Equinox Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

Uncover the critical political and economic factors shaping Equinox Gold's operational landscape. Our PESTLE analysis dives deep into regulatory shifts and market volatility, offering you a clear view of potential opportunities and challenges. Invest in actionable intelligence – download the full report now to fortify your strategic decisions.

Political factors

Equinox Gold operates in countries like Mexico, Canada, and the United States, where political stability is generally high, but shifts in policy can still occur. For instance, changes in mining regulations or tax structures, while less common in these stable jurisdictions, could impact profitability and investment decisions. The risk of resource nationalism, though currently low in these specific regions, remains a background consideration for any mining company operating internationally.

Equinox Gold operates in jurisdictions like Mexico and Canada, where obtaining and maintaining mining permits can involve complex and time-consuming processes. Changes in environmental regulations, such as stricter tailing management rules or biodiversity protection requirements, could increase compliance costs and potentially delay project timelines. For instance, in 2024, several mining projects globally faced scrutiny over water usage and community engagement, highlighting the evolving regulatory landscape. Equinox Gold's proactive approach to community relations and environmental stewardship is crucial for navigating these challenges and ensuring continued operational success.

Changes in international trade policies, particularly those affecting mining inputs or finished gold products, can significantly impact Equinox Gold's operational costs and market access. For instance, the imposition of tariffs on mining equipment or reagents could increase capital expenditures and operating expenses. In 2024, ongoing trade discussions and potential protectionist measures in key markets could create uncertainty for global commodity flows.

Geopolitical tensions can disrupt supply chains and increase the cost of transporting materials and finished gold. If trade routes become less secure or more costly due to international disputes, Equinox Gold might face challenges in efficiently moving its products to buyers or sourcing necessary supplies. This could lead to increased logistics expenses and potential delays in sales realization.

International Relations and Geopolitical Risks

Global geopolitical tensions, such as ongoing conflicts and trade disputes, can significantly impact investor sentiment towards gold as a safe-haven asset. For Equinox Gold, which operates primarily in the Americas, instability in regions like Central America or South America could disrupt operations or affect local regulatory environments. For instance, heightened tensions in Latin America during 2024 could lead to increased volatility in gold prices, impacting Equinox's revenue streams.

These broader geopolitical risks can also influence supply chain resilience. Disruptions stemming from international sanctions or diplomatic standoffs could affect the availability and cost of essential mining equipment and supplies. Equinox Gold's diversified operational base across countries like Mexico, the United States, and Canada helps mitigate some of these risks, but it doesn't eliminate exposure to global economic and political shocks.

The overall stability of gold markets is intrinsically linked to global geopolitical events. For example, a major international conflict or a significant shift in global trade policies in 2024 could drive gold prices higher, benefiting Equinox Gold. Conversely, a period of prolonged global peace and economic prosperity might reduce demand for gold as an investment, potentially pressuring the company's profitability.

- Geopolitical Instability: Escalating conflicts or diplomatic tensions in key regions could increase gold's appeal as a safe-haven asset, potentially boosting Equinox Gold's revenue.

- Supply Chain Disruptions: International sanctions or trade wars could impact the cost and availability of mining inputs, affecting Equinox Gold's operational efficiency.

- Market Volatility: Global events can cause significant fluctuations in gold prices, directly influencing Equinox Gold's financial performance and investor confidence.

- Regional Operations Impact: Political instability in countries where Equinox Gold operates, such as Mexico or Brazil, poses direct risks to its mining activities and asset values.

Government Support and Incentives for Mining

Government support and incentives play a crucial role in the mining sector, directly impacting companies like Equinox Gold. Many countries actively seek to attract foreign investment in mining through various measures. For instance, in 2024, Mexico continued to offer tax incentives for mining exploration and production, aiming to boost the sector's contribution to its GDP, which stood at approximately 2.5% in 2023. These policies can significantly enhance a company's profitability and operational efficiency by reducing capital expenditure and operational costs.

Equinox Gold's operating regions often benefit from specific government programs designed to foster mining development. In Canada, for example, provincial governments frequently offer tax credits for exploration activities. British Columbia, a key province for mining, has historically provided incentives that have helped junior miners and established companies alike advance their projects. Such support can de-risk early-stage exploration and accelerate the development of new mining operations, ultimately improving the financial outlook for companies like Equinox Gold.

Furthermore, governments often invest in essential infrastructure that supports mining operations, such as roads, ports, and power grids. These developments, often undertaken to attract foreign direct investment, reduce logistical challenges and operational costs for mining companies. For example, ongoing infrastructure projects in parts of South America, where Equinox Gold has interests, are designed to improve access to remote mining sites. These initiatives can directly translate into enhanced profitability and operational efficiency for the company.

- Tax Breaks: Governments in key mining jurisdictions offer reduced corporate tax rates or specific tax credits for exploration and capital expenditures.

