Equinox Gold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

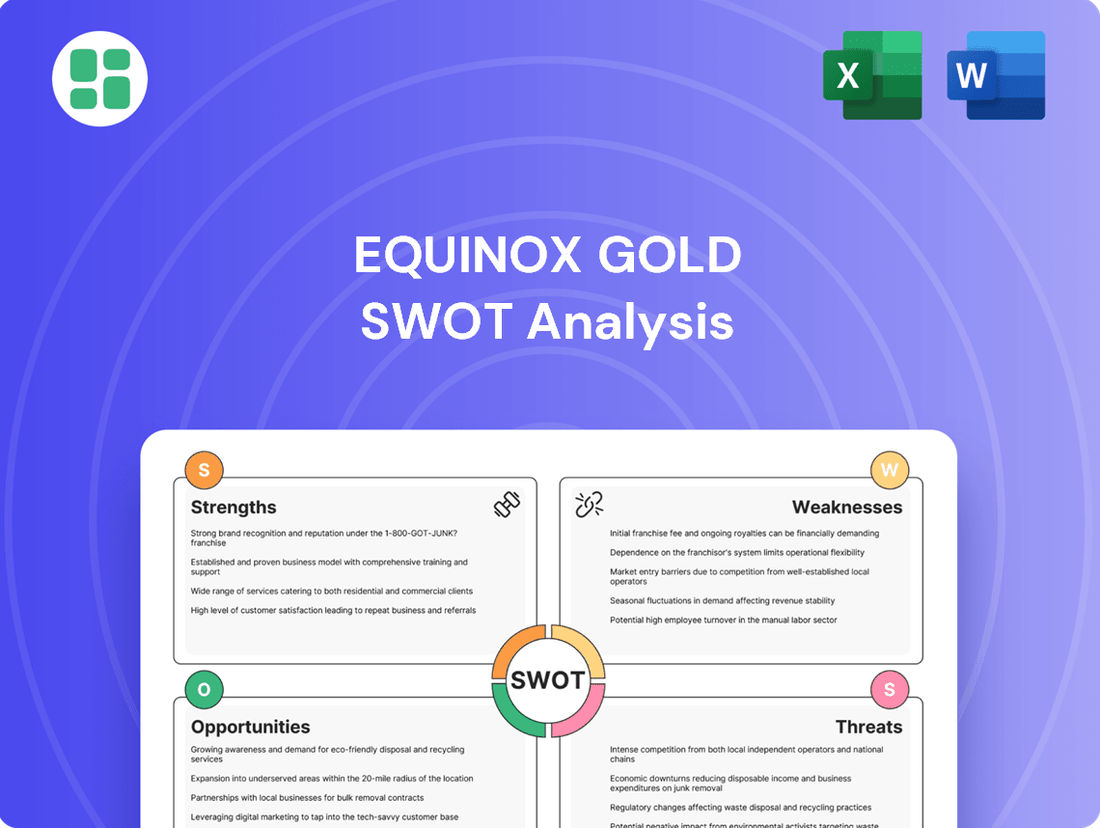

Equinox Gold's strengths lie in its growing production and strategic mine portfolio, but potential weaknesses include operational challenges and reliance on commodity prices. The company faces opportunities in expanding its existing mines and exploring new discoveries, yet must navigate threats from regulatory changes and environmental concerns.

Want the full story behind Equinox Gold's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Equinox Gold demonstrated robust operational performance, achieving record gold production in both Q4 2024 and the full year 2024, with 213,960 ounces and 621,870 ounces respectively. This momentum continued into 2025, as the company reported its highest ever first-quarter production, exceeding 145,000 ounces of gold.

A key driver for this impressive output was the successful ramp-up and commencement of commercial production at the Greenstone Mine. Equinox Gold's full ownership of Greenstone, secured in May 2024, has significantly contributed to these operational milestones and production growth.

