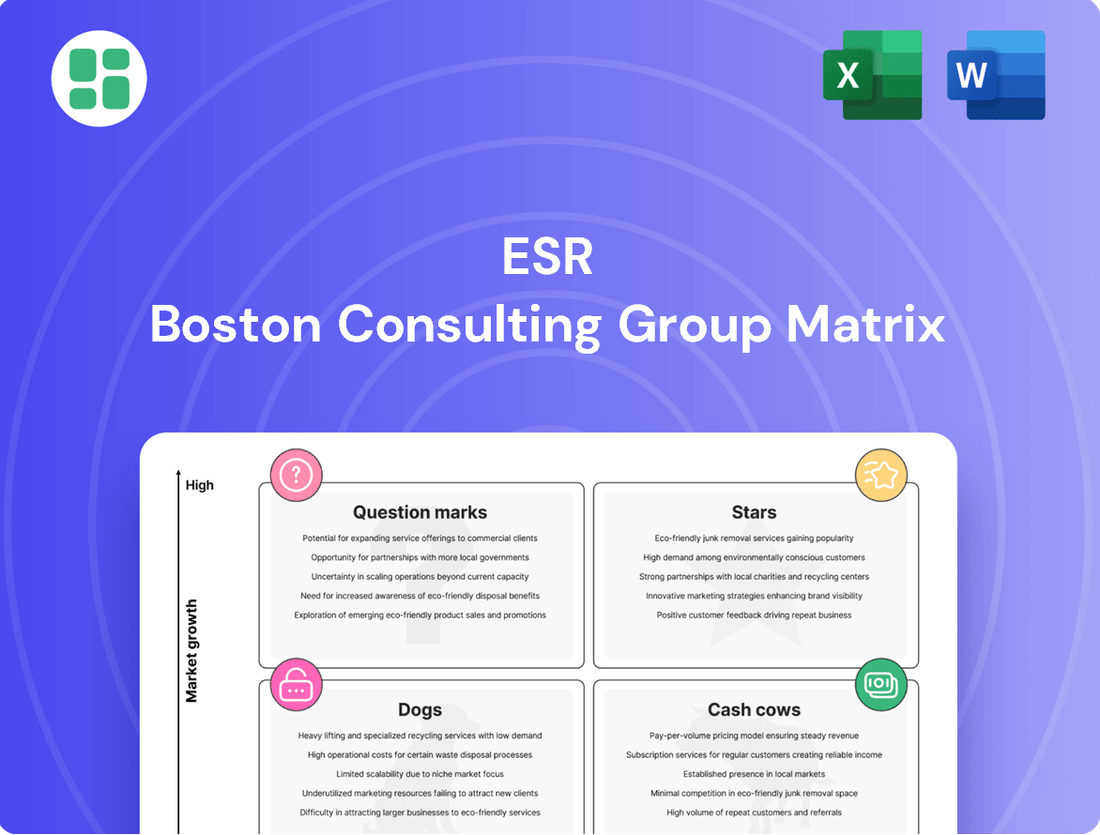

ESR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

Uncover the strategic positioning of key products with this essential BCG Matrix overview. Understand the fundamental concepts of Stars, Cash Cows, Dogs, and Question Marks that drive portfolio decisions. Purchase the full BCG Matrix report to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product portfolio and investment strategy.

Stars

ESR's robust 1.5-gigawatt data center pipeline across key APAC markets like Tokyo, Osaka, Seoul, and Sydney firmly places it in a high-growth, high-market-share quadrant. This strategic positioning is fueled by the 'turbocharged' demand for data centers, especially those catering to AI workloads.

By the close of 2024, ESR has 375 megawatts of data center projects actively under construction. This significant development pipeline underscores ESR's substantial presence and commitment within the rapidly expanding APAC data center sector, which is projected to be a major contributor to global capacity increases by 2028.

ESR's modern logistics facilities in developed APAC hubs like Japan, Australia, and South Korea are performing exceptionally well. These assets are seeing strong rental growth and consistently high occupancy rates, reflecting their prime position in the market.

The demand is fueled by the rapid expansion of e-commerce and the ongoing need for supply chain upgrades across the region. ESR's strategic development in these key markets further solidifies their leading role in providing essential logistics infrastructure, making them a clear star performer.

ESR's New Economy assets are a clear star in its BCG matrix, with over 75% of its FY2024 capital raised targeting logistics and data centers. This substantial capital inflow demonstrates robust investor appetite and ESR's strong market position in these high-growth sectors.