- Infrastructure Development: Public investment in transportation networks, energy supply, and water management benefits mining operations by lowering logistical and operational costs.

- Foreign Investment Policies: Stable regulatory frameworks and policies designed to attract and protect foreign investment encourage capital inflow for mining projects.

- Royalties and Fees: While not strictly incentives, predictable and competitive royalty structures are crucial for financial planning and investment decisions in the mining sector.

Government policies regarding resource extraction and environmental protection significantly shape Equinox Gold's operational landscape. For instance, Canada's federal and provincial governments continue to refine environmental impact assessment processes, influencing project approvals and operational standards. In 2024, discussions around stricter tailings management regulations in several Canadian provinces could increase compliance burdens for mining companies.

Political stability in Mexico, where Equinox Gold has substantial operations, remains a key factor. While generally stable, changes in government administration can lead to policy shifts. For example, the Mexican government's stance on foreign investment in strategic sectors like mining is closely watched, with any adverse changes potentially impacting future investment decisions.

The company's ability to navigate varying regulatory frameworks across its operating regions, including the United States, Canada, and Mexico, is critical. In 2024, the ongoing focus on critical minerals in North America could lead to new incentives or regulations that Equinox Gold can leverage or must adapt to, impacting its strategic planning and capital allocation.

| Country | Key Political Factor | Impact on Equinox Gold | 2024/2025 Relevance |

|---|---|---|---|

| Mexico | Resource Nationalism/Permitting | Potential for increased state involvement, complex regulatory environment | Ongoing scrutiny of mining concessions and environmental permits. |

| Canada | Environmental Regulations/Provincial Policies | Stricter tailings management, varied provincial incentives | Focus on ESG compliance, potential for new exploration credits. |

| United States | Critical Minerals Policy/Permitting | Potential for government support for domestic production, evolving permitting | Opportunities related to critical minerals, but also complex federal permitting. |

What is included in the product

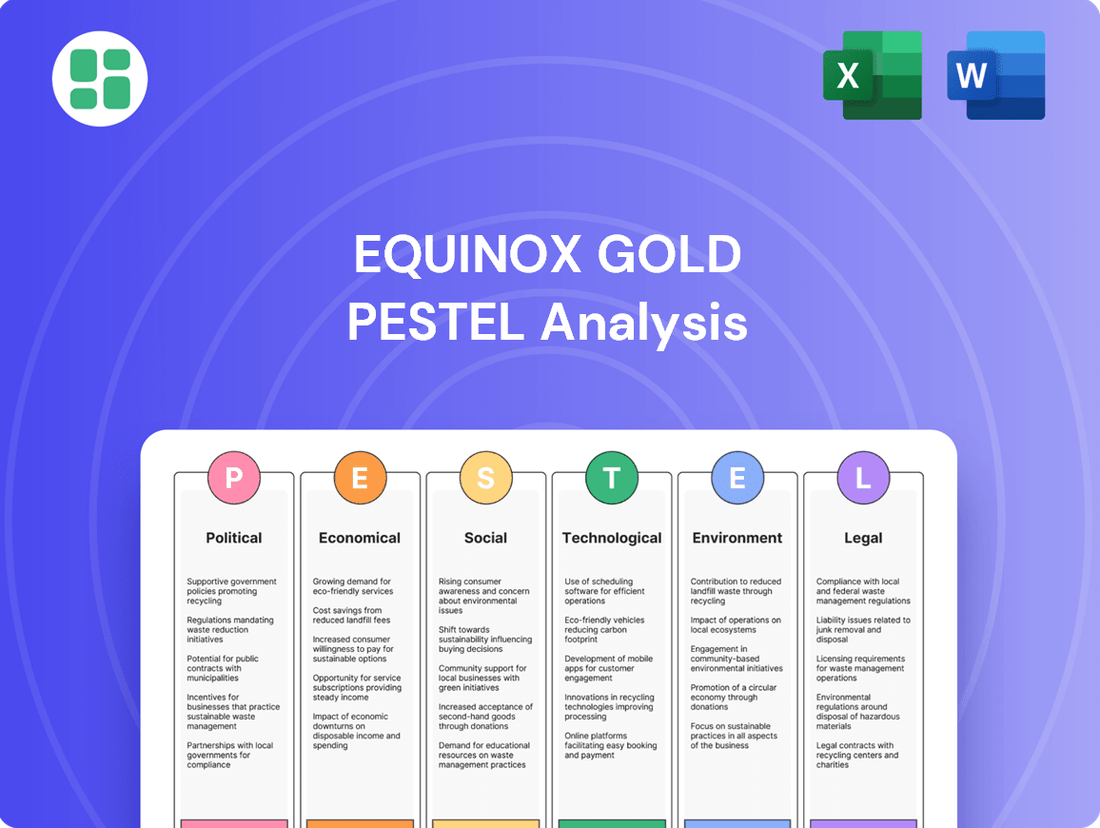

This PESTLE analysis of Equinox Gold provides a comprehensive examination of the external macro-environmental factors influencing its operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into potential threats and opportunities, supported by current trends and data relevant to the gold mining industry.

