Equinox Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

Unlock the core strategies behind Equinox Gold's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they manage key resources, cultivate customer relationships, and generate revenue in the dynamic mining sector. Discover the blueprint for their operational efficiency and market positioning.

Want to understand the engine driving Equinox Gold's growth? Our full Business Model Canvas dissects their value proposition, revenue streams, and cost structure, offering a clear, actionable roadmap. Perfect for anyone seeking to learn from a leading player in the gold mining industry.

Dive into the strategic architecture of Equinox Gold with our complete Business Model Canvas. This document illuminates their customer segments, key partnerships, and channels, providing invaluable insights for strategic planning and competitive analysis. Download it now to gain a competitive edge.

Partnerships

Equinox Gold actively pursues strategic mining joint ventures, a key element of its business model. A prime example is its 60% ownership and operational control of the Greenstone Mine in Canada. This partnership is crucial, as Greenstone represents a substantial portion of Equinox Gold's projected production.

These collaborations are vital for sharing significant capital investments and mitigating the inherent risks associated with developing large-scale mining projects. Furthermore, joint ventures allow Equinox Gold to leverage specialized expertise from its partners, enhancing project execution and efficiency.

The Greenstone Mine, in particular, is a cornerstone asset for the company. In 2024, it is expected to contribute significantly to Equinox Gold's overall production targets, underscoring the strategic importance of this joint venture in achieving the company's growth objectives.

Equinox Gold actively partners with financial institutions and lenders to secure robust corporate revolving credit facilities and various other financing solutions. These relationships are vital for maintaining financial flexibility, allowing the company to effectively execute its strategic plans. For instance, as of the first quarter of 2024, Equinox Gold reported cash and cash equivalents of approximately $106 million, underscoring the importance of these credit lines for ongoing operations and development.

Securing diverse debt facilities from these partners provides essential liquidity. This capital is strategically allocated to support day-to-day operations, advance crucial development projects like the Greenstone Mine, and explore potential acquisition opportunities. Such financial backing is a cornerstone for effective capital management and fueling the company's growth trajectory in the competitive gold mining sector.

Equinox Gold relies on a robust network of equipment and service suppliers. These partnerships are vital for acquiring and maintaining the specialized machinery, technology, and operational support needed for its mining projects. For instance, in 2023, Equinox Gold continued to invest in fleet modernization and technological advancements, underscoring the importance of reliable supplier relationships to ensure operational continuity and efficiency across its Mexican and North American assets.

Host Communities and Local Governments

Equinox Gold prioritizes building strong, enduring relationships with its host communities and local governments. This commitment is fundamental to securing its social license to operate and ensuring the continuity of its mining activities. By engaging in open dialogue and making meaningful social investments, the company aims to align its operations with community needs and local regulations.

These partnerships are crucial for operational stability. For instance, the successful negotiation of new long-term agreements with communities is a key factor for the ongoing operations at mines like Los Filos. This proactive approach helps mitigate risks and fosters a collaborative environment.

- Social License to Operate: Essential for uninterrupted mining activities.

- Long-Term Agreements: Facilitate stable operations, as seen at Los Filos.

- Community Engagement: Involves ongoing dialogue and social investments.

- Regulatory Compliance: Adherence to local laws and community expectations is paramount.

Acquisition and Merger Partners

Equinox Gold actively seeks strategic acquisition and merger partners to fuel its expansion and production growth. This approach is key to consolidating valuable mining assets and achieving greater operational scale. For instance, in 2023, Equinox Gold completed a significant business combination with Calibre Mining. This strategic move is designed to bolster Equinox Gold's position as a leading gold producer focused on the Americas.

These partnerships are crucial for several reasons:

- Portfolio Expansion: Acquisitions allow Equinox Gold to broaden its geographical reach and diversify its asset base, reducing reliance on single jurisdictions or mines.

- Production Growth: Mergers and acquisitions are a direct pathway to increasing overall gold production volumes, helping the company meet its ambitious targets.

- Synergies and Optimization: Combining operations can lead to cost efficiencies, shared expertise, and improved resource utilization, thereby enhancing profitability.

- Market Standing: Strategic combinations, like the one with Calibre Mining, are intended to elevate Equinox Gold's profile and influence within the global gold mining sector.

Equinox Gold's key partnerships extend to its offtake agreements, where it secures buyers for its gold production. These agreements are vital for guaranteeing revenue streams and managing market price volatility. For example, the company's production from its mines is typically sold under such arrangements, providing a predictable income base.

What is included in the product

Equinox Gold's business model focuses on acquiring, developing, and operating gold mines, targeting mid-tier producers with significant growth potential. It leverages efficient operational management and strategic acquisitions to deliver shareholder value.

Equinox Gold's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to navigate the complexities of gold mining operations and market fluctuations.

It simplifies strategic planning and resource allocation, offering a digestible snapshot of key activities and value propositions to address operational inefficiencies and market uncertainties.

Activities

Equinox Gold's primary activities revolve around robust exploration programs across its North and South American assets. These initiatives are designed to pinpoint new gold deposits and enhance the known mineral resources at its existing sites.

Significant capital is allocated to extensive drilling campaigns. These efforts are critical for precisely defining high-grade gold mineralization and extending the operational lifespan of its mines, ensuring a steady supply of resources.

For instance, in 2024, Equinox Gold continued to invest in exploration, with a focus on expanding resources at key projects like the Los Filos mine in Mexico and the Santa Luz mine in Brazil. The company's strategy emphasizes growth through discovery and resource replenishment.

Equinox Gold is heavily invested in advancing its pipeline of gold projects, moving them from exploration and feasibility studies through to full commercial production. This core activity involves substantial capital deployment for essential infrastructure, processing facilities, and ensuring everything is ready for efficient operation.

