ESR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

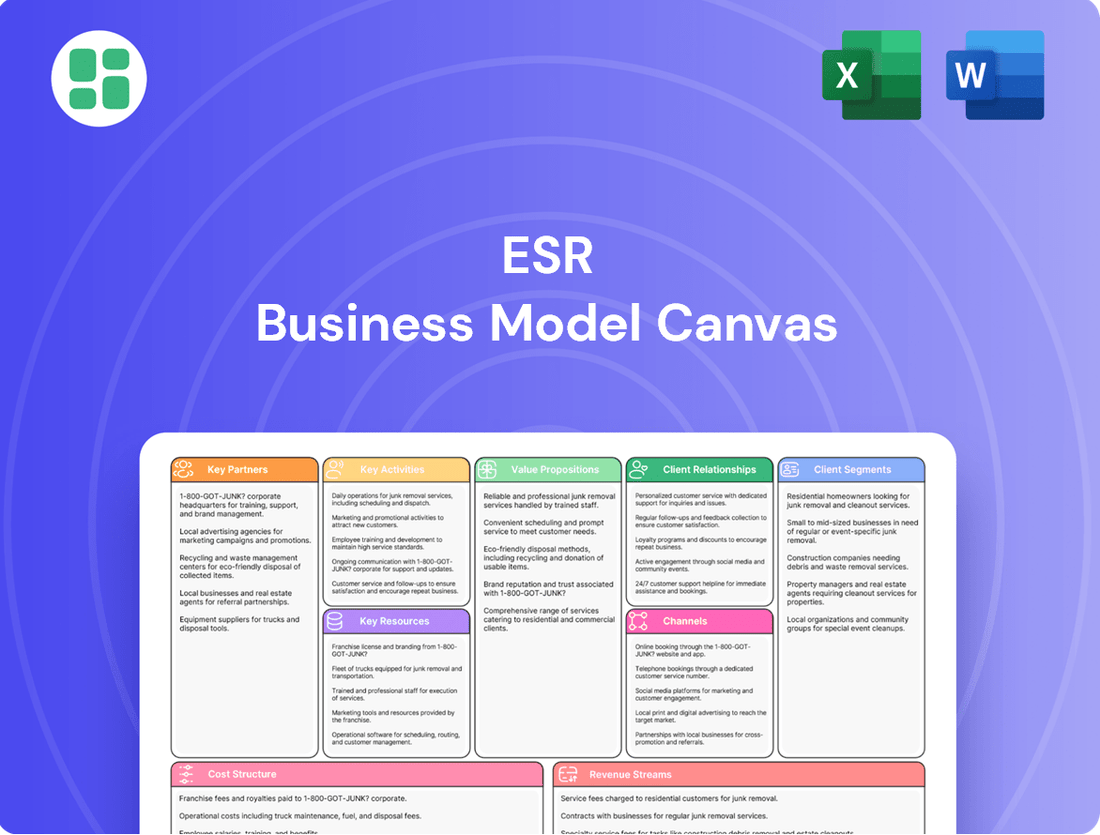

Curious about ESR's winning formula? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. Discover the strategic framework that fuels their success and gain inspiration for your own ventures.

Partnerships

ESR actively partners with major institutional investors, including sovereign wealth funds, pension funds, and insurance companies, for strategic co-investments. These collaborations are crucial for funding large-scale logistics and data center developments across the Asia Pacific region.

These partnerships provide ESR with substantial capital, enabling the company to undertake significant new developments and acquisitions. For instance, ESR's funds often see participation from prominent entities, bolstering their capacity to manage and grow a diverse and complex real estate portfolio.

ESR collaborates with top-tier construction and development firms to ensure efficient project delivery. These partnerships are vital for accessing specialized labor and materials, critical for building advanced logistics and data center facilities. For example, in 2024, ESR continued to leverage these relationships to manage its extensive development pipeline across Asia Pacific.

ESR's strategic alliances with technology and infrastructure providers are crucial for embedding advanced capabilities within its properties, especially its data centers and smart logistics facilities. These partnerships facilitate the integration of cutting-edge solutions, such as high-speed network connectivity and sophisticated automation systems, thereby boosting operational efficiency and the overall value proposition of ESR's real estate portfolio.

Government and Regulatory Bodies

ESR actively collaborates with government agencies and regulatory bodies to navigate complex approval processes. This engagement is crucial for obtaining permits and land use rights, essential for ESR's development projects.

These partnerships help ESR ensure compliance with zoning and environmental standards, minimizing operational risks and facilitating expansion. For instance, in 2024, ESR secured key approvals for several logistics hubs across Asia-Pacific, demonstrating the effectiveness of these relationships.

- Government Engagement: ESR works with national and local governments to secure development permits and land approvals.

- Regulatory Compliance: Adherence to zoning laws and environmental regulations is managed through ongoing dialogue with regulatory bodies.

- Risk Mitigation: Strong relationships with authorities help preempt and resolve regulatory hurdles, ensuring smoother project execution.

- Market Access: Collaboration with governments facilitates ESR's entry and operation in new strategic markets.

E-commerce and Logistics Platform Integrators

Collaborating with major e-commerce platforms and logistics service providers is crucial for ESR. These partnerships enable ESR to stay ahead of tenant needs by understanding the dynamic operational requirements of businesses in the New Economy. This insight allows for the design of highly optimized properties that directly support e-commerce and logistics efficiency.

These strategic alliances also foster long-term leasing agreements and the development of bespoke property solutions. For instance, by integrating with platforms like Shopify or working with logistics giants such as DHL, ESR can tailor its real estate offerings. This approach solidifies ESR's standing as a preferred real estate partner, particularly within the rapidly expanding New Economy sector.

- E-commerce Platform Integration: ESR’s properties are designed to seamlessly integrate with leading e-commerce platforms, facilitating efficient inventory management and order fulfillment for tenants.

- Logistics Service Provider Collaboration: Partnerships with logistics companies ensure ESR’s facilities are optimized for last-mile delivery, warehousing, and distribution, enhancing supply chain velocity.

- Data-Driven Property Design: Insights gained from these collaborations inform the design of ESR’s industrial and logistics assets, ensuring they meet the evolving demands of digital commerce.

