Equinox Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

Equinox Gold operates in a dynamic mining sector where supplier power is moderate, influenced by the availability of specialized equipment and skilled labor. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and regulatory hurdles, but the potential for disruptive technologies remains a consideration.

The complete report reveals the real forces shaping Equinox Gold’s industry—from buyer power to the intensity of rivalry. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The gold mining sector, including companies like Equinox Gold, depends on a select group of global manufacturers for highly specialized heavy mining equipment. These essential suppliers, such as Caterpillar and Komatsu, hold considerable sway over pricing and contract conditions because demand is consistently high and viable alternatives are scarce.

This concentration of specialized equipment providers significantly strengthens their bargaining position. For instance, Caterpillar reported record revenues in 2023, underscoring the robust demand for their mining machinery, which directly impacts the cost of capital expenditures for mining operations.

Moreover, the financial and operational hurdles involved in switching major equipment suppliers are considerable. These switching costs extend beyond the purchase price of new machinery to include extensive employee training, specialized maintenance infrastructure, and the complex integration of new equipment into existing operational workflows, further entrenching the power of existing providers.

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is fueling a significant demand for sustainable and eco-friendly mining technologies. This trend is particularly pronounced in 2024, as companies like Equinox Gold increasingly integrate ESG into their operational strategies and investor relations.

A limited number of specialized firms possess the expertise and technology to meet these stringent environmental requirements. For instance, a report from Statista in early 2024 indicated that investments in green mining technologies saw a year-over-year increase of approximately 15%, highlighting the niche nature of these suppliers and their resulting leverage.

This scarcity grants these eco-technology providers considerable bargaining power. Equinox Gold, in its pursuit of responsible mining practices and to meet its stated social investment initiatives, may find itself facing higher procurement costs or a degree of dependency on these select suppliers to achieve its environmental performance targets.

Suppliers of critical mining inputs, such as explosives and specialized chemicals like cyanide, wield considerable bargaining power. This is largely due to the concentrated nature of their supply chains, with a few global manufacturers dominating the market for these essential materials. For instance, in 2024, the global explosives market saw significant price volatility, impacting mining operations worldwide.

These price fluctuations for critical inputs can directly affect Equinox Gold's operational expenses and, consequently, its overall profitability. For example, a 10% increase in the cost of cyanide, a key chemical for gold extraction, could translate to millions in additional operating costs for a company of Equinox Gold's scale.

Skilled Labor and Technical Expertise

The mining industry, including companies like Equinox Gold, heavily relies on a specialized workforce. Geologists, engineers, and skilled mine operators are essential for efficient and safe operations. The availability and cost of this talent directly impact operational expenses and project timelines.

Regions experiencing a shortage of qualified mining professionals or where labor unions are strong tend to see increased employee bargaining power. This can translate into higher wage demands and more stringent working condition negotiations, affecting a company's profitability. For Equinox Gold, operating in diverse geographical locations across the Americas, managing these varying labor market conditions is a key consideration.

- Skilled Workforce Dependency: Mining operations require specialized expertise, making skilled labor a critical input.

- Labor Market Dynamics: Scarcity of talent or strong union presence amplifies employee bargaining power.

- Equinox Gold's Challenge: Navigating diverse labor markets across the Americas presents unique challenges in talent acquisition and wage negotiation.

Energy and Fuel Costs

Energy and fuel represent significant operating expenses for mining operations like Equinox Gold, with prices heavily influenced by volatile global markets. For instance, Brent crude oil prices fluctuated significantly throughout 2024, impacting fuel costs for transportation and machinery. While the energy market generally has many suppliers, the critical need for consistent supply and potential regional limitations can grant certain energy providers a degree of bargaining power.

Equinox Gold's financial performance is directly tied to these external cost pressures. The company's ability to manage energy consumption efficiently and secure favorable fuel contracts is therefore crucial for maintaining profitability. In 2023, Equinox Gold reported that energy and fuel costs constituted a notable portion of their overall operating expenditures, highlighting the sensitivity of their margins to these commodity prices.

- Energy costs are a major component of mining expenses.

- Global market fluctuations in oil and gas prices directly impact Equinox Gold.

- Regional supply constraints can empower energy providers.

- Efficient energy management is vital for Equinox Gold's profitability.