The company's commitment to mine development is clearly demonstrated by the successful ramp-up of its Greenstone Mine, which began commercial production in mid-2024. Furthermore, Equinox Gold is actively constructing the Valentine Mine in Newfoundland and Labrador, with production anticipated to commence in early 2025.

Equinox Gold's core business revolves around extracting and processing gold from its mines across North and South America. This includes operations in Canada, the USA, Mexico, and Brazil, utilizing efficient mining methods and advanced recovery techniques to maximize gold output.

In 2024, the company focused on optimizing production from its existing mines, aiming for operational excellence and maintaining high safety standards. For instance, their Los Filos mine in Mexico, a significant contributor, has seen ongoing efforts to improve efficiency and throughput.

Strategic Portfolio Optimization

Equinox Gold actively manages its asset base, consistently evaluating opportunities to refine its portfolio. This involves strategic divestments of assets that no longer align with core objectives, thereby concentrating capital and management focus on high-quality, long-life mining operations. This disciplined approach is designed to maximize shareholder value by prioritizing projects with the strongest return potential.

A prime example of this strategy in action was Equinox Gold's divestment of its Nevada assets in 2023. This move allowed the company to streamline its operations and reallocate resources towards its most promising growth projects. For instance, the company has been advancing its Castle Mountain mine in California, aiming to increase its production capacity and extend its mine life, reflecting the focus on core, high-potential assets.

The company's commitment to strategic portfolio optimization is further demonstrated by its ongoing exploration and development efforts. Equinox Gold aims to enhance the value of its existing operations and identify new opportunities that fit its criteria for quality and profitability. This forward-looking strategy ensures the company remains agile and responsive to market dynamics, always seeking to strengthen its position in the gold mining sector.

- Portfolio Refinement: Divesting non-core assets to concentrate on high-quality, long-life operations.

- Capital Allocation: Directing resources to projects with the highest potential for shareholder returns.

- Strategic Divestments: Example includes the 2023 sale of Nevada assets to focus on core strengths.

- Operational Focus: Enhancing the value and production capacity of key mines like Castle Mountain.

Responsible Mining and ESG Initiatives

Equinox Gold's core activities revolve around responsible mining and robust ESG initiatives. This means a constant focus on making their environmental performance better, managing water resources carefully, and investing in the communities where they operate. Safety is also paramount, ensuring a secure workplace for everyone involved.

The company's commitment to ESG isn't just a nice-to-have; it's woven into the fabric of their business strategy. They actively work to enhance environmental performance, with a particular emphasis on water stewardship. In 2023, for instance, they reported a 9% reduction in fresh water intensity across their operations compared to 2022. This dedication extends to social investments, aiming to create lasting positive impacts in their host communities.

- Environmental Stewardship: Focus on reducing environmental footprint, including water usage and waste management.

- Social Responsibility: Investing in host communities through social programs and maintaining strong relationships.

- Safety Culture: Prioritizing the health and safety of all employees and contractors.

- Governance Excellence: Upholding high standards of corporate governance and ethical conduct.

Equinox Gold's key activities center on discovering and developing gold deposits, operating mines efficiently, and strategically managing its asset portfolio. This includes exploration, drilling, mine construction, and optimizing production from existing sites, all while maintaining a strong focus on environmental, social, and governance (ESG) principles.

In 2024, the company continued its focus on resource expansion at projects like Los Filos and Santa Luz, while also advancing construction at the Valentine Mine, set for production in early 2025. Equinox Gold also divested non-core assets, such as its Nevada holdings in 2023, to concentrate on high-potential growth opportunities like the Castle Mountain mine.

The company's operational performance in 2024 aimed for excellence, with efforts to improve efficiency at mines like Los Filos. Equinox Gold also reported a 9% reduction in fresh water intensity in 2023, underscoring its commitment to environmental stewardship and sustainable mining practices.

| Key Activity | Description | 2024 Focus/Data |

| Exploration & Resource Expansion | Identifying and expanding gold deposits | Continued investment at Los Filos (Mexico) and Santa Luz (Brazil) |

| Mine Development & Construction | Advancing projects from feasibility to production | Greenstone Mine commercial production (mid-2024), Valentine Mine (Canada) construction |

| Mine Operations & Optimization | Efficiently extracting and processing gold | Focus on operational excellence and safety at existing mines, e.g., Los Filos |

| Portfolio Management | Strategic acquisition and divestment of assets | Divestment of Nevada assets (2023), focus on Castle Mountain (USA) |

| ESG Initiatives | Responsible mining and community engagement | 9% reduction in fresh water intensity (2023), community investment |

