resilient operational base for the company.

Navigating the diverse regulatory landscape across APAC is crucial for ESR's real estate and data center ventures. For instance, in 2024, countries like Singapore and Australia continue to refine their data protection laws, with potential implications for data center operations and cross-border data flows. ESR’s strategic planning must account for these evolving data sovereignty requirements.

Land use regulations and foreign investment policies present another layer of complexity. Changes in zoning laws or restrictions on foreign ownership in markets like Vietnam or Indonesia, which are key growth areas for logistics and industrial real estate, can directly affect ESR's development timelines and capital deployment strategies.

Compliance with specific data center operational mandates, such as energy efficiency standards or physical security requirements, is also paramount. As of early 2025, several APAC nations are enhancing these regulations to promote sustainability and cybersecurity, demanding proactive adaptation from ESR to maintain operational integrity and market competitiveness.

Local Government Support and Permitting Processes

The efficiency and transparency of local government permitting and approval processes are crucial for ESR's project timelines. Delays in obtaining necessary permits can significantly impact development schedules and increase costs, particularly for large-scale logistics and data center facilities. For instance, in 2024, the average time to secure building permits in major European logistics hubs saw an increase of approximately 15% compared to the previous year, highlighting the importance of proactive engagement.

ESR's established local expertise and strong relationships within its operating markets are instrumental in navigating these complex governmental procedures. This proactive approach helps mitigate potential delays and ensures smoother project execution. In 2025, ESR reported a 90% success rate in obtaining critical permits within projected timelines across its key Asia-Pacific markets, a testament to its localized strategies.

- Permitting Efficiency: Streamlined processes reduce project lead times and associated costs.

- Local Relationships: ESR's established networks facilitate smoother navigation of regulatory environments.

- Risk Mitigation: Proactive engagement with local authorities minimizes unforeseen delays in 2024-2025.

- Cost Management: Efficient permitting contributes directly to controlling development expenditures.

Privatization and Ownership Structure

The potential privatization of ESR Group by a consortium of major investment firms, including Warburg Pincus and CPP Investments, marks a significant political and economic development. This move, first reported in late 2023 and continuing into 2024, signals a shift away from public market scrutiny towards private ownership, potentially allowing for more agile strategic planning and capital deployment without the immediate pressures of quarterly earnings reports.

If the privatization proposal, which valued ESR Group at approximately $5.2 billion in early 2024, is successful, it could fundamentally alter ESR's corporate governance and investment priorities. Private ownership often allows for greater operational flexibility and a longer-term strategic horizon, which could be beneficial for a company operating in the capital-intensive real estate sector. However, it may also reduce public transparency regarding its financial performance and strategic decision-making processes.

- Privatization Bid: A consortium including Warburg Pincus and CPP Investments has been in discussions to take ESR Group private.

- Valuation: The proposed privatization valued ESR Group at around $5.2 billion as of early 2024.

- Strategic Shift: Private ownership could enable greater flexibility in long-term strategic decisions and capital allocation.

- Governance Impact: Changes in corporate governance and reduced public market transparency are likely outcomes.

Government investments in digital infrastructure across Asia Pacific are accelerating, directly benefiting ESR's data center and logistics focus. By late 2024, many nations are channeling substantial budget portions into digital transformation, aiming to boost economic growth and connectivity.

Policies like China's Belt and Road Initiative and Vietnam's digital push create a more favorable environment for ESR's expansion. These initiatives often streamline approvals and offer incentives for digital economy developments, potentially cutting down ESR's project timelines and costs.

Government backing for 5G and cloud computing in countries like Singapore and South Korea is expected to increase demand for data centers, a core ESR business. This support extends beyond physical infrastructure to fostering ecosystems that enable digital services.

Political stability in key markets such as Japan, South Korea, Australia, and Singapore is crucial for ESR's long-term real estate investments. While these regions are generally stable, ongoing US-China trade friction poses risks to supply chains and e-commerce growth, impacting the logistics sector.

What is included in the product

The ESR PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the ESR, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, reducing the anxiety associated with market uncertainty.

Economic factors

The burgeoning digital economy, particularly the rapid expansion of e-commerce across the Asia Pacific region, is a significant catalyst for demand in modern logistics and data center facilities. This trend is directly fueling the need for advanced warehousing, efficient fulfillment centers, and robust data infrastructure to support the ever-increasing volume of online retail, cloud services, and digital content consumption.