The year-on-year growth in capital raising for these New Economy mandates underscores increasing investor confidence. This segment's performance is not just a snapshot but a trend, indicating sustained demand and ESR's ability to capture significant market share in a rapidly evolving fund management landscape.

This success directly fuels ESR's expansion and development pipeline within the New Economy real estate space. The capital raised acts as a powerful engine, enabling further investment in and growth of its logistics and data center portfolios, solidifying its star status.

Pan-APAC Infrastructure Platform Expansion

ESR's strategic expansion into its pan-APAC infrastructure platform, encompassing energy transition and digital infrastructure, positions it as a strong contender in a high-growth sector. This initiative leverages ESR's established real estate acumen and extensive network to meet the burgeoning regional demand for sustainable and advanced infrastructure.

- Strategic Focus: ESR is investing heavily in energy transition and digital infrastructure across the Asia-Pacific region.

- Market Position: The company is actively building market share in these rapidly expanding sectors.

- Capital Intensive Growth: This expansion requires significant capital investment but offers high potential for future returns.

- Leveraging Expertise: ESR utilizes its existing real estate expertise and network to drive growth in new infrastructure areas.

Sustainable and Green Building Initiatives

ESR's dedication to environmental, social, and governance (ESG) principles is a significant driver for its position in the real estate market. The company has set ambitious goals, such as powering its data centers with 100% renewable energy by 2040, demonstrating a clear commitment to sustainability.

Achieving prestigious green building certifications, like the BCA Green Mark Platinum, further solidifies ESR's leadership in environmentally conscious development. This focus resonates strongly with a market increasingly prioritizing sustainable properties, enabling ESR to capture a substantial share in this rapidly expanding sector.

- ESG Commitment: Targets 100% renewable energy for data centers by 2040.

- Green Certifications: Aims for BCA Green Mark Platinum for its buildings.

- Market Demand: Capitalizes on growing tenant and investor preference for eco-friendly real estate.

- Competitive Edge: High market share in the high-growth sustainable property segment.

ESR's New Economy assets, particularly its data centers and modern logistics facilities, are clearly positioned as Stars in its portfolio. The company's significant development pipeline, with 375 megawatts of data center projects under construction by the end of 2024, and strong rental growth in prime logistics hubs, highlight its high market share in rapidly expanding sectors. This success is further bolstered by substantial investor appetite, with over 75% of FY2024 capital raised targeting these New Economy mandates, demonstrating sustained demand and ESR's ability to capture market leadership.

| Asset Class | Market Position | Growth Potential | Key Data Points (2024) |

|---|---|---|---|

| Data Centers | High Market Share (APAC) | High | 1.5 GW pipeline; AI workload demand |

| Modern Logistics | High Market Share (Developed APAC) | High | Strong rental growth; high occupancy |

| New Economy Mandates | High Investor Appetite | High | >75% of FY24 capital raised |

What is included in the product

The ESR BCG Matrix analyzes products/business units by market share and growth, guiding investment decisions.

Quickly visualize your portfolio's health and identify areas needing attention.

Focus strategic discussions on where to invest, divest, or hold.

Cash Cows

ESR's established logistics portfolios in mature APAC markets, excluding Mainland China, are genuine cash cows. These properties, boasting a robust 95% occupancy rate as of late 2023, consistently deliver significant and stable rental income, acting as a reliable cash flow engine for the company.

The recurring core fund management fee income is a significant cash cow for ESR, representing over 75% of their total revenue. This stable income, generated from managing extensive assets for capital partners, provides a robust cash flow that underpins other business operations, demonstrating its crucial role in ESR's asset-light model.

Fully leased prime logistics parks represent classic cash cows within the ESR portfolio. These assets, often situated in crucial Asia Pacific gateway markets, boast long-term leases and near-perfect occupancy rates. This translates into a highly predictable and substantial rental income stream, reflecting their established competitive advantage and minimal need for further capital expenditure beyond routine maintenance.

The operational efficiency of these prime logistics parks allows for exceptionally high profit margins. For instance, in 2024, the industrial and logistics real estate sector in Asia Pacific saw continued strong demand, with average occupancy rates for prime assets remaining above 95% across major hubs. This stability means these properties can effectively be 'milked' for their strong cash generation, providing vital funds for ESR's strategic growth initiatives in other areas.