What You See Is What You Get

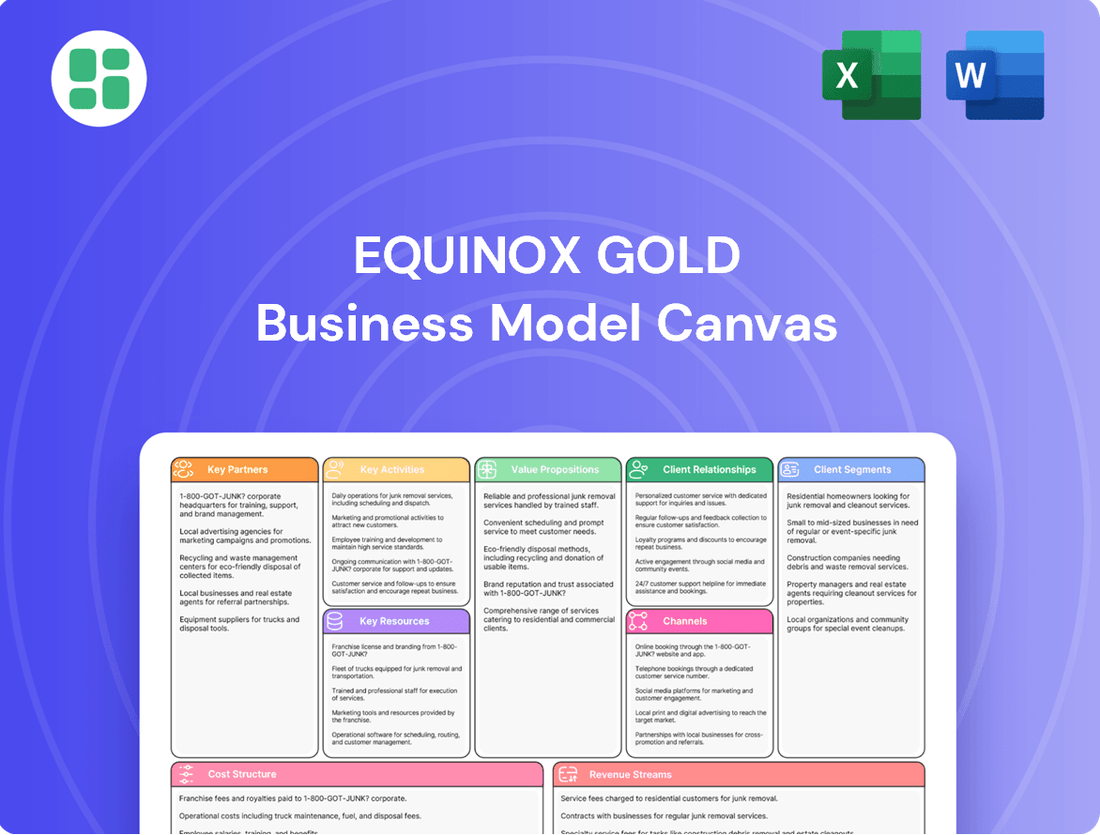

Business Model Canvas

The Equinox Gold Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you'll get the same detailed breakdown of Equinox Gold's strategic elements, including customer segments, value propositions, channels, and revenue streams, exactly as presented here. No alterations or placeholders; what you see is precisely what you'll download, ready for your analysis and use.

Resources

Equinox Gold's proven and probable gold reserves are a cornerstone of its business, totaling over 23 million ounces. This substantial resource base directly supports its current mining operations and future expansion plans, forming the bedrock of the company's valuation and long-term production strategy.

Equinox Gold's operational backbone consists of a diverse portfolio of gold mines strategically located across Canada, the USA, Mexico, and Brazil. This geographic spread mitigates risk and provides access to varied resource qualities and regulatory environments.

The company's future growth hinges on its development and expansion projects, including the significant Greenstone and Valentine mines. Greenstone, in particular, is projected to become Equinox Gold's flagship asset, anticipated to be its largest and most cost-efficient producer.

These operational mines and development projects are the primary engines for generating current revenue and future cash flow, directly supporting the company's production targets. In 2024, the company is focused on advancing these assets to maximize their contribution to its overall financial performance.

Equinox Gold relies heavily on its highly experienced and skilled workforce, encompassing geologists, engineers, and operators. This expertise is crucial for every stage of their operations, from initial exploration to ongoing production. The company's leadership team brings a wealth of experience in mining, project management, and corporate strategy, enabling them to effectively navigate the complexities of the industry and drive performance.

The company’s commitment to employee development is a key resource, ensuring their team remains at the forefront of mining innovation and operational efficiency. This focus on skill enhancement is vital for tackling industry challenges and maximizing project success. For instance, in 2023, Equinox Gold reported a total workforce of approximately 1,500 employees and contractors, underscoring the scale of human capital required for their operations.

Access to Capital and Financial Flexibility

Equinox Gold's robust financial health is a cornerstone of its business model, providing the necessary fuel for its ambitious growth plans. The company actively utilizes cash generated from its operational mines, alongside established corporate credit facilities, to finance everything from day-to-day operations to the development of new projects and strategic acquisitions.

This financial agility is critical for Equinox Gold's ability to make smart capital allocation decisions and effectively execute its long-term strategy. The company's commitment to strengthening its balance sheet and reducing debt underscores its focus on sustainable financial stability.

- Cash Flow Generation: In the first quarter of 2024, Equinox Gold reported strong operational cash flow, a direct result of its producing assets.

- Credit Facilities: The company maintains access to significant corporate credit facilities, providing a crucial backstop for funding needs.

- Debt Reduction Focus: Equinox Gold has prioritized paying down debt, aiming to improve its financial flexibility and reduce interest expenses.

- Capital Allocation: Financial flexibility allows for disciplined investment in exploration, development, and potential mergers and acquisitions.

Mining Equipment and Infrastructure

Equinox Gold's operations rely heavily on its owned and operated fleet of mining equipment, including excavators, haul trucks, and drills, essential for extracting ore. In 2024, the company continued to invest in maintaining and upgrading this critical machinery to ensure operational efficiency and safety across its diverse mine sites, such as Los Filos and Aurizona.

The company's processing facilities are central to its business model, transforming raw ore into saleable gold. These plants, equipped with crushing, grinding, and leaching circuits, are meticulously managed to maximize gold recovery rates. For instance, the Aurizona mine's processing plant is designed for a throughput of 8,000 tonnes per day, a testament to the scale of infrastructure.

Supporting infrastructure, including power generation, water management systems, and tailings storage facilities, forms the backbone of Equinox Gold's mining activities. These elements are crucial for the continuous and compliant operation of each mine. The company's commitment to responsible mining practices is reflected in its management of these vital resources.