- Long-Term Leasing and Bespoke Solutions: These key partnerships often translate into stable, long-term leasing commitments and the creation of customized real estate solutions tailored to specific tenant operational needs.

ESR's key partnerships are fundamental to its business model, providing essential capital, expertise, and market access. These alliances enable the company to execute large-scale projects and maintain its competitive edge in the logistics and data center sectors.

By collaborating with institutional investors, ESR secures the significant capital required for development. Partnerships with construction firms ensure efficient project execution, while alliances with technology providers enhance property functionality. Furthermore, engagement with government bodies and e-commerce platforms facilitates market access, regulatory compliance, and tenant satisfaction.

In 2024, ESR continued to solidify its relationships with global institutional investors, securing substantial capital commitments for new developments across Asia Pacific. These partnerships are critical for funding ESR’s ambitious growth plans and expanding its portfolio of modern logistics and data center facilities.

| Partner Type | Key Contribution | Examples/Impact in 2024 |

|---|---|---|

| Institutional Investors | Capital for development & acquisitions | Significant co-investment in new logistics hubs; bolstered fund capacity. |

| Construction & Development Firms | Project execution expertise, specialized labor | Managed complex builds, ensuring timely delivery of advanced facilities. |

| Technology & Infrastructure Providers | Integration of advanced capabilities (e.g., high-speed networks) | Enhanced data center efficiency and smart logistics features. |

| Government Agencies | Permits, land use rights, regulatory compliance | Secured key approvals for multiple logistics hubs, mitigating risks. |

| E-commerce & Logistics Platforms | Tenant needs insights, long-term leasing | Informed property design for optimized e-commerce operations. |

What is included in the product

A detailed, pre-built business model reflecting ESR's strategic approach, covering all nine Business Model Canvas blocks with specific insights into their operations.

Eliminates the pain of scattered business strategy by providing a structured, visual framework to identify and address key challenges.

Reduces the frustration of complex planning by offering a clear, actionable map to solve business model pain points.

Activities

ESR's primary activities revolve around pinpointing, securing, and constructing high-quality logistics and data center assets throughout Asia Pacific. This encompasses everything from choosing the right locations and designing the facilities to managing the building process and ensuring they cater to the needs of New Economy businesses like e-commerce and tech firms.

The company's strategic growth is heavily reliant on its ability to expand its real estate holdings. For instance, in 2024, ESR continued its aggressive development pipeline, with a significant portion of its capital expenditure dedicated to new projects designed to meet the surging demand for modern logistics and data infrastructure across key Asian markets.

ESR's core activities revolve around expertly managing investment vehicles and funds. This involves attracting capital from a broad range of institutional investors, a crucial step in their operational model. In 2024, ESR continued to demonstrate its prowess in this area, building on its established track record.

The company's fund management strategy encompasses sophisticated asset allocation, diligent portfolio management, and transparent investor reporting. The primary objective is to consistently deliver strong returns for its fund investors, a testament to their integrated approach to capital management and operational scalability.

ESR's property and asset management is central to its strategy, focusing on optimizing its vast logistics and data center portfolio. This includes proactive maintenance, securing and managing leases, fostering strong tenant relationships, and integrating smart building technologies to enhance efficiency and tenant experience.

In 2024, ESR continued to emphasize operational excellence, aiming to maximize rental income and preserve the high quality of its assets. This hands-on approach ensures that properties not only meet current market demands but also appreciate in value over time, contributing significantly to the company's overall financial performance and investor returns.

Strategic Capital Deployment

Strategic capital deployment at ESR is all about smartly investing funds into new building projects and acquiring existing properties. This involves a careful balancing act, weighing potential risks against the expected returns to ensure profitable growth. In 2024, ESR continued to focus on this, with significant capital allocated to logistics and data center developments across Asia Pacific.

This process includes rigorous due diligence to understand every aspect of a potential investment, alongside detailed financial modeling to forecast outcomes. ESR's transaction structuring aims to optimize deals, ultimately boosting shareholder value and extending the company's reach into new markets. For instance, in the first half of 2024, ESR completed several strategic acquisitions that significantly expanded its footprint in key Southeast Asian markets.

- Capital Allocation Focus: Prioritizing investments in high-growth sectors like modern logistics and data centers.

- Transaction Structuring: Expertise in crafting complex deals to maximize financial returns and strategic advantage.

- Due Diligence Rigor: Comprehensive analysis of potential projects and acquisitions to mitigate risk.

- Market Expansion: Deploying capital to enter and solidify presence in promising geographic regions.

Technology Integration and Innovation

ESR actively integrates cutting-edge technologies across its portfolio, from smart building management systems in logistics parks to advanced cooling solutions in data centers. In 2024, the company continued its focus on digital transformation, aiming to boost operational efficiency and tenant experience. This commitment to innovation is key to maintaining ESR's competitive edge in the rapidly evolving real estate market.

Key technological initiatives include:

- Data Analytics: Utilizing big data to optimize energy consumption, predict maintenance needs, and enhance space utilization in properties.

- Automation: Implementing robotics and automated systems within logistics facilities to streamline warehousing and distribution processes, a trend that saw significant investment in 2024.

- High-Performance Infrastructure: Ensuring robust and scalable IT infrastructure for its data center segment, supporting the growing demand for digital services.

- Sustainability Tech: Incorporating green technologies like solar power and advanced water management systems to reduce environmental impact and operational costs.

ESR's key activities center on developing and managing logistics and data center properties across Asia Pacific. This includes identifying prime locations, designing state-of-the-art facilities, and overseeing construction to meet the demands of e-commerce and technology businesses. The company also excels in fund management, attracting institutional capital and expertly allocating it to real estate investments. Furthermore, ESR actively manages its extensive property portfolio, focusing on tenant satisfaction, operational efficiency, and technological integration to drive value and returns.

| Activity Area | Key Actions | 2024 Highlights |

|---|---|---|

| Property Development & Management | Site selection, design, construction, leasing, asset optimization | Continued aggressive development pipeline, focus on modern logistics and data centers in key Asian markets. |

| Fund Management | Capital raising, investment structuring, portfolio management, investor relations | Demonstrated prowess in attracting and managing capital from institutional investors. |

| Capital Deployment | Strategic acquisitions, new project investments, due diligence, financial modeling | Significant capital allocated to logistics and data center developments, completion of strategic acquisitions in Southeast Asia. |

| Technology Integration | Implementing smart building tech, data analytics, automation, sustainability solutions | Focus on digital transformation to boost operational efficiency and tenant experience. |

What You See Is What You Get

Business Model Canvas

The ESR Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means no discrepancies in formatting or content; what you see is precisely what you'll get to download and utilize. You can be confident that the comprehensive structure and detailed sections are representative of the final, complete file, ready for your strategic planning.