Stabilized Hyperscale Data Centers

Once ESR's newly completed hyperscale data centers become fully operational and leased, they are positioned as stable cash cows within the BCG matrix. These facilities, like the ESR Cosmosquare OS1 in Osaka, are designed for long-term operation with anchor tenants and extended lease agreements, ensuring consistent and significant recurring revenue streams. This stability means they require considerably less new capital investment for expansion compared to the initial development stage.

These stabilized assets represent mature, high-demand businesses that generate more cash than they consume. For instance, the global data center market was valued at approximately $240 billion in 2023 and is projected to grow substantially. ESR's strategy focuses on securing long-term leases with hyperscale clients, which typically have a duration of 10-15 years, providing a predictable revenue base.

- Stable Revenue Generation: Long-term leases with major cloud providers ensure predictable cash flow.

- Reduced Capital Expenditure: Post-stabilization, these assets require minimal new investment for growth, freeing up capital.

- Market Demand: The ongoing demand for hyperscale capacity, driven by cloud computing and AI, supports sustained occupancy and rental rates.

- Operational Efficiency: Mature facilities benefit from optimized operations, further enhancing profitability.

Investments in Managed REITs (e.g., ESR-REIT)

ESR's strategic backing of managed REITs, such as ESR-REIT, positions these assets as significant cash cows within the BCG framework. These REITs, holding a diverse range of income-generating industrial properties, are designed to provide consistent distributions and management fees to ESR. This creates a reliable stream of passive income, bolstering ESR's overall cash flow.

These investments are characterized by their maturity and stability, offering dependable returns rather than rapid expansion. While growth prospects may be modest, their established market share in specific industrial property segments ensures a consistent contribution to ESR's financial health. For instance, in 2024, ESR-REIT continued to focus on its portfolio optimization, aiming to enhance rental reversions and occupancy rates across its industrial and logistics assets.

- Stable Distributions: REITs like ESR-REIT provide regular income distributions to unitholders, acting as a consistent cash flow generator for ESR.

- Management Fees: ESR earns management fees from its sponsorship and management of these REITs, adding to its revenue.

- Mature Assets: The underlying properties are typically well-established, contributing to their stability and predictable income generation.

- Low Growth, High Share: While not high-growth ventures, their strong position in mature industrial property markets ensures a significant and reliable market share.

ESR's fully leased prime logistics assets are textbook cash cows, consistently generating substantial and stable rental income. These properties, often located in key Asia Pacific gateway cities, benefit from long-term leases and near-perfect occupancy, ensuring a predictable revenue stream with minimal need for new capital investment beyond routine upkeep.

In 2024, the industrial and logistics real estate sector in Asia Pacific maintained robust demand, with prime assets across major hubs reporting occupancy rates exceeding 95%. This stability allows these assets to be leveraged for strong cash generation, funding ESR's strategic growth in other business segments.

The core fund management fee income is a significant cash cow for ESR, contributing over 75% of their total revenue. This reliable income, derived from managing extensive assets for capital partners, provides a stable cash flow that supports other business operations, underscoring its importance in ESR's asset-light strategy.

| Asset Type | Occupancy Rate (Late 2023) | Revenue Contribution | Capital Expenditure Needs |

| Mature Logistics Portfolios (APAC ex-China) | 95% | Significant & Stable Rental Income | Low (Routine Maintenance) |

| Fully Leased Prime Logistics Parks | Near-Perfect | Highly Predictable Rental Income | Minimal |

| Core Fund Management | N/A | >75% of Total Revenue | N/A |

What You See Is What You Get

ESR BCG Matrix

The ESR BCG Matrix preview you're examining is the identical, fully completed document you will receive immediately after your purchase. This means no altered content, watermarks, or demo limitations—you get the comprehensive, professionally formatted strategic tool as shown.

Dogs

Legacy Non-New Economy Real Estate Holdings represent traditional assets that don't fit ESR's core strategy of logistics and data centers. These might include older retail spaces or office buildings with declining demand.

ESR's focus is on shedding these non-core holdings to boost efficiency and free up funds for growth in their preferred sectors. For instance, in 2024, ESR continued its strategy of portfolio optimization, which included the disposal of certain traditional real estate assets.

Certain newly completed properties in Mainland China are currently underperforming, struggling to meet their projected occupancy and rental income targets. This situation resulted in revaluation losses and negative rental reversions for the fiscal year 2024, impacting overall portfolio performance.