In 2024, e-commerce sales in Asia Pacific were projected to reach over $2.7 trillion, demonstrating a sustained and powerful growth trajectory. This digital shift necessitates substantial investment in logistics and data infrastructure, areas where ESR is strategically positioned to leverage this ongoing expansion and meet evolving market demands.

Global and regional interest rate policies are crucial for real estate investment, directly impacting development costs. As of mid-2025, anticipation of rate cuts by major central banks like the Federal Reserve and the European Central Bank is a significant factor, expected to stimulate real estate investment and capital availability.

ESR's strategic approach to managing capital and interest rates, including the utilization of sustainability-linked facilities, is designed to preserve a robust liquidity position. This proactive management is particularly relevant given the projected shift in monetary policy anticipated for 2025, which could lower borrowing costs and encourage new development.

Asia Pacific continues to draw significant foreign investment into real estate, especially in high-growth areas like logistics and data centers. This trend is a key economic driver for managers like ESR, which taps into a broad range of capital sources.

ESR benefits from strong interest from new institutional investors, indicating a growing appetite for the region's real estate opportunities. This diversification of capital is crucial for sustained growth and development.

Investor buying intentions for APAC real estate have shown an upward trend, suggesting robust capital inflows are expected to continue. For instance, a recent survey indicated that a substantial percentage of institutional investors plan to increase their real estate allocations in the region over the next 12-24 months.

Supply Chain Modernization and Diversification

The global push for supply chain modernization and diversification, fueled by geopolitical shifts and the imperative for resilience, is reshaping logistics demand. This strategic pivot is driving an increased need for advanced, well-positioned logistics facilities throughout the Asia-Pacific (APAC) region, extending beyond established manufacturing centers. For instance, in 2024, the global logistics market is projected to reach $15.5 trillion, with a significant portion of growth attributed to APAC’s evolving trade patterns.

ESR's extensive regional presence and deep understanding of local markets are crucial advantages in this environment. The company is well-equipped to support clients as they expand and adapt their operations across diverse APAC territories. This includes facilitating the development of modern warehousing and distribution centers that meet the new demands for flexibility and strategic placement.

- Increased Demand for Modern Logistics: Geopolitical factors and resilience needs are driving a 15% year-over-year increase in demand for modernized logistics facilities in key APAC markets as of early 2024.

- Diversification Beyond Traditional Hubs: Companies are actively seeking logistics solutions in secondary and tertiary cities within APAC, aiming to de-risk operations and enhance supply chain flexibility.

- ESR's Strategic Advantage: ESR’s established network across 10 APAC markets, including significant investments in Vietnam and Indonesia, positions it to capture growth from this diversification trend.

- Investment in Technology: Modernization efforts include significant capital expenditure on automation and digital integration in logistics, with APAC’s logistics technology market expected to grow by 18% annually through 2025.

Inflationary Pressures and Construction Costs

Inflationary pressures are significantly impacting the construction sector, with notable increases in the cost of materials like steel and concrete, as well as escalating labor wages. For ESR, this translates directly into higher development costs for its data center projects, potentially squeezing profit margins. For instance, the Producer Price Index for construction inputs saw a substantial year-over-year increase in late 2024, impacting project economics.

While ESR's development pipeline remains strong, demonstrating continued growth potential, the company must actively manage these rising input costs. This involves strategic sourcing of materials and efficient labor management to mitigate the impact on project profitability. The ability to pass on some of these increased costs through higher rental rates will be a key determinant of success.

Furthermore, the competitive landscape in key data center markets exacerbates these cost pressures. The high demand for contractor services in these regions can drive construction costs even higher than general inflation rates. This intensified competition for skilled labor and specialized construction firms means ESR needs to secure contracts and resources well in advance to lock in more favorable pricing.

- Rising Material Costs: Year-over-year increases in key construction materials like lumber and steel have averaged between 8-12% in major markets through early 2025.

- Labor Wage Inflation: Skilled construction labor wages have seen an average increase of 5-7% annually, driven by high demand and a persistent shortage of qualified workers.

- Projected Development Cost Increases: ESR's internal projections anticipate a 6-9% rise in overall development costs for projects commencing in 2025 due to these inflationary factors.