The bargaining power of suppliers for Equinox Gold is significant, particularly concerning specialized mining equipment and critical inputs like explosives and chemicals. Companies like Caterpillar and Komatsu, major players in heavy mining machinery, benefit from high demand and limited alternatives, allowing them to influence pricing and contract terms. Similarly, a concentrated market for explosives and chemicals means a few global manufacturers can impact operational costs for mining firms.

The increasing demand for ESG-compliant mining technologies further concentrates power among a select group of specialized technology providers. These suppliers, capable of meeting stringent environmental requirements, gain leverage due to the niche nature of their offerings. For instance, investments in green mining technologies saw a notable increase in 2024, indicating the growing importance and potential cost implications of these specialized solutions for companies like Equinox Gold aiming to meet their sustainability targets.

Furthermore, the availability of a skilled workforce and the cost of energy are key factors influencing supplier power. Scarcity of specialized mining talent or strong labor unions can increase employee bargaining power, leading to higher wage demands. Energy prices, influenced by volatile global markets, also represent a significant operating expense, with regional supply constraints potentially empowering certain energy providers.

| Supplier Category | Key Factors Influencing Power | Impact on Equinox Gold |

|---|---|---|

| Specialized Mining Equipment | High demand, limited alternatives, high switching costs | Increased capital expenditure, potential delays in equipment upgrades |

| Explosives & Chemicals | Market concentration, price volatility | Higher operational costs, direct impact on profitability |

| ESG Technology Providers | Niche expertise, stringent environmental requirements | Potential for higher procurement costs for sustainable solutions |

| Skilled Labor | Talent scarcity, union strength | Increased wage demands, potential for higher labor costs |

| Energy & Fuel | Global market volatility, regional supply constraints | Fluctuating operating expenses, need for efficient energy management |

What is included in the product

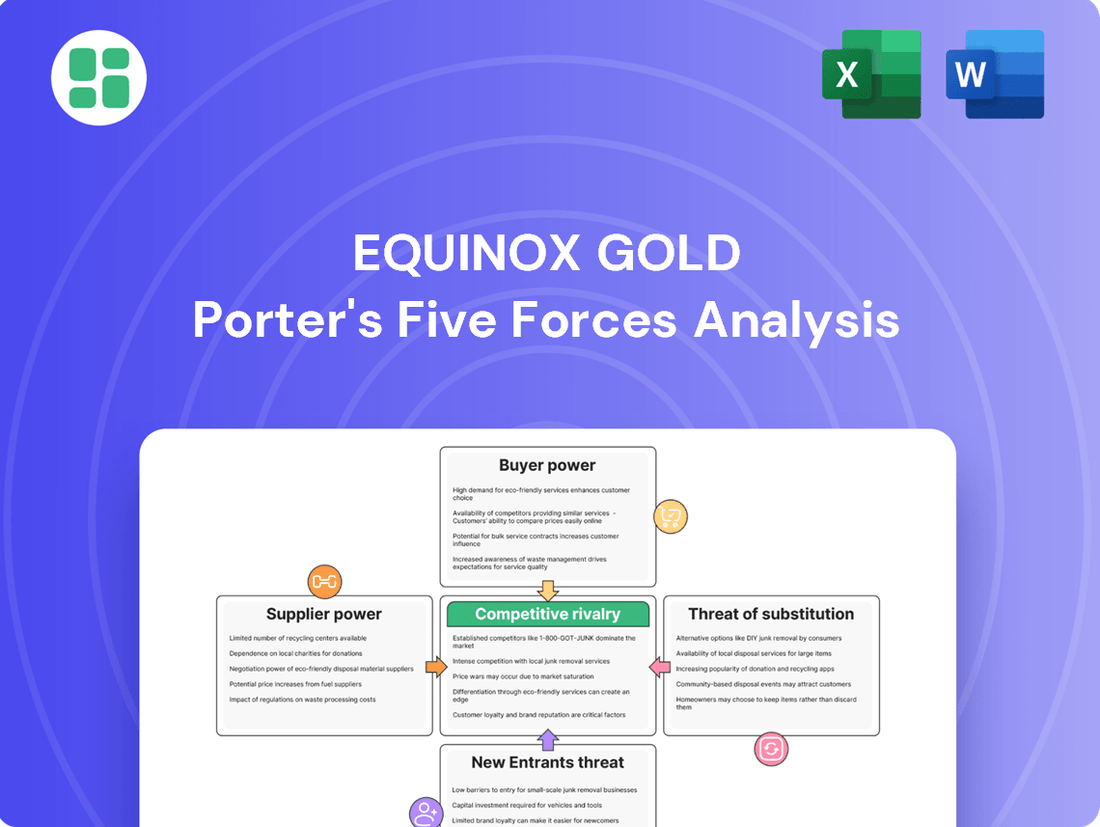

This analysis examines the competitive forces impacting Equinox Gold, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the gold mining industry.