Equinox Gold boasts a geographically diverse asset portfolio spanning the Americas, including operations in Canada, the USA, Mexico, and Brazil. This spread across multiple jurisdictions inherently reduces the company's exposure to region-specific political or operational risks.

The strategic merger with Calibre Mining in late 2023 significantly amplified this diversification, bringing in valuable assets in Nicaragua and Newfoundland & Labrador. This expansion solidifies Equinox Gold's position as a more resilient and broadly spread gold producer, with projected combined production reaching approximately 1 million ounces in 2024.

Equinox Gold's strategic growth is a significant strength, highlighted by its acquisition of Calibre Mining in February 2025 for $1.8 billion. This move firmly established the combined company as a major player among North America's largest gold producers.

Furthermore, the company's robust development pipeline, including key projects like Greenstone, Valentine, and expansions at Castle Mountain, is crucial. These projects are designed to propel Equinox Gold towards its ambitious goal of exceeding one million ounces of gold production annually.

Commitment to Responsible Mining and ESG Performance

Equinox Gold demonstrates a strong commitment to responsible mining and Environmental, Social, and Governance (ESG) performance. Its 2024 Sustainability Report highlights significant achievements, including a 31% improvement in environmental performance year-over-year. The company also reported zero tailings or heap leach-related environmental or safety incidents, underscoring its dedication to operational integrity.

Further strengthening its ESG profile, Equinox Gold increased its social investments to US$10.1 million in 2024. This focus on community engagement and development, coupled with consistently strong safety records across all its operations, positions the company favorably in the eyes of stakeholders.

- Responsible Mining Practices: Emphasized in the 2024 Sustainability Report.

- Environmental Performance: Achieved a 31% improvement compared to 2023.

- Safety Record: Zero tailings or heap leach-related incidents and strong overall safety performance.

- Social Investment: Increased to US$10.1 million in 2024.

Strong Financial Position and Liquidity

Equinox Gold boasts a robust financial standing, underscored by its liquidity. As of the close of 2024, the company reported approximately $240 million in cash and cash equivalents, complemented by readily accessible credit facilities. This strong balance sheet is a testament to its operational efficiency and strategic financial management.

The company's financial resilience was further evidenced by its Q4 2024 performance, which saw a significant rebound driven by record gold production and elevated sales volumes. This surge in output and revenue directly translated into enhanced cash flow generation, reinforcing the company's ability to meet its financial obligations and pursue growth opportunities.

- Solid Liquidity: Approximately $240 million in cash and equivalents at year-end 2024, plus available credit.

- Record Production: Q4 2024 featured record gold production, boosting sales and revenue.

- Cash Flow Generation: Increased sales and production directly contributed to positive cash flow.

- Foundation for Growth: Ample liquidity supports ongoing operations and future strategic initiatives.

Equinox Gold's operational execution is a core strength, evidenced by achieving record gold production in Q4 2024 (213,960 ounces) and for the full year 2024 (621,870 ounces). This upward trend continued into Q1 2025, with production exceeding 145,000 ounces, marking a new quarterly high. The successful ramp-up and full ownership of the Greenstone Mine, secured in May 2024, were pivotal to this performance, significantly boosting output and contributing to growth. The company's strategic expansion, including the acquisition of Calibre Mining in February 2025 for $1.8 billion, solidified its position as a major North American gold producer, with projected combined production around 1 million ounces for 2024.

| Metric | Q4 2024 | Full Year 2024 | Q1 2025 |

|---|---|---|---|

| Gold Production (ounces) | 213,960 | 621,870 | >145,000 |

| Key Mine Contribution | Greenstone Mine ramp-up | Greenstone Mine ramp-up | Greenstone Mine ramp-up |

| Strategic Acquisition Impact | N/A | Calibre Mining (late 2023) | Calibre Mining (Feb 2025) |

What is included in the product

Delivers a strategic overview of Equinox Gold’s internal and external business factors, highlighting its operational strengths and market opportunities while acknowledging potential financial and operational weaknesses and competitive threats.