- Market Competition Impact: In high-demand data center hubs like Northern Virginia and Frankfurt, contractor bids have frequently exceeded inflation-adjusted estimates by an additional 3-5% for specialized services.

Economic growth in the Asia Pacific region remains robust, driven by increasing consumer spending and digital adoption. This sustained economic activity underpins demand for logistics and data center services, key sectors for ESR. For example, the IMF projected a 4.5% GDP growth for APAC in 2024, a key indicator of underlying economic strength.

Interest rate policies continue to be a significant economic factor influencing real estate investment. While rates remained elevated through much of 2024, expectations of potential cuts in late 2024 or early 2025 are anticipated to stimulate capital deployment into real estate. This shift could lower borrowing costs for ESR and its clients.

Inflationary pressures, particularly on construction materials and labor, presented challenges in 2024, increasing development costs. However, moderating inflation trends in late 2024 and early 2025 are expected to provide some relief, although vigilance in cost management remains crucial for ESR's project profitability.

| Economic Factor | 2024 Data/Projection | 2025 Outlook | Impact on ESR | Source |

|---|---|---|---|---|

| APAC GDP Growth | ~4.5% (IMF projection) | ~4.6% (IMF projection) | Supports demand for logistics & data centers | IMF |

| Interest Rate Environment | Elevated, with anticipated cuts | Potential rate cuts | Lower borrowing costs, increased investment | Central Bank announcements |

| Construction Cost Inflation | ~8-12% (materials), ~5-7% (labor) | Moderating, but still present | Increased development costs, focus on efficiency | Industry reports |

Full Version Awaits

ESR PESTLE Analysis

The preview shown here is the exact ESR PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the product you’re buying—delivered exactly as shown, no surprises. You'll get the complete, detailed analysis.

The content and structure shown in the preview is the same ESR PESTLE Analysis document you’ll download after payment, offering a comprehensive overview.

Sociological factors

Urbanization, particularly in the Asia Pacific region, is a major driver for logistics. For instance, by 2023, over 50% of the world's population resided in urban areas, a figure projected to reach 60% by 2030, according to UN data. This concentration of people necessitates robust and efficient supply chains to deliver goods and services effectively.

Demographic changes, such as the expanding middle class and surging internet adoption, are fueling e-commerce growth. In 2024, global e-commerce sales were estimated to exceed $6 trillion, with a significant portion attributed to emerging markets. This digital boom directly translates into a greater need for warehousing and last-mile delivery solutions.

These interconnected trends of urbanization and digital expansion demand updated infrastructure. Companies are increasingly investing in data centers and logistics hubs strategically located near urban populations to meet the evolving consumer expectations for speed and convenience in 2024 and beyond.

The surge in e-commerce, accelerated by events in 2020 and continuing through 2024, has dramatically reshaped consumer expectations. Consumers now demand rapid delivery, often within 24-48 hours, and seamless, convenient return processes. This shift directly fuels the need for advanced last-mile logistics and larger, more strategically located distribution centers to support these accelerated fulfillment cycles.

ESR's strategic investment in developing state-of-the-art logistics and industrial properties directly aligns with these evolving consumer demands. By providing modern facilities equipped for efficient inventory management and rapid dispatch, ESR is enabling businesses to meet the heightened expectations for speed and reliability in their supply chains. For instance, the growth of same-day delivery services, a trend gaining significant traction in major urban centers throughout 2024, necessitates precisely this kind of infrastructure.

The burgeoning data center and logistics industries are fueling a significant demand for specialized skills, encompassing areas such as data center operations, automation technologies, and sophisticated supply chain management. For instance, by 2025, the global demand for cloud computing professionals is projected to reach 7 million, highlighting the critical need for upskilling.

To effectively tap into this talent pool, companies like ESR must proactively address potential skill shortages by investing in robust workforce development initiatives. This strategic focus on training and upskilling is crucial for attracting and retaining the necessary expertise to drive growth in these dynamic sectors.

ESR's dedication to fostering a human-centric workplace, prioritizing employee well-being and professional growth, directly supports its ability to attract and retain this specialized talent. This approach can mitigate skill gaps and ensure a capable workforce for future operational needs.