Instantly visualize competitive intensity and identify strategic vulnerabilities within the gold mining sector, enabling Equinox Gold to proactively address threats.

Customers Bargaining Power

Gold's status as a commodity significantly amplifies customer bargaining power. Because gold from different producers, including Equinox Gold, is essentially indistinguishable, buyers can easily switch suppliers based on price. This lack of product differentiation means customers are highly price-sensitive, forcing Equinox Gold to compete primarily on cost rather than product features or brand loyalty. For instance, in 2024, the average cost of gold production globally hovered around $1,200 per ounce, with significant variations, making price a critical factor in purchasing decisions.

Equinox Gold's customers are incredibly varied, ranging from central banks and large institutional investors to individual buyers and jewelry makers. This wide distribution of end-users means no single customer or small group can dictate terms.

The demand for gold comes from many sectors, including electronics and other industrial uses, further fragmenting the buyer landscape. Consequently, pricing power rests more with global supply and demand, influenced by macroeconomic trends, rather than any specific customer group.

The bargaining power of customers in the gold market, particularly for a producer like Equinox Gold, is very limited. This is because gold prices are determined on global exchanges, influenced by broad macroeconomic forces such as inflation, interest rates, and geopolitical stability, not by direct negotiation with individual buyers.

Equinox Gold, therefore, operates as a price-taker. Its revenue is primarily a function of the prevailing global gold price, which in 2024 remained a significant factor. For instance, gold prices fluctuated throughout 2024, reaching highs driven by central bank buying and safe-haven demand, directly impacting Equinox Gold's top-line performance without any ability to set its own prices.

Lack of Switching Costs for Buyers

Customers looking to buy physical gold encounter virtually no barriers when switching between different suppliers. This is because gold itself is a standardized commodity, meaning there's little to differentiate one producer's gold from another's. This homogeneity significantly weakens the leverage gold producers have over their buyers.

The ease with which buyers can change suppliers means they can readily opt for the seller offering the most favorable market price. In 2024, global gold demand remained robust, with central banks continuing to be significant purchasers, further highlighting the price-sensitive nature of the market. For instance, central bank net purchases of gold were substantial throughout the first half of 2024, driven by diversification strategies.

- Homogenous Product: Physical gold is a standardized commodity with no inherent brand loyalty or product differentiation among producers.

- Price Sensitivity: Buyers can easily compare prices across different suppliers and choose the most cost-effective option.

- Low Switching Costs: There are no significant financial or operational hurdles for customers to move their business from one gold supplier to another.

- Market Dynamics: In 2024, the gold market saw continued strong demand from various sectors, reinforcing the competitive pricing environment for producers.

Investor and Central Bank Demand Dynamics

Investor and central bank demand significantly influences gold prices, acting as a crucial driver for the entire market. In 2024, central banks continued to be substantial net buyers of gold, with the World Gold Council reporting net purchases of 290 tonnes in the first quarter of 2024, a strong start to the year. This collective demand, while vital, is diffuse, meaning these large buyers are not typically negotiating directly with individual gold producers like Equinox Gold. Their purchasing is more about overall market sentiment and asset allocation rather than targeting specific suppliers.

This dynamic limits the direct bargaining power of investors and central banks over individual mining companies. While their aggregate demand can shape the price Equinox Gold receives, they are not in a position to dictate terms or demand specific concessions from the company. Their power lies in their ability to enter or exit the market, thereby influencing overall price levels, rather than exerting direct pressure on production costs or supply agreements.

- Investor and Central Bank Demand: Central banks and investors are major gold consumers, seeking it as a safe-haven asset and store of value.

- Market Influence: Their collective buying and selling decisions significantly impact global gold prices.

- Limited Direct Bargaining Power: This demand is not typically directed at specific producers, thus reducing their ability to negotiate directly with companies like Equinox Gold.

- 2024 Trends: Central banks maintained strong buying momentum in early 2024, with significant net purchases reported in Q1.