Provides a concise version of Equinox Gold's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments regarding the external risks and opportunities impacting Equinox Gold.

Economic factors

Fluctuating global gold prices significantly impact Equinox Gold's revenue and profitability. For instance, if the average realized gold price per ounce decreases from $2,000 in 2023 to $1,800 in 2024, Equinox Gold's top-line revenue could see a substantial reduction, affecting its ability to cover operational costs and invest in new projects.

Market demand, driven by factors like inflation hedging and jewelry consumption, alongside investor sentiment and global economic uncertainty, directly influences gold price movements. A surge in geopolitical tensions or a weakening US dollar often boosts gold prices, benefiting Equinox Gold, while periods of economic stability might see prices dip.

The outlook for gold prices in 2024 and 2025 remains cautiously optimistic, with many analysts predicting prices to remain elevated due to ongoing inflation concerns and central bank buying, potentially supporting Equinox Gold's financial performance.

Global economic growth significantly shapes industrial demand for gold and influences investor sentiment. A robust global economy generally supports higher industrial usage, while economic slowdowns or recessions often see gold acting as a safe-haven asset, potentially boosting investor demand. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.0% in 2023, indicating a moderately supportive environment for gold demand.

Investor behavior is particularly sensitive to economic uncertainty. During periods of high inflation or geopolitical instability, investors often flock to gold as a hedge against currency devaluation and market volatility. This trend was evident in 2023, where gold prices reached record highs driven by persistent inflation and central bank buying, which directly impacts market opportunities for companies like Equinox Gold.

Inflation directly impacts Equinox Gold's operating costs, with rising prices for energy, labor, and essential materials like explosives and chemicals potentially squeezing profit margins. For instance, if the Consumer Price Index (CPI) continues its upward trend, as seen with a 3.4% year-over-year increase in the US as of April 2024, Equinox's expenses could outpace the gold price, which has shown volatility but reached over $2,300 per ounce in early May 2024.

Changes in interest rates significantly affect Equinox Gold's financial health. Higher rates increase the cost of servicing existing debt and make new project financing, such as for mine development or expansion, more expensive. With a substantial debt load, like the $1.2 billion in senior secured notes due in 2028, an increase in benchmark interest rates could materially elevate the company's financial burden and impact its ability to fund growth initiatives or manage its capital structure effectively.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Equinox Gold, as its operations span multiple countries with different currencies. The company reports in Canadian dollars (CAD), but its key operating assets are in the United States (USD), Brazil (BRL), Mexico (MXN), and Nicaragua (NIO). This creates exposure to volatility between the CAD and these other currencies.

For instance, a stronger US dollar relative to the Canadian dollar can positively impact Equinox Gold's reported revenues when converting USD-denominated sales into CAD. Conversely, a weaker USD would have the opposite effect. Similarly, fluctuations in the BRL, MXN, and NIO against the CAD can alter the cost of local expenses, such as labor and supplies, when translated back into the reporting currency. This directly impacts the company's overall profitability and financial performance.

Equinox Gold's financial results are therefore sensitive to these movements. For example, in its Q1 2024 report, the company noted that changes in foreign currency exchange rates had a notable impact on its earnings. While specific hedging strategies are not always detailed publicly for every period, companies like Equinox Gold often employ financial instruments to mitigate some of this currency risk, aiming to stabilize costs and revenues across its diverse operational footprint.

- Impact on Costs and Revenue: Fluctuations between CAD and USD, BRL, MXN, and NIO directly affect the cost of local operations and the translated value of sales.

- Reporting Currency Sensitivity: As a CAD-reporting entity, a stronger USD can boost reported revenues, while a weaker USD reduces them.

- Operational Exposure: The company's mines in the US, Brazil, Mexico, and Nicaragua mean it must manage currency risks across multiple foreign exchange markets.

- Hedging Strategies: Equinox Gold may utilize financial instruments to hedge against adverse currency movements, though the extent of hedging can vary.

Capital Availability and Investment Climate

Capital availability for mining projects, particularly for gold exploration and development, remains a critical factor influencing Equinox Gold's growth trajectory. The overall investment climate for the precious metals sector, influenced by macroeconomic conditions and commodity prices, directly impacts investor confidence and the willingness of financial institutions to provide debt and equity financing. In 2024, the gold sector has seen a generally positive investment climate, with gold prices trading robustly, which should support Equinox Gold's ability to secure funding for its expansion plans and potential acquisitions.