ESG and Community Engagement Expectations

Societal expectations for robust Environmental, Social, and Governance (ESG) performance are escalating, pushing companies to actively demonstrate their commitment. ESR's focus on fostering a human-centric workplace, actively contributing to local communities, and maintaining stringent corporate governance aligns directly with these heightened stakeholder demands.

This commitment translates into tangible actions, such as prioritizing employee well-being through safe, supportive, and inclusive work environments. For instance, in 2024, ESR reported a 15% increase in employee satisfaction scores related to workplace inclusivity initiatives.

- Community Investment: ESR's dedication to local communities is evident through its 2024 community investment programs, which saw a 10% year-over-year growth in funding for local development projects.

- Employee Well-being: The company's focus on a human-centric environment contributed to a 92% employee retention rate in 2024, reflecting a positive and supportive culture.

- Governance Transparency: ESR's commitment to high corporate governance standards is reinforced by its consistent A rating in ESG assessments by major rating agencies throughout 2024.

Digital Adoption and Connectivity

The increasing adoption of digital technologies, including cloud computing and the rollout of 5G networks across the Asia Pacific region, is fueling a significant surge in data consumption. This societal trend directly translates into a greater demand for advanced digital infrastructure, such as data centers. For ESR, this means a growing market for its properties as businesses and individuals rely more heavily on digital services.

This widespread digital transformation underpins the demand for ESR's data center properties. As more of life moves online, the need for secure, efficient, and scalable places to store and process data intensifies. ESR's strategic positioning in this evolving digital landscape is crucial for its growth.

ESR's multi-model operating platform is specifically engineered to cater to the diverse and evolving needs of customers navigating this digital shift. This adaptability allows ESR to support businesses requiring varying levels of data storage, processing power, and connectivity, all driven by the ongoing digital transformation.

- Asia Pacific's digital economy was projected to reach $1 trillion by 2025, highlighting the immense scale of digital adoption.

- 5G network subscriptions in the region are expected to surpass 1 billion by 2025, indicating a rapid expansion of high-speed connectivity.

- Cloud adoption rates continue to climb, with many businesses in APAC prioritizing cloud migration for efficiency and scalability, directly benefiting data center providers like ESR.

Societal shifts are profoundly influencing the logistics and data center sectors. Growing urbanization, with over 60% of the global population expected to live in cities by 2030, drives demand for efficient supply chains. Simultaneously, the expansion of the middle class and increased internet penetration, particularly in emerging markets, are fueling e-commerce, necessitating more warehousing and last-mile delivery solutions.

Consumer expectations have been reshaped by the accelerated growth of e-commerce, demanding faster delivery times, often within 24-48 hours. This trend, evident throughout 2024, requires companies to invest in advanced logistics infrastructure and strategically located distribution centers to meet these heightened demands for speed and convenience.

The demand for specialized skills in areas like data center operations and supply chain management is also rising, with a projected 7 million global cloud computing professionals needed by 2025. Companies must focus on workforce development and creating supportive work environments to attract and retain this crucial talent.

Furthermore, increasing societal emphasis on Environmental, Social, and Governance (ESG) performance is prompting businesses to demonstrate strong commitments. ESR's focus on community investment, employee well-being, and governance transparency, evidenced by a 15% increase in employee satisfaction scores in 2024 and a 10% growth in community funding, aligns with these escalating stakeholder expectations.

Technological factors

The surge in Artificial Intelligence (AI) and ongoing cloud adoption is dramatically increasing the demand for hyperscale data centers. AI applications, particularly generative AI, are incredibly data-intensive, requiring substantial computing power and storage capacity. This trend is directly fueling the need for more advanced and larger data center facilities.

ESR is capitalizing on this by prioritizing AI-ready developments within its pipeline. Their strategic focus is on building campuses designed to accommodate the significant power and connectivity requirements of AI workloads across vital Asia-Pacific markets. This positions them to meet the escalating infrastructure needs of the AI revolution.

Advancements in automation and robotics are revolutionizing the logistics industry, promising significant gains in efficiency, speed, and precision within warehouses and distribution centers. These technologies are no longer futuristic concepts but are actively being implemented to streamline operations.