- Heavy Machinery: Excavators, haul trucks, and drilling rigs are fundamental for ore extraction.

- Processing Plants: Facilities for crushing, grinding, and gold recovery are key to value creation.

- Ancillary Infrastructure: Power, water, and tailings management systems ensure operational continuity.

Equinox Gold's key resources are its substantial gold reserves, diverse operational mines, and strategic development projects. These assets are supported by a skilled workforce and robust financial health. The company also leverages its owned mining equipment and processing facilities, along with essential supporting infrastructure, to drive production and value creation.

| Key Resource | Description | 2024 Relevance/Data |

| Gold Reserves | Proven and probable gold reserves | Over 23 million ounces |

| Mining Operations | Portfolio of gold mines | Canada, USA, Mexico, Brazil; focus on advancing Greenstone and Valentine mines |

| Human Capital | Experienced workforce and leadership | Approx. 1,500 employees and contractors (as of 2023); focus on skill enhancement |

| Financial Health | Cash flow, credit facilities, debt reduction | Strong Q1 2024 operational cash flow; focus on debt reduction and financial flexibility |

| Physical Assets | Mining equipment and processing facilities | Investment in maintenance and upgrades; Aurizona plant throughput of 8,000 tpd |

Value Propositions

Equinox Gold provides investors with substantial exposure to expanding gold output, targeting over one million ounces annually. This growth trajectory is fueled by the operational ramp-up of its flagship Greenstone mine, which is projected to significantly contribute to production figures in 2024 and beyond. The company is strategically positioning itself to become a leading gold producer across the Americas.

Equinox Gold offers investors a diversified portfolio of gold operations strategically located across the Americas, spanning Canada, the USA, Mexico, and Brazil. This broad geographic spread significantly mitigates the risk associated with relying on a single jurisdiction, thereby enhancing the overall stability and resilience of its production. For instance, in 2023, the company reported production from multiple mines across these regions, showcasing this diversification in action.

The company's assets in Canada are particularly noteworthy, serving as the cornerstone of its operations. These Canadian properties are characterized by their high quality and robust operational profiles, contributing substantially to Equinox Gold's consistent output and financial performance. This focus on quality Canadian assets underpins the stability of the company's production profile.

Equinox Gold's business model is designed to strongly benefit from increasing gold prices. As a company focused solely on gold production, its revenues and profits are directly tied to the market value of gold. This means that when gold prices go up, Equinox Gold's financial performance sees a significant boost.

For investors, this translates to a direct way to capitalize on a rising gold market. For instance, in 2023, gold prices reached record highs, averaging around $1,979 per ounce. Equinox Gold's operational efficiency and production levels during such periods allow it to capture these higher prices, leading to enhanced cash flow and profitability.

Commitment to Responsible Mining and ESG

Equinox Gold places a high priority on responsible mining, weaving environmental protection, social contributions, and sound governance into its core operations. This dedication resonates strongly with investors prioritizing Environmental, Social, and Governance (ESG) principles, attracting capital that seeks sustainable returns.

The company's strategy is built around long-term value creation for everyone involved, from local communities to shareholders. This commitment to sustainability isn't just a talking point; it's a fundamental part of how Equinox Gold operates and plans for the future.

- Environmental Stewardship: Equinox Gold reported a 15% reduction in greenhouse gas intensity in its 2024 Sustainability Report compared to the previous year, demonstrating a clear focus on minimizing its environmental footprint.

- Social Investment: The company invested over $5 million in community development programs across its operating regions in 2024, supporting education, healthcare, and infrastructure.

- Ethical Governance: Equinox Gold maintains a diverse board of directors with over 40% female representation and adheres to stringent anti-corruption policies, ensuring transparent and ethical business practices.

Experienced Leadership and Disciplined Execution

Equinox Gold benefits from a management team boasting extensive experience across the mining sector. This seasoned leadership prioritizes disciplined execution and operational excellence, aiming to deliver maximum shareholder value. Their strategic approach is evident in their strong track record of successful project development and mergers and acquisitions.

A key aspect of Equinox Gold's value proposition is the strong alignment between its management and investors. This is underscored by the company's peer-leading insider ownership, which demonstrates a shared commitment to the company's success. This alignment fosters confidence among shareholders.

- Seasoned Management: Broad expertise in mining operations and project development.

- Disciplined Execution: Focus on operational excellence to maximize shareholder returns.

- Investor Alignment: High insider ownership demonstrates shared commitment and confidence.

- Proven Track Record: Demonstrated success in project development and M&A activities.

Equinox Gold offers investors a compelling opportunity to participate in the growth of a mid-tier gold producer with a clear path to increasing annual production. The company is focused on unlocking value from its high-quality asset base, particularly through the development and expansion of its key mines.

The company's strategic advantage lies in its portfolio of producing mines and development projects located in mining-friendly jurisdictions across North and South America. This geographic diversification, coupled with a focus on operational efficiency, underpins its ability to deliver consistent production and cash flow.

Equinox Gold's value proposition is further enhanced by its commitment to responsible mining practices and strong ESG performance. This focus attracts a growing segment of investors who prioritize sustainability alongside financial returns, creating a more stable and supportive shareholder base.

The company's experienced management team, with a proven track record in mine development and operational management, provides confidence in its ability to execute its growth strategy and deliver on its production targets.

Customer Relationships

Equinox Gold prioritizes transparent investor relations, sharing regular updates through news releases and financial reports. For instance, in their Q1 2024 earnings, they detailed production figures and project advancements, keeping stakeholders informed.