Offers a clear, actionable framework to identify and mitigate risks, turning potential weaknesses into strategic advantages for Equinox Gold.

Weaknesses

The ramp-up at Equinox Gold's Greenstone Gold Mine has faced operational hurdles, with its progress since achieving commercial production in Q4 2024 falling behind initial projections. Mine productivity and equipment availability have not met anticipated levels.

These operational shortfalls have directly impacted mining rates, consequently delaying access to richer ore zones at Greenstone. This situation has necessitated a revision of the company's 2025 production guidance for the mine.

Such challenges in operational execution can have a significant ripple effect, potentially hindering overall production targets and negatively impacting cost efficiencies across the company's operations.

Operations at Equinox Gold's Los Filos mine faced a significant hurdle with a suspension stemming from unresolved community agreement issues. This disruption directly impacted the company's financial performance in Q1 2025, leading to higher per-unit production costs and a dampening effect on overall profitability.

The prolonged suspension at Los Filos created uncertainty regarding the resumption of full operations, posing an ongoing risk to Equinox Gold's production targets and ultimately its financial outlook for the 2024-2025 period.

Equinox Gold's heavy reliance on gold as its primary revenue source makes it particularly vulnerable to the inherent volatility of commodity prices. For instance, while gold prices averaged around $2,300 per ounce in early 2024, significant drops could quickly erode profit margins.

This dependence on a single commodity means that market swings, driven by global economic factors and investor sentiment, directly impact the company's financial health. A substantial decline in gold prices, even if Equinox Gold maintains efficient operations, could significantly compress its profitability and cash flow.

Higher Operating Costs and Adjusted Net Loss

Equinox Gold experienced higher operating costs in the first quarter of 2025, leading to an adjusted net loss despite increased revenue. This was primarily driven by elevated finance expenses and losses on foreign exchange contracts.

The company's all-in sustaining costs (AISC) per ounce remain a concern, especially when factoring in the performance of the Los Filos mine. For instance, in Q1 2025, the AISC at Los Filos was reported at $1,473 per ounce, significantly higher than other operations and impacting overall profitability.

- Increased Finance Expenses: Q1 2025 saw a notable rise in finance costs, contributing to the net loss.

- Foreign Exchange Losses: Realized losses on foreign exchange contracts further impacted the company's bottom line.

- High AISC at Los Filos: The Los Filos mine reported an AISC of $1,473 per ounce in Q1 2025, a key driver of higher overall operating costs.

- Profitability Pressure: Elevated costs can squeeze margins, particularly if gold prices do not keep pace with these expenses.

Integration Risks from Acquisitions

The recent significant merger with Calibre Mining, finalized in early 2024, while strategically sound, introduces substantial integration risks. Successfully merging two large mining operations necessitates meticulous management of diverse operational expertise, distinct corporate cultures, and disparate IT systems to unlock the projected synergies and cost efficiencies.

Failure to execute this integration seamlessly could result in significant operational disruptions, potentially delaying the realization of expected benefits and impacting production targets. For instance, the combined entity must align its exploration strategies and mine development plans across multiple jurisdictions, a complex undertaking that could face unforeseen hurdles.

- Integration Challenges: Merging Calibre Mining into Equinox Gold's operations presents a complex integration task.

- Synergy Realization: Achieving anticipated cost savings and operational efficiencies hinges on effective integration of systems and cultures.

- Operational Risks: Mishandling the integration could lead to disruptions in mining activities and impact production schedules.

- Cultural Alignment: Bridging the cultural differences between the two organizations is crucial for smooth collaboration and talent retention.

Equinox Gold's operational execution at Greenstone has been slower than anticipated, impacting mining rates and delaying access to higher-grade ore. This has led to a downward revision of 2025 production forecasts for the mine, potentially affecting overall company output and cost efficiency.