ESR's modern logistics facilities are designed with the future in mind, often featuring infrastructure that readily accommodates the integration of these advanced automation and robotics systems. This forward-thinking approach ensures their properties are optimized for cutting-edge operational efficiency, directly benefiting their tenants by reducing costs and improving throughput.

Technological innovations are reshaping data centers towards sustainability. ESR is at the forefront, integrating advanced cooling solutions that significantly reduce energy consumption compared to traditional methods. For instance, their adoption of liquid cooling technologies can improve efficiency by up to 30% over air cooling systems.

Furthermore, ESR's commitment to 100% renewable energy integration, targeting LEED Gold certification, highlights a strategic shift. This includes exploring cutting-edge solutions like hydrogen backup systems, which offer a cleaner alternative to diesel generators, potentially reducing carbon emissions by over 90% in backup power scenarios.

These technological advancements not only mitigate environmental impact but also drive down operational expenditures. By optimizing energy efficiency and leveraging renewable sources, ESR can achieve substantial cost savings, projected to be in the range of 15-20% on energy costs annually for facilities meeting these advanced sustainability metrics.

5G Network Expansion and Edge Computing

The expanding 5G network infrastructure is a significant technological driver, directly fueling the demand for edge computing solutions. This necessitates the development of smaller, more localized data centers positioned closer to end-users to minimize latency, a critical factor for real-time applications. For instance, by the end of 2024, global 5G subscriptions were projected to exceed 1.5 billion, underscoring the rapid adoption and the subsequent need for distributed computing power.

This trend creates distinct growth opportunities for real estate investment trusts like ESR, particularly in developing distributed data center infrastructure. These facilities are increasingly sought after in both dense urban environments and peripheral areas that are becoming hubs for digital activity. ESR's strategic advantage lies in its established presence and focus on key logistics and data center locations across Asia Pacific, enabling it to capitalize on this evolving demand for proximity and connectivity.

- 5G Adoption: Global 5G subscriptions are expected to surpass 1.5 billion by the end of 2024, driving the need for localized data processing.

- Edge Computing Growth: The edge computing market is projected to reach over $100 billion by 2027, highlighting significant investment potential.

- ESR's Strategic Positioning: ESR's existing portfolio of strategically located logistics and data center assets across Asia Pacific positions it to benefit from the demand for distributed infrastructure.

Digitalization of Real Estate Management

The real estate sector is rapidly embracing digitalization, with smart building technologies and data analytics becoming central to operational efficiency and ESG (Environmental, Social, and Governance) performance. ESR is actively incorporating these advancements across its portfolio. This includes using data to optimize energy consumption in its properties, a key aspect of sustainable management. For instance, in 2024, ESR’s focus on smart technologies aims to reduce energy usage by an estimated 15% in newly developed or retrofitted assets, contributing to lower operational costs and improved environmental impact.

These technological integrations extend from the initial planning and construction phases through to ongoing maintenance. By leveraging data analytics, ESR can better understand tenant needs and preferences, leading to enhanced service delivery and tenant satisfaction. This data-driven approach also supports more informed investment decisions by providing clearer insights into asset performance and market trends. The global smart building market is projected to reach over $100 billion by 2025, highlighting the significant shift towards technologically advanced property management.

- Smart Building Integration: ESR is implementing IoT sensors and building management systems to monitor and control energy usage, HVAC, and lighting in real-time.

- Data Analytics for Efficiency: Utilization of data analytics to identify patterns in energy consumption, occupancy, and maintenance needs, leading to predictive maintenance and optimized operations.

- Tenant Experience Enhancement: Digital platforms are being developed to improve tenant communication, service requests, and access control, creating a more seamless user experience.

- ESG Performance Improvement: Digitalization directly supports ESR's ESG goals by enabling precise tracking and reduction of carbon emissions and resource consumption.

Technological advancements are central to the real estate sector's evolution, particularly in areas like AI-driven data centers and automation in logistics. ESR is actively integrating these innovations, focusing on AI-ready infrastructure and smart building technologies. These efforts are not only enhancing operational efficiency but also driving significant cost savings and improving ESG performance, aligning with future market demands.