Investor confidence in mining, especially in jurisdictions with stable regulatory frameworks, is paramount. Equinox Gold's access to credit facilities and its capacity to raise equity will be directly tied to its operational performance and its strategic positioning within the industry. The company's ability to fund its growth initiatives, such as the development of its existing projects and any future acquisitions, hinges on favorable capital markets and a strong perception of its management and asset base.

- Gold prices in early 2024 have remained strong, often exceeding $2,000 per ounce, which typically boosts investor appetite for gold mining companies.

- The cost of capital, both debt and equity, can fluctuate significantly based on global interest rates and perceived risk in the mining sector.

- Equinox Gold's financial results, particularly its cash flow generation from existing mines, are crucial for demonstrating its ability to service debt and attract new equity investment for future projects.

- Access to diverse funding sources, including bank loans, corporate bonds, and equity offerings, is vital for supporting the company's ambitious development pipeline.

Global economic growth influences industrial gold demand and investor sentiment. The IMF projected 3.2% global growth for 2024, a slight increase from 2023, suggesting a moderately supportive environment for gold. Investor behavior, particularly towards gold as a safe haven during uncertainty, remains a key driver.

Inflation directly impacts Equinox Gold's operating costs, as seen with the US CPI at 3.4% year-over-year in April 2024. This can squeeze profit margins if costs rise faster than the gold price, which traded over $2,300 per ounce in early May 2024.

Interest rate changes affect Equinox Gold's debt servicing costs and financing for new projects. With $1.2 billion in senior secured notes due in 2028, higher rates increase financial burden.

Currency fluctuations are significant for Equinox Gold, which reports in CAD but operates in USD, BRL, MXN, and NIO. A stronger USD boosts reported revenues, while a weaker USD reduces them, impacting overall profitability.

| Economic Factor | Impact on Equinox Gold | Supporting Data (2023-2024) |

|---|---|---|

| Global Economic Growth | Influences industrial demand and investor sentiment. | IMF projected 3.2% global growth for 2024. |

| Inflation | Increases operating costs (energy, labor, materials). | US CPI at 3.4% YoY (April 2024); Gold price >$2,300/oz (May 2024). |

| Interest Rates | Affects debt servicing and project financing costs. | Equinox Gold has $1.2B in senior secured notes due 2028. |

| Currency Exchange Rates | Impacts reported revenue and local operating costs. | Operations in USD, BRL, MXN, NIO vs. CAD reporting currency. |

Same Document Delivered

Equinox Gold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Equinox Gold PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights for strategic decision-making.

Sociological factors

Equinox Gold prioritizes strong community relations, recognizing that a social license to operate is crucial for project success and operational continuity. In 2023, the company reported investing $11.1 million in community development programs across its operations, aiming to foster positive relationships and mitigate potential disruptions. Negative community sentiment can lead to significant delays and reputational damage, impacting future exploration and expansion efforts.

Equinox Gold's operations are heavily reliant on a skilled workforce, and managing labor relations is crucial. In 2024, the mining industry continues to face challenges in attracting and retaining talent, particularly in specialized roles. Wage expectations are influenced by inflation and the demand for experienced miners, with average annual wages for skilled trades in mining often exceeding $70,000 in North America.

Unionization is a significant factor, with many mining operations having established collective bargaining agreements. Labor disputes, strikes, or even the threat of them can disrupt production schedules and impact costs. For instance, a prolonged strike at a major mine can lead to millions in lost revenue and increased operational expenses due to idle equipment and delayed shipments.

Maintaining high health and safety standards is paramount, not only for regulatory compliance but also for employee well-being and productivity. Investments in employee development and well-being programs are increasingly seen as vital for fostering a stable and motivated workforce, mitigating risks of turnover and enhancing overall operational efficiency in 2024.

Public perception of the mining industry significantly influences operational viability. Growing awareness of environmental and social governance (ESG) issues means negative sentiment can trigger heightened regulatory scrutiny and community opposition, impacting project timelines and costs. For instance, a 2024 survey indicated that 65% of respondents believe mining companies do not do enough to mitigate environmental damage.

Equinox Gold actively addresses these concerns by emphasizing its commitment to responsible mining. The company highlights initiatives focused on water management, biodiversity protection, and community engagement in its 2024 sustainability reports. These efforts aim to build trust and demonstrate a dedication to minimizing negative impacts, thereby improving its public image and fostering a more favorable operating environment.

Demographic Trends and Local Employment

Equinox Gold's operations are situated in regions experiencing varied demographic shifts. For instance, parts of Mexico, a key operating area, have seen a net migration of younger workers to urban centers, potentially impacting the availability of skilled labor for mining operations. The company actively addresses this by investing in local training programs, aiming to upskill residents and create a stable workforce. This focus on local talent development is crucial for their social license to operate.