The suspension at the Los Filos mine due to community issues in Q1 2025 significantly hurt financial performance, increasing per-unit costs and reducing profitability. This ongoing uncertainty at Los Filos poses a direct risk to Equinox Gold's production targets and financial outlook for the 2024-2025 period.

The company's heavy reliance on gold makes it susceptible to price volatility; for example, a drop in gold prices could compress margins. Higher operating costs, including finance expenses and foreign exchange losses, contributed to a net loss in Q1 2025, with Los Filos's high all-in sustaining cost (AISC) of $1,473 per ounce in Q1 2025 being a particular concern.

The recent merger with Calibre Mining, while strategic, introduces significant integration risks. Failure to align operations, cultures, and systems could lead to disruptions, delay synergy realization, and impact production targets, as seen in the complex task of aligning exploration and development plans across multiple jurisdictions.

| Weakness | Impact | Key Metric/Event |

| Greenstone Mine Operational Ramp-up | Delayed access to richer ore, revised 2025 guidance | Mine productivity and equipment availability below projections |

| Los Filos Mine Community Issues | Suspension, increased costs, reduced profitability | Q1 2025 AISC at Los Filos: $1,473/oz |

| Gold Price Volatility | Erodes profit margins, impacts cash flow | Gold prices averaged ~$2,300/oz in early 2024 |

| High Operating Costs | Net loss in Q1 2025, pressure on margins | Elevated finance expenses and FX losses in Q1 2025 |

| Merger Integration Risks | Potential operational disruptions, delayed synergies | Merger with Calibre Mining completed early 2024 |

Full Version Awaits

Equinox Gold SWOT Analysis

The preview you see is the actual Equinox Gold SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown covers the company's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. Purchase unlocks the entire in-depth version, ready for your immediate use.

Opportunities

The Greenstone Mine, now fully owned by Equinox Gold, offers a prime opportunity for enhanced gold production as it progresses towards its peak operational capacity. This ramp-up is crucial for the company's growth trajectory.

Optimizing mining and processing at Greenstone is key to unlocking higher gold volumes and achieving better cost management. This operational refinement will directly impact profitability and output.

By 2024, Greenstone is anticipated to be a cornerstone of Equinox Gold's portfolio, projected to contribute significantly to the company's overall gold output, potentially reaching hundreds of thousands of ounces annually, and becoming one of its most cost-effective mines.

Equinox Gold is making significant strides with its development pipeline, notably the Valentine Gold Mine, now fully owned after the Calibre acquisition, and the Castle Mountain Phase 2 expansion. These projects are on track for construction completion or progressing through crucial permitting stages, setting the stage for future growth.

The Castle Mountain project's inclusion in the FAST-41 federal permitting program is a key development. This program is designed to accelerate environmental reviews and approvals for critical infrastructure projects, potentially shaving valuable time off the development schedule and de-risking the path to production.

These advancement efforts are projected to substantially boost Equinox Gold's future gold output. For instance, Valentine is expected to produce approximately 190,000 ounces of gold annually in its first five years, while Castle Mountain Phase 2 aims for an average of 130,000 ounces per year over a decade, significantly enhancing the company's long-term value proposition.

The merger with Calibre Mining significantly bolsters Equinox Gold's operational footprint, creating a larger, more diversified gold producer. This strategic move expands its presence to five countries across the Americas, enhancing resilience against localized operational or political risks.

This increased scale and geographic diversification are expected to translate into greater operational flexibility. The combined entity is projected to achieve higher annual gold production, strengthening its market position and making it a more attractive prospect for investors.

Exploration Upside and Resource Expansion

Equinox Gold is actively pursuing exploration, with a multi-rig drill program in place. This program continues to uncover significant new high-grade gold mineralization at its existing operations, like the El Limon mine. These ongoing efforts hold the promise of considerable growth in mineral resources and the potential for entirely new discoveries across their substantial land holdings.