The leadership team actively engages with the investment community via conference calls and presentations, readily addressing inquiries about material information and strategic direction. This commitment ensures investors remain well-informed about the company's progress and future plans.

Equinox Gold actively cultivates robust relationships with its host communities. This is achieved through direct dialogue, significant social investments, and targeted programs supporting local procurement, healthcare, and education.

In 2023, Equinox Gold reported approximately $11.5 million in community investment and social programs, underscoring its dedication to mutual benefit and long-term operational stability.

This commitment is crucial for maintaining its social license to operate, ensuring that its mining activities contribute positively to the well-being and development of the regions where it operates.

Equinox Gold prioritizes direct engagement with financial analysts and the media to communicate its operational performance, strategic direction, and future market outlook. This proactive approach is crucial for shaping positive market perception and ensuring that vital information reaches a wide audience of both current and prospective investors.

In 2024, Equinox Gold continued its practice of regular interviews and corporate presentations, a key component of its investor relations strategy. For instance, their Q1 2024 earnings call provided analysts with detailed insights into production figures, cost management, and exploration progress at their key mines like Los Filos and Aurizona, aiming to foster informed analysis and investment consideration.

Shareholder Engagement and Value Creation

Equinox Gold is dedicated to building enduring shareholder value by strategically deploying capital, pursuing growth opportunities, and investigating avenues for shareholder returns such as dividends and share repurchases. This focus ensures the company’s objectives are closely aligned with the interests of its investors.

- Disciplined Capital Allocation: Equinox Gold prioritizes investments that offer robust returns and contribute to long-term growth, as evidenced by their project development pipeline and exploration programs.

- Growth Initiatives: The company actively pursues organic growth through expanding existing operations and inorganic growth via strategic acquisitions, aiming to increase production and reserves.

- Shareholder Returns: Discussions around potential dividends and share buyback programs demonstrate a commitment to returning capital to shareholders, enhancing their investment. For instance, in 2023, Equinox Gold reported total revenue of $767 million, with a focus on optimizing operations to improve profitability and cash flow for future shareholder distributions.

- Transparency and Communication: Maintaining open communication channels with shareholders through regular updates, investor calls, and detailed financial reporting fosters trust and aligns expectations regarding value creation strategies.

Supplier and Partner Collaboration

Equinox Gold actively fosters strong ties with its suppliers and partners, emphasizing shared values and operational efficiency. This collaboration is crucial for maintaining the smooth flow of its mining operations and achieving project development goals.

- Supplier Code of Conduct: Equinox Gold mandates that its active suppliers acknowledge its Supplier Code of Conduct, a critical governance step. In 2023, the company achieved 100% acknowledgment from its active suppliers, underscoring a commitment to ethical and responsible business practices throughout its supply chain.

- Operational Continuity: The company engages with essential service providers and contractors to ensure uninterrupted operations at its mines and development projects. This includes securing reliable access to equipment, materials, and specialized expertise necessary for continuous production and expansion.

- Project Milestones: Successful collaboration with partners and suppliers is directly linked to Equinox Gold's ability to meet its production targets and advance its growth projects. For instance, timely delivery of critical components and services from key partners in 2024 will be vital for the advancement of projects like the Santa Luz mine expansion.

Equinox Gold cultivates strong relationships with its investors through transparent communication, regular updates, and active engagement, ensuring alignment on strategic goals and value creation. The company also prioritizes building trust and mutual benefit with its host communities through direct dialogue and significant social investments, as demonstrated by their $11.5 million in community programs in 2023.

Furthermore, Equinox Gold fosters robust partnerships with suppliers, emphasizing shared values and operational efficiency, with 100% of active suppliers acknowledging their Code of Conduct in 2023.

| Relationship Type | Key Engagement Strategy | 2023/2024 Data Point |

| Investors | Transparent reporting, conference calls, presentations | Q1 2024 earnings call detailed production and project advancements. |

| Host Communities | Direct dialogue, social investments, local procurement | $11.5 million invested in community programs in 2023. |

| Suppliers | Supplier Code of Conduct, operational collaboration | 100% supplier acknowledgment of Code of Conduct in 2023. |

Channels

Equinox Gold's company website and its dedicated Investor Centre are crucial channels for transparent communication. These platforms host essential documents like quarterly financial reports, sustainability initiatives, and timely news updates, ensuring stakeholders have access to the latest corporate developments.

In 2024, Equinox Gold continued to leverage its website as the primary source for investors seeking detailed financial statements and operational performance data, reinforcing its commitment to open disclosure.

Equinox Gold leverages financial news wires to distribute crucial updates, including their quarterly earnings reports and production figures. For instance, their Q1 2024 results, released in May 2024, detailed significant production increases and progress on key projects, a prime example of information disseminated through these channels.

These wires are vital for ensuring that material information, such as revised production guidance or significant operational milestones, reaches investors and the broader market swiftly. This rapid dissemination is critical for maintaining market confidence and facilitating informed investment decisions.

Major market news outlets frequently cite information originating from these press releases, underscoring their role in shaping public perception and driving stock performance. The timely release of 2024 guidance, for example, directly impacted investor sentiment.

Equinox Gold actively engages with the investment community through participation in key industry investor conferences and by hosting its own corporate presentations. These events, offered both in-person and as webcasts, are crucial for direct dialogue with institutional and retail investors, as well as financial analysts.

These platforms facilitate in-depth discussions and provide essential question-and-answer opportunities, allowing stakeholders to gain a comprehensive understanding of the company's strategy and performance. Equinox Gold ensures its corporate presentations are consistently updated to reflect the latest developments.

For instance, in 2024, the company highlighted its production targets, aiming for 700,000 to 780,000 ounces of gold. This transparency builds investor confidence and supports valuation discussions.