These specific assets hold a low market share within a region experiencing slower economic stabilization. Consequently, they are tying up valuable capital with minimal returns, presenting a significant risk of becoming cash traps for the company.

ESR's strategic review has led to the reclassification of certain holdings, like its stake in Cromwell, as non-core. This move, coupled with significant impairment losses recognized in 2023, signals that these investments possess low market share and lack strategic alignment with ESR's core business objectives.

These underperforming assets represent prime candidates for divestiture. They consume valuable capital and management attention without delivering commensurate returns or contributing to future growth, making their sale a logical step to unlock capital for more promising ventures.

Functionally Obsolete Older Industrial Assets

Functionally obsolete older industrial assets, those that haven't kept pace with modern building standards and technological advancements, often find themselves outcompeted. In 2024, for example, many older warehouses lack the clear heights, dock door configurations, and energy efficiency sought by today's logistics companies, limiting their leasing appeal.

These properties typically represent a low market share within the industrial sector and face dim growth prospects due to their inherent limitations. Their inability to attract premium tenants or command competitive rental rates, especially when new, high-specification developments are entering the market, can lead to underperformance and make divestment a strategic consideration.

- Low Tenant Demand: Older industrial assets often lack the features required by modern businesses, such as high bay ceilings, advanced HVAC systems, and sufficient power capacity.

- Declining Rental Income: As newer, more efficient facilities come online, the rental rates for obsolete properties tend to stagnate or decline.

- High Capital Expenditure: Bringing these assets up to modern standards can require prohibitively expensive renovations, making them less attractive investment opportunities.

- Market Saturation: In many industrial markets, the supply of modern, well-equipped facilities is increasing, further pressuring the value and leasing potential of older, obsolete properties.

Divested Business Segments

ESR's divestment of the ARA Private Funds business and USHT aligns with the Dogs quadrant of the BCG Matrix. These divested segments likely exhibited low growth and low market share, making them candidates for strategic pruning to enhance overall portfolio efficiency.

By shedding these underperforming assets, ESR aims to concentrate resources on its more promising business units, thereby optimizing its balance sheet and improving its competitive positioning. This strategic move reflects a commitment to streamlining operations and focusing on core strengths.

For instance, ESR's divestment activity in 2024, such as the sale of certain logistics assets, demonstrates a proactive approach to portfolio management. These actions are geared towards enhancing profitability and shareholder value by exiting segments that no longer align with the company's long-term growth objectives.

- Divested Assets: ARA Private Funds business and USHT.

- BCG Classification: Dogs (low growth, low market share).

- Strategic Rationale: Optimization of balance sheet and portfolio streamlining.

- Financial Impact: Focus on core strengths and improved resource allocation.

Dogs in the ESR BCG Matrix represent business units or assets with low market share in low-growth industries. These are typically underperforming and require significant capital without generating substantial returns.

ESR's strategic divestment of segments like the ARA Private Funds business and USHT in 2024 exemplifies this classification. These were likely areas with limited growth prospects and a diminished competitive standing.

The rationale behind divesting these "Dogs" is to free up capital and management focus, allowing ESR to reinvest in its high-growth core businesses such as logistics and data centers, thereby enhancing overall portfolio efficiency.

By shedding these underperforming assets, ESR aims to optimize its balance sheet and improve its competitive positioning, as seen in its continued portfolio optimization efforts throughout 2024.

| Asset/Segment | ESR's BCG Classification | Market Growth | Market Share | Strategic Action |

|---|---|---|---|---|

| ARA Private Funds business | Dog | Low | Low | Divested |

| USHT | Dog | Low | Low | Divested |

| Legacy Non-New Economy Real Estate Holdings | Dog | Low | Low | Strategic pruning/divestiture |

| Certain underperforming Mainland China properties (2024) | Dog | Low | Low | Revaluation losses, potential divestiture |

Question Marks

ESR's strategic foray into nascent sub-markets within high-growth emerging economies, such as specific developing urban centers in India or burgeoning Southeast Asian territories, positions these ventures as Question Marks within the BCG framework. These regions are characterized by substantial projected market expansion, yet ESR's current footprint and market share are relatively small, necessitating considerable capital infusion to cultivate a dominant position.