The company's commitment to local employment and economic development is a cornerstone of its social sustainability strategy. In 2023, Equinox Gold reported that a significant percentage of its workforce, over 80%, was hired locally across its Mexican and Canadian operations. This commitment extends to local procurement, with substantial spending on goods and services from regional suppliers, fostering broader community economic benefits beyond direct employment.

- Local Employment: In 2023, Equinox Gold employed over 2,000 individuals, with more than 80% being local hires across its Mexican and Canadian sites.

- Training Initiatives: The company invested over $5 million in 2023 in employee training and development programs, focusing on technical skills relevant to mining.

- Local Procurement: Equinox Gold's local procurement spending in 2023 exceeded $150 million, supporting regional businesses and economic growth.

- Community Engagement: Projects focused on community infrastructure and social development received over $10 million in funding from Equinox Gold in 2023.

Health, Safety, and Human Rights

Equinox Gold places a strong emphasis on the health, safety, and human rights of its workforce and the communities where it operates. The company actively monitors safety performance, aiming to minimize incidents and ensure a secure working environment. In 2023, Equinox Gold reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.25, demonstrating a commitment to improving safety metrics.

To achieve these standards, Equinox Gold invests in comprehensive safety training programs for all employees and contractors. These programs cover a range of topics, from hazard identification to emergency response protocols. Furthermore, the company has established policies on ethical conduct and conducts human rights due diligence throughout its operations and supply chain, ensuring fair labor practices and respect for local populations.

- Safety Performance: Equinox Gold tracks key safety indicators like the Total Recordable Injury Frequency Rate (TRIFR), which was 1.25 in 2023.

- Employee Training: Robust safety training programs are implemented for all personnel to foster a culture of safety.

- Ethical Conduct: Policies are in place to ensure ethical behavior and adherence to human rights standards across all operations.

- Human Rights Due Diligence: The company actively assesses and addresses potential human rights impacts within its business activities and supply chain.

Sociological factors significantly influence Equinox Gold's operations, particularly concerning community relations and workforce management. The company's commitment to local employment, with over 80% of its workforce being local hires in 2023 across its Mexican and Canadian sites, highlights its strategy to build strong community ties. Furthermore, substantial investments in community development programs, totaling $11.1 million in 2023, underscore the importance of maintaining a social license to operate.

| Factor | 2023 Data/Observation | Implication for Equinox Gold |

|---|---|---|

| Community Relations | $11.1 million invested in community development programs. | Crucial for social license to operate; negative sentiment can cause delays. |

| Workforce Demographics | Net migration of younger workers in some operating regions (e.g., Mexico). | Potential impact on skilled labor availability; necessitates local training investments. |

| Local Employment & Procurement | Over 80% local hires; over $150 million in local procurement spending. | Fosters positive community relationships and economic benefits. |

| Labor Relations & Safety | TRIFR of 1.25 in 2023; significant investment in safety training. | Essential for employee well-being, productivity, and regulatory compliance. |

Technological factors

Equinox Gold is increasingly integrating advanced mining technologies and automation to boost efficiency and safety. The company is exploring autonomous drilling systems and digital transformation initiatives across its operations. These advancements, supported by the use of IoT sensors for real-time data monitoring, are designed to enhance operational excellence and drive productivity gains.

Equinox Gold leverages cutting-edge technologies to refine its exploration efforts. AI-driven geological mapping and advanced geospatial analysis tools are instrumental in identifying promising mineral deposits with greater precision and speed.

These technological advancements significantly improve the accuracy of exploration, allowing for faster identification of potential mineral resources. This directly contributes to expanding the company's resource base and strengthening its growth pipeline.

Technological advancements in gold processing and metallurgy are significantly boosting recovery rates and cutting operational expenses for companies like Equinox Gold. Innovations in areas such as froth flotation and gravity separation are enabling more efficient extraction of gold from complex ores. For instance, advancements in fine grinding technologies, like those employed in modern mills, can liberate finer gold particles, leading to higher overall recovery. These improvements are crucial for maximizing yield from existing reserves.

Water management and waste treatment technologies are also evolving, contributing to more sustainable and cost-effective operations. Closed-loop water systems, for example, reduce water consumption and minimize the discharge of process water, which is vital for environmental compliance and cost savings. Furthermore, advancements in tailings management, including paste thickening and dry stacking, reduce the environmental footprint and reclamation liabilities. These innovations directly support Equinox Gold's commitment to sustainable production practices.

Data Analytics and Digitalization

Data analytics and digitalization are increasingly integral to Equinox Gold's operations, enhancing everything from mine site monitoring to strategic planning. The company leverages big data for predictive maintenance, aiming to reduce downtime and associated costs. For instance, advanced analytics can predict equipment failures, allowing for proactive servicing. This digital transformation directly contributes to operational efficiency and cost reduction across the board.