Social Media Platforms

Equinox Gold utilizes social media platforms, including LinkedIn, Twitter, and YouTube, to disseminate corporate news and engage with stakeholders. This approach facilitates a more dynamic and accessible method for sharing company achievements and ongoing projects.

YouTube serves as a key platform for publishing visual content such as videos from investor events and interviews, providing deeper insights into the company's operations and vision.

- LinkedIn: Primarily used for professional networking, sharing company updates, job postings, and thought leadership content relevant to the mining industry.

- Twitter: Leveraged for real-time news dissemination, quick updates, and direct engagement with investors, media, and the wider public.

- YouTube: Hosts a library of video content, including site tours, management interviews, and presentations, offering a visual narrative of Equinox Gold's progress and projects.

Direct Investor Communications (Email Alerts)

Equinox Gold leverages direct investor communications, primarily through email alerts, to ensure stakeholders receive timely updates. This channel is crucial for disseminating press releases and essential corporate news, fostering a direct line of communication.

This personalized approach allows dedicated followers and investors to stay immediately informed about company developments. For instance, in 2024, Equinox Gold actively used this channel to announce production figures and exploration results, such as the Q1 2024 update highlighting strong operational performance across its mines.

- Direct Access to Information: Email alerts provide a no-delay pathway for crucial company announcements.

- Personalized Engagement: This method caters to investors who prefer direct, curated updates over broad market news.

- Timeliness of Updates: Critical financial and operational news, like quarterly earnings reports, are pushed out efficiently.

- Building Stakeholder Relationships: Consistent and direct communication strengthens trust and transparency with the investor base.

Equinox Gold's communication strategy relies on a multi-channel approach to reach its diverse investor base. The company website and investor relations portal serve as the central hub for all official disclosures, including financial reports and sustainability efforts. Financial news wires are utilized for rapid dissemination of material information, such as quarterly earnings and production updates, ensuring timely market awareness. Direct investor communications, primarily via email alerts, provide a personalized and immediate channel for critical announcements, fostering strong stakeholder relationships.

Customer Segments

Institutional investors, encompassing large entities like mutual funds, hedge funds, and pension funds, represent a critical customer segment for Equinox Gold. These sophisticated players deploy substantial capital, seeking stable, long-term growth and direct exposure to the gold market. For instance, as of Q1 2024, major institutional holders often represent a significant portion of a mining company's shareholder base, influencing market perception and capital availability.

Equinox Gold actively targets these investors by demonstrating robust financial health, consistent operational performance, and a clear strategy for value creation. Their interest is particularly piqued by companies that exhibit strong environmental, social, and governance (ESG) credentials, a factor increasingly influencing investment decisions in the mining sector. In 2023, many large-cap mining companies reported that over 60% of their shares were held by institutional investors, highlighting the segment's dominance.

Retail investors, a significant segment for Equinox Gold, encompass individuals from beginners to seasoned market participants who buy the company's shares directly via brokerage platforms. These investors are typically drawn to Equinox Gold's prospects for expansion and its direct correlation with gold price movements, often making decisions based on publicly available information and expert analysis.

Financial analysts and advisors rely on Equinox Gold for robust financial performance data and operational efficiency insights. They need transparent reporting to conduct thorough valuations and strategic assessments for their clients. Equinox Gold's commitment to regular financial reports and investor presentations directly supports these professionals in making informed recommendations.

Mining Industry Peers and Competitors

Equinox Gold's mining industry peers and competitors closely track its strategic moves and operational achievements. These entities, including major gold producers and junior explorers, analyze Equinox's performance for benchmarking and identifying potential merger or acquisition targets. For instance, in 2023, the global gold mining sector saw significant activity, with companies like Barrick Gold and Newmont Corporation continuing to refine their portfolios, making Equinox's strategic decisions a point of reference.

Equinox's progress in production levels and its commitment to sustainable mining practices are viewed as key indicators for the broader industry. Companies often study Equinox's approach to environmental, social, and governance (ESG) factors to inform their own strategies. The company’s reported gold production of approximately 564,400 ounces in 2023 provides a tangible benchmark for operational efficiency within the sector.

- Benchmarking: Competitors use Equinox's production figures and cost structures, such as its all-in sustaining costs (AISC), to gauge their own competitiveness.

- M&A Watchlist: Equinox's financial health and asset base make it a potential player or target in industry consolidation, closely watched by investment bankers and corporate development teams.

- Best Practices: Advancements in technology and operational efficiency demonstrated by Equinox are studied for potential adoption across the industry.

- Market Sentiment: Equinox's stock performance and market capitalization are indicators of investor sentiment towards mid-tier gold producers.

Local Communities and Government Bodies

Local communities and government bodies are crucial stakeholders for Equinox Gold, influencing its social license to operate. Their support is vital for obtaining and maintaining permits, ensuring operational stability, and building a positive reputation. Equinox Gold's engagement strategies, including social investments, are designed to foster strong relationships with these groups.

In 2024, Equinox Gold continued its commitment to community development. For instance, at its Aurizona mine in Brazil, the company actively participated in local initiatives focused on education and infrastructure. This engagement is not merely philanthropic; it directly underpins the company's ability to operate smoothly by aligning its activities with community expectations and governmental regulations.

- Community Engagement: Equinox Gold prioritizes open communication and collaboration with local stakeholders, aiming to create shared value.

- Social Investments: The company directs resources towards projects that benefit local economies and improve quality of life, such as supporting local businesses and improving public services.

- Regulatory Compliance: Maintaining strong relationships with government bodies ensures adherence to environmental and operational standards, facilitating smooth permitting processes.