ESR's foray into real estate credit investment platforms, beginning with its South Korean launch in FY2024, marks a strategic move into a sector with significant upside but also considerable initial challenges. This new venture is positioned within a high-potential market, yet currently faces a constrained credit environment, necessitating substantial capital investment to build market share and establish a competitive foothold.

Highly innovative but unproven development projects, often seen in the New Economy space, represent potential high-growth opportunities. These ventures, like the development of large-scale vertical farms integrated with AI-driven logistics or experimental mixed-use developments featuring advanced sustainable energy systems, demand significant capital. For instance, a project aiming to create self-sustaining, modular urban living spaces with integrated blockchain for property management might require hundreds of millions in initial investment before proving its market viability.

These projects fall into the Question Marks category of the ESR BCG Matrix because their future success is uncertain. While they hold the promise of substantial returns if they achieve market acceptance, they also carry a high risk of failure. The market adoption rate for such cutting-edge concepts is a critical unknown; consider the initial struggles of many proptech startups in gaining widespread user trust and integration into traditional real estate markets. As of early 2024, many proptech firms are still navigating this challenge, with some pivoting business models to ensure survival.

AI-Ready Data Center Projects Under Early Construction

ESR’s extensive 2 GW pipeline of AI-ready data center projects, currently in early construction or planning phases, fits the profile of a Question Mark in the BCG Matrix. These ventures are in a rapidly expanding market driven by AI demand, but they haven't yet begun generating revenue or establishing a dominant market position. Significant capital is required to bring these projects to fruition, making their future success uncertain.

- High Growth Potential: The burgeoning demand for AI infrastructure positions these data centers in a high-growth sector.

- Uncertain Market Share: As projects are in early stages, they have not yet secured significant market share or proven revenue streams.

- Capital Intensive: Substantial investment is necessary for development, construction, and operational setup.

- Strategic Importance: Despite the risks, these projects are crucial for ESR to capture future market opportunities in AI computing.

Specialized Niche Logistics Solutions

Specialized niche logistics solutions, like advanced cold chain or tech-heavy urban hubs, represent a classic question mark in the ESR BCG Matrix. These ventures tap into rapidly growing demand, driven by sectors such as pharmaceuticals and e-commerce, yet they typically begin with a modest market presence.

The significant capital outlay needed for specialized infrastructure and technology, coupled with the challenge of building market share in a complex, regulated environment, positions these as high-risk, high-reward opportunities. For instance, the global cold chain logistics market was valued at approximately $167.7 billion in 2023 and is projected to grow substantially, highlighting the potential but also the investment required to capture a meaningful slice of this market.

- High Growth Potential: Driven by increasing demand for temperature-controlled goods and efficient urban delivery networks.

- Significant Investment Needs: Requiring substantial capital for specialized facilities, technology, and regulatory compliance.

- Low Initial Market Share: Typically starting from a small base, necessitating aggressive market penetration strategies.

- Strategic Importance: Essential for supporting critical industries and adapting to evolving consumer expectations.

Question Marks in ESR's portfolio represent ventures with high growth potential but currently low market share, demanding significant investment. Success hinges on market acceptance and strategic capital allocation to transition them into Stars. Failure to gain traction could lead to them becoming Dogs, requiring divestment.

ESR's investments in emerging markets like India and Southeast Asia, along with new ventures such as its South Korean real estate credit platform launched in FY2024, exemplify Question Marks. These are characterized by substantial market expansion prospects but require considerable capital to build a dominant position from a small initial footprint.

The company's pipeline of 2 GW of AI-ready data centers, still in early development, also falls into this category. While the AI market is booming, these projects are yet to generate revenue or establish market dominance, necessitating significant capital for their realization.

Innovative but unproven development projects, such as AI-integrated vertical farms or blockchain-enabled urban living spaces, are classic Question Marks. These demand substantial upfront investment, with their future market viability remaining uncertain, mirroring the challenges faced by many proptech startups in gaining user trust as of early 2024.

| Venture Type | Market Growth | Current Market Share | Capital Requirement | Risk Level |

|---|---|---|---|---|

| Emerging Market Logistics (e.g., India) | High | Low | High | High |

| Real Estate Credit Platform (South Korea, FY2024) | High | Low | High | High |

| AI-Ready Data Centers (2 GW Pipeline) | Very High | Low | Very High | High |

| Innovative Proptech Developments | High | Very Low | Very High | Very High |

| Specialized Niche Logistics (e.g., Cold Chain) | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.