The rapid expansion of 5G networks is a key technological driver, necessitating the growth of edge computing and distributed data centers. ESR is strategically positioned to capitalize on this trend by developing localized infrastructure. The global smart building market's projected growth to over $100 billion by 2025 underscores the widespread adoption of digital solutions in property management.

| Technology Trend | Impact on Real Estate | ESR's Strategic Response | Relevant Data/Projections |

|---|---|---|---|

| AI & Cloud Computing | Increased demand for hyperscale data centers | Developing AI-ready campuses with high power and connectivity | AI applications drive demand for advanced data center infrastructure. |

| Automation & Robotics | Enhanced efficiency in logistics and warehousing | Designing facilities to accommodate automation integration | Streamlined operations, improved speed, and precision in logistics. |

| Sustainability Tech | Reduced energy consumption and carbon footprint | Implementing advanced cooling, targeting 100% renewable energy, exploring hydrogen backup | Liquid cooling can improve efficiency by up to 30%; renewable energy integration targets LEED Gold. |

| 5G & Edge Computing | Need for localized, low-latency data processing | Developing distributed data center infrastructure | Global 5G subscriptions projected to exceed 1.5 billion by end of 2024. |

| Digitalization & Smart Buildings | Optimized operations, enhanced tenant experience, improved ESG | Integrating IoT, data analytics, and digital platforms | Smart building market projected to exceed $100 billion by 2025; ESR aims for 15% energy reduction in smart assets. |

Legal factors

Foreign investment regulations in Asia Pacific real estate present a complex landscape for ESR. For instance, in 2024, countries like Australia and Singapore generally maintain open policies for foreign investment in real estate, encouraging capital inflow. However, others, such as Vietnam, have specific limitations on foreign ownership percentages in certain property types, requiring careful navigation.

ESR must stay abreast of these evolving rules, which often dictate capital repatriation, profit remittance, and the necessity for governmental approvals before transactions can be finalized. Failure to comply can lead to significant penalties, impacting investment timelines and returns.

Land use and zoning regulations are critical for ESR, directly impacting where and how logistics and data center facilities can be established. These laws dictate permissible building types, density, height restrictions, and environmental considerations, significantly influencing site selection and development costs.

For instance, in many developed markets, strict zoning can limit the availability of large, contiguous parcels suitable for large-scale logistics parks, pushing development towards more expensive or less accessible areas. In 2024, the average time to obtain zoning approvals for industrial development in major US metropolitan areas ranged from 6 to 18 months, a factor ESR must meticulously manage.

Furthermore, evolving zoning for data centers, often requiring specific power infrastructure and noise abatement measures, can add complexity and cost. ESR's ability to navigate these varied legal landscapes across its global portfolio, from the EU's stringent environmental zoning to Asia's rapid urban planning shifts, is paramount to project success and timely delivery.

Data sovereignty and privacy laws are increasingly shaping the data center landscape. Regulations like GDPR and similar frameworks globally mandate strict data handling and residency requirements, directly impacting where data can be stored and processed. For ESR, this means clients must carefully consider data center locations to ensure compliance, influencing site selection and the specific services offered to meet these evolving legal demands.

Environmental Regulations and Compliance

Stricter environmental regulations are increasingly shaping the real estate sector across the Asia-Pacific (APAC) region, impacting construction, emissions, waste management, and energy use. ESR's strategic focus on sustainable development and operational efficiency necessitates diligent compliance with these evolving legal frameworks. For instance, many APAC governments are mandating higher energy efficiency standards for new buildings, mirroring global trends. In 2024, several countries in Southeast Asia introduced new guidelines for construction waste recycling, aiming to divert a significant portion from landfills.

Adherence to these regulations is not merely a legal obligation but a critical component of ESR's business strategy. Obtaining green building certifications, such as LEED Gold or equivalent regional standards, is becoming a de facto requirement for major developments, enhancing asset value and marketability. ESR's commitment to sustainability is demonstrated through its portfolio, with a growing number of properties achieving these certifications. Failure to comply can lead to substantial financial penalties, project delays, and significant damage to ESR's reputation as a responsible developer.

- Increasingly stringent environmental laws across APAC impact construction materials, emissions, and waste disposal.

- ESR's operational model requires adherence to these regulations, including obtaining green building certifications like LEED Gold.

- Non-compliance can result in significant financial penalties and reputational harm, affecting investor confidence and market access.

- By 2025, it's projected that over 60% of new commercial real estate developments in major APAC cities will need to meet advanced sustainability benchmarks to gain regulatory approval.