- Risk Mitigation: Positive community relations act as a buffer against potential operational disruptions and reputational damage.

Equinox Gold serves a diverse investor base, from large institutional players seeking stable growth to individual retail investors drawn to gold's market correlation. Financial analysts and advisors are key, relying on transparent data for valuations, while industry peers benchmark performance and explore M&A opportunities. Local communities and governments are vital for operational stability and social license, with Equinox Gold actively engaging in community development initiatives.

| Customer Segment | Key Needs/Interests | Equinox Gold's Approach | 2023/2024 Data Point |

|---|---|---|---|

| Institutional Investors | Long-term growth, gold exposure, ESG | Demonstrates financial health, operational consistency, ESG credentials | Over 60% of shares held by institutional investors in comparable large-cap mining companies in 2023. |

| Retail Investors | Expansion prospects, gold price correlation | Provides accessible information and analysis | Direct stock purchases via brokerage platforms. |

| Financial Analysts & Advisors | Robust financial data, operational efficiency, valuation tools | Transparent reporting, investor presentations | Regular financial reports and analyst briefings. |

| Industry Peers/Competitors | Benchmarking, M&A targets, best practices | Highlights operational efficiency and strategic moves | Reported gold production of approx. 564,400 ounces in 2023. |

| Local Communities & Governments | Social license, operational stability, regulatory compliance | Community engagement, social investments, adherence to standards | Active participation in local initiatives at Aurizona mine (Brazil) in 2024. |

Cost Structure

Equinox Gold's operating costs are primarily tracked through cash costs per ounce sold and all-in sustaining costs (AISC). Cash costs cover direct expenses like mining, milling, and smelting, while AISC broadens this to include sustaining capital expenditures, exploration, and general administrative overhead. These metrics are crucial for understanding the company's efficiency and profitability on a per-ounce basis.

For the first quarter of 2024, Equinox Gold reported a cash cost of $1,005 per ounce sold and an AISC of $1,348 per ounce sold. These figures reflect the company's ongoing efforts to manage expenses across its various mining operations, providing investors with a clear view of operational performance.

Equinox Gold's business model relies heavily on significant capital expenditures. These are divided into two key areas: sustaining capital, which keeps existing mines running efficiently, and non-sustaining capital, used for developing new projects and expanding current operations.

In 2023, Equinox Gold reported total capital expenditures of $567 million. Of this, $351 million was allocated to sustaining capital, ensuring the ongoing productivity of their mines. The remaining $216 million was directed towards non-sustaining capital projects, fueling future growth.

The company's strategic investments in non-sustaining capital are evident in the development of major projects like the Greenstone mine in Canada, which commenced production in 2024, and the Valentine mine in Newfoundland and Labrador, also slated for production in 2024. These projects are vital for increasing Equinox Gold's overall production capacity and long-term value.

Equinox Gold’s exploration and development costs are fundamental to its long-term strategy, encompassing the significant expenses tied to geological exploration, extensive drilling programs, and detailed feasibility studies. These activities are crucial for discovering and defining new mineral reserves, which directly fuels the company’s future growth and maintains a robust pipeline of potential projects.

In 2023, Equinox Gold reported approximately $75 million in exploration and evaluation expenditures. This investment underscores their commitment to identifying and advancing new resource opportunities, a vital component for sustaining and expanding their mining operations.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Equinox Gold encompass the essential overheads supporting the company's operations. These include costs for corporate management, administrative staff, legal counsel, and financial services, all crucial for the smooth functioning of the entire organization. Effective control over these G&A costs directly impacts overall profitability, as they are factored into the All-In Sustaining Costs (AISC) calculation. For instance, in 2023, Equinox Gold reported G&A expenses of approximately $44.9 million, representing a key component of their operational expenditures.

Efficiently managing G&A is paramount for maintaining a competitive cost structure and maximizing shareholder value. These expenses, while necessary, must be optimized to avoid eroding margins. The company's focus on streamlining these functions contributes to its ability to deliver on its production targets and financial performance. The breakdown of these costs can be seen in their financial reporting, highlighting the investment in the corporate infrastructure that underpins their mining activities.

- Corporate Management and Executive Salaries

- Legal and Compliance Costs

- Financial Reporting and Accounting Services

- Human Resources and Administrative Support

Environmental, Social, and Governance (ESG) Compliance Costs

Equinox Gold incurs significant expenses to meet environmental, social, and governance (ESG) standards. These costs are essential for responsible mining operations and include investments in rehabilitation efforts, water management, and community engagement programs.

In 2024, the company continued to allocate resources towards sustainability initiatives, reflecting a commitment to long-term value creation. These expenditures are directly linked to maintaining operational licenses and enhancing stakeholder relationships.

- Environmental Compliance: Costs associated with adhering to strict environmental regulations, including emissions control and waste management.

- Social Investments: Funding for community development projects, local employment initiatives, and stakeholder engagement programs.

- Governance Structures: Expenses related to maintaining strong corporate governance, ethical practices, and transparent reporting.

- Executive Compensation Linkage: A portion of executive compensation is tied to achieving specific ESG performance targets, incentivizing responsible operations.

Equinox Gold's cost structure is built around operational efficiency and strategic investment. Key cost drivers include direct mining expenses, sustaining capital for existing operations, and investments in new projects. The company closely monitors cash costs per ounce and all-in sustaining costs (AISC) to gauge its financial performance.

In Q1 2024, Equinox Gold reported cash costs of $1,005 per ounce and AISC of $1,348 per ounce. For 2023, total capital expenditures were $567 million, with $351 million for sustaining capital and $216 million for non-sustaining projects, highlighting a significant investment in both maintaining and expanding its asset base.