The bargaining power of customers for Equinox Gold is notably low, primarily due to the homogenous nature of gold as a commodity. Buyers can easily switch between suppliers without incurring significant costs, as gold from different mines is largely indistinguishable. This price sensitivity means Equinox Gold, like other producers, acts as a price-taker, with global market forces dictating the price it receives.

While large entities like central banks and institutional investors are significant gold purchasers, their influence is on the overall market price rather than direct negotiation with individual companies. For example, central banks were substantial net buyers in early 2024, with Q1 2024 seeing 290 tonnes purchased, according to the World Gold Council. This broad demand, while crucial for price discovery, doesn't translate into specific bargaining leverage over producers like Equinox Gold.

| Factor | Impact on Equinox Gold | Customer Bargaining Power |

| Product Homogeneity | No differentiation, buyers focus on price. | High |

| Switching Costs | Minimal for buyers to change suppliers. | High |

| Price Sensitivity | Buyers readily seek the lowest market price. | High |

| Buyer Concentration | Demand is fragmented across many buyers. | Low |

| Aggregate Demand Influence | Large buyers (e.g., central banks) influence global price, not direct terms. | Low (direct) |

Full Version Awaits

Equinox Gold Porter's Five Forces Analysis

This preview showcases the comprehensive Equinox Gold Porter's Five Forces Analysis, detailing the competitive landscape for the company. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises or placeholder content. This professionally formatted analysis is ready for your immediate use, providing valuable insights into the industry's dynamics.

Rivalry Among Competitors

The global gold mining sector is highly competitive, featuring numerous established firms of varying sizes. Giants such as Newmont Corporation and Barrick Gold Corporation, both with significant market capitalizations and production volumes, set a high bar for operational efficiency and cost management.

Equinox Gold, despite its expansion, faces this intense rivalry. In 2023, Newmont reported gold sales of approximately 5.5 million ounces, while Barrick Gold sold around 4.5 million ounces, illustrating the scale of operations that smaller companies must contend with.

This crowded field means that Equinox Gold must continuously innovate and optimize its operations to maintain and grow its market share. The presence of many global players, from diversified majors to specialized mid-tier producers, intensifies pressure on pricing and operational costs.

Gold's commodity nature means there's very little to set one producer apart from another, so competition really boils down to who can mine it most cheaply. This pushes companies like Equinox Gold to focus intensely on lowering their All-in Sustaining Costs (AISC). For instance, in Q1 2024, Equinox Gold reported an AISC of $1,305 per ounce, a figure they actively work to reduce to stay competitive against rivals who might have even lower production costs.

The gold mining industry is characterized by exceptionally high fixed costs. These include massive capital outlays for exploration, mine development, processing facilities, and heavy machinery. For instance, building a new gold mine can easily cost hundreds of millions, even billions, of dollars. This significant upfront investment creates a powerful imperative for companies to operate at high capacity.

To recoup these substantial fixed costs and achieve profitability, gold mining companies are driven to maximize their production output. This pressure to produce more leads to aggressive production targets and a constant focus on operational efficiency. In 2023, for example, global gold mine production was estimated to be around 3,200 tonnes, a figure that companies strive to contribute to and expand upon.

This drive for higher production inherently intensifies competitive rivalry. Companies are incentivized to outproduce rivals to gain market share and generate greater revenue, which helps spread those fixed costs more effectively. This can manifest as price competition, aggressive exploration for new deposits, or mergers and acquisitions to consolidate production capacity, all contributing to a more cutthroat environment.

Mergers and Acquisitions as a Competitive Strategy

The gold mining industry is characterized by significant consolidation through mergers and acquisitions (M&A). Companies pursue these deals to gain economies of scale, secure valuable mineral assets, and lessen competitive intensity. This trend is evident as firms aim to become larger, more efficient players in the global market.

A notable recent development is Equinox Gold's business combination with Calibre Mining. This strategic move is designed to create a leading gold producer with a strong focus on the Americas. The merger aims to bolster the combined entity's competitive position by leveraging operational synergies and expanding its asset base.

- Economies of Scale: Larger operations can reduce per-unit production costs.

- Asset Acquisition: M&A allows companies to gain access to high-grade reserves and promising exploration projects.

- Reduced Competition: Consolidation can lead to fewer, but stronger, market participants.

- Strategic Alliances: Partnerships and joint ventures also play a role in managing competitive pressures.