Resources

ESR's extensive real estate portfolio, a cornerstone of its business model, features strategically positioned logistics and data center properties. This robust physical asset base is crucial for serving its e-commerce, logistics, and technology clients, providing the essential space and infrastructure they need to operate and grow.

The company's substantial land bank further bolsters its competitive edge, enabling future development and expansion opportunities. As of the first half of 2024, ESR managed a substantial portfolio, underscoring the scale and importance of these physical assets in its operations and long-term strategy.

ESR's strong financial capital, evidenced by its robust balance sheet, is a cornerstone of its business model. This financial muscle allows for significant property acquisitions and development initiatives, driving growth across its portfolio.

The company's diverse institutional investor base, a testament to its proven track record, provides crucial access to substantial capital. This investor confidence underpins ESR's ability to pursue large-scale, long-term projects and strategic expansion, including significant capital deployment in 2024 for new developments and acquisitions.

ESR's deep expertise in real estate and investment management is a cornerstone of its business model. This is built upon a team with extensive experience across the Asia Pacific, covering development, investment, and fund operations.

This human capital is crucial for spotting market trends, successfully completing intricate deals, and managing properties effectively. For instance, in 2024, ESR continued to expand its portfolio, demonstrating this expertise through strategic acquisitions and development projects that enhanced its asset base and income streams.

The firm's specialized knowledge acts as a significant competitive advantage. It allows ESR to navigate complex regulatory environments and identify unique investment opportunities, ultimately driving superior returns for its investors and stakeholders.

Reputable Brand and Market Leadership

ESR's established brand reputation as the largest New Economy real estate manager in Asia Pacific is a significant intangible asset, underpinning its market leadership. This strong standing directly translates into attracting high-quality tenants and securing capital from institutional investors, fostering crucial trust and opening doors for new business ventures.

The company's brand recognition is instrumental in its ability to negotiate and secure premium deals across its portfolio. For instance, in 2024, ESR continued to solidify its position, managing a substantial portfolio that attracted major global logistics players and technology firms seeking prime New Economy spaces.

- Market Dominance: ESR is the largest New Economy real estate manager in Asia Pacific.

- Tenant Attraction: Strong brand reputation draws high-quality, often multinational, tenants.

- Investor Confidence: Market leadership instills trust, facilitating capital raising from institutional investors.

- Deal Premium: Brand recognition enables securing favorable terms and premium pricing on assets.

Advanced Technology Infrastructure and Data Capabilities

ESR's advanced technology infrastructure is a cornerstone of its business model, particularly for its data center and smart logistics operations. This includes high-speed connectivity, reliable power, and efficient cooling systems, all vital for New Economy clients who depend on seamless operations. For instance, in 2024, ESR continued to invest in upgrading its network capabilities across its portfolio to support the increasing demands for data transfer and processing.

The company's ability to collect and analyze vast amounts of data on property performance and market trends is another critical resource. This data-driven approach enhances operational efficiency and informs strategic decisions, allowing ESR to anticipate market shifts and client needs. By leveraging analytics, ESR can optimize facility management and identify new investment opportunities, ensuring its assets remain competitive.

These technological assets are indispensable for serving the specialized requirements of New Economy businesses. The integration of smart technologies within ESR's facilities, such as IoT sensors for real-time monitoring and automation, directly supports the operational demands of sectors like e-commerce and cloud computing. In 2024, ESR reported a significant increase in the utilization of its smart logistics features, driven by client demand for enhanced supply chain visibility and efficiency.

- High-Speed Connectivity: Essential for data-intensive operations, enabling rapid data transfer and communication for clients.

- Robust Power and Cooling: Critical for the uninterrupted operation of data centers and sensitive logistics equipment.

- Data Analytics Capabilities: Supports informed decision-making by analyzing property performance and market trends.

- Smart Facility Integration: Utilizes IoT and automation to enhance operational efficiency and client service in logistics and data centers.

ESR's extensive real estate portfolio, featuring strategically positioned logistics and data center properties, forms a core resource. This physical asset base is crucial for its New Economy clients, providing the essential infrastructure they need. As of the first half of 2024, ESR managed a substantial portfolio, highlighting the scale and importance of these physical assets.

The company's substantial land bank is another key resource, enabling future development and expansion. This allows ESR to adapt to evolving market demands and secure long-term growth opportunities. ESR's financial capital, demonstrated by its robust balance sheet, fuels property acquisitions and development, driving portfolio expansion and value creation.

ESR's deep expertise in real estate and investment management, built by a team with extensive Asia Pacific experience, is a critical human capital resource. This allows them to navigate complex markets and identify unique investment opportunities. The firm's established brand reputation as the largest New Economy real estate manager in Asia Pacific is a significant intangible asset, fostering trust and attracting both tenants and investors.

ESR's advanced technology infrastructure, including high-speed connectivity and robust power and cooling systems, is vital for its data center and logistics operations. The company's data analytics capabilities enhance operational efficiency and inform strategic decisions. In 2024, ESR continued to invest in upgrading its network capabilities and reported increased utilization of its smart logistics features.

| Key Resource | Description | Significance | 2024 Highlight |

| Real Estate Portfolio | Logistics and data center properties | Provides essential infrastructure for New Economy clients | Substantial portfolio managed as of H1 2024 |

| Land Bank | Strategically located land parcels | Enables future development and expansion | Supports long-term growth strategy |

| Financial Capital | Strong balance sheet and access to capital | Funds property acquisitions and development initiatives | Significant capital deployment for new developments |

| Human Capital | Expertise in real estate and investment management | Navigates complex markets, identifies opportunities | Continued portfolio expansion through strategic projects |

| Brand Reputation | Largest New Economy real estate manager in Asia Pacific | Attracts high-quality tenants and investors, builds trust | Solidified market position with major global players |

| Technology Infrastructure | High-speed connectivity, data center tech, smart logistics | Supports specialized needs of New Economy businesses | Investment in network upgrades and smart features |

Value Propositions

ESR offers unparalleled strategic access to essential New Economy real estate, including logistics hubs and data centers. In 2024, ESR's portfolio continued to expand, with significant investments in key Asian markets like China and Australia, reflecting the growing demand for modern industrial and data infrastructure.