Equinox Gold utilizes digitalization to optimize its supply chain, ensuring timely delivery of materials and efficient logistics. Furthermore, sophisticated data analysis plays a crucial role in risk management, identifying potential operational or market risks early on. The company's investment in these technologies is a key driver for improving productivity and maintaining a competitive edge in the gold mining sector.

- Operational Efficiency: Digital tools enable real-time monitoring of mining processes, leading to quicker identification of inefficiencies.

- Predictive Maintenance: Advanced analytics help forecast equipment failures, minimizing costly unplanned shutdowns.

- Supply Chain Optimization: Data-driven insights improve logistics and inventory management, reducing operational overhead.

- Risk Mitigation: The use of big data enhances the ability to predict and manage operational and market-related risks.

Sustainable Mining Technologies

Equinox Gold is increasingly integrating sustainable mining technologies to bolster its environmental, social, and governance (ESG) performance. This includes adopting renewable energy sources to power its operations, thereby reducing greenhouse gas emissions. For instance, the company is advancing solar power projects at its mines, aiming to decrease reliance on fossil fuels and lower operational costs.

Waste diversion and management are also key technological focuses. Equinox Gold is exploring innovative methods for tailings management and the repurposing of mine waste, aligning with circular economy principles. These initiatives are crucial for minimizing the environmental impact of mining activities and ensuring responsible resource utilization.

Furthermore, the company is investing in advanced land rehabilitation techniques. These technologies aim to restore mined areas to their natural state or to a beneficial post-mining land use. By prioritizing these methods, Equinox Gold demonstrates a commitment to mitigating long-term environmental effects and meeting its sustainability targets, such as reducing its carbon footprint by a projected 30% by 2030.

- Renewable Energy Integration: Equinox Gold is expanding solar power capacity at its mines, with a target to significantly increase renewable energy usage by 2025.

- Waste Diversion Technologies: Exploring advanced tailings management systems and waste rock reprocessing to minimize environmental impact.

- Land Rehabilitation Innovations: Implementing cutting-edge techniques for site reclamation and biodiversity restoration post-mining.

- ESG Performance Improvement: These technological adoptions directly support Equinox Gold's sustainability goals, aiming for a 30% reduction in carbon emissions by 2030.

Equinox Gold is heavily investing in automation and digitalization to enhance operational efficiency and safety across its mines. By 2024, the company aims to have autonomous drilling systems implemented at key sites, significantly reducing human exposure to hazardous environments and improving drilling precision. This focus on digital transformation extends to real-time data analytics for predictive maintenance, which is projected to decrease equipment downtime by up to 15% in 2024-2025.

Technological advancements in mineral processing are crucial for Equinox Gold's profitability. Innovations in gravity separation and advanced leaching techniques are being deployed to increase gold recovery rates, with targets to boost overall recovery by 2-3% by the end of 2025. For instance, the company is piloting new reagent technologies that promise higher yields from complex ore bodies, directly impacting the cost per ounce of gold produced.

Furthermore, Equinox Gold is prioritizing sustainable technologies, including renewable energy integration. The company has committed to powering a significant portion of its operations with solar energy, with a goal to source 25% of its electricity from renewables by 2026. This not only reduces its carbon footprint but also mitigates exposure to volatile energy prices, contributing to stable operational costs.

The company is also leveraging AI and machine learning for more accurate geological modeling and resource estimation. This technology allows for faster identification of high-grade zones, improving the efficiency of exploration programs and ensuring a robust pipeline of future projects. By the end of 2025, Equinox Gold expects these advanced exploration techniques to have identified at least two new significant gold deposits.

Legal factors

Equinox Gold operates under diverse mining laws in countries like Mexico and Canada, requiring adherence to specific concession terms, royalty payments, and operational permits. For instance, Mexico's mining law mandates royalty payments based on revenue, while Canadian provinces have their own fee structures and environmental regulations. Changes to these frameworks, such as increased royalty rates or stricter permitting processes, directly influence Equinox Gold's cost of production and profitability, potentially impacting projects like the Los Filos mine in Mexico. The company's 2023 annual report details its ongoing compliance efforts and the proactive engagement with regulatory bodies to navigate potential legal challenges and ensure operational continuity.

Equinox Gold operates under a complex web of environmental laws that dictate everything from air emissions and water discharge to waste disposal and site rehabilitation. For instance, in 2023, the company reported its ongoing efforts to meet stringent water quality standards at its Los Filos mine in Mexico, a key operational focus. Failure to comply with these regulations can lead to significant fines, operational shutdowns, and reputational damage, underscoring the critical need for robust environmental management systems.

The company emphasizes its commitment to environmental stewardship, as demonstrated by its sustainability reports. In 2024, Equinox Gold continued to invest in land reclamation projects at its former mining sites, aiming to restore ecosystems and minimize long-term environmental impact. This proactive approach is crucial for maintaining its social license to operate and mitigating potential legal liabilities associated with its mining activities.