Geographical Diversification and Jurisdictional Risk

Competitive rivalry in the gold mining sector extends beyond operational prowess to the very jurisdictions in which companies operate. Equinox Gold's strategy of geographical diversification, with assets in Canada, the USA, Mexico, and Brazil, aims to mitigate country-specific risks. However, this broad footprint means it contends with rivals who might possess a more concentrated portfolio of exceptionally high-grade deposits within a single, stable jurisdiction.

This jurisdictional competition is significant. For instance, while Equinox Gold operates in diverse markets, companies solely focused on, say, Nevada's prolific gold belt might leverage deeper regional expertise and established supply chains. In 2024, the political and regulatory stability of operating regions remains a key differentiator. For example, Canada and the USA generally offer more predictable mining regulations compared to some emerging markets, influencing investor perception and operational costs.

- Jurisdictional Advantage: Companies in politically stable mining regions with clear regulatory frameworks can attract investment more readily and face fewer operational disruptions.

- Asset Concentration vs. Diversification: While diversification spreads risk, a concentrated portfolio in a high-quality, stable jurisdiction can offer focused operational efficiencies and potentially higher margins.

- Regulatory Environment Impact: Changes in environmental regulations, taxation, or permitting processes in any of Equinox Gold's operating countries can directly impact its competitive standing against peers in more favorable locations.

Competitive rivalry within the gold mining industry is fierce, driven by the commodity nature of gold and the high fixed costs associated with production. Companies like Equinox Gold must focus on cost efficiency, with All-in Sustaining Costs (AISC) being a key metric. For example, Equinox Gold's Q1 2024 AISC was $1,305 per ounce, a figure that needs to remain competitive against global peers.

The industry sees significant consolidation through mergers and acquisitions, as seen with Equinox Gold's business combination with Calibre Mining, aiming for economies of scale and enhanced market position. This trend reduces the number of players but increases the strength of the remaining ones, intensifying the competition for prime assets and efficient operations.

Jurisdictional advantages also play a crucial role, with companies in stable regions like Canada and the USA benefiting from predictable regulations. Equinox Gold's diversified portfolio across the Americas faces rivals who might have concentrated assets in highly favorable mining belts, creating varied competitive landscapes based on regional stability and expertise.

| Company | 2023 Gold Sales (Moz) | Q1 2024 AISC ($/oz) | Key Operating Jurisdictions |

|---|---|---|---|

| Newmont Corporation | ~5.5 | $1,217 | North America, South America, Australia, Africa |

| Barrick Gold Corporation | ~4.5 | $1,304 | North America, South America, Africa, Australia |

| Equinox Gold | ~0.7 (Standalone 2023) | $1,305 | Canada, USA, Mexico, Brazil |

SSubstitutes Threaten

Investors seeking a store of value and inflation hedge have many options beyond gold. For instance, as of early 2024, U.S. Treasury bonds offered yields that made them attractive alternatives, with the 10-year Treasury note yielding around 4.2% at times, providing a steady income stream.

Other precious metals like silver and platinum also compete for investor capital, often moving in correlation with gold but offering their own unique supply and demand dynamics. Real estate and equities, particularly in robust economic periods, can provide higher potential returns that draw funds away from gold.

The burgeoning cryptocurrency market, with assets like Bitcoin, has also emerged as a digital store of value for some, further fragmenting the investment landscape. This diversification of investment choices directly impacts the demand for gold as an asset class.

Recycled gold, salvaged from old jewelry, industrial components, and electronic waste, presents a substantial alternative supply source to newly extracted gold. This stream of secondary supply can significantly impact the market. For instance, in 2023, the World Gold Council reported that recycled gold supply reached approximately 1,246 tonnes, demonstrating its considerable contribution to the overall gold market.

When gold prices surge, it incentivizes more individuals and businesses to sell their existing gold items for recycling. This increased recycling activity directly reduces the demand for primary gold production from mining operations. This persistent, indirect substitution pressure can influence the pricing and supply dynamics for companies like Equinox Gold.

While gold is prized for its conductivity and inertness in electronics and dentistry, the threat of substitutes is real. For instance, copper is a far more abundant and cheaper alternative for electrical conductivity, and advancements in specialized ceramics could offer similar inertness in certain applications, potentially impacting industrial demand.

The market for industrial gold is not monolithic. In 2023, the World Gold Council reported that while jewelry and central bank reserves are the largest demand drivers, industrial uses accounted for approximately 7% of global gold demand, around 220 tonnes. This segment is particularly vulnerable to innovation in material science, where cost-effectiveness and performance parity could lead to substitution.