This access enables e-commerce and technology firms to optimize their supply chains and digital operations, a critical advantage in today's fast-paced market. For instance, ESR's development of advanced logistics facilities directly supports the efficiency gains needed to shorten delivery windows, a key performance indicator for online retailers.

Investors benefit from this strategic positioning, gaining exposure to resilient and high-growth real estate segments. The demand for logistics space, driven by e-commerce growth, remained robust throughout 2024, with rental growth in prime markets exceeding expectations.

ESR provides a seamless, all-in-one service for institutional investors, covering everything from investment and fund management to the ongoing oversight of their real asset portfolios. This integrated model streamlines the investment journey, offering a single, reliable partner for managing diverse property holdings.

By consolidating these critical functions, ESR delivers significant convenience and deep expertise, ensuring that client assets are consistently optimized. This approach simplifies complex real asset investments, allowing investors to benefit from a unified strategy and expert management across their entire portfolio.

ESR's technologically advanced properties are designed to boost tenant operational efficiency. This translates to smoother warehousing, distribution, and secure data storage, as seen in their APAC logistics portfolio which saw a 9% increase in occupancy in the first half of 2024.

The inherent scalability of ESR's real estate solutions allows businesses to easily adjust their space requirements. This flexibility is crucial for companies experiencing rapid growth, enabling them to expand operations without disruptive relocations, supporting their dynamic market presence.

Strong Returns and Value Creation for Investors

ESR provides its institutional investors with compelling, risk-adjusted returns by leveraging its deep expertise in real asset management. The company focuses on identifying promising assets, executing strategic property development, and actively managing its extensive portfolio to drive capital appreciation and generate consistent income streams for its partners.

In 2024, ESR continued to demonstrate its commitment to value creation. For instance, the company reported strong growth in its Funds Under Management (FUM), reaching over $150 billion by the end of the first half of 2024. This growth directly translates into increased investment capacity and potential for enhanced investor returns.

- Attractive Risk-Adjusted Returns: ESR targets superior financial performance through strategic asset selection and development.

- Capital Appreciation & Income Generation: The company aims to maximize both long-term growth and recurring revenue for investors.

- Expertise in Real Asset Management: Leveraging deep market knowledge and operational capabilities to enhance portfolio value.

- Portfolio Growth: Sustained expansion of Funds Under Management, as evidenced by figures exceeding $150 billion in H1 2024, underpins future return potential.

Reliable and Resilient Infrastructure

ESR's value proposition centers on delivering logistics and data center infrastructure that businesses can absolutely count on. This reliability is paramount for tenants whose operations cannot afford downtime. For instance, in 2024, ESR continued its focus on enhancing power redundancy and network connectivity across its portfolio, ensuring seamless operations for its diverse client base, which includes major e-commerce players and cloud service providers.

The resilience of ESR's properties is built into their design and management. This means robust physical security measures, advanced fire suppression systems, and backup power solutions are standard. In 2024, ESR reported that its data center facilities maintained an uptime of 99.99%, a critical metric for clients in the digital economy. Their commitment extends to high sustainability standards, which not only benefits the environment but also contributes to operational stability and cost efficiency for tenants.

Businesses relying on ESR's facilities for their mission-critical activities, such as inventory management, data processing, and digital storage, find a dependable partner. This allows them to focus on their core competencies, secure in the knowledge that their infrastructure is managed to the highest standards of availability and security. ESR's proactive approach to infrastructure maintenance and upgrades, evident throughout 2024, underscores this commitment to tenant success and operational continuity.

- Critical Uptime Assurance: ESR facilities are engineered for maximum uptime, crucial for businesses like global logistics providers who experienced peak demand in 2024.

- Redundant Systems: Robust power and network redundancy are standard, minimizing disruption risks for data-intensive operations.

- High Security Standards: Adherence to stringent security protocols protects tenant assets and data, a key concern for financial institutions utilizing ESR's data centers.

- Sustainability Integration: Eco-friendly designs and operational practices contribute to resilience and can lower operating costs for tenants, a growing priority in 2024 business strategy.

ESR's value proposition is built on providing essential New Economy real estate, offering strategic access to logistics and data centers that are vital for modern business operations. This focus ensures that e-commerce and technology firms can optimize their supply chains and digital infrastructure, gaining a competitive edge. Investors are drawn to ESR's portfolio for its exposure to resilient, high-growth real estate segments, as evidenced by continued strong demand and rental growth in key Asian markets throughout 2024.

Customer Relationships

ESR focuses on building long-term strategic partnerships with its major institutional investors and key tenants, aiming for mutual growth rather than just one-off deals. This approach involves deeply understanding their long-term goals and offering customized real estate solutions that align with their investment strategies.

These robust relationships are crucial for ESR's business model, driving recurring revenue streams and opening doors for collaborative development projects. For example, in 2024, ESR continued to strengthen its ties with major global investors, securing significant capital commitments that underscore the trust and value placed in these strategic alliances.

ESR's business model emphasizes dedicated account management for key clients and investors, fostering personalized service and proactive communication. This approach ensures clients receive expert advice tailored to their needs.

For investors, ESR provides regular performance reporting and transparent financial disclosures. This commitment to open communication builds trust and ensures investors are well-informed about fund performance, a crucial element in maintaining strong relationships.

ESR acts as a strategic advisor, offering tenants and investors deep insights into evolving market trends. In 2024, this advisory role was crucial as the logistics real estate sector navigated shifts in e-commerce demand and supply chain resilience. By providing tailored real estate solutions, ESR helps clients optimize their operations and investment portfolios, fostering stronger, long-term partnerships.