Equinox Gold operates under diverse labor laws across its mining jurisdictions, including Mexico, Canada, and the United States. These regulations dictate minimum wages, working conditions, and employee benefits, with companies like Equinox Gold needing to ensure compliance. For instance, in Mexico, the Federal Labor Law sets standards for working hours, overtime pay, and mandatory profit-sharing, while Canadian provinces have their own labor standards acts. In 2024, minimum wage adjustments in these regions continue to impact operational costs.

Adherence to union rights is also a critical factor, as many mining operations involve organized labor. Equinox Gold's commitment to fair employment practices and workforce well-being is essential to mitigate the risk of legal disputes and maintain positive labor relations. The company's 2024 sustainability reports often detail their initiatives in employee safety and development, reflecting an understanding of the importance of these legal frameworks.

Indigenous Rights and Land Use Agreements

Equinox Gold operates in regions where indigenous land rights are a significant legal consideration. The company must navigate a complex web of national and international laws governing these rights, often requiring adherence to principles like Free, Prior, and Informed Consent (FPIC) before commencing exploration or mining activities. Failure to secure FPIC can lead to project delays, legal challenges, and reputational damage. For instance, in 2023, several mining projects in Canada faced significant opposition and legal battles stemming from disputes over indigenous consultation and consent, highlighting the critical nature of these agreements.

The company's ability to establish and maintain respectful, long-term relationships with indigenous communities is paramount. This involves transparent communication, benefit-sharing agreements, and a commitment to environmental stewardship that aligns with traditional land management practices. Unresolved land claims or ongoing disputes can create substantial legal and operational risks, potentially impacting project timelines and financial viability. Equinox Gold's proactive engagement and commitment to partnership are therefore crucial for mitigating these risks and ensuring sustainable operations.

Corporate Governance and Anti-Corruption Laws

Equinox Gold, as a publicly traded entity, operates under stringent legal frameworks governing corporate governance and anti-corruption. Compliance with securities regulations, such as those enforced by the SEC, is paramount, requiring robust disclosure and transparent financial reporting. The company must also adhere to international and local anti-bribery laws, like the U.S. Foreign Corrupt Practices Act (FCPA) and Canada's Corruption of Foreign Public Officials Act (CFPOA), to ensure ethical business conduct throughout its global operations.

The company's commitment to ethical practices is reflected in its governance structure, which typically includes an independent board of directors and established audit committees. These bodies oversee compliance and risk management, ensuring adherence to policies designed to prevent bribery and corruption. For instance, in 2023, Equinox Gold reported zero material incidents of corruption, underscoring its ongoing efforts in this area.

- Corporate Governance Compliance: Adherence to SEC and TSX reporting standards.

- Anti-Corruption Laws: Compliance with FCPA and CFPOA in all operational jurisdictions.

- Ethical Business Practices: Implementation of codes of conduct and whistleblower policies.

- Transparency and Disclosure: Regular reporting on governance structures and ethical performance.

Equinox Gold must navigate evolving mining legislation, including royalty structures and permitting processes in jurisdictions like Mexico and Canada, impacting production costs. For example, changes in Mexican mining law can directly affect profitability at mines like Los Filos. The company's 2023 annual report highlights its proactive engagement with regulatory bodies to manage these legal complexities and ensure operational continuity.

Environmental factors

Climate change policies and regulations directly impact Equinox Gold's operations. For instance, the increasing adoption of carbon pricing mechanisms and stringent emissions targets by governments worldwide necessitate significant adjustments in how the company sources energy and manages its carbon footprint. Equinox Gold's 2023 sustainability report highlighted efforts to reduce its Scope 1 and Scope 2 greenhouse gas emissions, aiming for a 20% reduction by 2030 compared to a 2020 baseline.

Analyzing Equinox Gold's carbon footprint is crucial, with a focus on its mining and processing activities, which are energy-intensive. The company is actively pursuing strategies to lower its greenhouse gas emissions, including investing in renewable energy sources for its mines. For example, the company has been exploring solar power integration at its Mexican operations, aiming to decrease reliance on fossil fuels.

The energy transition is a key strategic area for Equinox Gold. This involves improving energy efficiency across its sites and transitioning to cleaner energy alternatives. By enhancing energy efficiency and exploring cleaner power sources, Equinox Gold aims to mitigate the financial and operational risks associated with climate change and evolving environmental regulations, aligning with global decarbonization efforts.

Equinox Gold's mining operations, like all in the sector, are heavily reliant on water for various processes, from dust suppression to mineral processing. Managing this water effectively, including sourcing, consumption, and discharge, is a significant environmental consideration. The company must navigate the complexities of water availability, especially in arid or semi-arid regions where many mines are located.