Shifts in Jewelry Trends and Consumer Preferences

The threat of substitutes for gold in the jewelry market is a significant factor for companies like Equinox Gold. Consumer tastes can pivot, favoring platinum, silver, or even less costly alternatives like fashion jewelry made from base metals and synthetic stones. For instance, in 2024, the global jewelry market saw continued interest in silver, with its price remaining considerably lower than gold, presenting a direct substitute for many consumers.

Economic fluctuations also play a crucial role. During periods of economic uncertainty or recession, consumers often reduce discretionary spending on high-value items like gold jewelry. They may opt for more affordable materials or postpone purchases altogether. This trend was evident in late 2023 and early 2024, where reports indicated a slowdown in luxury goods sales in some regions, with consumers seeking value-for-money options.

While gold's inherent value and traditional appeal remain strong, the evolving landscape of fashion and affordability introduces viable substitutes. The industry must remain attuned to these shifts.

- Shifting Material Preferences: Consumers increasingly explore alternatives like platinum and silver, which offer different aesthetic appeal and price points.

- Economic Sensitivity: During economic downturns, the demand for gold jewelry can be impacted as consumers seek more budget-friendly options.

- Fashion and Design Trends: Evolving fashion trends can elevate the desirability of non-precious metals and innovative materials, posing a threat to traditional gold dominance.

- Price Volatility: Fluctuations in gold prices can make substitutes more attractive, especially for price-sensitive segments of the market.

Changes in Global Economic Stability and Risk Perception

The threat of substitutes for gold, particularly for Equinox Gold, is influenced by shifts in global economic stability and how investors perceive risk. When the global economy is robust, demand for gold as a safe-haven asset can decrease. For instance, in periods of strong economic growth, investors might favor equities or other growth-oriented assets over gold, seeing less need for a hedge against uncertainty. This reduced investment demand can act as a substitute for direct gold investment.

Furthermore, the attractiveness of alternative safe-haven assets plays a crucial role. If government bonds from stable economies, such as U.S. Treasuries or German Bunds, offer competitive yields and are perceived as secure, they can draw capital away from gold. For example, during the first half of 2024, while inflation concerns persisted, yields on some sovereign debt instruments saw increases, potentially making them more appealing to risk-averse investors compared to non-yielding gold.

The perception of risk itself is a key driver. When geopolitical tensions ease and economic outlooks brighten, the urgency to hold gold diminishes. Conversely, heightened uncertainty, like that experienced during the early stages of the COVID-19 pandemic in 2020, typically boosts gold prices as investors flock to it. Therefore, changes in these perceptions directly impact the demand for gold as a substitute for other investment vehicles.

- Safe-Haven Demand: Gold's demand is often inversely related to global economic stability.

- Alternative Assets: Increased attractiveness of government bonds or other stable investments can reduce gold's appeal.

- Risk Perception: Shifts in investor sentiment regarding economic and geopolitical risks directly impact gold's role as a hedge.

- Economic Growth Impact: Periods of strong economic growth may lead investors to favor growth assets over gold, diminishing its substitute value.

The threat of substitutes for gold is multifaceted, impacting Equinox Gold by offering alternatives in investment, jewelry, and industrial applications. In investment, assets like U.S. Treasury bonds, which offered yields around 4.2% in early 2024, compete with gold as a store of value. Recycled gold, contributing approximately 1,246 tonnes to the market in 2023 according to the World Gold Council, also serves as a significant substitute supply. In jewelry, silver's lower price point in 2024 makes it a direct competitor, while industrial uses see copper and advanced ceramics as potential replacements.

| Substitute Category | Example Substitute | Key Differentiating Factor | 2023/2024 Data Point |

|---|---|---|---|

| Investment | U.S. Treasury Bonds | Yield/Income Generation | Yields around 4.2% (early 2024) |

| Supply | Recycled Gold | Availability from existing stock | 1,246 tonnes supplied (2023) |

| Jewelry | Silver | Price/Affordability | Significantly lower price than gold (2024) |

| Industrial | Copper | Cost/Abundance | More abundant and cheaper than gold |

Entrants Threaten

The gold mining industry demands immense capital for exploration, mine development, and operational setup. Building a new gold mine can easily cost hundreds of millions to several billion dollars, presenting a significant hurdle for any new company looking to enter the market.