Performance-Driven Transparency

ESR prioritizes performance-driven transparency, offering investors clear insights into fund performance, asset valuations, and key operational metrics. This open approach is crucial for fostering investor confidence and enabling effective tracking of their investments.

This commitment to openness is reflected in their regular, detailed reporting. For instance, in 2024, ESR continued its practice of providing quarterly investor updates, which include comprehensive breakdowns of Net Asset Value (NAV) per share, occupancy rates across their portfolio, and progress on development projects. This consistent flow of information reinforces trust and accountability within their investor base.

- Enhanced Investor Confidence: ESR's transparent reporting practices, including detailed NAV per share and occupancy rate disclosures in 2024, build significant trust with their investor base.

- Effective Investment Tracking: Regular and accessible performance data allows investors to monitor their capital's growth and the underlying asset performance with precision.

- Accountability and Trust: The open communication about operational metrics and valuation methodologies underscores ESR's commitment to accountability, strengthening long-term relationships.

- Data-Driven Insights: By providing granular data, ESR empowers investors to make informed decisions based on tangible results and market realities.

Community and Industry Engagement

ESR actively participates in industry associations, contributing to the advancement of real estate standards and sustainability practices. For instance, in 2024, ESR continued its involvement with organizations like the Urban Land Institute (ULI) and the Asia Pacific Real Estate Association (APREA), aiming to shape industry dialogues and promote best practices.

The company also prioritizes local community engagement, investing in development projects that benefit residents and enhance the social fabric. In 2024, ESR supported several community initiatives focused on education and environmental conservation in the regions where it operates, fostering positive local relationships and a stronger brand image.

- Industry Association Participation: ESR's continued membership in key real estate associations in 2024 facilitated knowledge sharing and collaborative problem-solving on critical industry issues.

- Sustainability Initiatives: Through its 2024 sustainability programs, ESR demonstrated a commitment to environmental stewardship, aligning with growing investor and community expectations for ESG performance.

- Community Development: Localized projects undertaken by ESR in 2024 aimed to create tangible benefits for communities, strengthening the company's social license to operate and enhancing its reputation as a responsible corporate citizen.

ESR cultivates enduring relationships by acting as a strategic partner, offering tailored real estate solutions and deep market insights to its institutional investors and key tenants. This client-centric approach, exemplified by dedicated account management and transparent reporting, fosters trust and drives collaborative growth.

In 2024, ESR continued to solidify these bonds through active participation in industry associations and meaningful community engagement, underscoring its commitment to both professional advancement and social responsibility.

These deep relationships are critical for securing capital, driving recurring revenue, and identifying new development opportunities, all while enhancing ESR's reputation as a trusted advisor and responsible corporate citizen.

| Relationship Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Investor Partnerships | Capital commitments, performance reporting, transparent disclosures | Strengthened ties with global investors, securing significant capital commitments. |

| Tenant Engagement | Customized real estate solutions, market trend insights | Provided tailored solutions to optimize operations amidst evolving e-commerce demand. |

| Industry Involvement | Association participation, best practice promotion | Continued involvement with ULI and APREA to shape industry dialogues. |

| Community Relations | Local development support, social initiatives | Supported education and environmental conservation initiatives in operating regions. |

Channels

ESR’s direct sales and business development teams are crucial for forging partnerships with major players like institutional investors and e-commerce leaders. These teams are instrumental in understanding client needs and offering customized solutions, fostering strong, direct relationships.

In 2024, ESR continued to leverage these dedicated teams to secure significant deals, directly contributing to their robust pipeline and market expansion. Their ability to negotiate directly with key decision-makers ensures that ESR’s offerings are precisely aligned with the evolving demands of the logistics and technology sectors.

ESR utilizes its extensive connections with major investment banks and financial advisory firms to tap into a global pool of institutional investors. These partnerships are vital for successful fundraisings and strategic capital deployment, enabling ESR to reach a diverse investor base and execute intricate financial deals. For instance, in 2024, ESR successfully raised significant capital through these channels to fuel its expansion in key markets.

ESR leverages industry conferences, forums, and summits as a critical channel to connect with stakeholders. These events, such as major real estate and logistics gatherings, offer invaluable platforms for networking and business development.

Participation in these key industry events allows ESR to showcase its expertise and attract new clients and investors. For instance, in 2024, ESR actively participated in numerous global and regional forums, highlighting its commitment to thought leadership in the logistics and industrial real estate sectors.

These gatherings are instrumental in staying informed about emerging market trends and technological advancements. By engaging in discussions and presentations at these forums, ESR aims to solidify its position as a leader and foster strategic partnerships.

Corporate Website and Digital Platforms

ESR's corporate website and digital platforms are crucial for sharing information, managing investor relations, and highlighting its extensive portfolio and expertise. These online assets offer easy access to valuable resources for prospective tenants and investors, such as property listings, financial reports, and company updates. For instance, as of the first half of 2024, ESR reported a significant increase in digital engagement across its platforms, with website traffic up by 15% year-over-year, reflecting a growing interest in its offerings.

These digital channels are instrumental in building brand awareness and facilitating communication on a global scale. They provide a centralized hub for all corporate information, ensuring transparency and accessibility for a diverse audience. ESR leverages these platforms to not only showcase its development pipeline and existing assets but also to communicate its sustainability initiatives and corporate social responsibility efforts, which are increasingly important to stakeholders.

- Digital Reach: ESR's website and social media channels are key to its global marketing strategy, reaching potential clients and investors worldwide.

- Investor Relations: The platforms provide essential information for investors, including annual reports, financial statements, and sustainability disclosures, fostering trust and transparency.

- Tenant Acquisition: Digital listings and virtual tours of properties are vital for attracting and engaging potential tenants, streamlining the leasing process.

- Brand Storytelling: ESR utilizes its digital presence to communicate its vision, values, and impact, reinforcing its position as a leading real asset manager in Asia Pacific.

Brokerage and Real Estate Advisory Firms

ESR partners with prominent real estate brokerage and advisory firms to enhance its market penetration and deal sourcing capabilities. These collaborations are crucial for identifying suitable tenants and uncovering new land acquisition prospects, effectively extending ESR's operational reach.