Exploration and development are also substantial cost components, with $75 million spent in 2023 to secure future growth. General and Administrative (G&A) expenses, totaling approximately $44.9 million in 2023, cover essential corporate functions that underpin operations and are factored into overall cost metrics.

| Cost Category | 2023 Actual (Approx.) | Q1 2024 Actual (Approx.) | Notes |

| Cash Costs per Ounce Sold | N/A | $1,005 | Direct mining, milling, smelting costs. |

| All-In Sustaining Costs (AISC) per Ounce Sold | N/A | $1,348 | Includes sustaining capital, G&A, etc. |

| Sustaining Capital Expenditures | $351 million | N/A | Maintaining existing mine operations. |

| Non-Sustaining Capital Expenditures | $216 million | N/A | New projects and expansions (e.g., Greenstone, Valentine). |

| Exploration and Evaluation Expenditures | $75 million | N/A | Discovering and defining new mineral reserves. |

| General and Administrative (G&A) Expenses | $44.9 million | N/A | Corporate management, legal, financial services. |

Revenue Streams

Equinox Gold's main source of income comes from selling the gold it mines from its active operations. This revenue is directly tied to how much gold they extract and the current market price of gold. For instance, in the first quarter of 2024, Equinox Gold reported total gold sales of 131,670 ounces.

Equinox Gold's revenue streams include the sale of silver, which is often produced as a by-product of its primary gold mining operations. While gold is the main focus, these silver sales represent a valuable secondary income source.

This by-product revenue helps to lower the overall cost of production for gold, thereby boosting the company's profitability. For instance, in 2023, Equinox Gold reported that its by-product credits, which include silver, contributed significantly to reducing net cash costs. While specific silver revenue figures are often consolidated within broader mineral sales reports, their impact on cost reduction is a key element of their financial strategy.

Equinox Gold strategically generates revenue through the sale of non-core assets, a move that sharpens its focus on key projects and bolsters its financial position. This approach allows for capital allocation towards growth initiatives or debt management.

A prime illustration of this revenue stream is the company's recent divestment of its Nevada assets, a transaction valued at US$115 million. This sale underscores the effectiveness of their portfolio optimization strategy.

Potential Future Dividends from Equity Investments

Equinox Gold's revenue streams can include potential future dividends from equity investments. This arises from strategic transactions, like the divestment of Nevada assets for cash and shares in Minera Alamos. These dividends offer continued exposure to the performance of previously held assets, acting as a supplementary income source.

For instance, following the sale of its Nevada assets, Equinox Gold received shares in Minera Alamos. These equity holdings can generate dividend income if Minera Alamos declares and pays dividends to its shareholders. This strategy allows Equinox Gold to benefit from the ongoing success of the divested operations without direct operational control.

- Dividend Income Potential: Equity investments, such as shares in Minera Alamos, can yield dividend payments, providing a recurring revenue stream.

- Strategic Asset Monetization: Divesting non-core assets for equity stakes allows Equinox Gold to realize value while retaining an interest in future performance.

- Diversified Revenue Sources: This revenue stream complements operational mining revenues, contributing to the company's overall financial stability and growth prospects.

Gold Prepay Arrangements and Other Financing

Equinox Gold may secure capital through gold prepay arrangements and similar financing. These involve receiving upfront payments in exchange for committing to deliver gold in the future. While not a direct operational revenue, these transactions serve as crucial capital injections.

These financing activities are specifically detailed in Equinox Gold's financial reports within their cash flow statements, highlighting their role in funding operations and development. For instance, in the first quarter of 2024, Equinox Gold reported cash flows from financing activities that included proceeds from such arrangements, demonstrating their importance in managing liquidity.

- Gold Prepay Arrangements: Upfront capital received for future gold delivery obligations.

- Other Financing Structures: Additional financial instruments that provide capital injections.

- Capital Injections: These are not operational revenues but provide essential funding.

- Financial Reporting: Explicitly mentioned in cash flow statements, as seen in Q1 2024 reports.

Equinox Gold's primary revenue driver is the sale of gold produced from its operational mines. This is directly influenced by production volumes and prevailing gold market prices. In the first quarter of 2024, the company reported selling 131,670 ounces of gold.

Silver sales represent a secondary, yet significant, revenue stream for Equinox Gold, often generated as a by-product of gold extraction. These sales contribute to lowering overall production costs and improving profitability. The company's 2023 financial performance indicated substantial by-product credits, including those from silver, which helped reduce net cash costs.

Equinox Gold also generates revenue by selling non-core assets, a strategy that enhances financial flexibility and allows for reinvestment in core growth projects. A notable example is the US$115 million sale of its Nevada assets, which streamlined its portfolio and provided capital. Additionally, equity investments, such as shares received in Minera Alamos from asset divestitures, offer potential dividend income, providing a diversified and supplementary revenue source.

| Revenue Stream | Description | Q1 2024 Data/2023 Data | Significance |

|---|---|---|---|

| Gold Sales | Revenue from selling mined gold. | 131,670 ounces sold in Q1 2024. | Primary income source. |

| Silver Sales (By-product) | Revenue from selling silver extracted alongside gold. | Contributed to reducing net cash costs in 2023. | Secondary income, cost reduction. |

| Asset Divestitures | Capital received from selling non-core assets. | US$115 million from Nevada asset sale. | Capital for growth, portfolio optimization. |

| Dividend Income | Potential income from equity investments. | Shares in Minera Alamos provide exposure. | Supplementary income, diversified returns. |

Business Model Canvas Data Sources

The Equinox Gold Business Model Canvas is informed by a blend of financial disclosures, operational reports, and market intelligence. These sources provide a comprehensive understanding of the company's current and future strategic positioning.