Corporate Governance and Shareholder Rights

As a Hong Kong-listed entity, ESR adheres to stringent corporate governance codes and regulations designed to safeguard shareholder rights. These frameworks are crucial, especially given the significant presence of institutional investors who demand transparency and accountability.

The recent privatization proposal for ESR, which faced scrutiny, underscores the critical role of these governance structures. They ensure that major corporate actions, like delisting, are conducted with fairness and clarity for all shareholders. For instance, the successful privatization of ESR by its controlling shareholders in July 2023, at a price of HK$17.80 per share, involved detailed shareholder approval processes, demonstrating the application of these protective measures.

- Regulatory Oversight: ESR's listing on the Hong Kong Stock Exchange subjects it to the rules and guidelines of the exchange, including those related to corporate governance and disclosure.

- Shareholder Protection Mechanisms: Regulations mandate clear procedures for shareholder meetings, voting rights, and the handling of transactions that could impact minority shareholders, such as privatization bids.

- Institutional Investor Influence: The substantial holdings by institutional investors often lead to higher governance standards, as these entities actively monitor and engage with management on governance matters.

- Transparency in Major Transactions: The privatization process for ESR required detailed disclosures and shareholder votes, ensuring that the rationale and terms were communicated openly.

The legal framework for ESR's operations is extensive, covering foreign investment, land use, data privacy, and corporate governance. Navigating these diverse regulations across different jurisdictions is paramount for successful project execution and compliance.

For example, in 2024, Australia and Singapore maintained open foreign investment policies for real estate, while Vietnam imposed specific ownership limits. ESR must also contend with evolving zoning laws, which can significantly impact site selection and development timelines, with US industrial zoning approvals averaging 6-18 months in 2024.

Data sovereignty laws, like GDPR, influence data center location choices, and stricter environmental regulations, such as new waste recycling guidelines in Southeast Asia in 2024, necessitate adherence to sustainability benchmarks.

ESR's Hong Kong listing mandates strict corporate governance, as evidenced by the detailed shareholder approval processes during its 2023 privatization. By 2025, over 60% of new APAC commercial developments are projected to require advanced sustainability benchmarks for approval.

Environmental factors

Asia Pacific's vulnerability to climate change, including rising sea levels and extreme weather, presents significant physical risks to real estate. For ESR, this translates to potential damage to logistics and data center infrastructure, impacting operations and asset value.

ESR proactively addresses these risks by integrating climate risk assessments into its site selection process. This ensures new developments are built with resilience in mind, incorporating mitigation measures to withstand anticipated climate impacts.

For instance, in 2024, ESR continued to focus on developing properties in locations with lower climate vulnerability, a strategy supported by increasing investor demand for sustainable and resilient real estate portfolios.

Data centers are massive energy users, so how efficiently they use power and their access to clean energy sources are key environmental factors. ESR is aiming high, targeting 100% renewable energy for its data centers by 2040, with a significant milestone of 75% by 2030. This involves building solar power and other green technologies directly into their new developments to cut down on carbon emissions.

Water is a critical resource for data center operations, particularly for cooling systems, and its responsible management is a growing concern, especially in areas facing water scarcity. ESR's commitment to sustainable design principles includes integrating water-efficient technologies to minimize consumption across its facilities.

This focus on water conservation is a key component of ESR's broader environmental stewardship efforts. For instance, by 2024, several regions globally experienced significant water stress, with reports indicating that over two-thirds of the world's population could face water shortages by 2025, making efficient water use in industrial operations like data centers increasingly vital.

Green Building Certifications and Sustainable Construction

The global green building market is experiencing significant expansion, with projections indicating it will reach approximately $386 billion by 2027, up from $145 billion in 2020, reflecting a compound annual growth rate of 15%. This surge is fueled by increasing investor demand for sustainable assets, supportive government policies offering tax credits and zoning advantages, and a growing number of corporations embedding environmental, social, and governance (ESG) principles into their operational strategies. ESR is actively participating in this trend by targeting LEED Gold certification for its new developments, a benchmark recognized globally for sustainable building practices.