Leveraging the deep local market expertise and established client networks of these external partners allows ESR to gain invaluable market intelligence and a broader flow of potential transactions. For instance, in 2024, ESR's strategic alliances with brokerage firms in key Asia-Pacific markets facilitated the leasing of over 1.5 million square meters of logistics space.

- Expanded Market Reach: Brokerage firms provide access to diverse client segments and geographic areas that ESR might not directly cover.

- Enhanced Deal Flow: Advisory firms bring a pipeline of potential acquisition targets and leasing opportunities, driven by their market insights.

- Specialized Expertise: These partners offer specific knowledge in areas like tenant needs, market trends, and property valuation, complementing ESR's internal capabilities.

- Cost-Effective Expansion: Collaborating with established firms is often more efficient than building out extensive internal teams for every market.

ESR's channels are multifaceted, encompassing direct engagement, strategic partnerships, and robust digital platforms. These avenues are designed to connect with institutional investors, e-commerce giants, and a broad spectrum of stakeholders, ensuring efficient market penetration and capital access.

In 2024, ESR's direct sales and business development teams were pivotal in securing major deals, directly contributing to their expansion. Their ability to negotiate directly with key decision-makers ensures ESR's offerings align with evolving market demands.

ESR also leverages its extensive network of investment banks and financial advisory firms to tap into global institutional capital. These partnerships were crucial for significant capital raises in 2024, fueling ESR's growth in key markets.

Industry conferences and forums serve as vital channels for ESR to network and showcase its expertise. Participation in these events in 2024 highlighted ESR's thought leadership and commitment to fostering strategic partnerships.

ESR's corporate website and digital platforms are essential for information dissemination and investor relations. In the first half of 2024, ESR saw a 15% year-over-year increase in website traffic, indicating growing stakeholder interest.

Collaborations with real estate brokerage and advisory firms enhance ESR's market reach and deal sourcing. These alliances, particularly in 2024, facilitated the leasing of over 1.5 million square meters of logistics space through strategic market access.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Business Development | Forging partnerships, understanding client needs, customized solutions | Secured significant deals, robust pipeline expansion |

| Financial Partnerships (Investment Banks, Advisors) | Fundraising, capital deployment, accessing institutional investors | Successful capital raises to fuel market expansion |

| Industry Events (Conferences, Forums) | Networking, showcasing expertise, market trend analysis | Active participation in global and regional forums |

| Digital Platforms (Website, Social Media) | Information sharing, investor relations, brand awareness | 15% YoY increase in website traffic (H1 2024) |

| Real Estate Brokerage & Advisory Firms | Market penetration, deal sourcing, tenant identification | Facilitated leasing of over 1.5 million sqm logistics space |

Customer Segments

Global institutional investors, including major pension funds, sovereign wealth funds, and insurance companies, are key clients for ESR. These entities are actively seeking diversified, stable, long-term returns from real asset investments, making ESR's focus on New Economy real estate particularly appealing. In 2024, global pension fund assets were projected to reach over $50 trillion, highlighting the immense capital available from this segment.

Asset managers also form a significant part of this customer segment, leveraging ESR's integrated fund management capabilities to access specialized real estate opportunities. They are drawn to ESR's track record and expertise in managing complex portfolios, aiming to enhance their clients' overall investment performance. The demand for real estate as an inflation hedge continues to be a strong driver for these investors.

Major e-commerce giants and large brick-and-mortar retailers with a substantial online presence are key customers. These businesses, like Amazon or Walmart, demand cutting-edge, strategically positioned logistics and distribution facilities to optimize their complex supply chains. They prioritize solutions offering speed, scalability, and technological integration for rapid order fulfillment.

ESR addresses this by providing advanced warehousing that directly supports their need for efficient last-mile delivery and broad market reach. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, underscoring the immense demand for sophisticated logistics infrastructure to serve this growing sector.

Third-Party Logistics (3PL) providers are a crucial customer segment for ESR, as they rely on strategically located, high-quality facilities to manage outsourced logistics for their clients. These companies, which handle warehousing, distribution, and fulfillment, need flexible space to adapt to the varying demands of their diverse customer base. ESR’s network of modern logistics assets directly supports these 3PL operations, enabling them to optimize supply chains efficiently.

Hyperscale and Cloud Technology Companies

Hyperscale and cloud technology companies are key customers for ESR, needing massive, high-performance data centers. These giants, like Amazon Web Services, Microsoft Azure, and Google Cloud, require robust power, advanced cooling, and superior connectivity to manage their extensive computing and data storage needs. ESR's specialized data center solutions are designed to meet these exacting demands.

The global hyperscale data center market is experiencing significant growth. For instance, in 2024, the market size was estimated to be around $270 billion, with projections indicating a compound annual growth rate of over 15% in the coming years. This expansion is driven by the ever-increasing demand for cloud services, artificial intelligence, and big data analytics, all of which necessitate vast data center capacity.

- Demand for Scalability: Hyperscalers need facilities that can quickly scale up or down based on fluctuating workloads.

- Connectivity Hubs: Proximity to major network exchange points and robust fiber optic infrastructure are critical for low latency.

- Power and Cooling Efficiency: High power densities and efficient cooling systems are essential for operational cost savings and environmental sustainability.

- Security and Reliability: Uninterrupted operations and stringent physical and digital security measures are paramount.

Emerging Technology and Data-Driven Businesses

Emerging technology and data-driven businesses, extending beyond major hyperscalers, represent a significant customer segment for data center providers like ESR. This group encompasses a wide array of companies, including artificial intelligence (AI) specialists, advanced analytics firms, and other businesses heavily reliant on processing and storing vast amounts of data. These enterprises often require flexible and scalable data center solutions to accommodate their rapid growth and evolving infrastructure needs.

ESR caters to this dynamic market by offering adaptable solutions, such as colocation services and smaller, dedicated data halls. This approach allows these businesses to secure the necessary capacity without the commitment of massive, purpose-built facilities. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the immense demand for robust data infrastructure to support these innovations.

The need for reliable and scalable data center capacity is paramount for these companies. They often operate in fast-paced environments where downtime can be extremely costly. ESR's ability to provide tailored solutions ensures these businesses can maintain operational continuity and scale their infrastructure efficiently as their data demands increase. The growth in cloud computing, which underpins many of these data-driven businesses, saw continued expansion in 2024, with global cloud spending expected to exceed $1 trillion.