The company’s commitment to exploration is directly linked to extending the operational life of its mines and ensuring consistent, sustainable gold production. For instance, at El Limon, recent drilling in Q1 2024 returned impressive grades, such as 11.5 meters grading 7.65 g/t gold, highlighting the success of their expansion strategy.

- Exploration Success: Ongoing drilling at existing sites like El Limon continues to yield high-grade gold intercepts.

- Resource Growth Potential: Active exploration programs across extensive land packages offer significant opportunities for expanding the mineral resource base.

- Mine Life Extension: Resource expansion is vital for increasing the long-term mine life and ensuring sustained production levels.

- New Discoveries: The company's vast land holdings present the possibility of identifying entirely new gold deposits.

Leveraging Favorable Gold Market Conditions

Equinox Gold is poised to benefit significantly from the current gold market, with prices hovering near record highs. This strong pricing environment directly translates into enhanced revenue and robust cash flow generation from their operational mines. The company can leverage this favorable backdrop to optimize the profitability of its existing assets and potentially accelerate growth initiatives.

The sustained strength in gold prices, which saw the commodity trade above $2,300 per ounce for much of late 2023 and early 2024, presents a substantial opportunity. For instance, a hypothetical 10% increase in average realized gold prices could significantly boost Equinox Gold's earnings per share, assuming stable production costs. This market dynamic provides a solid foundation for the company to maximize value extraction from its portfolio.

- Record Gold Prices: Gold prices have consistently traded near all-time highs, exceeding $2,300/oz in early 2024, offering a lucrative environment.

- Enhanced Revenue: Higher gold prices directly increase revenue generated from Equinox Gold's mining operations.

- Improved Cash Flow: Stronger revenue streams translate into improved operating cash flow, providing financial flexibility.

- Maximizing Asset Returns: The favorable market allows Equinox Gold to capitalize fully on the value of its producing gold assets.

The company's strategic acquisitions and development projects are key growth drivers. The full ownership of Greenstone, coupled with the Valentine Gold Mine and Castle Mountain Phase 2 expansion, are projected to significantly increase Equinox Gold's annual gold production in the coming years.

Exploration success, particularly at mines like El Limon, demonstrates the potential for resource growth and mine life extension. For example, Q1 2024 drilling at El Limon yielded 11.5 meters grading 7.65 g/t gold, highlighting ongoing high-grade intercepts.

The current strong gold market, with prices near record highs above $2,300 per ounce in early 2024, provides a substantial tailwind. This environment directly enhances revenue and cash flow from operations, allowing the company to maximize returns from its assets.

The merger with Calibre Mining has created a larger, more diversified producer with a presence in five countries, enhancing operational resilience and market position. This increased scale is expected to lead to higher overall gold output and greater financial flexibility.

| Project | Expected Annual Production (First 5 Years) | Status |

|---|---|---|

| Greenstone | Hundreds of thousands of ounces | Ramping up to peak capacity |

| Valentine Gold Mine | ~190,000 ounces | On track for construction completion |

| Castle Mountain Phase 2 | ~130,000 ounces | Progressing through permitting (FAST-41) |

Threats

Equinox Gold faces a significant threat from operational underperformance and cost overruns. The slower-than-expected ramp-up at its Greenstone mine, coupled with lower-than-anticipated mined grades and equipment availability issues, directly jeopardizes the company's ability to meet its production and cost targets for 2024 and beyond.

This operational drag is likely to push all-in sustaining costs higher than projected, negatively impacting profitability. For instance, if Greenstone's production falls short of its 2024 guidance, it could significantly widen the gap between actual and planned cost per ounce.

Furthermore, the inherent complexity of optimizing operations across Equinox Gold's diverse portfolio of mines presents a persistent challenge, potentially leading to increased operational expenditures and diminished overall efficiency, thereby eroding shareholder value.