Water scarcity presents a substantial challenge, potentially impacting operational continuity and increasing costs. In 2023, Equinox Gold reported on its water management practices, emphasizing recycling and conservation efforts across its sites. For instance, their Aurizona mine in Brazil has implemented advanced water management systems to minimize freshwater intake. These strategies are crucial not only for environmental compliance but also for maintaining positive relationships with local communities, as water use can have significant social implications.

Equinox Gold actively manages its impact on biodiversity, implementing strategies to minimize ecological disturbance at its operations. The company is committed to land reclamation and rehabilitation, aiming to restore mined areas to their original state or for beneficial alternative uses.

In 2023, Equinox Gold reported progress on its rehabilitation programs, with specific initiatives underway at its Aurizona mine in Brazil and its Los Filos mine in Mexico. These efforts include topsoil management, revegetation, and the establishment of wildlife corridors to support local ecosystems.

The company's environmental stewardship includes protecting sensitive habitats and engaging in biodiversity conservation. For instance, at Aurizona, Equinox Gold is working with local communities and environmental experts to monitor and protect native flora and fauna, reflecting a dedication to responsible mining practices.

Waste Management and Tailings Storage

Mining operations inherently generate significant waste, with tailings storage posing a critical environmental challenge. Equinox Gold is committed to responsible waste management, focusing on the safe disposal of tailings and minimizing the impact of hazardous materials. The company adheres to stringent industry best practices and regulatory requirements for its tailings facilities.

Equinox Gold implements robust waste diversion programs and pollution prevention strategies across its operations. For instance, at its Los Filos mine in Mexico, the company has invested in infrastructure to manage tailings, aiming for compliance with evolving environmental standards. Their approach emphasizes containment and monitoring to prevent any release into the surrounding environment.

The company's environmental performance is a key consideration. While specific incident data can fluctuate, Equinox Gold's stated commitment is to maintain a strong record on environmental incidents through diligent operational oversight and continuous improvement in waste handling protocols. This includes regular audits and assessments of their tailings management systems.

- Tailings Management: Equinox Gold employs engineered solutions for tailings storage, prioritizing stability and containment to meet or exceed regulatory requirements.

- Waste Diversion: The company actively seeks opportunities to reduce, reuse, and recycle materials generated during mining and processing, minimizing landfill reliance.

- Pollution Prevention: Robust water management systems and air quality controls are in place to prevent the release of pollutants from operational activities.

- Environmental Incident Record: Equinox Gold's focus is on proactive risk management and adherence to best practices to achieve a low incidence of environmental non-compliance.

Energy Consumption and Renewable Energy Integration

Mining is an energy-intensive industry, and Equinox Gold is actively working to improve its energy footprint. In 2023, the company reported a significant portion of its energy consumption still came from diesel and grid electricity, but it is prioritizing initiatives to boost efficiency and integrate renewables.

Equinox Gold is exploring opportunities to incorporate solar power at its Mexican operations, recognizing the potential for cost savings and reduced emissions. For instance, the Los Filos mine has been a focus for such explorations. These efforts are crucial for managing operational costs, as energy is a substantial expenditure in gold extraction, and for enhancing the company's environmental, social, and governance (ESG) performance.

- Energy Efficiency: Equinox Gold aims to optimize energy use through improved operational practices and equipment upgrades across its sites.

- Renewable Energy Exploration: The company is actively investigating the feasibility of solar power projects, particularly at its Mexican assets like Los Filos, to diversify its energy sources and reduce reliance on fossil fuels.

- Cost and Environmental Impact: Successful integration of renewables is expected to lower energy expenditures, a key operating cost, while simultaneously improving the company's environmental performance and reducing its carbon intensity.

Environmental regulations significantly shape Equinox Gold's operational landscape, influencing everything from emissions control to water usage. The company's 2023 sustainability report detailed a commitment to reducing Scope 1 and 2 greenhouse gas emissions by 20% by 2030, based on a 2020 baseline, underscoring the financial and strategic importance of climate policy adherence.

Water scarcity is a material risk for Equinox Gold, particularly in arid regions. The company's 2023 water management efforts, including recycling and conservation, are vital for operational continuity and community relations, as seen in the advanced systems at its Aurizona mine in Brazil.

Biodiversity management and land reclamation are ongoing priorities. Equinox Gold's 2023 progress reports highlighted rehabilitation initiatives at Aurizona and Los Filos, focusing on ecosystem restoration and protecting local flora and fauna.

Tailings management remains a critical environmental challenge, with Equinox Gold employing engineered solutions and robust waste diversion programs to ensure safety and regulatory compliance, as demonstrated by investments in infrastructure at its Los Filos mine.

PESTLE Analysis Data Sources

Our Equinox Gold PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and industry-specific reports. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends impacting the mining sector.