- Customer Focus: AI firms, data analytics companies, and other data-intensive businesses.

- Infrastructure Needs: Scalable capacity, colocation services, and smaller dedicated data halls.

- Market Context (2024): Global AI market projected over $200 billion; continued growth in cloud computing spending.

- ESR Value Proposition: Adaptable solutions supporting rapid growth and evolving infrastructure requirements.

ESR's customer base is diverse, encompassing global institutional investors like pension funds and sovereign wealth funds seeking stable, long-term returns from real assets. Asset managers also leverage ESR's expertise to access specialized real estate opportunities, enhancing client portfolios. These segments are driven by the ongoing demand for real estate as an inflation hedge.

Major e-commerce players and large retailers with significant online operations are critical customers, requiring advanced, strategically located logistics facilities for efficient supply chains. ESR provides cutting-edge warehousing to support rapid fulfillment and broad market reach. The global e-commerce market's projected growth to over $6.3 trillion in 2024 highlights this demand.

Third-Party Logistics (3PL) providers depend on ESR's high-quality, well-located facilities to manage outsourced logistics for their clients. These companies need flexible space to adapt to varying customer demands, and ESR's modern assets facilitate optimized supply chain operations.

Hyperscale and cloud technology companies are key clients for ESR's data centers, needing massive, high-performance facilities with robust power and cooling. The hyperscale data center market, valued around $270 billion in 2024, is growing rapidly due to demand for cloud services and AI.

Emerging technology firms, including AI specialists and data analytics companies, also form a significant segment. They require scalable and flexible data center solutions, such as colocation services, to support their rapid growth. The global AI market's projected size of over $200 billion in 2024 underscores the need for robust data infrastructure.

| Customer Segment | Key Needs | 2024 Market Context/Data |

|---|---|---|

| Global Institutional Investors | Stable, long-term returns, diversification | Global pension fund assets projected over $50 trillion |

| Asset Managers | Access to specialized real estate, enhanced client performance | Continued demand for real estate as inflation hedge |

| E-commerce & Retailers | Strategically located, advanced logistics for supply chains | Global e-commerce market projected over $6.3 trillion |

| 3PL Providers | Flexible, high-quality warehousing and distribution space | Demand driven by outsourced logistics needs |

| Hyperscale/Cloud Companies | Massive, high-performance data centers, power, cooling | Hyperscale data center market ~$270 billion, >15% CAGR |

| Emerging Tech/Data Firms | Scalable, flexible data center solutions (colocation) | Global AI market projected over $200 billion |

Cost Structure

Property development and construction costs represent a major capital outlay for ESR, encompassing land acquisition, architectural design, and the physical building of logistics and data center facilities. These expenses are fundamental to expanding their operational footprint and meeting market demand.

These costs include a broad spectrum of expenditures such as raw materials like steel and concrete, skilled labor wages, the rental or purchase of specialized construction machinery, and fees for project management and engineering services. For instance, in 2023, ESR reported significant capital expenditures, with a substantial portion allocated to development projects, reflecting the scale of these investments.

The sheer magnitude of these property development and construction costs directly dictates the initial capital investment required for each new facility. This makes efficient cost management and strategic project planning critical for ESR's profitability and growth trajectory.

The acquisition of prime land in key Asia Pacific markets is a significant expenditure for ESR. For instance, in 2023, ESR's investment in land and development properties amounted to approximately US$13.6 billion, highlighting the substantial capital required for this foundational element of their business model.

These costs are inherently variable, influenced by factors like the specific city, the acreage secured, and prevailing real estate market dynamics. Securing strategically positioned land is paramount for ESR's ongoing expansion and ability to develop high-demand logistics and industrial facilities.

ESR's Property Operating and Maintenance Expenses are the ongoing costs tied to keeping its vast real estate portfolio in top shape. These include essentials like utilities, regular repairs, security, cleaning services, and the salaries for property management teams. These recurring expenses are crucial for maintaining asset quality and tenant satisfaction.

For instance, in 2024, ESR reported significant spending in this area to ensure its logistics and data center facilities met high operational standards. These costs are fundamental to the performance and longevity of their real estate assets, directly impacting their ability to generate rental income.

Fund Management and Administrative Costs

ESR's fund management and administrative costs are significant, reflecting the operational demands of managing a diverse portfolio of real estate investments. These expenses include the salaries and bonuses for their dedicated investment management teams, who are responsible for sourcing, acquiring, and managing assets across various geographies and property types. For instance, in 2024, ESR continued to invest in talent to support its growth, with compensation for specialized roles in asset management, acquisitions, and portfolio oversight forming a core part of this cost base.

Beyond personnel, ESR incurs substantial costs for legal and compliance functions, ensuring adherence to the complex regulatory frameworks governing investment funds in each market. Marketing and investor relations activities, crucial for attracting and retaining capital from institutional investors, also contribute to these overheads. General administrative expenses, such as office rent, technology, and operational support, further underpin the management of its investment vehicles.

- Salaries and Bonuses: Compensation for investment professionals, asset managers, and support staff.

- Legal and Compliance: Fees for legal counsel, regulatory filings, and ongoing compliance monitoring.

- Marketing and Fundraising: Costs associated with investor outreach, roadshows, and marketing materials.

- General Administrative Overhead: Office expenses, technology, and other operational support costs.

Financing and Interest Expenses

ESR's cost structure includes significant financing and interest expenses, primarily stemming from debt used to fund property acquisitions, development projects, and general corporate operations. These costs are crucial as they directly impact profitability.

Interest payments on loans and bond issuances represent a substantial portion of these expenses. For instance, in 2023, ESR's finance costs amounted to approximately $800 million USD, reflecting the capital-intensive nature of real estate development and investment. Efficiently managing these financing costs is paramount for optimizing ESR's capital structure and ensuring sustained profitability.

- Interest on Loans: Costs incurred from borrowing funds for property development and acquisitions.

- Bond Issuances: Expenses related to raising capital through the issuance of corporate bonds.

- Debt Management: The ongoing cost of servicing various forms of debt used for operational and strategic purposes.