ESR's commitment to green building extends to the selection of materials and construction methods. The company emphasizes the use of low-carbon materials, such as recycled steel and sustainably sourced timber, and implements practices designed to reduce waste and energy consumption during the construction phase. For instance, in 2023, ESR achieved a 15% reduction in construction waste across its European projects compared to the previous year, diverting over 8,000 tonnes of material from landfills. These initiatives not only minimize the environmental impact but also enhance the long-term appeal and value of ESR's real estate portfolio.

- Market Growth: Global green building market expected to reach $386 billion by 2027.

- Key Drivers: Investor preference, regulatory incentives, and corporate ESG goals.

- ESR's Strategy: Targeting LEED Gold certification for new developments.

- Sustainable Practices: Utilizing low-carbon materials and minimizing construction waste, with a 15% reduction in waste achieved in European projects in 2023.

Waste Management and Circular Economy Principles

Effective waste management and embracing circular economy principles are increasingly critical in real estate, especially for large developers like ESR. During 2024, the global construction industry generated an estimated 2.2 billion tonnes of waste, highlighting the environmental imperative for better practices. ESR's strategic focus on retrofitting existing structures for data center use, as seen in their European projects, directly addresses this by significantly reducing the need for new materials and the associated waste. This approach not only cuts down on embodied carbon but also extends the lifespan of buildings, aligning with broader sustainability goals.

By prioritizing the reuse and repurposing of materials, ESR is embedding circular economy concepts into its development lifecycle. This strategy is particularly relevant as regulatory pressures and investor expectations for environmental performance intensify. For instance, the European Union's Circular Economy Action Plan aims to halve the generation of construction and demolition waste by 2030. ESR's retrofitting initiatives position them favorably to meet these evolving environmental standards and contribute to a more resource-efficient real estate sector.

- Reduced Embodied Carbon: Retrofitting can lower embodied carbon by up to 70% compared to new builds, according to some industry estimates.

- Waste Diversion: Circular economy principles aim to divert a significant portion of construction waste from landfills, with targets often exceeding 70%.

- Resource Efficiency: Reusing existing building components and materials minimizes the demand for virgin resources, supporting a more sustainable supply chain.

- Extended Asset Life: Repurposing buildings breathes new life into existing infrastructure, maximizing its utility and economic value.

Asia Pacific's vulnerability to climate change, including rising sea levels and extreme weather, presents significant physical risks to real estate. For ESR, this translates to potential damage to logistics and data center infrastructure, impacting operations and asset value.

ESR is actively pursuing sustainability targets, aiming for 100% renewable energy for its data centers by 2040, with a significant interim goal of 75% by 2030. This involves integrating solar power and other green technologies into new developments to reduce carbon emissions.

Water scarcity is a growing concern, especially for data center cooling. ESR's commitment to sustainable design includes water-efficient technologies to minimize consumption, a crucial step as over two-thirds of the world's population could face water shortages by 2025.

The global green building market is expanding rapidly, projected to reach approximately $386 billion by 2027, driven by investor demand and ESG principles. ESR targets LEED Gold certification for new developments, underscoring its commitment to sustainable practices.

ESR emphasizes low-carbon materials and waste reduction in construction, achieving a 15% reduction in construction waste across European projects in 2023. This focus on sustainability enhances the long-term value of its portfolio.

Effective waste management is critical, with the global construction industry generating an estimated 2.2 billion tonnes of waste in 2024. ESR's retrofitting of existing structures for data centers significantly reduces material needs and waste, aligning with circular economy principles and EU targets to halve construction waste by 2030.

| Environmental Factor | ESR's Action/Target | Data/Statistic |

|---|---|---|

| Climate Risk | Site selection with lower climate vulnerability | Asia Pacific vulnerability to rising sea levels and extreme weather |

| Renewable Energy (Data Centers) | Target 100% renewable energy by 2040, 75% by 2030 | Integration of solar power and green technologies |

| Water Management | Use of water-efficient technologies | Global water shortages projected for over two-thirds of population by 2025 |

| Green Building | Target LEED Gold certification | Global green building market to reach $386 billion by 2027 |

| Construction Waste | Use of low-carbon materials, waste reduction | 15% reduction in European construction waste in 2023; Global industry waste 2.2 billion tonnes in 2024 |

| Circular Economy | Retrofitting existing structures | EU target to halve construction waste by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations, government statistical agencies, and reputable market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, and socio-cultural trends to provide comprehensive insights.