For instance, the average all-in sustaining cost for gold producers in 2024, as reported by various industry analyses, often hovers around $1,200 to $1,500 per ounce, but the initial capital expenditure to bring a new deposit into production dwarfs these ongoing costs, acting as a powerful deterrent to new entrants.

The mining industry, including companies like Equinox Gold, is heavily burdened by extensive regulatory hurdles and protracted permitting processes. New entrants must navigate complex environmental impact assessments, secure land use permits, and often forge community agreements, a journey that can span many years and incur substantial legal and consulting costs.

For instance, Equinox Gold's Castle Mountain project sought and received FAST-41 approval, a legislative pathway designed to expedite and streamline the permitting process for critical infrastructure projects, highlighting the significant time and resource investment typically required.

The threat of new entrants for Equinox Gold, specifically concerning access to high-quality mineral deposits, is significantly mitigated by the finite nature of economically viable, high-grade gold reserves. Existing major mining companies often control these prime assets, making it a substantial hurdle for newcomers to secure a competitive resource base.

Discovering new, significant gold deposits is an arduous and expensive undertaking, demanding considerable geological expertise and substantial exploration budgets. For instance, the average cost to discover a new gold deposit can run into tens of millions of dollars, with no guarantee of success, further deterring potential new entrants.

Need for Specialized Expertise and Technology

The gold mining industry demands a deep well of specialized knowledge, encompassing geology, metallurgy, engineering, and operational management. Newcomers face a steep learning curve and significant investment to cultivate this expertise.

Furthermore, cutting-edge technologies are crucial for efficient exploration, extraction, and processing in today's competitive landscape. Acquiring or developing proficiency with these advanced tools presents a substantial hurdle for potential entrants.

For instance, in 2024, the average cost for a new gold exploration project can range from millions to tens of millions of dollars, heavily influenced by the technological sophistication employed. Companies like Barrick Gold and Newmont have invested billions in advanced automation and data analytics to optimize their operations, setting a high bar for any new player aiming to compete effectively.

- Geological Expertise: Understanding ore body characteristics and predicting yields.

- Metallurgical Skills: Optimizing metal recovery from ore.

- Engineering Prowess: Designing and managing complex mining operations.

- Technological Adoption: Utilizing AI, drone technology, and advanced processing equipment.

Established Economies of Scale and Cost Advantages

Established gold producers, including Equinox Gold, leverage significant economies of scale. This allows them to secure better pricing on supplies, optimize operational efficiency, and access more favorable financing terms. These advantages translate into lower per-ounce production costs, creating a substantial barrier for new, smaller companies trying to enter the market and compete on price.

The recent merger between Equinox Gold and Calibre Mining in late 2023, creating a larger, more diversified entity, further amplifies this scale advantage. This consolidation strengthens Equinox Gold's position by enhancing its purchasing power and operational reach, making it even more difficult for nascent competitors to gain traction.

- Economies of Scale: Large-scale operations lead to lower per-unit costs in procurement and production.

- Cost Advantages: Existing players benefit from established infrastructure and operational expertise.

- Financing Access: Larger companies typically have easier and cheaper access to capital.

- Competitive Pricing: Lower costs enable established firms to offer more competitive pricing, deterring new entrants.

The threat of new entrants in the gold mining sector, impacting companies like Equinox Gold, is generally low due to substantial capital requirements for mine development, which can run into billions of dollars. Navigating stringent regulations and lengthy permitting processes also presents a significant barrier, often taking years and substantial legal investment. Furthermore, securing access to high-quality, economically viable gold deposits is challenging, as these prime assets are typically controlled by established players, making it difficult for newcomers to acquire a competitive resource base.

| Barrier | Description | Impact on New Entrants |

| Capital Intensity | Extremely high upfront investment for exploration and mine construction. | Significant hurdle; requires access to substantial funding. |

| Regulatory Hurdles | Complex permitting, environmental assessments, and community relations. | Time-consuming and costly; can delay or halt projects. |

| Resource Access | Control of prime, high-grade gold deposits by established companies. | Difficult to secure a competitive resource base. |

| Technical Expertise | Need for specialized knowledge in geology, metallurgy, and engineering. | Steep learning curve and investment in talent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equinox Gold leverages data from company annual reports, investor presentations, and SEC filings to understand internal strategies and financial health. We also incorporate industry-specific reports from reputable sources like Wood Mackenzie and S&P Global Market Intelligence for external competitive landscape insights.