- Impact on Profitability: Financing costs directly reduce net income, making their efficient management a key performance indicator.

ESR's cost structure is heavily influenced by property development and construction expenses, which are fundamental to their growth. These include land acquisition, design, and the physical building of facilities, representing a significant capital outlay. For example, in 2023, ESR’s investment in land and development properties reached approximately US$13.6 billion, underscoring the scale of these initial investments.

Ongoing property operating and maintenance costs are also crucial for maintaining asset quality and tenant satisfaction. These recurring expenses cover utilities, repairs, security, and management staff. In 2024, ESR allocated substantial funds to ensure their facilities met high operational standards, directly impacting their ability to generate rental income.

Fund management and administrative costs are significant, encompassing salaries for investment teams, legal and compliance, marketing, and general overhead. These operational demands support the management of their diverse real estate portfolio. Finally, financing and interest expenses, particularly from debt used for acquisitions and development, represent a substantial cost. In 2023, ESR's finance costs were around $800 million USD, highlighting the impact of capital-intensive operations on profitability.

Revenue Streams

ESR's core revenue originates from the consistent rental income derived from its extensive portfolio of logistics and data center properties. This recurring income is secured through long-term leases with a wide array of tenants, primarily from the e-commerce, logistics, and technology sectors, ensuring a predictable and stable cash flow stream.

The financial performance of this segment is directly tied to the scale of ESR's operational footprint and its ability to maintain high occupancy rates across its properties. For instance, as of the first half of 2024, ESR reported a robust portfolio occupancy rate of 97%, underscoring the strong demand for its modern logistics and data center spaces.

ESR generates revenue through fund management fees, charging institutional investors a percentage of the assets they manage. For instance, as of the first half of 2024, ESR reported a significant portion of its revenue derived from these management and performance fees, reflecting its extensive real estate portfolio under management.

This consistent income stream, tied to Assets Under Management (AUM), underscores ESR's core competency in large-scale real estate portfolio operations and capital raising, providing stability irrespective of market fluctuations.

Beyond its management fees, ESR also earns revenue from performance-based fees, commonly known as carried interest. This occurs when ESR's investment funds surpass predefined return thresholds, typically around 8% annually. For instance, in 2023, ESR's funds demonstrated robust performance, enabling the realization of carried interest, although specific figures for this stream are often reported at the fund level and can fluctuate significantly year-to-year based on market conditions and investment success.

Development Profits and Property Sales

ESR also generates revenue from the profits it makes on developing properties and then selling them. This can be to external buyers or even to its own investment funds, always at the current market price. This revenue stream highlights the value ESR adds through its development skills and understanding of market timing.

While this can be a substantial income source, it's also less predictable than other revenue streams. For instance, in 2024, ESR's development profit and property sales were a key contributor to its financial performance, with the company reporting significant gains from its logistics and industrial property portfolio sales across Asia Pacific. Specific figures for this segment often fluctuate based on market conditions and the timing of property completions and disposals.

- Development Profits: Income earned from the difference between the cost of developing a property and its sale price.

- Property Sales: Revenue generated from the outright sale of completed properties.

- Market Timing: Realizing profits depends on selling properties when market values are favorable.

- Predictability: This revenue stream is variable and dependent on development cycles and market demand.

Asset Management and Advisory Fees

ESR generates revenue through asset management and advisory fees, which are distinct from its core fund management charges. These fees are typically project-based or service-based, reflecting ESR's deep operational expertise. For instance, ESR might charge for specific services like property optimization, managing tenant fit-outs, or offering strategic advice to its fund investors and direct clients, thereby enhancing its income streams by leveraging its specialized knowledge.

These supplementary fees allow ESR to monetize its hands-on operational capabilities. For example, in 2024, ESR continued to focus on value-added services for its portfolio companies and investors. While specific figures for these ancillary fees are often embedded within broader financial reports, the strategy is to capture additional value beyond basic fund administration. This approach directly complements the core fund management fees by capitalizing on ESR's extensive experience in real estate development and management.

- Property Optimization Fees: Charges for enhancing asset performance and value.

- Tenant Fit-out Management: Fees for overseeing and executing tenant-specific interior modifications.

- Strategic Advisory Services: Compensation for providing expert guidance on real estate investment and development strategies to clients.

- Project-Based Service Fees: Revenue generated from specific, time-bound operational or management tasks undertaken for investors or fund entities.

ESR's revenue streams are diverse, primarily driven by rental income from its vast logistics and data center portfolio, supplemented by fees from managing investment funds and generating profits from property development and sales.

The company's ability to maintain high occupancy rates, such as the 97% achieved in the first half of 2024, is crucial for its rental income stability. Furthermore, performance fees and property development profits, as seen with significant gains from portfolio sales in 2024, contribute to its overall financial performance, though these can be more variable.

ESR also leverages its expertise through asset management and advisory fees, offering specialized services that create additional income channels. These fees, while often embedded in broader reports, highlight the company's strategy to capitalize on its operational capabilities and market knowledge.

| Revenue Stream | Description | Key Drivers | 2024 Data/Context |

|---|---|---|---|

| Rental Income | Income from leasing logistics and data center properties. | Occupancy rates, lease terms, rental rates. | 97% portfolio occupancy (H1 2024). |

| Fund Management Fees | Fees charged on Assets Under Management (AUM). | Scale of AUM, management agreements. | Significant portion of revenue derived from these fees (H1 2024). |

| Performance Fees (Carried Interest) | Profits earned when investment funds exceed return thresholds. | Fund performance, market conditions, hurdle rates. | Realized in 2023 based on fund performance; fluctuates annually. |

| Development Profits & Property Sales | Profits from developing and selling properties. | Development execution, market timing, property valuations. | Key contributor in 2024 with significant gains from APAC portfolio sales. |

| Asset Management & Advisory Fees | Fees for specialized services like property optimization or strategic advice. | Operational expertise, client demand for services. | Focus on value-added services for portfolio companies and investors in 2024. |

Business Model Canvas Data Sources

The ESR Business Model Canvas is informed by comprehensive market research, internal operational data, and customer feedback. These sources provide a robust foundation for understanding our value proposition, customer segments, and revenue streams.