The suspension of operations at Equinox Gold's Los Filos mine in Mexico during 2023 due to community disputes underscores the significant geopolitical and social risks in mining. This halt directly impacted production, with the company reporting a substantial decrease in gold output for the period affected by these community relations issues. Securing and maintaining robust, long-term agreements with host communities is paramount to avoid such disruptive operational interruptions and ensure consistent cash flow.

A sharp drop in gold prices poses a significant threat to Equinox Gold. For instance, if gold prices were to fall by 10% from current levels, it could directly impact revenue streams.

Furthermore, increasing operational expenses due to higher energy, labor, and supply costs can squeeze profit margins. In 2023, many mining companies experienced increased energy costs, which directly affected their bottom lines.

Permitting Delays and Regulatory Hurdles

While Equinox Gold's Castle Mountain project benefits from FAST-41 status to expedite permitting, the broader reality for new or expanded mining operations involves intricate and time-consuming regulatory approval pathways. These processes can introduce significant uncertainty. For instance, in 2023, the mining industry globally continued to grapple with extended permitting timelines, impacting project economics and investor confidence.

Delays in securing essential permits or shifts in environmental regulations pose a direct threat by pushing back project schedules and inflating capital costs. This directly impacts Equinox Gold's strategic planning and financial projections. For example, a delay of even a few months in a critical permit could add millions to development expenses.

- Extended Permitting Timelines: Mining projects frequently encounter multi-year approval processes, creating inherent project development risks.

- Regulatory Uncertainty: Evolving environmental standards and political considerations can lead to unexpected hurdles and increased compliance costs.

- Impact on Production Ramp-Up: Delays in regulatory approvals can directly hinder Equinox Gold's ability to commence or expand production at key assets, affecting revenue forecasts.

Execution Risk of Strategic Initiatives

Equinox Gold faces significant execution risk concerning its major strategic initiatives, particularly the full integration of Calibre Mining and the ramp-up of the Greenstone mine. Management's ability to smoothly integrate acquired assets and overcome operational hurdles at key sites like Greenstone is critical. For instance, delays or cost overruns at Greenstone, which was projected to contribute significantly to production in 2024, could directly impact the company's ability to meet its output targets and realize anticipated synergies.

Failure to achieve these integration and ramp-up objectives could lead to a substantial shortfall in expected production volumes and financial performance. This risk directly impacts the realization of growth strategies, potentially undermining investor confidence and the company's valuation.

- Calibre Mining Integration: Successful integration is key to unlocking projected synergies and operational efficiencies.

- Greenstone Mine Ramp-up: Meeting production targets at Greenstone is vital for 2024/2025 output and financial forecasts.

- Operational Challenges: Unforeseen issues at any of Equinox Gold's key mines could derail strategic plans.

- Financial Impact: Execution failures can negatively affect revenue, profitability, and investor sentiment.

Equinox Gold faces substantial threats from fluctuating gold prices and rising operational costs. A significant drop in the price of gold directly impacts revenue, while increasing expenses for energy, labor, and supplies can severely compress profit margins. For example, many mining operations in 2023 saw their bottom lines squeezed by higher energy expenditures.

The company is also vulnerable to extended permitting timelines and regulatory uncertainty, which can delay crucial projects and inflate capital costs. These delays, common across the mining sector in 2023, create significant financial and strategic risks for Equinox Gold's development plans.

Furthermore, operational underperformance, such as the slower-than-expected ramp-up at the Greenstone mine and issues with mined grades, directly jeopardizes production and cost targets for 2024 and 2025. These challenges can lead to higher all-in sustaining costs, negatively impacting profitability and shareholder value.

Geopolitical and social risks, exemplified by the 2023 suspension at the Los Filos mine due to community disputes, pose a constant threat to uninterrupted operations and consistent cash flow. Maintaining strong community relations is vital to mitigate these disruptions.

SWOT Analysis Data Sources

This Equinox Gold SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a well-informed and accurate assessment.